Professional Documents

Culture Documents

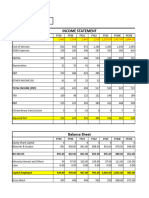

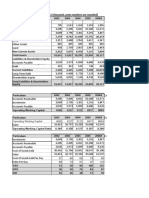

2 Income Statment

Uploaded by

Katia Lopez0 ratings0% found this document useful (0 votes)

4 views1 pageOriginal Title

2 income statment

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 page2 Income Statment

Uploaded by

Katia LopezCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Management's Discussion and Analysis - 2022 Annual Report - Desjardins Group

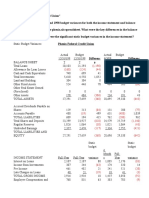

2.3 Analysis of fourth quarter results and quarterly trends

Table 18 – Results for the previous eight quarters

4

(unaudited, in millions of dollars and as a

2022 2021

percentage) Q4 Q3 Q2 Q1 Q4 Q3 Q2 Q1

Net interest income $ 1,579 $ 1,649 $ 1,596 $ 1,506 $ 1,455 $ 1,476 $ 1,452 $ 1,403

Net premiums 3,812 2,747 2,633 2,650 3,201 2,905 2,587 2,585

Other operating income(1)

Deposit and payment service charges 115 115 114 104 111 109 105 99

Lending fees and credit card service

revenues 263 276 225 227 168 198 182 187

Brokerage and investment fund

services 235 235 251 268 267 283 285 273

Management and custodial service fees 211 182 200 193 201 185 177 169

Foreign exchange income 42 19 27 31 29 34 28 30

Other 64 72 86 71 71 60 53 37

Operating income(1) 6,321 5,295 5,132 5,050 5,503 5,250 4,869 4,783

Investment income (loss)(1)

Net investment income (loss) 78 (38) (2,209) (2,336) 956 (90) 1,055 (1,602)

Overlay approach adjustment for

insurance operations financial assets (1) 224 371 153 (88) (24) (146) (146)

Investment income (loss)(1) 77 186 (1,838) (2,183) 868 (114) 909 (1,748)

Total income 6,398 5,481 3,294 2,867 6,371 5,136 5,778 3,035

Provision for (recovery of) credit losses 80 125 66 6 16 52 (3) 4

Claims, benefits, annuities and changes

in insurance contract liabilities 2,784 2,204 (133) (355) 3,185 1,713 2,191 (206)

Non-interest expense 2,833 2,565 2,712 2,528 2,736 2,288 2,377 2,165

Income taxes on surplus earnings 125 109 172 169 41 267 278 274

Surplus earnings before member

dividends 576 478 477 519 393 816 935 798

Member dividends, net of tax recovery 64 78 80 75 86 66 66 66

Net surplus earnings for the period after

member dividends $ 512 $ 400 $ 397 $ 444 $ 307 $ 750 $ 869 $ 732

Of which:

Group's share 495 386 381 424 267 716 830 702

Non-controlling interests' share 17 14 16 20 40 34 39 30

Contribution to surplus earnings by

business segment

Personal and Business Services 214 307 290 315 247 401 397 414

Wealth Management and Life and

Health Insurance 227 155 173 137 (6) 109 235 125

Property and Casualty Insurance 116 83 104 147 330 289 330 248

Other 19 (67) (90) (80) (178) 17 (27) 11

$ 576 $ 478 $ 477 $ 519 $ 393 $ 816 $ 935 $ 798

Total assets $ 407,109 $ 408,071 $ 404,070 $ 397,136 $ 397,085 $ 390,641 $ 389,278 $ 376,981

Indicators

Return on equity(2) 7.0 % 5.8 % 5.8 % 6.2 % 4.3 % 9.6 % 11.5 % 10.3 %

Tier 1A capital ratio(3) 20.2 18.7 19.5 20.6 21.1 21.2 21.4 22.1

Total capital ratio(3) 21.9 20.2 20.4 21.5 22.1 22.4 22.6 22.6

(1)

For more information about non-GAAP financial measures, see “Non-GAAP and other financial measures” on pages 3 to 7.

(2)

For further information about supplementary financial measures, see the Glossary on pages 113 to 120.

(3)

In accordance with the base capital adequacy guideline for financial services cooperatives issued by the AMF and taking into account the applicable relief measures

introduced by the AMF in response to the COVID-19 pandemic. See Section 3.2, “Capital management”.

41

You might also like

- Consolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)Document62 pagesConsolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)MUHAMMAD ISMAILNo ratings yet

- Instructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadDocument7 pagesInstructions To Candidates:: A. The Following Is The Summary of The Financial Statements of TENAGA NASIONAL BerhadyshazwaniNo ratings yet

- Q32023VZDocument17 pagesQ32023VZLuis DavidNo ratings yet

- Model Assignment Aug-23Document3 pagesModel Assignment Aug-23Abner ogegaNo ratings yet

- Performance AGlanceDocument1 pagePerformance AGlanceHarshal SawaleNo ratings yet

- TCS RATIO Calulations-1Document4 pagesTCS RATIO Calulations-1reddynagendrapalle123No ratings yet

- Annual Report 2015 EN 2 PDFDocument132 pagesAnnual Report 2015 EN 2 PDFQusai BassamNo ratings yet

- NIKE Inc Ten Year Financial History FY19Document1 pageNIKE Inc Ten Year Financial History FY19Moisés Ríos RamosNo ratings yet

- Q2fy23 Investor SheetDocument13 pagesQ2fy23 Investor SheetHello Brother2No ratings yet

- VIB - Section2 - Group5 - Final Project - ExcelDocument70 pagesVIB - Section2 - Group5 - Final Project - ExcelShrishti GoyalNo ratings yet

- TML q4 Fy 21 Consolidated ResultsDocument6 pagesTML q4 Fy 21 Consolidated ResultsGyanendra AryaNo ratings yet

- Almarai's Quality and GrowthDocument128 pagesAlmarai's Quality and GrowthHassen AbidiNo ratings yet

- 10-Year Consolidated Financial Statements Summary (2001-2010Document12 pages10-Year Consolidated Financial Statements Summary (2001-2010anshu sinhaNo ratings yet

- Excel Files For Case 12 - Value PublishinDocument12 pagesExcel Files For Case 12 - Value PublishinGerry RuntukahuNo ratings yet

- Economical Balance Sheet and Key Financial Ratios of a CompanyDocument5 pagesEconomical Balance Sheet and Key Financial Ratios of a CompanyAG InteriorNo ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 31 December 2019Nilupul BasnayakeNo ratings yet

- Symphony - DCF Valuation - Group6Document17 pagesSymphony - DCF Valuation - Group6Faheem ShanavasNo ratings yet

- Aiswarya Rachy Johnson p19105 Group GDocument10 pagesAiswarya Rachy Johnson p19105 Group GAthulya SanthoshNo ratings yet

- 2021 Q4 QFS ExternalDocument7 pages2021 Q4 QFS ExternalKshitij LakhanpalNo ratings yet

- Maruti Suzuki ValuationDocument39 pagesMaruti Suzuki ValuationritususmitakarNo ratings yet

- SELECTED FINANCIAL DATA 2006-2002Document1 pageSELECTED FINANCIAL DATA 2006-2002junerubinNo ratings yet

- 2010 q3 Telenor Financials - tcm28 56699Document23 pages2010 q3 Telenor Financials - tcm28 56699nemejebatNo ratings yet

- Blackstone 22Q1 Press Release and PresentationDocument41 pagesBlackstone 22Q1 Press Release and Presentation魏xxxappleNo ratings yet

- Summary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Document1 pageSummary Consolidated and Separate Financial Statements For The Period Ended 30 Sept 2021 (Unaudited)Fuaad DodooNo ratings yet

- Annual Report 2016: Financial SectionDocument39 pagesAnnual Report 2016: Financial SectionAlezNgNo ratings yet

- ' in LakhsDocument53 pages' in LakhsParthNo ratings yet

- Q4 16 Website Data PDFDocument11 pagesQ4 16 Website Data PDFAnggun SetyantoNo ratings yet

- Case 10 Value Line Publishing October 2002Document16 pagesCase 10 Value Line Publishing October 2002YogaPratamaDosenNo ratings yet

- TVS Motors Live Project Final 2Document39 pagesTVS Motors Live Project Final 2ritususmitakarNo ratings yet

- HBL Financial Statements - December 31, 2022Document251 pagesHBL Financial Statements - December 31, 2022Muhammad MuzammilNo ratings yet

- Quarterly Analysis: Analysis of Variation in Interim Results and Final AccountsDocument1 pageQuarterly Analysis: Analysis of Variation in Interim Results and Final Accounts.No ratings yet

- Trent LTDDocument23 pagesTrent LTDpulkitnarang1606No ratings yet

- MAN ACC ProjectDocument7 pagesMAN ACC ProjectNurassylNo ratings yet

- Saudi Aramco 9m 2019 Summary Financials PDFDocument4 pagesSaudi Aramco 9m 2019 Summary Financials PDFakshay_kapNo ratings yet

- Amazon Vs WallmartDocument13 pagesAmazon Vs WallmartHammad AhmedNo ratings yet

- Riyad Bank Data Supplement 4Q 2023Document13 pagesRiyad Bank Data Supplement 4Q 2023Lodhi AmmanNo ratings yet

- Alk Bird1Document5 pagesAlk Bird1evel streetNo ratings yet

- Exihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)Document22 pagesExihibit 1: Key Financial and Market Value Data, 2002-2011 (In Millions of Dollars Except For Ratios)JuanNo ratings yet

- 6 Years at A Glance: 2015 Operating ResultsDocument2 pages6 Years at A Glance: 2015 Operating ResultsHassanNo ratings yet

- Fourth Quarter 2021 Financial ResultsDocument12 pagesFourth Quarter 2021 Financial ResultsWinnie LaraNo ratings yet

- Sri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Document14 pagesSri Lanka Telecom PLC: Condensed Consolidated Interim Financial Statements For The Quarter Ended 30 September 2019Nilupul BasnayakeNo ratings yet

- HBL FSAnnouncement 3Q2016Document9 pagesHBL FSAnnouncement 3Q2016Ryan Hock Keong TanNo ratings yet

- Year Ended December 31, 1994 1995 1996 1997 1998 1999Document19 pagesYear Ended December 31, 1994 1995 1996 1997 1998 1999NISCHAL UPRETINo ratings yet

- Nasdaq Aaon 2018Document92 pagesNasdaq Aaon 2018gaja babaNo ratings yet

- Annual Report 2021Document3 pagesAnnual Report 2021hxNo ratings yet

- $R4UFVSNDocument3 pages$R4UFVSNGrace StylesNo ratings yet

- Blackstone 2 Q 22 Earnings Press ReleaseDocument41 pagesBlackstone 2 Q 22 Earnings Press ReleaseLinh Linh NguyenNo ratings yet

- Excel Files For Case 12 Value PublishingDocument12 pagesExcel Files For Case 12 Value PublishingOmer KhanNo ratings yet

- Cash Flow Analysis Love VermaDocument8 pagesCash Flow Analysis Love Vermalove vermaNo ratings yet

- Balance Sheet & P & LDocument3 pagesBalance Sheet & P & LSatish WagholeNo ratings yet

- Chapter 2Document32 pagesChapter 2AhmedNo ratings yet

- 31-March-2020Document8 pages31-March-2020lojanbabunNo ratings yet

- Restructuring at Neiman Marcus Group (A) Bankruptcy ValuationDocument66 pagesRestructuring at Neiman Marcus Group (A) Bankruptcy ValuationShaikh Saifullah KhalidNo ratings yet

- Particulars (INR in Crores) FY2015A FY2016A FY2017A FY2018ADocument6 pagesParticulars (INR in Crores) FY2015A FY2016A FY2017A FY2018AHamzah HakeemNo ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- Consolidated Profit and Loss Account for 2010Document1 pageConsolidated Profit and Loss Account for 2010Darshan KumarNo ratings yet

- Gone Rural Historical Financials Reveal Growth Over TimeDocument31 pagesGone Rural Historical Financials Reveal Growth Over TimeHumphrey OsaigbeNo ratings yet

- Quarterly Report on Financial Results and OperationsDocument21 pagesQuarterly Report on Financial Results and OperationsSuresh KumarNo ratings yet

- Foreclosure Letter - 20 - 26 - 19Document3 pagesForeclosure Letter - 20 - 26 - 19Santhosh AnantharamanNo ratings yet

- Citibank ElenaDocument8 pagesCitibank ElenaAndre BarrazaNo ratings yet

- Accomplishment ReportDocument19 pagesAccomplishment ReportEllorvie Carcueva SandoyNo ratings yet

- Sanction Letter A2301300139 1Document1 pageSanction Letter A2301300139 1Mohammed Masood0% (1)

- Retirement Capital Adjustments NotesDocument2 pagesRetirement Capital Adjustments NotesBlastik FalconNo ratings yet

- Class 5Document29 pagesClass 5Summit MirzaNo ratings yet

- Lecture 15 Commercial Real Estate Finance (MS PowerPoint)Document14 pagesLecture 15 Commercial Real Estate Finance (MS PowerPoint)minani marcNo ratings yet

- Holiday Pay Holiday Pay: Homecrew Best Services Phils. Corp. Homecrew Best Services Phils. CorpDocument1 pageHoliday Pay Holiday Pay: Homecrew Best Services Phils. Corp. Homecrew Best Services Phils. CorpVic CumpasNo ratings yet

- RTI Data Item Guide 20-21 v1-1Document57 pagesRTI Data Item Guide 20-21 v1-1chethanNo ratings yet

- 2023 03 21 14 30 06apr 22 - 400070Document7 pages2023 03 21 14 30 06apr 22 - 400070Sakila SNo ratings yet

- MAT112 - Past Year Instalment PurchaseDocument4 pagesMAT112 - Past Year Instalment PurchaseatiqahcantikNo ratings yet

- Chapter 18Document3 pagesChapter 18Yasmeen YoussefNo ratings yet

- RBI LoduDocument2 pagesRBI Lodussfd sdfsNo ratings yet

- Real Estate MortgageDocument3 pagesReal Estate MortgageJuven MoradaNo ratings yet

- Sonali BondreDocument75 pagesSonali BondreidealNo ratings yet

- Assignment 2Document2 pagesAssignment 2Anil RaiNo ratings yet

- Section 80 C and TaxationDocument3 pagesSection 80 C and TaxationdeepeshmahajanNo ratings yet

- Account Statement 1 Nov 2023 To 13 Feb 2024Document5 pagesAccount Statement 1 Nov 2023 To 13 Feb 2024tebogotb2016No ratings yet

- T-5 Banking TechnologyDocument18 pagesT-5 Banking TechnologyNamanNo ratings yet

- Sps. Dela Cruz V Asian Consumer FactsDocument1 pageSps. Dela Cruz V Asian Consumer FactsHyuga NejiNo ratings yet

- MayoDocument6 pagesMayodakpi479No ratings yet

- Employee Benefits Quiz Module 4Document1 pageEmployee Benefits Quiz Module 4Ronnah Mae FloresNo ratings yet

- Maria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 07712Document2 pagesMaria Baez 1408 Rustic Drive Apt 5 OCEAN NJ 0771216baezmcNo ratings yet

- Ipo UpiDocument19 pagesIpo UpivikasmandapeNo ratings yet

- Historical Mortgage Rates 1970-2020Document11 pagesHistorical Mortgage Rates 1970-2020GoKi VoregisNo ratings yet

- Finance Module 10 Managing Personal FinanceDocument5 pagesFinance Module 10 Managing Personal FinanceJOHN PAUL LAGAONo ratings yet

- CORPORATION REORGANIZATION AND DEBT RESTRUCTURINGDocument30 pagesCORPORATION REORGANIZATION AND DEBT RESTRUCTURINGMarie Garpia100% (1)

- Takaful Myclick Term PDSDocument3 pagesTakaful Myclick Term PDSLan MazlanNo ratings yet

- Credit AppDocument1 pageCredit Appautoheim59No ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument11 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSarath KumarNo ratings yet