Professional Documents

Culture Documents

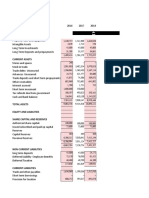

Consolidated Profit and Loss Account for 2010

Uploaded by

Darshan Kumar0 ratings0% found this document useful (0 votes)

20 views1 page- The document is the Consolidated Profit and Loss Account for the year ended December 31, 2010 for an organization. It shows the organization's earnings and expenses for 2010 and compares it to 2009.

- In 2010, the organization had a net markup/interest income of Rs. 22,545,678 thousand compared to Rs. 18,723,449 thousand in 2009. After provisions, the net income was Rs. 18,462,293 thousand in 2010 and Rs. 14,212,283 thousand in 2009.

- Total non-markup/interest income was Rs. 5,867,308 thousand in 2010 compared to Rs. 6,078,257 thousand in 2009.

- Total non-

Original Description:

Original Title

consolicated_pl_account

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document- The document is the Consolidated Profit and Loss Account for the year ended December 31, 2010 for an organization. It shows the organization's earnings and expenses for 2010 and compares it to 2009.

- In 2010, the organization had a net markup/interest income of Rs. 22,545,678 thousand compared to Rs. 18,723,449 thousand in 2009. After provisions, the net income was Rs. 18,462,293 thousand in 2010 and Rs. 14,212,283 thousand in 2009.

- Total non-markup/interest income was Rs. 5,867,308 thousand in 2010 compared to Rs. 6,078,257 thousand in 2009.

- Total non-

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

20 views1 pageConsolidated Profit and Loss Account for 2010

Uploaded by

Darshan Kumar- The document is the Consolidated Profit and Loss Account for the year ended December 31, 2010 for an organization. It shows the organization's earnings and expenses for 2010 and compares it to 2009.

- In 2010, the organization had a net markup/interest income of Rs. 22,545,678 thousand compared to Rs. 18,723,449 thousand in 2009. After provisions, the net income was Rs. 18,462,293 thousand in 2010 and Rs. 14,212,283 thousand in 2009.

- Total non-markup/interest income was Rs. 5,867,308 thousand in 2010 compared to Rs. 6,078,257 thousand in 2009.

- Total non-

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

Consolidated Profit and Loss Account

for the year ended December 31, 2010

December 31, December 31, Note December 31, December 31,

2010 2009 2010 2009

US $ in ‘000 Rupees in ‘000

525,606 488,413 Mark–up / Return / Interest earned 24 45,011,184 41,144,667

262,336 266,154 Mark–up / Return / Interest expensed 25 22,465,506 22,421,218

263,270 222,259 Net Mark–up / Interest income 22,545,678 18,723,449

35,903 37,546 Provision against non–performing loans and advances 10.4 3,074,576 3,162,963

15,057 12,673 Provision for diminution in the value of investments – net 9.3 1,289,404 1,067,608

(3,277) 3,331 (Reversal) / provision against lendings to financial institutions 8.5 (280,595) 280,595

– – Bad debts written off directly 10.5 – –

47,683 53,550 4,083,385 4,511,166

215,587 168,709 Net Mark–up / Interest income after provisions 18,462,293 14,212,283

Non mark–up / interest income

30,902 33,241 Fee, commission and brokerage income 26 2,646,260 2,800,306

13,059 16,369 Dividend income 1,118,270 1,378,919

4,888 9,045 Income from dealing in foreign currencies 418,524 761,934

16,764 13,075 Gain on sale of securities 27 1,435,594 1,101,477

Unrealized loss on revaluation of investments

(32) (4) classified as held for trading – net 9.14 (2,668) (365)

2,935 427 Other income 28 251,328 35,986

68,516 72,153 Total Non–markup / Interest income 5,867,308 6,078,257

284,103 240,862 24,329,601 20,290,540

Non mark–up / interest expenses

132,468 112,980 Administrative expenses 29 11,344,090 9,517,584

3,867 (670) Provision / (Reversal) against other assets – net 13.2 331,077 (56,431)

Reversal against off–balance sheet

(1,031) (301) obligations – net 19.1 (88,239) (25,353)

2,992 2,561 Workers Welfare fund 31 256,146 215,741

832 800 Other charges 30 71,248 67,377

139,128 115,370 Total non–markup / Interest expenses 11,914,322 9,718,918

– – Extra–ordinary / unusual items – –

144,975 125,492

Profit before taxation

12,415,279 10,571,622

Taxation 32

48,760 42,158 Current 4,175,600 3,551,493

4,362 – Prior years 373,475 –

(4,877) (1,533) Deferred (417,613) (129,181)

48,245 40,625 4,131,462 3,422,312

96,730 84,867

Profit after taxation

8,283,817 7,149,310

142,050 100,613 Unappropriated profit brought forward 12,164,662 8,475,791

421 384 Transfer from surplus on revaluation of fixed assets – net of tax 36,046 32,360

142,471 100,997 12,200,708 8,508,151

239,201 185,864 Profit available for appropriation

20,484,525 15,657,461

0.13 0.11

Earnings per share – Basic and Diluted (in Rupees) 33 10.59 9.14

The annexed notes 1 to 46 and annexure II form an integral part of these consolidated financial statements.

Chief Financial Officer President and Chief Executive Director

Director Chairman

153

You might also like

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Balance Sheet (December 31, 2008)Document6 pagesBalance Sheet (December 31, 2008)anon_14459No ratings yet

- Non-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286Document8 pagesNon-Mark-up/Interest Income: Profit Before Taxation 22,198,843 23,249,286shahzad khalidNo ratings yet

- HBL Financial Statements - December 31, 2022Document251 pagesHBL Financial Statements - December 31, 2022Muhammad MuzammilNo ratings yet

- Askari Bank Limited Financial Statement AnalysisDocument16 pagesAskari Bank Limited Financial Statement AnalysisAleeza FatimaNo ratings yet

- Atlas Honda (2019 22)Document6 pagesAtlas Honda (2019 22)husnainbutt2025No ratings yet

- MPCLDocument4 pagesMPCLRizwan Sikandar 6149-FMS/BBA/F20No ratings yet

- Case Ahold SolutionDocument18 pagesCase Ahold Solutiondeepanshu guptaNo ratings yet

- Unaudited Financials BSX December 2023Document2 pagesUnaudited Financials BSX December 2023BernewsNo ratings yet

- International Finance Investment and Commerce Bank Limited Profit and Loss Account For The Year Ended 31 December 2020 Particulars 2020 2021Document2 pagesInternational Finance Investment and Commerce Bank Limited Profit and Loss Account For The Year Ended 31 December 2020 Particulars 2020 2021Md. Safiqul IslamNo ratings yet

- 1321 Behroz TariqDocument11 pages1321 Behroz TariqBehroz Tariq 1321No ratings yet

- Lululemon Financial Highlights 2003-2009Document1 pageLululemon Financial Highlights 2003-2009LI WilliamNo ratings yet

- Bank Group WiseDocument6 pagesBank Group WisekamransNo ratings yet

- Tesla FSAPDocument20 pagesTesla FSAPSihongYanNo ratings yet

- Reckitt Benckiser Bangladesh Annual Report 2009Document4 pagesReckitt Benckiser Bangladesh Annual Report 2009dbjhtNo ratings yet

- Accounts Dec 2017Document188 pagesAccounts Dec 2017Sibgha100% (1)

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Document30 pages"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Quarterly Report 20200930Document18 pagesQuarterly Report 20200930Ang SHNo ratings yet

- NRSP Microfinance Bank Limited Balance Sheet and Profit & Loss HighlightsDocument15 pagesNRSP Microfinance Bank Limited Balance Sheet and Profit & Loss Highlightsshahzadnazir77No ratings yet

- UBA FS-31Dec2021Document2 pagesUBA FS-31Dec2021Fuaad DodooNo ratings yet

- 20230607-Trans-Audited-Financial-State-2022Document4 pages20230607-Trans-Audited-Financial-State-2022Sammy PinagodNo ratings yet

- Financial Statements Analysis: Arsalan FarooqueDocument31 pagesFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioNo ratings yet

- BHEL Valuation FinalDocument33 pagesBHEL Valuation FinalragulNo ratings yet

- Petron Corp - Financial Analysis From 2014 - 2018Document4 pagesPetron Corp - Financial Analysis From 2014 - 2018Neil Nadua100% (1)

- TML q4 Fy 21 Consolidated ResultsDocument6 pagesTML q4 Fy 21 Consolidated ResultsGyanendra AryaNo ratings yet

- The WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Document4 pagesThe WWF Indonesia Foundation and Subsidiaries Consolidated Statement of Financial Position 30 June 2020Mohammad Abram MaulanaNo ratings yet

- Tyson Foods Income Statement Analysis 2016-2014Document13 pagesTyson Foods Income Statement Analysis 2016-2014Adil SaleemNo ratings yet

- 07-MIAA2021 Part1-Financial StatementsDocument4 pages07-MIAA2021 Part1-Financial StatementsVENICE OMOLONNo ratings yet

- IFRS Financial Statements and Operating Metrics for FY09-FY19Document19 pagesIFRS Financial Statements and Operating Metrics for FY09-FY19Ketan JajuNo ratings yet

- Análisis de Estados Financieros de Starbucks (SBUXDocument7 pagesAnálisis de Estados Financieros de Starbucks (SBUXjosolcebNo ratings yet

- Quiz RatiosDocument4 pagesQuiz RatiosAmmar AsifNo ratings yet

- PIOC Data For Corporate ValuationDocument6 pagesPIOC Data For Corporate ValuationMuhammad Ali SamarNo ratings yet

- FIN 440 Group Task 1Document104 pagesFIN 440 Group Task 1দিপ্ত বসুNo ratings yet

- Pragathi Infra - Financial StatementDocument3 pagesPragathi Infra - Financial StatementAnurag ShuklaNo ratings yet

- Sun Pharma Q1 ResultsDocument4 pagesSun Pharma Q1 ResultsSagar ChaurasiaNo ratings yet

- Financial Analysis Data Sheet - Raymonds (2023) - Revised (29 Jun, 2023)Document22 pagesFinancial Analysis Data Sheet - Raymonds (2023) - Revised (29 Jun, 2023)b23005No ratings yet

- Ratio Analysis of Lanka Ashok Leyland PLCDocument6 pagesRatio Analysis of Lanka Ashok Leyland PLCThe MutantzNo ratings yet

- 1609913324.QCI Financials FY 2019-20 Final SignedDocument14 pages1609913324.QCI Financials FY 2019-20 Final SignedHari OmNo ratings yet

- Fintech Company:Paytm: 1.financial Statements and Records of CompanyDocument7 pagesFintech Company:Paytm: 1.financial Statements and Records of CompanyAnkita NighutNo ratings yet

- Ratio AnaylisDocument5 pagesRatio Anaylisfinance.mhotelkigaliNo ratings yet

- United Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Document2 pagesUnited Bank For Africa (Ghana) Limited Summary Financial Statements For The Year Ended 31 December 2020Fuaad DodooNo ratings yet

- Afs ProjectDocument8 pagesAfs ProjectAnam AbrarNo ratings yet

- Revenue and earnings analysis of company from 2019-2021Document8 pagesRevenue and earnings analysis of company from 2019-2021ashwani singhaniaNo ratings yet

- U Microfinance Bank Limited Condensed Interim Financial Statements (Un-Audited) For The PeriodDocument20 pagesU Microfinance Bank Limited Condensed Interim Financial Statements (Un-Audited) For The PeriodHayue MemonNo ratings yet

- 2020 Samsung Tai ChinhDocument3 pages2020 Samsung Tai Chinhhienys huynhNo ratings yet

- First Bank of Nigeria Unaudited Balance Sheet June 2010Document1 pageFirst Bank of Nigeria Unaudited Balance Sheet June 2010Kunle AdegboyeNo ratings yet

- Fsap 8e - Pepsico 2012Document46 pagesFsap 8e - Pepsico 2012Allan Ahmad Sarip100% (1)

- ANNEXUREDocument3 pagesANNEXUREAbhiNo ratings yet

- Royal Dutch Shell PLC: IndexDocument16 pagesRoyal Dutch Shell PLC: IndexedriceNo ratings yet

- Swedish Match 9 212 017Document6 pagesSwedish Match 9 212 017Karan AggarwalNo ratings yet

- Final Report - Draft2Document32 pagesFinal Report - Draft2shyamagniNo ratings yet

- 16-MCB Annual Report 2022Document3 pages16-MCB Annual Report 2022Ziaullah KhanNo ratings yet

- Group 7:: Abhishek Goyal Dhanashree Baxy Ipshita Ghosh Puja Priya Shivam Pandey Vidhi KothariDocument26 pagesGroup 7:: Abhishek Goyal Dhanashree Baxy Ipshita Ghosh Puja Priya Shivam Pandey Vidhi KothariABHISHEK GOYALNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- Fin 254 Group Project ExcelDocument12 pagesFin 254 Group Project Excelapi-422062723No ratings yet

- Chapter 2Document32 pagesChapter 2AhmedNo ratings yet

- Apollo Tyres FSADocument12 pagesApollo Tyres FSAChirag GugnaniNo ratings yet

- 4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014Document8 pages4.3 Financial Analysis 4.3.1 Financial Statements For The Year Ended December 31, 2014mustiNo ratings yet

- INR Crore FY 16 FY 17 FY 18 FY 19 FY 20Document5 pagesINR Crore FY 16 FY 17 FY 18 FY 19 FY 20Shivani SinghNo ratings yet

- Supreme Annual Report 2019Document148 pagesSupreme Annual Report 2019adoniscalNo ratings yet

- Gazz Annual Examination 2011 SEDocument111 pagesGazz Annual Examination 2011 SEDarshan KumarNo ratings yet

- Karachi Grammer School: Contact UsDocument3 pagesKarachi Grammer School: Contact UsDarshan KumarNo ratings yet

- Advanced Research Methods: Presented By: Saqib Wahab Mahar Darshan KumarDocument68 pagesAdvanced Research Methods: Presented By: Saqib Wahab Mahar Darshan KumarDarshan Kumar100% (1)

- Cir 7Document6 pagesCir 7Darshan KumarNo ratings yet

- ISO 9001-2015 AwarenessDocument42 pagesISO 9001-2015 AwarenessrajarajanNo ratings yet

- Financial statements and audit typesDocument3 pagesFinancial statements and audit typesansari naseem ahmadNo ratings yet

- M2 Assignment GW Group 9 ACC C614 AUDITING AND ASSURANCE SPECIALIZED INDUSTRIESDocument4 pagesM2 Assignment GW Group 9 ACC C614 AUDITING AND ASSURANCE SPECIALIZED INDUSTRIESReginald ValenciaNo ratings yet

- Treasurer GuidelinesDocument23 pagesTreasurer GuidelinessinorkkNo ratings yet

- Civil Service Exam Reviewer Clerical OperationsDocument9 pagesCivil Service Exam Reviewer Clerical OperationslordaiztrandNo ratings yet

- Integrated Model For Entrepreneurship Development in PakistanDocument23 pagesIntegrated Model For Entrepreneurship Development in PakistanMuhammad Shahzad KhanNo ratings yet

- Nacpil Vs IBCDocument2 pagesNacpil Vs IBCNiñanne Nicole Baring BalbuenaNo ratings yet

- The Crime of Irish Government Illegally Giveaway Free Oil and Gas, Now They Want To Sell Our Water, FG, FF, LB and PD, GP All Rigged Our Referendums TooDocument441 pagesThe Crime of Irish Government Illegally Giveaway Free Oil and Gas, Now They Want To Sell Our Water, FG, FF, LB and PD, GP All Rigged Our Referendums TooRita CahillNo ratings yet

- Finance (Allowances) Department: G.O.No. 106, DATED 28 Apr Il, 201 4Document2 pagesFinance (Allowances) Department: G.O.No. 106, DATED 28 Apr Il, 201 4Papu KuttyNo ratings yet

- Sas 70 AuditDocument2 pagesSas 70 AuditVamsi KrishnaNo ratings yet

- S I A (SIA) 6 A P: Tandard On Nternal Udit Nalytical RoceduresDocument8 pagesS I A (SIA) 6 A P: Tandard On Nternal Udit Nalytical RoceduresDivine Epie Ngol'esuehNo ratings yet

- Financial Accounting - MGT101 Power Point Slides Lecture 25Document21 pagesFinancial Accounting - MGT101 Power Point Slides Lecture 25daood abdullah100% (1)

- Basic BookkeepingDocument61 pagesBasic BookkeepingJayson Reyes50% (4)

- CalypsoTraining PDFDocument399 pagesCalypsoTraining PDFanubhav92% (13)

- Steinhoff 20171219 Bank PresentationDocument58 pagesSteinhoff 20171219 Bank PresentationZerohedgeNo ratings yet

- Ilovepdf MergedDocument688 pagesIlovepdf MergedSpade XNo ratings yet

- Audit Checklist 1Document2 pagesAudit Checklist 1Jagi NikNo ratings yet

- Chapter 7 - Accepting The Engagement and Planning The AuditDocument9 pagesChapter 7 - Accepting The Engagement and Planning The Auditsimona_xoNo ratings yet

- Advanced Auditing and Professional EthicsDocument54 pagesAdvanced Auditing and Professional EthicsManu JainNo ratings yet

- Notification No 35 DD-GKY Qualitative Appraisal ToolDocument30 pagesNotification No 35 DD-GKY Qualitative Appraisal ToolVivek KankipatiNo ratings yet

- Gardy Amos CVDocument4 pagesGardy Amos CVAmos GardyNo ratings yet

- Case Analysis 1-EditedDocument5 pagesCase Analysis 1-EditedChris WongNo ratings yet

- My AnalysisDocument92 pagesMy AnalysisintauditNo ratings yet

- Pmi - Selftestengine.capm - PDF.download.2023 Sep 10.by - Fabian.534q.vceDocument39 pagesPmi - Selftestengine.capm - PDF.download.2023 Sep 10.by - Fabian.534q.vcejosemolina20No ratings yet

- Course / Learning Packet in (Pre 2) : Auditing & Assurance Concepts & Application 1Document58 pagesCourse / Learning Packet in (Pre 2) : Auditing & Assurance Concepts & Application 1Elias YagoNo ratings yet

- IFRS in EthiopiaDocument46 pagesIFRS in EthiopiaAshu W Chamisa100% (2)

- Form Land RegistrationDocument3 pagesForm Land RegistrationJulo R. TaleonNo ratings yet

- ACCTG 201 Support Department Cost Allocation 1Document1 pageACCTG 201 Support Department Cost Allocation 1Jessa YuNo ratings yet

- 2021T1 ACC309 Final Exam (Online)Document5 pages2021T1 ACC309 Final Exam (Online)Shamha NaseerNo ratings yet

- AUDIT 411 - ConciseDocument3 pagesAUDIT 411 - ConciseKathleenNo ratings yet