Professional Documents

Culture Documents

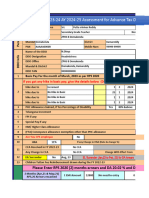

Br. Statement of Advance Income Tax - TDS (10604090) During The Year 2019 Format

Br. Statement of Advance Income Tax - TDS (10604090) During The Year 2019 Format

Uploaded by

muktagacha00100 ratings0% found this document useful (0 votes)

6 views1 pageOriginal Title

_Br. Statement of Advance Income Tax -TDS (10604090) during the year 2019 Format

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

6 views1 pageBr. Statement of Advance Income Tax - TDS (10604090) During The Year 2019 Format

Br. Statement of Advance Income Tax - TDS (10604090) During The Year 2019 Format

Uploaded by

muktagacha0010Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

You are on page 1of 1

`qv K‡i dvBj wU cÖ_‡g wi‡bg Kiæb ïiæ‡Z kvLvi bvg w`‡q

Please Send only Soft copy ( Email to agsme.ad@gmail.com)

Don't Input red mark cell

Branch name: xyz Br.

Agrani SME Financing Company Limited

Statement of Advance Income Tax -TDS (10604090) during the year 2019

Name of the Branch Balance of Advance Addition/ Total Deduction and Statement of Advance Difference Remarks (If Have any contra/

Income Tax-TDS Debit of Advance Transfer/ Total Advance Income Tax- any reversal voucher

(10604090) as on 31- Income Tax-TDS Credit of Advance Income Tax - TDS difference in of Advance

12-2018 as per (10604090) Income Tax-TDS TDS (10604090) as column no.7) Income Tax -TDS

statement of affairs/ during 2019 from (10604090) during (10604090) for on 31-12-2019 (10604090) during

Trial Balance as on ledger statement 2018 from ledger 2019 as per the year 2019. If

31-12-2018 (From 01-01-2019 statement (From statement of yes, please insert

to 31-12-2019) 01-01-2019 to 31- affairs/ Trial the amount.

12-2019) Balance as on

31-12-2019

1 2 3 4 5=(2+3-4) 6 7=(5-6) 8 9

xyz Br. 0.00 0.00

You might also like

- Turnover CertificateDocument1 pageTurnover CertificateAnil Batra57% (7)

- E Tax 20200504201259Document3 pagesE Tax 20200504201259monitganatra100% (1)

- Accountable Plan - Excel TemplateDocument9 pagesAccountable Plan - Excel Templateelnara safronovaNo ratings yet

- Module 2 - Partnership Operation and Financial Reporting Module 2 - Partnership Operation and Financial ReportingDocument12 pagesModule 2 - Partnership Operation and Financial Reporting Module 2 - Partnership Operation and Financial ReportingmsjoyceroxaneNo ratings yet

- Depreciation (110,500 20%) 21,780 Depreciation (3,660 10%) 366Document1 pageDepreciation (110,500 20%) 21,780 Depreciation (3,660 10%) 366Ali MohamedNo ratings yet

- Turnover Certificate To Whom It May ConcernDocument1 pageTurnover Certificate To Whom It May ConcernAnil Batra0% (1)

- PREPAYMENTS and ACCRUALSDocument7 pagesPREPAYMENTS and ACCRUALSJoshua BrownNo ratings yet

- 11th BPS Arrears Income Tax Relief 89 1 RajManglamDocument8 pages11th BPS Arrears Income Tax Relief 89 1 RajManglamShubhamGuptaNo ratings yet

- TOPIC 3 - SELF-ASSESSMENT SYSTEM FOR COMPANY - NoridayuDocument18 pagesTOPIC 3 - SELF-ASSESSMENT SYSTEM FOR COMPANY - NoridayuNik Fatehah NajwaNo ratings yet

- Assignment BAC4102 FDocument5 pagesAssignment BAC4102 FKeemeNo ratings yet

- UGBA 120AB Chapter 16 With Solutions Spring 2020 For ClassDocument144 pagesUGBA 120AB Chapter 16 With Solutions Spring 2020 For Classyadi lauNo ratings yet

- TS IT FY 2023-24 Full Version 1.0Document16 pagesTS IT FY 2023-24 Full Version 1.0atheendrareddyNo ratings yet

- TS IT FY 2022-23 Full Version 1.1Document16 pagesTS IT FY 2022-23 Full Version 1.1teja chavaNo ratings yet

- TS IT FY 2023-24 Full Version 1.0Document16 pagesTS IT FY 2023-24 Full Version 1.0varshithvarma051No ratings yet

- Computation 22-23Document2 pagesComputation 22-23Ruloans VaishaliNo ratings yet

- Question No 06 Chapter No 12 - D.K Goal 11 ClassDocument1 pageQuestion No 06 Chapter No 12 - D.K Goal 11 ClassNafe MNo ratings yet

- Cash Flow Tata ChemicalsDocument2 pagesCash Flow Tata ChemicalsAkash GavandiNo ratings yet

- PUTTADocument16 pagesPUTTAtdsbolluNo ratings yet

- Vimal Kumar PTRCDocument3 pagesVimal Kumar PTRCsapkalniraj2005No ratings yet

- SAS Schedule 2019 USE IX 2020Document3 pagesSAS Schedule 2019 USE IX 2020Hafiz MusannefNo ratings yet

- Basic ConceptsDocument4 pagesBasic ConceptsHarry IcwaNo ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- 1111Document2 pages1111Karan JangidNo ratings yet

- 2013 Itr1 PR11Document9 pages2013 Itr1 PR11Akshay Kumar SahooNo ratings yet

- Gratuity Sep 2023Document33 pagesGratuity Sep 2023joseph davidNo ratings yet

- ITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamDocument11 pagesITR-4S: Assessment Year (Presumptive Business Income Tax Return) Indian Income Tax Return SugamcachandhiranNo ratings yet

- 2nd StatmentDocument19 pages2nd StatmentFaiza RasheedNo ratings yet

- DeferredDocument11 pagesDeferredShubham MaheshwariNo ratings yet

- Accurate Umayal Sales 2019-20Document2 pagesAccurate Umayal Sales 2019-20heyaanshNo ratings yet

- CP Half Yearly PT Service Request ReceiptDocument1 pageCP Half Yearly PT Service Request Receiptpremk87No ratings yet

- LossesReport 202307101810Document1 pageLossesReport 202307101810Keval GandhiNo ratings yet

- Expected MCQs CompressedDocument31 pagesExpected MCQs CompressedAdithya kesavNo ratings yet

- Assessment Year Sahaj Indian Income Tax ReturnDocument7 pagesAssessment Year Sahaj Indian Income Tax Returnrajshri58No ratings yet

- Depreciation NotesDocument3 pagesDepreciation NotesDixit PhuyalNo ratings yet

- Ass 2 Quest 2 FilledDocument1 pageAss 2 Quest 2 FilledNam TranNo ratings yet

- Please Sign PPP Origination Application - PDF BDocument12 pagesPlease Sign PPP Origination Application - PDF BpayneNo ratings yet

- Assessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DateDocument3 pagesAssessment Year Indian Income Tax Return Year Sahaj: Seal and Signature of Receiving Official Receipt No/ DatethakurrobinNo ratings yet

- The Following Information Is Required For Tax Auditaddress Where Books of AccountsDocument3 pagesThe Following Information Is Required For Tax Auditaddress Where Books of AccountsJasmeet DhamijaNo ratings yet

- Income Tax 2023-24 Statement - Mahesh R1Document2 pagesIncome Tax 2023-24 Statement - Mahesh R1akhilhed100% (1)

- Budget Estimates 2019 20Document12 pagesBudget Estimates 2019 20Iram FatimaNo ratings yet

- TS IT FY 2022-23 Income Tax Software 16.11.2022.Document37 pagesTS IT FY 2022-23 Income Tax Software 16.11.2022.TestNo ratings yet

- Manorama Com 3Document2 pagesManorama Com 3nitin patidarNo ratings yet

- Notice To Taxpayers 20 12 2022Document6 pagesNotice To Taxpayers 20 12 2022Anonymous nyOx1XmqzCNo ratings yet

- GIRO Instalment Plan For Income Tax: Month Month Amount ($) Amount ($)Document2 pagesGIRO Instalment Plan For Income Tax: Month Month Amount ($) Amount ($)Nelly HNo ratings yet

- Ntermediate: M.K.Gupta Ca EducationDocument164 pagesNtermediate: M.K.Gupta Ca EducationChhaya JajuNo ratings yet

- Compu TationDocument3 pagesCompu TationAbhilash M NairNo ratings yet

- Indian Income Tax Return Assessment Year SahajDocument7 pagesIndian Income Tax Return Assessment Year SahajSubrata BiswasNo ratings yet

- Balance Sheet Design Textile 18-19 Final - RevisedDocument11 pagesBalance Sheet Design Textile 18-19 Final - RevisedAscend KannanNo ratings yet

- MTP May21 ADocument11 pagesMTP May21 Aomkar sawantNo ratings yet

- Hi Prasanth, Here's Your Bill: Page 1 of 3Document3 pagesHi Prasanth, Here's Your Bill: Page 1 of 3Prasanth LivicNo ratings yet

- Form No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryDocument2 pagesForm No. 16 (See Rule 31 (1) (A) ) Certificate Under Section 203 of The Income-Tax Act, 1961 For Tax Deducted at Source On SalaryNavneet SharmaNo ratings yet

- Assessment Year Indian Income Tax Return: I - IndividualDocument6 pagesAssessment Year Indian Income Tax Return: I - IndividualManjunath YvNo ratings yet

- Liquidity and Profitabilty of Tech MahindraDocument5 pagesLiquidity and Profitabilty of Tech MahindraShwetaNo ratings yet

- Computation of Total Income Income From Business or Profession (Chapter IV D) 470243Document4 pagesComputation of Total Income Income From Business or Profession (Chapter IV D) 470243Aman AggarwalNo ratings yet

- INP - 2211 - Account - SUGGESTED ANSWERSDocument15 pagesINP - 2211 - Account - SUGGESTED ANSWERSSachin ChourasiyaNo ratings yet

- Form PDF 690991540220622Document10 pagesForm PDF 690991540220622Vijay BhaipNo ratings yet

- Income Tax - Computation - 2021Document26 pagesIncome Tax - Computation - 2021umasankarNo ratings yet

- Mhban14374600000012832 2018Document1 pageMhban14374600000012832 2018swapnildanavale17No ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet