Professional Documents

Culture Documents

Ijcrti020009 4

Uploaded by

modib388630 ratings0% found this document useful (0 votes)

4 views1 pageResearch page -4

Original Title

IJCRTI020009-4

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentResearch page -4

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageIjcrti020009 4

Uploaded by

modib38863Research page -4

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

www.ijcrt.

org © 2021 IJCRT | Volume 9, Issue 11 November 2021 | ISSN: 2320-2882

autoencoder, and also

the restricted physicist machine—

on the network’s overall ability to

predict future market behavior.

III. PROPOSED METHODOLOGY

A. Yahoo Data

Stock market prediction seems a complex problem because

there are many factors that have yet to be addressed and it

doesn’t seem statistical at first. But by proper use of previous

data for machine learning techniques to make appropriate

assumptions and the current data and train the machine to

learn from it.

We used dataset for analysis was picked up from Yahoo

Finance. The dataset consisted of approximately 1 lakh

records of the required stock prices and other relevant values.

At certain time intervals for each day of the year the data

returns the stock prices. It made up of various sections

namely low, symbol, open, date, high and volume. The data

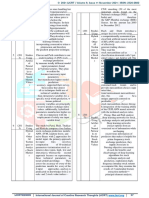

C. Long Short Term Memory(LSTM) Network Based

of only one company is considered for the purpose of

Model

simulation and analysis. First All the data is read which is

available in a file of csv format and transformed into a data- Long Short Term Memory is the advanced version of

frame using the keras, tensorflow in Python. From this, the Recurrent-Neural-Networks (RNN) where the information

data for one particular company is extracting by segregating belonging to previous state persists. These are different from

data on the basis of the symbol field. Following this RNNs as They involve long term dependencies and RNNs

normalization of the data was performed through usage of the works on finding the relationship between the recent and the

scikit library in Python and the data was divided into two current information so this are different from RNNs. it is

parts i.e testing and training sets. The test set was kept as 20% indicates that the interval of information is relatively smaller

of the available dataset. than that to LSTM.

Machine learning has many models but this paper focuses The predictions depends on large amounts of data and are

on four of the most important amongst them and made the generally dependent on the long term history of the market it

predictions using these. is the main purpose behind using LSTM model in stock

market prediction. LSTM regulates error by giving an aid to

B. Regression Based Models

In general, the Regression based Model is used for predicting

continuous values through some given independent values.

Regression uses a given linear function for predicting

continuous values:

V = a + bK + error [1]

Where, V is a continuous value; K represents known

independent values; and, a, b are coefficients. Fig. 1 Flow

Chart for Regression Based Mode.

The paper utilizes for predicting correct values by

minimizing the error function as given in Fig.1 the gradient

descent linear regression algorithm is uses. Linear Regression

algorithm as governed by equation [1] is performed on the

data and then the relevant predictions are made. Low, open,

high, close and volume are he factors considered for the

regression.

Fig 2 Flow Chart for LSTM

IJCRTI020009 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org 38

You might also like

- Anomaly Prediction in Mobile Networks: A Data Driven Approach For Machine Learning Algorithm SelectionDocument7 pagesAnomaly Prediction in Mobile Networks: A Data Driven Approach For Machine Learning Algorithm SelectionLanceloth01No ratings yet

- Stock Price Prediction Using LSTM Model and DashDocument5 pagesStock Price Prediction Using LSTM Model and DashIJRASETPublications100% (1)

- Stock Market Prediction Using Machine LearningDocument3 pagesStock Market Prediction Using Machine LearningMayank JacksonNo ratings yet

- Stock Market Prediction Using Machine Learning: December 2018Document4 pagesStock Market Prediction Using Machine Learning: December 2018shauryaNo ratings yet

- Algorithmic Trading Stock Price ModelDocument9 pagesAlgorithmic Trading Stock Price ModelIJRASETPublications100% (1)

- Stock Market Prediction Using Machine Learning: December 2018Document4 pagesStock Market Prediction Using Machine Learning: December 2018Fatima-Ezzahra AINo ratings yet

- Stock Market Prediction Using Machine Learning: December 2018Document4 pagesStock Market Prediction Using Machine Learning: December 2018Akash GuptaNo ratings yet

- Indian Stock Market Prediction Using Deep LearningDocument6 pagesIndian Stock Market Prediction Using Deep LearningrekhaNo ratings yet

- StockMarketPredictionTermPaper Final1Document4 pagesStockMarketPredictionTermPaper Final1sahil kolekarNo ratings yet

- Novel Deep Learning Model With CNN and Bi-Directional LSTM For Improved Stock Market Index PredictionDocument7 pagesNovel Deep Learning Model With CNN and Bi-Directional LSTM For Improved Stock Market Index PredictionsdfghNo ratings yet

- Summer Training Project ReportDocument13 pagesSummer Training Project ReportprateekNo ratings yet

- It 6001 Da 2 Marks With Answer PDFDocument10 pagesIt 6001 Da 2 Marks With Answer PDFkumar3544No ratings yet

- Big Data Internal 2 Answers-1-9Document9 pagesBig Data Internal 2 Answers-1-9TKKNo ratings yet

- Big Data Internal 2 AnswersDocument9 pagesBig Data Internal 2 AnswersTKKNo ratings yet

- Construction and Simulation of The Market Risk EarlyWarning Model Based On Deep Learning MethodsScientific ProgrammingDocument8 pagesConstruction and Simulation of The Market Risk EarlyWarning Model Based On Deep Learning MethodsScientific ProgrammingJairo Rafael Peralta MercadoNo ratings yet

- Project Team Report 13Document9 pagesProject Team Report 13Mukilan BaskaranNo ratings yet

- Parmar2018 PDFDocument3 pagesParmar2018 PDFAparna KambleNo ratings yet

- 2marks With AnswersDocument10 pages2marks With AnswerssangeethaNo ratings yet

- Stock Price Prediction Based On CNN-LSTM Model in The Pytorch EnvironmentDocument5 pagesStock Price Prediction Based On CNN-LSTM Model in The Pytorch Environment許嘖嘖No ratings yet

- Forecasting Stock Prices Using LSTM and Web Sentiment AnalysisDocument4 pagesForecasting Stock Prices Using LSTM and Web Sentiment AnalysisVipul SinghNo ratings yet

- Chapter 2 Project PythonDocument3 pagesChapter 2 Project PythonParas Mani MishraNo ratings yet

- A Project Report: Submitted in Partial Fulfillment For The Award of The Degree ofDocument18 pagesA Project Report: Submitted in Partial Fulfillment For The Award of The Degree ofShikhar GuptaNo ratings yet

- Pang2020 Article AnInnovativeNeuralNetworkApproDocument21 pagesPang2020 Article AnInnovativeNeuralNetworkApproRuheena SNo ratings yet

- Mathematics 09 00800Document21 pagesMathematics 09 00800Harsh MittalNo ratings yet

- Methodology: 3.1.1. News CollectionDocument6 pagesMethodology: 3.1.1. News CollectionPRONIR gamingNo ratings yet

- IRJET Price Prediction and Analysis of FDocument7 pagesIRJET Price Prediction and Analysis of Fanand.dhawaleNo ratings yet

- Stock Price Prediction Using Long Short Term Memory: International Research Journal of Engineering and Technology (IRJET)Document9 pagesStock Price Prediction Using Long Short Term Memory: International Research Journal of Engineering and Technology (IRJET)Amit SheoranNo ratings yet

- Stock Market Prediction Using Machine Learning Algorithms A Classification StudyDocument4 pagesStock Market Prediction Using Machine Learning Algorithms A Classification StudyrekhaNo ratings yet

- A Review of Machine Learning Algorithms For Cryptocurrency Price PredictionDocument9 pagesA Review of Machine Learning Algorithms For Cryptocurrency Price PredictionVIVA-TECH IJRINo ratings yet

- Financial Trends Prediction Using The Back Propagation Neural Network and YQLDocument6 pagesFinancial Trends Prediction Using The Back Propagation Neural Network and YQLpukkapadNo ratings yet

- Tan 2021 J. Phys. Conf. Ser. 1982 012013Document8 pagesTan 2021 J. Phys. Conf. Ser. 1982 012013Cosmin AntoheNo ratings yet

- Irjet V5i9192 PDFDocument6 pagesIrjet V5i9192 PDFPRSNo ratings yet

- Systems 10 00243 v3 PDFDocument31 pagesSystems 10 00243 v3 PDFzik1987No ratings yet

- Application of Fake News Detection in Stock Market Analyzer and Predictor Using Sentiment AnalysisDocument7 pagesApplication of Fake News Detection in Stock Market Analyzer and Predictor Using Sentiment Analysisalperen.unal89No ratings yet

- Long Short-Term Memory (LSTM) : 1. Problem StatementDocument6 pagesLong Short-Term Memory (LSTM) : 1. Problem StatementEmmanuel Lwele Lj JuniorNo ratings yet

- Stock Market Prediction Using Reinforcement Learning With Sentiment AnalysisDocument20 pagesStock Market Prediction Using Reinforcement Learning With Sentiment AnalysisJames MorenoNo ratings yet

- Fin Irjmets1676988272Document6 pagesFin Irjmets1676988272fawarah477No ratings yet

- 8317 PramodBSDocument7 pages8317 PramodBSAakash DebnathNo ratings yet

- ML InterviewDocument17 pagesML InterviewMarvel MoviesNo ratings yet

- Stock Price Predictions Using Machine Learning ModelsDocument11 pagesStock Price Predictions Using Machine Learning Modelstocilo5465No ratings yet

- Ijirt155690 PaperDocument6 pagesIjirt155690 PaperraghavNo ratings yet

- Which Artificial Intelligence Algorithm Better PreDocument10 pagesWhich Artificial Intelligence Algorithm Better Preadel.afettoucheNo ratings yet

- Draft 1 MidetermDocument15 pagesDraft 1 MidetermAmartyaNo ratings yet

- Application of Predictive Analytics in Volume Forecasting and Resource PlanningDocument69 pagesApplication of Predictive Analytics in Volume Forecasting and Resource PlanningVamsi KrishnaNo ratings yet

- Fnal+Report Advance+StatisticsDocument44 pagesFnal+Report Advance+StatisticsPranav Viswanathan100% (1)

- Shah Etal 2018 - IEEE 2018Document9 pagesShah Etal 2018 - IEEE 2018fortniteNo ratings yet

- Stock Market Analysis PDFDocument5 pagesStock Market Analysis PDFVrinda VashishthNo ratings yet

- Paper 3Document5 pagesPaper 3Muhammad Mustafa KhanNo ratings yet

- Paper 5Document11 pagesPaper 5MangeshNo ratings yet

- In Certain Applications Involving Big Data, Data Sets Get So Large and Complex That It Becomes Difficult ToDocument16 pagesIn Certain Applications Involving Big Data, Data Sets Get So Large and Complex That It Becomes Difficult ToASHUMENDRA YADAVNo ratings yet

- Operations Research Applications in The Field of Information and CommunicationDocument6 pagesOperations Research Applications in The Field of Information and CommunicationrushabhrakholiyaNo ratings yet

- Comparative Study of Financial Time Series Prediction by Artificial Neural Network With Gradient Descent LearningDocument8 pagesComparative Study of Financial Time Series Prediction by Artificial Neural Network With Gradient Descent LearningArka GhoshNo ratings yet

- BigData AssignmentDocument14 pagesBigData AssignmentPARNEET SAININo ratings yet

- Cao 2019Document13 pagesCao 2019Matheus LaranjaNo ratings yet

- Sustainability 10 03765Document18 pagesSustainability 10 03765teytjbberys2s6jt teytjbberys2s6jtNo ratings yet

- Stock Market Prediction Using Machine LearningDocument5 pagesStock Market Prediction Using Machine LearningragadeepikaNo ratings yet

- Novel Approaches To Sentiment Analysis For Stock PredictionDocument6 pagesNovel Approaches To Sentiment Analysis For Stock PredictionV.K. JoshiNo ratings yet

- Predicting Stock Price Movement Using Social Media Analysis: Derek TsuiDocument4 pagesPredicting Stock Price Movement Using Social Media Analysis: Derek Tsuipaul pauliNo ratings yet

- Modern Data Mining Algorithms in C++ and CUDA C: Recent Developments in Feature Extraction and Selection Algorithms for Data ScienceFrom EverandModern Data Mining Algorithms in C++ and CUDA C: Recent Developments in Feature Extraction and Selection Algorithms for Data ScienceNo ratings yet

- Advanced Analytics with Transact-SQL: Exploring Hidden Patterns and Rules in Your DataFrom EverandAdvanced Analytics with Transact-SQL: Exploring Hidden Patterns and Rules in Your DataNo ratings yet

- Ijcrti020009 3Document1 pageIjcrti020009 3modib38863No ratings yet

- Ijcrti020009 1Document1 pageIjcrti020009 1modib38863No ratings yet

- Ijcrti020009 2Document1 pageIjcrti020009 2modib38863No ratings yet

- Ijcrti020009 5Document1 pageIjcrti020009 5modib38863No ratings yet

- Unit IiDocument8 pagesUnit Iinikhilsinha789No ratings yet

- Question Bank DMCDocument28 pagesQuestion Bank DMCachal sahareNo ratings yet

- Qualcomm Ai Research Jester Download InstructionsDocument2 pagesQualcomm Ai Research Jester Download InstructionsisharkNo ratings yet

- Decision Tree AlgorithmDocument22 pagesDecision Tree Algorithmvani_V_prakashNo ratings yet

- Naive BayesDocument11 pagesNaive Bayescloud projectNo ratings yet

- SMS Spam Detection Using Machine LearningDocument9 pagesSMS Spam Detection Using Machine LearningNishant KhandharNo ratings yet

- DDOS in NMIMS TempDocument23 pagesDDOS in NMIMS Temp1132190193No ratings yet

- Seasonal Crops Disease Prediction and Classification Using Deep Convolutional Encoder NetworkDocument19 pagesSeasonal Crops Disease Prediction and Classification Using Deep Convolutional Encoder NetworkmulhamNo ratings yet

- 2nd YearDocument22 pages2nd YearMahendra Kumar PrajapatNo ratings yet

- XAI For Intrusion Detection System Comparing Explanations Based On Global and Local ScopeDocument23 pagesXAI For Intrusion Detection System Comparing Explanations Based On Global and Local Scopecuongduong172839No ratings yet

- Energetic Assessment of A Precalcining Rotary Kiln in A Cement Plant Using Process Simulator and Neural NetworksDocument14 pagesEnergetic Assessment of A Precalcining Rotary Kiln in A Cement Plant Using Process Simulator and Neural NetworksMarco HernandezNo ratings yet

- MCQs DL Mid I R20 2023 With AnswersDocument3 pagesMCQs DL Mid I R20 2023 With AnswersNaga vijayNo ratings yet

- Advances, Challenges and Opportunities in Creating Data For Trustworthy AIDocument9 pagesAdvances, Challenges and Opportunities in Creating Data For Trustworthy AIAhmed AlmasriNo ratings yet

- The Dark Net De-Anonymization, Classification and AnalysisDocument126 pagesThe Dark Net De-Anonymization, Classification and AnalysisclashroyaleNo ratings yet

- 1 s2.0 S0956713523004875 MainDocument8 pages1 s2.0 S0956713523004875 MainAARON BENJAMIN QUISPE ROMERONo ratings yet

- Disease Detection and Consultation Using Django and Machine LearningDocument9 pagesDisease Detection and Consultation Using Django and Machine LearningAschalew AyeleNo ratings yet

- DATA ACQUISITION NotesDocument3 pagesDATA ACQUISITION Notesrnimlik668No ratings yet

- Stress Detection Project Using Machine LearningDocument9 pagesStress Detection Project Using Machine LearningKrishna KumarNo ratings yet

- Proposal AIPHERDocument14 pagesProposal AIPHERvaheNo ratings yet

- Project Report (ML PRO)Document71 pagesProject Report (ML PRO)ajeyanajeyan3No ratings yet

- An Approach Based Iris Flower Species Recognition Using Machine Learning ClassifiersDocument7 pagesAn Approach Based Iris Flower Species Recognition Using Machine Learning Classifiers205 216 Lakshmi durgaNo ratings yet

- Amygda - Building Reusable and Flexible AI ModelsDocument9 pagesAmygda - Building Reusable and Flexible AI ModelsRaviteja ValluriNo ratings yet

- Machine Learning Section2 EbookDocument16 pagesMachine Learning Section2 EbookcamgovaNo ratings yet

- AliGalipSekeroglu GraduationProjectDocument14 pagesAliGalipSekeroglu GraduationProjectvojike2899No ratings yet

- HW 6Document2 pagesHW 6Dhroov PatelNo ratings yet

- Deep Adaptive Input NormalizationDocument7 pagesDeep Adaptive Input Normalizationyatipa cNo ratings yet

- Flower Recog SystemDocument11 pagesFlower Recog SystemESHAAN SONAVANENo ratings yet

- Small Data Machine Learning in Materials Science: Review ArticleDocument15 pagesSmall Data Machine Learning in Materials Science: Review Articleportatilcasca2No ratings yet

- Capstone Project Report (Digit-Recognition Using CNN)Document11 pagesCapstone Project Report (Digit-Recognition Using CNN)seenuNo ratings yet

- 03-Data Science MethodologyDocument8 pages03-Data Science MethodologyabdessalemdjoudiNo ratings yet