Professional Documents

Culture Documents

Ijcrti020009 5

Ijcrti020009 5

Uploaded by

modib38863Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ijcrti020009 5

Ijcrti020009 5

Uploaded by

modib38863Copyright:

Available Formats

www.ijcrt.

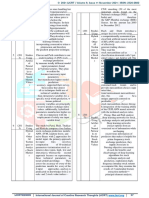

org © 2021 IJCRT | Volume 9, Issue 11 November 2021 | ISSN: 2320-2882

the RNNs through retaining information for older stages Firstly we import the required libraries like numpy

making the prediction more accurate Thus proving itself as ,pandas etc. then we load data and convert it into time series

much more reliable compared to other methods. data. Plotting of time series data is important to see the trend

Stock market involves processing of huge data, the and seasonality in data. After that splitting the data into

gradients with respect to the weight matrix may become very training and testing for evaluation purpose.

small and may degrade the learning rate. This corresponds to

the problem of Vanishing Gradient. LSTM prevents this from IV. CONCLUSION

happening. The LSTM consists of a remembering cell, input A. This paper provides a review on machine learning

gate, output gate and a forget gate. The cell remembers the techniques to predict share prices, In This review we

value for long term propagation and the gates regulate them. have surveyed an articles that have used artificial neural

network (ANN) and support vector machine (SVM) as a

D. Autoregressive Integrated Moving Average (ARIMA) forecasting model for stock prices. We also used LSTM

model algorithm, Linear Regression algorithm. LSTM

ARIMA model is short form of Autoregressive Integrated and Regression, on the Yahoo finance dataset. Both the

Moving Average. It is a class of models that 'explains' a techniques have shown an improvement in the accuracy

given time series based on its own past values, that is, its own of predictions, thereby yielding positive results. Use of

lags and the lagged forecast errors, so that equation can be recently introduced machine learning techniques in the

used to forecast future values. It converts non-stationary data prediction of stocks have yielded promising results and

into stationary data. thereby marked the use of them in profitable exchange

ARIMA is divided into three parts i.e. Auto schemes. It has led to the conclusion that it is possible to

Regression(AR), Integrated(I) and Moving Average(MA). predict stock market with more accuracy and efficiency

Auto Regression shows a regresses on its own lagged, or using machine learning techniques.

prior, values which is changing variables. Integrated shows

he differencing of raw observations to allow for the time

series to become stationary, i.e., data values are replaced by

the difference between the data values and the previous V. REFERENCES

values. Moving Average incorporates the dependency [1] National Stock Exchange

between an observation and a residual error from a moving https://www.nseindia.com/

average model applied to lagged observations. [2] Bombay Stock Exchange

https://www.bseindia.com/

[3] Stock market prediction using machine learning approach

https:// www.ijies.net/finial-docs/finial-pdf/220519CS11/

[4] API Keys

https:// www.alphavantage.co2

[5] Stock Market Prediction Using Artificial Neural

Networks

http://citeseerx.ist.psu.edu/viewdoc/download?doi=10.1.1.1

34.1114&rep=rep1&type=pdf/

[6] Stock market prediction using supervised machine

learning techniques

https://www.computer.org/csdl/proceedings-

article/csde/2020/09411609/1taFeSM9YBy/

[7] M. Usmani, S. H. Adil, K. Raza and S. S. A. Ali, "Stock

market prediction using machine learning techniques," 2016

3rd International Conference on Computer and Information

Sciences (ICCOINS)

https:// scialert.net/fulltext/?doi=jai.2018.48.54/

[8] "Regression techniques for the prediction of stock price

trend," 2012 International Conference on Statistics in

Science, Business and Engineering (ICSSBE)

https://ieeexplore.ieee.org/document/6396535/

[9] LSTM and Regression Methods for Stock Market

Prediction

ARIMA consists of three parameters which is nothing but p,

https://www.ijcrt.org/papers/IJCRT2005021.pdf

d and q. Where p stands for lag observation in model also

[10] Stock transaction prediction modeling and analysis

known as the lag model, d stands for the number of times that

based on LSTM

the raw observations are differenced; also known as the

https://www.researchgate.net/publication/326050300_Stock

degree of differencing and q stands for the size of the moving

_transaction_prediction_modeling_and_analysis_based_on_

average window; also known as the order of the moving

LSTM

average.

[11] Stock Price Prediction Using the ARIMA Model

https://ieeexplore.ieee.org/document/7046047

IJCRTI020009 International Journal of Creative Research Thoughts (IJCRT) www.ijcrt.org 39

You might also like

- Data Collection and Analysis PDFDocument353 pagesData Collection and Analysis PDFHallelujah TubeNo ratings yet

- Stock Price Prediction Using LSTM Model and DashDocument5 pagesStock Price Prediction Using LSTM Model and DashIJRASETPublications100% (1)

- Time Series Analysis With RDocument6 pagesTime Series Analysis With RGregorio MendozaNo ratings yet

- Report On Cost EstimationDocument41 pagesReport On Cost EstimationTuhin SamirNo ratings yet

- Activity Analysis, Cost Behavior and Cost Estimation SolutionDocument62 pagesActivity Analysis, Cost Behavior and Cost Estimation Solutionkayetrish86% (14)

- Prediction of Stock Market Using Machine Learning AlgorithmsDocument12 pagesPrediction of Stock Market Using Machine Learning AlgorithmsterranceNo ratings yet

- Stock Price Prediction Using Arima Forecasting and LSTM Based Forecasting, Competitive AnalysisDocument7 pagesStock Price Prediction Using Arima Forecasting and LSTM Based Forecasting, Competitive AnalysisIJRASETPublicationsNo ratings yet

- Airfare SynopsisDocument6 pagesAirfare SynopsisDanamma MirjiNo ratings yet

- Machine Learning ModelDocument8 pagesMachine Learning ModelShrishti HoreNo ratings yet

- Machine Learning PriceDocument8 pagesMachine Learning PriceSergio AymiNo ratings yet

- A Machine Learning Model For Stock Market Prediction: December 2013Document8 pagesA Machine Learning Model For Stock Market Prediction: December 2013Deevansh Mehta100% (1)

- Stock Price Prediction Website Using Linear RegresDocument10 pagesStock Price Prediction Website Using Linear RegresTiến Anh NguyễnNo ratings yet

- Group Id 2. Project Title 3. Project Option 4. Internal Guide 5. Sponsorship and External Guide 6. Technical Keywords (As Per ACM Keywords)Document3 pagesGroup Id 2. Project Title 3. Project Option 4. Internal Guide 5. Sponsorship and External Guide 6. Technical Keywords (As Per ACM Keywords)Pawankumar KhetreNo ratings yet

- Copie Article PfeDocument4 pagesCopie Article PfeMohamed RachdiNo ratings yet

- IEEEDocument9 pagesIEEERishabh KhetanNo ratings yet

- 17SCSE121004 - RAHUL NARAYAN TYAGI PROJECT 1 - Rahul Narayan TyagiDocument22 pages17SCSE121004 - RAHUL NARAYAN TYAGI PROJECT 1 - Rahul Narayan TyagiSuneet KhareNo ratings yet

- Elasticsimmate: A Fast and Accurate Gem5 Trace-Driven Simulator For Multicore SystemsDocument9 pagesElasticsimmate: A Fast and Accurate Gem5 Trace-Driven Simulator For Multicore Systemsshukri aden madeyNo ratings yet

- A Machine Learning Model For Stock Market Prediction: December 2013Document8 pagesA Machine Learning Model For Stock Market Prediction: December 2013GoofyNo ratings yet

- Fin Irjmets1681823617 PDFDocument6 pagesFin Irjmets1681823617 PDFappuNo ratings yet

- 05.stock Market Prediction UsingDocument4 pages05.stock Market Prediction Usingkamran raiysatNo ratings yet

- 2019 - Machine Learning (6) (Teori)Document10 pages2019 - Machine Learning (6) (Teori)Rosnani Ginting TBANo ratings yet

- Speed, Direction, Color and Type Identification of NHAI Expansions Using Deep LearningDocument7 pagesSpeed, Direction, Color and Type Identification of NHAI Expansions Using Deep LearningIJRASETPublicationsNo ratings yet

- Stock Market Prediction Using LSTMDocument7 pagesStock Market Prediction Using LSTMIJRASETPublications100% (1)

- Nandini Project ReportDocument55 pagesNandini Project Reportvijay kumar nNo ratings yet

- 19 Stock Price Trend Predictionusing Multiple Linear RegressionDocument6 pages19 Stock Price Trend Predictionusing Multiple Linear Regressionnhoxsock8642No ratings yet

- Overview On Data Mining Schemes To Design Business Intelligence Framew Ork For Mobile TechnologyDocument6 pagesOverview On Data Mining Schemes To Design Business Intelligence Framew Ork For Mobile Technologykhan.pakiNo ratings yet

- Stock Market Prediction Using Machine Learning: December 2018Document4 pagesStock Market Prediction Using Machine Learning: December 2018shauryaNo ratings yet

- Stockmarket Analysis Using Map Reduce and Py SparkDocument12 pagesStockmarket Analysis Using Map Reduce and Py SparkPriyank KushwahaNo ratings yet

- A Novel Evaluation Approach ToDocument13 pagesA Novel Evaluation Approach ToAIRCC - IJNSANo ratings yet

- Complete Panoptic Traffic Recognition System With Ensemble of YOLO Family ModelsDocument9 pagesComplete Panoptic Traffic Recognition System With Ensemble of YOLO Family ModelsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Art 20174805Document11 pagesArt 20174805aymenNo ratings yet

- Clustering-Classification Based Prediction of Stock Market Future PredictionDocument4 pagesClustering-Classification Based Prediction of Stock Market Future PredictionAnkitNo ratings yet

- Application of Machine Learning in Internet of Things (IoTs)Document8 pagesApplication of Machine Learning in Internet of Things (IoTs)IJRASETPublicationsNo ratings yet

- Machine Learning Platform Design and Application Based On SparkProceedings of SPIE The International Society For Optical EngineeringDocument6 pagesMachine Learning Platform Design and Application Based On SparkProceedings of SPIE The International Society For Optical EngineeringFerdaous HdioudNo ratings yet

- A Flight Fare Prediction Using Machine LearningDocument8 pagesA Flight Fare Prediction Using Machine LearningIJRASETPublicationsNo ratings yet

- Project Report - Payal KatariaDocument53 pagesProject Report - Payal KatariaNeha MishraNo ratings yet

- Analysis of Trends in Stock MarketDocument10 pagesAnalysis of Trends in Stock MarketIJRASETPublications100% (1)

- Application of Data Acquisition and Telemetry System Into A Solar VehicleDocument6 pagesApplication of Data Acquisition and Telemetry System Into A Solar VehicleJosé Manuel Mendes GasparNo ratings yet

- Stock Market Prediction Using Machine Learning: December 2018Document4 pagesStock Market Prediction Using Machine Learning: December 2018Akash GuptaNo ratings yet

- Index: S.No. Particulars Page NoDocument30 pagesIndex: S.No. Particulars Page NoAnuj TiwariNo ratings yet

- Comparative Analysis of Time-Series Forecasting Algorithms For Stock Pice Prediction 2019Document6 pagesComparative Analysis of Time-Series Forecasting Algorithms For Stock Pice Prediction 2019nurdi afriantoNo ratings yet

- A Hybrid Model To Forecast Stock Trend UDocument8 pagesA Hybrid Model To Forecast Stock Trend URam KumarNo ratings yet

- Fligh Price PaperDocument6 pagesFligh Price PaperV Rajendra Kumar RKNo ratings yet

- Parmar2018 PDFDocument3 pagesParmar2018 PDFAparna KambleNo ratings yet

- Analysis of Stock Price Prediction Using ML TechniquesDocument7 pagesAnalysis of Stock Price Prediction Using ML TechniquesIJRASETPublications100% (1)

- Algorithmic Trading Stock Price ModelDocument9 pagesAlgorithmic Trading Stock Price ModelIJRASETPublications100% (1)

- Dynamic Price Prediction Using IBM Watson StudioDocument7 pagesDynamic Price Prediction Using IBM Watson StudioIJRASETPublicationsNo ratings yet

- Artificial Intelligence Based Stock Market Prediction Model Using Technical IndicatorsDocument8 pagesArtificial Intelligence Based Stock Market Prediction Model Using Technical IndicatorsEditor IJTSRDNo ratings yet

- A - Deep - Learning - Model - For - Smart - Manufacturing - Using - Convolutional - LSTM - Neural - Network - Autoencoders OkDocument10 pagesA - Deep - Learning - Model - For - Smart - Manufacturing - Using - Convolutional - LSTM - Neural - Network - Autoencoders OkFerry amirulNo ratings yet

- Ijaerv13n10 102Document9 pagesIjaerv13n10 102Oluwatomisin PreciliaNo ratings yet

- Stock Closing Price Prediction Using Machine Learning SVM ModelDocument7 pagesStock Closing Price Prediction Using Machine Learning SVM ModelIJRASETPublications100% (1)

- Airlines Reservation SystemDocument30 pagesAirlines Reservation Systemmonalisha aggarwalNo ratings yet

- Prediction of Stock Market Prices Using Machine Learning-1Document17 pagesPrediction of Stock Market Prices Using Machine Learning-1errorfinder22No ratings yet

- Spatio-Temporal Summarized Multi-ViewDocument20 pagesSpatio-Temporal Summarized Multi-ViewUlugbek KhamdamovNo ratings yet

- Traffic Sign Detection Using Yolo v5Document7 pagesTraffic Sign Detection Using Yolo v5IJRASETPublicationsNo ratings yet

- An Effective Approach For Load Balancing and ResouDocument13 pagesAn Effective Approach For Load Balancing and ResouRABINA BAGGANo ratings yet

- Algorithmic Financial Trading With Deep CNN PreprintDocument30 pagesAlgorithmic Financial Trading With Deep CNN Preprintquoc tuNo ratings yet

- Latest Tools For Data Mining and MachineDocument6 pagesLatest Tools For Data Mining and Machinebasirma.info.officer.2017No ratings yet

- Deepak Stock PaperDocument6 pagesDeepak Stock PaperthumuvsreddyNo ratings yet

- A Machine Learning Model For Flight Delay Prediction: CertificateDocument17 pagesA Machine Learning Model For Flight Delay Prediction: CertificateRamesh KumarNo ratings yet

- Evaluation of Auto Scaling and Load Balancing FeatDocument5 pagesEvaluation of Auto Scaling and Load Balancing FeatBarry AllenNo ratings yet

- Stock Market Prediction Using Machine Learning AlgorithmsDocument7 pagesStock Market Prediction Using Machine Learning AlgorithmsAkash GuptaNo ratings yet

- Ijcrti020009 4Document1 pageIjcrti020009 4modib38863No ratings yet

- Ijcrti020009 3Document1 pageIjcrti020009 3modib38863No ratings yet

- Ijcrti020009 1Document1 pageIjcrti020009 1modib38863No ratings yet

- Ijcrti020009 2Document1 pageIjcrti020009 2modib38863No ratings yet

- 1 Forecasting-QuestionsDocument4 pages1 Forecasting-QuestionsUsman FarooqNo ratings yet

- ECO4000 SyllabusDocument10 pagesECO4000 SyllabusshakeraojNo ratings yet

- Least-Squares Regression in Cost Estimation: FormulasDocument4 pagesLeast-Squares Regression in Cost Estimation: FormulasIsmael AbbasNo ratings yet

- Lev&Thiagaraian 1993JARDocument27 pagesLev&Thiagaraian 1993JARBeeHoofNo ratings yet

- 325unit 1 Simple Regression AnalysisDocument10 pages325unit 1 Simple Regression AnalysisutsavNo ratings yet

- Impact of Macroeconomic Variables On The Stock Market Prices of The Stockholm Stock ExchangeDocument48 pagesImpact of Macroeconomic Variables On The Stock Market Prices of The Stockholm Stock ExchangePiklooBear100% (1)

- Itae002 Test 2Document150 pagesItae002 Test 2Nageshwar SinghNo ratings yet

- 道德、经济、数量、组合、固收、衍生Document170 pages道德、经济、数量、组合、固收、衍生Ariel MengNo ratings yet

- Advanced Intelligent Systems For Sustainable Development AI2SD 2018 Vol 3 Advanced Intelligent Systems Applied To Environment Mostafa EzziyyaniDocument54 pagesAdvanced Intelligent Systems For Sustainable Development AI2SD 2018 Vol 3 Advanced Intelligent Systems Applied To Environment Mostafa Ezziyyanitammy.lourentzos986100% (4)

- History of Regression: Dr. Deepak Mehta Associate Professor Ait CseDocument16 pagesHistory of Regression: Dr. Deepak Mehta Associate Professor Ait Csemudit nNo ratings yet

- Final Requirement FIN 004 Group 3Document80 pagesFinal Requirement FIN 004 Group 3Can't think of any namesNo ratings yet

- CH 12Document30 pagesCH 12Yash DarajiNo ratings yet

- Climate Change Impacts in The Design of Drainage Systems: Case Study of PortugalDocument38 pagesClimate Change Impacts in The Design of Drainage Systems: Case Study of PortugalCotuinio FerreroNo ratings yet

- Simple Linear Regression - Assignn5Document8 pagesSimple Linear Regression - Assignn5Sravani AdapaNo ratings yet

- Chapter 1. Introduction and Review of Univariate General Linear ModelsDocument25 pagesChapter 1. Introduction and Review of Univariate General Linear Modelsemjay emjayNo ratings yet

- LP-III Lab ManualDocument49 pagesLP-III Lab ManualNihal GujarNo ratings yet

- CHAPTER 3 Multiple Linear RegressionDocument35 pagesCHAPTER 3 Multiple Linear RegressionFakhrulShahrilEzanieNo ratings yet

- Does Psychological Capital and Social Support Impact Burnout in Online Distance Learning StudentsDocument9 pagesDoes Psychological Capital and Social Support Impact Burnout in Online Distance Learning Studentsalifianda qistiNo ratings yet

- Correlation and RegressionDocument37 pagesCorrelation and RegressionLloyd LamingtonNo ratings yet

- Nina Weighed A Random Sample of 50 Carrots From Her Shop and Recorded The Weight, inDocument20 pagesNina Weighed A Random Sample of 50 Carrots From Her Shop and Recorded The Weight, inHalal BoiNo ratings yet

- Gellish 2007Document8 pagesGellish 2007siputu panditNo ratings yet

- 1 s2.0 S2352484723013422 MainDocument13 pages1 s2.0 S2352484723013422 MainAkray AchseinNo ratings yet

- D 5720-95Document9 pagesD 5720-95ipkm123No ratings yet

- Breast Cancer Aiml ProjectDocument25 pagesBreast Cancer Aiml Project2203a52222No ratings yet

- Solar Power Prediction Using Machine LearningDocument7 pagesSolar Power Prediction Using Machine LearningA PuNo ratings yet

- A Correlation Analysis On Chlorophyll Content and SPAD Value in Tomato LeavesDocument6 pagesA Correlation Analysis On Chlorophyll Content and SPAD Value in Tomato LeavesPablo Cesar Serrano AgudeloNo ratings yet

- Chapter 14 Forecasting: Operations Management: Processes and Supply Chains, 10e (Krajewski Et Al.)Document64 pagesChapter 14 Forecasting: Operations Management: Processes and Supply Chains, 10e (Krajewski Et Al.)Ahmad JundiNo ratings yet