Professional Documents

Culture Documents

Loan Sanction Letter

Loan Sanction Letter

Uploaded by

asmotorsghugus01Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Loan Sanction Letter

Loan Sanction Letter

Uploaded by

asmotorsghugus01Copyright:

Available Formats

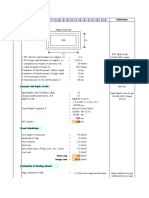

MAS Financial Services Limited

6, Ground Floor, Narayan Chambers, B/H Patang Hotel, Phone No.: 079‐41106500

Ashram Road, Ahmedabad : 380009 Website: www.mas.co.in

SANCTION LETTER

Date: 24/04/2024

To,

Devanand Shamrao Jogi

H NO 4885 SAI NAGAR, WARD NO 06 GHUGUS,

NEAR HANUMAN MANDIR, CHANDRAPUR,

CHANDRAPUR, MAHARASHTRA ‐ 442502

Subject : Sanction of your NEW TWO WHEELER Loan

Dear Sir / Madam,

With reference to your application no. TW2678506, we are pleased to inform you that your loan has been approved, subject to the terms & conditions given below:

Nature Of Facility NEW TWO WHEELER

Loan Amount (in INR) 77,697.00

Interest Rate (% Per Annum) 20.55

EMI (in INR) 2909

Gross Tenure (In Months) 36

Advance EMI ( In Months) 0

Net Tenure (In Months) 36

Processing Fees (in INR) 815.00

Disbursement In Favor Of Anjikar Automobiles Llp ‐Chandrapur ‐ Sa741

Credit Life Premium (in INR) 624.00

EMI Protection Premium (in INR) 685.00

Upfront Charges + GST (in INR) 2099.00

Primary – 1st Charge over asset created

Security

Secondary – Security PDCs

Co‐Applicant Name (if Applicable) ‐

Guarantor Name (if Applicable) ‐

Default Charges/Bounce Charges (in INR) 650/‐ for EMI <= 7500/‐ and 1250/‐ for EMI > 7500/‐

Delay of EMI because of non‐registration of

650/‐ for EMI <= 7500/‐ and 1250/‐ for EMI > 7500/‐

NACH/ECS Mandate(in INR)

Penal Interest/Late Payment Charges 36% p.a. on default amount would be levied from the date of default till customer pays the amount due

Vehicle Seizing Charges (in INR) Two‐Wheeler – 4500/‐

Any other material breach of terms and condition

36% p.a. on default amount from the date of default till customer regularises the breach

of loan, including Event of Default

Prepayment/Foreclosure Charges (in INR) 4% of the loan outstanding

Documents to be submitted before disbursement :

1. NACH Mandate Activated + Security PDCs (as per policy)

2. Any other requisite documents. (as required by the company)

3. Dealer Documents : Invoice, Insurance

4. Credit Life insurance and other insurance as per loan amount and age. (if applicable)

Set of agreement to be signed by the applicant, co‐applicant/s & guarantor

All documents should be self‐attested with OSV done by a MAS official

The risk premium is decided on a case to case basis as determined by the company. To check the approach for gradation of risk, please visit our website

mas.co.in.

For Refinance & Repurchase cases, the registration with MAS hypothecation has to be submitted within 45 days from the date of this letter.

New vehicle owners are requested to share the registration number either within 30 days of the disbursal of their loan or within 7 days of the receipt of the

registration number, whichever is earlier, on the below mentioned contact number. Failure to do so would attract a penalty.

MFSL shall release all the original movable/immovable property documents and remove charges registered with any registry by visiting Registrar’s Office

along with the customer, within a period of 30 days after full repayment/settlement of the loan account. The borrower shall have the option of collecting

the original movable/immovable property documents either from the branch where the loan account was serviced or the office of MFSL where the

documents are available.

The above charges are excluding any applicable taxes such as GST/TDS etc. The additional tax would be levied as per statutory norms.

This Sanction Letter is valid for 30 Days from the date of issue.

For regional language template of loan agreement, please visit our website www.mas.co.in.

For further details regarding your loan account, kindly contact us on 079‐49137777 or mail us at response@mas.co.in.

We look forward to our long term mutually beneficial relationship.

Thanking you,

MAS Financial Services Limited

It is System generated letter and therefore does not require any signature

You might also like

- Sanction Letter V2Document3 pagesSanction Letter V2SRINIVASREDDY PIRAMALNo ratings yet

- Premium ReceiptDocument1 pagePremium ReceiptVivekanand Gupta0% (2)

- Sanctionletter 10045975 29-8-2023 113638Document3 pagesSanctionletter 10045975 29-8-2023 113638greenrootfinancialservicesNo ratings yet

- 803 20200218 111928 PDFDocument7 pages803 20200218 111928 PDFlaxmangosavi100% (1)

- K-TRON Digi DriveDocument48 pagesK-TRON Digi DriveIvan100% (1)

- Premium Receipt - 008927742 - 131423Document2 pagesPremium Receipt - 008927742 - 131423Vignesh MahadevanNo ratings yet

- Legal NoticeDocument2 pagesLegal NoticeAjay rawatNo ratings yet

- DHFL Sanction LetterDocument6 pagesDHFL Sanction LetterRamesh Kulkarni75% (4)

- Renewal ReceiptDocument1 pageRenewal ReceiptAnkit SinghNo ratings yet

- Confirmation PDFDocument2 pagesConfirmation PDFAtiq khanNo ratings yet

- Bajaj Cash Assure Renewal Receipt PDFDocument1 pageBajaj Cash Assure Renewal Receipt PDFPawan KumarNo ratings yet

- Asme B18.2.2 - 2010Document40 pagesAsme B18.2.2 - 2010leandro_estudo100% (1)

- 3045TW0057673Document2 pages3045TW0057673Amit KumarNo ratings yet

- Sanction Letter FAST7651617444854859 371328176989144Document7 pagesSanction Letter FAST7651617444854859 371328176989144hm7072302No ratings yet

- Commercial Motor Passenger CarryingDocument14 pagesCommercial Motor Passenger Carryingromeoahmed687No ratings yet

- Kannadasan K SbiDocument14 pagesKannadasan K Sbijayantha InsuranceNo ratings yet

- Personal Nivedhitha N Narayana Swamy Saradhamani 1995-07-09 Female Single Private Employee Indian Indian CBBPN3910N Paperlessaadhaar PermanentDocument29 pagesPersonal Nivedhitha N Narayana Swamy Saradhamani 1995-07-09 Female Single Private Employee Indian Indian CBBPN3910N Paperlessaadhaar PermanentnavaneethakrishnanNo ratings yet

- Adroit Auto: Mob No:8178259898 Sub: Offer LetterDocument2 pagesAdroit Auto: Mob No:8178259898 Sub: Offer LetterSunny SharmaNo ratings yet

- LXS C09023 242379575 - Terms & ConditionsDocument22 pagesLXS C09023 242379575 - Terms & ConditionsnehainverterbatteryNo ratings yet

- Bishram Singh (Ssa)Document16 pagesBishram Singh (Ssa)Akhand SinghNo ratings yet

- Policy Document BajajAllianz General InsuranceDocument5 pagesPolicy Document BajajAllianz General InsurancealirezadoctorNo ratings yet

- FD ReceiptDocument2 pagesFD ReceiptRaghavendra KumarNo ratings yet

- Duplicate Receipt Dear Sandip KamaniDocument2 pagesDuplicate Receipt Dear Sandip KamaniSandip PatelNo ratings yet

- KT 1070169204Document4 pagesKT 1070169204shivu patilNo ratings yet

- CE Cashback Program - Oct 22Document8 pagesCE Cashback Program - Oct 22Kamal SharmaNo ratings yet

- HL - Pni - V1 - NTR - 3596132948944013913 - NTR - 7818877607244788448 - 11Document2 pagesHL - Pni - V1 - NTR - 3596132948944013913 - NTR - 7818877607244788448 - 11KanakaReddyKannaNo ratings yet

- Long Term SheetDocument8 pagesLong Term SheetZabid khanNo ratings yet

- Sanction Letter V4Document2 pagesSanction Letter V4DaMoN0% (1)

- Early Termination QuoteDocument1 pageEarly Termination QuoteagrahulNo ratings yet

- Sanction 4Document4 pagesSanction 4ParinithNo ratings yet

- Bajaj Allianz General Insurance Company Ltd. Bajaj Allianz House, Airport Road, Yerawada, Pune - 411006 Group Personal Accident Policy ScheduleDocument2 pagesBajaj Allianz General Insurance Company Ltd. Bajaj Allianz House, Airport Road, Yerawada, Pune - 411006 Group Personal Accident Policy Schedulehari bharadwajNo ratings yet

- FD ReceiptDocument2 pagesFD Receiptthetrilight2023No ratings yet

- OfferLetter 712470 31012024 9928 638423112048934621Document6 pagesOfferLetter 712470 31012024 9928 638423112048934621My ArchitectNo ratings yet

- Dear Karthik P,: Policy DetailsDocument5 pagesDear Karthik P,: Policy DetailsKarthik PandianNo ratings yet

- Commercial Motor Goods CarryingDocument17 pagesCommercial Motor Goods CarryingADHAR SHARMANo ratings yet

- HL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448Document2 pagesHL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448KanakaReddyKannaNo ratings yet

- Loan Term Sheet - 09 - 50 - 35Document13 pagesLoan Term Sheet - 09 - 50 - 35Kumar SaurabhNo ratings yet

- 20875366Document1 page20875366tahamasoodiNo ratings yet

- LXS-H09023-242564415 - Terms & ConditionsDocument23 pagesLXS-H09023-242564415 - Terms & Conditionsdewic29037No ratings yet

- Sanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001Document7 pagesSanction Letter: Shop No 7 11 C Prince Plaza Sneha Nagar, Indore Indore, Madhya Pradesh, 452001NISHA BANSALNo ratings yet

- Legal Notice 2006397 XXXXXXXXXX6392 PDFDocument2 pagesLegal Notice 2006397 XXXXXXXXXX6392 PDFAyush KumarNo ratings yet

- Sanction LetterDocument1 pageSanction LetterShivraj JaiswarNo ratings yet

- SWATI SBI - OrganizedDocument5 pagesSWATI SBI - OrganizedVinod MNo ratings yet

- POCMVPC0100108319Document14 pagesPOCMVPC0100108319BIKRAM KUMAR BEHERANo ratings yet

- One Pager AgreementDocument2 pagesOne Pager Agreementselva9404368No ratings yet

- Commercial Motor Goods CarryingDocument17 pagesCommercial Motor Goods CarryingAbhay SrivastavaNo ratings yet

- Presentation On Manappuram Gold Finance by Indu & Sheena of GRGSMS, Cbe.Document26 pagesPresentation On Manappuram Gold Finance by Indu & Sheena of GRGSMS, Cbe.indukanna143100% (1)

- Commercial Motor Goods CarryingDocument14 pagesCommercial Motor Goods CarryingJANAKI BABJEENo ratings yet

- WLC LTRDocument6 pagesWLC LTRraghu INo ratings yet

- Dear Prakash Chandra Sharma,: Policy DetailsDocument5 pagesDear Prakash Chandra Sharma,: Policy DetailsShivam SharmaNo ratings yet

- Po CMV PC 0100045555Document15 pagesPo CMV PC 0100045555Vishal Singh RathourNo ratings yet

- Bajaj Finance LTD: Ganesh So UdaymalDocument4 pagesBajaj Finance LTD: Ganesh So UdaymalYASH PATNINo ratings yet

- Preview AgreementDocument11 pagesPreview Agreementasoukot84No ratings yet

- 80C Relience InsuranceDocument1 page80C Relience Insuranceshailesh.kumarNo ratings yet

- Welcome Letter 193521762Document3 pagesWelcome Letter 193521762Deeptej Singh MatharuNo ratings yet

- HL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448 NTR 2643578978408764679 NTR 4658264169499347647Document2 pagesHL Pni V1 NTR 3596132948944013913 NTR 7818877607244788448 NTR 2643578978408764679 NTR 4658264169499347647G “Vijay Ramesh” RameshNo ratings yet

- Welcomeletter Ka3024cd0401313Document9 pagesWelcomeletter Ka3024cd0401313davalmobile25No ratings yet

- Bajaj FinservDocument3 pagesBajaj FinservManmeet KumarNo ratings yet

- Loan Agreement 402a55f2 Cecb 4a30 Bcf8 7d7f4427f940Document24 pagesLoan Agreement 402a55f2 Cecb 4a30 Bcf8 7d7f4427f940Henil BaldhaNo ratings yet

- Shriram Transport Finance Co. LTD Unnati FD - SanriyaDocument4 pagesShriram Transport Finance Co. LTD Unnati FD - Sanriyasudeshna palitNo ratings yet

- Business LoanDocument6 pagesBusiness Loansandeep Kumar Dubey100% (1)

- Payment Acknowledgement 321835305Document1 pagePayment Acknowledgement 321835305sanjeevkumar.141.ssNo ratings yet

- Agent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaFrom EverandAgent Banking Uganda Handbook: A simple guide to starting and running a profitable agent banking business in UgandaNo ratings yet

- CS 301 - Lecture 5 Regular Grammars, Regular Languages, and Properties of Regular Languages ReviewDocument16 pagesCS 301 - Lecture 5 Regular Grammars, Regular Languages, and Properties of Regular Languages ReviewFitawu TekolaNo ratings yet

- Budget and Budgetary Control - HeritageDocument10 pagesBudget and Budgetary Control - HeritageMohmmedKhayyumNo ratings yet

- ControlLogix M580 v.2Document20 pagesControlLogix M580 v.2Benoit GalarneauNo ratings yet

- Forensic PhotographyDocument3 pagesForensic PhotographyRonalyn PaunalNo ratings yet

- On Board NotationDocument12 pagesOn Board NotationChi Duc NgoNo ratings yet

- Secure Architecture PrinciplesDocument67 pagesSecure Architecture Principlessalim ucarNo ratings yet

- GOOGLE INDIA PRIVATE LIMITED v. VISHAKA INDUSTRIESDocument148 pagesGOOGLE INDIA PRIVATE LIMITED v. VISHAKA INDUSTRIESIshita TomarNo ratings yet

- Explorations in Language Acquisition and Use: The Taipei Lectures by Stephen D. KrashenDocument22 pagesExplorations in Language Acquisition and Use: The Taipei Lectures by Stephen D. KrashenGuy Colvin67% (3)

- Field Behaviour of Stiffened Deep Cement Mixing PilesDocument17 pagesField Behaviour of Stiffened Deep Cement Mixing PilesNguyen Quoc KhanhNo ratings yet

- Unthinkable Passage With Solution ArgumentativeDocument3 pagesUnthinkable Passage With Solution ArgumentativeChaudhuri Misavvir Asif 2122170630No ratings yet

- Centrífuga Thermo Cl40 Cl40r (Manual de Servicio)Document44 pagesCentrífuga Thermo Cl40 Cl40r (Manual de Servicio)Diego Alonso SanchezNo ratings yet

- Sophomore English ModuleDocument157 pagesSophomore English ModuleYohannes Alemayehu93% (14)

- Design of A MSF Desalination Plant To Be Supplied by A New Specific 42 MW Power Plant Located in IranDocument7 pagesDesign of A MSF Desalination Plant To Be Supplied by A New Specific 42 MW Power Plant Located in Iranayman jummaNo ratings yet

- 4400 BrochureDocument12 pages4400 BrochureBoca JuniorNo ratings yet

- DESIGN OF SLAB - ContdDocument4 pagesDESIGN OF SLAB - ContdmeenuNo ratings yet

- Effectiveness of Communicative Language Teaching in Business English Živorad NinkovićDocument22 pagesEffectiveness of Communicative Language Teaching in Business English Živorad NinkovićYesicaManurungNo ratings yet

- Ge22 (Edp Syllabus Summer)Document4 pagesGe22 (Edp Syllabus Summer)Daisy Jean Abas CastilloNo ratings yet

- Management Funda UNIT II MCQDocument3 pagesManagement Funda UNIT II MCQTarunNo ratings yet

- Feed and FeedstuffsDocument60 pagesFeed and Feedstuffspaineir103185No ratings yet

- Full Download Foundations of Finance 9Th Edition Keown Solutions Manual PDFDocument49 pagesFull Download Foundations of Finance 9Th Edition Keown Solutions Manual PDFpaul.martin924100% (15)

- MNG3701 Learning Unit 2 PDFDocument27 pagesMNG3701 Learning Unit 2 PDFKhathutshelo KharivheNo ratings yet

- DVT and PeDocument25 pagesDVT and PeOmar AbdillahiNo ratings yet

- Exm 2017Document16 pagesExm 2017Stuff Newsroom50% (2)

- Student Text Homework Helper: Unit 1Document216 pagesStudent Text Homework Helper: Unit 1Faist Name Last NameNo ratings yet

- Pictorial List of Space Marine Chapters (A-L) : Welcome To The Grim Dark!Document94 pagesPictorial List of Space Marine Chapters (A-L) : Welcome To The Grim Dark!Lucas Lima FerreiraNo ratings yet

- Unforgiven by Lauren KateDocument38 pagesUnforgiven by Lauren KateRandom House Kids100% (7)

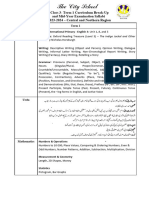

- 'Class 3 Term 1 Curriculum Break Up and MYE Syallabi CR-NRDocument2 pages'Class 3 Term 1 Curriculum Break Up and MYE Syallabi CR-NRManahil ImranNo ratings yet