Professional Documents

Culture Documents

PM02CMBA52 Managerial Accounting-II

PM02CMBA52 Managerial Accounting-II

Uploaded by

Jenish patelCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PM02CMBA52 Managerial Accounting-II

PM02CMBA52 Managerial Accounting-II

Uploaded by

Jenish patelCopyright:

Available Formats

SARDAR PATEL UNIVERSITY

Vallabh Vidyanagar, Gujarat

(Reaccredited with ‘A’ Grade by NAAC (CGPA 3.25)

Syllabus with effect from the Academic Year 2021-2022

M.B.A. Semester II

PM02CMBA52: MANAGERIAL ACCOUNTING-II

Course Code Title of the Managerial Accounting-II

PM02CMBA52

Course

Total Credits Hours per 04

04

of the Course Week

Course • To impart conceptual knowledge of core concepts of Managerial

Objectives: Accounting.

• Provide practical experience of managerial accountants' skills,

decision-making by analyzing different alternatives.

Course Content: 30 sessions

Unit Description Weightage

(%)

1. The Nature of Management Accounting, the Business Organization and 25

Professional Ethics; Cost Concepts; Cost Behaviour, Marginal Costing;

Cost Volume profit analysis, Strategic Planning and Budgeting; type of

Budgets, preparing Master Budget, Budgets as Financial Planning

Models, Flexible budgets.

2. Short-Run Alternative Choice Decisions, Management Control 25

Environment: balanced scorecard, Relevant Information for Decision

Making with a Focus on Operational Decisions, Relevant Information for

Decision Making with a Focus on Pricing Decisions

3. Standard Costing, causes of Variances, Material and Labour variances 25

Inventory management, Cost Allocation, A General Framework for Cost

Allocation, Allocation of Service Department Costs

4. Joint product and by-product costing, Process costing, Product and 25

Service Costing, International issues in cost management, Distinction

Between Job costing and process Costing, Job costing in Service and

Non-profit Organisation

SARDAR PATEL UNIVERSITY

Vallabh Vidyanagar, Gujarat

(Reaccredited with ‘A’ Grade by NAAC (CGPA 3.25)

Syllabus with effect from the Academic Year 2021-2022

Teaching- • Lectures, Class discussion on concept and issues, case study

Learning

Methodology discussion, assignment submissions

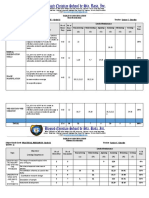

Evaluation Pattern

Sr. Details of the Evaluation Weightage

No.

1. Mid Semester Written / Practical Examination 30%

2. Internal Continuous Assessment in the form of Practical, Quizzes, 30%

Attendance

3. End – Semester University Examination 40%

Course Outcomes: Having completed this course, the learner will be able to

1. Get foundational understanding and clarity of basic principles and core concepts of cost and

management accounting.

2. Blend theory of cost and management accounting practices in the real-world.

3. Take optimum financial decisions based on alternative evaluations.

4. Enhance skills capability.

Suggested References:

Sr. References

No.

1. Don R. Hansen and Maryanne M. Mowen, Cost Management –Accounting and Control

Thomson publication; Latest edition.

2. Ronald Hilton, Managerial Accounting, creating value in a Dynamic Business

Environment, Tata McGraw Hill Edition; 6th edition

SARDAR PATEL UNIVERSITY

Vallabh Vidyanagar, Gujarat

(Reaccredited with ‘A’ Grade by NAAC (CGPA 3.25)

Syllabus with effect from the Academic Year 2021-2022

3. Blocher, Chen, Cokins and Lin Cost Management, A Strategic Emphasis, Tata McGraw

Hill.

4. Anthony R N, Hawkins D F, Merchant K A, Accounting– Text and cases, McGraw-Hill

Companies; latest edition.

5. Paresh Shah, Management Accounting, Oxford University Press, latest edition.

6. Ronald Hilton, Managerial Accounting, creating value in a Dynamic Business

Environment, Tata McGraw Hill Edition; 6th edition

Online Resources

https://icmai.in/studentswebsite/Inter-Papers.php

https://corporatefinanceinstitute.com/resources/knowledge/accounting

www.freebookcentre.net/Business/Accounting-Books.html

https://quickbooks.intuit.com/in/resources/accounting-taxes/accounting-ratios

You might also like

- Fundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsFrom EverandFundamentals of Performance Improvement: Optimizing Results through People, Process, and OrganizationsNo ratings yet

- Teaching Coding To Children A Methodology For Kids 5Document7 pagesTeaching Coding To Children A Methodology For Kids 5humayNo ratings yet

- Hidden CurriculumDocument89 pagesHidden CurriculumNur AfiqahNo ratings yet

- Philippine History of EducationDocument27 pagesPhilippine History of EducationMai Palco Roa100% (2)

- NSC Integrated Science Grade 7 9 APSE III Jan7Document172 pagesNSC Integrated Science Grade 7 9 APSE III Jan7Harvagale BlakeNo ratings yet

- Syllabus in Cost ManagementDocument9 pagesSyllabus in Cost ManagementChristine LealNo ratings yet

- OCT 8 How To Calculate Percentage MarkupDocument3 pagesOCT 8 How To Calculate Percentage MarkupMaria Jobelle Borja AlbiaNo ratings yet

- Narrative Report of Gulayan Sa PaaralanDocument1 pageNarrative Report of Gulayan Sa PaaralanUniss100% (9)

- Four Week TEFL Course Syllabus and ContentDocument25 pagesFour Week TEFL Course Syllabus and ContentJimRossNo ratings yet

- Managerial Accounting Module DescriptorDocument4 pagesManagerial Accounting Module Descriptorవెంకటరమణయ్య మాలెపాటిNo ratings yet

- Syllabus Introduction Cost & Management - Accounting - BBA Sem II Jan 24Document12 pagesSyllabus Introduction Cost & Management - Accounting - BBA Sem II Jan 24DirysNo ratings yet

- Syllabus - Managerial Accounting - APD - RevisedDocument4 pagesSyllabus - Managerial Accounting - APD - RevisedKhánh HòaNo ratings yet

- 511 Ac & Finance For ManagersDocument3 pages511 Ac & Finance For ManagersMesi YE GINo ratings yet

- Strategic Cost ManagementDocument3 pagesStrategic Cost ManagementShubakar ReddyNo ratings yet

- SYLLABUS-Cost & Management AccountingDocument3 pagesSYLLABUS-Cost & Management AccountinglakshmiNo ratings yet

- AF5115Document5 pagesAF5115Chin LNo ratings yet

- BMT6125 - Costing-Methods-And-Techniques - TH - 1.0 - 55 - BMT6125 - 54 AcpDocument2 pagesBMT6125 - Costing-Methods-And-Techniques - TH - 1.0 - 55 - BMT6125 - 54 AcpchrisNo ratings yet

- ACC804 - Advanced Management AccountingDocument10 pagesACC804 - Advanced Management AccountingRavinesh PrasadNo ratings yet

- COA Course OutlineDocument4 pagesCOA Course OutlineSanjana WadhankarNo ratings yet

- Subject Description Form: A. B. C. DDocument3 pagesSubject Description Form: A. B. C. DLi LianaNo ratings yet

- AG920 MA Outline May 2019Document2 pagesAG920 MA Outline May 2019Tono IndraNo ratings yet

- Indian Institute of Management Kozhikode Post Graduate Programme in ManagementDocument4 pagesIndian Institute of Management Kozhikode Post Graduate Programme in ManagementRiturajPaulNo ratings yet

- Course Outline (Tentative) - Manac - 2020Document7 pagesCourse Outline (Tentative) - Manac - 2020Shivi CholaNo ratings yet

- Management Accounting - Costing and Budgeting (Edexcel)Document21 pagesManagement Accounting - Costing and Budgeting (Edexcel)Nguyen Dac Thich100% (1)

- MGT 319Document6 pagesMGT 319Ali Akbar MalikNo ratings yet

- Updated - Cma - PGP 25 t2 Course OutlineDocument4 pagesUpdated - Cma - PGP 25 t2 Course OutlineSwati PorwalNo ratings yet

- Cost Sheet-NEW FORMAT - RevisedDocument3 pagesCost Sheet-NEW FORMAT - RevisedJuhie GuptaNo ratings yet

- 3529202Document4 pages3529202HarishNo ratings yet

- Kud ConsumerBehaviour PDFDocument93 pagesKud ConsumerBehaviour PDFAvinash PatilNo ratings yet

- Core - 22-23Document37 pagesCore - 22-23amankhore86No ratings yet

- C.P Managerial AccountingDocument7 pagesC.P Managerial Accountinggoharmahmood203No ratings yet

- Core Course CommerceDocument11 pagesCore Course CommerceDilshad AnsariNo ratings yet

- Management Accounting PDFDocument6 pagesManagement Accounting PDFSukalp MittalNo ratings yet

- MANAGEMENT ACCOUNTING SYLLABUS Januari 2024-1Document13 pagesMANAGEMENT ACCOUNTING SYLLABUS Januari 2024-1TobiasNo ratings yet

- Rangka Kursus - BIDocument3 pagesRangka Kursus - BIXin TungNo ratings yet

- Mac 234 2023 Course Outline - 5Document26 pagesMac 234 2023 Course Outline - 5Mika-eelNo ratings yet

- Cost & Management Accounting Syllabus 2015Document3 pagesCost & Management Accounting Syllabus 2015KunalNo ratings yet

- Marketing Management - Ii: MBA I Year II Trimester School of ManagementDocument17 pagesMarketing Management - Ii: MBA I Year II Trimester School of ManagementRIZWAN SHAIKNo ratings yet

- ACT502 - Managerial Accounting & Control - Course SyllabusDocument7 pagesACT502 - Managerial Accounting & Control - Course Syllabusfarhansadique29No ratings yet

- Cost and Capital Accounting For Decision MakingDocument2 pagesCost and Capital Accounting For Decision MakingRishi CharanNo ratings yet

- Jaipuria Institute of Management PGDM Trimester Ii Academic Year 2019-20Document9 pagesJaipuria Institute of Management PGDM Trimester Ii Academic Year 2019-20Sanjana SinghNo ratings yet

- CMA II Course OutlineDocument1 pageCMA II Course OutlineHussen AbdulkadirNo ratings yet

- BAC3674 - Syllabus Sem1 2013-2014Document7 pagesBAC3674 - Syllabus Sem1 2013-2014secsmyNo ratings yet

- MBA-23-103 Management AccountingDocument4 pagesMBA-23-103 Management Accountinggadekarganesh977No ratings yet

- Course Outline Managerial AccountingDocument5 pagesCourse Outline Managerial AccountingShobha SheikhNo ratings yet

- 8 Trim 6 FIN - Strategic Financial ManagementDocument2 pages8 Trim 6 FIN - Strategic Financial Management27vxjtfbh8No ratings yet

- Managemnt Accounting, 2011Document3 pagesManagemnt Accounting, 2011rajeshraghuvansi1991No ratings yet

- Management Accounting SyllabusDocument12 pagesManagement Accounting Syllabuswikka nindyaNo ratings yet

- Bba Tumkur NepDocument46 pagesBba Tumkur NepJobin GeorgeNo ratings yet

- BFIA 2nd SEM COREDocument6 pagesBFIA 2nd SEM COREChetan SinghNo ratings yet

- Introduction To Management AccountingDocument7 pagesIntroduction To Management AccountingsaminacheemaNo ratings yet

- 1 Course Outline - Accounting For Managers - AY - 2022 - 2023Document7 pages1 Course Outline - Accounting For Managers - AY - 2022 - 2023Mansi GoelNo ratings yet

- 511 Ac & Finance For ManagersDocument3 pages511 Ac & Finance For ManagersYonasNo ratings yet

- MGT-408 Fall 2023Document5 pagesMGT-408 Fall 2023Ali Akbar MalikNo ratings yet

- Bac 1624 - ObeDocument4 pagesBac 1624 - ObeAmiee Laa PulokNo ratings yet

- Accounting For Managers Course PlanDocument3 pagesAccounting For Managers Course PlankelifaNo ratings yet

- MBA Syllabus PDF - 2018Document78 pagesMBA Syllabus PDF - 2018Mohammad Rafiq DarNo ratings yet

- Co. OutlineDocument3 pagesCo. Outlineyiberta69No ratings yet

- ACCM01B Costing and Pricing-1Document3 pagesACCM01B Costing and Pricing-1Lylanie Gustilo AlcantaraNo ratings yet

- ACT202 - Management AccountingDocument7 pagesACT202 - Management AccountingSHANILA AHMED KHANNo ratings yet

- BAC302 - 04 Advanced Cost and Management Accounting With Integrated Case StudyDocument2 pagesBAC302 - 04 Advanced Cost and Management Accounting With Integrated Case StudyldlNo ratings yet

- Course Outline Aacsb Mba 611 Management AccountingDocument6 pagesCourse Outline Aacsb Mba 611 Management AccountingNishant TripathiNo ratings yet

- RPS - Akuntansi - Manajemen - Berbasis - OBE - DistanceLearning - Share Ke MHSDocument13 pagesRPS - Akuntansi - Manajemen - Berbasis - OBE - DistanceLearning - Share Ke MHSaulia endiniNo ratings yet

- BMT6115 - Financial-Management - Decisions-And-Applications - TH - 1.0 - 55 - BMT6115 - 54 AcpDocument2 pagesBMT6115 - Financial-Management - Decisions-And-Applications - TH - 1.0 - 55 - BMT6115 - 54 AcpM AnuradhaNo ratings yet

- Syllabus of MBA, Batch (2018-2020) - 3Document84 pagesSyllabus of MBA, Batch (2018-2020) - 3Yenkee Adarsh AroraNo ratings yet

- Course Details & Program SyllabusDocument7 pagesCourse Details & Program SyllabusParitosh SinghNo ratings yet

- Competency-Based Accounting Education, Training, and Certification: An Implementation GuideFrom EverandCompetency-Based Accounting Education, Training, and Certification: An Implementation GuideNo ratings yet

- Preview For Behv. FinanceDocument3 pagesPreview For Behv. FinanceJenish patelNo ratings yet

- Recruitment Notice Apr2024Document2 pagesRecruitment Notice Apr2024Jenish patelNo ratings yet

- Eom 3Document37 pagesEom 3Jenish patelNo ratings yet

- Sip Project 2023Document56 pagesSip Project 2023Jenish patelNo ratings yet

- B P S U: Ataan Eninsula Tate NiversityDocument6 pagesB P S U: Ataan Eninsula Tate NiversityCharles Vincent DavidNo ratings yet

- MGMT 142-Principles of Management-Muhammad AyazDocument6 pagesMGMT 142-Principles of Management-Muhammad AyazAhsan Ahmed MoinNo ratings yet

- TOS FINALS Emtech PR2Document3 pagesTOS FINALS Emtech PR2Lhay GonzalesNo ratings yet

- Kushla Vaishnawi NaiduDocument2 pagesKushla Vaishnawi NaiduKaeyshna JanniferNo ratings yet

- 9 - Unit Assessment Map TemplateDocument2 pages9 - Unit Assessment Map TemplateRODJHEN ANNE P. BARQUILLA100% (1)

- Subhas Chandra Bose's Political Ideas1Document9 pagesSubhas Chandra Bose's Political Ideas1Apurbo MaityNo ratings yet

- IELTS Listening Actual Tests and Answers 2021 Trang 25 52Document28 pagesIELTS Listening Actual Tests and Answers 2021 Trang 25 52Ngân NguyễnNo ratings yet

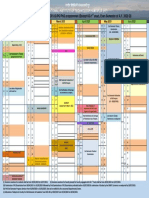

- Even Sem Academic Calendar16681626302389Document1 pageEven Sem Academic Calendar16681626302389Shivani SoniNo ratings yet

- Barangay 6. DIEGO SILANG: Local SourcesDocument28 pagesBarangay 6. DIEGO SILANG: Local SourcesNorzen LaguraNo ratings yet

- Session 2 Understanding The Role of The PPST in RPMSDocument22 pagesSession 2 Understanding The Role of The PPST in RPMSGladys Glo MarceloNo ratings yet

- Module of Learning and PedagogyDocument156 pagesModule of Learning and PedagogyPark RahmawatiNo ratings yet

- Critical Analysis of Role of Teacher and School in Pakistani CommunityDocument1 pageCritical Analysis of Role of Teacher and School in Pakistani CommunityTania Chaudhry30% (10)

- Chinese Language Program For International Students - Fall 2021Document3 pagesChinese Language Program For International Students - Fall 2021Daniel YonathanNo ratings yet

- Department of Education: Crafting/Conference ON School Governance Council S.YDocument5 pagesDepartment of Education: Crafting/Conference ON School Governance Council S.YRenalyn CuntapayNo ratings yet

- Huc Applicationform Local 1 4Document2 pagesHuc Applicationform Local 1 4Izzat FaisalNo ratings yet

- Arizona Early Learning StandardsDocument4 pagesArizona Early Learning Standardsapi-316131028No ratings yet

- 5 Stages of Reading Development InfographicsDocument1 page5 Stages of Reading Development InfographicsJennette LuaresNo ratings yet

- Art & Culture RB Class 7 English - Merg 08.01.23Document104 pagesArt & Culture RB Class 7 English - Merg 08.01.23Saifullah SherajiNo ratings yet

- 11 Effective Note Taking Strategies - PDF - SafeDocument2 pages11 Effective Note Taking Strategies - PDF - SafeAnnieNo ratings yet

- Accomplishment Report 2018Document10 pagesAccomplishment Report 2018Reign-i FrancisquiteNo ratings yet

- Deped-Paaralang Sekundarya NG Lucban Integrated School: Enclosure No. 3 To Deped Order No. 011, S. 20Document1 pageDeped-Paaralang Sekundarya NG Lucban Integrated School: Enclosure No. 3 To Deped Order No. 011, S. 20Victor SalvanNo ratings yet

- Definition of TermsDocument3 pagesDefinition of TermsShara Mae GarciaNo ratings yet

- Back To Basics Competency Based TrainingDocument3 pagesBack To Basics Competency Based TrainingNaharia RangirisNo ratings yet