Professional Documents

Culture Documents

Lecture-2 Principles of Insurance

Lecture-2 Principles of Insurance

Uploaded by

adilahtabassum0 ratings0% found this document useful (0 votes)

11 views24 pagesOriginal Title

Lecture-2 Principles of Insurance (1)

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

11 views24 pagesLecture-2 Principles of Insurance

Lecture-2 Principles of Insurance

Uploaded by

adilahtabassumCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 24

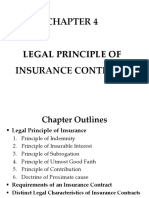

Principles of Insurance

Benazir Imam Majumder

Assistant Professor

Department of Banking and Insurance

Faculty of Business Studies

University of Dhaka

Agenda

Principle of Utmost Good Faith

Principle of Insurable Interest

Principle of Indemnity

Principle of Subrogation

Principle of Contribution

Principle of Proximate Cause/ Causa Proxima

Requirements of an Insurance Contract

Distinct Legal Characteristics of Insurance Contracts

Law and the Insurance Agent

Principle of Utmost Good Faith

A higher degree of honesty is imposed on both parties to

an insurance contract than is imposed on parties to other

contracts

Supported by three legal doctrines:

Representations

Concealment

Warranty

Principle of Utmost Good Faith

Representations are statements made by the applicant for

insurance

A contract is voidable if the representation is material, false,

and relied on by the insurer

Material means that if the insurer knew the true facts, the

policy would not have been issued, or would have been issued

on different terms

An innocent misrepresentation of a material fact, if relied on by

the insurer, makes the contract voidable

Principle of Insurable Interest

The insured must be in a position to lose financially if a covered

loss occurs

Purposes:

To prevent gambling

To reduce moral hazard

To measure the amount of the insured’s loss

An insurable interest can be supported by:

Ownership of property

Potential legal liability

Serving as a secured creditor

Contractual rights

Principle of Insurable Interest

When must insurable interest exist?

Property insurance:

at the time of the loss

Life insurance:

only at inception of the policy

The question of insurable interest does not arise when you purchase

life insurance on your own life

Insurable interest in another person’s life can be shown by close

family ties, marriage, or a pecuniary (financial) interest

Principle of Indemnity

The insurer agrees to pay no more than the actual amount

of the loss

Purpose:

To prevent the insured from profiting from a loss

To reduce moral hazard

Principle of Indemnity

In property insurance, indemnification is based on the

actual cash value (ACV) of the property at the time of

loss

There are three main methods to determine actual cash

value:

Replacement cost less depreciation

Fair market value is the price a willing buyer would pay a

willing seller in a free market

Broad evidence rule means that the determination of ACV

should include all relevant factors an expert would use to

determine the value of the property

Principle of Indemnity

For example, Sarah has a favorite couch that burns in a fire. Assume

she bought the couch five years ago, the couch is 50 percent

depreciated, and a similar couch today would cost $1000. Under the

actual cash value rule, Sarah will collect $500 for the loss because

the replacement cost is $1000, and depreciation is $500, or 50

percent. If she were paid the full replacement value of $1000, the

principle of indemnity would be violated. She would be receiving the

value of a new couch instead of one that was five years old. In short,

the $500 payment represents indemnification for the loss of a five-

year-old couch.

Replacement cost = $1000

Depreciation = $500 (couch is 50 percent depreciated)

Replacement cost - Depreciation = Actual cash value

$1000 - $500 = $500

Principle of Indemnity

There are some exceptions to the principle of indemnity:

Valued policy

Valued policy laws

Replacement cost insurance

Life insurance

A valued policy pays the face amount of insurance if a total loss

occurs.

Some states have a valued policy law that requires payment of the

face amount of insurance to the insured if a total loss to real property

occurs from a peril specified in the law.

Replacement cost insurance means there is no deduction for

depreciation in determining the amount paid for a loss.

A life insurance contract is a valued policy that pays a stated sum to

the beneficiary upon the insured’s death.

Principle of Indemnity

Valued Policy:

For example, you may have a valuable antique clock that

was owned by your great-grandmother. You may feel that

the clock is worth $10,000 and have it insured for that

amount. If the clock is totally destroyed in a fire, you

would be paid $10,000 regardless of the actual cash value

of the clock at the time of loss

Principle of Subrogation

Substitution of the insurer in place of the insured for the

purpose of claiming indemnity from a third party for a

loss covered by insurance.

Purpose:

To prevent the insured from collecting twice for the

same loss

To hold the negligent person responsible for the loss

To hold down insurance rates

Principle of Subrogation

The insurer is entitled only to the amount it has paid under

the policy

The insured cannot impair the insurer’s subrogation rights

Subrogation does not apply to life insurance contracts

The insurer cannot subrogate against its own insureds

Principle of Contribution

Contribution establishes a corollary among all the

insurance contracts involved in an incident or with the

same subject.

Contribution allows for the insured to claim indemnity to

the extent of actual loss from all the insurance contracts

involved in his or her claim.

Principle of Contribution

For instance, imagine that you have taken out two

insurance contracts on your used Lamborghini. Let’s say

you have a policy with A that covers $30,000 in property

damage and a policy with B that cover $50,000 in

property damage. If you end up in a wreck that causes

$50,000 worth of damage to your vehicle. Then about

$18,750 will be covered by A and $31,250 by B.

Each policy you have on the same subject matter pays

their proportion of the loss incurred by the policyholder.

It’s an extension of the principle of indemnity that allows

proportional responsibility for all insurance coverage on

the same subject matter.

Principle of Proximate Cause

The loss of insured property can be caused by more than

one incident even in succession to each other.

Property may be insured against some but not all causes of

loss.

When a property is not insured against all causes, the

nearest cause is to be found out.

If the proximate cause is one in which the property is

insured against, then the insurer must pay compensation.

If it is not a cause the property is insured against, then the

insurer doesn’t have to pay.

Principle of Proximate Cause

The perils relevant to an insurance claim can be classified

under three headings:

Insured perils: Insured perils are specifically mentioned and covered

under the policy as the possible cause of the loss or damage to the

subject matter of the insurance. For example, a policy can be taken to

insure the subject matter from perils, such as fire, lightning, storm

and theft.

Excepted or excluded perils: Practically all insurance policies are

excluded from coverage and certain perils arising from factors that

can cause losses. Normally, a separate section of the contract lists and

describes all the excluded perils, e.g. riot, strike, earthquake or war.

Uninsured or other perils: Those perils are not mentioned in the

policy at all. Smoke and water may not be excluded nor mentioned as

insured in a fire policy.

Requirements of an Insurance Contract

To be legally enforceable, an insurance contract must meet

four requirements:

Offer and acceptance of the terms of the contract

Consideration – the value that each party gives to the other

Competent parties, with legal capacity to enter into a binding

contract

The contract must exist for a legal purpose

Distinct Legal Characteristics of

Insurance Contracts

An insurance contracts is:

Aleatory: values exchanged are not equal

Unilateral: only the insurer makes a legally enforceable

promise

Conditional: policy owner must comply with all policy

provisions to collect for a covered loss

Personal: property insurance policy cannot be validly assigned

to another party without the insurer's consent

A contract of adhesion: the insured must accept the entire

contract with all of its terms and conditions

Distinct Legal Characteristics of Insurance

Contracts

Courts have ruled that any ambiguities or uncertainties in

the contract are construed against the insurer.

The principle of reasonable expectations states that an

insured is entitled to coverage under a policy that he or

she reasonably expects it to provide, and that to be

effective, exclusions or qualifications must be

conspicuous, plain, and clear.

Law and the Insurance Agent

An agent is someone who has the authority to act on

behalf of a principal (the insurer)

Several laws govern the actions of agents and their

relationship to insureds

There is no presumption of an agency relationship

An agent must be authorized to represent the principal

A principal is responsible for the acts of agents acting

within the scope of their authority

Limitations can be placed on the powers of agents

Law and the Insurance Agent

An agent’s authority comes from three sources

Express authority

Implied authority

Apparent authority

Knowledge of the agent is presumed to be knowledge of

the principal with respect to matters within the scope of

the agency relationship

Insurers can place limitations on the power of agents by

adding a non-waiver clause to the application or policy

Law and the Insurance Agent

Waiver is defined as the voluntary relinquishment of a

known legal right

Estoppel occurs when a representation of fact made by

one person to another person is reasonably relied on by

that person to such an extent that it would be inequitable

to allow the first person to deny the truth of the

representation

Thank You……

You might also like

- People vs. Echaves Case DigestDocument1 pagePeople vs. Echaves Case DigestMj Briones100% (2)

- The Characteristics of Insurance ContractsDocument4 pagesThe Characteristics of Insurance Contractsvij_puvva6446No ratings yet

- Fundamental Principles of InsuranceDocument2 pagesFundamental Principles of InsuranceRaja Thangavelu33% (3)

- UGA RMIN 4000 Exam 2 Study GuideDocument13 pagesUGA RMIN 4000 Exam 2 Study GuideBrittany Danielle ThompsonNo ratings yet

- Counter GuaranteeDocument2 pagesCounter GuaranteeSreenivasulu Kusetty100% (3)

- Principles of InsuranceDocument17 pagesPrinciples of Insurancekirthi nairNo ratings yet

- Chapter FourDocument10 pagesChapter FourMeklit TenaNo ratings yet

- New Microsoft Office Word DocumentDocument63 pagesNew Microsoft Office Word DocumentAmin HoqNo ratings yet

- Principles of Insurance PDF A6cd35c5Document4 pagesPrinciples of Insurance PDF A6cd35c5Mutende ChimfyendeNo ratings yet

- ch-2 Principles of Insurance SRDocument4 pagesch-2 Principles of Insurance SRAmitNo ratings yet

- Chapter 5 - Insurance LawDocument11 pagesChapter 5 - Insurance LawMarrick MbuiNo ratings yet

- InsuranceDocument20 pagesInsuranceYvonne BarrackNo ratings yet

- Legal Principal of Insurance Contracts @CH 6Document38 pagesLegal Principal of Insurance Contracts @CH 6Yuba Raj DahalNo ratings yet

- $R5W2XTXDocument52 pages$R5W2XTXTayyab AliNo ratings yet

- Risk CH 4 PDFDocument12 pagesRisk CH 4 PDFWonde BiruNo ratings yet

- InsurancesDocument7 pagesInsuranceskidvictor16No ratings yet

- Risk 4Document9 pagesRisk 4Tadele BekeleNo ratings yet

- Module:-1 Introduction To Life InsuranceDocument67 pagesModule:-1 Introduction To Life InsuranceMandy RandiNo ratings yet

- Principles of Insurance: Risk Management, To HedgeDocument7 pagesPrinciples of Insurance: Risk Management, To HedgeifthisamNo ratings yet

- Basics of Insurance: Course Instructor: Nusrat FarzanaDocument16 pagesBasics of Insurance: Course Instructor: Nusrat FarzanamjrNo ratings yet

- Insurance TemplateDocument41 pagesInsurance Templatereimart sarmientoNo ratings yet

- Chapter 4 Legal Principles of Insurance ContractDocument13 pagesChapter 4 Legal Principles of Insurance ContractgozaloiNo ratings yet

- Principle of InsuranceDocument11 pagesPrinciple of InsuranceUdayJahanNo ratings yet

- CHAP4Legal Prin InsDocument9 pagesCHAP4Legal Prin InsEbsa AdemeNo ratings yet

- CH 4 Risk EditedDocument13 pagesCH 4 Risk EditedHayelom Tadesse GebreNo ratings yet

- Essentials of An Insurance ContractDocument7 pagesEssentials of An Insurance ContractSameer JoshiNo ratings yet

- Principles of InsuranceDocument5 pagesPrinciples of InsuranceayushNo ratings yet

- Chapter 4Document26 pagesChapter 4Yebegashet AlemayehuNo ratings yet

- BỘ CÂU HỎI BẢO HIỂMDocument26 pagesBỘ CÂU HỎI BẢO HIỂMEli LiNo ratings yet

- New ch-4 IndemnityDocument5 pagesNew ch-4 IndemnityMilkias MuseNo ratings yet

- Wa0058 PDFDocument5 pagesWa0058 PDFamir rabieNo ratings yet

- Insu 2 Insurance ContactDocument7 pagesInsu 2 Insurance ContactMahfuzur RahmanNo ratings yet

- Basic Principles of InsuranceDocument2 pagesBasic Principles of Insurancenikita2802No ratings yet

- Unit 4 Legal Principles of InsuranceDocument13 pagesUnit 4 Legal Principles of InsuranceMahlet Abraha100% (1)

- Principles & Types of InsuranceDocument6 pagesPrinciples & Types of InsuranceSudhansu Shekhar pandaNo ratings yet

- 3 Principles of InsuranceDocument15 pages3 Principles of InsuranceZerin Hossain100% (1)

- Insurance Law (Definition, Nature and Function of Insurance) B. Principles of Insurance C. Kinds of InsuranceDocument13 pagesInsurance Law (Definition, Nature and Function of Insurance) B. Principles of Insurance C. Kinds of InsuranceAJAY TAJANo ratings yet

- Insuarance WorkDocument5 pagesInsuarance Workmillenrobert77No ratings yet

- ch-4 RiskDocument18 pagesch-4 RiskYebegashet AlemayehuNo ratings yet

- Risk & Estate Planning NotesDocument46 pagesRisk & Estate Planning NotesSurekhaNo ratings yet

- History and Sources of Law of InsuranceDocument4 pagesHistory and Sources of Law of InsuranceMary-Lou Anne MohrNo ratings yet

- Risk Chapter 4Document14 pagesRisk Chapter 4Wonde BiruNo ratings yet

- Risk CH 4Document15 pagesRisk CH 4Mubarik AhmedinNo ratings yet

- Principals of InsuranceDocument25 pagesPrincipals of InsuranceaadyaaNo ratings yet

- Principles of InsuranceDocument4 pagesPrinciples of InsuranceVandita KhudiaNo ratings yet

- Insurance and Risk Management Unit IDocument9 pagesInsurance and Risk Management Unit Ipooranim1976No ratings yet

- What Is Risk ManagementDocument4 pagesWhat Is Risk Managementsudipta deyNo ratings yet

- Chapter 1-What Is Insurance?Document20 pagesChapter 1-What Is Insurance?Akshada Chitnis100% (2)

- Chapter 2Document25 pagesChapter 2Nivaashene SaravananNo ratings yet

- Insurance Act 2079 RevisedDocument32 pagesInsurance Act 2079 Revisedjojokiki296No ratings yet

- Phases of Development of InsuranceDocument20 pagesPhases of Development of InsuranceJackie Don ShrivastavaNo ratings yet

- Principles of LI PolicyDocument33 pagesPrinciples of LI PolicyManik MittalNo ratings yet

- Insurance and Risk Management w24YgEaPRNe6Document7 pagesInsurance and Risk Management w24YgEaPRNe6Anupriya HiranwalNo ratings yet

- FMS - Unit 6 - Insurance PDFDocument6 pagesFMS - Unit 6 - Insurance PDFHarushika MittalNo ratings yet

- Insurance As ContractDocument3 pagesInsurance As ContractAparajita SharmaNo ratings yet

- Pbi Module 4Document25 pagesPbi Module 4SUBHECHHA MOHAPATRANo ratings yet

- Institution That Offers A Person, Company, or Other Entity Reimbursement or Financial Protection Against Possible Future Losses or DamagesDocument16 pagesInstitution That Offers A Person, Company, or Other Entity Reimbursement or Financial Protection Against Possible Future Losses or DamagesHrishikesh DharNo ratings yet

- Expalain The Following Principles of Insurance The Principle of Insurable InterestDocument4 pagesExpalain The Following Principles of Insurance The Principle of Insurable InterestUzoma FrancisNo ratings yet

- Lecture On Insurance LawDocument8 pagesLecture On Insurance LawGianaNo ratings yet

- 1.1. Principles of General InsuranceDocument22 pages1.1. Principles of General Insurancebeena antuNo ratings yet

- Chap 3Document10 pagesChap 3shanmughipriya nagarajanNo ratings yet

- 131 Dager Mamal ArjiDocument8 pages131 Dager Mamal ArjiadilahtabassumNo ratings yet

- 93 JAIBB 4. Marketing of Financial ServicesDocument4 pages93 JAIBB 4. Marketing of Financial ServicesadilahtabassumNo ratings yet

- NPL and Its Impact On The Banking Sector of Bangladesh - The Financial ExpressDocument3 pagesNPL and Its Impact On The Banking Sector of Bangladesh - The Financial ExpressadilahtabassumNo ratings yet

- Statistics Report New 1Document11 pagesStatistics Report New 1adilahtabassumNo ratings yet

- 94 JAIBB 6. Principles of Economics Bangladesh EconomyDocument2 pages94 JAIBB 6. Principles of Economics Bangladesh EconomyadilahtabassumNo ratings yet

- 93 JAIBB 2. Business CommunicationDocument2 pages93 JAIBB 2. Business CommunicationadilahtabassumNo ratings yet

- Digest Cases On Constitutional LawDocument12 pagesDigest Cases On Constitutional LawJunDagzNo ratings yet

- Lagua v. Cusi GR L-44649, April 15, 1988Document3 pagesLagua v. Cusi GR L-44649, April 15, 1988Shienna BaccayNo ratings yet

- Law AssignmentDocument11 pagesLaw AssignmentGalvin ChongNo ratings yet

- PP v. Santiago. 43 Phil. 120 (1922)Document7 pagesPP v. Santiago. 43 Phil. 120 (1922)Hann Faye Babael100% (1)

- Chhrey Chea, A027 321 642 (BIA Dec. 22, 2014)Document9 pagesChhrey Chea, A027 321 642 (BIA Dec. 22, 2014)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Del Carmen Jr. VS BacoyDocument8 pagesDel Carmen Jr. VS BacoyNoo NooooNo ratings yet

- Confidentiality AgreementDocument2 pagesConfidentiality AgreementSuzanne CarterNo ratings yet

- Cruz v. Sec. of DENR, GR No. 135385, Dec. 6, 2000Document2 pagesCruz v. Sec. of DENR, GR No. 135385, Dec. 6, 2000Jamiah Obillo HulipasNo ratings yet

- 7 - de Los Santos vs. Jebsen MaritimeDocument12 pages7 - de Los Santos vs. Jebsen Maritimejie100% (1)

- Chester Hollman v. Harry E. Wilson, Superintendent, Retreat The District Attorney of The County of Philadelphia The Attorney General of The State of Pennsylvania, 158 F.3d 177, 3rd Cir. (1998)Document10 pagesChester Hollman v. Harry E. Wilson, Superintendent, Retreat The District Attorney of The County of Philadelphia The Attorney General of The State of Pennsylvania, 158 F.3d 177, 3rd Cir. (1998)Scribd Government DocsNo ratings yet

- Anti Torture Act RA 9745Document29 pagesAnti Torture Act RA 9745Say Say BarrokNo ratings yet

- Crisostomo V CADocument1 pageCrisostomo V CAdwight yuNo ratings yet

- NAS 501 Research Methods and Scientific Ethics: Asist. Prof. Dr. Fatih BalcıDocument21 pagesNAS 501 Research Methods and Scientific Ethics: Asist. Prof. Dr. Fatih BalcıMustafaMahdiNo ratings yet

- KK Sinha Appellant - 20210326Document22 pagesKK Sinha Appellant - 20210326rishi rajaniNo ratings yet

- Case Digests (July - Dec 2003)Document52 pagesCase Digests (July - Dec 2003)Sitti Warna IsmaelNo ratings yet

- Equity and Common LawDocument4 pagesEquity and Common LawManjare Hassin RaadNo ratings yet

- Virtual Class SCORM E4 U3Document26 pagesVirtual Class SCORM E4 U3jesus saanchezNo ratings yet

- Re Final Report On The Judicial AuditDocument15 pagesRe Final Report On The Judicial AuditJunery BagunasNo ratings yet

- Sarfaesi Act 2002Document3 pagesSarfaesi Act 2002Ram IyerNo ratings yet

- PVL2602 PDFDocument21 pagesPVL2602 PDFVertozil BezuidenhoudtNo ratings yet

- Topic 13 - Estate PlanningDocument62 pagesTopic 13 - Estate Planningaarzu dangiNo ratings yet

- Ebook Legal Imperialism - 6Document27 pagesEbook Legal Imperialism - 6qsadNo ratings yet

- Republic ActDocument3 pagesRepublic ActJerma Cam Espejo100% (1)

- Alfafara Vs AcebedoDocument1 pageAlfafara Vs AcebedoattycertfiedpublicaccountantNo ratings yet

- Appen - CrowdsourcingDocument14 pagesAppen - CrowdsourcingkalaisenthilNo ratings yet

- SHULIKOV v. STATE OF MAINE - Document No. 4Document2 pagesSHULIKOV v. STATE OF MAINE - Document No. 4Justia.comNo ratings yet

- Crim Landmark CasesDocument5 pagesCrim Landmark CasesDavid BaquiranNo ratings yet

- Pelayo vs. Lauron, 12 Phil. 453Document2 pagesPelayo vs. Lauron, 12 Phil. 453Gilda P. OstolNo ratings yet