Professional Documents

Culture Documents

Act Ch09 l04 English

Act Ch09 l04 English

Uploaded by

aubrymichalllllllllll44Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Act Ch09 l04 English

Act Ch09 l04 English

Uploaded by

aubrymichalllllllllll44Copyright:

Available Formats

Health Coverage Comparison

CHAPTER 9, LESSON 4

NAME(S) DATE

Aubrey 4/24/24

DIRECTIONS

Use the Health Plan Comparison Sheet to calculate the total out-of-pocket medical expense for each insurance

plan, Health Choice and Super Health, and record your answers in the chart. When you begin, your deductible

has not been met. The fee listed next to each item is the cost of that service without any health insurance.

COST WITH COST WITH

SERVICE AND COST

HEALTH CHOICE SUPER HEALTH

1. Doctor’s office visit for a sore throat and cough

5 95

(in network) $95

2. Emergency room for stitches (in network) $115 25 115

DEDUCTIBLE NOW MET

3. Appendectomy (in network)

» Surgery $14,000

10 7

» Two-night hospital stay $2,000

» Prescription (brand) $185

4. Eye exam (in network) $45 10 4.5

5. Urgent care (out of network) $85 17 8.5

6. Prescription (generic, in network) $85 5 5

7. Prescription (brand, out of network) $225 56.25 5

8. Annual physical (in network) $95 5 9.5

9. Emergency room for snowboard accident

25 0

(concussion, broken leg, X-rays, etc.) $6,500

10. Urgent care (in network) $105 10 10.5

FO U N DATI O NS I N PERSONA L FI NA NCE PAGE 1 O F 3

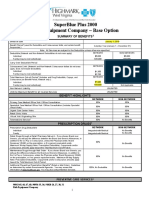

Health Plan Comparison Sheet

SERVICE

HEALTH CHOICE SUPER HEALTH

AND COST

90% of approved amount after

Emergency

$25 co-pay deductible; 100% of approved amount

Room for accidental injury

In Network: $10 co-pay; 100% for initial

exam for accident/medical emergency

Out of Network: 80% of approved

Urgent Care 90% of approved amount after deductible

amount after deductible, 100% of

approved amount for initial exam for

accident/medical emergency

In Network: 100% of approved amount

Surgery Out of Network: 80% of approved 100% of approved amount

amount after deductible

In Network: 100% of approved amount

100% of approved amount plus $5 per

Hospital Care Out of Network: 80% of approved day for private room

amount after deductible

In Network: Co-pay $5 generic/$10 brand

Prescriptions Co-pay $5 generic/brand

Out of Network: 75% of approved amount

In Network: $5 co-pay; 100% approved

amount for initial exam for injury/

medical emergency

Physician 90% of approved amount after

Out of Network: 80% of approved

Office Visit deductible;100% for accidental injury

amount after deductible; 100% approved

amount for initial exam for injury/

medical emergency

In Network: $10 co-pay for one exam per

calendar year

Vision 90% of approved amount after deductible

Out of Network: 80% of approved

amount after deductible

In Network: None

Deductible Out of Network: $250 individual per $250 per calendar year

calendar year

In Network: None

Maximum

Out of Network: 100% after payments 100% after payments reach $1,000

Out of Pocket

reach $2,500

FO U N DATI O NS I N PERSONA L FI NA NCE PAGE 2 O F 3

Health Coverage Comparison

CHAPTER 9, LESSON 4

DIRECTIONS

Answer the following questions and be ready to discuss your answers with the class.

1. How much total money would you have spent out of pocket with each plan?

None with health choice but 100% if up to $1000 with super health.

2. With each plan, how much total money would you have to spend before the insurance

coverage pays 100% of your medical costs?

up to $25 co-pay with health choice

3. What is the purpose of health insurance?

To cover expected and unexpected expected to make health care for afordable

4. Why is it important for young adults to understand the role of health insurance?

So they know what they need to get

FO U N DATI O NS I N PERSONA L FI NA NCE PAGE 3 O F 3

You might also like

- Fundamentals of Data Warehousing: Ms. Liza Mae P. NismalDocument15 pagesFundamentals of Data Warehousing: Ms. Liza Mae P. NismalNoel JosefNo ratings yet

- Heat PumpsDocument317 pagesHeat PumpsDiana SoareNo ratings yet

- Mobile Platform Safety RequirementDocument56 pagesMobile Platform Safety Requirementtnsv222No ratings yet

- Animal Management in Disasters, Volume 2, Animals and CommunitiesFrom EverandAnimal Management in Disasters, Volume 2, Animals and CommunitiesNo ratings yet

- 13 Alvarez II vs. Sun Life of CanadaDocument1 page13 Alvarez II vs. Sun Life of CanadaPaolo AlarillaNo ratings yet

- Efficacy of Sim in Improving The Academic Performance of Grade VI Pupils in Science in The New NormalDocument8 pagesEfficacy of Sim in Improving The Academic Performance of Grade VI Pupils in Science in The New NormalInternational Journal of Innovative Science and Research Technology100% (1)

- AnswerDocument39 pagesAnswerALMACHIUS RWERENGELA86% (7)

- Manitou PDF DVD 3 15 8 GB Service and Parts ManualDocument27 pagesManitou PDF DVD 3 15 8 GB Service and Parts Manualgeraldshaffer020389gdb100% (1)

- BCBS Enrollment GuideDocument6 pagesBCBS Enrollment GuideAnonymous Lri40PrlkNo ratings yet

- Cotización de Póliza de Salud en PanamaDocument4 pagesCotización de Póliza de Salud en PanamacuentasygastosdecasaNo ratings yet

- Isoa Hea OMPASS - 2016 - 2017 PDFDocument13 pagesIsoa Hea OMPASS - 2016 - 2017 PDFSharif M Mizanur RahmanNo ratings yet

- Participant DocumentsDocument8 pagesParticipant DocumentsSergiu EniNo ratings yet

- Shape B: Schedule of BenefitsDocument6 pagesShape B: Schedule of BenefitsRana GreeneNo ratings yet

- Lewermark Health Insurance Copay Plan For Delta State UniversityDocument3 pagesLewermark Health Insurance Copay Plan For Delta State Universityroby sorianoNo ratings yet

- 2023 FMCNA Medical Plan Cost ComparisonDocument2 pages2023 FMCNA Medical Plan Cost ComparisonCristal PeoplesNo ratings yet

- Compass: Gold / SilverDocument16 pagesCompass: Gold / SilverStan SmithNo ratings yet

- Benefits Overview 2018Document5 pagesBenefits Overview 2018Joby JoNo ratings yet

- Benefits HighlightsDocument1 pageBenefits HighlightsRobert AvramescuNo ratings yet

- Employee Benefits-Wellness Guide 2023-24Document30 pagesEmployee Benefits-Wellness Guide 2023-24shanzeh2609No ratings yet

- 2017 Anthem GHIP Benefits Booklet (Final)Document119 pages2017 Anthem GHIP Benefits Booklet (Final)Alexander NewberryNo ratings yet

- 2017 Anthem GHIP Benefits Booklet (Final)Document119 pages2017 Anthem GHIP Benefits Booklet (Final)Alexander NewberryNo ratings yet

- Patriot Accident-2016fDocument2 pagesPatriot Accident-2016fapi-310035632No ratings yet

- 2010 UnitedHealthcare Benefits SummaryDocument1 page2010 UnitedHealthcare Benefits Summaryapi-27017317No ratings yet

- Accident & Sickness Insurance For International Students OnDocument14 pagesAccident & Sickness Insurance For International Students OnFilipe SoaresNo ratings yet

- AMERICAN HEALTH SOLUTIONS CAT Office 97-2003Document7 pagesAMERICAN HEALTH SOLUTIONS CAT Office 97-2003Safe2day FinancialNo ratings yet

- Aflac Accicent 4 A36475NNDRDocument16 pagesAflac Accicent 4 A36475NNDRBruce henschelNo ratings yet

- CIEE Insurance CoverageDocument2 pagesCIEE Insurance CoverageMiguelNo ratings yet

- Silver: Dedicated Insurance For International StudentsDocument13 pagesSilver: Dedicated Insurance For International StudentsDoucouré HawaNo ratings yet

- Product Fact Sheet Year 2024Document6 pagesProduct Fact Sheet Year 2024Shanis LinNo ratings yet

- Guard - Me Benefit Summary 2018Document2 pagesGuard - Me Benefit Summary 2018Luna AdonayNo ratings yet

- USS Pre-Medicare PPO With RX PlanDocument3 pagesUSS Pre-Medicare PPO With RX PlanAnonymous w0egAgMouGNo ratings yet

- Vanderbilt phf-21-22Document2 pagesVanderbilt phf-21-22api-458468763No ratings yet

- Generic Open Enrollment KitDocument22 pagesGeneric Open Enrollment KitSteve BarrowsNo ratings yet

- EmblemHealth Benefits 2019Document7 pagesEmblemHealth Benefits 2019Jorge Luis Rivera AgostoNo ratings yet

- AARP UHC 2024 Benefit Highlights LA 004P FocusDocument4 pagesAARP UHC 2024 Benefit Highlights LA 004P FocusAlaa ZaidNo ratings yet

- Eb 2019 Oe Guideplussbc GenericDocument19 pagesEb 2019 Oe Guideplussbc GenericCybernaughtNo ratings yet

- Snap Guardian Dental Plan Summary 2022Document4 pagesSnap Guardian Dental Plan Summary 2022Samson FungNo ratings yet

- 2022 Steven Charles BAG - CODocument4 pages2022 Steven Charles BAG - COAlejuanchis Kamacho GarciaNo ratings yet

- Select PlanDocument3 pagesSelect PlanLuis EscobarNo ratings yet

- gmmc2019 SummaryDocument2 pagesgmmc2019 Summaryabhijeet nafriNo ratings yet

- Benefit Highlights: AARP Medicare Advantage Choice (PPO)Document3 pagesBenefit Highlights: AARP Medicare Advantage Choice (PPO)EstherNo ratings yet

- What You Pay in The PPO PlanDocument2 pagesWhat You Pay in The PPO Plannathan wongNo ratings yet

- Benefits DocumentDocument11 pagesBenefits DocumentAndrew VlackNo ratings yet

- Us Apple Plus Ppo Feb2019 en 1Document3 pagesUs Apple Plus Ppo Feb2019 en 1Lucas Coleta AlmeidaNo ratings yet

- Aetna Y0001 H5521 380 PR25 SB24 M 2024 SF20240425Document23 pagesAetna Y0001 H5521 380 PR25 SB24 M 2024 SF20240425kevin.mccreaNo ratings yet

- Cigna OAP 0 Summary 1020Document12 pagesCigna OAP 0 Summary 1020santiagomNo ratings yet

- Critical Illness EnrollKit - CVSDocument16 pagesCritical Illness EnrollKit - CVSTheodore AvdursekzNo ratings yet

- Patriot America Plus: Certificate of InsuranceDocument35 pagesPatriot America Plus: Certificate of InsuranceNavidadNo ratings yet

- 2024 Aflac Accident Brochure - ScribdDocument14 pages2024 Aflac Accident Brochure - ScribdnicketeststuffNo ratings yet

- 2021 Group Brochure: Work & Travel Group Number: WT20G16500Document5 pages2021 Group Brochure: Work & Travel Group Number: WT20G16500Margorie MendozaNo ratings yet

- Keystone HMO Silver ProactiveDocument12 pagesKeystone HMO Silver ProactiveANKIT SINGHNo ratings yet

- Safe Travels Usa Cost Saver Insurance Policy DocumentDocument18 pagesSafe Travels Usa Cost Saver Insurance Policy DocumentShabana AqilNo ratings yet

- United Healthcare UHC Premier 1500 CEFP GoldDocument14 pagesUnited Healthcare UHC Premier 1500 CEFP GoldSteveNo ratings yet

- Aurora - Baseline Option 2019 SOBIDocument4 pagesAurora - Baseline Option 2019 SOBISean MurrayNo ratings yet

- KP - Plan Summary Medical - PPODocument3 pagesKP - Plan Summary Medical - PPOshanegbaker51No ratings yet

- DIANins Blue 100 Policy Terms Conditions V2 2023 2024Document47 pagesDIANins Blue 100 Policy Terms Conditions V2 2023 2024suritrue9644No ratings yet

- Snic - Payless Tob 2021Document6 pagesSnic - Payless Tob 2021DIVYAS11No ratings yet

- Health Qube BrochureDocument6 pagesHealth Qube BrochureAbhay BaruahNo ratings yet

- Rish Equipment Base Plan Option Eff. 1.1.2019Document4 pagesRish Equipment Base Plan Option Eff. 1.1.2019michala anthonyNo ratings yet

- 2022 Patriot America Plus PATAP PGTAPDocument37 pages2022 Patriot America Plus PATAP PGTAPmaNo ratings yet

- Lawe Silver BrochureDocument6 pagesLawe Silver BrochureLavinea SmithNo ratings yet

- Benefits Summaries-Health Dental VisionDocument6 pagesBenefits Summaries-Health Dental VisionNiña MoradaNo ratings yet

- QBE PA Prestige - Brochure - 051120 - BrochureDocument10 pagesQBE PA Prestige - Brochure - 051120 - BrochureCheah Chee MunNo ratings yet

- WWW - Healthcare.gov/sbc-Glossary: Important Questions Answers Why This MattersDocument10 pagesWWW - Healthcare.gov/sbc-Glossary: Important Questions Answers Why This MattersRohitKumarNo ratings yet

- Fhpv23apr231218j7r2 Veasna UkDocument6 pagesFhpv23apr231218j7r2 Veasna UkSela SinNo ratings yet

- Standard Schedule of Benefits - Market Street LTD 2022Document2 pagesStandard Schedule of Benefits - Market Street LTD 2022mariojesus8807No ratings yet

- Brochure ExplicativoDocument8 pagesBrochure ExplicativoramonNo ratings yet

- Power DesignerDocument112 pagesPower DesignerLuis Eduardo RivasNo ratings yet

- Business Law - Revised Slides - Full SyllabusDocument46 pagesBusiness Law - Revised Slides - Full SyllabusAliza IshraNo ratings yet

- Karl Liebknecht - in Spite of Everything! (1919)Document4 pagesKarl Liebknecht - in Spite of Everything! (1919)Luka ENo ratings yet

- Australian Beef Product GuideDocument13 pagesAustralian Beef Product GuideRamirez Carduz Domingo Orlando100% (1)

- UTECH Excel Virtual Lab Wednesday Morning Test Spring 2021Document4 pagesUTECH Excel Virtual Lab Wednesday Morning Test Spring 2021Dane EdwardsNo ratings yet

- 7.4 Cancel Calibration: CanceledDocument14 pages7.4 Cancel Calibration: CanceledleogerguzNo ratings yet

- Bar Charts in ResearchDocument5 pagesBar Charts in ResearchPraise NehumambiNo ratings yet

- DocumentsDocument5 pagesDocumentsRayyan JamaluddinNo ratings yet

- Ck3-Faie-Lrw (9.2022)Document12 pagesCk3-Faie-Lrw (9.2022)Nguyễn Diệu LinhNo ratings yet

- 2020 Coach RecordDocument1 page2020 Coach RecordCheryl QuintoNo ratings yet

- Bliss: Blind Source Separation and ApplicationsDocument4 pagesBliss: Blind Source Separation and ApplicationspostscriptNo ratings yet

- The Pueblo of Santa Ana Is Looking To Fill The Following PositionDocument1 pageThe Pueblo of Santa Ana Is Looking To Fill The Following Positionapi-86832247No ratings yet

- University of San AgustinDocument4 pagesUniversity of San AgustinMark PerryNo ratings yet

- Account Receivable ClassDocument30 pagesAccount Receivable ClassBeast aNo ratings yet

- APA Refresher - ReferencesDocument46 pagesAPA Refresher - ReferencesNewton YusufNo ratings yet

- Hrms Database DesignDocument3 pagesHrms Database Designjamshed90No ratings yet

- Iron Through The Ages: Alan W. PenseDocument11 pagesIron Through The Ages: Alan W. PenseMohamed IsmailNo ratings yet

- IoT2x Module 4 PID ActivityDocument5 pagesIoT2x Module 4 PID Activityvanishree raNo ratings yet

- Gauri Parbati/ Mrit Sanjiwoni J/V: Detail Cost Break DownDocument2 pagesGauri Parbati/ Mrit Sanjiwoni J/V: Detail Cost Break DownDoodhpokhari ChepeNo ratings yet

- Pmac201 HW CatalogDocument2 pagesPmac201 HW CatalogDaniel MaldonadoNo ratings yet

- GDDocument18 pagesGDSnehashis PatnaikNo ratings yet

- Customs Issuance System IndexDocument819 pagesCustoms Issuance System Indexthe uggorimNo ratings yet

- Master Clock SystemDocument19 pagesMaster Clock SystemkushwahanirajNo ratings yet