Professional Documents

Culture Documents

AP - Diagnostic Exam.

AP - Diagnostic Exam.

Uploaded by

sapilanfranceneOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AP - Diagnostic Exam.

AP - Diagnostic Exam.

Uploaded by

sapilanfranceneCopyright:

Available Formats

REY OCAMPO ONLINE!

AUDITING PROBLEMS

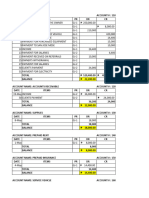

DIAGNOSTIC EXAMINATION OCTOBER 2020 CPALE

INSTRUCTION: Select the correct answer for each of the e) Due to the carelessness of the

following questions. Mark only one answer for each item receiving department, a December

by shading the box corresponding to the letter of your shipment was damaged by rain.

choice on the answer sheet provided. STRICTLY NO These goods were later sold at cost 40,000

ERASURES ALLOWED. in December.

SITUATIONAL Based on the preceding information, determine the

following:

SITUATION 1

QUESTIONS:

PRTC, Inc. is an importer and wholesaler of cellphone

1. Adjusted net purchases

accessories. Its merchandise is purchased from a number

A. Up to November 30: P2,666,000;

of suppliers and is warehoused until sold to customers.

Up to December 31: P3,190,000

B. Up to November 30: P2,700,000;

In conducting your audit of PRTC’s financial statements

Up to December 31: P3,164,000

for the year ended December 31, 2020, you determined

C. Up to November 30: P2,696,000;

that the internal control system is functioning effectively.

Up to December 31: P3,186,000

You observed the physical count of inventory on

D. Up to November 30: P2,704,000;

November 30, 2020.

Up to December 31: P3,184,000

The following information were obtained from PRTC’s 2. Gross profit ratio for 11 months ended November 30,

accounting records: 2020

A. 21.58% C. 21.47%

Sales for 11 months ended November 30 P3,400,000 B. 20.94% D. 20.82%

Sales for the year ended December 31 3,840,000

Purchases for 11 months ended Nov. 30 2,700,000 3. Gross profit for the month of December 2020

Purchases for the year ended Dec. 31 3,200,000 A. P92,136 C. P83,760

Inventory, January 1 350,000 B. P91,236 D. P88,000

Inventory, Nov. 30 (per physical count) 380,000 4. Estimated inventory at December 31, 2020

A. P491,760 C. P490,000

Your audit disclosed the following information: B. P456,000 D. P455,120

a) Shipments received in unsalable 5. An auditor selected items for test counts while

condition and excluded from physical observing a client’s physical inventory. The auditor

inventory. The returns were not then traced the test counts to the client’s inventory

recorded because no credit memos listing. This procedure most likely obtained evidence

were received from vendors: concerning

Total at November 30 P 4,000 A. Existence. C. Rights.

Total at December 31 B. Completeness. D. Valuation.

(including the November 30

unrecorded returns) 6,000

b) Deposit made with vendor and charged SITUATION 2

to Purchases in October. The goods

were shipped in January 2021. 8,000 In the audit of the books of Manila Corporation for the

c) Deposit made with vendor and charged year 2020, the following items and information appeared

to Purchases in November. The in the Production Machine account of the client:

goods were shipped FOB destination Date Particulars Debit Credit

on November 29 and were included 01/01 Balance–Machine 1, 2,

in physical inventory as goods in 3, and 4 at P180,000 P 720,000

transit. 22,000 each

d) Shipments received in November and 02/28 Machine 5 396,000

included in the physical count at Machine 1 P 6,000

November 30 but recorded as 09/01 Machine 6 192,000

December purchases. 30,000 12/01 Machine 7 432,000

Page 1 of 10 facebook.com/reyocampo.ol.3 AP.Diagnostic

TEAM PRTC

The Accumulated Depreciation account contained no Amount

entries for the year 2020. The balance on January 1, Date (in Php) Additional information

2020 per your audit, was as follows: 1 Jan. 2020 200,000,000 20 per cent of the price

Machine 1 P168,750 is attributable to the

Machine 2 78,750 land

Machine 3 67,500 1 Jan. 2020 20,000,000 Non-refundable transfer

Machine 4 45,000 taxes (not included in

the P200,000,000

Based on your further inquiry and verification, you noted purchase price)

the following: 1 Jan. 2020 1,000,000 Legal costs directly

1. Machine 5 was purchased for cash; it replaced attributable to the

Machine 1, which was sold on this date for P6,000. acquisition

2. Machine 2 was destroyed by the thickness of engine 1 Jan. 2020 10,000 Reimbursing the

oil used leading to explosion on December 1, 2020. previous owner for

Machine 7 was to replace Machine 2. prepaying the non-

3. Machine 3 was traded in for Machine 6 at an refundable local

allowance of P24,000; the difference was paid in cash government property

and charged to Production Machine account. taxes for the six-month

4. Depreciation rate is recognized at 25% per annum. period ending 30 June

2020

QUESTIONS: 1 Jan. 2020 500,000 Advertising campaign to

attract tenants

Based on the above and the result of your audit, answer 2 Jan. 2020 200,000 Opening function to

the following: celebrate new rental

business that attracted

6. The gain or loss on sale of Machine 1 is

extensive coverage by

A. P6,000 gain C. P1,500 loss

the local press

B. P5,250 loss D. P2,250 gain

30 June 2020 20,000 Non-refundable annual

7. The loss on trade in of Machine 3 is local government

A. P58,500 C. P51,000 property taxes for the

B. P54,750 D. P88,500 year ending 30 June

2021

8. The Production Machine account is overstated by

Throughout 120,000 Day-to-day repairs and

A. P534,000 C. P714,000

2020 maintenance, including

B. P510,000 D. P690,000

the salary and other

9. The total depreciation for the year ended December costs of the

31, 2020 is administration and

A. P237,000 C. P233,250 maintenance staff.

B. P232,500 D. P236,250 These costs are

attributable equally to

10. The carrying amount of production machine as of each of the ten units.

December 31, 2020 is

A. P1,024,500 C. P1,069,500 The entity uses one of the ten units to accommodate its

B. P1,029,000 D. P 990,750 administration and maintenance staff. The other nine

units are rented to independent third parties under non-

cancellable operating leases.

SITUATION 3

Davao Corporation, a real estate entity, has total assets of At 31 December 2020, the entity made the following

not more than P350 million and total liabilities of not more assessments about the units:

than P250 million. Davao’s debt and equity instruments • Useful life of the buildings: 50 years from the date

are not traded in a public market. of acquisition

• The entity will consume the buildings’ future

Davao Corporation incurred (and paid) the following economic benefits evenly over 50 years from the

expenditures in acquiring property consisting of ten date of acquisition.

identical freehold detached houses each with separate

legal title including the land on which it is built: The fair value of the units can be determined reliably

without undue cost or effort on an ongoing basis and that

the residual value of the owner-occupied unit is nil.

Page 2 of 10 facebook.com/reyocampo.ol.3 AP.Diagnostic

TEAM PRTC

At 31 December 2020 the fair value of each unit was b. On May 1, 2020, Bacolod sold Patent B in exchange for

reliably estimated as P25,000,000. a P5,000,000 non-interest bearing note due on May 1,

2023. There was no established exchange price for the

QUESTIONS: patent, and the note had no ready market. The

prevailing rate of interest for a note of this type at May

Based on the above and the result of your audit, answer

1, 2020 was 14%. The patent was purchased for

the following as of and for the year ended December 31,

P3,150,000 on September 1, 2016. On that date, the

2020:

remaining legal life was fifteen years, which was also

11. Davao Corporation is a _________ determined to be the useful life.

A. Large entity

c. On January 3, 2020, in connection with the purchase of

B. Medium-sized entity

a trademark from Joe Corporation, the parties entered

C. Small entity

into a noncompetition agreement and a consulting

D. Micro entity

contract. Bacolod paid Joe P8,000,000, of which

12. How much should be reported as property, plant and three-quarters was for the trademark and one-quarter

equipment? was for Joe’s agreement not to compete for a five-year

A. P21,747,384 C. P 21,746,400 period in the line of business covered by the

B. P21,648,000 D. Nil trademark. Bacolod considers the life of the trademark

to be indefinite. Under the consulting contract,

13. How much should be recognized in profit or loss Bacolod agreed to pay Joe P500,000 annually on

regarding the increase in fair value of investment January 3 for five years. The first payment was made

properties? on January 3, 2020.

A. P26,100,000 C. P27,000,000

B. P26,091,000 D. P29,636,000 d. At December 31, 2020, Bacolod determined the

14. How much is the total expense to be recognized in recoverable amount of the intangible assets as follows:

profit or loss? Patent A P1,350,000

A. P1,193,616 C. P1,193,600 Trademark 5,500,000

B. P2,192,000 D. P4,376,000 Noncompetition agreement 1,800,000

15. Assume that the fair value of the units cannot be

determined reliably without undue cost or effort on an

QUESTIONS:

ongoing basis, how much is the total expense to be

recognized in profit or loss? Based on the above and the result of your audit,

A. P5,360,000 C. P4,366,000 determine the following:

B. P4,376,000 D. P4,376,160

16. Gain on sale of Patent B

A. P2,620,000 C. P 995,000

SITUATION 4 B. P1,012,500 D. P 977,500

The statement of financial position of Bacolod Corporation 17. Total amortization to be recognized in 2020

as of December 31, 2019 reported the Intangible Assets, A. P680,000 C. P 767,500

net as follows: B. P750,000 D. P1,950,000

Patent A P1,680,000 18. Total impairment loss to be recognized in 2020

Patent B 2,450,000 A. P750,000 C. P550,000

P4,130,000 B. P620,000 D. P 50,000

19. Intangible assets to be recognized in the statement of

During the course of your audit, you noted the following. financial position as of December 31, 2020

a. Patent A was purchased for P1,920,000 on January 1, A. P7,750,000 C. P8,450,000

2018, at which date the remaining legal life was B. P7,950,000 D. P8,850,000

sixteen years. On January 1, 2020, Bacolod 20. In auditing intangible assets, an auditor most likely

determined that the useful life of the patent was only would review or recompute amortization and

eight years from the date of acquisition. determine whether the amortization period is

reasonable in support of management’s financial

statement assertion of

A. Valuation. C. Existence

B. Completeness. D. Rights

Page 3 of 10 facebook.com/reyocampo.ol.3 AP.Diagnostic

TEAM PRTC

SITUATION 5 QUESTIONS:

You were able to gather the following from the December Based on the above and the result of your audit, compute

31, 2020 trial balance of Santiago Corporation in for the adjusted balances of following:

connection with your audit of the company:

21. Cash on hand

Cash on hand P 372,000 A. P282,000 C. P408,000

Petty cash fund 10,000 B. P246,000 D. P342,000

BPI current account 950,000

22. Petty cash fund

Security Bank current account No. 01 1,280,000

A. P6,700 C. P 2,100

Security Bank current account No. 02 (40,000)

B. P9,100 D. P10,000

PNB savings account 500,000

PNB time deposit 300,000 23. BPI current account

A. P1,086,000 C. P1,000,000

Cash on hand includes the following items: B. P 914,000 D. P 950,000

a. Customer’s check for P60,000 returned by bank on 24. Cash and cash equivalents

December 26, 2020 due to insufficient fund but A. P2,914,700 C. P2,614,700

subsequently redeposited and cleared by the bank on B. P2,954,700 D. P3,414,700

January 8, 2021.

b. Customer’s check for P30,000 dated January 2, 2021, 25. Which of the following balance-related audit

received on December 29, 2020. objectives typically is assessed as having high

c. Postal money orders received from customers, inherent risk for cash?

P36,000. A. Presentation and disclosure

B. Valuation

The petty cash fund consisted of the following items as of C. Cutoff

December 31, 2020. D. Existence

Currency and coins P 2,100

Employees’ vales 1,600 SITUATION 6

Currency in an envelope marked “collections

for charity” with names attached 1,200 The Cavite Corp. sells direct to retail customers and also

Unreplenished petty cash vouchers 800 to wholesalers. Accounts receivable and an allowance for

Check drawn by Santiago Corporation, bad debts are maintained separately for each division. On

payable to the petty cashier 4,600 January 1, 2020 the balance of the retail accounts

P10,300 receivable was P209,000 while the bad debts with respect

to retail customers was a credit of P7,600.

Included among the checks drawn by Santiago

Corporation against the BPI current account and recorded The following summary pertains only to retail sales since

in December 2020 are the following: 2017:

Bad Debts Bad Debts

a. Check written and dated December 29, 2020 and

Credit Sales Written Off Recoveries

delivered to payee on January 2, 2021, P50,000.

2017 P1,110,000 P26,000 P2,150

b. Check written on December 27, 2020, dated January

2018 1,225,000 29,500 3,750

2, 2021, delivered to payee on December 29, 2020,

2019 1,465,000 30,000 3,600

P86,000.

2020 1,500,000 31,000 4,200

The credit balance in the Security Bank current account

Bad debts are provided for as a percentage of credit sales.

No. 2 represents checks drawn in excess of the deposit

The accountant calculates the percentage annually by

balance. These checks were still outstanding at December

using the experience of the three years prior to the

31, 2020.

current year. The formula is bad debts written off less

recoveries expressed as a percentage of the credit sales

The savings account deposit in PNB has been set aside by

for the same period. Cash receipts in 2020 from credit

the board of directors for acquisition of new equipment.

sales to retail customers was P1,380,200.

This account is expected to be disbursed in the next 3

months from the balance sheet date.

Page 4 of 10 facebook.com/reyocampo.ol.3 AP.Diagnostic

TEAM PRTC

QUESTIONS: • On July 1, 2020, the entity sold half of the

investment for its fair value of P800,000.

Based on the above and the result of your audit, answer

• Fair value of the investment: December 31, 2018,

the following:

P1,200,000; December 31, 2019, P1,500,000;

26. The percentage to be used to compute the allowance December 31, 2020, P900,000.

for bad debts on December 31, 2020 is

A. 1% C. 2% Investment in Bonds

B. 1.9% D. 3% • The entity uses the ‘held for collection’ business

model for acquired and originated debt instruments.

27. For 2020, the provision for bad debts with respect to • P1,000,000, 10% bonds, purchased for P1,051,510

credit sales is including transaction costs of P20,000. Interest is

A. P28,802 C. P30,000 payable annually every December 31. The bonds

B. P45,000 D. P57,604 mature on December 31, 2022..

28. The ledger balance of the accounts receivable after • The prevailing market rate for the bonds is 9% at

necessary adjustments on December 31, 2020 was a December 31, 2020.

debit of

A. P275,396 C. P303,000 QUESTIONS:

B. P288,000 D. P297,800 Based on the above and the result of your audit, answer

29. The ledger balance of the allowance for bad debts the following:

after necessary adjustments on December 31, 2020 31. The carrying amount of Investment in Ordinary

was a credit of Shares as of December 31, 2020 is misstated by

A. P10,800 C. P25,800 A. P200,000 over C. P50,000 over

B. P 6,600 D. P31,800 B. P200,000 under D. P50,000 under

30. All of the following are examples of substantive tests 32. The effective interest rate on Investment in Bonds is

to verify valuation of net accounts receivable except A. 7% C. 9%

the B. 8% D. 10%

A. Re-computation of the allowance for bad debts.

B. Inspection of the aging schedule and credit 33. The carrying amount of Investment in Bonds as of

records of past due accounts. December 31, 2020 is overstated by

C. Comparison of the allowance for bad debts with A. P13,900 C. P18,020

past records. B. P15,880 D. P33,900

D. Inspection of accounts for current versus non-

34. The net amount to be recognized in 2020 profit or loss

current status in the statement of financial

related to these investments is

position.

A. P384,121 C. P134,121

B. P284,121 D. P114,121

SITUATION 7 35. Which statement is correct regarding audit of

investment securities?

Laguna Corporation’s accounting records included the

A. An auditor’s audit objective is to determine

following investments:

whether the securities are authentic.

Investment in Ordinary Shares B. Examination of paid checks issued in payment of

1/1/18 P1,000,000 7/1/20 P800,000 securities purchased is the most effective

12/31/18 200,000 procedure to verify existence.

12/31/19 300,000 C. In performing tests of the carrying amount of

investments in equity securities, the auditor would

usually refer to the quoted market prices of the

Investment in Bonds

securities.

1/1/20 P1,051,510

D. If a client has a large and active investment

portfolio that is kept in a bank safe-deposit box

and the auditor is unable to count the securities at

During the course of your audit, you noted the following.

the end of the reporting period, the auditor most

likely will request the bank to confirm to the

Investment in Ordinary Shares

auditor the contents of the safe deposit box at the

• The investment is not designated at FVTOCI.

end of the reporting period.

• Acquired on January 1, 2018 at P950,000 plus

transaction costs of P50,000.

Page 5 of 10 facebook.com/reyocampo.ol.3 AP.Diagnostic

TEAM PRTC

SITUATION 8 The accrual method is used by Cebu to account for the

warranty and premium costs for financial reporting

Cebu Music Emporium carries a wide variety of music

purposes. The balance in the accounts related to

promotion techniques - warranties and premiums – to

warranties and premiums on January 1, 2020, were as

attract customers.

shown below:

Musical instrument and sound equipment are sold in a Inventory of Premium AM/FM radio P 39,950

one-year warranty for replacement of parts and labor. Estimated Premium Claims Outstanding 44,800

The estimated warranty cost, based on past experience, is Estimated Liability from Warranties 136,000

2% of sales.

QUESTIONS:

The premium is offered on the recorded and sheet music.

Based on the above and the result of your audit,

Customers receive a coupon for each peso spent on

determine the amounts that will be shown on the 2020

recorded music or sheet music. Customers may exchange

financial statements for the following:

200 coupons and P20 for an AM/FM radio. Cebu pays P34

for each radio and estimates that 60% of the coupons 36. Warranty expense

given to customers will be redeemed. A. P108,000 C. P164,000

B. P144,000 D. P80,000

Cebu’s total sales for 2020 were P7,200,000 - P5,400,000

from musical instrument and sound reproduction 37. Estimated liability from warranties

equipment and P1,800,000 from recorded music and A. P108,000 C. P136,000

sheet music. Replacement parts and labor for warranty B. P164,000 D. P80,000

work totaled P164,000 during 2020. A total of 6,500 38. Premium expense

AM/FM radio used in the premium program were A. P 75,600 C. P108,000

purchased during the year and there were 1,200,000 B. P183,600 D. P126,000

coupons redeemed in 2020.

39. Inventory of AM/FM radio

A. P46,950 C. P77,350

B. P39,950 D. P56,950

40. Estimated liability for premiums

A. P75,600 C. P63,450

B. P36,400 D. P44,800

SITUATION 9

CDO Corporation was organized on January 1, 2018, and began operations immediately. Unfortunately, the company

hired an incompetent bookkeeper. For the years 2018 through 2020, the bookkeeper presented an annual balance

sheet that reported only one amount for shareholders' equity. Also, the condensed income statement reported as

follows: 2018, net loss, P175,000; 2019, net profit, P220,000; and 2020, net profit, P410,000. The president has

recommended to the board of directors that a cash dividend of P450,000 be declared and paid during January 2021.

The outside director on the board has objected on the basis that the company's financial statements contain major

errors (there has never been an audit). You have been engaged to clarify the situation. The single shareholders' equity

account, provided by the bookkeeper, appeared as follows:

Shareholders' Equity

2018 Share issue costs P 15,000 2018 Ordinary shares, par P5

2018 Net loss 175,000 200,000 shares issued P1,600,000

2019 Bought 10,000 shares from an unhappy 2019 Net profit (including P100,000

shareholder X 70,000 land write-up based on

president’s estimate) 220,000

Depreciation expense* 2019 Ordinary shares, 2,000

(2018, P15,000; 2019, P17,000; 2020, shares issued 18,000

P23,000) 55,000

Miscellaneous expenses* 2020 Sold 5,000 of X’s shares 27,000

(2018, P20,000; 2019, P25,000; 2020,

P5,000) 50,000

2020 Cash loan to the company president 200,000 2020 Net profit 410,000

P565,000 P2,275,000

* Recorded as expense but not shown on the income statement.

Page 6 of 10 facebook.com/reyocampo.ol.3 AP.Diagnostic

TEAM PRTC

QUESTIONS: Naga Company

Statement of Cash Flows

Based on the above and the result of your audit,

For the Year Ended December 31, 2020

determine the adjusted balances of following as of

December 31, 2020: Cash flows from operating activities:

Cash collected from

41. Share capital customers P685,300

A. P 985,000 C. P1,603,000

Cash payments for:

B. P1,010,000 D. P1,618,000

Inventory purchases P300,000

42. Share premium General expenses 102,000

A. P593,000 C. P601,000

Wages expense 150,000

B. P595,000 D. P608,000

Interest expense 11,000

43. Retained earnings Income tax expense 23,900 586,900

A. P342,000 C. P242,000 Net cash provided by

B. P250,000 D. P227,000 operating activities P 98,400

44. Total equity Cash flows from investing activities:

A. P1,980,000 C. P1,810,000 Sale of property, plant, and

B. P1,896,000 D. P1,710,000 equipment P 27,200

Purchase of property, plant,

45. An auditor usually obtains evidence of shareholders’ and equipment (60,000)

equity transactions by reviewing the entity’s

Net cash used in investing

A. Canceled stock certificates.

activities (32,800)

B. Transfer agent’s records.

Cash flows from financing activities:

C. Treasury stock certificate book.

D. Minutes of board of directors meetings. Retirement of bonds payable P(23,000)

Payment of dividends (42,000)

Net cash used in financing

SITUATION 10 activities (65,000)

The following financial statements are for Naga Company. Net increase in cash P 600

Cash at the beginning of the year 3,400

Naga Company

Comparative Statements of Financial Position Cash at the end of the year P 4,000

December 31, 2020 and 2019 Consider the following additional information:

(a) All accounts payable relate to inventory purchases.

2020 2019

(b) Property, plant, and equipment sold had an original

Assets cost of P75,000 and a carrying amount of P22,000.

Cash P 4,000 P 3,400

Accounts receivable 25,000 18,000 QUESTIONS:

Inventory 30,000 34,000 Based on the foregoing, compute the following for the

Prepaid general expenses 5,700 5,000 year ended December 31, 2020:

Properly, plant, and equipment 305,000 320,000

Accumulated depreciation (103,500) (128,900) 46. Cost of goods sold

Patent 36,000 40,000 A. P307,000 C. P299,000

B. P300,000 D. P293,000

Total assets P302,200 P291,500 47. Depreciation expense

A. P27,600 C. P53,000

Liabilities and Equity B. P25,400 D. P78,400

Accounts Payable P 25,000 P 22,000

48. Total operating expenses

Wages Payable 12,000 10,300

A. P282,400 C. P310,000

Interest Payable 2,800 4,000

B. P284,600 D. P335,400

Dividends Payable 14,000 -

Income taxes Payable 1,600 1,200 49. Loss on retirement of bonds payable

Bonds Payable 100,000 120,000 A. P 3,000 C. P23,000

Share capital 50,000 50,000 B. P20,000 D. P 0

Retained Earnings 96,800 84,000

50. Net income

Total Liabilities and

A. P12,800 C. P40,800

Shareholders' Equity P302,200 P291,500

B. P54,800 D. P68,800

J - end - J

Page 7 of 10 facebook.com/reyocampo.ol.3 AP.Diagnostic

TEAM PRTC

Page 8 of 10 facebook.com/reyocampo.ol.3 AP.Diagnostic

You might also like

- AudDocument13 pagesAudKenneth RobledoNo ratings yet

- Clarkson Lumber SolutionDocument9 pagesClarkson Lumber SolutionDiego F. Guty JadueNo ratings yet

- Ratios-Industry Averages The President of Brewster Company Has Been Concerned About ItsDocument6 pagesRatios-Industry Averages The President of Brewster Company Has Been Concerned About ItsAzenith Margarette Cayetano100% (1)

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionFrom EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionNo ratings yet

- Chapter 27 - Inventory Inclusion: Problem 27-1 (AICPA Adapted)Document11 pagesChapter 27 - Inventory Inclusion: Problem 27-1 (AICPA Adapted)Kimberly Claire AtienzaNo ratings yet

- INVENTORYDocument10 pagesINVENTORYGiulia Tabara100% (1)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- VIRAY, NHICOLE S. Audit of Inventory 3 For QuizDocument2 pagesVIRAY, NHICOLE S. Audit of Inventory 3 For QuizZeeNo ratings yet

- Financial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Document4 pagesFinancial Accounting 2 BBA 212 Instructions: 1 Answer One (1) Question Only Q. 1Mwilah Joshua ChalobaNo ratings yet

- PWCFinancialDocument92 pagesPWCFinancialgshearod2uNo ratings yet

- AP 2020 - Inventories 2Document9 pagesAP 2020 - Inventories 2Heinie Joy PauleNo ratings yet

- PRC AUD Prelim Wit Ans KeyDocument10 pagesPRC AUD Prelim Wit Ans KeyJeanette FormenteraNo ratings yet

- AP 2020 - Inventories 2Document9 pagesAP 2020 - Inventories 2Lora Mae JuanitoNo ratings yet

- NFJPIA - Mockboard 2011 - APDocument12 pagesNFJPIA - Mockboard 2011 - APHazel Iris CaguinginNo ratings yet

- NFJPIA - Mockboard 2011 - AP PDFDocument6 pagesNFJPIA - Mockboard 2011 - AP PDFaizaNo ratings yet

- Mockboard AP PDFDocument6 pagesMockboard AP PDFKathleen JaneNo ratings yet

- NFJPIA - Mockboard 2011 - AP PDFDocument6 pagesNFJPIA - Mockboard 2011 - AP PDFJohnny EspinosaNo ratings yet

- Auditing InventoriesDocument8 pagesAuditing InventoriesSabel FordNo ratings yet

- M2.3e Diy-Problems (Answer Key)Document7 pagesM2.3e Diy-Problems (Answer Key)Liandrew MadronioNo ratings yet

- Nfjpia Mockboard 2011 p1 With Answers PDF FreeDocument12 pagesNfjpia Mockboard 2011 p1 With Answers PDF FreeBea GarciaNo ratings yet

- Audit Problem Inventories Part 1Document4 pagesAudit Problem Inventories Part 1Rio Cyrel CelleroNo ratings yet

- AP 9206-1 InventoriesDocument5 pagesAP 9206-1 InventoriesmiobratataNo ratings yet

- NFJPIA Mockboard 2011 P1Document7 pagesNFJPIA Mockboard 2011 P1Jaymee Andomang Os-agNo ratings yet

- 2023 Aud A 03Document2 pages2023 Aud A 03geraldjakeNo ratings yet

- 1 - CPAR - Audit of Inventory - Theo×ProbDocument5 pages1 - CPAR - Audit of Inventory - Theo×ProbMargaux CornetaNo ratings yet

- NFJPIA Mockboard 2011 P1 PDFDocument9 pagesNFJPIA Mockboard 2011 P1 PDFLei LucasNo ratings yet

- Mockboard - Practical Accounting 1Document8 pagesMockboard - Practical Accounting 1Jaymee Andomang Os-agNo ratings yet

- PRACTICE SET III Audit of InventoriesDocument9 pagesPRACTICE SET III Audit of InventoriesAldyn Jade GuabnaNo ratings yet

- Development For ProductionDocument6 pagesDevelopment For Productiongazer beamNo ratings yet

- Following File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamDocument7 pagesFollowing File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamAnna TaylorNo ratings yet

- (Template) Assignment - Audit of InventoriesDocument5 pages(Template) Assignment - Audit of InventoriesEdemson NavalesNo ratings yet

- Auditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaDocument12 pagesAuditing Problems Final Preboard Examination Batch 87 SET: Cpa Review School of The Philippines ManilaMarwin AceNo ratings yet

- Homework On Inventories Problem 1 (Borrowing Cost ConceptsDocument3 pagesHomework On Inventories Problem 1 (Borrowing Cost ConceptsJazehl Joy ValdezNo ratings yet

- Practical Accounting 1: 2011 National Cpa Mock Board ExaminationDocument7 pagesPractical Accounting 1: 2011 National Cpa Mock Board Examinationcacho cielo graceNo ratings yet

- Quiz No. 1 - Finals (Pas 2: Inventories) Multiple Choice: Kindly Write Your Final Answer Beside Each Question Number. Strictly No ErasuresDocument8 pagesQuiz No. 1 - Finals (Pas 2: Inventories) Multiple Choice: Kindly Write Your Final Answer Beside Each Question Number. Strictly No ErasuresCassandra MarieNo ratings yet

- Audit Problem Inventories Part 2Document6 pagesAudit Problem Inventories Part 2Rio Cyrel CelleroNo ratings yet

- Ac20 Quiz 3 - DGCDocument10 pagesAc20 Quiz 3 - DGCMaricar PinedaNo ratings yet

- 112.inventory ExercisesDocument6 pages112.inventory ExercisesJalanur MarohomNo ratings yet

- Problem 1Document4 pagesProblem 1Live LoveNo ratings yet

- SUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Document5 pagesSUBJECT: Accounting 13 NC Descriptive Title: Auditing and Assurance Concepts and Applications 1Prince CalicaNo ratings yet

- Applied - 3 MidtermDocument7 pagesApplied - 3 MidtermMarjorieNo ratings yet

- Date Description AmountDocument5 pagesDate Description AmountClaire BarbaNo ratings yet

- AUDITPR1Document3 pagesAUDITPR1Baby ValixNo ratings yet

- Effects of Errors 2021Document2 pagesEffects of Errors 2021Ali SwizzleNo ratings yet

- Auditing Problem 12-18-21Document23 pagesAuditing Problem 12-18-21Joebelle JamosoNo ratings yet

- Problem No. 1Document20 pagesProblem No. 1ChrisNo ratings yet

- FAR Test BankDocument34 pagesFAR Test BankRaamah DadhwalNo ratings yet

- PROBLEM NO. 1: CAIMAN, INC. Uses A Perpetual Inventory System and Reports Inventory at The Lower of FIFODocument4 pagesPROBLEM NO. 1: CAIMAN, INC. Uses A Perpetual Inventory System and Reports Inventory at The Lower of FIFOAnn SarmientoNo ratings yet

- HEBEROLA SFExam 12Document22 pagesHEBEROLA SFExam 12Marjorie Joyce BarituaNo ratings yet

- College of Business and Entrepreneurship: Eastern Visayas State UniversityDocument5 pagesCollege of Business and Entrepreneurship: Eastern Visayas State UniversityHelton Jun M. TuralbaNo ratings yet

- AP03 Audit of Inventories QDocument6 pagesAP03 Audit of Inventories Qbobo kaNo ratings yet

- Sample Problems (CAT Level 1)Document20 pagesSample Problems (CAT Level 1)Justine LouiseNo ratings yet

- Audit of Inventory 2021 - ExamDocument9 pagesAudit of Inventory 2021 - ExammoreNo ratings yet

- Part 1: Reviewer#5: Midterm Quiz 9fundamentals of Accounting 1 & 2)Document5 pagesPart 1: Reviewer#5: Midterm Quiz 9fundamentals of Accounting 1 & 2)annedanyle acabadoNo ratings yet

- Handout No. 3Document6 pagesHandout No. 3Villena Divina VictoriaNo ratings yet

- ACC-122 Inventory QuizDocument2 pagesACC-122 Inventory QuizPea Del Monte Añana100% (1)

- 7104 - InventoryDocument2 pages7104 - InventoryGerardo YadawonNo ratings yet

- FAR B92 1st PB PDFDocument14 pagesFAR B92 1st PB PDFomer 2 gerdNo ratings yet

- Ap-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash EquivalentsDocument27 pagesAp-500Q: Quizzer On Purchasing/Disbursement Production and Revenue/Receipt Cycles: Audit of Inventories, Receivables and Cash and Cash Equivalentsruel c armillaNo ratings yet

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020From EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020No ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Finding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesFrom EverandFinding Balance 2023: Benchmarking Performance and Building Climate Resilience in Pacific State-Owned EnterprisesNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Jyoiti PathakDocument53 pagesJyoiti PathakNitinAgnihotriNo ratings yet

- BBM 320 Group AssignmentDocument7 pagesBBM 320 Group Assignmentteddy chirchirNo ratings yet

- CBP - Cost SubmissionDocument10 pagesCBP - Cost SubmissionGerald CrewsNo ratings yet

- Budget Template and Samples GuideDocument5 pagesBudget Template and Samples GuidebelijobNo ratings yet

- Budget Assignment Norma GDocument5 pagesBudget Assignment Norma Gapi-242614310No ratings yet

- Bos 54380 CP 6Document198 pagesBos 54380 CP 6Sourabh YadavNo ratings yet

- Ar067 68Document72 pagesAr067 68sauravkafle1No ratings yet

- 2 IFRS 17 The Actuarial ViewDocument33 pages2 IFRS 17 The Actuarial ViewmarhadiNo ratings yet

- E5-4:E5-3 and Emma's AlternationsDocument4 pagesE5-4:E5-3 and Emma's AlternationsAman KailaniNo ratings yet

- Session 1 & 2 Financial Management - Kurnadi GularsoDocument23 pagesSession 1 & 2 Financial Management - Kurnadi GularsoChintya FransiscaNo ratings yet

- Governance Policies Procedures ManualDocument34 pagesGovernance Policies Procedures ManualmojiamaraNo ratings yet

- FY19 - QBDT Client - Lesson-12 - Payroll With QuickBooks - BDB - v2Document32 pagesFY19 - QBDT Client - Lesson-12 - Payroll With QuickBooks - BDB - v2Nyasha MakoreNo ratings yet

- Steuerbuch2022 en v03 BarrierefreiDocument204 pagesSteuerbuch2022 en v03 BarrierefreilaescuderoNo ratings yet

- 1 - Finance Short NotesDocument12 pages1 - Finance Short NotesSudhanshu PatelNo ratings yet

- TAX - IPCC Amendment For Nov, 2013 Attempt (Carocks - Wordpress.com)Document84 pagesTAX - IPCC Amendment For Nov, 2013 Attempt (Carocks - Wordpress.com)Dushyant SinghaniaNo ratings yet

- Accountancy MARKING SCHEME Class-XII Set-IDocument9 pagesAccountancy MARKING SCHEME Class-XII Set-Iaamiralishiasbackup1No ratings yet

- What Is Costing?Document27 pagesWhat Is Costing?wickygeniusNo ratings yet

- Financial Statement Analysis Part 2Document10 pagesFinancial Statement Analysis Part 2Kim Patrick VictoriaNo ratings yet

- Ledger 2Document4 pagesLedger 2Hellarica AnabiezaNo ratings yet

- Tax - PDF of Prof. Mamalateo'sDocument18 pagesTax - PDF of Prof. Mamalateo'sRenante Rodrigo100% (1)

- National Income: Macroeconomics: An IntroductionDocument35 pagesNational Income: Macroeconomics: An IntroductionNisarg KhamarNo ratings yet

- Chapter 13 Audit of Co Operative Societies PMDocument8 pagesChapter 13 Audit of Co Operative Societies PMJyotiParangeNo ratings yet

- Acn Chapter 7 Problem 6-19Document10 pagesAcn Chapter 7 Problem 6-19Lady Zyanien DevarasNo ratings yet

- PSEB Class 11 Accountancy I Syllabus 2021 2022Document5 pagesPSEB Class 11 Accountancy I Syllabus 2021 2022A VNo ratings yet

- Product Project Report On Gesh LighterDocument68 pagesProduct Project Report On Gesh LighterRohit Sevra50% (2)

- How To Read and Analyze An Income StatementDocument5 pagesHow To Read and Analyze An Income StatementsaketNo ratings yet