Professional Documents

Culture Documents

LIC Housing Finance Limited

LIC Housing Finance Limited

Uploaded by

abhishek.26722Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LIC Housing Finance Limited

LIC Housing Finance Limited

Uploaded by

abhishek.26722Copyright:

Available Formats

Press Release

LIC Housing Finance Limited (Revised)

March 23, 2022

Ratings

Rating

Facilities/Instruments Amount (Rs. crore) Rating1

Action

CARE AAA; Stable

Lower Tier II 500.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Lower Tier II 250.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Bonds 25,000.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Debentures 150.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Debentures 372.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Debentures 154.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Debentures 33,765.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Debentures 15,000.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Debentures 18,000.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Debentures 25,000.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Debentures 25,000.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Debentures 35,000.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Non-convertible Debentures 35,000.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Tier II Bonds 3,000.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Upper Tier II 500.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Upper Tier II 500.00 Reaffirmed

(Triple A; Outlook: Stable)

CARE AAA; Stable

Upper Tier II 500.00 Reaffirmed

(Triple A; Outlook: Stable)

217,691.00

Total Long-term (Rs. Two lakh seventeen

Instruments thousand six hundred ninety-one

crore only)

Details of instruments/facilities in Annexure-1

Detailed Rationale & Key Rating Drivers

The rating continues to factor in the support LIC Housing Finance Limited (LICHFL) derives from Life Insurance Corporation of

India (LIC) (largest life insurer in India), which holds 45.24% stake in the company and the strategic importance accorded by

LIC to LICHFL. The rating continues to reflect LIC’s demonstrated financial, managerial, operational, and marketing support to

LICHFL; as well as LICHFL’s long-standing track record and market position. The rating also considers adequate capitalisation,

moderate profitability levels, moderation in asset quality parameters and adequate liquidity position supported by strong

resource raising capability. The continued support from the promoters, gearing levels, profitability and asset quality would

remain the key monitorable.

1

Complete definition of the ratings assigned are available at www.careedge.in and other CARE Ratings Ltd.’s publications

1 CARE Ratings Ltd.

Press Release

Rating Sensitivities

Negative Factors- Factors that could lead to negative rating action/downgrade:

• Moderation in support from Life Insurance Corporation of India (LIC).

• Material deterioration in the asset quality on a sustained basis.

• Fall in profitability with return on total assets (ROTA) below 1% on a sustained basis.

• Significant fall in the proportion of Home Loans portfolio.

• Weakening of the capital structure and gearing beyond 12x.

Detailed description of the key rating drivers

Key Rating Strengths

Strong promoter support from its largest shareholder; Life Insurance Corporation of India

LIC holds 45.24% stake in LICHFL as on December 31, 2021, which increased from 40.31% as on March 31, 2021, after the

issue of equity shares worth Rs.2,335 crore in September 2021, under preferential allotment. LICHFL derives strong promoter

support from its parent entity. The common brand linkage, agent network, funding and managerial support extended to the

operations of LICHFL indicate the strategic importance attached to LICHFL by LIC.

LICHFL generates its business through leads provided by home loan agents (HLAs), direct sales agents (DSAs), customer

relation associates (CRAs), its wholly-owned subsidiary, LICHF Financial Services Ltd. (LFSL) and direct branch walk-ins.

Together, HLAs and LFSL account for the LIC ecosystem that account for two-thirds of the loans disbursed by LICHFL. LICHFL’s

reliance on this LIC ecosystem is increasing over past few years. Additionally, LIC has deputed more than 60 employees to

LICHFL to lend support to its functioning and management. Apart from this, LIC has nominated three Directors on the Board of

LICHFL, including Managing Director and CEO of the company.

The rating continues to derive strength from the depth and spread of demonstrated support extended by LIC to LICHFL.

Long-standing track record and market position in housing finance sector

Established in 1989, LICHFL has a long and profitable track record of operations of over three decades. The company is the

second-largest market player in the housing finance industry having a loan portfolio of over Rs.232,003 crore as on March 31,

2021, as compared with Rs.210,600 crore at the end of FY20 (refers to the period April 1 to March 31). The asset under

management (AUM) has witnessed a growth of around 15% compounded annual growth rate (CAGR) during FY17-21. The

reported AUM stood at Rs.243,413 crore as on December 31, 2021.

Diversified resource profile

LICHFL has strong and well-diversified resource profile. Due to its strong brand name and parent support, LICHFL enjoys

diversified funding sources from banks, non-convertible debentures (NCDs), commercial papers, etc. As on December 31, 2021,

NCD’s accounted for 54.30% of the total borrowing, loans from banks at 27.42%, commercial paper share at 4.82% and other

sources (refinancing from NHB and fixed deposits and subordinated debt) at 13.46%.

There has been a shift in the sourcing of borrowings to the bank facilities due to the lower interest rate funding available from

the banks and on account of diversification of funding sources. The loans from banks have grown steadily from 10% in FY18 to

around 27% in 9MFY22.

During FY21, the incremental cost of borrowings stood at 5.62%, whereas for Q3FY22, the incremental cost of borrowings

stood at 5.27% as reported by LICHFL.

Adequate capitalisation and high gearing levels

LICHFL has adequate capitalisation with reported capital adequacy ratio (CAR) as on March 31, 2021, at 15.28% and Tier I CAR

at 13.87%. Over the years, LIC has been periodically infusing funds via equity and debt route. The capitalisation levels of the

2 CARE Ratings Ltd.

Press Release

company are further supported by healthy internal accruals. During the period FY18-21, its net worth and the borrowings

increased by around 14% CAGR. The overall capital adequacy improved in 9MFY22 with additional equity infusion of Rs.2,335

crore in September 2021 and the company reported CAR at 16.95% and Tier I CAR at 15.63% as on September 30, 2021.

As on March 31, 2021, the company reported gearing levels of 10.53x. With additional equity infusion and healthy retention of

profits in H1FY22, it’s gearing levels reduced to 9.38x as on September 30, 2021. Going forward, continued parent support and

strong resource raising ability are expected to enable the company in raising capital to meet its future business growth.

Key Rating Weaknesses

Moderate profitability parameters with lower margins in prime home loan segment

As on December 31, 2021, individual housing segment made up 80% of the total portfolio. With majority portfolio skewed

towards housing segment, the spreads remain low for LICHFL considering strong competition in home loan segment from banks

and housing finance companies (HFCs).

On a standalone basis, during FY21, net interest margins (NIMs) remained moderate at 2.32% [P.Y.: 2.31%], while its ROTA

improved marginally to 1.21% in FY21 as compared with 1.15% in FY20. Credit cost remained more or less stable in FY21 at

0.6% as compared with 0.5% in FY20.

The profit after tax (PAT) declined by 29% to Rs.1,669 crore in 9MFY22 from Rs.2,335 crore in 9MFY21 due to significant

increase in the credit costs from Rs.340 crore in 9MFY21 to Rs.1,811 crore in 9MFY22, amid rise in delinquencies and to shore

up the provision coverage.

Weakening asset quality

The asset quality of LICHFL has been deteriorating over the last few quarters, due to increasing stress levels in the underlying

assets in the recent years, driven primarily by Covid-19 and slowdown in the economy along with slippages in developer loan

portfolio. As on March 31, 2021, LICHFL’s gross non-performing asset (GNPA) deteriorated to 4.16% from 2.83% as on March

31, 2020, while net NPA (NNPA) stood at 2.59% [P.Y.: 1.99%]. As on December 31, 2021, LICHFL reported GNPA ratio of

5.14% with NNPA of 3.20%.

Majority share of loan book (80% of the total portfolio) is individual home loans where the company enjoys relatively sound

asset quality with GNPA at 2.1% as on December 31, 2021, as against the peak 2.6% as on June 30, 2021, post the second

wave of Covid. Furthermore, CARE Ratings Ltd also takes comfort from the collection efficiency of 99% for December 2021 for

retail portfolio.

Major deterioration of the asset quality has been reported in project loans which forms 5.8% of the overall loan portfolio, with

GNPA of 27% as on December 31, 2021. The non-housing individual loan portfolio and non-housing corporate loan portfolio

reported GNPA of 9% and 15.9%, respectively. The company is continuing with the recovery efforts and simultaneously

increasing its provisioning coverage with total provision to gross loan book at 2.35% as on December 31, 2021, as compared

with 1.68% as on March 31, 2021, and 1.24% as on March 31, 2020.

Liquidity Profile – Adequate

As on December 31, 2021, LICHFL’s liquidity profile shows negative cumulative mismatches in short to medium-term buckets.

In the short-term bucket (up to 12m), LICHFL has negative cumulative mismatch of Rs.13,673 crore. Furthermore, CP

outstanding as on December 31, 2021, was around Rs.10,400 crore accounting for around 4.82% of the total borrowings.

CARE Ratings Ltd takes comfort from strong resource raising capability of LICHFL, considering parentage of LIC. Further, the

sanctioned undrawn bank lines stood at Rs.10,825 crore, providing further comfort.

In the domain of asset-liability management, it has been able to use its liquid investments and invoke unutilised bank lines to

tide over its short-term mismatches in its repayment schedule. Furthermore, in case of insufficient asset-side support, it has

leveraged on its brand and industry position to mobilise resources to manage its liability calendar.

3 CARE Ratings Ltd.

Press Release

Analytical approach: Standalone

CARE Ratings Ltd has analysed standalone credit profile of LICHFL factoring linkages with its parent, LIC. CARE Ratings Ltd has

considered the 45.24% shareholding of LIC in LICHFL, along with the depth and spread of demonstrated support extended by

LIC to LICHFL. LICHFL benefits from common brand linkage, logo, agent network, funding support and managerial support

from LIC.

Applicable Criteria

Policy on default recognition

Factoring Linkages Parent Sub JV Group

Financial Ratios - Financial Sector

Rating Outlook and Credit Watch

Rating Methodology: Housing Finance Companies

About the Company

LICHFL is India’s second-largest housing finance player with outstanding loan portfolio of Rs.243,413 crore as on December 31,

2021. LIC, the largest life insurance company of India, continues to be the largest shareholder in LICHFL, with around 45.24%

shareholding as on December 31, 2021. LICHFL’s portfolio composition has undergone a major change in FY17-20. HL exposure

has improved in FY21 and 9MFY22 at 80% of the AUM as on December 31, 2021.

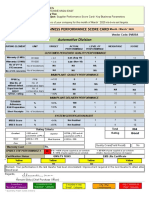

Brief Financials (Rs. crore) 31-03-2020 (A) 31-03-2021 (A) 9MFY 2022 (UA)

Total operating income 19,670 19,848 15,144

PAT 2,402 2,734 1,669

Total Assets 216,806 235,633 NA

Net NPA (%) (as per IGAAP) 1.99 2.59 3.21

ROTA (%) 1.15 1.21 NA

A: Audited; UA: Unaudited

Status of non-cooperation with previous CRA: Not applicable

Any other information: Not applicable

Rating History for last three years: Please refer Annexure-2

Covenants of rated instrument / facility: Detailed explanation of covenants of the rated instruments/facilities is given in

Annexure-3

Complexity level of various instruments rated for this company: Annexure 4

Annexure-1: Details of Instruments / Facilities

Size of the Rating assigned

Name of the Date of Coupon Maturity

ISIN Issue along with Rating

Instrument Issuance Rate Date

(Rs. crore) Outlook

Non-Convertible

INE115A07BY3 30-Jan-12 9.45% 30-Jan-22 300 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07CA1 10-Feb-12 9.43% 10-Feb-22 200 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07CT1 24-Jul-12 9.35% 24-Jul-22 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07CY1 14-Sep-12 9.30% 14-Sep-22 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07DA9 25-Oct-12 9.05% 25-Oct-22 335 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07DD3 12-Nov-12 9.25% 12-Nov-22 400 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07DG6 13-Dec-12 9.23% 13-Dec-22 200 CARE AAA; Stable

Debentures

4 CARE Ratings Ltd.

Press Release

Non-Convertible

INE115A07DH4 17-Dec-12 9.30% 17-Dec-22 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07DI2 01-Jan-13 9.25% 01-Jan-23 750 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07DQ5 12-Mar-13 9.13% 12-Mar-23 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07DS1 09-Apr-13 9.00% 09-Apr-23 525 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07DT9 25-Apr-13 8.89% 25-Apr-23 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07DX1 21-May-13 8.37% 21-May-23 900 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07FC0 19-Mar-14 9.80% 19-Mar-24 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07FJ5 07-Jul-14 9.29% 05-Jul-24 605 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07FO5 25-Aug-14 9.47% 23-Aug-24 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07FP2 25-Aug-14 9.39% 23-Aug-24 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07FW8 30-Sep-14 9.24% 30-Sep-24 650 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07FY4 16-Oct-14 9.22% 16-Oct-24 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07GL9 08-Jan-15 8.62% 08-Jan-25 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07GP0 30-Jan-15 8.40% 30-Jan-25 10 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07GS4 24-Feb-15 8.50%. 24-Feb-25 600 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07GT2 03-Mar-15 8.52% 03-Mar-25 425 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07GY2 31-Mar-15 8.22% 31-Mar-25 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07HG7 29-May-15 8.55% 29-May-25 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07HH5 04-Jun-15 8.50% 04-Jun-25 205 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07HP8 20-Jul-15 8.57% 18-Jul-25 195 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07HT0 03-Aug-15 8.58% 01-Aug-25 300 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07HU8 17-Aug-15 8.55% 14-Aug-25 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07HX2 31-Aug-15 8.50% 29-Aug-25 300 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07HW4 31-Aug-15 8.48% 29-Aug-25 200 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IC4 08-Oct-15 8.34% 08-Oct-25 210 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IF7 23-Oct-15 8.25% 23-Oct-25 381 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IH3 13-Nov-15 8.20% 13-Nov-25 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IN1 14-Dec-15 8.40% 12-Dec-25 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IO9 05-Jan-16 8.50% 05-Jan-21 350 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IP6 05-Jan-16 8.50% 05-Jan-21 150 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IQ4 19-Jan-16 8.58% 19-Jan-23 490 CARE AAA; Stable

Debentures

5 CARE Ratings Ltd.

Press Release

Non-Convertible

INE115A07IR2 28-Jan-16 8.42% 28-Jan-26 750 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IS0 02-Feb-16 8.43% 02-Feb-26 750 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IT8 08-Feb-16 8.58% 08-Feb-24 137.3 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IW2 26-Feb-16 8.53% 26-Feb-26 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IX0 03-Mar-16 8.57% 03-Mar-26 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07IY8 08-Mar-16 8.75% 03-Aug-21 600 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JB4 14-Mar-16 8.75% 12-Feb-21 750 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JF5 28-Mar-16 8.60% 26-Feb-21 367 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JI9 27-Apr-16 8.32% 27-Apr-26 300 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JK5 10-May-16 8.37% 10-May-21 505 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JM1 23-May-16 8.45% 22-May-26 510 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JN9 23-May-16 8.45% 21-May-21 250 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JO7 10-Jun-16 8.48% 09-Jun-23 272 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JP4 10-Jun-16 8.47% 10-Jun-26 495 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JQ2 15-Jun-16 8.47% 15-Jun-26 357 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JS8 29-Jun-16 8.48% 29-Jun-26 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JT6 29-Jun-16 8.48% 29-Jun-26 348.8 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JW0 12-Jul-16 8.43% 10-Jul-26 472.4 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07JY6 15-Jul-16 8.30% 15-Jul-21 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KB2 27-Jul-16 8.19% 27-Jul-21 105 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KE6 18-Aug-16 7.90% 18-Aug-26 200 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KJS 19-Sep-16 7.86% 19-Sep-23 200 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KK3 19-Sep-16 7.81% 19-Oct-21 300 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KM9 26-Sep-16 7.83% 25-Sep-26 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KN7 29-Sep-16 7.75% 27-Aug-21 200 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KQ0 14-Oct-16 7.59% 14-Oct-21 497 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KR8 21-Oct-16 7.66% 21-Oct-21 140 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KS6 25-Oct-16 7.48% 23-Oct-26 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KY4 16-Dec-16 7.16% 16-Dec-26 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07KZ1 23-Dec-16 7.25% 22-Dec-23 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07LC8 13-Jan-17 7.57% 13-Jan-22 500 CARE AAA; Stable

Debentures

6 CARE Ratings Ltd.

Press Release

Non-Convertible

INE115A07LM7 24-Mar-17 7.95% 24-Mar-22 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07LO3 27-Mar-17 7.95% 26-Mar-27 600 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07LQ8 03-May-17 7.80% 03-May-22 250 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07LS4 08-May-17 7.90% 08-May-24 250 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07LU0 17-May-17 7.86% 17-May-27 700 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07LW6 23-May-17 7.78% 23-May-22 300 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07LX4 29-May-17 7.67% 29-Jul-21 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07LZ9 12-Jun-17 7.48% 10-Jun-22 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MC6 14-Jun-17 7.56% 14-Jun-27 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MA0 14-Jun-17 7.40% 14-Aug-20 250 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MB8 14-Jun-17 7.40% 18-Aug-20 250 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07ME2 30-Jun-17 7.47% 13-Jul-20 300 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MG7 21-Jul-17 7.42% 15-Jul-22 1100 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MJ1 30-Aug-17 7.39% 30-Aug-22 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07ML7 07-Sep-17 7.40% 06-Sep-24 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MO1 17-Oct-17 7.45% 17-Oct-22 1000 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MQ6 23-Nov-17 7.75% 23-Nov-27 530 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MR4 29-Nov-17 7.57% 18-Feb-21 1250 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MS2 18-Dec-17 7.85% 16-Feb-22 1205 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MT0 12-Jan-18 7.88% 28-Jan-21 327 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MW4 29-Jan-18 7.95% 29-Jan-28 1477 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MX2 12-Mar-18 8.19% 25-Mar-21 1173 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07ND2 10-Oct-18 9.08% 10-Oct-28 912 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NE0 17-Oct-18 9.08% 17-Oct-23 448 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NF7 24-Oct-18 9.17% 24-Mar-22 495 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NH3 24-Oct-18 9.10% 24-Sep-28 630.5 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NI1 06-Nov-18 9.19% 06-Jun-23 1663 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NL5 19-Nov-18 8.97% 17-Nov-28 274.9 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NM3 27-Nov-18 9.10% 25-Feb-22 1622 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NO9 10-Dec-18 8.75% 08-Dec-23 775 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NP6 10-Dec-18 8.75% 08-Dec-28 1606 CARE AAA; Stable

Debentures

7 CARE Ratings Ltd.

Press Release

Non-Convertible

INE115A07NR2 24-Dec-18 8.70% 24-Dec-25 1522.4 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NS0 11-Jan-19 8.69% 19-Apr-22 651.8 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NU6 28-Jan-19 8.80% 25-Jan-29 1365 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NW2 22-Feb-19 8.70% 04-May-22 529.5 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NY8 05-Mar-19 8.79% 05-Mar-24 315 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NY8 08-Mar-19 8.79% 05-Mar-24 1500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07NZ5 14-Mar-19 8.60% 14-Jan-22 2500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OA6 19-Mar-19 8.25% 17-Sep-21 1675 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OB4 25-Mar-19 8.70% 23-Mar-29 3400 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OD0 20-May-19 8.50% 20-Jun-22 2035 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OE8 31-May-19 8.33% 31-May-24 2674 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OF5 12-Jul-19 7.99% 12-Jul-29 2500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OG3 23-Jul-19 7.85% 23-Sep-22 1200 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OH1 22-Aug-19 7.60% 22-Nov-22 1165 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OI9 29-Aug-19 7.78% 29-Aug-24 770 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OJ7 09-Sep-19 7.45% 13-Jan-23 910 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OK5 23-Sep-19 7.24% 23-Aug-21 1595 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OL3 23-Sep-19 7.75% 23-Jul-24 1455 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OM1 18-Oct-19 7.79% 18-Oct-24 2700 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07ON9 04-Nov-19 6.95% 04-Jun-21 501 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OO7 28-Nov-19 7.03% 28-Dec-21 1935 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OG3 06-Dec-19 7.16% 23-Sep-22 250 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OH1 06-Dec-19 7.18% 22-Nov-22 300 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OP4 20-Dec-19 7.22% 19-Nov-21 750 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OQ2 10-Jan-20 7.45% 10-Feb-23 3250 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OR0 28-Jan-20 7.97% 28-Jan-30 1120 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MJ1 06-Feb-20 7.20% 30-Aug-22 1050 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OS8 12-Feb-20 7.33% 12-Feb-25 1510 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OT6 12-Feb-20 6.57% 13-Jul-21 340 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OU4 26-Jun-20 5.90% 11-May-23 520 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OU4 02-Jul-20 5.82% 11-May-23 500 CARE AAA; Stable

Debentures

8 CARE Ratings Ltd.

Press Release

Non-Convertible

INE115A07ML7 15-Jul-20 5.82% 06-Sep-24 1250 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OV2 26-Aug-20 5.45% 25-Aug-23 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OV2 10-Sep-20 5.40% 25-Aug-23 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OW0 25-Sep-20 6.19% 25-Nov-24 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MG7 09-Oct-20 5.01% 15-Jul-22 1500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OW0 09-Oct-20 6.15% 25-Nov-24 1075 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OX8 01-Dec-20 5.53% 20-Dec-24 2595 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OY6 11-Dec-20 5.78% 11-Sep-25 500 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OZ3 31-Dec-20 4.96% 14-Sep-23 665 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PA3 22-Jan-21 5.23% 26-Jul-23 905.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OS8 28-Jan-21 7.33% 12-Feb-25 325.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07MJ1 28-Jan-21 7.39% 30-Aug-22 300.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PB1 22-Feb-21 5.72% 22-Feb-24 800.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PC9 01-Mar-21 5.35% 20-Mar-23 1300.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PD7 08-Mar-21 6.40% 24-Jan-25 1425.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PE5 08-Mar-21 4.55% 28-Mar-22 1000.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PB1 15-Mar-21 5.72% 22-Feb-24 500.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PD7 25-Mar-21 6.40% 24-Jan-25 1100.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PC9 25-Mar-21 5.35% 20-Mar-23 1000.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PF2 19-May-21 6.01% 19-May-26 550.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PG0 24-May-21 5.38% 15-May-24 555.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OY6 31-May-21 5.78% 11-Sep-25 990.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PH8 04-Jun-21 6.68% 04-Jun-28 320.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PI6 03-Sep-21 6.17% 03-Sep-26 1500.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PJ4 09-Sep-21 4.98% 12-Jan-24 1000.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PK2 03-Sep-21 5.69% 20-May-25 550.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PL0 24-Sep-21 6.95% 24-Sep-31 975.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PM8 01-Oct-21 5.65% 25-Apr-25 675.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A070Z3 12-Nov-21 4.96% 14-Sep-23 745.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PH8 12-Nov-21 6.68% 04-Jun-28 420.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PK2 23-Nov-21 5.69% 20-May-25 1120.00 CARE AAA; Stable

Debentures

9 CARE Ratings Ltd.

Press Release

Non-Convertible

INE115A07PN6 30-Nov-21 6.40% 30-Nov-26 1000.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PO4 30-Nov-21 5.32% 30-Nov-23 950.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PP1 30-Nov-21 7.13% 28-Nov-31 750.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PP1 07-Dec-21 7.13% 28-Nov-31 250.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PQ9 14-Dec-21 5.99% 12-Mar-25 2400.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PP1 27-Dec-21 7.13% 28-Nov-31 657.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OV2 17-Jan-22 5.45% 25-Aug-23 1250.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07OZ3 17-Jan-22 4.96% 14-Sep-23 500.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PJ4 25-Jan-22 4.98% 12-Jan-24 1110.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PS5 15-Feb-22 5.75% 14-Jun-24 1030.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PR7 15-Feb-22 6.65% 15-Feb-27 500.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PS5 23-Feb-22 5.75% 14-Jun-24 525.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PR7 23-Feb-22 6.65% 15-Feb-27 300.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07PM8 23-Feb-22 6.08% 25-Apr-25 725.00 CARE AAA; Stable

Debentures

Non-Convertible

INE115A07932 10-Aug-10 8.90% 10-Aug-20 630 CARE AAA; Stable

Debentures*

Non-Convertible

INE115A07AA5 13-Oct-10 8.88% 13-Oct-20 465 CARE AAA; Stable

Debentures*

Non-Convertible

INE115A07AC1 23-Nov-10 9.00% 23-Nov-20 366 CARE AAA; Stable

Debentures*

Non-Convertible

INE115A07AH0 04-Jan-11 9.35% 04-Jan-21 107 CARE AAA; Stable

Debentures*

Non-Convertible

INE115A07AJ6 18-Jan-11 9.00% 18-Jan-21 1000 CARE AAA; Stable

Debentures*

Non-Convertible

INE115A07AL2 07-Mar-11 9.60% 07-Mar-21 250 CARE AAA; Stable

Debentures*

Non-Convertible

INE115A07AP3 11-May-11 9.40% 11-May-21 500 CARE AAA; Stable

Debentures*

Non-Convertible

INE115A07AT5 07-Jun-11 9.80% 07-Jun-21 500 CARE AAA; Stable

Debentures*

Non-Convertible

INE115A07BH8 19-Sep-11 9.40% 19-Sep-21 500 CARE AAA; Stable

Debentures*

Non-Convertible

INE115A07BL0 11-Nov-11 9.90% 11-Nov-21 200 CARE AAA; Stable

Debentures*

Non-Convertible

Proposed - - - 68271.40 CARE AAA; Stable

Debentures

Upper Tier II INE115A08328 31-Mar-10 8.70% 31-Mar-25 500 CARE AAA; Stable

Upper Tier II INE115A08344 26-Oct-10 8.90% 26-Oct-25 500 CARE AAA; Stable

Upper Tier II INE115A08351 29-Nov-10 9.00% 29-Nov-25 500 CARE AAA; Stable

Lower Tier II Proposed NA NA NA 250 CARE AAA; Stable

Lower Tier II* INE115A08336 15-Sep-10 8.95 15-Sep-20 500 CARE AAA; Stable

Tier II Bonds INE115A08369 21-Dec-20 7.05% 21-12-2030 1,000 CARE AAA; Stable

Tier II Bonds INE115A08377 19-Mar-21 7.70% 19-03-2031 500 CARE AAA; Stable

Tier II Bonds INE115A08369 31-Mar-21 7.05% 19-03-2031 300 CARE AAA; Stable

Tier II Bonds Proposed NA NA NA 1,200 CARE AAA; Stable

10 CARE Ratings Ltd.

Press Release

Annexure-2: Rating history of last three years

Current Ratings Rating history

Name of the Date(s) & Date(s) & Date(s) & Date(s) &

Sr. Amount

Instrument/Bank Rating(s) Rating(s) Rating(s) Rating(s)

No. Type Outstanding Rating

Facilities assigned in assigned in assigned in assigned in

(Rs. crore)

2021-2022 2020-2021 2019-2020 2018-2019

1)CARE

AAA; Stable

(31-Mar-21)

2)CARE

Debentures-Non- CARE 1)CARE

AAA;

1 Convertible LT 150.00 AAA; - - AAA; Stable

Stable

Debentures Stable (07-Jan-19)

(07-Aug-20)

3)CARE

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

(31-Mar-21)

Debentures-Non- CARE 2)CARE 1)CARE

2 Convertible LT 372.00 AAA; - AAA; Stable - AAA; Stable

Debentures Stable (07-Aug-20) (07-Jan-19)

3)CARE

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

(31-Mar-21)

Debentures-Non- CARE 2)CARE 1)CARE

3 Convertible LT 154.00 AAA; - AAA; Stable - AAA; Stable

Debentures Stable (07-Aug-20) (07-Jan-19)

3)CARE

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

CARE (31-Mar-21) 1)CARE

4 Bonds-Lower Tier II LT 500.00 AAA; - - AAA; Stable

Stable 2)CARE (07-Jan-19)

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

CARE (31-Mar-21) 1)CARE

5 Bonds-Upper Tier II LT 500.00 AAA; - - AAA; Stable

Stable 2)CARE (07-Jan-19)

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

CARE (31-Mar-21) 1)CARE

6 Bonds-Upper Tier II LT 500.00 AAA; - - AAA; Stable

Stable 2)CARE (07-Jan-19)

AAA; Stable

(07-Apr-20)

CARE 1)CARE 1)CARE

7 Bonds-Lower Tier II LT 250.00 - -

AAA; AAA; Stable AAA; Stable

11 CARE Ratings Ltd.

Press Release

Stable (31-Mar-21) (07-Jan-19)

2)CARE

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

(31-Mar-21)

Debentures-Non- CARE 2)CARE 1)CARE

8 Convertible LT 33765.00 AAA; - AAA; Stable - AAA; Stable

Debentures Stable (07-Aug-20) (07-Jan-19)

3)CARE

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

CARE (31-Mar-21) 1)CARE

9 Bonds-Upper Tier II LT 500.00 AAA; - - AAA; Stable

Stable 2)CARE (07-Jan-19)

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

(31-Mar-21)

Debentures-Non- CARE 2)CARE 1)CARE

10 Convertible LT 15000.00 AAA; - AAA; Stable - AAA; Stable

Debentures Stable (07-Aug-20) (07-Jan-19)

3)CARE

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

(31-Mar-21)

Debentures-Non- CARE 2)CARE 1)CARE

11 Convertible LT 18000.00 AAA; - AAA; Stable - AAA; Stable

Debentures Stable (07-Aug-20) (07-Jan-19)

3)CARE

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

(31-Mar-21)

Debentures-Non- CARE 2)CARE 1)CARE

12 Convertible LT 25000.00 AAA; - AAA; Stable - AAA; Stable

Debentures Stable (07-Aug-20) (07-Jan-19)

3)CARE

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

CARE (31-Mar-21) 1)CARE

Bonds-Non-

13 LT 25000.00 AAA; - - AAA; Stable

Convertible Bonds

Stable 2)CARE (07-Jan-19)

AAA; Stable

(07-Apr-20)

14 Debentures-Non- LT 25000.00 CARE - 1)CARE - 1)CARE

12 CARE Ratings Ltd.

Press Release

Convertible AAA; AAA; Stable AAA; Stable

Debentures Stable (31-Mar-21) (10-Dec-18)

2)CARE

AAA; Stable

(07-Aug-20)

3)CARE

AAA; Stable

(07-Apr-20)

1)CARE

AAA; Stable

Debentures-Non- CARE (31-Mar-21) 1)CARE

15 Convertible LT 35000.00 AAA; - AAA; Stable -

Debentures Stable 2)CARE (13-Jun-19)

AAA; Stable

(07-Aug-20)

1)CARE

AAA; Stable

CARE (31-Mar-21)

16 Bonds-Tier II Bonds LT 3000.00 AAA; - - -

Stable 2)CARE

AAA; Stable

(07-Aug-20)

Debentures-Non- CARE 1)CARE

17 Convertible LT 35000.00 AAA; - AAA; Stable - -

Debentures Stable (31-Mar-21)

* Long Term / Short Term

Annexure-3: Detailed explanation of covenants of the rated instrument / facilities: Not applicable

Annexure 4: Complexity level of various instruments rated for this company

Sr. No Name of instrument Complexity level

1 Bonds-Lower Tier II Complex

2 Bonds-Non-Convertible Bonds Simple

3 Bonds-Tier II Bonds Complex

4 Bonds-Upper Tier II Highly Complex

5 Debentures-Non Convertible Debentures Simple

Annexure 5: Bank lender details for this company

To view the lender-wise details of bank facilities please click here

Note on complexity levels of the rated instrument: CARE Ratings Ltd. has classified instruments rated by it on the basis

of complexity. Investors/market intermediaries/regulators or others are welcome to write to care@careedge.in for any

clarifications.

Contact us

Media Contact

Name: Mradul Mishra

Contact no.: +91-22-6754 3573

Email ID: mradul.mishra@careedge.in

Analyst Contact

Name: Karthik Raj K

Contact no.: 9980562244

Email ID: karthik.raj@careedge.in

Relationship Contact

Name: Saikat Roy

Contact no.: +91-98209 98779

Email ID: saikat.roy@careedge.in

13 CARE Ratings Ltd.

Press Release

About CARE Ratings Limited:

Established in 1993, CARE Ratings Ltd. is one of the leading credit rating agencies in India. Registered under the Securities and

Exchange Board of India (SEBI), it has also been acknowledged as an External Credit Assessment Institution (ECAI) by the

Reserve Bank of India (RBI). With an equitable position in the Indian capital market, CARE Ratings Limited provides a wide

array of credit rating services that help corporates to raise capital and enable investors to make informed decisions backed by

knowledge and assessment provided by the company.

With an established track record of rating companies over almost three decades, we follow a robust and transparent rating

process that leverages our domain and analytical expertise backed by the methodologies congruent with the international best

practices. CARE Ratings Limited has had a pivotal role to play in developing bank debt and capital market instruments including

CPs, corporate bonds and debentures, and structured credit.

Disclaimer

The ratings issued by CARE Ratings Limited are opinions on the likelihood of timely payment of the obligations under the rated instrument and are not

recommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security. These ratings do not convey suitability or

price for the investor. The agency does not constitute an audit on the rated entity. CARE Ratings Limited has based its ratings/outlooks based on information

obtained from reliable and credible sources. CARE Ratings Limited does not, however, guarantee the accuracy, adequacy or completeness of any information and is

not responsible for any errors or omissions and the results obtained from the use of such information. Most entities whose bank facilities/instruments are rated by

CARE Ratings Limited have paid a credit rating fee, based on the amount and type of bank facilities/instruments. CARE Ratings Limited or its subsidiaries/associates

may also be involved with other commercial transactions with the entity. In case of partnership/proprietary concerns, the rating /outlook assigned by CARE Ratings

Limited is, inter-alia, based on the capital deployed by the partners/proprietor and the current financial strength of the firm. The rating/outlook may undergo a

change in case of withdrawal of capital or the unsecured loans brought in by the partners/proprietor in addition to the financial performance and other relevant

factors. CARE Ratings Limited is not responsible for any errors and states that it has no financial liability whatsoever to the users of CARE Ratings Limited’s rating.

Our ratings do not factor in any rating related trigger clauses as per the terms of the facility/instrument, which may involve acceleration of payments in case of

rating downgrades. However, if any such clauses are introduced and if triggered, the ratings may see volatility and sharp downgrades.

**For detailed Rationale Report and subscription information, please contact us at www.careedge.in

14 CARE Ratings Ltd.

You might also like

- Natural Mouthwash Recipe Guide: Dr. Pedram Shojai OMD, Dr. Elmira Shojai DDS, Sean RivasDocument16 pagesNatural Mouthwash Recipe Guide: Dr. Pedram Shojai OMD, Dr. Elmira Shojai DDS, Sean RivasMaria StankovaNo ratings yet

- GERDAU: Wide Flange Beams For Solar PostsDocument1 pageGERDAU: Wide Flange Beams For Solar PostsersinNo ratings yet

- Barangay Certification: Office of The Punong Barangay Barangay Jugno CouncilDocument1 pageBarangay Certification: Office of The Punong Barangay Barangay Jugno CouncilMarivic Donque Sienes100% (1)

- Scorecard Mar 20Document3 pagesScorecard Mar 20Chiller PartyNo ratings yet

- WFRP 4e CombatDocument1 pageWFRP 4e CombatJoachimSvela0% (1)

- EE3080 Design and Innovation Project - OBTLDocument7 pagesEE3080 Design and Innovation Project - OBTLAaron TanNo ratings yet

- BarillaDocument7 pagesBarillasahil.ssc838No ratings yet

- Livro de RST Manual RSTDocument31 pagesLivro de RST Manual RSTAntonio DiabanzaNo ratings yet

- Whitepaper 10 Qualities of Great ConsultantsDocument10 pagesWhitepaper 10 Qualities of Great Consultantsapi-538826312No ratings yet

- Care RatingDocument12 pagesCare Ratingpankaj_xaviersNo ratings yet

- 2nd DocumentDocument14 pages2nd DocumentSanjay GulatiNo ratings yet

- Avanse Financial Services LimitedDocument13 pagesAvanse Financial Services LimitedRohan RautelaNo ratings yet

- Kalpataru Power Transmission LimitedDocument8 pagesKalpataru Power Transmission LimitedjayNo ratings yet

- Annual ReportDocument16 pagesAnnual ReportKrishnan ChockalingamNo ratings yet

- Rating Symbols Pursuant PDFDocument5 pagesRating Symbols Pursuant PDFsunny kumarNo ratings yet

- Bush RotorDocument1 pageBush RotorDanil AdityaNo ratings yet

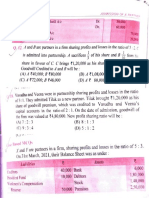

- Guarantee of Profits: Profit & Loss Appropriation A/cDocument4 pagesGuarantee of Profits: Profit & Loss Appropriation A/cVarun RaghunathanNo ratings yet

- National Sample Survey Organisation (F O D) - Durg (C.G.)Document20 pagesNational Sample Survey Organisation (F O D) - Durg (C.G.)riazahmadNo ratings yet

- Revision in Rating Symbols Pursuant To SEBI and RBI GuidelinesDocument4 pagesRevision in Rating Symbols Pursuant To SEBI and RBI GuidelinespradipdeNo ratings yet

- Mahavir Coal Washeries Private LimitedDocument3 pagesMahavir Coal Washeries Private LimitedAbhay bhattNo ratings yet

- Tarsons Products LimitedDocument6 pagesTarsons Products LimitedRAROLINKSNo ratings yet

- Admission of PartnerDocument6 pagesAdmission of PartnerYutika DoshiNo ratings yet

- Computation of Total Income: N: F ' N: A : A N: D B:::: A:: N BDocument3 pagesComputation of Total Income: N: F ' N: A : A N: D B:::: A:: N Bzenith chhablaniNo ratings yet

- Press Release IL&FS Financial Services Limited: Details of Instruments/facilities in Annexure-1Document11 pagesPress Release IL&FS Financial Services Limited: Details of Instruments/facilities in Annexure-1adhia_saurabhNo ratings yet

- Dec 2023 7Document7 pagesDec 2023 7SUNKARA ISNo ratings yet

- Advance Class Exerciseriver Sept 15Document2 pagesAdvance Class Exerciseriver Sept 15SANDY MARILOU RAMIREZNo ratings yet

- John Paul SonDocument21 pagesJohn Paul SonfwallstreetNo ratings yet

- Nov 2023 10Document7 pagesNov 2023 10SUNKARA ISNo ratings yet

- Denah Hotel Bintang 2Document3 pagesDenah Hotel Bintang 2Muhamad FauzyNo ratings yet

- A1 WFRP 4e Combat PDF FreeDocument1 pageA1 WFRP 4e Combat PDF Freekevin binneyNo ratings yet

- Gambar Gudang Di Jatake r1Document12 pagesGambar Gudang Di Jatake r1jackNo ratings yet

- Ag Group: Item No. Part Number Description Qty. 1 AG-0001-C Ring Segment 20Document1 pageAg Group: Item No. Part Number Description Qty. 1 AG-0001-C Ring Segment 20Anonymous IQD4PqB876No ratings yet

- Maithan Alloys LimitedDocument6 pagesMaithan Alloys Limiteddrkashish1989No ratings yet

- AST Outcome 1 ResitDocument3 pagesAST Outcome 1 Resit6p86m84qb2No ratings yet

- Group Exercise #15 - WaterfallDocument1 pageGroup Exercise #15 - WaterfallDhruv KapoorNo ratings yet

- Sample Employer's Response To Unfair Dismissal ApplicationDocument9 pagesSample Employer's Response To Unfair Dismissal ApplicationAraceli GloriaNo ratings yet

- Group DiscussionDocument2 pagesGroup Discussionaaashu77No ratings yet

- Team 01, Memo, PetitionerDocument33 pagesTeam 01, Memo, PetitionerSachin ShuklaNo ratings yet

- Inter Ai Centres - 2022-23Document32 pagesInter Ai Centres - 2022-23Eeshwar KatravathNo ratings yet

- Analog Digital LabDocument3 pagesAnalog Digital LabAdvanceElectronicesNo ratings yet

- NATCO FinalDocument19 pagesNATCO FinalSagar BhardwajNo ratings yet

- Pizza CaseDocument4 pagesPizza CaseSayeda Nasrin ShumiNo ratings yet

- Use Case - Canteen Ordering SystemDocument1 pageUse Case - Canteen Ordering SystemSourabh BhattacharyaNo ratings yet

- Final Examination (Final Exam Weightage:25%) Principle of Finance (Finn 100)Document3 pagesFinal Examination (Final Exam Weightage:25%) Principle of Finance (Finn 100)Taimoor ShahidNo ratings yet

- Introduction To EE618 CMOS Analog VLSI Design: A Fully Online PG Course With 120+ Students!Document15 pagesIntroduction To EE618 CMOS Analog VLSI Design: A Fully Online PG Course With 120+ Students!Saksham RitheNo ratings yet

- Peake Nasrallah InternshipDocument1 pagePeake Nasrallah Internshipapi-301054604No ratings yet

- BiotechnologyDocument7 pagesBiotechnologyAhsanFarooqNo ratings yet

- "He Got Game" Theory? Optimal Decision Making and The NBADocument28 pages"He Got Game" Theory? Optimal Decision Making and The NBAmensrea0No ratings yet

- How To Calculate P90 (Or Other PXX) PV Energy Yield Estimates - SolargisDocument8 pagesHow To Calculate P90 (Or Other PXX) PV Energy Yield Estimates - SolargisgoyalmanojNo ratings yet

- Financial Management - MRCDocument7 pagesFinancial Management - MRCEleine Taroma AlvarezNo ratings yet

- 4B GRAMMAR Present Perfect or Past Simple? (1) : I / Never Fly / in A HelicopterDocument1 page4B GRAMMAR Present Perfect or Past Simple? (1) : I / Never Fly / in A HelicopterB McNo ratings yet

- HTTP & TCP - IpDocument3 pagesHTTP & TCP - IpBitupan KalitaNo ratings yet

- GMPE Shallow Crustal EQ-paper (Sadigh Chang Egan 1997) PDFDocument10 pagesGMPE Shallow Crustal EQ-paper (Sadigh Chang Egan 1997) PDFZens Irving Huamani RodriguezNo ratings yet

- Data Science Assignment 01Document4 pagesData Science Assignment 01Abdul MAalikNo ratings yet

- Homebrew Sector Antenna For Wifi ISM BandDocument12 pagesHomebrew Sector Antenna For Wifi ISM Bandoneligam100% (1)

- 2010 EarningsDocument144 pages2010 EarningsaroenNo ratings yet

- Mn00224e-ALPlus2 - ALCPlus2 - ALCPlus2eDocument388 pagesMn00224e-ALPlus2 - ALCPlus2 - ALCPlus2eAlberto Rodrigues de SouzaNo ratings yet

- WT Poject ProposalDocument11 pagesWT Poject ProposalSARAD THAPANo ratings yet