Professional Documents

Culture Documents

Tata Consumer ANNEXURE - 6 Non Resident PE and Beneficial Ownership Declaration

Tata Consumer ANNEXURE - 6 Non Resident PE and Beneficial Ownership Declaration

Uploaded by

Anbarasu MookiahpandianOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tata Consumer ANNEXURE - 6 Non Resident PE and Beneficial Ownership Declaration

Tata Consumer ANNEXURE - 6 Non Resident PE and Beneficial Ownership Declaration

Uploaded by

Anbarasu MookiahpandianCopyright:

Available Formats

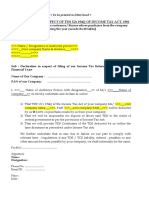

<letter head>

Date:

To,

Tata Consumer Products Limited

1 Bishop Lefroy Road

Kolkata - 700020

Dear Sir,

Sub: Certification with regard to Payment

For the purpose of determination of tax liability u/s. 195 of the [Indian] Income-tax

Act, 1961, (including information required as per Rule 37BC of the Income Tax Rules,

1962), I/We hereby certify that -

Nature of information Details

Name of the Shareholder

Folio No

Address in the country of

residence

Email i.d.

Contact number

Status Company / LLP / Partnership / Trust / Individual

Tax identification number in

the country of residence

1. I/We, << Name of the shareholder >> confirm that I/We are a tax resident of

<<Insert country>> and are eligible to claim benefits of the India - << Insert

country>> Double Tax Avoidance Agreement (DTAA/Tax treaty), read with the

provisions laid down in Multilateral Instrument (MLI), wherever applicable.

2. I/We, <<Name of the shareholder >> are the beneficial owner of the shares allotted

in above folio no. as well as of the dividend arising from such shareholding.

3. I/We further declare that I/we have the right to use and enjoy the dividend received/

receivable from the above shares and such right is not constrained by any

contractual and/ or legal obligation to pass on such dividend to another person.

4. I/We either do not have a Permanent Establishment (P.E.) in India or Dividend

income earned by us in not attributable/effectively connected to the our P.E. in

India as defined under the Income Tax Act, 1961 and DTAA between India and

<Name of Country> read with the provisions laid down in Multilateral Instruments

(MLI), wherever applicable, during the financial year <<<Year>>>. In the event

of I/We having a P.E. in India or Dividend income is attributable/effectively

connected to such P.E., I/We acknowledge our obligation to inform you forthwith

with necessary details.

Int

ern

al

5. I/We hereby declare that the investments made by me/us in the shares of Tata

Consumer Products Limited are not arranged in a manner which results in obtaining

a tax benefit, whether directly or indirectly, as one of its principal purposes. The tax

benefit, if any, derived from such investments would be in accordance with the

object and purpose of the relevant provisions of the Double Taxation Avoidance

Agreement between India and [………………………………………..Insert name

of country of which the shareholder is tax resident]

6. I / We further declare that I / We are eligible to claim benefit of the tax treaty

between India and [Name of the Country of residence of shareholder] including

satisfaction of the Limitation of Benefits clause (wherever applicable).

I/We further agree to indemnify Tata Consumer Products Limited for any penal

consequences arising out of any acts of commission or omission initiated by << Name of

the Shareholder>> by relying on our above averment.

Thanking you,

Yours Sincerely,

For <Name of the Shareholder>

_________________

Name: <insert authorised person name>

<Insert designation>

Int

ern

al

You might also like

- Ub 0630 09 30 2022Document2 pagesUb 0630 09 30 2022Kc CapacioNo ratings yet

- Monzo Bank StatementDocument2 pagesMonzo Bank StatementAlpamis100% (1)

- Letter in Case A Foreign Company Does Not Have A "PE" in IndiaDocument2 pagesLetter in Case A Foreign Company Does Not Have A "PE" in IndiaAmit GhangasNo ratings yet

- Bpi Authorization LetterDocument1 pageBpi Authorization LetterLyka CebreroNo ratings yet

- TaxDocument3 pagesTaxArven FrancoNo ratings yet

- Video Production Quote TemplateDocument2 pagesVideo Production Quote TemplateJosé Carlos Godinez VasquezNo ratings yet

- Self Declaration From ShareholderDocument2 pagesSelf Declaration From ShareholderSimul MondalNo ratings yet

- Remittance Certificate ChecklistDocument8 pagesRemittance Certificate ChecklistAnuj GuptaNo ratings yet

- Annexure - 6 - Non-Resident Tax DeclarationDocument2 pagesAnnexure - 6 - Non-Resident Tax Declarationprateek agrawalNo ratings yet

- ANNEXURE-1 Declaration For Resident ShareholderDocument2 pagesANNEXURE-1 Declaration For Resident Shareholderhemendra.nuwalNo ratings yet

- Form 15Cb: U. Mohanan & Co Chartered AccountantDocument4 pagesForm 15Cb: U. Mohanan & Co Chartered AccountantKrishna S MohanNo ratings yet

- Annexure 3 Declaration of Category of ShareholderDocument2 pagesAnnexure 3 Declaration of Category of Shareholderdandagedeepali910No ratings yet

- REC TAx Free Bond Application FormDocument8 pagesREC TAx Free Bond Application FormPrajna CapitalNo ratings yet

- Hinduja Global DeclarationDocument1 pageHinduja Global DeclarationGiang Nguyen HoangNo ratings yet

- Checklist For 15CBDocument4 pagesChecklist For 15CBKrishna S MohanNo ratings yet

- Self Declaration FormDocument1 pageSelf Declaration FormProfile ConsultingNo ratings yet

- Declaration/Undertaking To Be Taken From Supplier (On His Letter Head)Document1 pageDeclaration/Undertaking To Be Taken From Supplier (On His Letter Head)Mehul SinghNo ratings yet

- No PE DeclarationDocument1 pageNo PE DeclarationDebasisNo ratings yet

- Dtaa Annexure CUSTOMER ID No - For Period - Self DeclarationDocument1 pageDtaa Annexure CUSTOMER ID No - For Period - Self DeclarationPRADIP BHATTACHARJEENo ratings yet

- Limitation of BenefitsDocument9 pagesLimitation of Benefitssanket karwaNo ratings yet

- FDC Demat Tender FormDocument2 pagesFDC Demat Tender FormManoranjan AnmolNo ratings yet

- Unit 4 International TaxationDocument4 pagesUnit 4 International TaxationTharun VelammalNo ratings yet

- Bid Number: Date: For Registrar Use Inward No. Date Stamp: Status (Please Tick Appropriate Box)Document5 pagesBid Number: Date: For Registrar Use Inward No. Date Stamp: Status (Please Tick Appropriate Box)solanki YashNo ratings yet

- Dtaa AnnexureDocument4 pagesDtaa AnnexureAkansha SharmaNo ratings yet

- Beneficial Owndership DeclarationDocument1 pageBeneficial Owndership Declarationjamesbond50No ratings yet

- Permanent Esta ResearchDocument24 pagesPermanent Esta ResearchNeha PandeyNo ratings yet

- The Issue On Jurisdiction Regarding Double Taxation Avoidance Agreements: An OverviewDocument6 pagesThe Issue On Jurisdiction Regarding Double Taxation Avoidance Agreements: An Overviewrushi sreedharNo ratings yet

- 9AKIHKTQ FATCAIndividualZerodhapdfDocument2 pages9AKIHKTQ FATCAIndividualZerodhapdfSHOBHA VERMANo ratings yet

- Opinion On Taxation of Equity Investment in SingaporeDocument3 pagesOpinion On Taxation of Equity Investment in SingaporeKeval ShahNo ratings yet

- DTAA AnnexureDocument1 pageDTAA AnnexureNaresh KewalramaniNo ratings yet

- How Do I Start A Salon in IndiaDocument4 pagesHow Do I Start A Salon in IndiahridayNo ratings yet

- Lut BondDocument4 pagesLut BondprabinkumarsNo ratings yet

- Deep Nit LTDDocument208 pagesDeep Nit LTDRavi BhatiyaNo ratings yet

- Dgt-1 Form - Per 10 - 2017Document12 pagesDgt-1 Form - Per 10 - 2017Adanbungaran PangribNo ratings yet

- Lecture (VI) - International Taxation and DTAADocument17 pagesLecture (VI) - International Taxation and DTAAAbhishek RaiNo ratings yet

- Tender Form DematDocument2 pagesTender Form DematPavithraBhishmaNo ratings yet

- The Of: Executed On Non-Judicial Stamp 100/-)Document4 pagesThe Of: Executed On Non-Judicial Stamp 100/-)Ashok PalakondaNo ratings yet

- Fatca & Ubo FormDocument6 pagesFatca & Ubo FormAshokNo ratings yet

- Form DGT 1Document5 pagesForm DGT 1halimNo ratings yet

- Temporary Vendor Registration Form GST Coc WBPDocument15 pagesTemporary Vendor Registration Form GST Coc WBPrashidnyouNo ratings yet

- DGT FormDocument9 pagesDGT FormsyuhayudaNo ratings yet

- Gratuity Account Opening FormatDocument9 pagesGratuity Account Opening FormatTikaram ChaudharyNo ratings yet

- Form Foreign Direct Investment (FDI) in Limited Liability Partnership (LLP) - 16.05.2016Document12 pagesForm Foreign Direct Investment (FDI) in Limited Liability Partnership (LLP) - 16.05.2016RahulBoseNo ratings yet

- Promoter DeclarationDocument2 pagesPromoter Declarationseemarani12713No ratings yet

- Wepik Exploring The Legal Framework A Comprehensive Analysis of The Limited Liability Partnership Act 20 20231109181347AjHPDocument23 pagesWepik Exploring The Legal Framework A Comprehensive Analysis of The Limited Liability Partnership Act 20 20231109181347AjHPaaddyy290No ratings yet

- 31400sm DTL Finalnew Vol3 May Nov14 Cp1Document6 pages31400sm DTL Finalnew Vol3 May Nov14 Cp1sunitadklNo ratings yet

- Notice of Commisonor of Income TaxDocument4 pagesNotice of Commisonor of Income Taxshovit singhNo ratings yet

- Declaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Document2 pagesDeclaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Cma Saurabh AroraNo ratings yet

- DTAA Declaration NRI With Tax Residency CertificateDocument1 pageDTAA Declaration NRI With Tax Residency CertificateSandeep JamwalNo ratings yet

- Class Assignment IiDocument5 pagesClass Assignment IisangeethaNo ratings yet

- Unit 2 Lesson 1Document23 pagesUnit 2 Lesson 1Zuhaib BazazNo ratings yet

- International Taxation Law: - Shaista NeeluDocument25 pagesInternational Taxation Law: - Shaista NeeluShaista KhanNo ratings yet

- Income TaxDocument126 pagesIncome TaxIndranil RayNo ratings yet

- FSI GST Wavier Undertaking Cum Indeminity 24.08.2021Document2 pagesFSI GST Wavier Undertaking Cum Indeminity 24.08.2021sai nair100% (1)

- 2023 154 Taxmann Com 318 SC 15 09 2023 Principal Commissioner of Income Tax 10 Vs KriDocument8 pages2023 154 Taxmann Com 318 SC 15 09 2023 Principal Commissioner of Income Tax 10 Vs KriThe Chartered Professional NewsletterNo ratings yet

- ShekharDocument10 pagesShekharashishNo ratings yet

- 2.no Permanent Establishment DeclarationDocument1 page2.no Permanent Establishment DeclarationAmit SharmaNo ratings yet

- Expatriates Law in IndiaDocument26 pagesExpatriates Law in IndiaBabli JhaNo ratings yet

- GST Declaration and Undertaking 2Document1 pageGST Declaration and Undertaking 2Snnd NsndNo ratings yet

- 19 Performa 2 For No Pe CertificateDocument6 pages19 Performa 2 For No Pe CertificateromysugandhNo ratings yet

- GST Assignment PDFDocument15 pagesGST Assignment PDFAzharNo ratings yet

- Direct Taxation: Click To Edit Master Subtitle StyleDocument17 pagesDirect Taxation: Click To Edit Master Subtitle StyleJeet KhandelwalNo ratings yet

- Prague Tuesday PM - IssuerDocument58 pagesPrague Tuesday PM - IssuerbenNo ratings yet

- Senior Citizen and PDWDocument6 pagesSenior Citizen and PDWNico evansNo ratings yet

- GST - Idea: Whose HASDocument118 pagesGST - Idea: Whose HASvskconsultantsNo ratings yet

- Loantap SOADocument3 pagesLoantap SOASanthosh KRNo ratings yet

- ProblemsDocument12 pagesProblemsJohn Carlo J. DominoNo ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Triplicate For Supplier)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Triplicate For Supplier)Subhashree PriyadarsiniNo ratings yet

- Entro Scolar Niversity: Lowell Bolongaita JRDocument1 pageEntro Scolar Niversity: Lowell Bolongaita JREzekiel ArtetaNo ratings yet

- GSRTC Ticket PreviewDocument1 pageGSRTC Ticket PreviewVinayNo ratings yet

- Department of Labor: Kben3290 (Rev-06-90)Document1 pageDepartment of Labor: Kben3290 (Rev-06-90)USA_DepartmentOfLaborNo ratings yet

- 1 Basics IcaiDocument36 pages1 Basics IcaiArif GokakNo ratings yet

- Non Taxable Income, Income From Salary and Income From HPDocument35 pagesNon Taxable Income, Income From Salary and Income From HPAnonymous ckTjn7RCq8No ratings yet

- Payroll Solution in Single SheetDocument818 pagesPayroll Solution in Single SheetTarique KhanNo ratings yet

- Tax DocumentDocument2 pagesTax DocumentDutchNo ratings yet

- It 000141516198 2022 00Document1 pageIt 000141516198 2022 00Abdul Basit KtkNo ratings yet

- MonthlyPaySlip 2023 02 20T07 04 10Document1 pageMonthlyPaySlip 2023 02 20T07 04 10Prashank ShandilyaNo ratings yet

- Capshaw WagesDocument2 pagesCapshaw WagesNevaeh SuttonNo ratings yet

- Tax Pref.Document4 pagesTax Pref.Ma. Kristine GarciaNo ratings yet

- Sindh Revenue Board: PSID #: 44660232Document2 pagesSindh Revenue Board: PSID #: 44660232farhan usmanNo ratings yet

- RA 4103 Indeterminate Sentence LawDocument2 pagesRA 4103 Indeterminate Sentence LawtoshkenbergNo ratings yet

- 2-4-2-8-Answers (Empleo Book)Document5 pages2-4-2-8-Answers (Empleo Book)lcNo ratings yet

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument7 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceindraNo ratings yet

- GSTDocument15 pagesGSTNausheen MerchantNo ratings yet

- Student Information On Fee PaymentDocument28 pagesStudent Information On Fee PaymentAbdimalik mohamed HusseinNo ratings yet

- Republic of The Philippines Department of Finance Revenue Region No. 08 Revenue District Office No. 049 North MakatiDocument2 pagesRepublic of The Philippines Department of Finance Revenue Region No. 08 Revenue District Office No. 049 North MakatiHanabishi RekkaNo ratings yet

- EARNINGS PER SHARE-Answer KeyDocument2 pagesEARNINGS PER SHARE-Answer KeyMikaela FraniNo ratings yet