Professional Documents

Culture Documents

Self Declaration Form

Uploaded by

Profile ConsultingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Self Declaration Form

Uploaded by

Profile ConsultingCopyright:

Available Formats

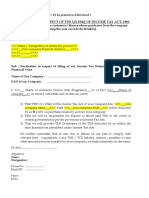

(ON THE LETTER HEAD OF SHAREHOLDER)

Date: DD/MM/YYYY

Issuer Name

Issuer Address 1

Issuer Address 2

Issuer Address 2

Issuer Address 4

Dear Sir/Madam,

Re: Declaration provided to _______________________ Limited (“The Company”) for claiming the tax

treaty benefits for the financial year 2023-24(ending on March 31, 2024).

Declaration

This is to confirm that,

- [NAME OF SHAREHOLDER] is a tax resident of [COUNTRY OF RESIDENCE] as per the provisions of the Agreement for

Avoidance of Double Taxation and Prevention of Fiscal Evasion between India and [COUNTRY OF RESIDENCE] (the

“India-[COUNTRY OF RESIDENCE] DTAA”);

- [NAME OF SHAREHOLDER] will continue to maintain the ‘tax resident’ status in *his/her/its respective Country for the

application of the provisions of the India-[COUNTRY OF RESIDENCE] DTAA, during the financial year 2023-24;

- [NAME OF SHAREHOLDER] is eligible to claim the benefits under the provisions of India-[COUNTRY OF RESIDENCE]

DTAA;

- The claim of benefits by [NAME OF SHAREHOLDER] is not impaired in any way;

- [NAME OF THE SHAREHOLDER] is the beneficial owner of [NO OF SHARES] shares held in the Company. Further,

[NAME OF THE SHAREHOLDER] is the beneficial owner of dividendreceivable from the Company in relation to

aforementioned shares;

- [NAME OF THE SHAREHOLDER] does not have any taxable presence, fixed base or permanent establishment in India

as per the provisions of the India- [COUNTRY OF RESIDENCE] DTAA during the Financial Year 2023-24; and

- [NAME OF THE SHAREHOLDER] will inform immediately the Company if there is a change in the status.

*I/We hereby confirm that the declarations made above are complete, true and bona fide.This declaration is issued to

the Company to enable them to decide upon the withholding tax applicable on the dividend income receivable by

[NAME OF SHAREHOLDER].

Yours faithfully,

For[NAME OF SHAREHOLDER]

Authorized Signatory [Name/designation]

Email address: [Please insert]

Contact Number: [Please insert]

Contact address: [Please insert]

You might also like

- Undertaking For Notice Period Buyout Reimb - pdf.1 PDFDocument1 pageUndertaking For Notice Period Buyout Reimb - pdf.1 PDFYogesh kuarNo ratings yet

- Deed of Admission Cum RetirementDocument3 pagesDeed of Admission Cum RetirementBadrinath Hemakumar100% (1)

- Letter in Case A Foreign Company Does Not Have A "PE" in IndiaDocument2 pagesLetter in Case A Foreign Company Does Not Have A "PE" in IndiaAmit GhangasNo ratings yet

- Annexure - 6 - Non-Resident Tax DeclarationDocument2 pagesAnnexure - 6 - Non-Resident Tax Declarationprateek agrawalNo ratings yet

- Self Declaration From ShareholderDocument2 pagesSelf Declaration From ShareholderSimul MondalNo ratings yet

- Gateway Distriparks - FormDocument4 pagesGateway Distriparks - FormKomal ParmarNo ratings yet

- PVR LIMITED Application FormDocument4 pagesPVR LIMITED Application FormKrishna YadatiNo ratings yet

- 2023 No Permanent Establishment CertificateDocument1 page2023 No Permanent Establishment CertificateAnrica FerdiantiNo ratings yet

- Affidavit FormatDocument1 pageAffidavit Formatsourav84No ratings yet

- FDC Demat Tender FormDocument2 pagesFDC Demat Tender FormManoranjan AnmolNo ratings yet

- Registered Office:: Assuming Full SubscriptionDocument4 pagesRegistered Office:: Assuming Full SubscriptionpadmaNo ratings yet

- Remittance Certificate ChecklistDocument8 pagesRemittance Certificate ChecklistAnuj GuptaNo ratings yet

- RELIANCE INDUSTRIES LIMITED-Application FormDocument5 pagesRELIANCE INDUSTRIES LIMITED-Application FormSubham PatjoshiNo ratings yet

- Eih Limited: West Bengal, India Delhi 110 054, India S.N. Sridhar, Company Secretary and Compliance OfficerDocument4 pagesEih Limited: West Bengal, India Delhi 110 054, India S.N. Sridhar, Company Secretary and Compliance Officerudeybeer7045No ratings yet

- Dtaa AnnexureDocument4 pagesDtaa AnnexureAkansha SharmaNo ratings yet

- REC TAx Free Bond Application FormDocument8 pagesREC TAx Free Bond Application FormPrajna CapitalNo ratings yet

- 8506 - Generic FSA - Tranche VI NRS Linkage Auction and Onwards - Single Document Updated February 2023 (3) - 59-61Document3 pages8506 - Generic FSA - Tranche VI NRS Linkage Auction and Onwards - Single Document Updated February 2023 (3) - 59-61poweranalytics.cilNo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- Declaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Document2 pagesDeclaration in Respect of Tds U/S 194Q of Income Tax Act, 1961Cma Saurabh AroraNo ratings yet

- GST Declaration and Undertaking 2Document1 pageGST Declaration and Undertaking 2Snnd NsndNo ratings yet

- Application Form - IISL Right IssueDocument4 pagesApplication Form - IISL Right Issuepoo987pNo ratings yet

- Deepak Fertilisers and Petrochemicals Corporation LimitedDocument4 pagesDeepak Fertilisers and Petrochemicals Corporation LimitedSrikanth ReddyNo ratings yet

- CompaniesAct1956 18011956 6246 1 ClickhereforSCH-IVDocument9 pagesCompaniesAct1956 18011956 6246 1 ClickhereforSCH-IVparulshinyNo ratings yet

- DTAA AnnexureDocument1 pageDTAA AnnexureNaresh KewalramaniNo ratings yet

- PARTNERSHIP DEED Model 1Document4 pagesPARTNERSHIP DEED Model 1SiddharthaNo ratings yet

- DeclarationDocument2 pagesDeclarationCA Deepak JainNo ratings yet

- Declaration FormatsDocument4 pagesDeclaration FormatsG N Harish Kumar YadavNo ratings yet

- No PE DeclarationDocument1 pageNo PE DeclarationDebasisNo ratings yet

- Termination AgreementDocument3 pagesTermination AgreementPrachi RajputNo ratings yet

- FSI GST Wavier Undertaking Cum Indeminity 24.08.2021Document2 pagesFSI GST Wavier Undertaking Cum Indeminity 24.08.2021sai nair100% (1)

- Annex UreDocument9 pagesAnnex Ureharshad ahakeNo ratings yet

- 2000 5000 Full Company Update 20230309Document40 pages2000 5000 Full Company Update 20230309Contra Value BetsNo ratings yet

- Se2rig ApplicationformDocument4 pagesSe2rig ApplicationformBhrugu SevakNo ratings yet

- Service Agreement PDFDocument3 pagesService Agreement PDFPriyam MhashilkarNo ratings yet

- Deed of Agreement IndiaDocument3 pagesDeed of Agreement IndiaDimpleNo ratings yet

- Income Tax Declaration Form - F.Y. 2020-21Document8 pagesIncome Tax Declaration Form - F.Y. 2020-21LTelford RudraprayagNo ratings yet

- Declration SamirahmedDocument1 pageDeclration Samirahmedsamirahmed atashbajiwalaNo ratings yet

- Dpid Client Id: 1203840001721110 Amit Konar: Panagarh Gram Po-Panagarh Bazar Burdwan West Bengal 713148Document2 pagesDpid Client Id: 1203840001721110 Amit Konar: Panagarh Gram Po-Panagarh Bazar Burdwan West Bengal 713148AtanuMajiNo ratings yet

- Format of Merger AgreementDocument3 pagesFormat of Merger AgreementLILIANA VALENTINA VACA ARRIAGANo ratings yet

- Sclrig In30021438009618Document2 pagesSclrig In30021438009618Gaurav DaveNo ratings yet

- @CAhelp23 - Inter IncomeTax Must Do List Dec2021Document100 pages@CAhelp23 - Inter IncomeTax Must Do List Dec2021rajuNo ratings yet

- Muthoot Finance NCD Application Form Mar 2012Document8 pagesMuthoot Finance NCD Application Form Mar 2012Prajna CapitalNo ratings yet

- M&M Fin Right Issue TemplateDocument12 pagesM&M Fin Right Issue TemplateAshutosh PandeyNo ratings yet

- Indian Infotech and Software LimitedDocument183 pagesIndian Infotech and Software LimitedvineminaiNo ratings yet

- Application Form - SCO 84 18-02-2020Document33 pagesApplication Form - SCO 84 18-02-2020Nidhi Yadav100% (1)

- Indemnity Bond Format 2019 PDFDocument2 pagesIndemnity Bond Format 2019 PDFPiyush Mishra94% (17)

- Reliance Industries Limited Rights Issue Abridged Letter of Offer PDFDocument12 pagesReliance Industries Limited Rights Issue Abridged Letter of Offer PDFMayank AsthanaNo ratings yet

- Aptrig ApplicationformDocument4 pagesAptrig ApplicationformyagnicNo ratings yet

- Mflrig 1203320158246115Document2 pagesMflrig 1203320158246115kunal.kadu2727No ratings yet

- Final Investment AgreementDocument15 pagesFinal Investment AgreementdivyanshaNo ratings yet

- Abridged Letter of Offer Equity 01102021Document12 pagesAbridged Letter of Offer Equity 01102021Nitesh BairagiNo ratings yet

- Text CorretorDocument4 pagesText CorretorARUNAVA SAMANTANo ratings yet

- Power of Attorney Subrogation & IndemnityDocument5 pagesPower of Attorney Subrogation & IndemnityJagjeet SinghNo ratings yet

- Declaration - For - Due Date After Cut Off DateDocument1 pageDeclaration - For - Due Date After Cut Off DateJitender MadanNo ratings yet

- Dtaa Annexure CUSTOMER ID No - For Period - Self DeclarationDocument1 pageDtaa Annexure CUSTOMER ID No - For Period - Self DeclarationPRADIP BHATTACHARJEENo ratings yet

- TCS Tender Form Demat CleanDocument2 pagesTCS Tender Form Demat CleanNagNo ratings yet

- Speci-Deed-Retire PDDocument11 pagesSpeci-Deed-Retire PDnarasimhaNo ratings yet

- Class Assignment IiDocument5 pagesClass Assignment IisangeethaNo ratings yet

- Tax PlanningDocument28 pagesTax PlanningDishaNo ratings yet