Professional Documents

Culture Documents

Assignment 3

Assignment 3

Uploaded by

Ridhwan AfiffCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Assignment 3

Assignment 3

Uploaded by

Ridhwan AfiffCopyright:

Available Formats

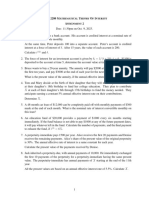

Assignment 3: General Annuities

1. A perpetuity paying 1 at the beginning of each 6-month period has a present value of

20. A second perpetuity pays 𝑋 at the beginning of every 2 years. Assuming the same

annual effective interest rate, the two present values are equal. Determine 𝑋. (Ans:

3.71)

𝑛

2. For a given 𝑛, it is known that 𝑎̅𝑛⏋ = 𝑛 − 4 and 𝛿 = 10%. Find ∫0 𝑎̅𝑛⏋ 𝑑𝑡. (Ans: 40)

3. A perpetuity has payments at the end of each four-year period. The first payment at

the end of four years is 1. Each subsequent payment is 5 more than the previous

payment. It is known that 𝑣 4 = 0.75. calculate the present value of this perpetuity. (Ans:

48)

4. A perpetuity makes payments starting five years from today. The first payment is $1000

and each payment thereafter increases by 𝑘% per year. The present value of this

perpetuity is equal to $4096 when computed at 𝑖 =25%. Find 𝑘. (Ans: 7851.19)

5. If 𝑋 is the present value of a perpetuity of 1 per year with the first payment at the end

of the second year and 20𝑋 is the present value of a series of annual payments 1, 2,

3, . . . with the first payment at the end of the third year, find 𝑑. (Ans: 1/21)

6. A loan of 10,000 is repaid with a payment made at the end of each year for 20 years.

The payments are 100, 200, 300, 400, and 500 in years 1 through 5, respectively. In

the subsequent 15 years, equal annual payments of 𝑋 are made. The annual effective

interest rate is 5%. Calculate 𝑋. (Ans: 1075)

7. An insurance company purchases a perpetuity-due providing a geometric series of

quarterly payments for a price of 100,000 based on an annual effective interest rate of

𝑖. The first and second quarterly payments are 2000 and 2010, respectively. Calculate

𝑖. (Ans: 10.6%)

8. Mike buys a perpetuity-immediate with varying annual payments. During the first 5

years, the payment is constant and equal to 10. Beginning in year 6, the payments

start to increase. For year 6 and all future years, the payment in that year is 𝐾% larger

than the payment in the year immediately preceding that year, where 𝐾 <9.2. At an

annual effective interest rate of 9.2%, the perpetuity has a present value of 167.50.

Calculate 𝐾. (Ans: 4.0)

9. Seth, Janice, and Larry each borrow 5000 for 5 years at an annual nominal interest

rate of 12% compounded semiannually. Seth has interest accumulated over the five

years and pays all the interest and principal in a lump sum at the end of five years.

Janice pays interest at the end of every six-month period as it is accrued and the

principal at the end of five years. Larry repays his loan with 10 level payments at the

end of every six-month period. Calculate the total amount of interest paid on all three

loans. (Ans: 8747.64)

You might also like

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)From EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- Tutorial 5Document2 pagesTutorial 5Aqilah Nur15No ratings yet

- Case Study - The Hair EmporiumDocument2 pagesCase Study - The Hair EmporiumVanessa Lubiano0% (1)

- SImple and Compound Interest Notes Lyst6475Document11 pagesSImple and Compound Interest Notes Lyst6475AMIT VERMANo ratings yet

- Soal Matematika KeuanganDocument7 pagesSoal Matematika KeuanganchoirunnisaNo ratings yet

- XM400 2smDocument11 pagesXM400 2smAldrin TamayoNo ratings yet

- Calculus 2 - Chapter 3Document8 pagesCalculus 2 - Chapter 3Silverwolf CerberusNo ratings yet

- Exercise 2Document2 pagesExercise 2Jorvey HanNo ratings yet

- Stat2902 2022 A2Document2 pagesStat2902 2022 A2ching chauNo ratings yet

- Problems 1Document5 pagesProblems 1Mohit0% (2)

- Unit 4 - AnnuityDocument5 pagesUnit 4 - AnnuityShashank HundiaNo ratings yet

- TDMathfinDocument5 pagesTDMathfinLucien Vidad MAKOUALANo ratings yet

- Questions For Financial Functions in ExcelDocument20 pagesQuestions For Financial Functions in ExcelTarunSainiNo ratings yet

- Chapter 3 (Part 2)Document6 pagesChapter 3 (Part 2)Grace AlbidasNo ratings yet

- TUTORIALDocument10 pagesTUTORIALViễn QuyênNo ratings yet

- Tutorial 5Document2 pagesTutorial 5Lim Wei HanNo ratings yet

- Monthly Compounding of Interest: Example 1.8 (Textbook)Document6 pagesMonthly Compounding of Interest: Example 1.8 (Textbook)budi272007_138375163No ratings yet

- Lesson 39 Appendix I Section 5.6 (Part 1) : I R S R I I KDocument6 pagesLesson 39 Appendix I Section 5.6 (Part 1) : I R S R I I KPaul PaguiaNo ratings yet

- Handout 7.2 - Deferred Annuity QuizDocument5 pagesHandout 7.2 - Deferred Annuity QuizWIIGEENNo ratings yet

- MATH - 2280 - Assignment 4Document1 pageMATH - 2280 - Assignment 4Bludimir ClawgsburgNo ratings yet

- EJERCICIOS EQUIVALENCIAS Libros Varios v2Document4 pagesEJERCICIOS EQUIVALENCIAS Libros Varios v2SAID ALEJANDRO MELENDEZ ALBARRACINNo ratings yet

- Final ExamDocument1 pageFinal Examnurlan shabaevNo ratings yet

- Fundamental of Financial Management: Tutorial: Time Value of MoneyDocument5 pagesFundamental of Financial Management: Tutorial: Time Value of MoneyNguyễn Hải LongNo ratings yet

- MATH - 2280 - Assignment 2Document1 pageMATH - 2280 - Assignment 2Bludimir ClawgsburgNo ratings yet

- Annuity and DepreciationDocument22 pagesAnnuity and DepreciationthekeypadNo ratings yet

- Section 1.9.1 Annuity-ImmediateDocument15 pagesSection 1.9.1 Annuity-ImmediateMary Dianneil MandinNo ratings yet

- Discount, Denoted by D Which Is A Measure of Interest Where The Interest IsDocument3 pagesDiscount, Denoted by D Which Is A Measure of Interest Where The Interest IsNguyễn Quang TrườngNo ratings yet

- Sec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffDocument4 pagesSec - C - TVM 2019 - PW, FW, AW, GR, Nom-EffNaveen KumarNo ratings yet

- Exercises Loans-1Document2 pagesExercises Loans-1Egis BarciNo ratings yet

- Prac 2Document4 pagesPrac 2Esra Gunes YildizNo ratings yet

- Simple AnnuitiesDocument45 pagesSimple AnnuitiesKim TNo ratings yet

- Statistic Math PDFDocument40 pagesStatistic Math PDFNick GeneseNo ratings yet

- Section 1.8 Equation of ValuesDocument13 pagesSection 1.8 Equation of ValuesMary Dianneil MandinNo ratings yet

- Supplementary Problems On Signage CreationDocument2 pagesSupplementary Problems On Signage CreationArman AliNo ratings yet

- TVM Practice Questions With AnswersDocument4 pagesTVM Practice Questions With AnswersAhmed NomanNo ratings yet

- Session 1 - Time Value of Money - Ex2Document2 pagesSession 1 - Time Value of Money - Ex2Harsh GidwaniNo ratings yet

- Tutor FM Week 10Document3 pagesTutor FM Week 10Tiffany SasmitoNo ratings yet

- Tutorial 1 Time Value of Money PDFDocument2 pagesTutorial 1 Time Value of Money PDFLâm TÚc NgânNo ratings yet

- CompoundDocument3 pagesCompoundRytchad XplodeNo ratings yet

- Lecture 3 - AnnuityDocument20 pagesLecture 3 - AnnuityReu Emmanuel MarquezNo ratings yet

- FinanceDocument9 pagesFinanceNikhil MittalNo ratings yet

- Compound InterestDocument4 pagesCompound InterestSnigdho BhattacharyaNo ratings yet

- Sec 4.2 - Done PDFDocument4 pagesSec 4.2 - Done PDFTimothy TranNo ratings yet

- Interests: Interest and Denoted As S.IDocument8 pagesInterests: Interest and Denoted As S.Isitaram_akella_1No ratings yet

- EcoDocument21 pagesEcoMAYHAY, ADRIAN PAULNo ratings yet

- Simple Annuities (Revised)Document6 pagesSimple Annuities (Revised)Juliana CanonigoNo ratings yet

- Discussion Topics: AnnuitiesDocument15 pagesDiscussion Topics: AnnuitiesM. Amin QureshiNo ratings yet

- Lecture 13 - Annuities and MortgagesDocument15 pagesLecture 13 - Annuities and MortgagesM. Amin QureshiNo ratings yet

- Bai Tap Ham Tai ChinhDocument4 pagesBai Tap Ham Tai ChinhLoi NguyenNo ratings yet

- UntitledDocument17 pagesUntitledNgân Võ Trần TuyếtNo ratings yet

- Equations of ValueDocument1 pageEquations of ValueAnonymous jZc1vv2100% (1)

- Assignment 1Document4 pagesAssignment 1Ahmad Ullah KhanNo ratings yet

- Chapter 2 QDocument4 pagesChapter 2 QKiều LinhNo ratings yet

- Bus Math Sample Problem in HandoutsDocument7 pagesBus Math Sample Problem in HandoutsAria & Kira CatzNo ratings yet

- 05 03 04 Ann Sinkfund AmortDocument7 pages05 03 04 Ann Sinkfund AmortLöshini Priscilla EgbunikeNo ratings yet

- QF2101 1112S1 Tutorial 2Document4 pagesQF2101 1112S1 Tutorial 2Wei Chong KokNo ratings yet

- Simple AnnuityDocument2 pagesSimple AnnuityArden AnagapNo ratings yet

- Exam in StatDocument11 pagesExam in StatA-nn Castro NiquitNo ratings yet

- Transcript - 2024 03 26Document100 pagesTranscript - 2024 03 26Ridhwan AfiffNo ratings yet

- Tutorial 1Document3 pagesTutorial 1Ridhwan AfiffNo ratings yet

- Tutorial 2Document2 pagesTutorial 2Ridhwan AfiffNo ratings yet

- Disagree PointDocument2 pagesDisagree PointRidhwan AfiffNo ratings yet

- Argumentative Essay - Sample 2 - Students Should Spend Less Time Listening To MusicDocument2 pagesArgumentative Essay - Sample 2 - Students Should Spend Less Time Listening To MusicRidhwan AfiffNo ratings yet

- Food Taste (No Image)Document27 pagesFood Taste (No Image)Trọng LâmNo ratings yet

- MIT15 401F08 Review Mid PDFDocument38 pagesMIT15 401F08 Review Mid PDFGasimovskyNo ratings yet

- Mohammed Atheel: Profile SummaryDocument1 pageMohammed Atheel: Profile Summary21MBA078 Shane MNo ratings yet

- Test Bank For M Finance Applications and Theory 1st Edition CornettDocument24 pagesTest Bank For M Finance Applications and Theory 1st Edition Cornettmistakersoubahzrl2gNo ratings yet

- Don Peebles 1801 Vine Street Contract CancelledDocument7 pagesDon Peebles 1801 Vine Street Contract CancelledDon Peebles Financial DocumentsNo ratings yet

- ICICI FASTag - Closure Form - NewDocument2 pagesICICI FASTag - Closure Form - NewMadan ShivashankarNo ratings yet

- (2015) New Design Challenges To Widely Implement Sustainable Product-Service Systems'Document12 pages(2015) New Design Challenges To Widely Implement Sustainable Product-Service Systems'André ZidaneNo ratings yet

- NortelDocument3 pagesNortelMarkNo ratings yet

- Northwind-Full 39 Queries: Exercise 1Document11 pagesNorthwind-Full 39 Queries: Exercise 1Lucusx TNo ratings yet

- Ramesh Singh Indian Economy Class 26Document94 pagesRamesh Singh Indian Economy Class 26Abhijit NathNo ratings yet

- Infrastructure Financing And: Business ModelsDocument9 pagesInfrastructure Financing And: Business ModelsAbhijeet JhaNo ratings yet

- Drven Roll 530 - 4200 Steel Rubber CoatedDocument1 pageDrven Roll 530 - 4200 Steel Rubber CoatedJulian DelgadoNo ratings yet

- Week 1 - Understand BusinessDocument41 pagesWeek 1 - Understand BusinessTran Minh KhanhNo ratings yet

- Notes On Partnership. Arts. 1812 To 1820Document2 pagesNotes On Partnership. Arts. 1812 To 1820Precious RuivivarNo ratings yet

- Eco - Ed. 428 Nepalese EconomyDocument7 pagesEco - Ed. 428 Nepalese EconomyHari PrasadNo ratings yet

- Allama Iqbal Open UniversityDocument8 pagesAllama Iqbal Open UniversityNosha FatimaNo ratings yet

- AC216 Unit 1 Inventory Methods - Practice With SolutionsDocument8 pagesAC216 Unit 1 Inventory Methods - Practice With SolutionsRaymond BarbosaNo ratings yet

- Chapter 5 - Student Lecture Notes - Nominal Interest Rates 2022fDocument42 pagesChapter 5 - Student Lecture Notes - Nominal Interest Rates 2022fLuqmaan KhanNo ratings yet

- Grade 10 Provincial Exam Accounting P2 (English) November 2019 Answer Book - 050044Document10 pagesGrade 10 Provincial Exam Accounting P2 (English) November 2019 Answer Book - 050044hobyanevisionNo ratings yet

- Practical Accounting 2 by Antonio Dayag: Home Office, Branch, and AgencyDocument43 pagesPractical Accounting 2 by Antonio Dayag: Home Office, Branch, and Agencysino ako100% (2)

- Monmouth CaseDocument6 pagesMonmouth CaseMohammed Akhtab Ul HudaNo ratings yet

- SITXFIN011 Manage Pysical Assests Assessment 2 v1.0 Updated 23 January 2023 AICDocument21 pagesSITXFIN011 Manage Pysical Assests Assessment 2 v1.0 Updated 23 January 2023 AICPhúc NguyễnNo ratings yet

- Nepal Budget Highlights: Financial Year 2020-21Document18 pagesNepal Budget Highlights: Financial Year 2020-21samit shresthaNo ratings yet

- Lease 1Document5 pagesLease 1richard kayNo ratings yet

- 2020 Cs F Regional Clearance Form Updated July 2023 1Document2 pages2020 Cs F Regional Clearance Form Updated July 2023 1ronmfamedinaNo ratings yet

- Summative Assessment - 02Document5 pagesSummative Assessment - 02Joris YapNo ratings yet

- COA Unit 2 Issue of Shares - ProblemsDocument3 pagesCOA Unit 2 Issue of Shares - ProblemsGayatri Prasad BirabaraNo ratings yet

- Organizational PlanDocument4 pagesOrganizational PlanCheradee EscalonaNo ratings yet

- Project Appraisal Ratio Analysis - 2023 - Students - SlidesDocument36 pagesProject Appraisal Ratio Analysis - 2023 - Students - SlidesThaboNo ratings yet