Professional Documents

Culture Documents

Intacc Chapter 21

Intacc Chapter 21

0 ratings0% found this document useful (0 votes)

18 views5 pagesOriginal Title

INTACC-CHAPTER-21

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

18 views5 pagesIntacc Chapter 21

Intacc Chapter 21

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 5

CHAPTER 21

ACCOUNTING FOR INCOME TAX

Basic problems

Problem 21-1 (IAA)

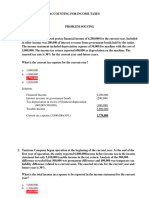

Hilton Company reported pretax financial income of P6,200,000 for the current year. Included in

other income was P200,000 of tax-exempt interest revenue from government bonds held by the

entity.

The income statement included depreciation expense of P500,000 for a machine with cost of

P3.000,000. The income tax return reported P600,000 as depreciation on the machine. The enacted

tax rate is 25% for the current year and future years.

1. What amount should be reported as current tax expense for the current year?

Solution: Refer to Problem 21- 1 (Page 269)

Problem 21-2 (IAA)

Everest Company began operations at t the beginning of the current Fear. At the end of the first

year of operations, the entity reporent P6,000,000 income before income tax in the income

statement but only P5, 100,000 taxable income in the tax return.

Analysis of the P900,000 difference revealed that P500,000 was a Permanent difference and

P400,000 was a temporary tax liability Difference related to a current asset.

The enacted tax rate for the current year and future years is 25%.

1. What amount should be reported as current tax expense?

2. What amount should be reported as total income tax expense in the income statement for the

current year?

Solution: Refer to Problem 21- 2 (Page 270)

Problem 21-3 (IAA)

During the current year, Tiger Company reported pretax financial income DTP5,000,000. Included

in the pretax financial income are P900,000 of nontaxable life insurance proceeds received as a

result of death of an officer, PJ 200,000 of estimated warranty expertise accrued at year-end and

P200,000 of life insurance premiums for a policy for an officer.

No income tax was previously paid during the year and the income tax rate is 25%.

1. What amount should be reported as income tax payable at year-end?

2. What amount should be reported as total tax expense?

Solution: Refer to Problem 21- 3 (Page 271)

Problem 21-4 (AICPA Adapted)

Viking Company reported pretax financial income of P6,000,000 in the income statement for the

current year

Tax return Accounting record

Rent income 70,000 120,000

Depreciation 280,000 220,000

Payment of penalty 10,000

Premiums on officers life insurance 90,000

Income tax rate. 25%

1. What amount should be reported as current provision for income tax for the current year?

2. What amount should be reported as total tax expense?

Solution: Refer to Problem 21- 4 (Page 272)

Problem 21-5 (AICPA Adapted)

Crown Company reported in the first year of operations pretax financial income of P6,000,000.

The income tax rate is 25%.

Tax return Accounting record

Doubtful accounts expense 200,000 300,000

Depreciation expense 1,500,000 1,000,000

Tax exempt interest revenue 0 250,000

Premium on officers’ life insurance 0 150,000

Warranty cost 400,000 600,000

Rent received in advance 800,000 0

1. What amount should be reported as current tax expense?

2. What amount should be reported as total tax expense?

Solution: Refer to Problem 21-5 (Page 273)

Problem 21-6 (AICPA Adapted)

Dunn Company reported in the income statement for the current year P900,000 income before

provision for income tax.

Rent received in advance 150,000

Interest income on time deposit 200,000

Depreciation deducted for income tax purposes

In excess of financial depreciation 100,000

Income tax rate 25%

1. What amount should be reported as current provision for income tax or current tax expense

for the current year?

2. What amount should be reported as total tax expense?

Solution: Refer to Problem 21- 6 (Page 274)

Problem 21-7 (AICPA Adapted)

Pine Company reported pretax financial income of P8,000,000 for the current year. In the

computation of income taxes, the following data were considered:

Nontaxable gain 1,500,000

Depreciation deducted for tax purposes in excess of

depreciation deducted for book purposes 500,000

Estimated tax payment during the year 700,000

Enacted tax rate 25%

1. What amount should be reported as current tax liability or income tax payable at year-end?

2. What amount should be reported as total income tax expense?

Solution: Refer to Problem 21- 7 (Page 275)

Problem 21-8 (IFRS)

Ireland Company reported pretax accounting income of P8,000,000 for the current year which

included the following items of income and expense:

Donation to political parties – nondeductible 1,000,000

Depreciation – 20% 1,600,000

Annual leave expense 700,000

Rent revenue 1,200,000

Income tax rate 25%

For tax purposes, the depreciation rate is 25%, the annual leave paid is P800,000 and the rent

received is P1,000,000.

1. What amount should be reported as current tax liability at year-end?

Solution: Refer to Problem 21- 8 (Page 276)

Problem 21-9 (IAA)

Punk Company reported the following partial income statement after the first year of operations:

Income before income tax 7,500,000

Income tax expense

Current 1,750,000

Deferred 125,000 1,875,000

Net income 5,625,000

The entity used the straight line method of depreciation for financial reporting purposes and

accelerated depreciation for tax purposes. The amount charged to depreciation expense per book

was P1,500,000.

No other differences existed between book income and taxable income except for the amount of

depreciation. The income tax rate is 25%.

1. What amount was deducted for depreciation in the tax return for the current year?

2. What amount was reported as taxable income?

Solution: Refer to Problem 21- 9 (Page 277)

Problem 21-10 (AICPA Adapted)

Jasco Company is in the first year of operations and reported pretax accounting income of

P5,000,000. The entity provided the following information for the first year:

Premium on life insurance of key officer 150,000

Depreciation on tax return in excess of book depreciation 200,000

Tax-exempt interest income 50,000

Estimated warranty expense 90,000

Actual warranty repairs 30,000

Doubtful accounts expense 60,000

Writeoff of uncollectible accounts 20,000

Rent received in advance 300,000

Income tax rate 25%

1. What amount should be reported as current tax expense?

Solution: Refer to Problem 21- 10 (Page 278)

You might also like

- Homework Chapter 12Document28 pagesHomework Chapter 12Trung Kiên NguyễnNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Accounting For Income Tax Valix StudentDocument4 pagesAccounting For Income Tax Valix Studentvee viajeroNo ratings yet

- Chapter 19 Accounting For Income Tax Problem 19-1Document5 pagesChapter 19 Accounting For Income Tax Problem 19-1nicole bancoroNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- VOL 2 16. Accounting For Income TaxationDocument15 pagesVOL 2 16. Accounting For Income TaxationdmangiginNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxCamille GarciaNo ratings yet

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxShaira Bugayong0% (2)

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- 7062 - Deferred Income Tax SolvingDocument9 pages7062 - Deferred Income Tax SolvingstrmsantiagoNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Chapter 22 Deferred Tax Asset and LiabilityDocument8 pagesChapter 22 Deferred Tax Asset and LiabilityCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- Quizzz Intac 3Document10 pagesQuizzz Intac 3lana del reyNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Income Taxes: Name: Date: Professor: Section: ScoreDocument3 pagesIncome Taxes: Name: Date: Professor: Section: ScoreJamie Rose AragonesNo ratings yet

- Accounting For Taxes & Employee BenefitsDocument5 pagesAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Use The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3Document3 pagesUse The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3Irvin LevieNo ratings yet

- Taxes 4 19 PDFDocument2 pagesTaxes 4 19 PDFlana del reyNo ratings yet

- Topic 1: Accounting For Income TaxesDocument13 pagesTopic 1: Accounting For Income TaxesPillos Jr., ElimarNo ratings yet

- Accounting For Income Tax Comprehensive Problem 1: Additional InformationDocument1 pageAccounting For Income Tax Comprehensive Problem 1: Additional InformationAngel Keith MercadoNo ratings yet

- Chapter 25 and 26Document10 pagesChapter 25 and 26Sittie Aisah AmpatuaNo ratings yet

- Income TaxesDocument3 pagesIncome TaxesCENTENO, JOAN R.No ratings yet

- INCOME TAXATION OF CORPORATION ExercisesDocument3 pagesINCOME TAXATION OF CORPORATION ExercisesCheska DizonNo ratings yet

- TAX Preweek Lecture (B42) - December 2021 CPALEDocument16 pagesTAX Preweek Lecture (B42) - December 2021 CPALEkdltcalderon102No ratings yet

- Tax Practice Quiz QuestionsDocument3 pagesTax Practice Quiz QuestionsDanji MisoNo ratings yet

- Accounting For Income TaxDocument4 pagesAccounting For Income TaxRed YuNo ratings yet

- Other Taxpayers ProblemsDocument12 pagesOther Taxpayers ProblemsRaiNo ratings yet

- Tax Computations SampleDocument5 pagesTax Computations Samplelcsme tubodaccountsNo ratings yet

- Tutorial 2: Exercise 12.2 Calculation of Current TaxDocument13 pagesTutorial 2: Exercise 12.2 Calculation of Current TaxKim FloresNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- ASSIGNMENT - Accounting For Income TaxesDocument5 pagesASSIGNMENT - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- 25uber Accounting For Income Tax Deferred Taxes ANSWERSDocument16 pages25uber Accounting For Income Tax Deferred Taxes ANSWERSvee viajeroNo ratings yet

- Finacc 6 A3 1Document4 pagesFinacc 6 A3 1200617No ratings yet

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDocument4 pagesInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QNo ratings yet

- Ege, Kenneth M. Bsa22A1Document3 pagesEge, Kenneth M. Bsa22A1Kenneth Marcial Ege IINo ratings yet

- Quiz Chapter+9 Income+Taxes+-+Document5 pagesQuiz Chapter+9 Income+Taxes+-+Rena Jocelle NalzaroNo ratings yet

- Deferred Tax Asset and LiabilityDocument10 pagesDeferred Tax Asset and LiabilityCamille GarciaNo ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Domondon - Acctg 3 - Prelim Quiz 2Document2 pagesDomondon - Acctg 3 - Prelim Quiz 2Prince Anton DomondonNo ratings yet

- Aprelim - Mixed IncomeDocument17 pagesAprelim - Mixed IncomeAshley VasquezNo ratings yet

- Corporate Income TaxDocument8 pagesCorporate Income TaxClaire BarbaNo ratings yet

- Week 6 - ch19Document55 pagesWeek 6 - ch19bafsvideo4No ratings yet

- Income Taxes: ProblemsDocument12 pagesIncome Taxes: ProblemsCharles MateoNo ratings yet

- Q1 Week5 Illustrative ProblemDocument3 pagesQ1 Week5 Illustrative ProblemIt’s yanaNo ratings yet

- T01 - Income Tax QuestionsDocument7 pagesT01 - Income Tax QuestionsLijing CheNo ratings yet

- OSD and NOLCODocument2 pagesOSD and NOLCOAccounting FilesNo ratings yet

- Tax DeductionsDocument4 pagesTax DeductionsAnonymous LC5kFdtcNo ratings yet

- Accounting For Income TaxesDocument12 pagesAccounting For Income TaxesRMG Career Society BDNo ratings yet

- Class Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionDocument6 pagesClass Activities (Millan, 2019) : Requirements: A. How Much Is The Income Tax Expense For 2003? SolutionPrincess TaizeNo ratings yet

- Exercise CorporationDocument3 pagesExercise CorporationJefferson MañaleNo ratings yet

- Module-Accounting For Income TaxDocument13 pagesModule-Accounting For Income TaxJohn Mark FernandoNo ratings yet

- Final Exam 2021-2022Document10 pagesFinal Exam 2021-2022Clarito, Trisha Kareen F.No ratings yet

- Module 6 - Income Tax On Corporations - Part 2Document5 pagesModule 6 - Income Tax On Corporations - Part 2Never Letting GoNo ratings yet

- Cash FlowDocument15 pagesCash FlowCandy BayonaNo ratings yet

- Miscellaneous TopicsDocument93 pagesMiscellaneous Topicsgean eszekeilNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- How to Read a Financial Report: Wringing Vital Signs Out of the NumbersFrom EverandHow to Read a Financial Report: Wringing Vital Signs Out of the NumbersNo ratings yet

- Ais Reviewer MidtermDocument9 pagesAis Reviewer MidtermCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Era Sales ReportDocument2 pagesEra Sales ReportCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Group 1 - Bsa 2a - Definition&history of AisDocument7 pagesGroup 1 - Bsa 2a - Definition&history of AisCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- RIZALDocument7 pagesRIZALCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- BL ReportingDocument35 pagesBL ReportingCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Chapter 4 Bsa 2aDocument26 pagesChapter 4 Bsa 2aCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Financial Report SampleDocument11 pagesFinancial Report SampleCheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- Chapter 4 BS 2a - 20240208 - 105831 - 0000Document26 pagesChapter 4 BS 2a - 20240208 - 105831 - 0000Cheesca Macabanti - 12 Euclid-Digital ModularNo ratings yet

- InvoiceDocument2 pagesInvoiceakpmig29No ratings yet

- CREST Industrial Control Systems Technical Security Assurance Position PaperDocument15 pagesCREST Industrial Control Systems Technical Security Assurance Position PaperwaleedNo ratings yet

- Dpco Price List April 2015Document82 pagesDpco Price List April 2015sppNo ratings yet

- Ibanez V Hongkong Shanghai BankDocument5 pagesIbanez V Hongkong Shanghai BankAndrew GallardoNo ratings yet

- Salesforce Developer Salary Report 63 2Document11 pagesSalesforce Developer Salary Report 63 2deepak tamboliNo ratings yet

- Filipino Patients Bill of RightsDocument2 pagesFilipino Patients Bill of Rights@ngeloNo ratings yet

- Durga Puja in Frankfurt, GermanyDocument16 pagesDurga Puja in Frankfurt, GermanySvanhild WallNo ratings yet

- Arrangement of Events in A StoryDocument2 pagesArrangement of Events in A StoryJonathan AcuñaNo ratings yet

- Script For "Is University Worth It?"Document2 pagesScript For "Is University Worth It?"Simran KabotraNo ratings yet

- Seerah of Prophet Muhammed 56 - The Slander of Aisha (Ra) Part 2 - Yasir Qadhi April 2013Document6 pagesSeerah of Prophet Muhammed 56 - The Slander of Aisha (Ra) Part 2 - Yasir Qadhi April 2013Yasir Qadhi's Complete Seerah SeriesNo ratings yet

- I. Republic Act No. 10175 (Cybercrime Prevention Act of 2012)Document11 pagesI. Republic Act No. 10175 (Cybercrime Prevention Act of 2012)Dummy TenNo ratings yet

- WFH Company ListDocument29 pagesWFH Company Listrajpurohitpriyanshi2511No ratings yet

- Exercise Principles of Business CommunicationDocument2 pagesExercise Principles of Business CommunicationHaider TauseefNo ratings yet

- Activity No.16 PreliminariesDocument7 pagesActivity No.16 PreliminariesArnel Baldrias LopezNo ratings yet

- Ethics Final NotesDocument2 pagesEthics Final NotesBika BikaNo ratings yet

- 9 English - A Legend of The Northland - NotesDocument8 pages9 English - A Legend of The Northland - NotesAnitha S R100% (1)

- Case Study 2 HRMDocument3 pagesCase Study 2 HRMrienahsanari99No ratings yet

- Great Saltworks of Salins-les-Bains (France) No 203bis: 2. The PropertyDocument12 pagesGreat Saltworks of Salins-les-Bains (France) No 203bis: 2. The PropertyPrachurya BaruahNo ratings yet

- Case StudyDocument21 pagesCase StudyHuda Siddiqua70% (10)

- ICF Jobs - Workday PDFDocument3 pagesICF Jobs - Workday PDFRe ZaNo ratings yet

- Foreign ExchangeDocument20 pagesForeign ExchangeASHWINI SINHANo ratings yet

- Assessment ICTSUS601 3 of 3 V2Document9 pagesAssessment ICTSUS601 3 of 3 V2sammy0% (1)

- Smita Pandey - ITDocument12 pagesSmita Pandey - ITSmita PandeyNo ratings yet

- Authority Letter For CSD, Indent FormDocument3 pagesAuthority Letter For CSD, Indent Formmahesh0291No ratings yet

- BlahblahblahDocument172 pagesBlahblahblahSteven J LeeNo ratings yet

- DBA-THE LAW OF PERSONSdbaDocument27 pagesDBA-THE LAW OF PERSONSdbaElvice Ouma OnyangoNo ratings yet

- Ejercicio de Scary StoryDocument4 pagesEjercicio de Scary StoryRamhiroCarphioNo ratings yet

- Bad Sex: Lessons For LifeDocument3 pagesBad Sex: Lessons For Lifestefanaserafina9421No ratings yet

- Ungureanu Dragos Tara Romaneasca in Sistemul Militar Otoman La Sfarsitul Secolului Al Xvii LeaDocument27 pagesUngureanu Dragos Tara Romaneasca in Sistemul Militar Otoman La Sfarsitul Secolului Al Xvii Leacosmin racuNo ratings yet

- Sejal Raghuwanshi-Child RIghts SOPDocument2 pagesSejal Raghuwanshi-Child RIghts SOPSejal RaghuwanshiNo ratings yet