Professional Documents

Culture Documents

7062 - Deferred Income Tax Solving

Uploaded by

strmsantiago0 ratings0% found this document useful (0 votes)

1 views9 pagesSolution for deferred income tax

Original Title

7062 - Deferred Income Tax solving

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSolution for deferred income tax

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

1 views9 pages7062 - Deferred Income Tax Solving

Uploaded by

strmsantiagoSolution for deferred income tax

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 9

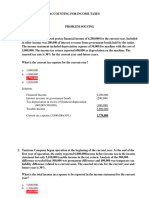

1. An entity reported pretax financial income of P8,000,000 for the current year.

The taxable income was

P7,000,000 for the current year. The difference is due to accelerated depreciation for income tax purposes.

The income tax rate is 25% and the entity made estimated tax payment of P500,000 during the current year.

What amount should be reported as current tax expense for the current year?

a. 1,750,000

b. 2,000,000

c. 1,400,000

d. 1,500,000

2. An entity reported pretax accounting income of P5,000,000 for the current year. The taxable income was

P5,500,000. The difference is due to rental received in advance. Rental income is taxable when received. The

income tax rate is 25% and the entity made no estimated tax payment in the current year. What amount should

be reported as total income tax expense for the current year?

a. 1,375,000

b. 1,250,000

c. 1,500,000

d. 2,625,000

3. At the end of the first year of operations, an entity had taxable temporary differences totaling P3,000,000. Of

this total, P500,000 relates to current items. The entity also had deductible temporary differences totaling

P1,000,000, P250,000 of which relates to current items. Pretax financial income for the current year was

P20,000,000. The tax rate is 25%.

1. What amount should be reported as current tax expense for current year?

a. 4,000,000

b. 5,000,000

c. 5,500,000

d. 4,500,000

2. What is the net deferred tax expense or benefit for the current year?

a. 750,000 expense

b. 250,000 benefit

c. 500,000 expense

d. 500,000 benefit

4. An entity reported pretax accounting income of P6,000,000 during the first year of operations. The entity

made estimated payment of income tax of P900,000 during the current year. The current year tax rate is 30%

and the enacted tax rate for future years is 25%.

Tax return Accounting record

Uncollectible accounts expense 200,000 300,000

Depreciation expense 1,600,000 1,000,000

Tax-exempt interest revenue 500,000

1. What amount should be reported as current tax expense?

a. 1,500,000

b. 1,250,000

c. 1,800,000

d. 1,650,000

2. What amount should be reported as total tax expense?

a. 1,625,000

b. 1,375,000

c. 1,800,000

d. 1,950,000

5. An entity reported in the first year of operations pretax financial income of P5,000,000

Tax return Accounting record

Premium on officers’ life insurance 0 150,000

Payment of tax penalty 0 250,000

Uncollectible accounts expense 200,000 600,000

Depreciation expense 1,200,000 1,000,000

Warranty cost 300,000 900,000

Rent received in advance 500,000 0

1. What is the current tax expense (Tax rate 25%)?

a. 1,675,000

b. 1,575,000

c. 1,550,000

d. 1,725,000

2. What is the net deferred tax expense or benefit?

a. 325,000 benefit

b. 325,000 expense

c. 425,000 benefit

d. 425,000 expense

3. What is the total tax expense?

a. 1,350,000

b. 2,000,000

c. 1,250,000

d. 1,300,000

6. An entity reported the following information after the first year of operations:

Income before income tax 5,400,000

Income tax expense

Current 1,250,000

Deferred 100,000 1,350,000

Net income 4,050,000

The entity used the straight line method of depreciation for financial reporting purposes and accelerated

depreciation for tax purposes. The amount charged to depreciation expense per book was P1,600,000. No

other differences existed between book income and taxable income except for the depreciation. The tax rate

is 25%. What amount was deducted for depreciation in the tax return?

a. 1,700,000

b. 1,500,000

c. 1,200,000

d. 2,000,000

7. An entity reported the following assets and liabilities at year-end:

Carrying amount Tax base

Machinery 1,650,000 1,250,000

Accounts receivable 1,500,000 1,750,000

Deposits received in advance 150,000 0

Provision for warranty 500,000 0

1. What amount should be reported as deferred tax liability?

a. 300,000

b. 200,000

c. 100,000

d. 400,000

2. What amount should be reported a deferred tax asset??

a. 900,000

b. 225,000

c. 125,000

d. 500,000

You might also like

- Chapter 5 - Statement of Comprehensive Income: Problem 5-1 (AICPA Adapted)Document20 pagesChapter 5 - Statement of Comprehensive Income: Problem 5-1 (AICPA Adapted)Asi Cas Jav100% (2)

- Accounting For Income TaxDocument4 pagesAccounting For Income Taxchowchow123No ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Kmart PDFDocument105 pagesKmart PDFkaranbhayaNo ratings yet

- Melancholic PersonalityDocument5 pagesMelancholic PersonalityChris100% (1)

- JOHARI Window WorksheetDocument2 pagesJOHARI Window WorksheetAnonymous j9lsM2RBaINo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument4 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureNoorodden50% (2)

- Use The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3Document3 pagesUse The Following Information To Answer Items 1 To 3:: FARQ 218 Page 1 of 3Irvin LevieNo ratings yet

- Special Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureDocument5 pagesSpecial Liabilities - Income Taxes: Income Tax Rate Is 40% and Is Not Expected To Change in The FutureClarisse AlimotNo ratings yet

- Chapter 19 Accounting For Income Tax Problem 19-1Document5 pagesChapter 19 Accounting For Income Tax Problem 19-1nicole bancoroNo ratings yet

- Single Entry and Error CorrectionDocument2 pagesSingle Entry and Error CorrectionAna Marie IllutNo ratings yet

- 6728 Statement of Comprehensive IncomeDocument4 pages6728 Statement of Comprehensive IncomeJane ValenciaNo ratings yet

- Lamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)Document14 pagesLamagan, Kyla T. BSA 401 Intermediate Acct. 2 Final Output Problem 16-13 (IAA)lana del reyNo ratings yet

- DocxDocument5 pagesDocxJohn Vincent CruzNo ratings yet

- Accounting For Income TaxDocument6 pagesAccounting For Income TaxCamille GarciaNo ratings yet

- Final Exam 2021-2022Document10 pagesFinal Exam 2021-2022Clarito, Trisha Kareen F.No ratings yet

- Solution - Accounting For Income TaxesDocument12 pagesSolution - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- IA3 Chapter 12 21Document12 pagesIA3 Chapter 12 21ZicoNo ratings yet

- ASSIGNMENT - Accounting For Income TaxesDocument5 pagesASSIGNMENT - Accounting For Income TaxesKlarissemay MontallanaNo ratings yet

- Income Tax - Corporations Sample Problems: SolutionsDocument12 pagesIncome Tax - Corporations Sample Problems: SolutionsYellow BelleNo ratings yet

- FA2-08 Income TaxesDocument3 pagesFA2-08 Income Taxeskrisha millo0% (1)

- Accounting For Taxes Employee BenefitsDocument6 pagesAccounting For Taxes Employee BenefitsBess Tuico MasanqueNo ratings yet

- 3rd Year Diagnostic TestDocument11 pages3rd Year Diagnostic TestRaizell Jane Masiglat CarlosNo ratings yet

- Chapter 5Document15 pagesChapter 5Coursehero PremiumNo ratings yet

- Answer Key Fa RemDocument4 pagesAnswer Key Fa RemMac b IBANEZNo ratings yet

- Accounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonDocument3 pagesAccounting 5 - Intermediate Accounting Part 3 Statement of Financial PositonCj GarciaNo ratings yet

- Self Test 9 - LiabilitiesDocument4 pagesSelf Test 9 - LiabilitiesLennier ArvinNo ratings yet

- 7295 - Single EntryDocument2 pages7295 - Single EntryJulia MirhanNo ratings yet

- Self Test 9 - LiabilitiesDocument4 pagesSelf Test 9 - LiabilitiesBasketball WorldNo ratings yet

- Corporate Liquidation DisDocument4 pagesCorporate Liquidation DisRenelyn DavidNo ratings yet

- Statement of Cash FlowsDocument6 pagesStatement of Cash FlowsLuiNo ratings yet

- Seatwork Far3Document3 pagesSeatwork Far3Mansour HamjaNo ratings yet

- Lagura - Ass04 Statement of Comprehensive IncomeDocument7 pagesLagura - Ass04 Statement of Comprehensive IncomeShane LaguraNo ratings yet

- Cfas ActivitiesDocument10 pagesCfas ActivitiesAntonNo ratings yet

- Acctg26 Prelim Pretest 1: Multiple ChoiceDocument3 pagesAcctg26 Prelim Pretest 1: Multiple ChoiceJeane Mae BooNo ratings yet

- 9405 - Corporate LiquidationDocument4 pages9405 - Corporate LiquidationKenneth Anthony BalitayoNo ratings yet

- AUDITING Material 2Document9 pagesAUDITING Material 2Blessy Zedlav LacbainNo ratings yet

- Accounting For Taxes & Employee BenefitsDocument5 pagesAccounting For Taxes & Employee BenefitsAveryl Lei Sta.Ana100% (1)

- Basic Accounting - With AnswersDocument12 pagesBasic Accounting - With AnswersMarie MeridaNo ratings yet

- Chapter 25 and 26Document10 pagesChapter 25 and 26Sittie Aisah AmpatuaNo ratings yet

- Unit Iii Assessment ProblemsDocument8 pagesUnit Iii Assessment ProblemsChin Figura100% (1)

- A. Journal Entries For 2020Document6 pagesA. Journal Entries For 2020Ollid Kline Jayson JNo ratings yet

- 6884 - Statement of Comprehensive IncomeDocument2 pages6884 - Statement of Comprehensive IncomeMaximusNo ratings yet

- Problems Problems 15-1 (IAA)Document6 pagesProblems Problems 15-1 (IAA)sarahNo ratings yet

- Las#3 - (Ia3) STATEMENT OF CASH FLOWS PDFDocument6 pagesLas#3 - (Ia3) STATEMENT OF CASH FLOWS PDFStella MarieNo ratings yet

- Cash Flow Part 2 For ClassDocument9 pagesCash Flow Part 2 For ClassKgothatso ArnanzaNo ratings yet

- Interim Financial Reporting and Operating Segment Discussion Problems and Answer KeyDocument4 pagesInterim Financial Reporting and Operating Segment Discussion Problems and Answer Keyprincess QNo ratings yet

- Practical Financial Accounting - Volume 1 (Condrado T. Valix)Document369 pagesPractical Financial Accounting - Volume 1 (Condrado T. Valix)Josh CruzNo ratings yet

- Statement of Comprehensive Income - Ia3Document16 pagesStatement of Comprehensive Income - Ia3SharjaaahNo ratings yet

- Cpa Review School of The Philippines ManilaDocument2 pagesCpa Review School of The Philippines ManilaAlliah Mae ArbastoNo ratings yet

- Quiz Accounting For Income TaxDocument5 pagesQuiz Accounting For Income TaxCmNo ratings yet

- Intacc - PrelimDocument10 pagesIntacc - PrelimRenalyn ParasNo ratings yet

- Chapter 2Document4 pagesChapter 2Julie Neay Afable0% (1)

- 6938 - Operating, Investisng and Financing ActivitiesDocument2 pages6938 - Operating, Investisng and Financing ActivitiesAljur SalamedaNo ratings yet

- Diara Po.Document7 pagesDiara Po.Rio Cyrel CelleroNo ratings yet

- Reviewer For Final Examination - ProblemsDocument11 pagesReviewer For Final Examination - Problemsreynald animosNo ratings yet

- Accounting 2Document18 pagesAccounting 2cherryannNo ratings yet

- Exercise CorporationDocument3 pagesExercise CorporationJefferson MañaleNo ratings yet

- Individual Taxation ExercisesDocument3 pagesIndividual Taxation ExercisesMargaux CornetaNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Toolbox Talks - Near Miss ReportingDocument1 pageToolbox Talks - Near Miss ReportinganaNo ratings yet

- Sand Casting OverviewDocument166 pagesSand Casting Overviewsamurai7_77No ratings yet

- Mil-Std-1949a NoticeDocument3 pagesMil-Std-1949a NoticeGökhan ÇiçekNo ratings yet

- Giardiasis PDFDocument14 pagesGiardiasis PDFSaad Motawéa0% (1)

- 2012 U.S. History End-of-Course (EOC) Assessment Field Test Fact SheetDocument2 pages2012 U.S. History End-of-Course (EOC) Assessment Field Test Fact SheetswainanjanNo ratings yet

- Polyken 4000 PrimerlessDocument2 pagesPolyken 4000 PrimerlessKyaw Kyaw AungNo ratings yet

- Coiled Tubing Safety Impact Firing Head (HP) - by DynaDocument16 pagesCoiled Tubing Safety Impact Firing Head (HP) - by DynamahsaNo ratings yet

- Science Form 3 2020 (Notes, PBD, Exercise) : Chapter: 8 RadioactivityDocument19 pagesScience Form 3 2020 (Notes, PBD, Exercise) : Chapter: 8 Radioactivitysakinah100% (1)

- Keith UrbanDocument2 pagesKeith UrbanAsh EnterinaNo ratings yet

- Eric CHE326 JournalpptDocument33 pagesEric CHE326 JournalpptRugi Vicente RubiNo ratings yet

- Time Sheets CraneDocument1 pageTime Sheets CraneBillie Davidson100% (1)

- Mental Health & TravelDocument18 pagesMental Health & TravelReyza HasnyNo ratings yet

- 18-MCE-49 Lab Session 01Document5 pages18-MCE-49 Lab Session 01Waqar IbrahimNo ratings yet

- Protection Solutions: Above-the-NeckDocument42 pagesProtection Solutions: Above-the-NeckMatt DeganNo ratings yet

- 5 Keto Pancake RecipesDocument7 pages5 Keto Pancake RecipesBai Morales VidalesNo ratings yet

- 20 Best Cognac CocktailsDocument1 page20 Best Cognac CocktailsHL XanticNo ratings yet

- Employee Leave PolicyDocument3 pagesEmployee Leave Policyladdu30No ratings yet

- Optimization Process of Biodiesel Production With Ultrasound Assisted by Using Central Composite Design MethodsDocument47 pagesOptimization Process of Biodiesel Production With Ultrasound Assisted by Using Central Composite Design MethodsMiftahFakhriansyahNo ratings yet

- Fora Active Plus P 30 ManualDocument32 pagesFora Active Plus P 30 ManualBvcNo ratings yet

- Open Courses Myanmar Strategic English Week 4: U Yan Naing Se NyuntDocument24 pagesOpen Courses Myanmar Strategic English Week 4: U Yan Naing Se NyuntYan Naing Soe NyuntNo ratings yet

- DoveDocument11 pagesDovekattyperrysherryNo ratings yet

- Building Technology (CE1303) : Window: Lecturer: Madam FatinDocument19 pagesBuilding Technology (CE1303) : Window: Lecturer: Madam FatinRazif AjibNo ratings yet

- Tda12110h1 N300Document1 pageTda12110h1 N300rolandseNo ratings yet

- JAR Part 66 Examination Mod 03Document126 pagesJAR Part 66 Examination Mod 03Shreyas PingeNo ratings yet

- WAM IPM Mechanical Pressure Gauge BrochureDocument4 pagesWAM IPM Mechanical Pressure Gauge BrochureOliver ConlonNo ratings yet

- Synopsis of Involex TurbineDocument3 pagesSynopsis of Involex TurbineTanviNo ratings yet