Professional Documents

Culture Documents

General Pump Company

General Pump Company

Uploaded by

Hassan KhanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

General Pump Company

General Pump Company

Uploaded by

Hassan KhanCopyright:

Available Formats

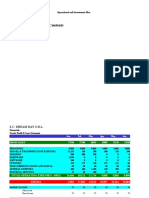

Cost of Capital 15%

Years 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

Savings 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000 35,000

Depreciation 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667

Pre-tax Savings 24,333 24,333 24,333 24,333 24,333 24,333 24,333 24,333 24,333 24,333 24,333 24,333 24,333 24,333 24,333

Less: Tax @ 40% 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733 9,733

Operating flows after tax 14,600 14,600 14,600 14,600 14,600 14,600 14,600 14,600 14,600 14,600 14,600 14,600 14,600 14,600 14,600

Add: depreciation 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667 10,667

Equipment Cost 154,000

Installation 6,000

Net Proceeds of sale 19,000

Tax on sale 5,200

146,200 25,267 25,267 25,267 25,267 25,267 25,267 25,267 25,267 25,267 25,267 25,267 25,267 25,267 25,267 25,267

NPV 1,544

IRR 15.22%

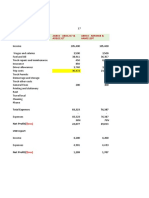

Payback

Time Cashflows Cumulative CF

0 146,200 146,200

1 25,267 120,933

2 25,267 95,666

3 25,267 70,399

4 25,267 45,132

5 25,267 19,865

6 25,267 5,402 Payback

7 25,267 30,669

8 25,267 55,936

9 25,267 81,203

10 25,267 106,470

11 25,267 131,737

12 25,267 157,004

13 25,267 182,271

14 25,267 207,538

15 25,267 232,805

Discounted Payback

Time Cashflows Discounted CFCumulative

0 146,200 146,200 146,200

1 25,267 21,971 124,229

2 25,267 19,105 105,123

3 25,267 16,613 88,510

4 25,267 14,446 74,063

5 25,267 12,562 61,501

6 25,267 10,924 50,577

7 25,267 9,499 41,079

8 25,267 8,260 32,819

9 25,267 7,182 25,636

10 25,267 6,246 19,391

11 25,267 5,431 13,960

12 25,267 4,723 9,237

13 25,267 4,107 5,131

14 25,267 3,571 1,560

15 25,267 3,105 1,546 Discounted Payback

Payback method puts long term investment projects at a disdvantage due to following factors:

- They donot incorporate the time value of money. While for short term investments, factoring TVM may not make much of a differnce, it will have huge impact for long term project.

- Payback period does not show any financial picture of the cash flows beyond the breaking point. For short term projects, cash flow returns are comparatively received in near future.

While for long-term investments, cash flow returns continue to be received. In case where higher cash flows are to be received at the later stages of the project life, and earlier stages only provide lower cash flows, The payback period calculated will be higher.

- It only tells us how much time is needed to recover the initial amount. No returns are shown

If Accelerated depreciation was used instead of straight line depreciation:

- Higher expense would be recorded in first 5 years cpomparitively.

- Lower profit before tax in first 5 years

- leading to lower tax payments (in cashflow terms)

Leading to higher NPV and IRR

You might also like

- Session 3 - Valuation Model - AirportsDocument105 pagesSession 3 - Valuation Model - AirportsPrathamesh GoreNo ratings yet

- Balantang Memorial Cemetery National ShrineDocument6 pagesBalantang Memorial Cemetery National ShrineJoahnna Paula CorpuzNo ratings yet

- IFS - Simple Three Statement ModelDocument1 pageIFS - Simple Three Statement ModelThanh NguyenNo ratings yet

- CFI 3 Statement Model Complete in ClassDocument10 pagesCFI 3 Statement Model Complete in ClassThiện NhânNo ratings yet

- CFI 3 Statement Model CompleteDocument14 pagesCFI 3 Statement Model CompleteMAYANK AGGARWALNo ratings yet

- Year Premiu M GST On at 8% Amt. # Bonus On Death BenefitDocument3 pagesYear Premiu M GST On at 8% Amt. # Bonus On Death BenefitShubham SinghalNo ratings yet

- Table I - VL & SL Credits Earned On A Monthly BasisDocument3 pagesTable I - VL & SL Credits Earned On A Monthly BasisJane SantosNo ratings yet

- Development Phase: PhasingDocument8 pagesDevelopment Phase: PhasingRahul lodhaNo ratings yet

- Control P PI PD 201950Document20 pagesControl P PI PD 201950Jonathan CellereNo ratings yet

- Pricing Semiannual BondsDocument3 pagesPricing Semiannual BondsmoneycreditandgreedNo ratings yet

- Plan Afaceri-Mirică Irina-MariaDocument83 pagesPlan Afaceri-Mirică Irina-MariaTheodor BondocNo ratings yet

- IFS Dividends IntroductionDocument2 pagesIFS Dividends IntroductionMohamedNo ratings yet

- Basic - Model - FSA - 2Document8 pagesBasic - Model - FSA - 2AhisjNo ratings yet

- Plan de Afaceri - Mirică Irina-MariaDocument80 pagesPlan de Afaceri - Mirică Irina-MariaTheodor BondocNo ratings yet

- Drilled Head Bolts AN73 Thru AN81: Superceded by MS20073 (Fine Thread) or MS20074 (Course Thread)Document1 pageDrilled Head Bolts AN73 Thru AN81: Superceded by MS20073 (Fine Thread) or MS20074 (Course Thread)Bogdan RusuNo ratings yet

- ULIP MF ComparisonDocument4 pagesULIP MF ComparisonAshutosh MishraNo ratings yet

- Salary Increase, 2021-22Document1 pageSalary Increase, 2021-22muhammd rizwanNo ratings yet

- Spicy Malunggay CookiesDocument19 pagesSpicy Malunggay CookiesChristine Margoux SiriosNo ratings yet

- Itsa Excel SheetDocument7 pagesItsa Excel SheetraheelehsanNo ratings yet

- Jet AirwaysDocument4 pagesJet Airwayssmith dabreoNo ratings yet

- Control P PI PD 201950Document21 pagesControl P PI PD 201950Jossy VegaNo ratings yet

- Cfin Assignment WorkingsDocument8 pagesCfin Assignment Workingspriyal batraNo ratings yet

- Plan de Afaceri - GĂGEAN GEORGE VLADDocument19 pagesPlan de Afaceri - GĂGEAN GEORGE VLADTheodor BondocNo ratings yet

- Cash FlowDocument56 pagesCash FlowMichael EncarnacionNo ratings yet

- Celyn FinancialDocument3 pagesCelyn FinancialHiruni RajapakshaNo ratings yet

- Assignment 2 - Statistical Process ControlDocument7 pagesAssignment 2 - Statistical Process Controlkjoel.ngugiNo ratings yet

- Geo StatisticsDocument5 pagesGeo StatisticsMaqsood IqbalNo ratings yet

- Bsais 4JDocument18 pagesBsais 4JArjay DeausenNo ratings yet

- Lecture - 5 - CFI-3-statement-model-completeDocument37 pagesLecture - 5 - CFI-3-statement-model-completeshreyasNo ratings yet

- TCS Financials - Summer 2023Document12 pagesTCS Financials - Summer 2023Abner ogegaNo ratings yet

- Project Report On: Saraswati Vidya Mandiram-NarpalaDocument24 pagesProject Report On: Saraswati Vidya Mandiram-NarpalaUsmankhan KhanNo ratings yet

- BASIC MODEL - Construction.Document10 pagesBASIC MODEL - Construction.KAVYA GUPTANo ratings yet

- CPSC - TruckingDocument32 pagesCPSC - TruckingSari Sari Store VideoNo ratings yet

- iMNS7jsuRvmEyLaZkLer - APS Balance SheetDocument3 pagesiMNS7jsuRvmEyLaZkLer - APS Balance SheetWajahat MazharNo ratings yet

- May Project Reports FinalDocument70 pagesMay Project Reports FinalWilton MwaseNo ratings yet

- 7-Basic - Model - FSA - 2 (Tax) - Rev-5Document14 pages7-Basic - Model - FSA - 2 (Tax) - Rev-5kIkiNo ratings yet

- Three Statement PredictionDocument8 pagesThree Statement PredictionKhush GosraniNo ratings yet

- Financial Statement UltimateDocument52 pagesFinancial Statement UltimateTEDY TEDYNo ratings yet

- Financial Statements-Ceres Gardening CompanyDocument9 pagesFinancial Statements-Ceres Gardening CompanyHarshit MalviyaNo ratings yet

- ADJUSTINGDocument2 pagesADJUSTINGZup ThanksNo ratings yet

- Finicial Model: Cost of Goods Sold (COGS)Document9 pagesFinicial Model: Cost of Goods Sold (COGS)Lawzy Elsadig SeddigNo ratings yet

- Port Huron's Preliminary 2017-18 BudgetDocument13 pagesPort Huron's Preliminary 2017-18 BudgetMichael EckertNo ratings yet

- Updated Fcss Receipts & PaymentsDocument6 pagesUpdated Fcss Receipts & PaymentsMubasar khanNo ratings yet

- MDKA SucorDocument6 pagesMDKA SucorFathan MujibNo ratings yet

- New Vra SSG 2018Document160 pagesNew Vra SSG 2018Wijaya TeknikNo ratings yet

- 04 LBP2015 Financial PositionDocument1 page04 LBP2015 Financial PositionHermione Eyer - TanNo ratings yet

- Spyder Student ExcelDocument21 pagesSpyder Student ExcelNatasha PerryNo ratings yet

- Plant Assets - Riovaldo & SyifaDocument14 pagesPlant Assets - Riovaldo & SyifaMuhammad RafiNo ratings yet

- Template de Mo Company Balance Sheet BudgetDocument2 pagesTemplate de Mo Company Balance Sheet BudgetDuta Hotel Group100% (1)

- Balance Sheet - Subros: Optimistic Senario Normal ScenarioDocument9 pagesBalance Sheet - Subros: Optimistic Senario Normal ScenarioAnonymous tgYyno0w6No ratings yet

- Financial Statements of SBC 1.1Document29 pagesFinancial Statements of SBC 1.1charnysayonNo ratings yet

- Annual Interest Rate % Loan Amount S.No. Instalment InterestDocument7 pagesAnnual Interest Rate % Loan Amount S.No. Instalment InterestshaamanNo ratings yet

- CF Tables 25y #6Document1 pageCF Tables 25y #6mvfw.hasenkampNo ratings yet

- Asm 2 - Ms Giang - Van NgocDocument12 pagesAsm 2 - Ms Giang - Van NgocNguyen Thanh LongNo ratings yet

- 2.0 Telus AnalysisDocument6 pages2.0 Telus Analysiskevin kipkemoiNo ratings yet

- 2023 Plws MonitoringDocument4 pages2023 Plws MonitoringCris GapasNo ratings yet

- PayrollDocument5 pagesPayrollChenie NazaraNo ratings yet

- Metodos Flujos de Caja, Ejemplo AltriaDocument5 pagesMetodos Flujos de Caja, Ejemplo AltriaEsteban BustamanteNo ratings yet

- Starting MoneyDocument12 pagesStarting MoneyJhervie AndisoNo ratings yet

- Profit & Loss StatementDocument16 pagesProfit & Loss StatementtaolaNo ratings yet

- New Doc 2019-11-29 09.37.24Document14 pagesNew Doc 2019-11-29 09.37.24Hassan KhanNo ratings yet

- Chap11_PPT - decisions makingDocument29 pagesChap11_PPT - decisions makingHassan KhanNo ratings yet

- Spirit1Document1 pageSpirit1Hassan KhanNo ratings yet

- PIA-solvedDocument7 pagesPIA-solvedHassan KhanNo ratings yet

- Australia-Mango Exoport - Ghulam MustafaDocument8 pagesAustralia-Mango Exoport - Ghulam MustafaHassan KhanNo ratings yet

- Equity FramingDocument1 pageEquity FramingHassan KhanNo ratings yet

- Business Plan Final - Ayesha SameenDocument5 pagesBusiness Plan Final - Ayesha SameenHassan KhanNo ratings yet

- Agri Project - Final Report - SarmadDocument6 pagesAgri Project - Final Report - SarmadHassan KhanNo ratings yet

- Pakistan Census 2023 Summary by FCG Including Top 10 Cities - 20-Oct-2023 - WADocument13 pagesPakistan Census 2023 Summary by FCG Including Top 10 Cities - 20-Oct-2023 - WAHassan KhanNo ratings yet

- 12.1. Vanourek 2013 Collaborative AlignmentDocument6 pages12.1. Vanourek 2013 Collaborative AlignmentHassan KhanNo ratings yet

- Agri Project - Muhammad AhmadDocument6 pagesAgri Project - Muhammad AhmadHassan KhanNo ratings yet

- DR SadiaDocument5 pagesDR SadiaHassan KhanNo ratings yet

- Newzeland (Muhammad Usman)Document9 pagesNewzeland (Muhammad Usman)Hassan KhanNo ratings yet

- Rice Export To Turkey - Adnan MushtaqDocument9 pagesRice Export To Turkey - Adnan MushtaqHassan KhanNo ratings yet

- Report - Mujahid ShababDocument5 pagesReport - Mujahid ShababHassan KhanNo ratings yet

- Right To Protest - A Fundamental Right - IpleadersDocument8 pagesRight To Protest - A Fundamental Right - IpleadersAyushNo ratings yet

- Form 1 - Child Care Enrolment and Subsidy Application (Jan 2022)Document12 pagesForm 1 - Child Care Enrolment and Subsidy Application (Jan 2022)Empathos XywinNo ratings yet

- Ninth Cycle Quiz 2Document4 pagesNinth Cycle Quiz 2Rodrigo BenNo ratings yet

- Pas Bahasa Inggris Kelas 7Document4 pagesPas Bahasa Inggris Kelas 7annisahjuashriNo ratings yet

- SCM MidtermDocument4 pagesSCM MidtermShershah AdnanNo ratings yet

- STS1036Document2 pagesSTS1036Shilpa AmitNo ratings yet

- ArchiMetal Case Study (Slides)Document23 pagesArchiMetal Case Study (Slides)Jaime ChavarriagaNo ratings yet

- Bilderberg08 & Trilateral Comission 08 MembersDocument17 pagesBilderberg08 & Trilateral Comission 08 MembersnortherndisclosureNo ratings yet

- Plywood Production and ConsumptionDocument7 pagesPlywood Production and ConsumptionSalman KhanNo ratings yet

- The Classical EraDocument14 pagesThe Classical Eravenus_marivicNo ratings yet

- Antenatal Registration Tetanus Toxoid Immunization Micronutrient Supplementation Treatment of DiseasesDocument81 pagesAntenatal Registration Tetanus Toxoid Immunization Micronutrient Supplementation Treatment of DiseasesFreeNursingNotesNo ratings yet

- Assignment Front PageDocument6 pagesAssignment Front PageAjay DNo ratings yet

- Exam 1 ReviewDocument7 pagesExam 1 ReviewJasmine GreenwaldNo ratings yet

- Consolidated Tax Invoice: Recipient Details Registrant DetailsDocument2 pagesConsolidated Tax Invoice: Recipient Details Registrant DetailsAccounts SkyHawkNo ratings yet

- Assignment #3Document1 pageAssignment #3Reniva KhingNo ratings yet

- J ctt1sq5x7k 14Document19 pagesJ ctt1sq5x7k 14anggaturanaNo ratings yet

- Fel and FeedDocument2 pagesFel and Feedacalerom3625100% (6)

- GoBia LTD Halal Cert 3 2021Document1 pageGoBia LTD Halal Cert 3 2021Maria TedescoNo ratings yet

- Rga 8872 Post-Elec 120414Document115 pagesRga 8872 Post-Elec 120414paul weichNo ratings yet

- MB Environment Education and Water SecurityDocument82 pagesMB Environment Education and Water SecurityHansika ChawlaNo ratings yet

- Dragnet ClauseDocument2 pagesDragnet ClauseAlarm GuardiansNo ratings yet

- EAPS Case SummaryDocument3 pagesEAPS Case SummaryNadia1214100% (1)

- Case Study Management EconomicsDocument4 pagesCase Study Management EconomicsMichael SantosNo ratings yet

- Dan Druz v. Valerie Noto, 3rd Cir. (2011)Document5 pagesDan Druz v. Valerie Noto, 3rd Cir. (2011)Scribd Government DocsNo ratings yet

- Marginal Costing 1st SemDocument6 pagesMarginal Costing 1st SemBheemeswar ReddyNo ratings yet

- Module Acquisition Monitoring Form (Mamf) - Week No. - : Taal Senior High SchoolDocument86 pagesModule Acquisition Monitoring Form (Mamf) - Week No. - : Taal Senior High SchoolJeppssy Marie Concepcion MaalaNo ratings yet

- Political InstabilityDocument11 pagesPolitical InstabilityAwais Shah100% (1)

- E RetailingDocument36 pagesE RetailingSurbhi SachdevNo ratings yet

- Arrange Marriage and Love MarriageDocument2 pagesArrange Marriage and Love MarriageAparannha RoyNo ratings yet