Professional Documents

Culture Documents

Homework 1-Finacc5

Homework 1-Finacc5

Uploaded by

CRISZA MAE BERICopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Homework 1-Finacc5

Homework 1-Finacc5

Uploaded by

CRISZA MAE BERICopyright:

Available Formats

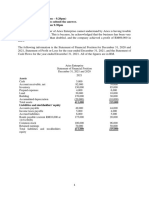

PROBLEM 1

The accounts below were taken from the unadjusted trial balance of C. Aquino Company at December 31,

2021:

Cash 124,000

Trading securities (cost) 87,000

Trade notes receivable 92,000

Accounts receivable 122,000

Allowance for uncollectible accounts 6,000

Trade notes payable 154,000

Accounts payable 75,000

Merchandise inventory 136,000

Bonds payable 250,000

Share dividends distributable 15,000

Income tax payable 28,000

An analysis of the above accounts disclosed the following:

a. Bank overdraft of P13,000 was deducted from cash balance.

b. Trade accounts receivable was net of customer’s deposit of P7,000.

c. Merchandise purchased on account worth P15,000 received December 30, 2021 was included in

the inventory but was not recorded as a purchase.

d. Accounts payable was net of suppliers’ debit balance of P12,000.

e. A bank loan of P30,000 due December 31, 2024 was included in the trade notes payable balance.

f. Bonds payable that was issued in 2021 will mature in five equal annual instalments beginning June

1, 2022.

g. The fair value of the equity investments at December 31, 2021 was P90,000.

Determine the following on December 31, 2021:

Total current assets

Cash ₱124,000

Trading securities (at fair value) (change from cost to FV cause of G) ₱90,000

Trade notes receivable ₱92,000

Accounts receivable ₱122,000

Allowance for uncollectible accounts ₱ (6,000)

Merchandise Inventory ( 136,000+15,000) ₱151,000

TOTAL CURRENT ASSET ₱573,00

Total current liabilities

Trade Notes Payable ₱124,000

e. Bank Loan Due on 2024 (₱ 30,000)

Accounts Payable ₱91,000

a. Bank Overdraft ₱ (13,000)

c. Merchandise Inventory ₱ 15,000

b. Advances from Customer 7,000

Share Dividends Distributable ₱15,000

Income Tax Payable ₱28,000

Portion of Bonds Payable due within a year: (P250,000/5) ₱50,000

TOTAL CURRENT LIABILITIES ₱287,000

Total non-current assets

NONE = 0 (NOT EXPLICITLY STATED)

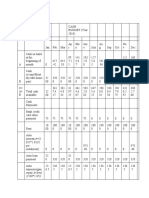

PROBLEM 2

The following totals are taken from the December 31, 2021 balance sheet and income

statement of Marcos Company: Current Assets—P4,500,000; Noncurrent Assets—P10,000,000; Current

liabilities—P2,000,000; Noncurrent liabilities—P3,700,000; Revenues—P5,500,000; Costs and Expenses

—P4,000,000.

Additional information:

• Accounts payable amounting to P540,000 was net of P122,000 suppliers’ debit balance

• Cash in bank amounting to P600,000 was net of P50,000 bank overdraft

• Accounts receivable amounting to P800,000 was net of P145,000 customers’ credit balance

• Checks totaling P100,000 payable to suppliers were written and recorded on December 29, 2021 but

were mailed on January 10, 2022.

Compute the following:

Total current assets

Current Assets (Unadjusted) ₱4,500,000

Cash on Bank for Bank Overdraft ₱ (50,000)

Accounts Receivable ₱145,000

Checks unreleased ₱100,000

Total Adjusted Current Assets ₱4,695,000

Total current liabilities

Current Liability (Unadjusted) ₱2,000,000

Accounts Payable ₱122,000

Checks Unreleased ₱100,000

Bank Overdraft ₱50,000

Total Adjusted Current Liability ₱2,272,000

You might also like

- Cost Accounting and Management AccountingDocument11 pagesCost Accounting and Management AccountingCollins AbereNo ratings yet

- Profit and Loss Questions For SSC CGL Set-2 PDFDocument7 pagesProfit and Loss Questions For SSC CGL Set-2 PDFshylesh86No ratings yet

- Quiz 2 Answers SolutionsDocument29 pagesQuiz 2 Answers SolutionsMarcus Monocay100% (2)

- Module 3-Planning Technical ActivitiesDocument9 pagesModule 3-Planning Technical ActivitiesLegenGaryNo ratings yet

- InvoiceDocument1 pageInvoiceKroma ServicesNo ratings yet

- 6727 Statement of Financial PositionDocument3 pages6727 Statement of Financial PositionJane ValenciaNo ratings yet

- AFAR - Corpo Liquidation: Home Office and Branch AccountingDocument5 pagesAFAR - Corpo Liquidation: Home Office and Branch AccountingJustine CruzNo ratings yet

- 1T Siñel ACTIVITY7Document10 pages1T Siñel ACTIVITY7Von Jaurdan SinelNo ratings yet

- 87549654Document3 pages87549654Joel Christian Mascariña100% (1)

- Audit of Long Term Liabilities 2Document5 pagesAudit of Long Term Liabilities 2Cesar EsguerraNo ratings yet

- Export Import DocumentationDocument15 pagesExport Import Documentationsurvish90% (10)

- Octane Service StationDocument8 pagesOctane Service StationKalyan Kumar83% (6)

- Problem 2-2: J.L. Gregory CompanyDocument5 pagesProblem 2-2: J.L. Gregory CompanyKAPIL MBA 2021-23 (Delhi)No ratings yet

- FAR - Final Preboard CPAR 92Document14 pagesFAR - Final Preboard CPAR 92joyhhazelNo ratings yet

- Financial Accounting and Reporting Problems Freebie PDFDocument46 pagesFinancial Accounting and Reporting Problems Freebie PDFC/PVT DAET, SHAINA JOYNo ratings yet

- Latih Soal Kieso E5-6 E5-12Document4 pagesLatih Soal Kieso E5-6 E5-12Agung Setya NugrahaNo ratings yet

- Liabilities With Answer For StudentsDocument29 pagesLiabilities With Answer For StudentsDivine CuasayNo ratings yet

- West Godavari District Officer Phone Numbers - Mobile Numbers Andhra Pradesh StateDocument5 pagesWest Godavari District Officer Phone Numbers - Mobile Numbers Andhra Pradesh StateSRINIVASARAO JONNALANo ratings yet

- Pantheon Tankers Management LTD Daily Position List: Malta 260 L/C 18-21/12Document6 pagesPantheon Tankers Management LTD Daily Position List: Malta 260 L/C 18-21/12Emmanouil Sfougg Sfouggaristos100% (1)

- Chapter 2Document20 pagesChapter 2Coursehero PremiumNo ratings yet

- Liquidity Ratios - Practice QuestionsDocument14 pagesLiquidity Ratios - Practice QuestionsOsama SaleemNo ratings yet

- Assignment 1 Practice Solving - Robles and EmpleoDocument4 pagesAssignment 1 Practice Solving - Robles and EmpleoLeah La MadridNo ratings yet

- FAR Final Exam - QuestionnaireDocument10 pagesFAR Final Exam - QuestionnairemavsgamingguildNo ratings yet

- TUGAS Topik Bab 5Document2 pagesTUGAS Topik Bab 5Imanuel ChrisNo ratings yet

- FABM 2 Peer TutorialDocument3 pagesFABM 2 Peer TutorialIrish LudoviceNo ratings yet

- FAR MaterialDocument25 pagesFAR MaterialJerecko Ace ManlangatanNo ratings yet

- Topic No. 1 - Statement of Financial Position PDFDocument4 pagesTopic No. 1 - Statement of Financial Position PDFSARAH ANDREA TORRESNo ratings yet

- Acctg 102 Prelim Exam With SolutionsDocument12 pagesAcctg 102 Prelim Exam With SolutionsYsabel ApostolNo ratings yet

- Week 4 PDF FreeDocument5 pagesWeek 4 PDF FreeM. Gibran KhalilNo ratings yet

- Mid Term ExamDocument6 pagesMid Term ExamWaizin KyawNo ratings yet

- Financial StatementsDocument2 pagesFinancial StatementsMaria Teresa VillamayorNo ratings yet

- Applied Auditing-Prelim FinalDocument3 pagesApplied Auditing-Prelim FinalDominic E. BoticarioNo ratings yet

- FAChapter 12Document3 pagesFAChapter 12zZl3Ul2NNINGZzNo ratings yet

- Group 8-SW Income Statement & Balance SheetDocument2 pagesGroup 8-SW Income Statement & Balance SheetDiễm Quỳnh QuáchNo ratings yet

- Question 1: Debit BalancesDocument9 pagesQuestion 1: Debit BalancesAsdfghjkl LkjhgfdsaNo ratings yet

- Bookkeeping Mock Answers2022 - GG1712Document6 pagesBookkeeping Mock Answers2022 - GG1712Karan KhannaNo ratings yet

- Examination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash FlowDocument3 pagesExamination Question and Answers, Set F (Problem Solving), Chapter 15 - Statement of Cash Flowjohn carlos doringoNo ratings yet

- Module 10 Financial StatementsDocument17 pagesModule 10 Financial StatementsChristine CariñoNo ratings yet

- Class 1 HomeworkDocument10 pagesClass 1 HomeworkAngel MéndezNo ratings yet

- 1ST Sem P.Y. Acct PaperDocument30 pages1ST Sem P.Y. Acct PaperSuraj KumarNo ratings yet

- Problem 1: Cash Flow Statement (Class Practice)Document2 pagesProblem 1: Cash Flow Statement (Class Practice)ronamiNo ratings yet

- Fundamentals in Accountancy and Business Management II: Specialized Subject: (GRADE 12 First Semester)Document8 pagesFundamentals in Accountancy and Business Management II: Specialized Subject: (GRADE 12 First Semester)MarielLee Ramos VillarealNo ratings yet

- Single Entry AccountingDocument12 pagesSingle Entry AccountingArjun ThawaniNo ratings yet

- PA T22WSB 3 Group Assignment 1Document4 pagesPA T22WSB 3 Group Assignment 1Pham Minh Thu NguyenNo ratings yet

- 2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Document8 pages2018-0232 Beldia, Pitchie Mae G. ACT142: Auditing and Assurance: Concepts and Application 1Melanie SamsonaNo ratings yet

- Activity Statement of CashflowDocument1 pageActivity Statement of CashflowAdrian Rodriguez PangilinanNo ratings yet

- Session 11,12&13 AssignmentDocument3 pagesSession 11,12&13 AssignmentMardi SutiosoNo ratings yet

- AssetsDocument2 pagesAssetsDier DalapNo ratings yet

- Cash and Cash EquivalentsDocument2 pagesCash and Cash EquivalentsAngelo Christian B. OreñadaNo ratings yet

- AFAR - 2.0 5.0 - Corp Liq and Hob - ASSESSMENTDocument5 pagesAFAR - 2.0 5.0 - Corp Liq and Hob - ASSESSMENTMakisa YuNo ratings yet

- 2021-22 F5 BAFS Mid-Year Exam (Question)Document7 pages2021-22 F5 BAFS Mid-Year Exam (Question)Anna TungNo ratings yet

- Midterm Practice QuestionsDocument4 pagesMidterm Practice QuestionsGio RobakidzeNo ratings yet

- Group 8 ACTIVITYDocument3 pagesGroup 8 ACTIVITYRoldan, Juan Miguel S.No ratings yet

- FAR - CASH ProbDocument2 pagesFAR - CASH Prob2216391No ratings yet

- Problem 1 2 IAADocument1 pageProblem 1 2 IAAJUARE MaxineNo ratings yet

- ACC203 - AssignmentDocument2 pagesACC203 - AssignmentHailsey WinterNo ratings yet

- Finals Quiz No. 1 AnswersDocument4 pagesFinals Quiz No. 1 AnswersMergierose DalgoNo ratings yet

- 1 Accounting Equation UniqueDocument3 pages1 Accounting Equation UniqueSohan AgrawalNo ratings yet

- Cfas AnswersDocument5 pagesCfas AnswersPATRICIA SANTOSNo ratings yet

- Chapter 12 ExercisesDocument2 pagesChapter 12 ExercisesAreeba QureshiNo ratings yet

- Quiz ZDocument5 pagesQuiz ZShannen CalimagNo ratings yet

- Property, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetDocument4 pagesProperty, Plant, Equipment: Abbey Corporation Statement of Financial Position DECEMBER 31,2015 AssetAstri KaruniaNo ratings yet

- ULOb - Let's Analyze & in A NutshellDocument5 pagesULOb - Let's Analyze & in A Nutshellemem resuentoNo ratings yet

- QUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDocument4 pagesQUIZ AFTER MID 114 - Daffa Fawwaaz RamadhanDaffa Ramadhan ArcheryNo ratings yet

- FM Quiz Set ADocument3 pagesFM Quiz Set AShaira Mae TomasNo ratings yet

- Unit 4 - Cash Flow Statement AnalysisDocument12 pagesUnit 4 - Cash Flow Statement Analysissikute kamongwaNo ratings yet

- Quiz 2Document3 pagesQuiz 2Abdullah AlziadyNo ratings yet

- Cash To Accrual AssignmentDocument3 pagesCash To Accrual AssignmentCRISZA MAE BERINo ratings yet

- NOTES - Practice Probs 2Document1 pageNOTES - Practice Probs 2CRISZA MAE BERINo ratings yet

- Statement of Cash Flows - Homework - Finacc5Document1 pageStatement of Cash Flows - Homework - Finacc5CRISZA MAE BERINo ratings yet

- Scitec Proj by PairDocument2 pagesScitec Proj by PairCRISZA MAE BERINo ratings yet

- Tolstoy's Definition of ArtDocument3 pagesTolstoy's Definition of ArtCRISZA MAE BERINo ratings yet

- FM II CH 1,2 and 3Document104 pagesFM II CH 1,2 and 3Andualem ZenebeNo ratings yet

- RMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFDocument12 pagesRMC No. 42-03 - Rules On Assessment of National INternal Revenue Taxes Covered by A LN Under The Relief System PDFCkey ArNo ratings yet

- Auditing BitsDocument48 pagesAuditing BitskalyanikamineniNo ratings yet

- How Should Obermeyer Management Think (Both Short-Term and Long-Term) About Sourcing in Honk Kong Versus China?Document6 pagesHow Should Obermeyer Management Think (Both Short-Term and Long-Term) About Sourcing in Honk Kong Versus China?Hafis SayedNo ratings yet

- Oracle PaaS and IaaS Public Cloud Services Pillar Document - April 2020Document39 pagesOracle PaaS and IaaS Public Cloud Services Pillar Document - April 2020SNo ratings yet

- Environmental and Social Management Framework ESMF Second Ethiopia Resilient Landscapes and Livelihoods Project P174385 PDFDocument152 pagesEnvironmental and Social Management Framework ESMF Second Ethiopia Resilient Landscapes and Livelihoods Project P174385 PDFMasresha BerhanuNo ratings yet

- ATOM Ride-Hailing AgreementDocument7 pagesATOM Ride-Hailing AgreementRaedNo ratings yet

- BEC1054 - Mid-Term (Take Home Test) - T1 - 20202021 (Q)Document6 pagesBEC1054 - Mid-Term (Take Home Test) - T1 - 20202021 (Q)Sweethaa ArumugamNo ratings yet

- Yes Bank FD OfferDocument3 pagesYes Bank FD OfferEsolNo ratings yet

- Bcom Information Systems Brochure A4 Ug Apr2018Document3 pagesBcom Information Systems Brochure A4 Ug Apr2018mapondaglodiNo ratings yet

- Cash BudgetDocument9 pagesCash BudgetColter SodjaNo ratings yet

- USSD Sales Kit: DisclaimerDocument12 pagesUSSD Sales Kit: DisclaimerVennu Ganesh KumarNo ratings yet

- Financial Management Mba (Syllabus)Document2 pagesFinancial Management Mba (Syllabus)lini liniNo ratings yet

- For Business Information, Annual Reports, Laws, Ordinances, Regulations and ArticlesDocument28 pagesFor Business Information, Annual Reports, Laws, Ordinances, Regulations and ArticlesPrince AdyNo ratings yet

- Quiz 1: D. The Market Price Per Share of The Firm's Common StockDocument2 pagesQuiz 1: D. The Market Price Per Share of The Firm's Common StockSauban AhmedNo ratings yet

- Pesticides Act 2076 (2019)Document29 pagesPesticides Act 2076 (2019)Rakesh yadavNo ratings yet

- QuizzDocument80 pagesQuizzvishvjeetpowar0202No ratings yet

- Penny Marie Stewart P.O BOX 561 Godley TX 76044 20101294310Document3 pagesPenny Marie Stewart P.O BOX 561 Godley TX 76044 20101294310Taylor LynnNo ratings yet

- Indian Bank Home LoanDocument60 pagesIndian Bank Home Loanriyazmaideen17No ratings yet

- EOQ1Document2 pagesEOQ1Shivraj GaikwadNo ratings yet

- EconomicsDocument18 pagesEconomicsVishakhaNo ratings yet

- Of Prepared by Benson James LyimoDocument3 pagesOf Prepared by Benson James LyimoOlva AcademyNo ratings yet