Professional Documents

Culture Documents

NOTES - Practice Probs 2

NOTES - Practice Probs 2

Uploaded by

CRISZA MAE BERIOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

NOTES - Practice Probs 2

NOTES - Practice Probs 2

Uploaded by

CRISZA MAE BERICopyright:

Available Formats

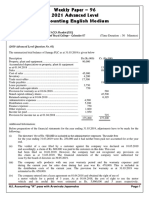

PROBLEM 1: Arya Stark Company was incorporated on January 1, 2017 and follows IFRS in preparing its

financial statements. In preparing its financial statements for financial year ending December 31, 2019, Arya

Stark Company used these useful lives for its property, plant and equipment:

Buildings 15 years

Plant and machinery 10 years

Furniture and fixtures 7 years

On January 1, 2020, the entity decides to review the useful lives of the property, plant and equipment. For this

purpose, it hired external valuation experts. These independent experts certified the remaining useful lives of

the property, plant and equipment of Arya Stark Company at the beginning of 2020 as

Buildings

10 years

Plant and machinery 7 years

Furniture and fixtures 5 years

Arya Stark Company uses the straight-line method of depreciation. The original cost of the various

components of property, plant and equipment were

Buildings 15,000,000

Plant and machinery 10,000,000

Furniture and fixtures 3,500,000

Required:

Compute the impact on the statement of comprehensive income for the year ending December 31, 2020, if

Arya Stark Company decides to change the useful lives of the property, plant, and equipment in compliance

with the recommendations of external valuation experts. Assume that there were no salvage values for the

three components of the property, plant, and equipment either initially or at the time the useful lives were

revisited and revised.

PROBLEM 2: On January 1, 2015, Samwell Tarly Company purchased a heavy-duty equipment for

P400,000. On the date of installation, it was estimated that the machine has a useful life of ten years and a

residual value of P40,000. Accordingly, the annual depreciation worked out to P36,000.

On January 1, 2019, after four years of using the equipment, the company decided to review the useful life of

the equipment and its residual value. Technical experts were consulted. According to them, the remaining

useful life of the equipment at January 1, 2019, was seven years and its residual value was P46,000.

Required:

Compute the revised annual depreciation for the year 2019 and future years.

You might also like

- AP-03 Audit of Intangible AssetsDocument11 pagesAP-03 Audit of Intangible AssetsMitch MinglanaNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- PPE ExerciseDocument4 pagesPPE ExerciseLlyod Francis LaylayNo ratings yet

- Test 1 - Test On IND As 16, 38, 40 - QuesDocument3 pagesTest 1 - Test On IND As 16, 38, 40 - Quesbhallavishal.socialmediaNo ratings yet

- Audit PpeDocument4 pagesAudit Ppenicole bancoroNo ratings yet

- Property, Plant, and EquipmentDocument3 pagesProperty, Plant, and EquipmentIzza Mae Rivera KarimNo ratings yet

- Test 1 - InD As 16, 38, 40 - QuestionsDocument5 pagesTest 1 - InD As 16, 38, 40 - Questionskapsemansi1No ratings yet

- Module 1 Ias 16 & Ias 38Document6 pagesModule 1 Ias 16 & Ias 38Muhammad Zulqarnain NainNo ratings yet

- Non Current Assets 2019ADocument4 pagesNon Current Assets 2019AKezy Mae GabatNo ratings yet

- ACP323 Audit of Iib and Ppe ReviewerDocument4 pagesACP323 Audit of Iib and Ppe ReviewerFRAULIEN GLINKA FANUGAONo ratings yet

- Property, Plant and Equipment (IAS-16)Document2 pagesProperty, Plant and Equipment (IAS-16)Raneem BilalNo ratings yet

- Unit 7. Audit of Property, Plant and Equipment - Handout - Final - t21516Document8 pagesUnit 7. Audit of Property, Plant and Equipment - Handout - Final - t21516mimi96No ratings yet

- Accounting 162 - Material 002Document2 pagesAccounting 162 - Material 002Angelli LamiqueNo ratings yet

- QuizDocument2 pagesQuizCassandra Dianne Ferolino MacadoNo ratings yet

- IA PPE (Unit Test)Document10 pagesIA PPE (Unit Test)Nina MarieNo ratings yet

- 2023 Tutorials Capital Allow & RecoupmtDocument10 pages2023 Tutorials Capital Allow & RecoupmtNchafie AsemahleNo ratings yet

- Prior To Revaluation As at 31-12-2018 Estimated Useful Life As Originally Estimated Cost Accumulated Depreciation Revalued AmountDocument2 pagesPrior To Revaluation As at 31-12-2018 Estimated Useful Life As Originally Estimated Cost Accumulated Depreciation Revalued AmountBabar MalikNo ratings yet

- A7 Audit of Intangible AssetsDocument4 pagesA7 Audit of Intangible AssetsKezNo ratings yet

- Problem 1Document3 pagesProblem 1Beverly MindoroNo ratings yet

- Audit of PPEDocument6 pagesAudit of PPEJuvy DimaanoNo ratings yet

- On January 1Document2 pagesOn January 1UNKNOWNNNo ratings yet

- Impairment of AssetsDocument21 pagesImpairment of AssetsSteffanie Granada50% (2)

- 2017 FIA324-test 2Document10 pages2017 FIA324-test 2popla poplaNo ratings yet

- Asistensi 8 - PPE (Revaluation Model)Document3 pagesAsistensi 8 - PPE (Revaluation Model)mirrmirmirNo ratings yet

- Assessment 1 (QP) IAS 16 + 23Document2 pagesAssessment 1 (QP) IAS 16 + 23Ali Optimistic100% (1)

- Ap106 Property Plant and Equipment Part 2 PDFDocument3 pagesAp106 Property Plant and Equipment Part 2 PDFVandixNo ratings yet

- CA (Final) Financial Reporting: InstructionsDocument5 pagesCA (Final) Financial Reporting: InstructionsNakul GoyalNo ratings yet

- Acctg3 QuizDocument2 pagesAcctg3 QuizSyril SarientasNo ratings yet

- Lecture # 43Document2 pagesLecture # 43HussainNo ratings yet

- Auditing Problems-Ppep1Document4 pagesAuditing Problems-Ppep1Par CorNo ratings yet

- FRK201 Nov2019Document11 pagesFRK201 Nov2019Alex ViljoenNo ratings yet

- Workbook 2Document19 pagesWorkbook 2zfy020807No ratings yet

- Ias 16Document6 pagesIas 16Noman Anser0% (1)

- Accounting 102 Intermediate Accounting Depreciation QuizDocument6 pagesAccounting 102 Intermediate Accounting Depreciation QuizApril Mae Intong TapdasanNo ratings yet

- Quiz - Intangible Assets With QuestionsDocument3 pagesQuiz - Intangible Assets With Questionsjanus lopezNo ratings yet

- Audit of Ppe ModuleDocument19 pagesAudit of Ppe ModuleEunice Enriquez100% (4)

- Financial Accounting and Reporting 1Document11 pagesFinancial Accounting and Reporting 1BablooNo ratings yet

- CA IPCC Accounts Mock Test Series 1 - Sept 2015Document8 pagesCA IPCC Accounts Mock Test Series 1 - Sept 2015Ramesh Gupta100% (1)

- Final MockDocument5 pagesFinal MockAbdullahSaqibNo ratings yet

- Problems - PPE & DepnDocument5 pagesProblems - PPE & DepnSaurabh SinghNo ratings yet

- KTQT Eng 1Document9 pagesKTQT Eng 1Huỳnh Như PhạmNo ratings yet

- Assignment 1Document8 pagesAssignment 1Ivan SsebugwawoNo ratings yet

- Acctg26 Accounting Changes: Multiple ChoiceDocument2 pagesAcctg26 Accounting Changes: Multiple Choicelinkin soyNo ratings yet

- Soal Asistensi Special EditionDocument6 pagesSoal Asistensi Special EditionEden ZaristaNo ratings yet

- Final Exam W MCQDocument12 pagesFinal Exam W MCQPatrick SalvadorNo ratings yet

- COMPREHENSIVE CASE 1 - Student - A202Document5 pagesCOMPREHENSIVE CASE 1 - Student - A202lim qsNo ratings yet

- BCOM Y3 - ACC 3 - June 2020 Take Home AssessmentDocument4 pagesBCOM Y3 - ACC 3 - June 2020 Take Home AssessmentNtokozo Siphiwo Collin DlaminiNo ratings yet

- Practice Questions For Ias 16Document6 pagesPractice Questions For Ias 16Uman Imran,56No ratings yet

- Financial Reporting Test 1 May 2024 Test Paper 1702362463Document12 pagesFinancial Reporting Test 1 May 2024 Test Paper 1702362463shauryagupta20013007No ratings yet

- IAS 40 ICAB QuestionsDocument5 pagesIAS 40 ICAB QuestionsMonirul Islam Moniirr100% (1)

- RT#1 CAF-1 FAR-1 - Question PaperDocument2 pagesRT#1 CAF-1 FAR-1 - Question Paperawaisawais95138No ratings yet

- AFAB233 Tutorial - PPE - 021819Document7 pagesAFAB233 Tutorial - PPE - 021819Leshiga GunasegarNo ratings yet

- Accounting English Medium: Weekly Paper - 96 2021 Advanced LevelDocument2 pagesAccounting English Medium: Weekly Paper - 96 2021 Advanced LevelMalar SrirengarajahNo ratings yet

- Referencer For Quick Revision: Final Course Paper-6E: Global Financial Reporting StandardsDocument16 pagesReferencer For Quick Revision: Final Course Paper-6E: Global Financial Reporting StandardsSivasankariNo ratings yet

- Inu 2121 Accounts - Question PaperDocument4 pagesInu 2121 Accounts - Question PaperSAKSHI AGRAWALNo ratings yet

- PGBP IllustrationsDocument14 pagesPGBP Illustrationskryptone 1No ratings yet

- 2021 Revision QuestionsDocument10 pages2021 Revision QuestionsTawanda Tatenda HerbertNo ratings yet

- Audit All Past Suggested Paper ICANDocument280 pagesAudit All Past Suggested Paper ICANMichael AdhikariNo ratings yet

- CORPORATE-REPORTING-May-2016-BORROWING COST-QUESTION 1 BPDFDocument28 pagesCORPORATE-REPORTING-May-2016-BORROWING COST-QUESTION 1 BPDFGen AbulkhairNo ratings yet

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisFrom EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisNo ratings yet

- Cash To Accrual AssignmentDocument3 pagesCash To Accrual AssignmentCRISZA MAE BERINo ratings yet

- Statement of Cash Flows - Homework - Finacc5Document1 pageStatement of Cash Flows - Homework - Finacc5CRISZA MAE BERINo ratings yet

- Homework 1-Finacc5Document2 pagesHomework 1-Finacc5CRISZA MAE BERINo ratings yet

- Scitec Proj by PairDocument2 pagesScitec Proj by PairCRISZA MAE BERINo ratings yet

- Tolstoy's Definition of ArtDocument3 pagesTolstoy's Definition of ArtCRISZA MAE BERINo ratings yet