Professional Documents

Culture Documents

CSS Financial Report Web 10-11

Uploaded by

LIFECommsOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

CSS Financial Report Web 10-11

Uploaded by

LIFECommsCopyright:

Available Formats

crisis support services

Financial Report

css 2011

financial report FOR THE YEAR ENDED 30 JUNE 2011

crisis support services inc ABN 33 185 295 654

contents

03 04 05 06 06 07 17 18

Directors report statement of comprehensive income statement of financial position statement of cash flows statement of changes in equity notes to the financial statements statement by the boarD of Directors auDitors report

Directors report

Your Board of Directors submit the financial report of Crisis Support Services Inc. for the financial year ended 30 June 2011.

Board Members Nicholas Voudouris Ron Forsyth Paul Geyer - resigned 11 February 2011 Michael Grigoletto Sen Hogan John McGrath - resigned 31 December 2010 Lynette OLoughlin Arthur Papakotsias The above board members have held office since the start of the financial year to the date of this report unless otherwise stated.

Principal Activities The principal activities of the Association during the financial year were to provide specialist telephone counselling services.

Significant Changes No significant change in the nature of these activities occurred during the year.

Operating Result The surplus for the year amounted to $306,700 (2010: Deficit $51,131).

Signed in accordance with a resolution of the Board of Directors.

Nicholas Voudouris

Lynette OLoughlin

Dated this 26th day of September 2011

CRISIS SUPPORT SERVICES INC

A.B.N 33 185 295 654

financial report

statement of comprehensive income

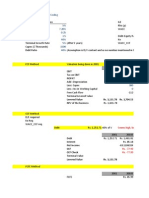

2011 $ Income Operating grants Donations Interest income Trusts, foundations & training Other income Total Income 8,478,556 11,997 203,051 58,216 34,034 8,785,854

2010 $

FOR THE YEAR ENDED 30 JUNE 2011

7,056,858 34,874 124,780 294,048 54,410 7,564,970

Expenditure Depreciation Telephone Workcover Rent and outgoings Superannuation Employee benefits expense Consultant and professional fees Equipment rental Travel expenses Other expenses Total Expenditure 78,520 236,807 83,579 217,460 521,538 6,147,470 288,725 80,276 54,336 770,443 8,479,154 126,233 206,829 77,518 207,564 442,630 5,217,054 513,486 74,831 63,220 686,736 7,616,101

Surplus/(Deficit) before income tax Income tax expense Surplus/(Deficit) for the year

306,700 306,700

(51,131) (51,131)

Other Comprehensive Income Total Other Comprehensive Income Total Comprehensive Income/(Deficit)

306,700

(51,131)

The accompanying notes form part of these financial statements

statement of financial position

AS AT 30 JUNE 2011

Note Current Assets Cash and cash equivalents Trade and other receivables Total Current Assets 2 3

2011 $

2010 $

3,303,451 693,507 3,996,958

3,129,858 518,433 3,648,291

Non Current Assets Plant and equipment Total Non Current Assets 4 84,813 84,813 148,167 148,167

Total Assets

4,081,771

3,796,458

Current Liabilities Trade and other payables Grants received in advance Total Current Liabilities 6 8 1,060,988 729,232 1,790,220 829,637 986,893 1,816,530

Non Current Liabilities Long term provisions Total Non Current Liabilities 7 58,783 58,783 53,860 53,860

Total Liabilities

1,849,003

1,870,390

Net Assets

2,232,768

1,926,068

Equity Accumulated funds Reserves Retained profits Total Equity 9 248,371 1,984,397 2,232,768 248,371 1,677,697 1,926,068

The accompanying notes form part of these financial statements

CRISIS SUPPORT SERVICES INC

A.B.N 33 185 295 654

financial report

FOR THE YEAR ENDED 30 JUNE 2011

statement of cash flows

Note Cash flows from operating activities: Receipts from operating activities Payments to suppliers and employees Interest received Net cash flows from operating activities 12

2011 $

2010 $

8,230,701 (8,213,959) 173,804 190,546

7,970,741 (7,498,135) 108,979 581,585

Cash flows from investing activities: Payments for plant and equipment Net cash flows from investing activities (16,953) (16,953) (50,854) (50,854)

Net (decrease)/increase in cash held Cash at the beginning of the year Cash at the end of the year 2

173,593 3,129,858 3,303,451

530,731 2,599,127 3,129,858

The accompanying notes form part of these financial statements

statement of changes in equity

Retained Profits $ Balance at 01 July 2009 Deficit for the year Other comprehensive income Total comprehensive income Transfer to General Reserve Balance at 30 June 2010 1,728,828 (51,131) (51,131) 1,677,697

General Reserve $ 248,371 248,371

Total $ 1,977,199 (51,131) (51,131) 1,926,068

FOR THE YEAR ENDED 30 JUNE 2011

Surplus for the year Other comprehensive income Total comprehensive income Transfer to General Reserve Balance at 30 June 2011

306,700 306,700 1,984,397

248,371

306,700 306,700 2,232,768

The accompanying notes form part of these financial statements

notes to the financial statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

1.1 Basis of accounting This financial report are special purpose financial statements prepared in accordance with the financial reporting requirements of the Associations Incorporation Act (Victoria) 1981. The Board of Directors has determined that the Association is not a reporting entity. The financial report has been prepared in accordance with the Associations Incorporation Act (Victoria) 1981 and the following Australian Accounting Standards: - AASB 101: Presentation of Financial Statements - AASB 107: Statement of Cash Flows - AASB 108: Accounting Policies, Changes in Accounting Estimates and Errors - AASB 110: Events after the Reporting Period - AASB 116: Property Plant & Equipment - AASB 117: Leases - AASB 119: Employee Benefits - AASB 1031: Materiality No other applicable Accounting Standards, Australian Accounting Interpretations or other authoritative pronouncements of the Australian Accounting Standards Board have been applied. This financial report has been prepared on an accruals basis. It is based on historic costs and does not take into account changing money values or, except where specifically stated, current valuations of non-current assets.

FOR THE YEAR ENDED 30 JUNE 2011

CRISIS SUPPORT SERVICES INC

A.B.N 33 185 295 654

financial report

notes to the financial statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

The following material accounting policies, which are consistent with the previous period unless otherwise stated, have been adopted in the preparation of this financial report:

FOR THE YEAR ENDED 30 JUNE 2011

1.2 Income tax exemption The Association is exempt from income tax under section 50-B of the Income Tax Assessment Act.

1.3 Plant and Equipment Each class of plant and equipment is carried at cost less accumulated depreciation and impairment losses. Plant and Equipment Plant and equipment are measured on the cost basis less depreciation and impairment losses. The carrying amount of plant and equipment is reviewed annually by directors to ensure it is not in excess of the recoverable amount from these assets. The recoverable amount is assessed on the basis of the expected net cash flows that will be received from the assets employment and subsequent disposal. The expected net cash flows have been discounted to their present values in determining recoverable amounts. Plant and equipment that have been contributed at no cost or for nominal cost are valued at the fair value of the asset at the date it is acquired. Depreciation The depreciable amount of all plant and equipment including building and capitalised lease assets, but excluding freehold land, is depreciated on a straight-line basis over their useful lives to the Association commencing from the time the asset is held ready for use. Leasehold improvements are depreciated over the shorter of either the unexpired period of the lease or the estimated useful lives of the improvements. The depreciation rates used for each class of depreciable assets are: Class of Fixed Asset Plant and equipment Depreciation Rate 20-33%

The assets residual values and useful lives are reviewed, and adjusted if appropriate, at each reporting date. Asset classes carrying amount is written down immediately to its recoverable amount if the assets carrying amount is greater than its estimated recoverable amount. Gains and losses on disposals are determined by comparing proceeds with the carrying amount. These gains or losses are included in the statement of comprehensive income. When revalued assets are sold, amounts included in the revaluation reserve relating to that asset are transferred to retained profits.

1.4 Cash and Cash Equivalents Cash and cash equivalents include cash on hand, deposits held at-call with banks, other short-term highly liquid investments with original maturities of eight months or less, and bank overdrafts.

1.5 Leases Leases of property, plant and equipment where substantially all the risks and benefits incidental to the ownership of the asset but not the legal ownership are transferred to the Association are classified as finance leases. Finance leases are capitalised by recording an asset and a liability at the lower of the amounts equal to the fair value of the leased asset or the present value of the minimum lease payments, including any guaranteed residual values. Lease payments are allocated between the reduction of the lease liability and the lease interest expense for the period. Leased assets are depreciated on a straight-line basis over the shorter of their estimated useful lives or the lease term. Lease payments for operating leases, where substantially all the risks and benefits remain with the lessor, are charged as expenses in the periods in which they are incurred. Lease incentives under operating leases are recognised as a liability and amortised on a straight-line basis over the life of the lease term.

1.6 Computer software and information technology support Expenditure incurred on acquiring computer software and the utilization of information technology support is expensed in the financial year.

1.7

Provision for Employee Benefits

Provision is made for the entitys liability for employee benefits arising from services rendered by employees to reporting date. Employee benefits expected to be settled within one year together with benefits arising from wages, salaries and annual leave which may be settled after one year, have been measured at the amounts expected to be paid when the liability is settled plus related on costs. Other employee benefits payable later than one year have been measured at the net present value. Contributions are made by the entity to an employee superannuation fund and are charged as expenses when incurred.

1.8

Grant Revenue Recognition

Grant revenue is recognised in the statement of comprehensive income when it is controlled. When there are conditions attached to grant revenue relating to the use of those grants for specific purposes it is recognised in the statement of financial position as a liability until such conditions are met or services provided. Donations and bequests are recognised as revenue when received unless they are designated for a specific purpose, where they are carried forward as liabilities on the statement of financial position.

CRISIS SUPPORT SERVICES INC

A.B.N 33 185 295 654

financial report

notes to the financial statements

NOTE 1: SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES (Continued)

Interest revenue and distribution income from investments is recognised on a proportional basis taking into account the interest rates applicable to the financial assets. Revenue from the rendering of a service is recognised upon the delivery of the service to the customers. All revenue is stated net of the amount of goods and services tax (GST).

FOR THE YEAR ENDED 30 JUNE 2011

1.9

Unexpended Grants

The entity receives grant monies to fund projects either for contracted periods of time or for specific projects irrespective of the period of time required to complete those projects. It is the policy of the Association to treat grants monies as unexpended grants in the statement of financial position where the Association is contractually obliged to provide the services in a subsequent financial period to when the grant is received or in the case of specific project grants where the project has not been completed.

1.10 Comparative Figures Where required by Accounting Standards comparative figures have been adjusted to conform to changes in presentation for the current year.

1.11 Economic Dependence Crisis Support Services Inc is dependent on the Department of Families, Housing, Community Services and Indigenous Affairs for the majority of its revenue used to operate the business. At the date of this report the Board of Directors has no reason to believe the Department will not continue its current relationship with Crisis Support Services Inc.

2011 $

2010 $

NOTE 2: CASH AND CASH EQUIVALENTS

Cash in hand and at bank Term deposit 803,451 2,500,000 3,303,451 1,129,858 2,000,000 3,129,858

NOTE 3: TRADE AND OTHER RECEIVABLES

Trade debtors Accrued income Prepayments and deposits 344,838 232,536 116,133 693,507 305,465 148,220 64,748 518,433

NOTE 4: PLANT AND EQUIPMENT

Computer equipment at cost Less accumulated depreciation 255,276 (228,592) 26,684 301,485 (258,787) 42,698

Office equipment at cost Less accumulated depreciation

353,142 (295,013) 58,129

366,769 (261,300) 105,469 148,167

Total Plant and Equipment

84,813

Plant and equipment movement: Computer Equipment $ Balance at the beginning of the year Additions Disposals/Written off Depreciation Carrying amount at the end of the year 42,698 9,120 (10) (25,124) 26,684 Office Equipment $ 105,469 7,833 (1,777) (53,396) 58,129 Total $ 148,167 16,953 (1,787) (78,520) 84,813

CRISIS SUPPORT SERVICES INC

A.B.N 33 185 295 654

financial report

notes to the financial statements

2011 $

2010 $

FOR THE YEAR ENDED 30 JUNE 2011

NOTE 5: AUDITORS REMUNERATION

Remuneration of the auditor of the parent entity for: Auditing Services 12,255 12,255 15,430 15,430

NOTE 6: TRADE AND OTHER PAYABLES

CURRENT Trade creditors GST payable Sundry including accruals Short term provisions Total 298,470 45,556 169,279 547,683 1,060,988 199,790 27,694 158,736 443,417 829,637

NOTE 7: PROVISIONS

NON CURRENT Long service leave 58,783 58,783 53,860 53,860

NOTE 8: GRANTS RECEIVED IN ADVANCE

CURRENT Unexpended grants 729,232 986,893

NOTE 9: RESERVES

General Reserve The general reserve records funds set aside for employee redundancies which may arise in the future. 248,371 248,371

2011 $

2010 $

NOTE 10: LEASING COMMITMENTS

Payable: - not later than 1 year - later than 1 year but not later than 5 years - later than 5 years 279,900 288,138 568,038 208,657 285,494 494,151

The first property lease is a non-cancelable lease with a 4-year term, with rent payable monthly in advance. Contingent rental provisions within the lease agreement require that the minimum lease payments shall be increased by 3% per annum. The 4-year term ended during 2009 and the first option was exercised to renew the lease for a 4-year term. An additional 1 term of 4 years exists. The second property lease is for a 3-year term with rent payable monthly in advance. Contingent rental provisions within the lease agreement require that the minimum lease payments shall increase annually by the CPI all groups rate at the end of years 1, 2, 4, 5, 7, 8 and be subject to a market rental review at the end of the 3rd and 6th year of the lease. The 3-year term ended during 2010 and the first option was exercised to renew the lease for a 3-year term. An additional 1 term of 3 years exists.

NOTE 11: OTHER COMMITMENTS

Payable: - not later than 1 year - later than 1 year but not later than 5 years - later than 5 years 228,240 362,600 590,840 -

The first is a Master Service Agreement for the provision of IT maintenance support services with 24/7 coverage for a 3 year term. Provision within the agreement requires that the minimum service payments shall increase annually by the CPI in Melbourne or Australia, whichever is lesser. An option exists to renew the agreement at the end of the 3-year term for an additional 1 term of 2 years. The second is a Value Added Network Services Agreement for the provision of network infrastructure services for a 2 year term.

CRISIS SUPPORT SERVICES INC

A.B.N 33 185 295 654

financial report

notes to the financial statements

2011 $

2010 $

FOR THE YEAR ENDED 30 JUNE 2011

NOTE 12: RECONCILIATION OF NET CASH FLOWS

Surplus/(Deficit) after income tax Cash flows excluded from profit attributable to operating activities Non-cash flows in profit Depreciation Plant & equipment written off 78,520 1,787 126,233 306,700 (51,131)

Changes in assets and liabilities, net of the effects of purchase and disposal of subsidiaries Increase in trade and other payables Increase/(Decrease) in provisions (Increase)/Decrease in trade and other receivables (Decrease)/Increase in unexpended operating grants 127,085 109,189 (175,074) 61,034 (22,793) 205,376

(257,661) 190,546

262,866 581,585

NOTE 13: NEW AND REVISED STANDARDS

Adoption of New and Revised Accounting Standards During the current year, the company has adopted all of the new and revised Australian Accounting Standards and Interpretations applicable to its operations which became mandatory. The adoption of these Standards has not had a significant impact on the financial statements of the Association. New Accounting Standards for Application in Future Periods The AASB has issued new and amended Accounting Standards and Interpretations that have mandatory application dates for future reporting periods and which the Association has decided not to early adopt. A discussion of those future requirements and their impact on the Association is as follows: AASB 200912: Amendments to Australian Accounting Standards [AASBs 5, 8, 108, 110, 112, 119, 133, 137, 139, 1023 & 1031 and Interpretations 2, 4, 16, 1039 & 1052] (applicable for annual reporting periods commencing on or after 1 January 2011).

This Standard makes a number of editorial amendments to a range of Australian Accounting Standards and Interpretations, including amendments to reflect changes made to the text of IFRSs by the IASB. The Standard also amends AASB 8 to require entities to exercise judgment in assessing whether a government and entities known to be under the control of that government are considered a single customer for the purposes of certain operating segment disclosures. The amendments are not expected to impact the Association. AASB 20104: Further Amendments to Australian Accounting Standards arising from the Annual Improvements Project [AASB 1, AASB 7, AASB 101 & AASB 134 and Interpretation 13] (applicable for annual reporting periods commencing on or after 1 January 2011). This Standard details numerous non-urgent but necessary changes to Accounting Standards arising from the IASBs annual improvements project. Key changes include: clarifying the application of AASB 108 prior to an entitys first AustralianAccounting-Standards financial statements; adding an explicit statement to AASB 7 that qualitative disclosures should be made in the context of the quantitative disclosures to better enable users to evaluate an entitys exposure to risks arising from financial instruments; amending AASB 101 to the effect that disaggregation of changes in each component of equity arising from transactions recognised in other comprehensive income is required to be presented, but is permitted to be presented in the statement of changes in equity or in the notes; adding a number of examples to the list of events or transactions that require disclosure under AASB 134; and making sundry editorial amendments to various Standards and Interpretations. This Standard is not expected to impact the Association. AASB 20105: Amendments to Australian Accounting Standards [AASB 1, 3, 4, 5, 101, 107, 112, 118, 119, 121, 132, 133, 134, 137, 139, 140, 1023 & 1038 and Interpretations 112, 115, 127, 132 & 1042] (applicable for annual reporting periods beginning on or after 1 January 2011). This Standard makes numerous editorial amendments to a range of Australian Accounting Standards and Interpretations, including amendments to reflect changes made to the text of IFRSs by the IASB. However, these editorial amendments have no major impact on the requirements of the respective amended pronouncements. AASB 20107: Amendments to Australian Accounting Standards arising from AASB 9 (December 2010) [AASB 1, 3, 4, 5, 7, 101, 102, 108, 112, 118, 120, 121, 127, 128, 131, 132, 136, 137, 139, 1023 & 1038 and Interpretations 2, 5, 10, 12, 19 & 127] (applies to periods beginning on or after 1 January 2013). This Standard makes amendments to a range of Australian Accounting Standards and Interpretations as a consequence of the issuance of AASB 9: Financial Instruments in December 2010. Accordingly, these amendments will only apply if the entity adopts AASB 9. The Association has not yet determined any potential impact on the financial statements from adopting AASB 9.

CRISIS SUPPORT SERVICES INC

A.B.N 33 185 295 654

financial report

notes to the financial statements

NOTE 14: RELATED PARTY TRANSACTIONS

The financial transactions between Board of Directors, members and the Association were of a minor nature and related to reimbursement of expenditure necessarily incurred on behalf of the Association.

FOR THE YEAR ENDED 30 JUNE 2011

NOTE 15: EVENTS AFTER THE REPORTING PERIOD

No matters or circumstances have arisen since the end of the financial year which significantly affected or may significantly affect the operations of the Association, the results of those operations, or the state of affairs of the Association in future financial years.

NOTE 16: REGISTERED AND PRINCIPAL PLACE OF BUSINESS

The registered and principal place of business is at: 88 Maribyrnong Street Footscray VICTORIA

statement by the boarD of Directors

The Board has determined that the Association is not a reporting entity and that these special purpose financial statements should be prepared in accordance with the Associations Incorporation Act (Victoria) 1981 and the accounting policies outlined in Note 1 to the financial statements.

In the opinion of the Board the financial report as set out on pages 4 to16: 1. Presents a true and fair view of the financial position of Crisis Support Services Inc. as at 30 June 2011 and its performance and cash flows for the year ended on that date in accordance with Note 1 to the financial statements. 2. At the date of this statement, there are reasonable grounds to believe that Crisis Support Services Inc. will be able to pay its debts as and when they fall due.

This statement is made in accordance with a resolution of the Board of Directors and is signed for and on behalf of the Board by:

Nicholas Voudouris CHAIR

Lynette OLoughlin CHAIR OF FINANCE COMMITTEE

Dated this 26th day of September 2011

CRISIS SUPPORT SERVICES INC

A.B.N 33 185 295 654

financial report

CRISIS SUPPORT SERVICES INC

A.B.N 33 185 295 654

crisis support services

PO Box 2335 Footscray Vic 3011 03 8371 2800 enquiries@crisissupport.org.au www.crisissupport.org.au ABN: 33 185 295 654 ASN: A0021399X

You might also like

- Intermediate Accounting 1: a QuickStudy Digital Reference GuideFrom EverandIntermediate Accounting 1: a QuickStudy Digital Reference GuideNo ratings yet

- FS ModelDocument13 pagesFS Modelalfx216No ratings yet

- Consolidated Accounts December 31 2011 For Web (Revised) PDFDocument93 pagesConsolidated Accounts December 31 2011 For Web (Revised) PDFElegant EmeraldNo ratings yet

- Shell Pakistan Limited Condensed Interim Financial Information (Unaudited) For The Half Year Ended June 30, 2011Document19 pagesShell Pakistan Limited Condensed Interim Financial Information (Unaudited) For The Half Year Ended June 30, 2011roker_m3No ratings yet

- Interim Condensed Consolidated Financial Statements: OJSC "Magnit"Document41 pagesInterim Condensed Consolidated Financial Statements: OJSC "Magnit"takatukkaNo ratings yet

- LGE 2010 4Q ConsolidationDocument89 pagesLGE 2010 4Q ConsolidationSaba MasoodNo ratings yet

- Ar 11 pt03Document112 pagesAr 11 pt03Muneeb ShahidNo ratings yet

- Manac-1: Group Assignment BM 2013-15 Section ADocument12 pagesManac-1: Group Assignment BM 2013-15 Section AKaran ChhabraNo ratings yet

- 18 Financial StatementsDocument35 pages18 Financial Statementswsahmed28No ratings yet

- SEC Form 10-Q FilingDocument39 pagesSEC Form 10-Q FilingalexandercuongNo ratings yet

- Cognizant+Technologies+9!30!11+Form+10 Q+ +as+filedDocument55 pagesCognizant+Technologies+9!30!11+Form+10 Q+ +as+filedKalpesh PatilNo ratings yet

- Ual Jun2011Document10 pagesUal Jun2011asankajNo ratings yet

- HCL Annual Report Analysis: Revenue Growth, Profit IncreaseDocument16 pagesHCL Annual Report Analysis: Revenue Growth, Profit IncreasemehakNo ratings yet

- Britannia Industries Q2 FY2012 Financial ResultsDocument2 pagesBritannia Industries Q2 FY2012 Financial Resultspvenkatesh19779434No ratings yet

- The Siam Cement Public and Its Subsidiaries: Company LimitedDocument73 pagesThe Siam Cement Public and Its Subsidiaries: Company LimitedMufidah 'mupmup'No ratings yet

- 2011 Consolidated All SamsungDocument43 pages2011 Consolidated All SamsungGurpreet Singh SainiNo ratings yet

- Consolidated2010 FinalDocument79 pagesConsolidated2010 FinalHammna AshrafNo ratings yet

- Unaudited Financial Statements for Year Ended 31 Dec 2011Document18 pagesUnaudited Financial Statements for Year Ended 31 Dec 2011Jennifer JohnsonNo ratings yet

- Pak Elektron Limited: Condensed Interim FinancialDocument15 pagesPak Elektron Limited: Condensed Interim FinancialImran RjnNo ratings yet

- Infosys Balance SheetDocument28 pagesInfosys Balance SheetMM_AKSINo ratings yet

- NIF 2011 Financial StatermentsDocument33 pagesNIF 2011 Financial StatermentsWeAreNIFNo ratings yet

- Cielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)Document72 pagesCielo S.A. and Subsidiaries: (Convenience Translation Into English From The Original Previously Issued in Portuguese)b21t3chNo ratings yet

- Jollibee Foods Corporation 2011 Audited Financial StatementsDocument82 pagesJollibee Foods Corporation 2011 Audited Financial StatementsRegla MarieNo ratings yet

- Auditors Report Financial StatementsDocument57 pagesAuditors Report Financial StatementsSaif Muhammad FahadNo ratings yet

- IRRI AR 2011 - Audited Financial StatementsDocument45 pagesIRRI AR 2011 - Audited Financial StatementsIRRI_resourcesNo ratings yet

- Infosys LimitedDocument3 pagesInfosys Limitedjyoti_jazzzNo ratings yet

- Report Arutmin Indonesia September 2011Document56 pagesReport Arutmin Indonesia September 2011Fredy Milson SimbolonNo ratings yet

- B26 (Official Form 26) (12/08) : RLF1 6305283v. 1Document15 pagesB26 (Official Form 26) (12/08) : RLF1 6305283v. 1Chapter 11 DocketsNo ratings yet

- Elpl 2009 10Document43 pagesElpl 2009 10kareem_nNo ratings yet

- Microsoft Corporation Annual Report 2011Document9 pagesMicrosoft Corporation Annual Report 2011rajesh_dawat1991No ratings yet

- Balance Sheet: As at June 30,2011Document108 pagesBalance Sheet: As at June 30,2011Asfandyar NazirNo ratings yet

- CoA Debit Credit TeoryDocument9 pagesCoA Debit Credit TeorymipapirolivecomNo ratings yet

- 1st QTR 30 Sep 11Document18 pages1st QTR 30 Sep 11m__saleemNo ratings yet

- Honeywell International Inc.: Consolidated Balance SheetDocument3 pagesHoneywell International Inc.: Consolidated Balance SheetAlanbertro OmarNo ratings yet

- TreeHouse Foods 10-Q Report for Q2 2010 Provides Details on Financial ResultsDocument45 pagesTreeHouse Foods 10-Q Report for Q2 2010 Provides Details on Financial ResultsSwisskelly1No ratings yet

- Negros Navigation Co., Inc. and SubsidiariesDocument48 pagesNegros Navigation Co., Inc. and SubsidiarieskgaviolaNo ratings yet

- Myer AR10 Financial ReportDocument50 pagesMyer AR10 Financial ReportMitchell HughesNo ratings yet

- Apple Inc.: Form 10-QDocument55 pagesApple Inc.: Form 10-QdsafoijoafjoasdNo ratings yet

- Glosario de FinanzasDocument9 pagesGlosario de FinanzasRaúl VargasNo ratings yet

- Balance Sheet As at 31 March, 2011: ST STDocument14 pagesBalance Sheet As at 31 March, 2011: ST STLambourghiniNo ratings yet

- TA ALERT 2010-44 - Non-controlling interests and OCIDocument8 pagesTA ALERT 2010-44 - Non-controlling interests and OCIsalehin1969No ratings yet

- HKSE Announcement of 2011 ResultsDocument29 pagesHKSE Announcement of 2011 ResultsHenry KwongNo ratings yet

- Daimler 2011 Annual Fin Statements of Legal Entity AGDocument42 pagesDaimler 2011 Annual Fin Statements of Legal Entity AGHeba HusseinNo ratings yet

- 2 PDocument238 pages2 Pbillyryan1100% (3)

- Hannans Half Year Financial Report 2012Document19 pagesHannans Half Year Financial Report 2012Hannans Reward LtdNo ratings yet

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasNo ratings yet

- ITR3Q11Document67 pagesITR3Q11Klabin_RINo ratings yet

- Metro Holdings Limited: N.M. - Not MeaningfulDocument17 pagesMetro Holdings Limited: N.M. - Not MeaningfulEric OngNo ratings yet

- Hyundai Motor Company Financial Statements and Auditors' Report 2011-2010Document65 pagesHyundai Motor Company Financial Statements and Auditors' Report 2011-2010ৰিতুপর্ণ HazarikaNo ratings yet

- Finance For Non FinanceDocument56 pagesFinance For Non Financeamitiiit31100% (3)

- Consolidated First Page To 11.2 Property and EquipmentDocument18 pagesConsolidated First Page To 11.2 Property and EquipmentAsif_Ali_1564No ratings yet

- Consolidated Financial Statements: Auditor's ReportDocument29 pagesConsolidated Financial Statements: Auditor's ReportPankaj DuggalNo ratings yet

- Company Accounting 9th Edition Solutions PDFDocument37 pagesCompany Accounting 9th Edition Solutions PDFatup12367% (9)

- Exam Financial Statement AnalysisDocument18 pagesExam Financial Statement AnalysisBuketNo ratings yet

- Aat P7 Hkas 1Document13 pagesAat P7 Hkas 1Edvan HervianNo ratings yet

- KHIND Annual Report MalaysiaDocument77 pagesKHIND Annual Report MalaysiakokueiNo ratings yet

- Annual Report OfRPG Life ScienceDocument8 pagesAnnual Report OfRPG Life ScienceRajesh KumarNo ratings yet

- On The Line 2012-13 Annual ReportDocument36 pagesOn The Line 2012-13 Annual ReportLIFECommsNo ratings yet

- CSS Annual Report 2012Document13 pagesCSS Annual Report 2012LIFECommsNo ratings yet

- Between The Lines: October 2012Document8 pagesBetween The Lines: October 2012LIFECommsNo ratings yet

- Sept Newsletter WebDocument8 pagesSept Newsletter WebLIFECommsNo ratings yet

- ROMANIAN Chart of AccountsDocument9 pagesROMANIAN Chart of AccountsMarina VoiculescuNo ratings yet

- MATH P1 GR11 NOV2013 QP (Eng)Document9 pagesMATH P1 GR11 NOV2013 QP (Eng)Kgalema KgomoNo ratings yet

- Accounting TestDocument4 pagesAccounting Testdinda ardiyaniNo ratings yet

- Chapter 12 - Cash Flow Estimation 1Document41 pagesChapter 12 - Cash Flow Estimation 1Phán Tiêu TiềnNo ratings yet

- Three Statement Financial ModelingDocument13 pagesThree Statement Financial ModelingJack Jacinto100% (1)

- Parcor Baysa Chapter 3 Parcor Baysa Chapter 3Document17 pagesParcor Baysa Chapter 3 Parcor Baysa Chapter 3FranciscoViloriaFrankNo ratings yet

- 7110 s05 QP 1Document12 pages7110 s05 QP 1kaviraj1006No ratings yet

- CISIDocument25 pagesCISISwapnaja DeshmukhNo ratings yet

- Analyze Financial Trends Over TimeDocument3 pagesAnalyze Financial Trends Over Timegr82b_b2bNo ratings yet

- Shoe Guru Business PlanDocument23 pagesShoe Guru Business Planapi-491240823100% (2)

- IGNOU MBA Project ManagemntDocument27 pagesIGNOU MBA Project ManagemntAmit SharmaNo ratings yet

- Intermediate Accounting ch02 PDFDocument4 pagesIntermediate Accounting ch02 PDFRonald KahoraNo ratings yet

- Paper 14Document129 pagesPaper 14dinesh kumarNo ratings yet

- Final Ready SampleDocument15 pagesFinal Ready SampleachsamirksNo ratings yet

- Philippine real estate appraisal seminar conceptsDocument9 pagesPhilippine real estate appraisal seminar conceptsDiwaNo ratings yet

- Capital BudgetingDocument35 pagesCapital Budgetingmurarimishra1750% (2)

- Cost Accounting and Financial Management: All Questions Are CompulsoryDocument4 pagesCost Accounting and Financial Management: All Questions Are CompulsorySudist JhaNo ratings yet

- Manufacture of Shirt (Top) and Skirts: Ntroduction Arket OtentialDocument5 pagesManufacture of Shirt (Top) and Skirts: Ntroduction Arket OtentialAnurag PalNo ratings yet

- Costing Analysis Boosts Denim Company ProfitsDocument3 pagesCosting Analysis Boosts Denim Company ProfitsKrutarthChaudhariNo ratings yet

- GCE A/L 2018 Accounting I & II (English) - Past PaperDocument20 pagesGCE A/L 2018 Accounting I & II (English) - Past PaperShihan HaniffNo ratings yet

- Cabria CPA Review Center's Property Plant and Equipment LectureDocument9 pagesCabria CPA Review Center's Property Plant and Equipment LectureMaeNo ratings yet

- Sample ProblemDocument2 pagesSample ProblemRalph ParduchoNo ratings yet

- CA Inter p1 Accounts All Question Papers Answers @CA InterDocument297 pagesCA Inter p1 Accounts All Question Papers Answers @CA InterNagendra TNNo ratings yet

- Adjust allowance for doubtful accounts, calculate income tax expense, and determine accounts receivable days sales outstandingDocument11 pagesAdjust allowance for doubtful accounts, calculate income tax expense, and determine accounts receivable days sales outstandingrahul ambatiNo ratings yet

- Bai Tap 7Document6 pagesBai Tap 7Bích DiệuNo ratings yet

- Ee Assignment Lu 6Document6 pagesEe Assignment Lu 6NethiyaaRajendranNo ratings yet

- Cash Flow Statement 2016-2020Document8 pagesCash Flow Statement 2016-2020yip manNo ratings yet

- Os Report-Anand Water MterDocument44 pagesOs Report-Anand Water MterJason Brown83% (6)

- 25th June - Sampa VideoDocument6 pages25th June - Sampa VideoAmol MahajanNo ratings yet

- Buku Fasilitas Dan Insentif Pajak-Subdit PPH Badan#ENGLISH HIJAU PDFDocument100 pagesBuku Fasilitas Dan Insentif Pajak-Subdit PPH Badan#ENGLISH HIJAU PDFHenryNo ratings yet