Professional Documents

Culture Documents

Int Financial Inst s Increasing Acceptance of Isfi 1687212282

Int Financial Inst s Increasing Acceptance of Isfi 1687212282

Uploaded by

25121962Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Int Financial Inst s Increasing Acceptance of Isfi 1687212282

Int Financial Inst s Increasing Acceptance of Isfi 1687212282

Uploaded by

25121962Copyright:

Available Formats

ISFIRE

REVIEW

INTERNATIONAL

FINANCIAL INSTITUTIONS

INCREASING ACCEPTANCE

FOR ISLAMIC FINANCE

Ahmed Ali Siddiqui

Group Head, Shariah Compliance, Meezan Bank

Samia Tahir Jawad

Research Associate, IBA Centre for Excellence in Islamic Finance

34 | ISFIRE, APRIL 2023 | ISFIRE REVIEW | W W W. I S F I R E . N E T

ISFIRE

REVIEW

During the last 40 years, Islamic finance has emerged as an billion worth of assets under management in 2021. The takaful

effective alternative for conventional financing around the industry grew by US$73 Billion during 2021 with a growth of

world. The sector is growing rapidly into areas like trade, real 17% during the year.

estate, manufacturing, banking and infrastructure. Muslim as

well as non-Muslim countries are adopting Islamic Finance World Bank is directly involved with Islamic finance since early

and its products for financing and catering the needs of those 2005 and is continuously supporting the sector. The World

customers who want Shari’a compliant and ethical financial Bank had established its Global Islamic Finance Development

products. Islamic financial products are directly linked with real Center by 2013 in partnership with government of Turkey to

assets and real economy, and mostly involve trade, rental or serve as a knowledge hub for development of Islamic finance

profit and loss sharing contracts while interest in any form is globally. The main role is to conduct research and training and

prohibited. to provide technical assistance and advisory services to the

World Bank Group client countries interested in developing

The emergence of Islamic finance across global markets has Islamic financial institutions and markets.

gained attention of several international financial institutions

like World Bank, International Monetary Fund (IMF) and Asian Every year, the World Bank and AAOIFI (Accounting and

Development Bank (ADB) and they now acknowledge Islamic Auditing Organisation of Islamic Finance Institute), Bahrain

finance for its sustainable and ethically responsible nature. jointly organise an international conference in Bahrain in which

These organisations have realised that Islamic finance has representatives from World Banks’ Islamic Finance department

potential to help in issues like poverty elimination and boosting participate and present their views and efforts on Islamic

prosperity in developing countries. finance. In 13th annual conference, Mr Ahmed Rostom, Senior

Financial Sector Specialist, World Bank presented the efforts

made in Islamic finance by World Bank and assure that World

THE GLOBAL ISLAMIC Bank will increase its participation in Islamic finance and help

those countries who want Shari’a compliant solutions for their

FINANCE INDUSTRY SHOWED financial needs.

RESILIENCE DURING The World Bank has also signed Memorandum of Understanding

(MoU) with The General Council for Islamic Banks and Financial

PANDEMIC. ACCORDING TO Institutions (CIBAFI), in July 2015. This MoU served as

foundation for cooperation between the World Bank and Islamic

INTER-COOPERATE DEPOSIT Financial institutions in the areas of knowledge generation and

dissemination; sharing of experience; encouraging research

ICD REFINITIVE ISLAMIC and promoting awareness; and enhancing capacity in the

FINANCE DEVELOPMENT Islamic financial services industry. Since then, World Bank is

also using Shari’a compliant products to help eliminate poverty

REPORT 2022, THE TOTAL and fostering shared prosperity. The World Bank Group has

financed and supported several projects through Islamic

ISLAMIC FINANCE ASSETS financing during last two decades which includes US$250

million, a line of credit to TSKB (Turkiye Sinai Kalkinma Bankas) ,

BOOSTED TO US$4 TRILLION a private Development and Investment bank in Turkey, financing

WITH A 17% ANNUAL for Jordan’s SMEs sector, murabaha financing facility of US$450

million to Natrindo Telepon Selular (NTS) in Indonesia and a

GROWTH RATE. political risk insurance for a project in Djibouti was provided by

Multilateral Investment Guarantee Agency (MIGA) was funded

through an Islamic financing structure.

The global Islamic finance industry showed resilience during The World Bank Group had also entered the Islamic capital

pandemic. According to inter-Cooperate Deposit ICD Refinitive market as an issuer of sukuk with two issues of sukuk in 2005

Islamic finance development report 2022, the total Islamic by the World Bank Treasury and the International Finance

finance assets boosted to US$4 trillion with a 17% annual Cooperation (IFC) respectively in Malaysia. IFC has also

growth rate. The global Islamic banking sector grew by 17% to issued its first US$100 million sukuk in Dubai and Bahrain. In

US$2.8 trillion. Sukuk, the second largest sector by assets, grew 2014, the World Bank serves as treasury manager for IFFIm

by 14% in 2021 to US$713 billion in sukuk outstanding. New (the International Finance Facility for Immunization) to issue

issuance rose by nine percent to a record US$202.1 billion. The US$500 million sukuk. These sukuks proved to be socially

issuance of Environmental, Social, and Governance (ESG) sukuk responsible and ethical alternatives for interest bearing bonds

in 2021 reached a new high of US$5.3 billion. Islamic funds, the and tapped a large number of investor base among Muslim as

third biggest sector, saw standout growth of 34% to US$238 well as non-Muslim countries.

W W W. I S F I R E . N E T | ISFIRE, APRIL 2023 | ISFIRE REVIEW | 35

ISFIRE

REVIEW

International Monetary Fund (IMF) also acknowledged the rapid growing demand for Islamic financing by its member

countries. The former Managing Director Christine Lagarde, addressed in the Islamic Finance Conference, Kuwait City,

Kuwait; November 11, 2015 on potential of Islamic finance, she stated; “We at the IMF are keen to participate, to listen,

to collaborate, innovate, and develop the promise of Islamic finance in a sound and sustainable way, by managing risks

appropriately and ensuring financial stability”.

“WE AT THE IMF ARE KEEN TO PARTICIPATE, TO LISTEN, TO

COLLABORATE, INNOVATE, AND DEVELOP THE PROMISE

OF ISLAMIC FINANCE IN A SOUND AND SUSTAINABLE WAY,

BY MANAGING RISKS APPROPRIATELY AND ENSURING

FINANCIAL STABILITY”. (BY CHRISTINE LAGARDE,

FORMER MANAGING DIRECTOR IMF)

In February 2017, the International Monetary Fund’s (IMF) executive board held its first formal discussion on Islamic

finance and adopted a set of proposals on the role that the IMF should play in this area. IMF played a vital role in the

establishment of Islamic Finance Service Board (IFSB) to provide regulatory guidelines for central banks on Islamic finance.

IMF Executive Board has also endorsed a proposal on the use of the core principles for Islamic Finance Regulation (CPIFR)

in 2018, which were developed by the Islamic Financial Services Board (IFSB) with the participation of the Secretariat

of the Basel Committee on Banking Supervision. An Interdepartmental Working Group was formed by IMF with an

objective of building institutional view on Islamic finance industry and train people to build in house expertise in Islamic

Finance and make policies to better coordinate with the stakeholders in the industry. This working group is focusing on

analytical work in the key areas of Islamic finance including Islamic banking regulations and supervision, macro-prudential

policy, financial inclusion, consumer protection, monetary policy, sukuk markets, public financial management, and tax

policy.

IMF has also established an External Advisory Group, comprised of standard-setters for Islamic finance and leading

international experts, to assist in identifying policy issues and to enhance coordination with different stakeholders

interested in Islamic finance.

IMF is now actively engaged in regulation activities in countries where Islamic finance is now deemed to be systemically

important and is focusing to enhance the consistency in applying Shari’a rules across all Shari’a-compliant products to

ensure smoother growth and financial stability.

Asian Development Bank as a policy supported Islamic Finance to ensure sustainable development and reduce poverty

across its member countries. ADB has 14 member countries having majority Muslim population including five countries

with biggest Muslim population globally. After realising the Asia’s vast investment needs, ADB not only recognised

the potential of Islamic finance to promote sustainable development in the region but also offer funds & financing for

infrastructure and green and ethical investment in the member countries.

ADB also offers support to member countries by assisting through Technical Assistance (TA) for assessment and

development of regulatory and supervisory frameworks. ADB also built a cooperation with standard setting organisation

like Islamic Financial Services board IFSB to assist its member countries about use of best international standards in

Islamic finance. In July 2021, ADB Trade and Supply Chain Finance Program (TSCFP) has signed an agreement with Dubai

Islamic Bank Pakistan Limited (DIBPL) to support trade in Pakistan. Most importantly, ADB is working with developing

countries for financial innovation, financial inclusion and help them to strengthen their Islamic financial sector and

address the challenges related to this particular sector.

36 | ISFIRE, APRIL 2023 | ISFIRE REVIEW | W W W. I S F I R E . N E T

ISFIRE

REVIEW

THE WORLD BANK, IMF AND ADB’S INVOLVEMENT IN

ISLAMIC FINANCE DURING THE LAST 17 YEARS HAS

INCREASED DUE TO ITS UNIQUE PROFIT & RISK SHARING

NATURE AND ETHICAL FEATURES AND THESE INSTITUTIONS

NOW APPRECIATE THE ROLE OF ISLAMIC FINANCE GLOBALLY

FOR SUSTAINABLE GROWTH.

It is evident that IMF, World Bank and ADB has not only

accepted Islamic finance as viable financial system but also

promote it as a tool for shared prosperity. This also presents

an opportunity for Pakistan to explore options with IMF,

World Bank & ADB to provide financing on Shari’a compliant

modes that can help Pakistan in conversion of country’s

external debt Islamic financing modes.

The World bank, IMF and ADB’s involvement in Islamic

finance during the last 17 years has increased due to its

unique profit & risk sharing nature and ethical features and

these institutions now appreciate the role of Islamic finance

globally for sustainable growth. The growing demand for

Shari’a compliant products will boost the share of Islamic

assets globally. The growth of Islamic finance also presents

an opportunity to expand financial markets, strengthen

financial inclusion and creation of new funding sources.

W W W. I S F I R E . N E T | ISFIRE, APRIL 2023 | ISFIRE REVIEW | 37

You might also like

- 20230501-Bank Statement Cap OneDocument4 pages20230501-Bank Statement Cap OneWaka Floka FlameNo ratings yet

- IFDI 2023 Report - Nov 30Document76 pagesIFDI 2023 Report - Nov 30firanouNo ratings yet

- " Sukanya Samriddhi Yojana ": Project ReportDocument62 pages" Sukanya Samriddhi Yojana ": Project ReportSuraj Dubey88% (8)

- Transunion NewDocument8 pagesTransunion NewCaleb HolleyNo ratings yet

- Islamic Financial Services Industry Development Ten-Year Framework and Strategies - A FINAL REVIEW - enDocument130 pagesIslamic Financial Services Industry Development Ten-Year Framework and Strategies - A FINAL REVIEW - enhikmat ameenNo ratings yet

- Iib MagazineDocument58 pagesIib Magazineعزالدين محمد أحمدNo ratings yet

- Dr. Muhammad Ashraf Imran UsmaniDocument16 pagesDr. Muhammad Ashraf Imran UsmaniMohamedNo ratings yet

- Prospects and Challenges in The Development of Islamic Finance For Bangladesh - enDocument114 pagesProspects and Challenges in The Development of Islamic Finance For Bangladesh - enDamilola SodjeteNo ratings yet

- Islamic Finance Development Report 2018: Building MomentumDocument44 pagesIslamic Finance Development Report 2018: Building MomentumVictoria MaciasNo ratings yet

- A Critical Assessment On Product Development & Innovation Within The Islamic Financial Services IndustryDocument15 pagesA Critical Assessment On Product Development & Innovation Within The Islamic Financial Services IndustryOppi TidjaniNo ratings yet

- Dr. Abdulbari MashalDocument12 pagesDr. Abdulbari MashalMohamedNo ratings yet

- Global Islamic Economy ReportDocument8 pagesGlobal Islamic Economy ReportMohsin NoorNo ratings yet

- Financial Stability and Islamic Finance:: Ishrat HusainDocument8 pagesFinancial Stability and Islamic Finance:: Ishrat HusainDrNaWaZ DurRaniNo ratings yet

- Toward Inclusive Islamic Finance GIZDocument54 pagesToward Inclusive Islamic Finance GIZceoNo ratings yet

- Malaysia VBI Full ReportDocument116 pagesMalaysia VBI Full ReportHasoNo ratings yet

- IDB in Brief 1426HDocument25 pagesIDB in Brief 1426HKamel SarsarNo ratings yet

- Advancing EconomiesDocument78 pagesAdvancing EconomiesBurak ÇıkıryelNo ratings yet

- Islamic Banking PPT - 1Document25 pagesIslamic Banking PPT - 1Govinda ChhanganiNo ratings yet

- Supporting GrowthDocument22 pagesSupporting GrowthKajal MahidaNo ratings yet

- Examining The Comparative Efficiency of GCC Islamic Banking (Plain File)Document21 pagesExamining The Comparative Efficiency of GCC Islamic Banking (Plain File)Naumankhan83No ratings yet

- Int. Finance Assignment OkDocument17 pagesInt. Finance Assignment OkMD.MOKTARUL ISLAMNo ratings yet

- Islamic Development BankDocument11 pagesIslamic Development Bankshuja002No ratings yet

- Chapter OneDocument13 pagesChapter OneAli ArnaoutiNo ratings yet

- An Evaluation of Takaful Insurance: Case of Pakistan: January 2017Document27 pagesAn Evaluation of Takaful Insurance: Case of Pakistan: January 2017Komal MubeenNo ratings yet

- Islamic Fintech - Final Draft - FinalDocument32 pagesIslamic Fintech - Final Draft - FinalmizzdylaNo ratings yet

- Investigating The Efficiency of GCC Banking Sector An Empirical Comparison of Islamic and Conventional BanksDocument22 pagesInvestigating The Efficiency of GCC Banking Sector An Empirical Comparison of Islamic and Conventional BanksNaumankhan83No ratings yet

- Contemporary Islamic Finance: An Introductory Analysis: MR - Najeebzada DR - Salim Ur RahmanDocument17 pagesContemporary Islamic Finance: An Introductory Analysis: MR - Najeebzada DR - Salim Ur RahmanInzemam Ul HaqNo ratings yet

- Chapter 1: Introduction: Shariah Principles and Avoid Prohibited Activities Such As Gharar (Excessive Uncertainty)Document76 pagesChapter 1: Introduction: Shariah Principles and Avoid Prohibited Activities Such As Gharar (Excessive Uncertainty)Vki BffNo ratings yet

- IFDI Report 2021Document78 pagesIFDI Report 2021mazarisofianeNo ratings yet

- 19 06 2021 1624077878 6 Impact - Ijrbm 2. Ijrbm Apr 2021 Islamic Finance EdDocument16 pages19 06 2021 1624077878 6 Impact - Ijrbm 2. Ijrbm Apr 2021 Islamic Finance EdImpact JournalsNo ratings yet

- World Development: Syedah Ahmad, Robert Lensink, Annika MuellerDocument26 pagesWorld Development: Syedah Ahmad, Robert Lensink, Annika Muellerkata brhNo ratings yet

- Outreach Brochure For MCPS For IndonesiaDocument6 pagesOutreach Brochure For MCPS For IndonesiaDyan Palupi WidowatiNo ratings yet

- International Trade Under Islamic BankingDocument9 pagesInternational Trade Under Islamic BankingMian AsadNo ratings yet

- A) Sukuk Powerhouse of The WorldDocument5 pagesA) Sukuk Powerhouse of The WorldNeha SahityaNo ratings yet

- Policy Framework Paper On MicrofinanceDocument80 pagesPolicy Framework Paper On MicrofinanceYoucef GrimesNo ratings yet

- Chapter Five: Islamic Banking and TakafulDocument9 pagesChapter Five: Islamic Banking and Takafulali-faycalNo ratings yet

- Principles of Islamic Finance: New Issues and Steps ForwardFrom EverandPrinciples of Islamic Finance: New Issues and Steps ForwardNo ratings yet

- AFN20203 - Topic1Document47 pagesAFN20203 - Topic1soon jasonNo ratings yet

- PGDIFP - Unit 3 Class 2Document93 pagesPGDIFP - Unit 3 Class 2Shadman ShakibNo ratings yet

- Islamic Finance: Opportunity For Long-Term Growth: by Rod Ringrow, State StreetDocument3 pagesIslamic Finance: Opportunity For Long-Term Growth: by Rod Ringrow, State StreetAiham ZidanNo ratings yet

- @wbg2030 Islamic Development Bank April 3, 2018: Mahmoud Mohieldin Senior Vice President World Bank GroupDocument30 pages@wbg2030 Islamic Development Bank April 3, 2018: Mahmoud Mohieldin Senior Vice President World Bank GroupFarah EgalNo ratings yet

- A Critical Shariah and Maqasid Appraisal of Islamic Credit CardsDocument7 pagesA Critical Shariah and Maqasid Appraisal of Islamic Credit CardsI'ffah NasirNo ratings yet

- Islamic Finance in BruneiDocument20 pagesIslamic Finance in BruneiTJPRC PublicationsNo ratings yet

- Concept of Islamic Microfinance-EdDocument28 pagesConcept of Islamic Microfinance-EdAdela Miranti YuniarNo ratings yet

- Islamic Banking in Morocco: The Factors of A Promising FutureDocument9 pagesIslamic Banking in Morocco: The Factors of A Promising FutureAmine IzamNo ratings yet

- The Role and Functions of Development BankingDocument18 pagesThe Role and Functions of Development BankingnehagoswamiNo ratings yet

- Issues Challenges On Islamic FinanceDocument46 pagesIssues Challenges On Islamic FinanceZohaib AhmedNo ratings yet

- SUKUK BOND: The Global Islamic Financial Instrument Salman Ahmed Shaikh & Shan SaeedDocument11 pagesSUKUK BOND: The Global Islamic Financial Instrument Salman Ahmed Shaikh & Shan SaeedASHYA SAFFA BINTI AHMADNo ratings yet

- MAF653-Group Assignment 2Document11 pagesMAF653-Group Assignment 2nurul syakirinNo ratings yet

- Islamic Banking in Morocco: The Factors of A Promising FutureDocument8 pagesIslamic Banking in Morocco: The Factors of A Promising FuturemekdadNo ratings yet

- Annual Report 1426H (2005-2006) : Islamic Development BankDocument34 pagesAnnual Report 1426H (2005-2006) : Islamic Development BankCma Abdul HadiNo ratings yet

- Musyarakah Mutanaqishah, Innovative Product For Islamic Banking Financing in IndonesiaDocument7 pagesMusyarakah Mutanaqishah, Innovative Product For Islamic Banking Financing in IndonesiaInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Islamic FinanceDocument8 pagesIslamic FinancemcyhndhieNo ratings yet

- The Role and Functions of Development BankingDocument3 pagesThe Role and Functions of Development BankingSudhir BansalNo ratings yet

- Introduction To Islamic Capital MarketsDocument5 pagesIntroduction To Islamic Capital MarketsSon Go HanNo ratings yet

- Islamic Banking: Malaysia'S PerspectiveDocument15 pagesIslamic Banking: Malaysia'S PerspectivejawadNo ratings yet

- 2018 Bahrain Country ReportDocument44 pages2018 Bahrain Country Reportinfadmohd2001No ratings yet

- Islamic Banking Versus Commercial Banking:: Prospects & OpportunitiesDocument37 pagesIslamic Banking Versus Commercial Banking:: Prospects & OpportunitiesHanis HazwaniNo ratings yet

- (Gunashree Sivaraja) ReportDocument5 pages(Gunashree Sivaraja) ReportGunashree SivarajaNo ratings yet

- Islamic Finance: Opportunities, Challenges, and Policy OptionsDocument10 pagesIslamic Finance: Opportunities, Challenges, and Policy OptionsInternational Monetary FundNo ratings yet

- Islamic Financial System Principles and Operations PDF 701 800Document100 pagesIslamic Financial System Principles and Operations PDF 701 800Asdelina R100% (1)

- The World Bank: International Bank For Reconstruction and DevelopmentDocument4 pagesThe World Bank: International Bank For Reconstruction and DevelopmentAubrey Faith Palen AgbalogNo ratings yet

- The Legality of Islamic Banking in Nigeria A CritiDocument27 pagesThe Legality of Islamic Banking in Nigeria A Criti25121962No ratings yet

- Kwaja APCJ - Vol5 - 1 - 00i - 064 - WebDocument77 pagesKwaja APCJ - Vol5 - 1 - 00i - 064 - Web25121962No ratings yet

- FGN - Asuu Initialed Agreement Jan. 2009Document51 pagesFGN - Asuu Initialed Agreement Jan. 200925121962No ratings yet

- ICT Minister Speech Social Media ConferenceDocument5 pagesICT Minister Speech Social Media Conference25121962No ratings yet

- Jonathan S 2012 Budget Speech Before The National AssemblyDocument27 pagesJonathan S 2012 Budget Speech Before The National Assembly25121962No ratings yet

- Main Report Vol.1 (1) JOS CrisDocument341 pagesMain Report Vol.1 (1) JOS Cris25121962No ratings yet

- CamelDocument43 pagesCamelsuyashbhatt1980100% (1)

- Brea ch05 BMM 7e SGDocument91 pagesBrea ch05 BMM 7e SGAshish BhallaNo ratings yet

- Promissory NoteDocument3 pagesPromissory NoteHurshVFadia100% (1)

- Secrecy in Bank DepositsDocument59 pagesSecrecy in Bank DepositsJenevieve Muya SobredillaNo ratings yet

- ListDocument6 pagesListJason KashinskiNo ratings yet

- Plastic Money Versus Paper Money by Kumar PalDocument5 pagesPlastic Money Versus Paper Money by Kumar PalKumar Pal Mehta75% (4)

- Term PaperDocument83 pagesTerm PaperIsmail Hossain TusharNo ratings yet

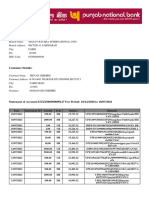

- PNBONE Mpassbook 18-12-2020 18-7-2021 XXXX006900009127Document9 pagesPNBONE Mpassbook 18-12-2020 18-7-2021 XXXX006900009127jeevan GhimireNo ratings yet

- Contactless Smart Card Technology - GRP 4Document17 pagesContactless Smart Card Technology - GRP 4samiyaNo ratings yet

- Loan Pay CalculatorDocument6 pagesLoan Pay CalculatorHRITHIK CHOUKSENo ratings yet

- Structure of Banking CompaniesDocument18 pagesStructure of Banking Companiesbeena antuNo ratings yet

- Lesson 1 - Intro To LiabilitiesDocument21 pagesLesson 1 - Intro To LiabilitiesGrace Joy MarcelinoNo ratings yet

- Chapter 25: Borrowing Costs Borrowing CostDocument3 pagesChapter 25: Borrowing Costs Borrowing CostImma Therese YuNo ratings yet

- ACT Guide LMADocument175 pagesACT Guide LMAMigle BloomNo ratings yet

- Bank Payment Obligation: - Trade Finance Goes DigitalDocument13 pagesBank Payment Obligation: - Trade Finance Goes DigitalCẩm VyNo ratings yet

- Wahid SirDocument6 pagesWahid SirJobayet HossainNo ratings yet

- Mutov122164407 01062023-07082023Document7 pagesMutov122164407 01062023-07082023sreekanthNo ratings yet

- Report On HSBCDocument32 pagesReport On HSBCehsanul1No ratings yet

- 01 CashandCashEquivalentsNotesDocument7 pages01 CashandCashEquivalentsNotesVeroNo ratings yet

- Transparency Documentation enDocument24 pagesTransparency Documentation enAditya SharmaNo ratings yet

- INSTITUTE-University School of Business Department - ManagementDocument30 pagesINSTITUTE-University School of Business Department - ManagementAbhishek kumarNo ratings yet

- Pmu FN 18 H2 CSOTJL0Document15 pagesPmu FN 18 H2 CSOTJL0Vipul BhatiaNo ratings yet

- Cashless Economy in India UPSC NotesDocument14 pagesCashless Economy in India UPSC NotesIshan KaushikNo ratings yet

- Quizzes - Chapter 6 - Business Transactions & Their AnalysisDocument6 pagesQuizzes - Chapter 6 - Business Transactions & Their AnalysisAmie Jane MirandaNo ratings yet

- Thrift Operations: Financial Markets and Institutions, 7e, Jeff MaduraDocument30 pagesThrift Operations: Financial Markets and Institutions, 7e, Jeff MaduraKevin NicoNo ratings yet

- Internship Report On Customer Satisfaction and General Operations of Rupali BankDocument43 pagesInternship Report On Customer Satisfaction and General Operations of Rupali BankjaiontyNo ratings yet

- Askari Bank Personal Loan CBD Excel SheetDocument4 pagesAskari Bank Personal Loan CBD Excel Sheetsumbul imranNo ratings yet