Professional Documents

Culture Documents

Exercise 1

Exercise 1

Uploaded by

Dương HàCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exercise 1

Exercise 1

Uploaded by

Dương HàCopyright:

Available Formats

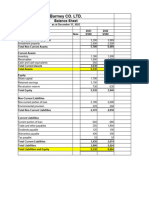

Exercise 1: The accountant of Zabit Co has prepared the following trial balances as at 31

December 20X7

$’000 $’000

50c ordinary shares 400

Share premium 220

10% loan stock (secured) 200

Retained earnings 1.1.X7 242

Revaluation surplus 1.1.X7 171

Land and buildings -cost 530

Plant and machinery – cost 830

Accumulated depreciation

Buildings 1.1.X7 20

Plant and machinery 1.1.X7 222

Inventory 1.1.X7 190

Sales 2,695

Purchases 2,152

Discount receipt 35

Disposal 150

Ordinary dividend 8

Loan interest 10

Wages and Salaries 254

Sundry expenses 113

Accounts receivable 179

Allowance for receivable 7

Accounts payable 195

Current tax (Tax payable) 4

Cash 122

Suspense accounts 135

Additional information as at 31 December 20X7:

1. A customer has gone bankrupt owing $73,000. This debt is not expected to be recovered

and an adjustment should be made. An allowance for receivables of 5% is to be set up.

2. In dealing with suspense account, the company has checked and found the following errors:

- Cash received from the sale of an equipment at 1st Jan 20X7 was correctly entered in the

cash book but was debited to the disposal account $80,000. The disposed equipment has been

correctly removed from the above trial balance.

- A $12,500 paid for machinery repairs was correctly treated in the cash book but was credited

to Plant and machinery asset account.

3. Building which has cost of $200,000 is depreciated at 5% per annum on their original cost.

Plant and machinery are depreciated at 20% per annum using reducing balance method.

Depreciation is charged to cost of sales.

At 31 December 20X7, Land and buildings was revalued downward by $70,000.

4. Sundry expenses include $12,000 paid in respect of insurance for the year ending 30 Sep

20X8.

5. Closing inventory at 31 Dec 20X7 was valued at $150,000

6. The balance of current tax (Tax payable) in the above trial balance represent an over or

under provision brought forward from previous period. Zabit Co estimates their tax liability

for profits earned in 20X7 will be $5,000.

Required:

(a) Journalize all the adjusting entries

(b) Prepare the statement of profit or loss for the year ended 31 Dec 20X7.

(c) Prepare the statement of financial position as at 31 Dec 20X7

You might also like

- The Chart of Accounts For Companies PDFDocument14 pagesThe Chart of Accounts For Companies PDFEmir Ademovic100% (1)

- Journalizing Exercise:: Date Debit (DR) Credit (CR) ParticularsDocument1 pageJournalizing Exercise:: Date Debit (DR) Credit (CR) ParticularsCamille PasionNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document14 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- Project On Project ManagementDocument92 pagesProject On Project ManagementSrinath Navada100% (1)

- 04 - Chapter 4 Cash Flow Financial PlanningDocument68 pages04 - Chapter 4 Cash Flow Financial Planninghunkie71% (7)

- FS QuestionsDocument5 pagesFS QuestionsDuyên BùiNo ratings yet

- Information and Communications University: TH THDocument5 pagesInformation and Communications University: TH THKj NayeeNo ratings yet

- BR - Q8 - Financial-information-for-Company-ADocument1 pageBR - Q8 - Financial-information-for-Company-AchiaraferragniNo ratings yet

- BFA301 Solution For Lecture Example 3-2Document6 pagesBFA301 Solution For Lecture Example 3-2erinNo ratings yet

- Statement of Cash Flow - Thorstved CoDocument5 pagesStatement of Cash Flow - Thorstved Cotun ibrahimNo ratings yet

- 1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 EpsDocument3 pages1.90 IAS 7 CFL Omnium 22 - 23 IAS 33 Epsarmaan ryanNo ratings yet

- AC201 Cash Flow - LLOYDDocument17 pagesAC201 Cash Flow - LLOYDJustice DhliwayoNo ratings yet

- 2023AcF100EXAM1JUNEFINAL AccountingandFSADocument11 pages2023AcF100EXAM1JUNEFINAL AccountingandFSAnikoleta demosthenousNo ratings yet

- 7001 Assignment #3Document9 pages7001 Assignment #3南玖No ratings yet

- Buacc5932 Assign. s1 2011Document4 pagesBuacc5932 Assign. s1 2011Dishank JainNo ratings yet

- Recognition of Current Assets and EquityDocument8 pagesRecognition of Current Assets and EquityMd. N UraminNo ratings yet

- The Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Document5 pagesThe Following Trial Balance Was Extracted From The Books of Craz LTD As at 31 Dec 2014Pham TrangNo ratings yet

- Ias 1 and 1as 7 Review QuestionsDocument10 pagesIas 1 and 1as 7 Review Questionsabuumgweno1803No ratings yet

- Company Financial Statements - FORMAT LTDDocument5 pagesCompany Financial Statements - FORMAT LTDrumelrashid_seuNo ratings yet

- Trial Balance To FSDocument9 pagesTrial Balance To FSYếnNo ratings yet

- Financial Accounting 19 PDF FreeDocument6 pagesFinancial Accounting 19 PDF FreeLyka Kristine Jane PacardoNo ratings yet

- Accounting Final Mock 1 2023Document13 pagesAccounting Final Mock 1 2023diya pNo ratings yet

- Module 2 - Financial Statement-SumsDocument2 pagesModule 2 - Financial Statement-Sumsajith.yamaneNo ratings yet

- Income Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsDocument1 pageIncome Statements For The November: @Chapter7AnalyslngandlnterpretlngflnanclalstatementsAik Luen LimNo ratings yet

- f3 AssignmentDocument6 pagesf3 Assignmentnoumanchaudhary902No ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Reconciliation Statement MathDocument6 pagesReconciliation Statement MathRajibNo ratings yet

- A-Academy Chapter (4)Document27 pagesA-Academy Chapter (4)alaamabood6No ratings yet

- 2022 Grade 10 Controlled Test 3 QP EngDocument5 pages2022 Grade 10 Controlled Test 3 QP EngkellzylesediNo ratings yet

- 01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022Document6 pages01 - FINC 0200 IP - Assignment Units 1 - 6 Questions - Winter 2022hermitpassiNo ratings yet

- H1 ReviewFinancialStatementsDocument4 pagesH1 ReviewFinancialStatementsTrang PhamNo ratings yet

- Cash Flow Questions RucuDocument5 pagesCash Flow Questions RucuWalton Jr Kobe TZNo ratings yet

- Solutions Totutorial 2-Fall 2022Document8 pagesSolutions Totutorial 2-Fall 2022chtiouirayyenNo ratings yet

- Chapter 12 3 Bài DàiDocument6 pagesChapter 12 3 Bài DàiMai Lâm LêNo ratings yet

- Accounting Mock Exam 3Document3 pagesAccounting Mock Exam 3Hâ HiiNo ratings yet

- Cash Flow StatementsDocument21 pagesCash Flow StatementsAnaya KaleNo ratings yet

- Duch Ravi (16ACT41sb1)Document3 pagesDuch Ravi (16ACT41sb1)chhayloeng60No ratings yet

- Valuation: © The Institute of Chartered Accountants of IndiaDocument72 pagesValuation: © The Institute of Chartered Accountants of IndiaNmNo ratings yet

- Assignment Chap 8 Torres, Erica Bianca B111Document6 pagesAssignment Chap 8 Torres, Erica Bianca B111Erica Bianca TorresNo ratings yet

- Accounting 1 - Lesson 4Document5 pagesAccounting 1 - Lesson 4Vhetty May PosadasNo ratings yet

- 10a Limited Company RevisionDocument3 pages10a Limited Company RevisionJoseph IbrahimNo ratings yet

- FE QUESTION FIN 2224 Sept2021Document6 pagesFE QUESTION FIN 2224 Sept2021Tabish HyderNo ratings yet

- Apply Your Knowledge: Case Study 1Document3 pagesApply Your Knowledge: Case Study 1Queen ValleNo ratings yet

- Cashflow Tutorial 2Document1 pageCashflow Tutorial 2Tadiwa ZamaniNo ratings yet

- Brewer Chapter 13Document7 pagesBrewer Chapter 13Atif RehmanNo ratings yet

- Bacc 237 Assignment Two (Multiple Choice)Document10 pagesBacc 237 Assignment Two (Multiple Choice)TarusengaNo ratings yet

- CSOC PawnshopDocument123 pagesCSOC Pawnshopaldred pera100% (1)

- 2021 Seminar Paper Marking SchemeDocument12 pages2021 Seminar Paper Marking Schemesayuru423geenethNo ratings yet

- Tobias Co. Problem AssignmentDocument2 pagesTobias Co. Problem AssignmentMiss MegzzNo ratings yet

- Consolidation Long QuestionsDocument11 pagesConsolidation Long QuestionsChaiz MineNo ratings yet

- Ac1104 Week1illDocument12 pagesAc1104 Week1illmjxncwk7nbNo ratings yet

- Paper - 1: Financial Reporting: AssetsDocument43 pagesPaper - 1: Financial Reporting: AssetsTisha AggarwalNo ratings yet

- Sslides - Vatel - Lslides - Review of Chap 4Document17 pagesSslides - Vatel - Lslides - Review of Chap 4uyenthanhtran2312No ratings yet

- Examination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Document8 pagesExamination Paper: Ba Accounting & Finance Level Five Financial Accounting 5AG006 (RESIT)Boago PhatshwaneNo ratings yet

- 20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Document3 pages20X5 20X6 $ $ $ $ Non-Current Assets Tangible Assets: Socf Ii HMWK Q Q1Takudzwa LanceNo ratings yet

- ACC705 Corporate Accounting AssignmentDocument9 pagesACC705 Corporate Accounting AssignmentMuhammad AhsanNo ratings yet

- Form6 Mock ExamDocument7 pagesForm6 Mock Examkya.pNo ratings yet

- HW3 - CH3 Adjustment AccountingDocument13 pagesHW3 - CH3 Adjustment Accountingvico lorenzoNo ratings yet

- 18.preparation of Financial Statements For Sole TradersDocument5 pages18.preparation of Financial Statements For Sole TradersNanda PriyaNo ratings yet

- Jeopardy SolutionsDocument14 pagesJeopardy SolutionsMirkan OrdeNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document15 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- BDFA1103Document5 pagesBDFA1103Yukie LimNo ratings yet

- Ias 1Document8 pagesIas 1daniloorestmarijaniNo ratings yet

- ACC Final 3 Flashcards - QuizletDocument13 pagesACC Final 3 Flashcards - QuizletAbdul Rahim RattaniNo ratings yet

- The Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingDocument8 pagesThe Institute of Chartered Accountants of Bangladesh: Sample Question Paper Certificate Level-AccountingArif UddinNo ratings yet

- Textile Composite S.NoDocument54 pagesTextile Composite S.NoAsho AliNo ratings yet

- Cash Quiz - 2024 - Set ADocument10 pagesCash Quiz - 2024 - Set Abasanstephaniealeya7No ratings yet

- 95 AFAR First PreboardDocument16 pages95 AFAR First PreboardGRACE C. FRANCISCONo ratings yet

- Mock Midterm Exam - QuestionnaireDocument13 pagesMock Midterm Exam - QuestionnaireMaeNo ratings yet

- Loan Amortization ScheduleDocument5 pagesLoan Amortization SchedulemeetleoNo ratings yet

- 01 Retirement and Death of Partner Notes With Questions by Sachin PareekDocument152 pages01 Retirement and Death of Partner Notes With Questions by Sachin PareekSachin PareekNo ratings yet

- 10 - Pas 20 - Government GrantsDocument4 pages10 - Pas 20 - Government GrantsAbbygail Michelle TalaveraNo ratings yet

- 09 Solutions PDFDocument15 pages09 Solutions PDFJaa Nat Cheung100% (1)

- Income Statement HTCDocument2 pagesIncome Statement HTCHuzafa Tuition CentreNo ratings yet

- Business Process Manual For Asset Accounting TransactionsDocument145 pagesBusiness Process Manual For Asset Accounting TransactionsVASEEMNo ratings yet

- Online/Physical Classes Worksheet Topic:: Financial StatementDocument106 pagesOnline/Physical Classes Worksheet Topic:: Financial StatementshamakafilallahmadadNo ratings yet

- Tally Erp9 Accountant: CompleteDocument127 pagesTally Erp9 Accountant: Completesathish kumarNo ratings yet

- Finance AccountDocument430 pagesFinance AccountRaman YadavNo ratings yet

- The Karanja Industries PVTDocument30 pagesThe Karanja Industries PVTvicky durg100% (3)

- Deprication and Fixed AssetsDocument7 pagesDeprication and Fixed AssetsManjeet KaurNo ratings yet

- 1 Chapter 5 Internal Reconstruction PDFDocument22 pages1 Chapter 5 Internal Reconstruction PDFAbhiramNo ratings yet

- Financial Accounting 1 by HaroldDocument421 pagesFinancial Accounting 1 by Haroldwilliam koechNo ratings yet

- Handouts 169Document15 pagesHandouts 169Rio Cyrel CelleroNo ratings yet

- Bagan Akun PT CahayaDocument2 pagesBagan Akun PT CahayaLucky JrNo ratings yet

- Jotham BalonzoDocument2 pagesJotham BalonzoJotham BalonzoNo ratings yet

- Objective Questions FinalDocument48 pagesObjective Questions FinalAvijitneetika Mehta100% (1)

- GP Accounting Grade 11 June 2023 P1 and MemoDocument28 pagesGP Accounting Grade 11 June 2023 P1 and Memompho99988No ratings yet

- IndusInd BankDocument9 pagesIndusInd BankSrinivas NandikantiNo ratings yet

- Introduction To Accounting Principles ADocument10 pagesIntroduction To Accounting Principles AYuj Cuares CervantesNo ratings yet