Professional Documents

Culture Documents

502ah Rev14 11 11a

Uploaded by

Anthony AnsolabehereOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

502ah Rev14 11 11a

Uploaded by

Anthony AnsolabehereCopyright:

Available Formats

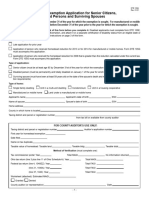

BOE-502-AH (P1) REV.

14 (11-11)

CHANGE IN OWNERSHIP STATEMENT

This statement represents a written request from the Assessor. Failure to file will result in the assessment of a penalty.

FILE THIS STATEMENT BY:

The law requires any transferee acquiring an interest in real property or manufactured home subject to local property taxation, and that is assessed by the county assessor, to file a Change in Ownership Statement with the County Recorder or Assessor. The Change in Ownership Statement must be filed at the time of recording or, if the transfer is not recorded, within 90 days of the date of the change in ownership, except that where the change in ownership has occurred by reason of death the statement shall be filed within 150 days after the date of death or, if the estate is probated, shall be filed at the time the inventory and appraisal is filed. The failure to file a Change in Ownership Statement within 90 days from the date of a written request by the Assessor results in a penalty of either: (1) one hundred dollars ($100); or (2) 10 percent of the taxes applicable to the new base year value reflecting the change in ownership of the real property or manufactured home, whichever is greater, but not to exceed five thousand dollars ($5,000) if the property is eligible for the homeowners exemption or twenty thousand dollars ($20,000) if the property is not eligible for the homeowners exemption if that failure to file was not willful. This penalty will be added to the assessment roll and shall be collected like any other delinquent property taxes, and be subject to the same penalties for nonpayment.

SELLER/TRANSFEROR BUYER/TRANSFEREE STREET ADDRESS OR PHYSICAL LOCATION OF REAL PROPERTY MAIL PROPERTY TAX INFORMATION TO (NAME) ADDRESS CITY MO STATE ZIP CODE DAY YEAR ASSESSOR'S PARCEL NUMBER BUYERS DAYTIME TELEPHONE NUMBER

IMPORTANT NOTICE

YES YES NO

NO This property is intended as my principal residence. If YES, please indicate the date of occupancy

or intended occupancy.

PART 1. TRANSFER INFORMATION

Please complete all statements.

A. This transfer is solely between spouses (addition or removal of a spouse, death of a spouse, divorce settlement, etc.). B. This transfer is solely between domestic partners currently registered with the California Secretary of State (addition or removal of a partner, death of a partner, termination settlement, etc.). C. This is a transfer between: parent(s) and child(ren) grandparent(s) and grandchild(ren). *

* D. This transaction is to replace a principal residence by a person 55 years of age or older.

Within the same county? YES NO

* E. This transaction is to replace a principal residence by a person who is severely disabled as defined by Revenue and Taxation Code

section 69.5. Within the same county? YES NO F. This transaction is only a correction of the name(s) of the person(s) holding title to the property (e.g., a name change upon marriage). If YES, please explain: : G. The recorded document creates, terminates, or reconveys a lender's interest in the property. H. This transaction is recorded only as a requirement for financing purposes or to create, terminate, or reconvey a security interest (e.g., cosigner). If YES, please explain: I. The recorded document substitutes a trustee of a trust, mortgage, or other similar document. J. This is a transfer of property: 1. to/from a revocable trust that may be revoked by the transferor and is for the benefit of the transferor, and/or the transferor's spouse registered domestic partner. 2. to/from a trust that may be revoked by the creator/grantor/trustor who is also a joint tenant, and which names the other joint tenant(s) as beneficiaries when the creator/grantor/trustor dies. 3. to/from an irrevocable trust for the benefit of the creator/grantor/trustor and/or grantor's/trustors spouse grantors/trustors registered domestic partner.

4. to/from an irrevocable trust from which the property reverts to the creator/grantor/trustor within 12 years.

K. This property is subject to a lease with a remaining lease term of 35 years or more including written options. L. This is a transfer between parties in which proportional interests of the transferor(s) and transferee(s) in each and every parcel being transferred remain exactly the same after the transfer. M. This is a transfer subject to subsidized low-income housing requirements with governmentally imposed restrictions.

* N. This transfer is to the first purchaser of a new building containing an active solar energy system. * If you checked YES to statements C, D, or E, you may qualify for a property tax reassessment exclusion, which may allow you to maintain your previous tax base. If you checked YES to statement N, you may qualify for a property tax new construction exclusion. A claim form must be filed and all requirements met in order to obtain any of these exclusions. Contact the Assessor for claim forms. Please provide any other information that will help the Assessor understand the nature of the transfer.

THIS DOCUMENT IS NOT SUBJECT TO PUBLIC INSPECTION

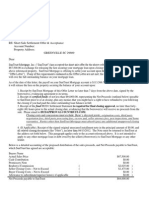

BOE-502-AH (P2) REV. 14 (11-11)

PART 2. OTHER TRANSFER INFORMATION

A. Date of transfer, if other than recording date: B. Type of transfer: Purchase Foreclosure Gift Trade or exchange Assignment of a lease

Check and complete as applicable.

Merger, stock, or partnership acquisition (Form BOE-100-B) Inheritance. Date of death: Termination of a lease. Date lease began: Remaining term in years (including written options):

Contract of sale. Date of contract: Sale/leaseback

Creation of a lease

Original term in years (including written options): Other. Please explain: C. Only a partial interest in the property was transferred. YES NO

If YES, indicate the percentage transferred:

PART 3. PURCHASE PRICE AND TERMS OF SALE

Down payment: $ Interest rate: %

Check and complete as applicable.

$ Seller-paid points or closing costs: $ Balloon payment: $

A. Total purchase or acquisition price. Do not include closing costs or mortgage insurance.

Loan carried by seller

Assumption of Contractual Assessment* with a remaining balance of: $ * An assessment used to finance property-specific improvements that constitutes a lien against the real property. Through real estate broker. Broker name: Phone number:

B. The property was purchased: Direct from seller Other. Please explain:

From a family member

C. Please explain any special terms, seller concessions, financing, and any other information (e.g., buyer assumed the existing loan balance) that would assist the Assessor in the valuation of your property.

PART 4. PROPERTY INFORMATION

A. Type of property transferred Single-family residence Multiple-family residence. Number of units: Other. Description: (i.e., timber, mineral, water rights, etc.) B. YES

Check and complete as applicable.

Co-op/Own-your-own Condominium Timeshare Manufactured home Unimproved lot Commercial/Industrial

NO Personal/business property, or incentives, are included in the purchase price. Examples are furniture, farm equipment, machinery, club memberships, etc. Attach list if available. If YES, enter the value of the personal/business property: $ YES YES NO A manufactured home is included in the purchase price. $ NO The manufactured home is subject to local property tax. If NO, enter decal number: NO The property produces rental or other income. Lease/rent Contract Good Mineral rights Average Other: Fair Poor If YES, enter the value attributed to the manufactured home:

C.

D.

YES

If YES, the income is from:

E. The condition of the property at the time of sale was:

CERTIFICATION

I certify (or declare) under penalty of perjury under the laws of the State of California that the foregoing and all information hereon, including any accompanying statements or documents, is true and correct to the best of my knowledge and belief. This declaration is binding on each and every buyer/transferee.

SIGNATURE OF BUYER/TRANSFEREE OR CORPORATE OFFICER DATE

NAME OF BUYER/TRANSFEREE/LEGAL REPRESENTATIVE/CORPORATE OFFICER (PLEASE PRINT)

E-MAIL ADDRESS

TITLE

The Assessors office may contact you for additional information regarding this transaction.

You might also like

- Petition For Issuance of New Owner's Duplicate Copy of Title - SampleDocument3 pagesPetition For Issuance of New Owner's Duplicate Copy of Title - SampleVanessa Mallari75% (8)

- KWU - SHIFT Effective People Leverage - Manual v3.2Document54 pagesKWU - SHIFT Effective People Leverage - Manual v3.2Stacey McVey100% (2)

- How to Transfer Land Title in the PhilippinesDocument5 pagesHow to Transfer Land Title in the Philippinesjayar medicoNo ratings yet

- Tamayao v. LacambraDocument6 pagesTamayao v. LacambraLorna IlustrisimoNo ratings yet

- Motion To Show Cause FinalDocument6 pagesMotion To Show Cause FinalTodd WetzelbergerNo ratings yet

- PCORDocument2 pagesPCORejmnyNo ratings yet

- Alameda County Form Boe-502-A For 2017Document4 pagesAlameda County Form Boe-502-A For 2017Mauricio BeyNo ratings yet

- Property Deed Transfer-2Document6 pagesProperty Deed Transfer-2JamesNo ratings yet

- SAN - BERNARDINO County Form BOE-502-A For 2021Document4 pagesSAN - BERNARDINO County Form BOE-502-A For 2021summitNo ratings yet

- Preliminary Change of Ownership Report (PCOR) FormDocument4 pagesPreliminary Change of Ownership Report (PCOR) FormSeniorNo ratings yet

- Boe 266Document2 pagesBoe 266Ohad Ben-YosephNo ratings yet

- Steps of Land TransferDocument6 pagesSteps of Land TransferKeith LlaveNo ratings yet

- Form 2766 Affidavit of Property TransferDocument2 pagesForm 2766 Affidavit of Property Transferricetech100% (15)

- Realty Transfer Tax Statement of Value REV 183Document2 pagesRealty Transfer Tax Statement of Value REV 183maria-bellaNo ratings yet

- Beneficial Ownership STMNTDocument5 pagesBeneficial Ownership STMNTSaba Amir Gondal86% (7)

- Chase Short Sale PackageDocument12 pagesChase Short Sale PackageZenMaster1969No ratings yet

- Guideline in The Transfer of Titles of Real PropertyDocument4 pagesGuideline in The Transfer of Titles of Real PropertyLeolaida AragonNo ratings yet

- Preliminary Change of Ownership (Rev. 10-2005)Document2 pagesPreliminary Change of Ownership (Rev. 10-2005)Juxv9dTct8No ratings yet

- PRINT in BLACK INK. Ovals Must Be Filled in Completely.Document2 pagesPRINT in BLACK INK. Ovals Must Be Filled in Completely.mik2bgNo ratings yet

- Step by Step - Transfer of TitleDocument4 pagesStep by Step - Transfer of TitleRommyr P. Caballero100% (2)

- TRANSFER LAND OWNERSHIPDocument5 pagesTRANSFER LAND OWNERSHIPCrisanta MarieNo ratings yet

- AspxDocument5 pagesAspxDenise StephensNo ratings yet

- Transferring Land Title StepsDocument4 pagesTransferring Land Title Stepsabogado101No ratings yet

- Addedum To The Contract of LeaseDocument3 pagesAddedum To The Contract of LeaseUndo ValenzuelaNo ratings yet

- Dte 105aDocument3 pagesDte 105aaishaxmailleNo ratings yet

- Virginia Tax Exemption Code - 84-178Document12 pagesVirginia Tax Exemption Code - 84-178tysontaylorNo ratings yet

- Letters of IntentDocument3 pagesLetters of IntentTheo100% (1)

- 6681606Document3 pages6681606Jay O CalubayanNo ratings yet

- Withdrawal Great American Life FormsDocument13 pagesWithdrawal Great American Life FormsMax PowerNo ratings yet

- Form DTE - DTE100EX - FI - 201406231430438077Document2 pagesForm DTE - DTE100EX - FI - 201406231430438077NaderNo ratings yet

- Closing of Real Estate Sale Transactions and Transfer of TitleDocument6 pagesClosing of Real Estate Sale Transactions and Transfer of TitleescaNo ratings yet

- A. Steps in Casual Sale of Real Estate: Fees To Be IncurredDocument9 pagesA. Steps in Casual Sale of Real Estate: Fees To Be IncurredMinmin WaganNo ratings yet

- Sharing Expenses When Transferring Real Estate TitleDocument2 pagesSharing Expenses When Transferring Real Estate TitlePogi akoNo ratings yet

- Duplicate Title No Lien MV-38Document2 pagesDuplicate Title No Lien MV-38Betty ColonNo ratings yet

- Assessor's HandbookDocument6 pagesAssessor's HandbookjackyNo ratings yet

- AAB App Instructions-2010Document2 pagesAAB App Instructions-2010szihaiNo ratings yet

- Extrajudicial Settlement of Estate Rule 74, Section 1 ChecklistDocument8 pagesExtrajudicial Settlement of Estate Rule 74, Section 1 ChecklistMsyang Ann Corbo DiazNo ratings yet

- GIT/REP-3 Form for NJ Seller's Residency CertificationDocument2 pagesGIT/REP-3 Form for NJ Seller's Residency CertificationAnkit DuggalNo ratings yet

- Certificate of Payment of Foreign Death Tax: For Paperwork Reduction Act Notice, See The Back of This FormDocument2 pagesCertificate of Payment of Foreign Death Tax: For Paperwork Reduction Act Notice, See The Back of This FormFrancis Wolfgang UrbanNo ratings yet

- Transfer of Title in The PhilsDocument6 pagesTransfer of Title in The PhilsAriel FFulgencioNo ratings yet

- 230 Short Sale Packet - BayviewDocument16 pages230 Short Sale Packet - BayviewrapiddocsNo ratings yet

- Other BN-related Application FormDocument3 pagesOther BN-related Application FormAnonymous ku7POqvKNo ratings yet

- Checklist for Underwriting ReviewDocument8 pagesChecklist for Underwriting ReviewSarvepalli Uday KiranNo ratings yet

- 60-Day Notice of TerminationDocument3 pages60-Day Notice of TerminationjlurosNo ratings yet

- LPGApplication PDFDocument17 pagesLPGApplication PDFAnkur MongaNo ratings yet

- TRANSFER OF LAND TITLEDocument8 pagesTRANSFER OF LAND TITLEAnonymous uMI5BmNo ratings yet

- GST/HST New Housing Rebate Application For Houses Purchased From A BuilderDocument4 pagesGST/HST New Housing Rebate Application For Houses Purchased From A BuilderEffel PradoNo ratings yet

- Authoritative Guide On Real Estate Transfer TaxesDocument37 pagesAuthoritative Guide On Real Estate Transfer TaxesJames ReyesNo ratings yet

- Guidelines for BIR Form 1604-C (Jan 2018Document1 pageGuidelines for BIR Form 1604-C (Jan 2018FedsNo ratings yet

- NJ Seller's Residencey CertificateDocument2 pagesNJ Seller's Residencey CertificateAndrew LiputNo ratings yet

- It-5 Wht-Sale of Immovable PropertyDocument1 pageIt-5 Wht-Sale of Immovable PropertyZar NootNo ratings yet

- Capital Improvement FormDocument2 pagesCapital Improvement Formnyc_guyNo ratings yet

- Transfer of Ownership (Too) - IndividualDocument2 pagesTransfer of Ownership (Too) - IndividualHarold VargasNo ratings yet

- Property Transfer AffidavitDocument3 pagesProperty Transfer AffidavitJusticeNo ratings yet

- RA - Yadi Hernandez (Eb1.1 + AOS)Document3 pagesRA - Yadi Hernandez (Eb1.1 + AOS)Andrea HernándezNo ratings yet

- Annual Declaration Form (Saln)Document4 pagesAnnual Declaration Form (Saln)tisay12100% (1)

- Application for Transfer to a Controlled CorporationDocument7 pagesApplication for Transfer to a Controlled CorporationAngela ArleneNo ratings yet

- Blank: 15.DAY To Pay Statement Covid.19 Related FinancialDocument5 pagesBlank: 15.DAY To Pay Statement Covid.19 Related FinancialJorge ArroyoNo ratings yet

- Titling 1. File and Secure The Documentary Requirements at The Bureau of Internal Revenue Regional District Office (BIR RDDocument3 pagesTitling 1. File and Secure The Documentary Requirements at The Bureau of Internal Revenue Regional District Office (BIR RDara abuNo ratings yet

- SunTrust Short Sale Approval (Fannie Mae)Document3 pagesSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- How to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionFrom EverandHow to Do a 1031 Exchange of Real Estate: Using a 1031 Qualified Intermediary (Qi) 2Nd EditionNo ratings yet

- Tax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesFrom EverandTax Sales for Rookies: A Beginner’s Guide to Understanding Property Tax SalesNo ratings yet

- 1040 Exam Prep: Module II - Basic Tax ConceptsFrom Everand1040 Exam Prep: Module II - Basic Tax ConceptsRating: 1.5 out of 5 stars1.5/5 (2)

- Quieting of Title DigestsDocument11 pagesQuieting of Title DigestsJDR JDRNo ratings yet

- From 'Crisis' To 'Optimism': A Host of Major Changes Are in The Works For The East End of False Creek Where 2,200 Olympic Athletes Will Be HousedDocument4 pagesFrom 'Crisis' To 'Optimism': A Host of Major Changes Are in The Works For The East End of False Creek Where 2,200 Olympic Athletes Will Be Housedlangleyrecord8339No ratings yet

- Foreclosure From Lenders Perspective - 2008Document65 pagesForeclosure From Lenders Perspective - 2008pennyh72No ratings yet

- Teil 11 Foreclosure FraudDocument43 pagesTeil 11 Foreclosure FraudNathan Beam100% (1)

- Glitz Danube BrochureDocument23 pagesGlitz Danube BrochureqasimNo ratings yet

- Florentino v. Encarnacion Sr. 27696Document8 pagesFlorentino v. Encarnacion Sr. 27696Mary LeandaNo ratings yet

- Paray and Espeleta vs. RodriguezDocument1 pageParay and Espeleta vs. RodriguezOM MolinsNo ratings yet

- 10) Pleasantville V CA - Case Digest - PropertyDocument1 page10) Pleasantville V CA - Case Digest - PropertyhectorjrNo ratings yet

- G.R. No. 12908 - Carmelita Leano vs. Court of AppealsDocument6 pagesG.R. No. 12908 - Carmelita Leano vs. Court of AppealsPrimabelle Sanchez DizonNo ratings yet

- Supreme Court: The Lawphil Project - Arellano Law FoundationDocument34 pagesSupreme Court: The Lawphil Project - Arellano Law FoundationJM BermudoNo ratings yet

- CWGV BrochureDocument14 pagesCWGV BrochureKapil RampalNo ratings yet

- Naranja V CADocument1 pageNaranja V CAK-phrenCandariNo ratings yet

- BAR EXAM Q - A LeaseDocument9 pagesBAR EXAM Q - A LeaseFLOYD MORPHEUSNo ratings yet

- Extrajudicial Settlement of The EstateDocument3 pagesExtrajudicial Settlement of The EstateAldrinNo ratings yet

- LAW - ENGR VAL. 2020pdfDocument9 pagesLAW - ENGR VAL. 2020pdfDavid AkomolafeNo ratings yet

- Campbell AvenueDocument22 pagesCampbell AvenueRyan SloanNo ratings yet

- Will Form - Testator - No Minors, No TrustsDocument7 pagesWill Form - Testator - No Minors, No TrustsShirley WeissNo ratings yet

- El Banco Español-Filipino V. James PetersonDocument1 pageEl Banco Español-Filipino V. James PetersonRia Evita RevitaNo ratings yet

- Extrajudicial Settlement of EstateDocument2 pagesExtrajudicial Settlement of EstateN.V.No ratings yet

- ATP ReviewerDocument22 pagesATP ReviewerShanelle NapolesNo ratings yet

- Kootenay Lake Jan. 22, 2019Document32 pagesKootenay Lake Jan. 22, 2019Pennywise PublishingNo ratings yet

- UntitledDocument8 pagesUntitledapi-26443221No ratings yet

- HGC Foreclosed Properties For Sale 20160718Document16 pagesHGC Foreclosed Properties For Sale 20160718jammiziNo ratings yet

- Pag-IBIG Fund Invites Offers to Purchase Foreclosed PropertiesDocument38 pagesPag-IBIG Fund Invites Offers to Purchase Foreclosed PropertiesRenier Palma CruzNo ratings yet

- Addendum A Local Condition Disclosure To CAR Form SBSADocument4 pagesAddendum A Local Condition Disclosure To CAR Form SBSAGlenn Stidger100% (1)

- JLL Real Estate As A Global Asset ClassDocument9 pagesJLL Real Estate As A Global Asset Classashraf187100% (1)