Professional Documents

Culture Documents

Chatgpt

Chatgpt

Uploaded by

Arushi PrasharOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chatgpt

Chatgpt

Uploaded by

Arushi PrasharCopyright:

Available Formats

external agents and institutions of corporate governance

ChatGPT

ChatGPT

Corporate governance involves the systems, processes, and structures through

which companies are directed and controlled. External agents and institutions

play crucial roles in ensuring that companies operate ethically, transparently,

and in the best interest of stakeholders. Here are some key external agents and

institutions involved in corporate governance:

1. Regulatory Bodies: Government agencies, such as the Securities and

Exchange Commission (SEC) in the United States or the Financial

Conduct Authority (FCA) in the UK, establish and enforce regulations

to ensure companies comply with legal requirements and standards.

2. Stock Exchanges: Exchanges like the New York Stock Exchange

(NYSE) or the London Stock Exchange (LSE) set listing requirements

that companies must meet to be listed. They also enforce rules related

to corporate governance, disclosure, and transparency.

3. Auditors: External auditors, typically independent accounting firms,

examine a company's financial statements and internal controls to

provide assurance on their accuracy and compliance with accounting

standards. They play a crucial role in maintaining transparency and

accountability.

4. Credit Rating Agencies: Agencies like Standard & Poor's, Moody's,

and Fitch assess the creditworthiness of companies by evaluating their

financial health, management quality, and corporate governance

practices. Their ratings influence investor confidence and borrowing

costs.

5. Investment Analysts and Institutional Investors: Analysts working

for investment banks, asset management firms, and institutional

investors scrutinize companies' financial performance, strategic

decisions, and governance practices to make investment

recommendations. Institutional investors often engage with companies

on governance issues and may vote on matters like board composition

and executive compensation.

6. Proxy Advisory Firms: These firms provide independent voting

recommendations to institutional investors on matters put forth for

shareholder vote, such as board elections and executive compensation

packages.

7. Legal System: Courts and legal mechanisms serve as a backstop for

corporate governance by adjudicating disputes, enforcing contracts,

and holding individuals and entities accountable for misconduct.

8. Industry Associations and Professional Bodies: Organizations like

the Institute of Directors (IoD) and the National Association of

Corporate Directors (NACD) provide guidance, training, and best

practices for corporate governance to directors and executives.

9. Non-Governmental Organizations (NGOs) and Advocacy Groups:

NGOs focused on corporate accountability and sustainability advocate

for improved governance practices, transparency, and ethical behavior

by engaging with companies, regulators, and other stakeholders.

10. Media and Public Opinion: Public scrutiny and media coverage can

influence corporate behavior and governance practices by exposing

wrongdoing, shaping public perception, and holding companies

accountable for their actions.

These external agents and institutions collectively contribute to the

effectiveness of corporate governance by providing oversight, accountability,

and guidance to companies and their stakeholders.

You

shareholder purpose in a corporation

ChatGPT

ChatGPT

The purpose of shareholders in a corporation is multifaceted, reflecting their

role as owners of the company. Here are some key aspects of shareholder

purpose:

1. Ownership Stake: Shareholders invest capital in the company by

purchasing shares, thereby becoming partial owners. Their primary

purpose is to seek a return on their investment, typically in the form of

capital appreciation (increase in share value) and dividends (share of

profits).

2. Maximizing Shareholder Value: Shareholders often expect the

company's management to make decisions that maximize shareholder

value. This can involve strategies aimed at increasing profitability,

growing revenues, optimizing capital allocation, and enhancing long-

term sustainability.

3. Governance Oversight: Shareholders exercise their ownership rights

through corporate governance mechanisms. They elect the board of

directors, approve significant corporate actions, such as mergers and

acquisitions, and may propose resolutions on matters of concern

through shareholder voting.

4. Risk Management: Shareholders have a vested interest in ensuring

that the company manages risks effectively to protect their

investments. They expect the board and management to implement

sound risk management practices to safeguard the company's financial

health and reputation.

5. Stewardship and Accountability: Shareholders hold the company's

management accountable for their decisions and performance. They

expect transparency, accountability, and effective communication from

the board and executives regarding the company's strategy, operations,

and financial results.

6. Alignment of Interests: Shareholders' interests should align with the

company's long-term success. They benefit when the company

generates sustainable profits, maintains a strong market position, and

operates ethically and responsibly.

7. Active Engagement: Some shareholders engage actively with the

company by participating in shareholder meetings, voicing concerns,

proposing resolutions, and advocating for changes in governance or

strategic direction.

8. Social Responsibility: Shareholders may increasingly consider

environmental, social, and governance (ESG) factors in their

investment decisions. They may encourage the company to adopt

responsible business practices, address social and environmental

issues, and contribute positively to society.

Overall, the purpose of shareholders in a corporation revolves around seeking

returns on their investment, exercising governance oversight, managing risks,

holding management accountable, and promoting the company's long-term

success and sustainability. However, it's important to note that shareholder

interests may sometimes conflict with other stakeholders' interests, such as

employees, customers, and communities, highlighting the need for balance and

responsible stewardship.

You

shareholder purpose in a corporation in corporate governance

ChatGPT

ChatGPT

In corporate governance, shareholders play a pivotal role as owners of the

company. Their purpose is multifaceted and crucial for ensuring that the

company operates in a manner aligned with their interests and those of other

stakeholders. Here's how shareholders contribute to corporate governance:

1. Electing the Board of Directors: Shareholders elect the board of

directors, which is responsible for overseeing the company's

management and strategic direction. Through their voting rights,

shareholders can influence the composition of the board, ensuring it

comprises individuals who represent their interests and possess the

necessary expertise to guide the company effectively.

2. Approving Major Decisions: Shareholders often have the authority to

approve significant corporate actions, such as mergers, acquisitions,

divestitures, and major capital expenditures. By exercising their voting

rights, shareholders provide oversight and ensure that such decisions

are made in the best interest of the company and its owners.

3. Monitoring Management: Shareholders hold the company's

management accountable for its performance and conduct. They do so

by evaluating financial reports, monitoring key performance indicators,

and scrutinizing management's actions to ensure they align with the

company's strategy and objectives. Shareholders may also engage in

dialogue with management, asking questions and expressing concerns

about the company's performance and governance practices.

4. Voicing Concerns and Proposals: Shareholders have the right to

voice their concerns and propose resolutions on matters of importance

at shareholder meetings. This includes topics such as executive

compensation, environmental policies, social responsibility initiatives,

and governance reforms. Shareholder proposals provide a mechanism

for investors to advocate for changes they believe will enhance the

company's long-term value and sustainability.

5. Exercising Ownership Rights: As owners of the company,

shareholders have certain rights that enable them to participate in

corporate governance processes. These rights may include voting on

matters such as the election of directors, amendments to the company's

bylaws, and other significant decisions affecting shareholders'

interests. Shareholders also have the right to inspect corporate records,

receive dividends, and participate in any legal proceedings involving

the company.

6. Promoting Transparency and Accountability: Shareholders

advocate for transparency and accountability in corporate governance

practices. They expect the company to disclose relevant information

about its operations, financial performance, risks, and governance

structure. By promoting transparency, shareholders help ensure that

investors can make informed decisions and hold the company

accountable for its actions.

7. Fostering Long-Term Value Creation: Shareholders play a critical

role in promoting the company's long-term success and sustainability.

They seek to maximize shareholder value by supporting strategies and

initiatives that drive sustainable growth, enhance competitive

advantage, and create value for all stakeholders. Shareholders may

encourage the company to adopt responsible business practices,

manage risks effectively, and pursue opportunities for innovation and

growth.

Overall, shareholders' purpose in corporate governance is to protect their

interests, ensure effective oversight of management, promote transparency and

accountability, and contribute to the company's long-term success and

sustainability. By actively engaging with the company and exercising their

rights, shareholders help foster a culture of responsible governance and value

creation.

You

stakeholders purpose in a corporation in corporate governance

ChatGPT

ChatGPT

Stakeholders in a corporation are individuals or groups who have an interest or

stake in the company's operations, performance, and outcomes. In corporate

governance, stakeholders play essential roles in ensuring that the company

operates ethically, responsibly, and in a manner that considers the interests of

all parties involved. Here's how various stakeholders contribute to corporate

governance:

1. Shareholders:

Purpose: Shareholders are owners of the company and seek to

maximize their return on investment. Their interests typically

revolve around financial performance, capital appreciation, and

dividend payments.

Contribution: Shareholders exercise governance oversight by

electing the board of directors, approving major decisions,

monitoring management's performance, and advocating for

changes that enhance shareholder value and sustainability.

2. Board of Directors:

Purpose: The board of directors represents the interests of

shareholders and oversees the company's management,

strategy, and performance.

Contribution: Directors provide strategic guidance, set

corporate objectives, appoint executive leadership, monitor

financial performance, and ensure compliance with laws,

regulations, and ethical standards. They also serve as a bridge

between management and shareholders, fostering transparency

and accountability.

3. Management:

Purpose: Management is responsible for executing the

company's strategy, achieving its objectives, and maximizing

shareholder value while considering the interests of other

stakeholders.

Contribution: Management develops business plans, allocates

resources, manages operations, implements policies and

procedures, and communicates with stakeholders. They are

accountable to the board and shareholders for the company's

performance and conduct.

4. Employees:

Purpose: Employees contribute their skills, knowledge, and

labor to the company and seek fair compensation, job security,

career advancement, and a safe work environment.

Contribution: Employees drive the company's day-to-day

operations, innovate, collaborate, and deliver products and

services to customers. They may also participate in decision-

making processes through employee representation on the

board or committees.

5. Customers:

Purpose: Customers purchase the company's products or

services and expect quality, value, reliability, and customer

service.

Contribution: Customers provide revenue and feedback that

influence product development, marketing strategies, and

customer experience initiatives. Their satisfaction and loyalty

are essential for the company's long-term success and

profitability.

6. Suppliers and Business Partners:

Purpose: Suppliers and business partners supply goods,

services, and resources to the company and seek fair treatment,

timely payment, and mutually beneficial relationships.

Contribution: Suppliers and business partners contribute to the

company's value chain, innovation, and operational efficiency.

Collaboration with reliable and ethical partners is critical for

maintaining supply chain integrity and mitigating risks.

7. Communities and Society:

Purpose: Communities and society at large are affected by the

company's operations and seek environmental sustainability,

social responsibility, economic development, and positive

contributions to the community.

Contribution: The company impacts the local economy,

environment, and social fabric through its employment

practices, philanthropy, community engagement, and

environmental stewardship. Building strong relationships with

communities and addressing their concerns can enhance the

company's reputation and social license to operate.

Overall, stakeholders in corporate governance contribute to the company's

success and sustainability by providing oversight, accountability, feedback,

resources, and support. Effective governance involves balancing the interests

of all stakeholders and fostering collaborative relationships that create long-

term value for the company and society.

You

communities and stake in corporation for corporate governance

ChatGPT

ChatGPT

Communities play a significant role as stakeholders in corporate governance,

despite not being direct shareholders in the traditional sense. Their stake in a

corporation's activities extends beyond financial interests and encompasses

various social, environmental, and economic considerations. Here's how

communities contribute to and benefit from corporate governance:

1. Social Responsibility: Communities expect corporations to operate

responsibly and ethically, considering the impact of their activities on

local residents, workers, and the broader community. Corporate

governance frameworks often include provisions for social

responsibility, encouraging companies to contribute positively to the

communities where they operate.

2. Environmental Stewardship: Communities are concerned about the

environmental impact of corporate activities, such as pollution,

resource depletion, and habitat destruction. Effective corporate

governance involves environmental stewardship practices that

minimize harm to ecosystems, conserve natural resources, and mitigate

climate change risks.

3. Health and Safety: Communities prioritize the health and safety of

residents and workers affected by corporate operations. Corporate

governance mechanisms, such as health and safety policies, risk

management frameworks, and regulatory compliance measures, aim to

protect community members from workplace hazards, industrial

accidents, and public health threats.

4. Economic Development: Communities benefit from corporate

investments, job creation, infrastructure development, and economic

growth stimulated by corporate activities. Corporate governance

practices that promote long-term value creation and sustainable

business growth contribute to local prosperity, employment

opportunities, and economic resilience.

5. Community Engagement: Effective corporate governance involves

engaging with communities in meaningful dialogue, consultation, and

collaboration. Companies should listen to community concerns,

address grievances, and incorporate local perspectives into decision-

making processes related to site selection, project development, and

operational planning.

6. Philanthropy and Social Investments: Many corporations engage in

philanthropic initiatives and social investments to support community

development, education, healthcare, and poverty alleviation. Corporate

governance frameworks may include provisions for corporate

philanthropy, establishing guidelines for charitable giving and

community investment strategies.

7. Stakeholder Advocacy: Communities may advocate for their interests

through grassroots movements, advocacy groups, and public

campaigns aimed at holding corporations accountable for their social

and environmental impacts. Effective corporate governance involves

listening to community stakeholders, responding to their concerns, and

adopting practices that align with community values and priorities.

8. Risk Mitigation and Crisis Management: Corporate governance

frameworks address risks related to community relations, social license

to operate, and reputational damage. Companies implement risk

mitigation strategies, crisis management plans, and stakeholder

engagement protocols to prevent or address conflicts, protests, and

community backlash resulting from adverse impacts of corporate

activities.

In summary, communities have a stake in corporate governance as

stakeholders impacted by corporate decisions, actions, and outcomes. Their

interests span social, environmental, economic, and ethical dimensions, and

effective corporate governance involves considering and balancing these

interests to promote sustainable and responsible business practices that benefit

both corporations and communities.

You

internal agents and institutions of corporate governance

ChatGPT

ChatGPT

Internal agents and institutions of corporate governance are the entities within

a corporation responsible for establishing and implementing governance

structures, policies, and practices to ensure effective oversight, accountability,

and compliance with legal and ethical standards. Here are some key internal

agents and institutions involved in corporate governance:

1. Board of Directors: The board of directors is a group of individuals

elected by shareholders to oversee the company's management and

affairs. The board sets corporate strategy, appoints executive

leadership, monitors performance, and ensures compliance with laws,

regulations, and corporate governance best practices. It typically

includes independent directors who provide objective oversight and

represent shareholder interests.

2. Executive Management: Executive management, led by the CEO

(Chief Executive Officer) or equivalent, is responsible for

implementing the board's directives, managing day-to-day operations,

and executing the company's strategy. Executives oversee functional

areas such as finance, operations, marketing, human resources, and

legal affairs, ensuring alignment with corporate objectives and ethical

standards.

3. Internal Audit Function: The internal audit function is responsible

for assessing and monitoring the effectiveness of internal controls, risk

management processes, and compliance with policies and procedures.

Internal auditors provide independent assurance to the board and

management on the integrity and reliability of financial reporting,

safeguarding of assets, and compliance with laws and regulations.

4. Compliance and Legal Department: The compliance and legal

department ensures that the company operates within the bounds of

applicable laws, regulations, and industry standards. Legal

professionals advise the board and management on legal risks,

contractual matters, corporate governance issues, and compliance

obligations. They also oversee regulatory filings, investigations, and

dispute resolution.

5. Risk Management Function: The risk management function

identifies, assesses, and manages risks that could impact the company's

objectives, operations, or reputation. Risk managers develop risk

management frameworks, conduct risk assessments, and implement

controls and mitigation strategies to minimize exposure to financial,

operational, strategic, and reputational risks.

6. Ethics and Corporate Responsibility Office: The ethics and

corporate responsibility office promotes ethical behavior, integrity, and

corporate citizenship within the organization. It develops and

communicates codes of conduct, ethics policies, and sustainability

initiatives to guide employee behavior and corporate decision-making.

The office may also handle ethics complaints, whistleblower programs,

and stakeholder engagement on social and environmental issues.

7. Finance and Accounting Function: The finance and accounting

function is responsible for maintaining accurate financial records,

preparing financial statements, and ensuring compliance with

accounting principles and reporting standards. Finance professionals

provide financial analysis, budgeting, forecasting, and treasury

management services to support strategic decision-making and investor

relations.

8. Human Resources Department: The human resources department

manages employee recruitment, training, development, performance

evaluation, compensation, and benefits administration. HR

professionals promote a positive workplace culture, diversity and

inclusion initiatives, and employee engagement programs that align

with corporate values and governance objectives.

9. Technology and Information Security Teams: In the digital age,

technology and information security teams play a crucial role in

safeguarding the company's data, systems, and digital assets from

cyber threats, data breaches, and privacy violations. They implement

cybersecurity measures, data protection policies, and IT governance

frameworks to mitigate risks and ensure the confidentiality, integrity,

and availability of information resources.

10. Corporate Secretary's Office: The corporate secretary's office

supports the board of directors and executive management in corporate

governance matters, including board meetings, shareholder

communications, record-keeping, and regulatory compliance. The

corporate secretary facilitates board governance processes, maintains

corporate records, and ensures adherence to corporate governance

guidelines and best practices.

These internal agents and institutions collaborate to establish and maintain

effective corporate governance structures, processes, and culture that promote

transparency, accountability, integrity, and responsible business practices

within the organization.

You

role of board of director in corporate governance

ChatGPT

ChatGPT

The board of directors plays a crucial role in corporate governance, providing

oversight, guidance, and strategic direction to the company. Here are some key

aspects of the board's role in corporate governance:

1. Setting Corporate Strategy: The board is responsible for setting the

company's overall strategic direction and objectives. It collaborates

with executive management to develop long-term plans, assess market

opportunities and risks, and allocate resources effectively to achieve

corporate goals.

2. Appointing Executive Leadership: The board appoints, evaluates,

and compensates executive officers, including the CEO (Chief

Executive Officer) and other senior executives. It ensures that the

leadership team possesses the necessary skills, experience, and

integrity to lead the company and execute its strategy.

3. Monitoring Performance: The board monitors the company's

performance against established goals and benchmarks. It reviews

financial reports, operational metrics, and key performance indicators

to assess the company's progress, identify areas for improvement, and

address emerging risks and challenges.

4. Risk Oversight: The board oversees the company's risk management

processes, ensuring that management identifies, assesses, and mitigates

risks effectively. It evaluates the adequacy of risk management

frameworks, internal controls, and compliance programs to safeguard

the company's assets, reputation, and long-term viability.

5. Financial Oversight: The board provides oversight of the company's

financial reporting and accounting practices to ensure accuracy,

transparency, and compliance with relevant regulations and standards.

It reviews financial statements, audits, and internal control

assessments, and appoints independent auditors to validate financial

information.

6. Compliance and Ethics: The board ensures that the company operates

in compliance with applicable laws, regulations, and ethical standards.

It establishes codes of conduct, ethics policies, and compliance

programs to promote integrity, transparency, and accountability

throughout the organization.

7. Shareholder Engagement: The board represents shareholder interests

and engages with investors to address concerns, solicit feedback, and

communicate the company's strategy, performance, and governance

practices. It fosters constructive dialogue with shareholders, proxy

advisory firms, and other stakeholders to build trust and enhance

shareholder value.

8. Succession Planning: The board is responsible for succession

planning and leadership development to ensure continuity and

effectiveness in executive leadership. It identifies and develops talent

within the organization, evaluates potential successors for key

leadership positions, and plans for leadership transitions in an orderly

manner.

9. Board Composition and Governance: The board evaluates its own

composition, structure, and effectiveness to ensure diversity,

independence, and alignment with corporate objectives. It establishes

governance policies, committee charters, and best practices to govern

its own operations and fulfill its oversight responsibilities effectively.

10. Crisis Management and Contingency Planning: In times of crisis or

uncertainty, such as economic downturns, natural disasters, or

corporate scandals, the board provides guidance and support to

management in navigating challenges, protecting stakeholders'

interests, and preserving the company's reputation and resilience.

Overall, the board of directors plays a pivotal role in corporate governance by

providing strategic leadership, oversight, and accountability to ensure that the

company operates in the best interests of its shareholders, employees,

customers, and other stakeholders. Effective board governance is essential for

maintaining trust, driving performance, and sustaining long-term value

creation for the company and its stakeholders.

You

role of managers in corporate governance

ChatGPT

ChatGPT

Managers, particularly executive management, have several important roles in

corporate governance. Here's an overview of their key responsibilities:

1. Implementing Board Directives: Managers are responsible for

executing the strategic direction set by the board of directors. They

translate the board's goals and objectives into actionable plans,

initiatives, and operational decisions to drive the company forward.

2. Day-to-Day Operations: Managers oversee the company's day-to-day

operations, ensuring that activities are conducted efficiently,

effectively, and in accordance with established policies, procedures,

and standards. They manage resources, allocate budgets, and optimize

processes to achieve organizational objectives.

3. Leadership and Decision-Making: Managers provide leadership,

guidance, and direction to employees, teams, and departments within

the organization. They make decisions on staffing, resource allocation,

project prioritization, and other operational matters, aligning actions

with strategic goals and corporate values.

4. Financial Management: Managers are responsible for financial

management, including budgeting, financial planning, and

performance monitoring. They ensure that financial resources are

managed prudently, expenditures are controlled, and financial

reporting is accurate and transparent.

5. Risk Management: Managers identify, assess, and mitigate risks that

could impact the company's operations, financial health, or reputation.

They implement risk management processes, internal controls, and

compliance measures to protect the company from potential threats and

vulnerabilities.

6. Stakeholder Engagement: Managers engage with stakeholders,

including employees, customers, suppliers, regulators, and investors, to

build relationships, address concerns, and foster trust. They

communicate the company's goals, values, and performance to

stakeholders and solicit feedback to inform decision-making.

7. Ethical Leadership: Managers promote ethical behavior, integrity,

and corporate responsibility within the organization. They set a tone at

the top by modeling ethical conduct, upholding company values, and

reinforcing compliance with laws, regulations, and ethical standards.

8. Performance Evaluation and Accountability: Managers are

accountable for their performance and the performance of their teams.

They set performance expectations, provide feedback, and evaluate

employee performance based on defined goals, metrics, and standards.

9. Corporate Culture and Employee Engagement: Managers shape the

corporate culture and work environment, fostering a culture of

innovation, collaboration, and employee engagement. They promote

diversity, inclusion, and employee well-being, recognizing that

engaged and motivated employees are key drivers of organizational

success.

10. Continuous Improvement: Managers encourage a culture of

continuous improvement and learning within the organization. They

seek opportunities to innovate, adapt to changing market conditions,

and enhance operational efficiency to maintain competitiveness and

drive long-term growth.

Overall, managers play a critical role in corporate governance by executing the

board's directives, managing day-to-day operations, mitigating risks, engaging

stakeholders, upholding ethical standards, and driving performance and

accountability throughout the organization. Their leadership and management

contribute to the effective governance, sustainability, and success of the

company.

You

role of shareholder in corporate governance

ChatGPT

ChatGPT

Shareholders play a significant role in corporate governance, as they are the

ultimate owners of the company. Here are the key aspects of their role:

1. Electing the Board of Directors: Shareholders have the right to elect

the board of directors, which represents their interests and oversees the

company's management. Through voting in annual general meetings

(AGMs) or special meetings, shareholders select directors who they

believe will act in the company's best interests and provide effective

governance.

2. Approving Major Decisions: Shareholders often have the authority to

approve significant corporate actions, such as mergers, acquisitions,

divestitures, and major capital expenditures. These decisions typically

require shareholder approval, ensuring that they have a say in matters

that may affect the company's direction and financial health.

3. Exercising Voting Rights: Shareholders have the right to vote on

various matters brought before them, including the election of

directors, approval of executive compensation packages, ratification of

auditors, and consideration of shareholder proposals. Voting allows

shareholders to express their views on corporate governance issues and

influence decision-making.

4. Monitoring Management: Shareholders monitor the performance of

the company's management and hold them accountable for their

actions. They assess financial reports, performance metrics, and

strategic decisions to ensure that management is acting in the

company's best interests and creating long-term shareholder value.

5. Engaging with Management and the Board: Shareholders have the

opportunity to engage with management and the board of directors

through shareholder meetings, investor presentations, and direct

communication channels. They can ask questions, express concerns,

and provide feedback on corporate governance practices, performance,

and strategy.

6. Proposing Shareholder Resolutions: Shareholders have the right to

propose resolutions on matters of concern at shareholder meetings.

These resolutions may relate to governance reforms, executive

compensation, environmental and social issues, or other topics deemed

relevant by shareholders. Proposals provide a mechanism for

shareholders to advocate for changes they believe will enhance

shareholder value and sustainability.

7. Exercising Ownership Rights: As owners of the company,

shareholders have certain rights that enable them to participate in

corporate governance processes. These rights may include inspecting

corporate records, attending shareholder meetings, receiving dividends,

and initiating legal actions on behalf of the company.

8. Influencing Corporate Strategy: Shareholders can influence

corporate strategy and decision-making through their voting power,

engagement efforts, and advocacy campaigns. By expressing their

preferences and concerns, shareholders can shape the company's

direction, priorities, and policies in alignment with their interests and

values.

9. Promoting Transparency and Accountability: Shareholders

advocate for transparency, accountability, and ethical behavior in

corporate governance practices. They expect the company to disclose

relevant information about its operations, financial performance,

governance structure, and risk management practices to enable

informed decision-making and hold management accountable for their

actions.

10. Seeking Returns on Investment: Ultimately, shareholders seek a

return on their investment in the company. They expect management to

implement strategies that generate sustainable profits, enhance

shareholder value, and deliver competitive returns over the long term.

By actively participating in corporate governance, shareholders aim to

protect and maximize their investment interests.

In summary, shareholders play a vital role in corporate governance by electing

the board of directors, approving major decisions, monitoring management,

engaging with company leadership, proposing resolutions, exercising

ownership rights, influencing corporate strategy, promoting transparency and

accountability, and seeking returns on their investment. Their active

involvement helps ensure that companies operate responsibly, transparently,

and in the best interests of their shareholders and other stakeholders.

You

corporate social responsibility

ChatGPT

ChatGPT

Corporate Social Responsibility (CSR) refers to a company's voluntary

initiatives to integrate social and environmental concerns into its business

operations and interactions with stakeholders. CSR goes beyond compliance

with laws and regulations, emphasizing ethical behavior, sustainability, and

accountability to create shared value for society and the business itself. Here

are some key aspects of corporate social responsibility:

1. Environmental Sustainability: CSR involves minimizing the

environmental impact of business activities, reducing carbon

emissions, conserving natural resources, and promoting eco-friendly

practices such as renewable energy adoption, waste reduction, and

pollution prevention.

2. Social Responsibility: Companies have a responsibility to contribute

positively to society by supporting community development,

education, healthcare, poverty alleviation, and other social causes. CSR

initiatives may include philanthropy, volunteerism, charitable

donations, and partnerships with nonprofit organizations to address

social challenges and improve quality of life for disadvantaged

populations.

3. Ethical Business Practices: CSR requires companies to uphold high

ethical standards in all aspects of their operations, including business

conduct, supply chain management, product safety, and marketing

practices. Ethical behavior involves transparency, honesty, fairness,

and integrity in dealings with customers, employees, suppliers, and

other stakeholders.

4. Stakeholder Engagement: Companies engage with stakeholders,

including employees, customers, suppliers, investors, communities,

and regulators, to understand their concerns, solicit feedback, and

address their needs and expectations. Stakeholder engagement fosters

trust, collaboration, and dialogue, enabling companies to make

informed decisions and build positive relationships with their

stakeholders.

5. Corporate Governance: Effective corporate governance is essential

for CSR, as it ensures that companies operate with transparency,

accountability, and integrity. Boards of directors oversee CSR

strategies and performance, integrating sustainability considerations

into corporate decision-making and risk management processes.

6. Employee Well-being: Companies have a responsibility to promote

the health, safety, and well-being of their employees. CSR initiatives

may include providing a safe work environment, offering competitive

wages and benefits, supporting work-life balance, investing in

employee training and development, and fostering diversity and

inclusion in the workforce.

7. Responsible Supply Chain Management: Companies are

increasingly held accountable for the social and environmental impacts

of their supply chains. CSR involves ensuring that suppliers and

business partners adhere to ethical standards, labor rights,

environmental regulations, and human rights principles throughout the

supply chain.

8. Transparency and Reporting: Companies disclose information about

their CSR policies, practices, and performance to stakeholders through

sustainability reports, annual reports, websites, and other

communication channels. Transparent reporting enables stakeholders

to assess companies' CSR efforts, track progress, and hold them

accountable for their commitments.

9. Long-Term Value Creation: CSR contributes to long-term value

creation by enhancing reputation, brand loyalty, employee morale,

customer trust, and investor confidence. Companies that integrate CSR

into their business strategies are better positioned to mitigate risks,

seize opportunities, and achieve sustainable growth over time.

10. Global Citizenship: In an interconnected world, companies operate

across borders and have a global impact on society and the

environment. CSR involves embracing global citizenship principles,

respecting human rights, promoting cultural diversity, and contributing

to global sustainability efforts through responsible business practices

and partnerships.

Overall, corporate social responsibility reflects a company's commitment to

ethical behavior, sustainability, and stakeholder engagement, guided by the

principles of accountability, transparency, and long-term value creation. By

integrating CSR into their business strategies, companies can create positive

social and environmental impacts while generating economic value for

shareholders and society as a whole.

Save your chat history, share chats, and personalize your

experience.

Sign up

You might also like

- Chap. 3. Internal and External Institutions and Influences of Corporate GovernanceDocument60 pagesChap. 3. Internal and External Institutions and Influences of Corporate GovernanceJessica Estolloso GoyagoyNo ratings yet

- Roles and Responsibilities of Corporate Governance ActorsDocument2 pagesRoles and Responsibilities of Corporate Governance ActorsGeremew workuNo ratings yet

- Overview of Governance Governance in GeneralDocument5 pagesOverview of Governance Governance in GeneralJohn Michael GeneralNo ratings yet

- Corporate 2,3Document10 pagesCorporate 2,3BappyNo ratings yet

- Bahr 1ST ReviewerDocument12 pagesBahr 1ST ReviewerTricia Nicole BahintingNo ratings yet

- Corporate Governance and Social Responsibility Assignment: Name: Ravneet Rehal 2 Year Section A Roll No. 36Document14 pagesCorporate Governance and Social Responsibility Assignment: Name: Ravneet Rehal 2 Year Section A Roll No. 36ravneetNo ratings yet

- Of August 23, 2021Document2 pagesOf August 23, 2021Lana sereneNo ratings yet

- Principles of Corporate GovernanceDocument11 pagesPrinciples of Corporate Governancefor thierNo ratings yet

- Corporate GovernanceDocument33 pagesCorporate GovernanceAmol Shelar50% (2)

- Corporate GovernanceDocument10 pagesCorporate GovernanceMarwah FaisalNo ratings yet

- Corporate Governance AssignmentDocument6 pagesCorporate Governance AssignmentAshika PrasadNo ratings yet

- AUDITDocument2 pagesAUDITmountain girlNo ratings yet

- 310 Corporate GovernanceDocument24 pages310 Corporate GovernanceManojNo ratings yet

- Unit 4 CGDocument7 pagesUnit 4 CGRaja SahilNo ratings yet

- Good Governance and Corporate Social Responsibility: Peter DruckerDocument6 pagesGood Governance and Corporate Social Responsibility: Peter DruckerRonel CacheroNo ratings yet

- TASK-NO.-1-EDUC-209 - Paberecio E.Document7 pagesTASK-NO.-1-EDUC-209 - Paberecio E.Emmarie PaberecioNo ratings yet

- Module IV Corporate Governance and Social Responsibility 3Document13 pagesModule IV Corporate Governance and Social Responsibility 3Pulak DixitNo ratings yet

- What Is Corporate GovernanceDocument9 pagesWhat Is Corporate GovernanceNitin TembhurnikarNo ratings yet

- Cooperate Governance Answers To Group QuestionsDocument86 pagesCooperate Governance Answers To Group Questionssaidkhatib368No ratings yet

- TM 2 - Fiduciary and Decision Roles and Duties of BOD, Board Committees, Board Models, Board CharacteristicDocument23 pagesTM 2 - Fiduciary and Decision Roles and Duties of BOD, Board Committees, Board Models, Board CharacteristicMuh Rizky HendrawanNo ratings yet

- 1cgesrob Long Notes 4 SemDocument23 pages1cgesrob Long Notes 4 Semsatyam ranaNo ratings yet

- 310 Corporate GovernanceDocument37 pages310 Corporate Governancemakrandbhagwat2000No ratings yet

- Shareholder ActivismDocument7 pagesShareholder ActivismADITI YADAVNo ratings yet

- Corporate Governance Is The System of Rules, Practices and Processes by Which A Company Is Directed and ControlledDocument8 pagesCorporate Governance Is The System of Rules, Practices and Processes by Which A Company Is Directed and ControlledNicefebe Love SampanNo ratings yet

- Corporate Governance MaterialDocument19 pagesCorporate Governance MaterialAkansha JaggiNo ratings yet

- What Is Corporate GovernanceDocument6 pagesWhat Is Corporate Governancewaseem ahsanNo ratings yet

- Corporate Governance and Social ResponsibilityDocument7 pagesCorporate Governance and Social ResponsibilityMohitNo ratings yet

- Group 2 Auditing and Corporate GovernanceDocument18 pagesGroup 2 Auditing and Corporate GovernanceAmaan SaifiNo ratings yet

- Corporate GovernanceDocument39 pagesCorporate Governanceibrahim AhmedNo ratings yet

- Corporate Governance AssgnDocument9 pagesCorporate Governance AssgnAtreya Terry VyasNo ratings yet

- Corporate Govenance and Ethical ConsiderationsDocument10 pagesCorporate Govenance and Ethical ConsiderationsCristine Joy AsduloNo ratings yet

- Company Law ConciseDocument30 pagesCompany Law ConciseKrupa Diamond DandNo ratings yet

- Notes of CgeDocument33 pagesNotes of Cgesurajverma76766No ratings yet

- Business Ethics and Corporate GovernanceDocument55 pagesBusiness Ethics and Corporate GovernanceVaidehi ShuklaNo ratings yet

- Corporate GovernanceDocument7 pagesCorporate GovernanceVir Ved Ratna Jaipuria LucknowNo ratings yet

- Corporate GovernanceDocument8 pagesCorporate Governanceshaifali pandeyNo ratings yet

- Corporate Governance Plays A Crucial Role in Determining The Performance of A FirmDocument1 pageCorporate Governance Plays A Crucial Role in Determining The Performance of A FirmIRFAN ULLAHNo ratings yet

- Corporate/Organization Governance Principles CorporationDocument4 pagesCorporate/Organization Governance Principles CorporationKathleen MarcialNo ratings yet

- Board of DirectorsDocument17 pagesBoard of DirectorsOyeleye TofunmiNo ratings yet

- Question Answered From Corporate Governance - A Book by Christine A. MallinDocument7 pagesQuestion Answered From Corporate Governance - A Book by Christine A. MallinUzzal Sarker - উজ্জ্বল সরকার100% (5)

- Mohammad Uvais PDF - 082250Document29 pagesMohammad Uvais PDF - 082250aizah25102000No ratings yet

- Project On Corporate GovernanceDocument21 pagesProject On Corporate GovernanceSamriddhi RakhechaNo ratings yet

- Samson, Roel Rhodael P. AC1204 MWF 10:30AM - 12:00AM GR344MCDocument4 pagesSamson, Roel Rhodael P. AC1204 MWF 10:30AM - 12:00AM GR344MCroel rhodael samsonNo ratings yet

- Corporate Governance Is A Fundamental Aspect of Business OperationsDocument5 pagesCorporate Governance Is A Fundamental Aspect of Business Operationsprojectssupervision70No ratings yet

- Governance, Risk, and EthicsDocument6 pagesGovernance, Risk, and EthicsbhoomailidNo ratings yet

- Ethics AssignmentDocument12 pagesEthics AssignmentMAKHIJA ROHIT DILIP F.Y.BBA.No ratings yet

- M Topic 5017-8225Document93 pagesM Topic 5017-8225asifn550No ratings yet

- Corporate GovernanceDocument19 pagesCorporate GovernanceNadeem GanaiNo ratings yet

- CORPORATE GOVERNANCE-assignmentDocument33 pagesCORPORATE GOVERNANCE-assignmentFitha FathimaNo ratings yet

- Corporate Governance: That Dictate How A Company's Board of Directors Manages and Oversees The Operations of A CompanyDocument12 pagesCorporate Governance: That Dictate How A Company's Board of Directors Manages and Oversees The Operations of A CompanyMagadia Mark JeffNo ratings yet

- Presentation On Corporate GovernanceDocument29 pagesPresentation On Corporate Governancesuren471988No ratings yet

- Acctg 9 Chap 3 TermsDocument9 pagesAcctg 9 Chap 3 TermsAnjelika ViescaNo ratings yet

- CSC-AE10-GBERMIC-Module 2Document6 pagesCSC-AE10-GBERMIC-Module 2Marjorie Rose GuarinoNo ratings yet

- Assignment On Corporate GovernanceDocument22 pagesAssignment On Corporate GovernanceRakib TusharNo ratings yet

- Notes5 Module3 BECG GCWDocument18 pagesNotes5 Module3 BECG GCWjayeshraj0000No ratings yet

- Project On Corporate GovernanceDocument22 pagesProject On Corporate GovernancePallavi PradhanNo ratings yet

- INTRODUCTION TO CORPORATE GOVERNANCE Law NotesDocument11 pagesINTRODUCTION TO CORPORATE GOVERNANCE Law Notesjoseph mbuguaNo ratings yet

- Company StructureDocument5 pagesCompany Structures4hilplaysNo ratings yet

- "Reigning the Boardroom: A Trailblazing Guide to Corporate Governance Success": GoodMan, #1From Everand"Reigning the Boardroom: A Trailblazing Guide to Corporate Governance Success": GoodMan, #1No ratings yet

- Synopsis PDFDocument4 pagesSynopsis PDFArushi PrasharNo ratings yet

- RRMI23 - Panjab University - Store Allocation ScheduleDocument14 pagesRRMI23 - Panjab University - Store Allocation ScheduleArushi PrasharNo ratings yet

- INTERNSHIPDocument70 pagesINTERNSHIPArushi PrasharNo ratings yet

- SYNOPSISDocument4 pagesSYNOPSISArushi PrasharNo ratings yet

- PSlip 210723 294108Document1 pagePSlip 210723 294108Arushi PrasharNo ratings yet

- Week 1: Bazaar&student ARUSHI PRASHAR&city LUDHIANA&store - Code FRBG&secret 241288&student - Cod e 230343004Document3 pagesWeek 1: Bazaar&student ARUSHI PRASHAR&city LUDHIANA&store - Code FRBG&secret 241288&student - Cod e 230343004Arushi PrasharNo ratings yet

- Data Structures (Queue) : Madhuri KalaniDocument45 pagesData Structures (Queue) : Madhuri KalaniMadhuri KalaniNo ratings yet

- Topic: Big Data - Research ICT-16-2015: EnglishDocument2 pagesTopic: Big Data - Research ICT-16-2015: EnglishpankajpandeylkoNo ratings yet

- General Settings: 152 Tutorial Manual - PLAXIS 2D 2018Document13 pagesGeneral Settings: 152 Tutorial Manual - PLAXIS 2D 2018Boni TamaNo ratings yet

- Ubc 2010 Fall Mueller JeffDocument168 pagesUbc 2010 Fall Mueller JeffmanojkumarNo ratings yet

- AluminiumDocument31 pagesAluminiumsamuelNo ratings yet

- 2017 - 03741 - Package Inserts Layout MC-Media Pad Aerobic Count - Rev 1Document2 pages2017 - 03741 - Package Inserts Layout MC-Media Pad Aerobic Count - Rev 1Alim BTuackNo ratings yet

- Judicial Activism and Juducial Restraint (Legal Language)Document26 pagesJudicial Activism and Juducial Restraint (Legal Language)Aishani ChakrabortyNo ratings yet

- Impact of COVID-19 in Education SectorDocument9 pagesImpact of COVID-19 in Education SectorIJRASETPublicationsNo ratings yet

- 2021 Elementary Cs Form 1 Revised 2017 PDF Position Description FormDocument20 pages2021 Elementary Cs Form 1 Revised 2017 PDF Position Description FormFe Belgrado SerranoNo ratings yet

- Ting Ho, Jr. v. Teng Gui, GR 130115, July 16, 2008, 558 SCRA 421Document1 pageTing Ho, Jr. v. Teng Gui, GR 130115, July 16, 2008, 558 SCRA 421Gia DimayugaNo ratings yet

- Gitam UniversityDocument100 pagesGitam UniversityvicterpaulNo ratings yet

- Graduation Paper TUDelft DPdeBruijn 4036549 RepositoryDocument197 pagesGraduation Paper TUDelft DPdeBruijn 4036549 RepositoryErmal SpahiuNo ratings yet

- Gypsum Board Shaftwall Arch Spec en 09260 09211623Document15 pagesGypsum Board Shaftwall Arch Spec en 09260 09211623can_cer087No ratings yet

- Dublin Core Metadata Element SetDocument6 pagesDublin Core Metadata Element SetCursoBD2008No ratings yet

- Ig 11-01 (LITHIUM-01X) ML COL MORNING 03-12-2023)Document28 pagesIg 11-01 (LITHIUM-01X) ML COL MORNING 03-12-2023)nour deghaidyNo ratings yet

- Recount Text Anggi 3Document3 pagesRecount Text Anggi 3Farrel AdhipramanaNo ratings yet

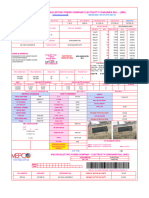

- MEPCO ONLINE BILL BankDocument1 pageMEPCO ONLINE BILL Bankahmadjutt19823No ratings yet

- Tiny Encryption Algorithm (TEA) For The Compact Framework: Download Source Files - 96.1 KBDocument5 pagesTiny Encryption Algorithm (TEA) For The Compact Framework: Download Source Files - 96.1 KBMichael MargoleseNo ratings yet

- Texas A&M Contract With AdidasDocument25 pagesTexas A&M Contract With AdidasJason TrahanNo ratings yet

- The Ultimate Yoga Teacher Training GuideDocument29 pagesThe Ultimate Yoga Teacher Training GuidealiounseydiNo ratings yet

- Angeles Univ Foundation v. City of AngelesDocument2 pagesAngeles Univ Foundation v. City of AngelesGlenn Mark Frejas RinionNo ratings yet

- A Resource Guide For Departmental Managers and HR ProfessionalsDocument37 pagesA Resource Guide For Departmental Managers and HR ProfessionalssimasolunkeNo ratings yet

- Edwards J. - Piping Workbook. Solving Piping and Header Networks Using Chemcad Version 6.2Document73 pagesEdwards J. - Piping Workbook. Solving Piping and Header Networks Using Chemcad Version 6.2نزار الدهاميNo ratings yet

- Remanufacturing Operations Performance, Firm Performance, PakistanDocument18 pagesRemanufacturing Operations Performance, Firm Performance, PakistanSandesh TariNo ratings yet

- Avarta WhitepaperDocument33 pagesAvarta WhitepaperTrần Đỗ Trung MỹNo ratings yet

- Angostura - Vals Venezolano Tab by Antonio Lauro at Ultimate-GuitarDocument3 pagesAngostura - Vals Venezolano Tab by Antonio Lauro at Ultimate-GuitarHarold CamayaguanNo ratings yet

- I) Measurement of ResistanceDocument20 pagesI) Measurement of Resistancesubho199167% (3)

- Hvac Resume SkillsDocument6 pagesHvac Resume Skillsg1hulikewes2100% (2)

- Tracvision Hd11 User'S Guide: Using The Web InterfaceDocument2 pagesTracvision Hd11 User'S Guide: Using The Web InterfaceMostafa ZidanNo ratings yet

- ImmuniWeb Website Security Test Report - Website Lldikti4Document13 pagesImmuniWeb Website Security Test Report - Website Lldikti4Hilfan SoeltansyahNo ratings yet