Professional Documents

Culture Documents

Helpful Innovation or Unnecessary Complication

Uploaded by

Mashael MoosaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Helpful Innovation or Unnecessary Complication

Uploaded by

Mashael MoosaCopyright:

Available Formats

UCLA Journal of Islamic and Near Eastern Law

____________________________________________________________________________________ Volume 9 2009-2010 Number 1

Articles

INNOCENT VICTIMS: AN ACCOUNTING OF ANTI-TERRORISM IN THE EGYPTIAN LEGAL CONTEXT

Mona Atia

OF SCALPELS AND SLEDGEHAMMERS: RELIGIOUS LIBERTY AND THE POLICING OF MUSLIM CHARITIES IN BRITAIN AND AMERICA SINCE 9/11

Malick W. Ghachem

Essays

TABARRU IN TAKAFUL: HELPFUL INNOVATION OR UNNECESSARY COMPLICATION?

Oliver Agha

Comments

VEILING RELIGION IN THE FORCE: THE VALIDITY OF RELIGION-NEUTRAL APPEARANCE AS AN EMPLOYER INTEREST

Sami Hasan

Tabarru in Takaful: Helpful Innovation or Unnecessary Complication?

Oliver Agha*

Aisha is an observant Muslim homemaker trying to build her life, and that of her family, around Islamic principles. She fasts, gives charity, prays and tries her best to live her life with respect for others and with dignity. Aisha avoids, as best as she can, any act that would be subject to opprobrium, and she is particularly aware of the condemnation of partaking in usury and conventional banking arrangements. A flashy new Islamic insurance product called "takaful" presents itself. Not many details are forthcoming except for the product being called "sharia 1 compliant". What are Aishas obligations in examining such a product before she can make a decision about whether she will subscribe to it? What if the product is based on a fundamentally flawed structure? Or what if it is based on a model that simply replicates a conventional profile? Does she partake in takaful, thrilled at the idea of having a choice that actually reflects her values? Or does Aisha ask questions until she understands and evaluates the basis for the structure? Aishas decision-making may be anecdotal, but it nonetheless reflects the decisions millions of Muslims make around the world. Islamic finance

* Oliver Agha is a founding partner of Agha & Shamsi, believed to be the first shari'a compliant law firm established, inter alia, to provide excellence in the field of Islamic finance. Mr. Agha, New York lawyer by training, previously with international firms (DLA Piper, Clifford Chance Saudi affiliate and Fulbright & Jaworski) is recognized as a leading finance authority having worked on many leading and innovative deals across the Islamic spectrum. He is on the board of the Accounting and Auditing Organization of Islamic Finance Instsitutions (AAOIFI) and is recognized as a top Islamic finance lawyer by numerous publications. He is the author of published papers, articles and presentations regarding salient Islamic finance topics and has been invited to speak at numerous Islamic conferences on a television (CNBC) and radio. The author would like to thank senior AAOIFI members for contribution to the article including Sheikh Esam Ishaq, associates at Agha & Shamsi including Mehreen Awan, and a senior associate at a previous firm, Peter Hodgins, for research and contribution. 1 Shari'a is commonly defined as Islamic Law. See WAEL B. HALLAQ, SHARI'A: THEORY, PRACTICE, TRANSFORMATIONS (2009) for an indepth account of viewing shari'a as Islamic Law.

101

102

9 UCLA J. ISLAMIC & NEAR E.L. 101 (2010)

financing steeped in the ethics and spirituality of Islamis at a crossroads. While the industry has largely avoided the crises in the conventional banking world, the real danger to Islamic finance looms from one endemic riskthe desire to develop sharia structures that replicate conventional products. As the industry grows and matures, more structures will be scrutinized and a narrower definition of what is permissible will likely develop as many Muslims, and non-Muslims (attracted to such products due to the ethical nature of Islamic finance), seek more genuineness in sharia products. Some have justified sanctioning products that replicate conventional profiles based on necessityasserting that the "development" of Islamic finance justifies structures that replicate conventional products.2 However, dressing up conventional structures in Islamic garb undermines the industry and imports dangers (relating to over-leverage and resulting from bifurcation of assets from debt) into the Islamic finance realm. What is equally discomforting as invoking "necessity" to justify products that are essentially conventional in substance is the adoption of structures that do this even when an independent Islamic construct would serve as a perfectly adequate basis for the intended commercial arrangement. This Article identifies one such circumstance where, despite the existence of sharia bases of support, tenuous structures are instead adopted that accomplish the intended commercial arrangements through a circuitous path and which suffer from serious enforceability issues. More importantly, such structures undermine the credibility of Islamic products as a whole and could likely result in many turning away from the industry. As the Islamic finance industry grows, its success must not come at the cost of sacrifice of its spiritual underpinning (to always put principle before profit). Success for ethical ventures cannot be measured in economic terms alone; rather, true success is measured in the adherence to a higher moral standard and the derivative success that flows from such adherence. The financial solution of takaful (Islamic insurance) has emerged in response to consumer demand for sharia compliant insurance products. The Arabic word takaful comes from the root word "kafala," which means guarantee. Takaful is therefore commonly interpreted as "mutual guarantee" and is growing at a staggering pace, as "the global Takaful industry is growing by [twenty percent] per annum."3 "The takaful industry recorded double-digit growth last year despite the global downturn, registering [eighteen and

2 Islamic Banking Special Supplement: Shari'a Governance a Challenge to Islamic Banking, TRADING MARKETS.COM, Oct. 11, 2009, http://www.tradingmarkets.com/.site/news/Stock%20 News/2573711/. 3 ERNST & YOUNG, THE WORLD TAKAFUL REPORT 24 (2008), available at http://www.ey. com/Publication/vwLUAssets/World_Takaful_Report_2008./$FILE/Ernst_&_Young_-_WTR 08%5B1%5D.pdf.

Tabarru in Takaful: Helpful Innovation or Unnecessary Complication?

103

twenty percent] rise in net contribution and total fund assets, respectively."4 "Islamic insurance (takaful) is estimated to grow to $3.519 billion (Dh12.91) by the end of 2010 in the Gulf and the industry would grow at a faster pace than conventional insurance . . . ."5 However, some of the transactional takaful structures upon which this industry is being built are questionable and of tenuous enforceability. Traditionally, insurance has been viewed sceptically by some in the Islamic world on the grounds that it covers a transaction that (i) has gharar (uncertainty); (ii) contains maisir (speculation) and (iii) is contrary to the concept of tawakkul (reliance on Allah).6 The elements of uncertainty and speculation are said to exist particularly in relation to nonlife insurances because it is said to be uncertain/speculative whether an event of loss will occur. Therefore, it is uncertain whether an insured will ever receive a benefit in return for his premium. In reaction to these issues, takaful has evolved by characterizing the contribution (premium) as a form of tabarru (donation).7 The rationale was that if the premium payor makes an absolute donation, then there is no legal expectation of return because donations are non-contingent and non-binding obligations, i.e. no contractual payment has been made. By making a donation, the premium payor is not entitled to a return upon the occurrence of an event of loss. By the same token, the insurer is not required to pay back the insured upon the occurrence of an event of loss because the insurer has received merely a donation (rather than a contractual premium payment) for which it cannot be obliged to act in any way. In a typical takaful contract, the expectation from both parties is to act as in a conventional insurance contract; however, in an Islamic adjudicative forum, it is unclear whether the arrangement would, in fact, represent enforceable obligations because under the structure, both sides relinquish rights to enforce at the onset. The use of tabarru in the takaful context is an innovation that lacks sharia basis and triggers both enforceability and transactional concerns and complexities. In particular, the application of the tabarru concept ironically

Laalitha Hunt, Innovation key to Growth for Takaful, STAR ONLINE, Aug. 8, 2009, http:// biz.thestar.com.my/news/story.asp?file=/2009/8/8/business/4346310&sec=business. 5 Laxman, Takaful Market to Grow Faster than Conventional Insurance, OPALESQUE.COM, Jan. 14, 2010, http://www.opalesque.com/IslamicFinance_Briefing/?p=5893. 6 Naturally, conventional insurance operations have other endemic features that are additionally problematic, such as interest returns on investments by the insurance company. See Fethullah Gulen, Tawakkul, Taslim, Tafwiz, and Thiqa (Reliance, Surrender, Commitment, and Trust), FETHULLAH GULEN'S WEB SITE, June 14, 2006, http://www.gulenmovement.com/ sufism-1/878-tawakkul-taslim-tafwiz-and-thiqa-reliance-surrender-commitment-and-confidence.pdf. 7 MUHAMMAD AYUB, UNDERSTANDING ISLAMIC FINANCE 125 (2007).

4

104

9 UCLA J. ISLAMIC & NEAR E.L. 101 (2010)

may result in undermining the utility of takaful, namely, to provide financial compensation to the participant in the event of a loss. By characterizing the contribution as tabarru, which is a unilateral obligation, the participants very right to compensation in the event of a loss comes into question. Furthermore, it is doubtful whether the concepts of gharar and maisir were ever intended to apply in the context of insurance. Gharar precludes tenuous transactions (originally focussed on uncertain subject matters of a salee.g., sale of fish before they are caught or more aptly the sale of an unborn calf which cannot be sold until it is born healthy).8 Unlike a contract for the sale of uncertain goods, in a takaful contract, the insured is accepting from the outset that an event of loss may not occur. By contrast, in the sale of an uncertain subject matter contract the buyer is counting on the delivery of certain goods but simply may not receive the goods in expected condition due to the inherent uncertainty of the transaction at the time the contract was formed. The application of gharar in the context of insurance misses the point because insurance obligations are not uncertain or tenuous but absolute (albeit contingent). There are only two possibilitieseither the loss will occur or it will not. In both cases the parties to a contract have a clear understanding as to which way to proceed at each event. Arguing that insurance is speculative (maisir) also misses the point. Maisir prohibits enrichment without labor.9 The primary reason for insurance is protection, not speculative investment. The niya (intention) and business purpose behind insurance would dictate further whether it is speculative; blanket judgement on insurance being speculative throws the baby out with the bathwater. Making the point that insurance conflicts with the principle of tawakkul as the insured is putting his trust in the insurer (or in their own provisions) rather than in God is similarly flawed as there is authority that alleviating risk is not necessarily contrary to the will of Allah (as referenced later in this Article).10 Furthermore, far from being inconsistent with tawakkul, communal risk sharing and mitigation of risk are in fact sharia ordained prescriptions. On balance, takaful arrangements by their very nature are congruous with sharia precepts and tabarru is not required to render such arrangements permissible. Takaful in practice effectively involves bilateral arrangements (not parallel unilateral undertakings based on donation). Most conventional insurance works on the basis of risk transfer, but takaful involves the concept of communal risk sharing.

8 See FRANK E. VOGEL & SAMUEL L. HAYES III, ISLAMIC LAW RISK AND RETURN 88 (Kluwer Law International) (1998). 9 See AYUB, supra note 7, at 112. 10 See infra note 15-18.

AND

FINANCE: RELIGION,

Tabarru in Takaful: Helpful Innovation or Unnecessary Complication?

105

INTRODUCTION Insurance is an essential component of modern commerce: it mitigates risks and minimizes the effect of losses on businesses. Management, financiers, investors and individuals all wish to have the certainty that business and family security will continue notwithstanding the occurrence of unforeseen risks and often require that such insurance be in place. However, Muslim society has historically been slower to accept insurance as permissible or, indeed, necessary. This is due in part to the mutual support that has long existed within Muslim communities, bolstered by the religious imperative to help their members overcome such losses. However, the long running debate amongst scholars as to the permissibility of insurance11 has undoubtedly also led many Muslims to be skeptical about insurance products. Some scholars who accept that insurance is permissible in Islam,12 have sought to justify takaful by reference to the principle of tabarru.13 Based on the doctrine of tabarru, every takaful structure involves two unilateral contracts: I. A donation by the participant (insured) to the operator (insurer), i.e. the equivalent of the premium in a conventional insurance; and II. In the event of a loss, a second donation in the amount of the loss, this time from the operator, on behalf of the insurance pool, to the beneficiary (who will often also be the participant in many non-life insurances). The purpose of this Article is to consider whether any form of insurance is permissible under Islamic principles and, if so, whether it is necessary to resort to tabarru in order to comply with such principles. This Article therefore considers: I. The jurisprudence which favors the permissibility of insurance;

11 An example of the ruling against the permissibility of insurance is the following fatwa issued by the Fiqh Academy, Jeddah: "The commercial insurance contract, which has fixed premium, is a contract that has a high degree of uncertainty. This high degree of uncertainty invalidates a contract. Therefore, it is haram (impermissible) from the Shari'ah point of view." See http://www.isra.my/fatwas/takaful/modes-of-contract/70-resolution-no-9-resolution-9session-2-issued-by-the-international-council-of-fiqh-academy-regarding-insurance-andreinsurance.html. 12 There are scholars who totally reject any practice of insurance (whether by way of conventional insurance or takaful or otherwise) on the grounds that it is strictly prohibited in shari'a because of elements of riba, maisir and gharar. These scholars include Mustafa Zaid, Abdullah al-Qalqeeli and Jalal Mustafa al-Sayyad. See MOHD MA'SUM BILLAH, APPLIED TAKAFUL AND MODERN INSURANCE: LAW AND PRACTICE 70 (2007). 13 For example, the 1985 Fiqh Academy ruling declared that conventional insurance was forbidden but that insurance based on the application of cooperative principles, shari'a compliance and charitable donations was acceptable.

106

9 UCLA J. ISLAMIC & NEAR E.L. 101 (2010)

II. The arguments against the permissibility of insurance and the features of conventional insurance which require adaptation in order to achieve sharia compliance; III. The structures commonly used in takaful and the extent to which such structures address the concerns identified; and IV. The concept of tabarru and its role in modern takaful. This Article concludes that insurance appears to have sharia support (subject to certain modifications to the operations of insurers) and that the doctrine of tabarru, in particular, is an unnecessary complication that creates enforceability issues without solving the purported problems its usage seeks to address. I. THE PERMISSIBILITY

OF

INSURANCE

IN

ISLAM

The Qur'an encourages commerce and honoring obligations.14 Takaful is a blend of commerce and mutuality. It attempts to safeguard loss for protection of the family or insureds and therefore, subject to the application of certain principles, takaful would appear to be permissible. A. Islam is Not Restrictive Islamic jurisprudence encourages activities that positively contribute to the community. Positive innovation, that is not deceptive, is not to be restricted. Islam generally does not restrict any parties freedom to enter into transactions other than in respect of certain haram activities: "The origin of everything is lawful unless an authority proves it to be unlawful."15 It follows that every transaction (including insurance) is presumed to be permissible unless authority expressly proves otherwise. Furthermore, as a general principle, contractual obligations should be honored: ". . . O you who believe! Squander not your wealth among yourselves in vanity, except it be a trade by mutual consent . . . ."16 As contractual obligations, takaful contracts ought to be honored and are enforceable unless such contracts contravene an express Islamic authority. B. Is the Concept of Insurance Prohibited Per Se? A central argument commonly raised is that insurance is contrary to the concept of tawakkul, whereby each Muslim is required to put his trust in

See Qur'an 4:29 (Marmaduke Pickthall trans., 1930) (quoted in full below). SUYUTI, AL-IMAM JALAUDIN ADB RAHMAN, AL-ASHBAH WA-EL NAZAIR 60 (Dar alKutub al-llmiya 1983). 16 Qur'an 4:29 (Marmaduke Pickthall trans., 1930).

14 15

Tabarru in Takaful: Helpful Innovation or Unnecessary Complication?

107

Allah.17 Thus it is said that insurance conflicts with this principle as the insured is putting his trust in the insurer or in his own provisions rather than relying on Allah. This is a flawed argument. There is clear authority that alleviating risk is not necessarily contrary to the will of Allah: "The Holy Prophet told a Bedouin Arab who left his camel untied, trusting to the will of Allah, tie the camel first then leave it to the will of Allah . . . ."18 Furthermore, not only is the alleviation of risk permitted, Islam positively encourages people to overcome the difficulties in life as per Sahih al-Muslim, Kitab al-Birr: ". . . Narrated by Abu Huraira, the Holy Prophet said: Whosever removes a worldly grief from a 'Mumin,' Allah will take away from him one of the griefs of the hereafter. Whosoever alleviates a needy person Allah will alleviate him from both the world and the hereafter . . . ."19 ". . . Allah desires ease for you and He does not desire hardship for you . . . ."20 It is clear from the above examples that sharia principles support taking steps to reduce risk and mitigate loss, and therefore alleviate harm or burden to the wider community. The issue is not therefore with regard to the fundamental concept of insurance, but instead with regard to the way in which insurance operates in the modern commercial context. The focus should therefore be on examining the way in which conventional insurance is transfigured into a sharia compliant structure to ensure that it is sound from both a sharia and commercial perspective. II. ISSUES

WITH

CONVENTIONAL INSURANCE

Identified below are the issues that purportedly justify the prohibition on conventional insurance. Some of these issues pose serious sharia issues, but are obviated in an authentic takaful structure. Other objections raised in sharia are actually based on misconceptions of aspects of the structure in the conventional context and a resulting inaccurate application to the Islamic concepts: A. Riba (Interest/Usury)

There are two aspects to the argument that conventional insurance involves elements of riba. First, most (if not all) conventional insurers will invest premium income in interest bearing investments. This is contrary to the clear, and well recognized, prohibition in Islam:

17 The author has had several casual discussions with members of the community and at Islamic conferences where these arguments have been raised. 18 TIRMIDHI, SUNAN AL-TIRMIZI 668. 19 SAHIH AL-MUSLIM, KITAB AL-BIRR 59. 20 Qur'an 2:185 (Ali Quli Qarai trans.) (2003).

108

9 UCLA J. ISLAMIC & NEAR E.L. 101 (2010) Those who exact usury will not stand but like one deranged by the Devils touch. That is because they say: 'Trade is like usury. While Allah has allowed trade and forbidden usury. Whoever, on receiving advice from his Lord, relinquishes [usury], shall keep [the gains of] what is past, and his matter shall rest with Allah. As for those who resume, they shall be inmates of the Fire and they shall remain in it [forever]. Allah brings usury to naught, but He makes charities flourish.21

Such a criticism of conventional insurance albeit valid, is not fatal to the possibility of insurance in Islam. Clearly it is possible for an insurer to invest in assets that are sharia compliant using products developed by the Islamic finance markets. Second, the prohibition on riba may be said to result in a windfall for the beneficiary particularly if the payment on the event of loss exceeds the fair market value of the insureds property. However, the very purpose of the contract is to cover loss for the beneficiary and payments in excess of market value can be well guarded against. Furthermore, over-insurance does run the risk of the contract being considered in violation of the sharia for providing a disproportionate and speculative return and for violating the essential spirit of the takaful contract to the insured. However, this issue can be addressed, as well, through clear underwriting policies. And, in any event, many countries laws (including for example English law) prohibit such over-insurance.22 B. Maisir Some scholars have suggested that conventional insurance is akin to gambling. Again, the prohibition on gambling (qimar), which is equated to intoxication, is clear: "They ask you concerning wine and gambling. Say: 'There is a great sin in both of them . . . .'"23 Gambling involves betting money in a pool whereby there is a chance of losing the amount at stake or winning a much greater amount on an outcome. There are admittedly simiQur'an 2:275 (Ali Quli Qarai trans., 2003). Islamic commentators have referenced this verse as being poignant particularly in today's troubled economic times. The banking system, based on interest lending (riba) and sale of loan receivables, CDOs (contravenes the Islamic prohibition on trading of debt) and proliferation of hedge funds and speculative trading (maisir) has landed the conventional ship into stormy seas because it has navigated into spiritually forbidden waters. 22 For example, over-insurance in England may result in a policy being void for misrepresentation and is commonly expressly prohibited by the terms of the insurance policy. Notably, conventional insurers are typically keen to avoid either under-insurance or over-insurance on the basis that either such circumstance impacts upon the risk assessment (in particular the moral hazard associated with a risk) and the premium calculation. 23 Qur'an 2:219 (Ali Quli Qarai trans., 2003).

21

Tabarru in Takaful: Helpful Innovation or Unnecessary Complication?

109

larities between gambling and insurance in that they both involve: (i) the payment of a sum (the stake or the premium); (ii) the possibility of receiving a greater sum in return (the insurance claim or the winnings); and (iii) the return being based on the occurrence of a specific event. There are, however, real and significant differences that distinguish insurance from gambling. These differences are considered in the following paragraphs. Extensive consideration has been given to analyzing these differences in many Western jurisdictions, such as England, where gambling contracts are unenforceable as a matter of law, unlike contracts of insurance. i. Insurable Interest

Holding insurance akin to gambling involves a fundamental misconception of conventional insurance. As one leading insurance text notes:

Both insurance contracts and wagering contracts are aleatory. The risk of loss in a wager, however, is created by making the bet itself, and the sole interest of each party consists of the sum or stake he will either win or lose, whereas typically the function of insurance is protect the insured in respect of the risk of loss to an interest he possesses independently of the conclusion of the contract.24

Thus, in order to be an insured, the insured must stand to lose something in addition to the amount of his premium. What suffices for these purposes is defined in many common law systems by reference to the concept of "insurable interest." It is this interest in the subject matter of the insurance that fundamentally differentiates insurance from gambling. Most common law jurisdictions require the insured to have a pecuniary (i.e. economic) interest in the subject matter of the insurance. To the extent that an insured does not have a pecuniary interest in the risk insured, the insured cannot recover. The lack of an insurable interest renders the contract unenforceable. This principle has been reinforced in England by long-standing legislation; for example, the Marine Insurance Act 1745 provided:

[N]o assurance or assurances shall be made by any person or persons bodies corporate or politic on any ships or ships belonging to his Majesty or any of his subjects or any goods, merchandise, or effects, laden or to be laden on board any ship or ships, interest or no interest, or without further proof of interest than the policy, or by way of gaming or wagering . . . and that every such assurance shall be null or void to all intents and purposes.25

NICHOLAS LEGH-JONES, JOHN BIRDS & DAVID OWEN, MACGILLIVRAY ON INSURANCE LAW 7 (Sweet & Maxwell 11th ed. 2008). 25 Marine Insurance Act, 1745, 19 Geo. 2, c. 37 (Eng.) (repealed by the Marine Insurance Act of 1906).

24

110

9 UCLA J. ISLAMIC & NEAR E.L. 101 (2010)

The subsequent Marine Insurance Act of 1906 expressly provides at section 4(1) that every contract of marine insurance by way of gaming and wagering is void.26 Outside of the context of marine insurance, the Gaming Act of 1845 provides that: "All contracts or agreements, whether by parole or in writing, by way of gaming or wagering shall be null and void."27 The insurance industry in England is therefore fundamentally based on the understanding that insurance is not gambling. The jurisprudence on insurance in England has therefore developed after consideration of the characteristics of insurance in comparison to gambling. Admittedly, there are types of conventional insurance that are not indemnity-based and may be viewed as gambling from the perspective of the sharia, notwithstanding the different interpretation in English legislation. These may include insurance policies that provide for a fixed sum, or a sum calculated by a formula irrespective of the amount of loss (i.e. contingency policies); as well as valued policies and property policies which include "new for old" provisions which could, in theory, generate a profit for an insured in the event of loss. However, the existence of a few such policies, naturally, does not justify the conclusion that all insurance is impermissible under the sharia. It is only certain forms of insurance that would likely be prohibited under the scrutiny of sharia. ii. Other Distinctions A group of scholars headed by Sheikh Mustafa Al-Zarqa and Shaikh Abudullah Bin Menai have contested the prohibition of insurance on the basis that the element of chance is more limited than in gambling.28 Insurance companies underwrite risks on the basis of complex actuarial analysis of the probability of loss occurring based on a thorough investigation of the insured and the statistical loss data for the market. Underwriting is therefore a costplus exercise whereby the insurer charges a premium that will cover the probable losses of the portfolio of risks whilst allowing for a reasonable profit. Shaikh Abdullah bin Menai argues that for gambling to exist there should be a loser and a winner. In insurance, to the contrary, both parties stand to gain. The insurer gains the amount of premium and the insured the security against the risk of loss of the subject. Muhammed Nejatullah Siddiqi asserts that loss or gain associated with gambling is based on chance and luck only and does not involve any labor,

Marine Insurance Act, 1906, 6 Edw. 7, c. 41 4 (Eng.). Gaming Act of 1845, 8 & 9 Vict., c. 109 (Eng.) (repealed 1 Sept. 2007). 28 See generally SHEIKH MUSTAFA AL-ZARQA, NIZAM AL-TAMIN: HAQIQATUH, WA AL-RAY ALSHARI FIH (Muassasat Al-Risalah 4th ed. 1994).

26 27

Tabarru in Takaful: Helpful Innovation or Unnecessary Complication?

111

competence or service.29 The redistribution of money pursuant to gambling is a blind distribution and contrary to justice and fair play. In contrast, insurance premiums collected from insureds who do not suffer loss are used to pay those insureds who do. Siddiqi concludes that the redistribution associated with insurance is therefore a redistribution of risk and not money. Neither the insured who suffered loss nor the insured who did not suffer loss have made any undue gains in this situation. Instead, they have both shared the financial burden of the peril. C. Gharar and Jahalah

The concept of uncertainty is analyzed by Islamic scholars in two ways. One is gharar, which means the selling of something the availability of which is uncertain, such as selling an unborn calf. The other is jahalah,30 which means entering into a contract where the subject of the contract is unspecified in quantity or size, due to the parties lack of knowledge about the subject. Buying a car without knowledge of its model, type, mileage, condition or year of production would be an example of jahalah. In order to be valid, a contract ought to be free from uncertainty, whether in the form of gharar or jahalah. Some scholars argue that insurance is subject to such uncertainty, because neither the insurance company nor the insured know the consequences of the contract into which they are entering. The only 'uncertainty in an insurance contract relates to whether an event of loss will occur. If the event of loss does occur, the amount to be paid is either pre-agreed or arrived at upon the occurrence of the loss. If it does not, there is no expectation of payment. Therefore, contingency of whether or not an event occurs does not fall within the intended ambit of gharar or jahala because in either event there is absolute certainty (either a loss occurs and is compensated or it does not occur and therefore need not be compensated). As Mohammed Masum Billah notes: "An insurance contract also does not involve the elements of al-gharar (uncertainty). In an insurance policy the subject matter is usually the life or property that is protected against future risk. The subject matter of the insurance contract is definite and certain."31 Insurance is merely a contingent contract, where all of the salient terms of the contract are certain and pre-agreed. These salient terms of the contract, namely: (i) the subject matter of the insurance; (ii) the amount insured; (iii) the perils insured against; (iv) the matters that are ex29

SPECTIVE (Sci. Publishing Center, King 30 See VOGEL, supra note 8, at 90.

31

See generally MUHAMMAD NEJATULLAH SIDDIQI, TEACHING ECONOMICS Abdulaziz Univ., Jeddah, 1996). BILLAH, supra note 12, at 76.

IN ISLAMIC

PER-

112

9 UCLA J. ISLAMIC & NEAR E.L. 101 (2010)

cluded; and (v) the limits of the amount of the insurance are addressed in the insurance policy. The criticism of conventional insurance on the basis that the insured may not receive a benefit unless they suffer a compensable loss misconceives the purpose of insurance. Whilst premium rebates or no claims discounts are commonplace, an insured does receive a benefit of security and stability from purchasing an insurance policy. Further, this criticism overlooks the larger scale benefit provided by insurance, namely, the security that it provides and the overall reduction of the burden on society that would arise in respect of individuals and companies that suffer serious losses. Furthermore, it is paradoxical that insurance is criticized on the basis of the risk that the insured and insurer are undertaking. The prohibition of riba, although primarily applied in the context of loan transactions, is intended to prevent any transaction whereby one contracting party ensures a return at the expense of the other contracting party without undertaking any real risk. Such a transaction is not considered to be of benefit to society because one party gains at anothers expense without a commensurate share in the underlying risk to the borrower. Yet in the guise of gharar, conventional insurance is rejected precisely because the insurer is undertaking an element of business risk. D. Lack of Express Authority Some may argue that there is no express authority on the permissibility of insurance and therefore it is not permissible (in any form). This argument lacks jurisprudential basis and runs contrary to the innovative approach in Islam. More fundamentally, it directly contradicts the references to Quran and hadith cited above. In addition, there are at least two practices from the time of the Prophet, (peace be upon him) which are directly analogous to insurance. The first is the practice of hilf alfadool. This was a pact made between the people of Mecca to assist foreign traders in the event of a dispute with a Meccan whereby the Meccan refused to grant the trader his right. The pact was a sort of public indemnity to traders, albeit the traders did not have to pay any amount to get the benefit of the coverage offered by the pact. This pact was mentioned by the Prophet, (p.b.u.h), to his companions as being a virtue of Islamic nature. This shows that the doctrine of collective risk alleviation was in place prior to and during the time of the Prophet of Islam. The second practice is diyah (especially where the aqilah of an individual have shared responsibility for the payment of blood money on his/her behalf thereby reducing the burden on the individual) and mawalat (a contract whereby one party agrees to bequeath property to the other party on the

Tabarru in Takaful: Helpful Innovation or Unnecessary Complication?

113

basis that the other party will pay blood money due by the former). These practices highlight that during early Islamic times, mutual arrangements defraying risk to individuals were commercially and culturally accepted. III.

TAKAFUL

AND THE

CONCEPT

OF

TABARRU

Having analyzed the issues with conventional insurance, we now consider the structure of modern takaful operations. This section outlines a typical mudaraba/wakala32 structure, briefly addresses how this structure is intended to resolve the issues identified and focuses on the role of tabarru. As one author on the subject has noted:

The idea of getting cover against risks is not intrinsically bad. In case of genuine problems and remaining within the main sharia constraints, the rule of necessity comes into play to find proper solutions. Therefore, the scholars deemed it necessary to develop a scheme or system enabling human beings to avoid misfortune and to lessen the losses in a manner not against the principles of the sharia.33

The key to this statement is the need to find 'proper solutions'.

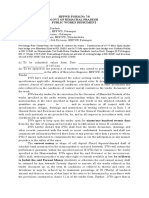

PARTICIPANT

Claim payment

CONTRIBUTIONS

PARTICIPANTS FUND Underwriting surplus RISK FUND Wakala Fee INVESTMENT FUND

Profit

Underwriting surplus Qard hasan (if necessary) TAKAFUL OPERATORS FUND

Profit

Diagram One provides an overview of a blend wakala/mudaraba model for takaful. The key features of this model are as follows:

32 Mudaraba is a trust-based contract whereby one party contributes the capital (rabb al maal) and the other party contributes labor (mudarib) to a business venture. A wakala contract is an agency contract whereby one party appoints the other party to be his agent. 33 AYUB, supra note 7, at 418.

114

9 UCLA J. ISLAMIC & NEAR E.L. 101 (2010)

Loss Sharing Not Loss Transfer: The takaful model operates on the basis that the participants insure each other on a mutual basis; thus, takaful is similar in many ways to mutual or cooperative insurance. Unlike in conventional insurance, the operator does not assume overt liability for the losses. If the losses exceed the amount in the risk fund then, depending upon the terms of the takaful policy, the operator or its shareholders may provide a qard hassan (interest-free loan) in order to ensure that losses can be paid.34 Wakala Element: The operator is appointed as wakeel (agent) for the participants in order to manage the underwriting, administration, management and claims of the takaful fund. In return the operator will receive a percentage of the contributions as a wakala fee. Mudaraba Element:35 The operator is appointed as mudarib on behalf of the takaful fund/participants (the rab al maal) to manage the investment of the amounts contained in the investment fund in a sharia compliant manner. In return for its services as mudarib, the operator receives a percentage of the profit on the investment fund in respect of its services and since the investment of the funds are on an Islamic basis (risk assumption investing) the riba prohibition is avoided. Return of Contributions: At the end of a fixed period (typically the operators financial year) a portion of the profit generated by the takaful fund after claims, reserves, operating expenses, etc. is returned to the insured. This supports the takaful contract as being a mutual risk-sharing arrangement and assuages the criticisms of maisir and gharar and unjust enrichment. Surplus: Many takaful structures also provide for a percentage of any surplus remaining in the risk fund to be paid to the operator as a performance incentive. A. Tabarru

As noted, one criticism of conventional insurance is that it includes elements of gharar (uncertainty) because the outcome of the contract in relation to the amount of loss between the participant and the operator is not known at the date of signing. It is in this regard the doctrine of tabarru has emerged. As explained above, the uncertainty as to the amount of the payment in the event of a loss is not, in the authors opinion, the type of uncer34 There may be some shari'a issues in relation to the provision of such a qard hasan by the operator particularly if it is encapsulated within the mudaraba documentary arrangements. 35 See SIDDIQUI, supra note 28.

Tabarru in Takaful: Helpful Innovation or Unnecessary Complication?

115

tainty that is intended to be prohibited by gharar and jahala. As explained above, there is a contingency but no uncertainty in an insurance contract. Prohibited uncertainty relates to subject matter rather than the contingency of events. Logically, if the inherent uncertainty in insurance arrangements does amount to gharar or jahala, this would in theory prohibit takaful as well as conventional insurance. However, it is that this point that many scholars resort to the doctrine of tabarru to justify the element of gharar. As one author on the subject notes:

[T]he concept of tabarru (donation) has been incorporated into the arrangement as the main ingredient of the contract. A participant of a takaful policy agrees to relinquish, as tabarru, the whole or a certain proportion of his takaful contributions that he undertakes to pay, thus enabling him to fulfil his obligation of mutual help should any of his fellow participants suffer.36

The incorporation of tabarru is intended to circumvent the absolute prohibition on gharar in commercial and commutative contracts by making it a unilateral donation and not in fact a bilateral contract. However, the problems with the tabarru analysis are manifest and it is doubtful that such an analysis is necessary or efficacious in resolving the perceived difficulty of gharar. i. No Conditional Tabarru A person who makes a tabarru has given away their property and their rights of ownership must therefore cease. Ownership transfers at the time of donation from the donor to the donee. It is unlawful for the donor to seek to derive any benefit from the donated property after the property has been transferred by way of tabarru: "IbnAbbas reported that the Messenger of Allah said: He who takes his gift/donation back is like a dog which takes back its vomiting."37 On this basis alone the doctrine of tabarru is wholly inconsistent with modern takaful practices, where the participant makes his contribution precisely on the basis that he expects to be reimbursed in the event of loss. Once a donation is made there can be no expectation of return. Therefore, there are critical issues of enforceability of the taburru structure under a rigorous and legalistic sharia analysis.

36 37

AYUB, supra note 7, at 42. 2 MISHKAT-UL-MASABIH 316 (Al-Haj Maulana Fazlul Karim trans., 1938).

116

9 UCLA J. ISLAMIC & NEAR E.L. 101 (2010)

ii. Inconsistency with Wakala As noted above, most models used by takaful operators include a wakala aspect whereby the operator acts as wakeel (agent) for the participants when operating the takaful fund. In its capacity as wakeel, the operator will typically have responsibility for the underwriting and claims functions. The doctrine of tabarru does not sit easily with the wakala relationship. In particular, a wakala arrangement is, by definition, a bilateral contract between a principal and an agent. Such a bilateral contract will typically involve: (1) an express grant of authority by the participant to the operator to operate the takaful fund; and, (2) a provision for the ratification of acts by the operator. The prohibition on conditional tabarru means that the operator would have free and unfettered discretion in the operation of the takaful fund. This is simply not reflected in market practice, where the operator is appointed as an agent and may be granted broad but NOT unfettered discretion. The absence of a bilateral contract between the operator and the participant undermines the utility of provisions seeking to ratify the acts of the operator. iii. Lack of Commercial Certainty It is clear that in the modern context of tabarru, where commercial entities are seeking protection against risk that the concept of donation is far from an accurate description. Far from seeking to donate their contribution for charitable purposes, such commercial entities are seeking to protect their assets (and thus indirectly benefit their shareholders); they are seeking the security that takaful provides and expect to be compensated in the event that an insured peril eventuates. CONCLUSION Tabarru is ostensibly considered to be a necessary element of takaful. The relationship between the operator and the participant in the form of parallel bilateral contracts is somehow thought to cause the element of gharar to disappear. The alleged vice which tabarru sets out to cure (mainly, the uncertainty with regard to whether an event of loss will occur) is simply not even a vice in this context. This kind of uncertainty is not impermissible. Neither the concept of gharar nor jahala were intended to prohibit takaful. Furthermore, even if the uncertainty identified falls within the concept of gharar and jahala, (and the author contends that it does not) the structuring of takaful arrangements through tabarru does not cure these issues. When applied in the context of takaful, tabarru is merely an innovation in form and not one in substance. It gives rise to conceptual, enforceability and

Tabarru in Takaful: Helpful Innovation or Unnecessary Complication?

117

transactional concerns that hinder the infrastructural development of the takaful industry rather than facilitate its growth. The views of Dr. Rafiq Yunus Al-Misri, therefore, ring true:

By permissibility of mutual cooperative insurance and commercial insurance, we mean permissibility in principle, without necessarily accepting all details. Therefore I prefer permissibility of insurance without hiyal (legal stratagems, or ruses); for there are jurists who forbid one thing, and then return to permit by various legal stratagems and means of circumvention, without worry or shame. We ask God to protect us from such practices.38

Tabarru and its use in the context of takaful is simply one more example of such a legal stratagem that misses the mark. As the Global Financial Industry emerges from recession and the spotlight turns to Islamic Finance to provide more ethical solutions, it is time to critically examine the status quo of industry practices and products. Now more than ever it is time to think outside the box and take up the challenge to create authentic and innovative sharia compliant products. From time to time, this will require each Muslim and stakeholders in the industry to have the courage to question sometimes widely accepted practices and principles. In the words of perhaps the greatest Islamic scholar of all time, Al-Ghazali, who when asked about his quest in discerning the truth from error said:

my daring in mounting from the lowland of servile conformism to the highland of independent investigation . . . what I found loathsome among the methods of the devotees of talim, who restrict the truth to uncritical acceptance of the Imams pronouncements . . . what I seek is knowledge of the true meaning of things . . . sure and certain knowledge is that in which the thing known is made so manifest that no doubt clings to it, nor is it accompanied by the possibility of error and deception, nor can the mind even suppose a possibility.39

See MAHMOUD A. EL-GAMAL, ISLAMIC FINANCE: LAW, ECONOMICS, AND PRACTICE 149 (Cambridge University Press 2006). 39 ABU HAMID MUHAMMAD AL-GHAZALI, AL-GHAZALI'S PATH TO SUFISM 17-20 (R.J. McCarthy trans., Fons Vitae 2000).

38

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Deed PropertyDocument8 pagesDeed PropertyUtkarsa GuptaNo ratings yet

- Risk As Financial IntermediationDocument20 pagesRisk As Financial Intermediationkaytokyid1412No ratings yet

- FFIEC IT Booklet Supervision of Technology Service Providers (TSP)Document30 pagesFFIEC IT Booklet Supervision of Technology Service Providers (TSP)ahong100No ratings yet

- Janki SingDocument72 pagesJanki SingJankiNo ratings yet

- Profit Maximization Vs Value MaximizationDocument2 pagesProfit Maximization Vs Value MaximizationNicklas Garștea100% (4)

- Final ExamDocument5 pagesFinal ExamSultan LimitNo ratings yet

- SaharaDocument14 pagesSaharaSunnyVermaNo ratings yet

- Wonders of ExcelDocument45 pagesWonders of ExceloscarhasibuanNo ratings yet

- Axis Bank SR 2018 Final Report - v1 0 PDFDocument114 pagesAxis Bank SR 2018 Final Report - v1 0 PDFAnurag KhareNo ratings yet

- A Study of Financial Planning and Invest2Document6 pagesA Study of Financial Planning and Invest2Saurav RanaNo ratings yet

- UmaliDocument2 pagesUmaliTrem GallenteNo ratings yet

- S&P - Standard & Poor's Risk-Adjusted Capital Framework Provides Insight IntDocument6 pagesS&P - Standard & Poor's Risk-Adjusted Capital Framework Provides Insight IntMaas Riyaz MalikNo ratings yet

- McKinsey Profile Up1 1201Document94 pagesMcKinsey Profile Up1 1201007003sNo ratings yet

- Building Blocks For Community InvestmentsDocument5 pagesBuilding Blocks For Community Investmentsnatasha mukukaNo ratings yet

- Various Time Value Situations Answer Each of These Unrelated QueDocument1 pageVarious Time Value Situations Answer Each of These Unrelated QueM Bilal SaleemNo ratings yet

- Solutions Manual: Modern Auditing & Assurance ServicesDocument17 pagesSolutions Manual: Modern Auditing & Assurance ServicessanjanaNo ratings yet

- 150.events After The Reporting PeriodDocument6 pages150.events After The Reporting PeriodMelanie SamsonaNo ratings yet

- Abhishek ReportDocument67 pagesAbhishek ReportAbhishek KarNo ratings yet

- Security Valuation G3 730AMDocument3 pagesSecurity Valuation G3 730AMKearn CercadoNo ratings yet

- FICO Vox Pop Report - Fine Tuning Our Financial FuturesDocument16 pagesFICO Vox Pop Report - Fine Tuning Our Financial FuturesChidera UnigweNo ratings yet

- Consumption, Saving, and InvestmentDocument50 pagesConsumption, Saving, and InvestmentMinerva EducationNo ratings yet

- Law of InsuranceDocument7 pagesLaw of InsuranceJack Dowson100% (1)

- Dycaico Vs SSSDocument5 pagesDycaico Vs SSSAbidz Bridge Rae AbadNo ratings yet

- Project Profile-ReadymixConcrete PlantDocument5 pagesProject Profile-ReadymixConcrete PlantAshish MajumderNo ratings yet

- Module 4Document3 pagesModule 4Robin Mar AcobNo ratings yet

- Vodafone Idea LTD.: Detailed QuotesDocument21 pagesVodafone Idea LTD.: Detailed QuotesVachi VidyarthiNo ratings yet

- HPPWD FORM No 7Document2 pagesHPPWD FORM No 7Ankur SheelNo ratings yet

- Residency ReportDocument83 pagesResidency ReportaromamanNo ratings yet

- KPMG - Newsletter Loi de Finances 2024 (English Version)Document6 pagesKPMG - Newsletter Loi de Finances 2024 (English Version)boukhlefNo ratings yet

- SBI PO Application FormDocument4 pagesSBI PO Application FormPranav SahilNo ratings yet