Professional Documents

Culture Documents

L&E Law and Finance 2012

Uploaded by

Deepak GaurOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

L&E Law and Finance 2012

Uploaded by

Deepak GaurCopyright:

Available Formats

School of Economics, Finance and Management MSc Law and Economics (ECONM2027) Brief Notes on Law and Finance

1. Quick background on Legal Families

The two big legal families are: Civil Law Common Law

Primary features of civil law are: Origin based on Roman Law and Code Napoleon Historically concerned with preventing disorder extensive regulation to control it by ensuring judges follow the states objectives Developed in continental Europe Based on general abstract principles regardless of case Codified with detailed definitions

Each rule sets out lengthy enumerations of specific applications or exceptions There are three sub families of civil law (French, German and Scandinavian)

Primary features of common law are: Origin based on traditional English Law Developed to control the power of the state (as represented initially by monarchy) Evolved in current form from 11th century onwards Doctrine of stare decisis (translation - stick to decisions, i.e., essentially precedent based) Based on reasoning from case to case Process of distinguishing (judges do not have to apply precedent if alleged precedent is significantly different from current case) Judge based law

English Common Law and French and German Civil Law have been exported throughout the world.

See Annex 1

2

2. Is the distinction between the legal families significant and permanent? Balas, La Porta, Lopez-de-Silanes and Shleifer (2008 paper: The divergence of legal procedures) suggest that it is. See Annex 2, 3 and 4 (taken from their paper). They look at two examples: Bounced cheque Eviction of tenant. Uses seven measures to create an index of formalism they show that civil law has more formalism than common law. Their evidence (from 1950 onwards) shows no convergence if anything there appears to be divergence.

3. Legal origin theory Annex 5 gives La Porta, Lopez-de-Silanes, and Shleifers view of the relationship between legal origin and outcomes. Common law appears to give greater protection to outside investors and creditors relative to civil common law.

If true, what might be reasons? One strand goes back to strength of the state versus individual Another suggests that common law is better able to change to meet new situations

So what follows if it is true? Better protection leads to better developed financial markets. See Annex 6, 7 8 and 9. Less well documented but growing view that developed financial markets are good for growth. See Annex 10.

4

Ownership concentration is response to these differences in investor protection (the concentration of ownership is highest in civil law countries).

4. All the above is hotly disputed.

Specific criticisms include: Poor data Reverse causality Omitted variables Not what is written but the implementation of it See Annex 11

5. Two Alternative views 5a Endowments Theory There are arguments that it is the fundamental initial endowments that matter, e.g., Beck, Demirguc-Kunt, and Levine (2003) argue (using settler mortality and latitude as a proxy for initial endowments) that it is initial endowments that matter. See Annex 12, 13, 14, 15 and 16.

5b. Trust Franks et al (2008) disagree with underlying thesis about legal origin and claim that there is little evidence once one looks in detail. They claim dispersion came first (formal investor protection only emerged in the second half of the century), claiming 1948 was the key date and that there was little protection in UK at all until end of 1920s - yet there was significant dispersion of ownership at this time and one could argue that the biggest changes came before 1950.

6

See Annex 17 They also claim protection came through statute not through common law. They claim the key issue is trust (arguing that local stock exchanges and shareholders distance from the company matter in creating trust). See Annex 18 and 19

References: (In each case you will probably need to press ctrl when you click) 1. The Economic Consequences of Legal Origins Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei Shleifer Journal of Economic Literature 2008, 46:2, 285332 http://papers.ssrn.com/sol3/papers.cfm?abstract_id=1028081 Contains Annex 1, 5, 6, 7, 8, 9, 10.

2. Law, endowments, and finance Thorsten Beck, Asli DemirgucKunt, and Ross Levine. Journal of Financial Economics Volume 70, Issue 2, November 2003, Pages 137-181 http://papers.ssrn.com/sol3/papers.cfm?abstract_id=321355 (click on NBER subscribers download)

Contains Annex 11, 12, 13, 14, 15 and 16.

3. Ownership: Evolution and Regulation, Julian Franks, Colin Mayer, and Stefano Rossi, in Review of Financial Studies (2008). http://papers.ssrn.com/sol3/papers.cfm?abstract_id=354381

Contains Annex 17, 18 and 19.

You might also like

- The Atlantic Divide in Antitrust: An Examination of US and EU Competition PolicyFrom EverandThe Atlantic Divide in Antitrust: An Examination of US and EU Competition PolicyNo ratings yet

- PhilippMaume DisclosureandFiduciaryDutiesDocument30 pagesPhilippMaume DisclosureandFiduciaryDutiesthiviyani sivaguruNo ratings yet

- Law and Finance: Common Law and Civil Law Countries Compared Fan Empirical CritiqueDocument24 pagesLaw and Finance: Common Law and Civil Law Countries Compared Fan Empirical CritiqueThu HuyềnNo ratings yet

- The Economic Consequences of Legal Origins: Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei ShleiferDocument48 pagesThe Economic Consequences of Legal Origins: Rafael La Porta, Florencio Lopez-de-Silanes, and Andrei ShleiferCesar OliveraNo ratings yet

- Graff 2007Document24 pagesGraff 2007Thu HuyềnNo ratings yet

- French and American Approaches To Contract Formation and EnforceaDocument45 pagesFrench and American Approaches To Contract Formation and EnforceaJorgeNo ratings yet

- SSRN Id354381Document68 pagesSSRN Id354381eko triyantoNo ratings yet

- La Porta ConsequencesDocument48 pagesLa Porta ConsequencesMafeAcevedoNo ratings yet

- On The Intellectual History of Freedom of Contract and RegulationDocument33 pagesOn The Intellectual History of Freedom of Contract and RegulationAnurag RaiNo ratings yet

- Comparing American Trust With French FiducieDocument6 pagesComparing American Trust With French FiducieAdaNo ratings yet

- Porta EconomicConsequencesLegal 2008Document49 pagesPorta EconomicConsequencesLegal 2008Anshita SinghNo ratings yet

- This Content Downloaded From 196.189.242.187 On Sat, 10 Apr 2021 15:10:41 UTCDocument20 pagesThis Content Downloaded From 196.189.242.187 On Sat, 10 Apr 2021 15:10:41 UTCFeleke TerefeNo ratings yet

- Law and FinanceDocument43 pagesLaw and FinanceThiago EngelsNo ratings yet

- La Porta Et Al. - 1998 - Law and Finance Rafael La Porta, Florencio Lopez-de-SilanesDocument44 pagesLa Porta Et Al. - 1998 - Law and Finance Rafael La Porta, Florencio Lopez-de-SilanesDiego TriviñoNo ratings yet

- Law and Finance PaperDocument80 pagesLaw and Finance PaperSafi UllahNo ratings yet

- La Porta Et Al. (1998) PDFDocument43 pagesLa Porta Et Al. (1998) PDFAnish KhaitanNo ratings yet

- Law and FinanceDocument44 pagesLaw and FinanceSiddiqiNo ratings yet

- Obligations of The Parties and Their Law PDFDocument11 pagesObligations of The Parties and Their Law PDFhellochris_No ratings yet

- Law School Survival Guide (Volume II of II) - Outlines and Case Summaries for Evidence, Constitutional Law, Criminal Law, Constitutional Criminal Procedure: Law School Survival GuidesFrom EverandLaw School Survival Guide (Volume II of II) - Outlines and Case Summaries for Evidence, Constitutional Law, Criminal Law, Constitutional Criminal Procedure: Law School Survival GuidesNo ratings yet

- Intro To Civil Law Legal Systems (CR 09-002)Document20 pagesIntro To Civil Law Legal Systems (CR 09-002)INPROL100% (2)

- 1 s2.0 S0014292101001969 MainDocument31 pages1 s2.0 S0014292101001969 Mainjosepbc7000No ratings yet

- Securities FraudDocument48 pagesSecurities FraudKhushi AgarwalNo ratings yet

- Enforcement of Intl Arbitral Awards To Icsid or Not To Icsid Is Not The QuestionDocument20 pagesEnforcement of Intl Arbitral Awards To Icsid or Not To Icsid Is Not The Questionakshatha.niranjanaNo ratings yet

- The University of Chicago PressDocument44 pagesThe University of Chicago PressAbdoul gadirou dialloNo ratings yet

- Capital Markets & Legal InstitutionsDocument37 pagesCapital Markets & Legal InstitutionsLuis Murillo TigreroNo ratings yet

- ArbitraseDocument26 pagesArbitraseOchiem WaeNo ratings yet

- Slowly Improving Human Protection: The normative character of R2P - Responsibility to Protect - and how it can slowly modify States behavior on Human protectionFrom EverandSlowly Improving Human Protection: The normative character of R2P - Responsibility to Protect - and how it can slowly modify States behavior on Human protectionNo ratings yet

- Globa Session 2Document14 pagesGloba Session 2Emilien MercenierNo ratings yet

- Global Antitrust CHPT 1 2d Ed FINAL PDFDocument106 pagesGlobal Antitrust CHPT 1 2d Ed FINAL PDFMichael PayneNo ratings yet

- Plain English Movement The Plain English Movement - Panel DiscussDocument15 pagesPlain English Movement The Plain English Movement - Panel Discusspiyush raj jainNo ratings yet

- Law & Capitalism: What Corporate Crises Reveal about Legal Systems and Economic Development around the WorldFrom EverandLaw & Capitalism: What Corporate Crises Reveal about Legal Systems and Economic Development around the WorldNo ratings yet

- St. John's Law Scholarship Repository St. John's Law Scholarship RepositoryDocument77 pagesSt. John's Law Scholarship Repository St. John's Law Scholarship RepositoryEla Dwyn CordovaNo ratings yet

- Difference Beween Civil and Common LawDocument33 pagesDifference Beween Civil and Common LawvsngosNo ratings yet

- Coordination Failures: What Are They Typical Things One That Catches Your Attention in A Developing Country?Document27 pagesCoordination Failures: What Are They Typical Things One That Catches Your Attention in A Developing Country?Hai PhamNo ratings yet

- Rule of LawDocument18 pagesRule of LawJ San DiegoNo ratings yet

- Conflict of Laws - HizonDocument52 pagesConflict of Laws - HizonellehcimsuarezNo ratings yet

- (Kyklos Vol. 62 Iss. 2) Victor Nee - Sonja Opper - Bureaucracy and Financial Markets (2009) (10.1111 - j.1467-6435.2009.00437.x) - Libgen - LiDocument23 pages(Kyklos Vol. 62 Iss. 2) Victor Nee - Sonja Opper - Bureaucracy and Financial Markets (2009) (10.1111 - j.1467-6435.2009.00437.x) - Libgen - LiMuhamad TaufikNo ratings yet

- New Microsoft Office Word DocumentDocument17 pagesNew Microsoft Office Word DocumentPraveen CpNo ratings yet

- Regulatory Breakdown: The Crisis of Confidence in U.S. RegulationFrom EverandRegulatory Breakdown: The Crisis of Confidence in U.S. RegulationNo ratings yet

- English Study NotesDocument31 pagesEnglish Study NotesEyuael SolomonNo ratings yet

- Statutory Interpretation and The Influence of StandardsDocument17 pagesStatutory Interpretation and The Influence of StandardsAyaz SathioNo ratings yet

- Modernisation and Harmonisation of C.L.Document14 pagesModernisation and Harmonisation of C.L.dikembe mutomboNo ratings yet

- Hu and Noe On Insider TradingDocument12 pagesHu and Noe On Insider TradingMikhail IlievNo ratings yet

- Sheehan NegotiorumgestioCivilian 2006Document28 pagesSheehan NegotiorumgestioCivilian 2006kenny mbakhwaNo ratings yet

- Insurance Law (DIP) Q&ADocument208 pagesInsurance Law (DIP) Q&Aamal husseinNo ratings yet

- Financial Transactions Taxes: in Brief: Updated March 27, 2019Document7 pagesFinancial Transactions Taxes: in Brief: Updated March 27, 2019EthanNo ratings yet

- The Growing Importance of Arbitration in International FinanceDocument11 pagesThe Growing Importance of Arbitration in International Financegino rivas casoNo ratings yet

- Public International LawDocument41 pagesPublic International Lawswetha shree chavan mNo ratings yet

- PIL January 2020 Model AnswersDocument7 pagesPIL January 2020 Model Answersleto andreouNo ratings yet

- Approach Different DrummerDocument27 pagesApproach Different DrummerCheshire CatNo ratings yet

- Hugh Beale - Inequality of Bargaining PowerDocument15 pagesHugh Beale - Inequality of Bargaining PowerJosé SouzaNo ratings yet

- The Emergence of The Corporate FormDocument45 pagesThe Emergence of The Corporate Formmaccio malloNo ratings yet

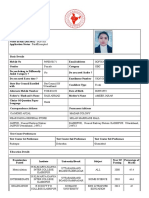

- PG 2014 Application FormDocument3 pagesPG 2014 Application FormDeepak GaurNo ratings yet

- Mi40 CalendarDocument1 pageMi40 CalendarDeepak GaurNo ratings yet

- Marxism and Quantum ConspiracyDocument13 pagesMarxism and Quantum ConspiracyDeepak GaurNo ratings yet

- Wing Geometry DefinitionsDocument3 pagesWing Geometry DefinitionsDeepak GaurNo ratings yet

- Elliptical Winglets: The World'S Fastest Business Jet Just Got BetterDocument2 pagesElliptical Winglets: The World'S Fastest Business Jet Just Got BetterDeepak GaurNo ratings yet

- Yehudi DesignDocument166 pagesYehudi DesignDeepak GaurNo ratings yet

- Note On-The Lift Slope, and Some Other Properties, of Delta and Swept-Back WingsDocument11 pagesNote On-The Lift Slope, and Some Other Properties, of Delta and Swept-Back WingsDeepak GaurNo ratings yet

- Mid-Vermont MTDDocument50 pagesMid-Vermont MTDAroha MackayNo ratings yet

- Lao Gi Vs CADocument2 pagesLao Gi Vs CARichel DeanNo ratings yet

- (U) Daily Activity Report: Marshall DistrictDocument6 pages(U) Daily Activity Report: Marshall DistrictFauquier NowNo ratings yet

- Causes of Child LabourDocument3 pagesCauses of Child LabourreshmabhurkudeNo ratings yet

- (1.) Rommel Was Issued A Certificate of Title Over ADocument18 pages(1.) Rommel Was Issued A Certificate of Title Over AMarco Mendenilla100% (2)

- Carey MTD OrderDocument17 pagesCarey MTD OrderTHROnlineNo ratings yet

- Case Digest 4 NATIONAL IRRIGATION ADMINISTRATION, Petitioner VS. CA and Dick Manglapus, RespondentDocument3 pagesCase Digest 4 NATIONAL IRRIGATION ADMINISTRATION, Petitioner VS. CA and Dick Manglapus, RespondentRomualdo CabanesasNo ratings yet

- People V KalaloDocument2 pagesPeople V KalaloMax RamosNo ratings yet

- Duque Rosario Vs Banco Filipino Savings and Mortgage BankDocument36 pagesDuque Rosario Vs Banco Filipino Savings and Mortgage BankJeff EnreraNo ratings yet

- DEED OF ABSOLUTE SALE - (Sample)Document3 pagesDEED OF ABSOLUTE SALE - (Sample)Antonio RodriguezNo ratings yet

- Franklin v. Michigan, State of - Document No. 2Document3 pagesFranklin v. Michigan, State of - Document No. 2Justia.comNo ratings yet

- TX Brief of AppellantDocument27 pagesTX Brief of AppellantTheresa Martin100% (1)

- Ayodhya JudgementDocument30 pagesAyodhya JudgementSaurabh YadavNo ratings yet

- Transfer Policy 2023Document22 pagesTransfer Policy 2023Athul U KrishnanNo ratings yet

- Explain The Concept of Nafaqa Under Muslim Law in India: Symbiosis Law School, NOIDADocument4 pagesExplain The Concept of Nafaqa Under Muslim Law in India: Symbiosis Law School, NOIDAFaraz ahmad KhanNo ratings yet

- Prof S Gutto - Constitutionalism, Elections and Democracy in Africa Theory and PraxisDocument10 pagesProf S Gutto - Constitutionalism, Elections and Democracy in Africa Theory and Praxiszeropointwith100% (1)

- LAWSUIT: Franz v. Oxford Community School DistrictDocument46 pagesLAWSUIT: Franz v. Oxford Community School DistrictJillian SmithNo ratings yet

- Index: Part-A Introduction To Moot CourtDocument4 pagesIndex: Part-A Introduction To Moot CourtRahil ExplorerNo ratings yet

- Prohibition of Child Marriage ActDocument13 pagesProhibition of Child Marriage ActSatyam PathakNo ratings yet

- Hipos, Sr. vs. BayDocument17 pagesHipos, Sr. vs. BayJan MartinNo ratings yet

- 22222222Document224 pages22222222Anonymous aqf7phNo ratings yet

- Grounds of Opposition-Milimani E12752 of 2021Document2 pagesGrounds of Opposition-Milimani E12752 of 2021Moses King'oriNo ratings yet

- Revised Complaint Form 2023 2Document6 pagesRevised Complaint Form 2023 2Kevin Rey CaballeroNo ratings yet

- Atlas Consolidated Mining Vs CIRDocument2 pagesAtlas Consolidated Mining Vs CIRKrish CasilanaNo ratings yet

- Shodhganga Personal LawDocument32 pagesShodhganga Personal LawAditya NemaNo ratings yet

- Articles of IncorporationDocument6 pagesArticles of IncorporationKimberly GallaronNo ratings yet

- Opposition To The Motion - Prac Court IDocument4 pagesOpposition To The Motion - Prac Court IAngel DeiparineNo ratings yet

- PNP MC-2015-032 - 1 PDFDocument7 pagesPNP MC-2015-032 - 1 PDFGlena Alvarado75% (8)

- APPLICATION FOR ALL INDIA BAR EXAMINATION AIBE-XVII - Preview ApplicationDocument2 pagesAPPLICATION FOR ALL INDIA BAR EXAMINATION AIBE-XVII - Preview ApplicationMOHD AFZANo ratings yet

- 2020-02-14 SCH Amended ComplaintDocument36 pages2020-02-14 SCH Amended ComplaintBrittanyNo ratings yet