0% found this document useful (0 votes)

204 views8 pagesForm 28

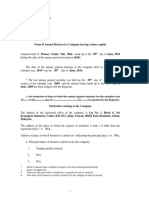

The document is Form 28, an Annual Return for companies in Trinidad and Tobago, which requires detailed information about the company, including its name, registration numbers, share capital, shareholders, directors, and beneficial owners. It outlines the necessary items to be completed and submitted to the Registrar under the Companies Act, along with instructions for each section. Compliance with the form is mandatory, with penalties for non-compliance regarding the disclosure of beneficial ownership information.

Uploaded by

inktower2Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

204 views8 pagesForm 28

The document is Form 28, an Annual Return for companies in Trinidad and Tobago, which requires detailed information about the company, including its name, registration numbers, share capital, shareholders, directors, and beneficial owners. It outlines the necessary items to be completed and submitted to the Registrar under the Companies Act, along with instructions for each section. Compliance with the form is mandatory, with penalties for non-compliance regarding the disclosure of beneficial ownership information.

Uploaded by

inktower2Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd