Professional Documents

Culture Documents

Annual Return Form28

Uploaded by

Gaia Wellness CompanyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Annual Return Form28

Uploaded by

Gaia Wellness CompanyCopyright:

Available Formats

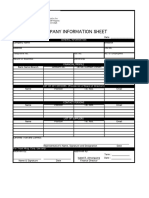

FORM 28

REPUBLIC OF TRINIDAD AND TOBAGO

THE COMPANIES ACT, CH. 81:01

[Section 194(1)]

ANNUAL RETURN OF A COMPANY FOR PROFIT INCORPORATED,

CONTINUED OR AMALGAMATED UNDER THE ACT

1. Name of Company 2. Company No.

3. Registered Office of Company

4. (a) Anniversary Date of [ ] Incorporation [ ] Continuance [ ] Amalgamation

4. (b) Share Capital Issued by Company in Purchased/Redeemed by

the last financial period Company in the last

financial period

Class of Number Amount of Number Amount of Number Reduction

Shares issued and stated of shares stated of shares of stated capital

outstanding capital capital

5. AUTHORIZED SHARE CAPITAL, IF ANY

Class of Shares Number of Shares in each Class

1.

2.

3.

4.

6. List of persons holding shares in the company on the day of ,

20 , and of persons who have held shares therein at any time since the date of the last return, or (in the case

of the first return) of the incorporation, continuance or amalgamation of the company, showing their names and

addresses and an account of the shares so held.

Class of Shares

Address/

Name Occupation/Status and Number Held

Registered Office

at date of Return

ACCOUNTS OF SHARES

Particulars of Shares transferred Particulars of Shares transferred since the

since the date of the last Return or (in date of the last Return or (in the case of the

the case of the first Return) of the first Return) of the incorporation of the

incorporation of the Company, or of its Company, or of its continuance, by persons

continuance, by persons who are still who have ceased to be Shareholders

Shareholders

Class of Shares and Date of

Class of shares and Number at date of Date of Registration

Number at date of Registration Remarks

Return of Transfer

Return of Transfer

Date Signature Title

7. Total amount of the indebtedness of the Company in respect of all mortgages and charges of the kind which are

required to be registered with the Registrar under the Companies Act $

8. The directors of the company as of the date of the Annual Return are:

Name Address Occupation

9. The secretary/assistant secretary(ies) of the company as of the date of the Annual Return is/are:

Address/Registered Office

Name Occupation/Status

Principal Place of Business

10. Particulars of share warrants or bearer share warrants surrendered to the company pursuant to section 33(7) or

cancelled under section 33(10):

Share Warrant/

Serial Number(s) Date of Surrender Date of Cancellation

Bearer Share Warrant

11. Particulars of holders and beneficial owners of shares in the company as of the date of the Annual Return:

Class of shares

Names, Addresses and Occupation/ Names, Addresses and Occupation of

and Number held

Status of Holder(s) of Shares Beneficial Owner(s)

at date of Return

Given Name(s) Nationality/

Address/ Given Number of

& Surnames/ Occupation/ Jurisdiction of Class of

Registered Name(s) Address Occupation Nationality Shares

Company Status Incorporation/ Shares

Office & Surnames held

Name Formation

12. Date Name and Title Signature

THE COMPANIES ACT, CH. 81:01

ANNUAL RETURN OF A COMPANY FOR PROFIT INCORPORATED,

CONTINUED OR AMALGAMATED UNDER THE ACT

FORM 28

INSTRUCTIONS

Format

Documents required to be sent to the Registrar pursuant to the Act must conform to regulation 3 of the

Regulations under the Act.

Items 1, 2

Set out the full legal name of the company, and except where a number has not been assigned, state the

company number.

Item 3

State full address of registered office of company.

Item 4

State the anniversary of incorporation, continuance or amalgamation under the Act. Tick the

appropriate box. N.B.-this Return is due “not later than the thirty days after each anniversary date of its

continuance, incorporation or amalgamation” under the Act [section 194(1)].

In the case of a company being continued, state “Not Applicable” or “N/A” in Item 4(b)

Item 5

State class(es) of shares by distinctive name or other form of designation and total number of shares in

each class.

Item 6

(i) State same date as at Item 4 above.

(ii) State full name of each shareholder, whether a natural person or a corporation.

(iii) State address (if a natural person) or registered office (if a corporation).

(iv) State occupation/calling (if a natural person) or status (i.e., “corporation”/“limited” or

“unlimited liability company”) (if a corporation).

(v) State class of shares as per 5 above and number held by each existing shareholder at date of

Return.

(vi) State particulars of shares transferred since the date of the last return or since the date of

incorporation, continuance or amalgamation of the company by persons who are still

shareholders or who have ceased to be shareholders, as the case may be.

In either case, state the following:

- the number of shares transferred.

- the relevant class(es) of the shares transferred.

- the date of registration of each transfer of shares.

- Insert the name of the transferee (the person to whom the shares have been transferred) in the

“Remarks” column immediately opposite the particulars of each transfer. N.B.-the particulars

of transfer should be placed opposite the name of the transferor (the person who has transferred

the shares) and not opposite that of the transferee.

Item 8

With respect to each director:

(a) set out first given name, middle name and family name;

(b) state full address; and

(c) specify other occupation clearly. Where possible, specify area of speciality e.g., electrical

engineer. In the case of an individual who has no business occupation, but who holds any other

directorships, particulars of that other directorship or at least one of those other directorships

should be stated. In the case of an individual who has no other business occupation or

directorship of any kind, state “Not applicable” or “N/A”.

Item 9

(a) In the case of an individual, set out first given name, middle name and family name; or

(b) In the case of a firm or corporation, set out the registered name.

(c) In the case of (a), state full address, in the case of (b), state principal place of business or

registered office, as the case may be.

(d) In the case of an individual, specify other business occupation clearly. Where possible, specify

area of speciality e.g., electrical engineer. In the case of an individual who has no business

occupation, but who holds any other secretaryship or secretaryships, particulars of that other

secretaryship or at least one of those other secretaryships should be stated. In the case of an

individual who has no other business occupation or secretaryship of any kind, state “Not

applicable” or “N/A”.

(e) In the case of a firm or corporation set out status e.g., “firm of accountants” or “company

incorporated under the laws of Trinidad and Tobago” (or elsewhere).

Item 10

Set out information as specified (e.g. in the first column state the type of instrument i.e., whether a

share warrant or bearer share warrant) if there are no serial numbers available, please indicate “Not

applicable” or “N/A”.

Item 11

Please set out all details of beneficial ownership information (as indicated) as at the date of the Annual

Return.

NOTE: The Companies Act, Chapter 81:01 (as amended by the Companies Amendment) Act requires

the disclosure of beneficial ownership information, (and any changes) with penalties for non-compliance.

Signature

A director or authorised officer of the company shall sign a return.

Completed documents, in duplicate, and the prescribed fees are to be filed at the office of the Registrar

and one set of the duplicate originals would be returned to the company or its representative with the

endorsement “Registered” and the date of registration.

You might also like

- Ab Rehab Guide 2019Document19 pagesAb Rehab Guide 2019Gaia Wellness CompanyNo ratings yet

- If Yes Please Indicate Changes On FormDocument2 pagesIf Yes Please Indicate Changes On FormGaia Wellness CompanyNo ratings yet

- Ultimate Beneficial Ownership (UBO) Declaration Form: Company DetailsDocument2 pagesUltimate Beneficial Ownership (UBO) Declaration Form: Company DetailsTímea Csizmadia0% (1)

- Statement of Assets and Liabilities As On - (This Form Should Be Obtained From Borrower / Co-Borrower/guarantors)Document4 pagesStatement of Assets and Liabilities As On - (This Form Should Be Obtained From Borrower / Co-Borrower/guarantors)Raghu Veer100% (1)

- Detox Acne Facial: Step 1: Step 2: Step 3: Step 4: Step 5Document1 pageDetox Acne Facial: Step 1: Step 2: Step 3: Step 4: Step 5Gaia Wellness CompanyNo ratings yet

- The Ultimate DR Recovery Guide 2Document12 pagesThe Ultimate DR Recovery Guide 2Gaia Wellness Company0% (1)

- Blocks Centre LTD C20150428066: Form 28Document5 pagesBlocks Centre LTD C20150428066: Form 28Gaia Wellness CompanyNo ratings yet

- Ns-Ar 2023Document4 pagesNs-Ar 2023Melissa OladiranNo ratings yet

- Form 45 - Return of Beneficial InterestDocument6 pagesForm 45 - Return of Beneficial InterestRussell O'NeillNo ratings yet

- UpdateDocument2 pagesUpdateishimweNo ratings yet

- FORM 41 Register Containing Particulars of Holders of Securities of Bearer Nature and Particulars of Such Securities Surrendered or CancelledDocument1 pageFORM 41 Register Containing Particulars of Holders of Securities of Bearer Nature and Particulars of Such Securities Surrendered or CancelledbehindthelinkNo ratings yet

- Companies Form 20Document6 pagesCompanies Form 20RimzMatic PNo ratings yet

- Account Opening Form PDFDocument5 pagesAccount Opening Form PDFWildan FrianaNo ratings yet

- SPMP - KYC FormDocument2 pagesSPMP - KYC FormAltaf AhamedNo ratings yet

- Memorandum of AssociationDocument27 pagesMemorandum of AssociationMian ahmad 395No ratings yet

- Australian Company: 1 State/territory of RegistrationDocument2 pagesAustralian Company: 1 State/territory of Registrationmdyafi8084No ratings yet

- Sw-1621406512-Form No 14dDocument3 pagesSw-1621406512-Form No 14dgman444No ratings yet

- Annexure IDocument1 pageAnnexure ISrishti JainNo ratings yet

- Annual Return TemplateDocument3 pagesAnnual Return TemplateFabian DurantNo ratings yet

- Sw-1621512367-Form No 14eDocument4 pagesSw-1621512367-Form No 14egman444No ratings yet

- Samp 02 - Incorporation Agreement Adopting Table 1Document13 pagesSamp 02 - Incorporation Agreement Adopting Table 1SolomonNo ratings yet

- Si 2019 - 62Document7 pagesSi 2019 - 62SkskskskNo ratings yet

- Form 1Document1 pageForm 1kami149No ratings yet

- CI FormDocument1 pageCI FormAljohn Sechico BacolodNo ratings yet

- Form 44 Change in OwnershipDocument2 pagesForm 44 Change in OwnershipSyed HunainNo ratings yet

- Bplo Unified Form PDFDocument2 pagesBplo Unified Form PDFTristan Lindsey Kaamiño AresNo ratings yet

- Master Creation Form For Bonds Debentures and PTCsDocument9 pagesMaster Creation Form For Bonds Debentures and PTCsAishvarya PujarNo ratings yet

- MA Standard - Transfer - FormDocument1 pageMA Standard - Transfer - Formapi-3852735No ratings yet

- A1 v2.5 Black FillableDocument8 pagesA1 v2.5 Black Fillabletafi66No ratings yet

- Accreditation Form & PisDocument3 pagesAccreditation Form & Pisamiel pugatNo ratings yet

- Revoking A Subchapter S Election - Internal Revenue ServiceDocument1 pageRevoking A Subchapter S Election - Internal Revenue ServiceLaLa BanksNo ratings yet

- NBFCsDocument17 pagesNBFCsTarun ParasharNo ratings yet

- Form 1Document7 pagesForm 1Srishti JainNo ratings yet

- InnBucks Coperate Account Opening FormDocument12 pagesInnBucks Coperate Account Opening FormkudzaiNo ratings yet

- Annexure IIDocument4 pagesAnnexure IISrishti JainNo ratings yet

- ECVC - SEC Form 17-C - Result of ASM and OBMDocument5 pagesECVC - SEC Form 17-C - Result of ASM and OBMJulius Mark TolitolNo ratings yet

- Auto and AlliedDocument4 pagesAuto and AlliedarsalanghuralgtNo ratings yet

- Proof: Lotus Bullion Private LimitedDocument2 pagesProof: Lotus Bullion Private LimitedRVS ASSOCIATESNo ratings yet

- Form 14b EmptyDocument3 pagesForm 14b Emptypunit vinodNo ratings yet

- Annexure I - Bidder's ProfileDocument2 pagesAnnexure I - Bidder's ProfilepraveenNo ratings yet

- Asiabest Group International Inc. - 17A - 10may2022Document97 pagesAsiabest Group International Inc. - 17A - 10may2022Ming MaoNo ratings yet

- The Companies Act, 2017 (Act No. 10 of 2017) - The Companies (Prescribed Forms) Regulations, 2018Document2 pagesThe Companies Act, 2017 (Act No. 10 of 2017) - The Companies (Prescribed Forms) Regulations, 2018Santanu Kumar MaharanaNo ratings yet

- Form No. 8: (Pursuant To Section 125/127/135)Document4 pagesForm No. 8: (Pursuant To Section 125/127/135)ipsraviNo ratings yet

- Wholesale and RetailDocument3 pagesWholesale and Retailrofi dogNo ratings yet

- Form 2019-20Document54 pagesForm 2019-20Brajmohan RayNo ratings yet

- Checklist Incorporation of Private Company in IndiaDocument4 pagesChecklist Incorporation of Private Company in IndiaShreya MindheNo ratings yet

- Company Details: Non - NativesDocument2 pagesCompany Details: Non - NativesIsmail AizatNo ratings yet

- Procedures of Forming A Company in TanzaDocument20 pagesProcedures of Forming A Company in TanzaMercy MzingaNo ratings yet

- Micro-Financing-Company MOADocument3 pagesMicro-Financing-Company MOAHashim TatlahNo ratings yet

- Australian Company License Company: 1 State/territory of RegistrationDocument2 pagesAustralian Company License Company: 1 State/territory of Registrationmdyafi8084No ratings yet

- Ipeople Inc - 17-C Approval of The BOD of Amendments To The By-Laws (Apr 8 2021)Document5 pagesIpeople Inc - 17-C Approval of The BOD of Amendments To The By-Laws (Apr 8 2021)dawijawof awofnafawNo ratings yet

- Company Registration Form - Gazette Final 2Document5 pagesCompany Registration Form - Gazette Final 2Auto VeteranNo ratings yet

- Form 3 Return of AllotmentDocument5 pagesForm 3 Return of AllotmentNabeel SafdarNo ratings yet

- FORM-24 Detail Article RtoDocument3 pagesFORM-24 Detail Article RtoSUNNY MANOJ RAJPUTNo ratings yet

- SEC Form 17-C - Results of Board Meeting June 6, 2023Document3 pagesSEC Form 17-C - Results of Board Meeting June 6, 2023Paul De CastroNo ratings yet

- FORM No.4CERTIFICATE OF REGISTRATIONDocument6 pagesFORM No.4CERTIFICATE OF REGISTRATIONarulprabinNo ratings yet

- Search Report: - Private LimitedDocument7 pagesSearch Report: - Private LimitedKunal MalhotraNo ratings yet

- Director RegisterDocument4 pagesDirector RegisterSriram VenkatramanNo ratings yet

- Form 10A - Filed FormDocument4 pagesForm 10A - Filed FormMAHALAKSHMI NAGESH BUDDHANo ratings yet

- SEC Cover Sheet For AFSDocument1 pageSEC Cover Sheet For AFSLorenz Samuel GomezNo ratings yet

- SEC Cover Sheet For AFS 1Document2 pagesSEC Cover Sheet For AFS 1janex92No ratings yet

- Rose Petal LemonadeDocument1 pageRose Petal LemonadeGaia Wellness CompanyNo ratings yet

- 10 Clients In30 Days CTDActionGuideDocument3 pages10 Clients In30 Days CTDActionGuideGaia Wellness CompanyNo ratings yet

- 50 Ways To Get Online Tutoring Students 2021 1Document16 pages50 Ways To Get Online Tutoring Students 2021 1Gaia Wellness CompanyNo ratings yet

- St. Faustina's Litany To The Blessed Host: (Diary of Saint Maria Faustina Kowalska, Paragraph 356)Document2 pagesSt. Faustina's Litany To The Blessed Host: (Diary of Saint Maria Faustina Kowalska, Paragraph 356)Gaia Wellness CompanyNo ratings yet

- Doha Form 842Document34 pagesDoha Form 842Gaia Wellness CompanyNo ratings yet

- Questions For Business Strategy SessionDocument3 pagesQuestions For Business Strategy SessionGaia Wellness CompanyNo ratings yet

- 30 - Second After Elevator Speech PuciataDocument3 pages30 - Second After Elevator Speech PuciataGaia Wellness CompanyNo ratings yet

- 071114blog ChecklistDocument1 page071114blog ChecklistGaia Wellness CompanyNo ratings yet

- 6 Steps To Attracting Your Ideal ClientDocument12 pages6 Steps To Attracting Your Ideal ClientGaia Wellness CompanyNo ratings yet

- Your Rock Solid Business Plan Template 2016Document24 pagesYour Rock Solid Business Plan Template 2016Gaia Wellness CompanyNo ratings yet

- CSP General Information Booklet - ECWA Sponsored Global Humanitarian Visa - 18 AUGUST 2022Document17 pagesCSP General Information Booklet - ECWA Sponsored Global Humanitarian Visa - 18 AUGUST 2022Gaia Wellness CompanyNo ratings yet

- RGD Receipt 115823592203Document1 pageRGD Receipt 115823592203Gaia Wellness CompanyNo ratings yet

- OSHA Employment Application Form (2) 2 - Copy - CompletedDocument3 pagesOSHA Employment Application Form (2) 2 - Copy - CompletedGaia Wellness CompanyNo ratings yet

- Human Skeletal SystemDocument1 pageHuman Skeletal SystemGaia Wellness CompanyNo ratings yet

- FNMGiftTag WEBDocument1 pageFNMGiftTag WEBGaia Wellness CompanyNo ratings yet

- Skincare ComparisonChart 2017-06-29Document2 pagesSkincare ComparisonChart 2017-06-29Gaia Wellness CompanyNo ratings yet

- Math Video Lessons For Remote Teaching EdpuzzleDocument4 pagesMath Video Lessons For Remote Teaching EdpuzzleGaia Wellness CompanyNo ratings yet

- ASCP Code of Ethics: 1. Commitment To My ClientsDocument1 pageASCP Code of Ethics: 1. Commitment To My ClientsGaia Wellness CompanyNo ratings yet

- Teams Get StartedDocument21 pagesTeams Get StartedGaia Wellness CompanyNo ratings yet

- Mini Appliances: Toaster Toaster OvenDocument1 pageMini Appliances: Toaster Toaster OvenGaia Wellness CompanyNo ratings yet

- All Rights Reserved by Author. For Classroom Use Only by A Single TeacherDocument11 pagesAll Rights Reserved by Author. For Classroom Use Only by A Single TeacherGaia Wellness CompanyNo ratings yet