Professional Documents

Culture Documents

Revoking A Subchapter S Election - Internal Revenue Service

Uploaded by

LaLa Banks0 ratings0% found this document useful (0 votes)

4 views1 pageThis document provides instructions for revoking a Subchapter S election. It states that to revoke the election, a statement of revocation must be submitted to the IRS service center where the annual return is filed. The statement must be signed by shareholders owning more than 50% of stock and include certain details such as shareholder names, addresses, tax IDs, number of shares owned, and the requested effective date of revocation. It also notes deadlines for submitting the revocation depending on whether it is effective on the first day of the tax year or another date.

Original Description:

Original Title

Revoking a Subchapter S Election | Internal Revenue Service

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document provides instructions for revoking a Subchapter S election. It states that to revoke the election, a statement of revocation must be submitted to the IRS service center where the annual return is filed. The statement must be signed by shareholders owning more than 50% of stock and include certain details such as shareholder names, addresses, tax IDs, number of shares owned, and the requested effective date of revocation. It also notes deadlines for submitting the revocation depending on whether it is effective on the first day of the tax year or another date.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

4 views1 pageRevoking A Subchapter S Election - Internal Revenue Service

Uploaded by

LaLa BanksThis document provides instructions for revoking a Subchapter S election. It states that to revoke the election, a statement of revocation must be submitted to the IRS service center where the annual return is filed. The statement must be signed by shareholders owning more than 50% of stock and include certain details such as shareholder names, addresses, tax IDs, number of shares owned, and the requested effective date of revocation. It also notes deadlines for submitting the revocation depending on whether it is effective on the first day of the tax year or another date.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 1

File Pay Refunds Credits & Deductions Forms & Instructions

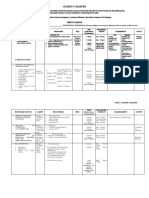

Revoking a Subchapter S Election

To revoke a Subchapter S election/small business election that was made on Form 2553, submit a statement of revocation to

the service center where you file your annual return. Related Items

The statement should state: About Form 1120-S, U.S. Income Tax

The corporation revokes the election made under Section 1362(a) Return for an S Corporation

Name of the shareholder(s), About Form 1128, Application to

Address of the shareholder(s), Adopt, Change or Retain a Tax Year

Taxpayer identification number of the shareholder(s), About Form 8716, Election to Have a

The number of shares of stock owned by the shareholder(s), Tax Year Other Than a Required Tax

The date (or dates) on which the stock was acquired Year

The date on which the shareholder's taxable year ends About Form 8832, Entity

The name of the S corporation Classification Election

The S corporation's EIN

About Form 8869, Qualified

The election to which the shareholder(s) revokes

Subchapter S Subsidiary Election

The statement must be signed by the shareholder(s) under penalties of perjury

About Form SS-4, Application for

Signature and consent of shareholder(s) who collectively own more than 50% of the number of issued and outstanding

Employer Identification Number

stock of the corporation, (whether voting or non-voting)

(EIN)

Indication of the effective date of the revocation (or prospective date)

Signature of person authorized to sign return About Form SS-4 (PR), Application

for Employer Identification Number

(EIN) (Puerto Rican Version)

Due Date of Revocation:

If revoking effective the first day of the tax year, the revocation is due by the 16th day of the third month of the tax year,

If revoking effective any day other than the first day of the tax year, the revocation must be received by IRS by the requested

effective date.

For example, the S corporation is on a December 31 tax year ending and requests a revocation effective January 1, the

revocation is due March 15.

The S corporation is on a December 31 tax year ending and requests a revocation effective February 14, the revocation is

due February 14.

Page Last Reviewed or Updated: 17-Mar-2022

:

You might also like

- F 2553Document3 pagesF 2553alpinetigerNo ratings yet

- In Principle ApprovalDocument5 pagesIn Principle ApprovalMariaNo ratings yet

- U.S. Partnership Declaration and Signature For Electronic FilingDocument2 pagesU.S. Partnership Declaration and Signature For Electronic FilingIRSNo ratings yet

- Form No. 11A: (Now Redundant) Application For Registration of A Firm For The Purposes of The Income-Tax Act, 1961Document2 pagesForm No. 11A: (Now Redundant) Application For Registration of A Firm For The Purposes of The Income-Tax Act, 1961Dinesh KhandelwalNo ratings yet

- How To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditFrom EverandHow To Structure Your Business For Success: Everything You Need To Know To Get Started Building Business CreditNo ratings yet

- Claim For Refund and Request For Abatement: See Separate InstructionsDocument1 pageClaim For Refund and Request For Abatement: See Separate InstructionsYang JeanNo ratings yet

- Blocks Centre LTD C20150428066: Form 28Document5 pagesBlocks Centre LTD C20150428066: Form 28Gaia Wellness CompanyNo ratings yet

- Procedure For Claiming of Shares From IEPFDocument5 pagesProcedure For Claiming of Shares From IEPF15986No ratings yet

- Fax Numbers For Filing Form 2553 Have ChangedDocument5 pagesFax Numbers For Filing Form 2553 Have ChangedMichael ZambitoNo ratings yet

- Form - 1 & 2Document5 pagesForm - 1 & 2Income TaxNo ratings yet

- US Internal Revenue Service: f8453s - 2003Document2 pagesUS Internal Revenue Service: f8453s - 2003IRSNo ratings yet

- GST Reg ChecklistDocument35 pagesGST Reg ChecklistShaik MastanvaliNo ratings yet

- Exempt Organization Declaration and Signature For Electronic FilingDocument2 pagesExempt Organization Declaration and Signature For Electronic FilingIRSNo ratings yet

- India Statutory Form TemplateDocument11 pagesIndia Statutory Form TemplateMadhusudan MadhuNo ratings yet

- Acctg122 - Chapter 1Document25 pagesAcctg122 - Chapter 1Ice James Pachano0% (1)

- Closing A Business-DtiDocument4 pagesClosing A Business-DtiSimon WolfNo ratings yet

- US Internal Revenue Service: f952 AccessibleDocument1 pageUS Internal Revenue Service: f952 AccessibleIRSNo ratings yet

- Company Incorporation ProcessDocument32 pagesCompany Incorporation ProcessChirag JainNo ratings yet

- Registration & Licensing Application FormDocument2 pagesRegistration & Licensing Application FormSahil AnasNo ratings yet

- US Acceptable DocumentationDocument5 pagesUS Acceptable DocumentationMargie LamarreNo ratings yet

- WorksManual RegFormDocument3 pagesWorksManual RegFormapi-3779088No ratings yet

- Certificate of Final Tax Withheld at Source: Kawanihan NG Rentas InternasDocument3 pagesCertificate of Final Tax Withheld at Source: Kawanihan NG Rentas Internasben carlo ramos srNo ratings yet

- Canara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormDocument2 pagesCanara Robeco Mutual Fund Additional Purchase Switch Redemption Systematic Transfer Plan Systematic Withdrawal Plan SIP Registration Application FormSudhansuSekharNo ratings yet

- 2020 08 08 16 32 44 678 - Aaecb8489p - 2019Document16 pages2020 08 08 16 32 44 678 - Aaecb8489p - 2019Jyoti MeenaNo ratings yet

- US Internal Revenue Service: f8869 AccessibleDocument2 pagesUS Internal Revenue Service: f8869 AccessibleIRSNo ratings yet

- Application FormatDocument2 pagesApplication Formatha6820474No ratings yet

- Claim Form For Industrial Attachment Grants Employer /company Levy Reg. No. Claim For The YearDocument1 pageClaim Form For Industrial Attachment Grants Employer /company Levy Reg. No. Claim For The Yeardickson muthomiNo ratings yet

- Gratuity Affidavit FormatDocument3 pagesGratuity Affidavit FormatSAI ASSOCIATE100% (1)

- Psa Standard Credit ApplicationDocument11 pagesPsa Standard Credit ApplicationtutorbritzNo ratings yet

- 2024 Preliminary Information Statement Apex Mining Co., Inc.Document136 pages2024 Preliminary Information Statement Apex Mining Co., Inc.Jonathan AccountingNo ratings yet

- Occupational Tax and Registration Return For Wagering: Type or PrintDocument6 pagesOccupational Tax and Registration Return For Wagering: Type or Printeugenio02No ratings yet

- Dpid Client Id: 1203840001721110 Amit Konar: Panagarh Gram Po-Panagarh Bazar Burdwan West Bengal 713148Document2 pagesDpid Client Id: 1203840001721110 Amit Konar: Panagarh Gram Po-Panagarh Bazar Burdwan West Bengal 713148AtanuMajiNo ratings yet

- SEC Form 17-C - Results of Board Meeting June 6, 2023Document3 pagesSEC Form 17-C - Results of Board Meeting June 6, 2023Paul De CastroNo ratings yet

- Form No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GDocument10 pagesForm No. 3Cb (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961 in The Case of A Person Referred To in Clause (B) of Sub-Rule (1) of Rule 6GsamaadhuNo ratings yet

- US Internal Revenue Service: f8453c AccessibleDocument2 pagesUS Internal Revenue Service: f8453c AccessibleIRSNo ratings yet

- Form 2019-20Document54 pagesForm 2019-20Brajmohan RayNo ratings yet

- Airfreight 2100, Inc.Document2 pagesAirfreight 2100, Inc.ben carlo ramos srNo ratings yet

- US Internal Revenue Service: f8453p - 1999Document2 pagesUS Internal Revenue Service: f8453p - 1999IRSNo ratings yet

- Revolt Dealership Application Form 17 Dec 2020Document8 pagesRevolt Dealership Application Form 17 Dec 2020abhishekNo ratings yet

- Application For Membership: Head OfficeDocument2 pagesApplication For Membership: Head OfficeAsadullah KhanNo ratings yet

- Addendum - 01 To Expression of Interest: Bhel Ps - Er Format For Enlisting of Vendor / Subcontractor Page 01&02 of 05Document9 pagesAddendum - 01 To Expression of Interest: Bhel Ps - Er Format For Enlisting of Vendor / Subcontractor Page 01&02 of 05Atakelt HailuNo ratings yet

- Smart 2306Document2 pagesSmart 2306Billing ZamboecozoneNo ratings yet

- Tender Form For Dematerialized Equity Shares Tcs Buyback 2018Document2 pagesTender Form For Dematerialized Equity Shares Tcs Buyback 2018Ankit LatiyanNo ratings yet

- ACEPH SEC 17-A (Year End Dec 2019) PDFDocument377 pagesACEPH SEC 17-A (Year End Dec 2019) PDFPeter Paul RecaboNo ratings yet

- ESI Form 5Document4 pagesESI Form 5savita17julyNo ratings yet

- Goodlett Quail 2019 Form 1065 SC SignedDocument19 pagesGoodlett Quail 2019 Form 1065 SC SignedSue StevenNo ratings yet

- Certificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)Document2 pagesCertificate of Final Tax Withheld at Source: (MM/DD/YYYY) (MM/DD/YYYY)ROGER DRIO, JRNo ratings yet

- US Internal Revenue Service: f8453s - 2004Document2 pagesUS Internal Revenue Service: f8453s - 2004IRSNo ratings yet

- Psira Renewal PDFDocument3 pagesPsira Renewal PDFMartha BoikanyoNo ratings yet

- Type Type of Books To Be Registered Quantity From ToDocument1 pageType Type of Books To Be Registered Quantity From ToVrix Ace MangilitNo ratings yet

- C-Corp Checklist: File Certificate of Incorporation With The Delaware Secretary of StateDocument2 pagesC-Corp Checklist: File Certificate of Incorporation With The Delaware Secretary of StateKevin Joe NathanNo ratings yet

- Election To Be Treated As A Possessions Corporation Under Section 936Document2 pagesElection To Be Treated As A Possessions Corporation Under Section 936IRSNo ratings yet

- Annual Return Form28Document5 pagesAnnual Return Form28Gaia Wellness CompanyNo ratings yet

- SEC Form ICA-RRDocument1 pageSEC Form ICA-RRPatrick HarrisNo ratings yet

- PF All Forms in Excel (Challan Monthly Return Annual Return)Document20 pagesPF All Forms in Excel (Challan Monthly Return Annual Return)Pardeep K AggarwalNo ratings yet

- EPA I OP OEJ 22 02 - Final - 8.5.22Document46 pagesEPA I OP OEJ 22 02 - Final - 8.5.22LaLa BanksNo ratings yet

- Sav 0107Document1 pageSav 0107LaLa BanksNo ratings yet

- Savpdp 0065Document2 pagesSavpdp 0065LaLa BanksNo ratings yet

- 2022 16860.federal - Epa.transitDocument4 pages2022 16860.federal - Epa.transitLaLa BanksNo ratings yet

- Sav 0040Document1 pageSav 0040LaLa BanksNo ratings yet

- Sav 0106Document2 pagesSav 0106LaLa BanksNo ratings yet

- File 9210Document8 pagesFile 9210JustaNo ratings yet

- GSRG 405 PT 1Document17 pagesGSRG 405 PT 1LaLa BanksNo ratings yet

- Sec 1014Document2 pagesSec 1014LaLa BanksNo ratings yet

- Sav 4239Document3 pagesSav 4239MichaelNo ratings yet

- GSRG 405 Sched 1Document5 pagesGSRG 405 Sched 1LaLa BanksNo ratings yet

- Treasury RFI SOFR FRN3Document3 pagesTreasury RFI SOFR FRN3LaLa BanksNo ratings yet

- Gsrgfin 4Document6 pagesGsrgfin 4LaLa BanksNo ratings yet

- GSRG 405 PT 2 InstrDocument14 pagesGSRG 405 PT 2 InstrLaLa BanksNo ratings yet

- GSRG 405 PT 2 ADocument9 pagesGSRG 405 PT 2 ALaLa BanksNo ratings yet

- Tentative Auction ScheduleDocument3 pagesTentative Auction ScheduleLaLa BanksNo ratings yet

- WWW Gpo GovDocument5 pagesWWW Gpo GovLaLa BanksNo ratings yet

- CFR 2021 Title31 Vol2 Part363Document35 pagesCFR 2021 Title31 Vol2 Part363LaLa BanksNo ratings yet

- GSRG 405 PT 2 AinstrDocument8 pagesGSRG 405 PT 2 AinstrLaLa BanksNo ratings yet

- CFR 2021 Title31 Vol2 Part353Document29 pagesCFR 2021 Title31 Vol2 Part353LaLa BanksNo ratings yet

- CFR 2021 Title31 Vol2 Part351Document17 pagesCFR 2021 Title31 Vol2 Part351LaLa BanksNo ratings yet

- Bbreg GsrbuybackDocument4 pagesBbreg GsrbuybackLaLa BanksNo ratings yet

- Treasury Offering AnnouncementDocument1 pageTreasury Offering AnnouncementLaLa BanksNo ratings yet

- FSForm 5441Document3 pagesFSForm 5441LaLa BanksNo ratings yet

- Treasury Offering AnnouncementDocument1 pageTreasury Offering AnnouncementLaLa BanksNo ratings yet

- SPL 20220901 1Document1 pageSPL 20220901 1LaLa BanksNo ratings yet

- Use Case Series Bill PayDocument2 pagesUse Case Series Bill PayLaLa BanksNo ratings yet

- Use Case Series Account To Account TransfersDocument2 pagesUse Case Series Account To Account TransfersLaLa BanksNo ratings yet

- Treasury Offering AnnouncementDocument1 pageTreasury Offering AnnouncementLaLa BanksNo ratings yet

- Unlock Instant Payment Use Cases With The Fednow ServiceDocument2 pagesUnlock Instant Payment Use Cases With The Fednow ServiceLaLa BanksNo ratings yet

- Railway GCC 2022Document124 pagesRailway GCC 2022Durgesh Pandey (Durgesh)No ratings yet

- Module 2 - Materials ManagementDocument74 pagesModule 2 - Materials Managementabera assefaNo ratings yet

- Role and Responsibilities of CommitteeDocument4 pagesRole and Responsibilities of Committeeasku0% (1)

- ANS KEY of CUSTOM WAREHOUSEDocument3 pagesANS KEY of CUSTOM WAREHOUSEjohn christopher rectoNo ratings yet

- Devolution PlanDocument22 pagesDevolution PlantoobaahmedkhanNo ratings yet

- Frances Food HouseDocument1 pageFrances Food HouselasamNo ratings yet

- DDM Federal BankDocument15 pagesDDM Federal BankShubhangi 16BEI0028No ratings yet

- Sales Report of FlipkartDocument1 pageSales Report of FlipkartSujit MauryaNo ratings yet

- Written SubmissionsDocument14 pagesWritten SubmissionsSahil ShrivastavNo ratings yet

- Evolution of The Local Governments in The PhilippinesDocument6 pagesEvolution of The Local Governments in The PhilippinesRonn Briane AtudNo ratings yet

- Dissolution of Trade Union President Under Trade Union Act, 1928Document4 pagesDissolution of Trade Union President Under Trade Union Act, 1928Amlan JenaNo ratings yet

- SA300535Document1 pageSA300535JEFF WONNo ratings yet

- A) B) C) D) E) F) G) H) I) : Signature of The Contractor With Stamp NBCCDocument1 pageA) B) C) D) E) F) G) H) I) : Signature of The Contractor With Stamp NBCCevonik123456No ratings yet

- Outlet: Imc Code of Ethics ForDocument6 pagesOutlet: Imc Code of Ethics ForMOHAMMED AHSAN ULLAH KHAN MOHAMMED AHSAN ULLAH KHANNo ratings yet

- CFAS4 - PAS 1 - Presentation of Financial StatementsDocument17 pagesCFAS4 - PAS 1 - Presentation of Financial Statementspamelajanmea2018No ratings yet

- The Philippine Economy Development Policies and Challenges by Arsenio M. Balisacan Hal HillDocument493 pagesThe Philippine Economy Development Policies and Challenges by Arsenio M. Balisacan Hal HillHersie BundaNo ratings yet

- Wallstreetjournaleurope 20170622 The Wall Street Journal EuropeDocument20 pagesWallstreetjournaleurope 20170622 The Wall Street Journal EuropestefanoNo ratings yet

- Receipt SampleDocument4 pagesReceipt SampleMee MeeNo ratings yet

- Career Testing Services Pakistan: Assistant Sub Station Attendant (ASSA) (Open Merit) Eligibility CriteriaDocument3 pagesCareer Testing Services Pakistan: Assistant Sub Station Attendant (ASSA) (Open Merit) Eligibility CriteriaM. UsamaNo ratings yet

- 2016 Revised Implementing Rules and Regulations (Revised IRR)Document4 pages2016 Revised Implementing Rules and Regulations (Revised IRR)rainNo ratings yet

- Bill For BooksDocument2 pagesBill For BooksDadhichNo ratings yet

- MD Uzzal HossainDocument4 pagesMD Uzzal HossainMD Omor FarukNo ratings yet

- For Arterior Decor LLPDocument3 pagesFor Arterior Decor LLPVivek BuddyNo ratings yet

- Amendments and Additions To Ifsca Banking Handbook and Other Issues12112021075247Document5 pagesAmendments and Additions To Ifsca Banking Handbook and Other Issues12112021075247Rishab GoelNo ratings yet

- Master Distributor Stock Components: Bulletin HY14-2700/USDocument70 pagesMaster Distributor Stock Components: Bulletin HY14-2700/USElias80No ratings yet

- DR Basilio PPT September 18Document21 pagesDR Basilio PPT September 18Jericho MercadoNo ratings yet

- International OrganisationsDocument7 pagesInternational OrganisationsSydney SebroNo ratings yet

- SsJRXEHGuuGPvefyA6pE PDFDocument314 pagesSsJRXEHGuuGPvefyA6pE PDFaf vaf vcafweaNo ratings yet

- Module 1: Business Governance: Learning OutcomesDocument30 pagesModule 1: Business Governance: Learning OutcomesMicah Ruth PascuaNo ratings yet

- Vision Mission: Citizen'S CharterDocument3 pagesVision Mission: Citizen'S CharterClaire G. Naguio100% (1)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementFrom EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementRating: 4.5 out of 5 stars4.5/5 (20)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingFrom EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingRating: 4.5 out of 5 stars4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorFrom EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorRating: 4.5 out of 5 stars4.5/5 (132)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseFrom EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseNo ratings yet

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpFrom EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpRating: 4 out of 5 stars4/5 (214)

- Introduction to Negotiable Instruments: As per Indian LawsFrom EverandIntroduction to Negotiable Instruments: As per Indian LawsRating: 5 out of 5 stars5/5 (1)

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorFrom EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorRating: 4.5 out of 5 stars4.5/5 (63)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASFrom EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASRating: 3 out of 5 stars3/5 (5)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersFrom EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersNo ratings yet

- Learn the Essentials of Business Law in 15 DaysFrom EverandLearn the Essentials of Business Law in 15 DaysRating: 4 out of 5 stars4/5 (13)

- Indian Polity with Indian Constitution & Parliamentary AffairsFrom EverandIndian Polity with Indian Constitution & Parliamentary AffairsNo ratings yet

- Competition and Antitrust Law: A Very Short IntroductionFrom EverandCompetition and Antitrust Law: A Very Short IntroductionRating: 5 out of 5 stars5/5 (3)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesFrom EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesRating: 5 out of 5 stars5/5 (1)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsFrom EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsNo ratings yet

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessFrom EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessRating: 5 out of 5 stars5/5 (1)

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicFrom EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicRating: 5 out of 5 stars5/5 (1)

- Economics and the Law: From Posner to Postmodernism and Beyond - Second EditionFrom EverandEconomics and the Law: From Posner to Postmodernism and Beyond - Second EditionRating: 1 out of 5 stars1/5 (1)

- California Employment Law: An Employer's Guide: Revised and Updated for 2024From EverandCalifornia Employment Law: An Employer's Guide: Revised and Updated for 2024No ratings yet

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessFrom EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessNo ratings yet

- Building Your Empire: Achieve Financial Freedom with Passive IncomeFrom EverandBuilding Your Empire: Achieve Financial Freedom with Passive IncomeNo ratings yet