0% found this document useful (0 votes)

67 views1 pageHMM 03 07

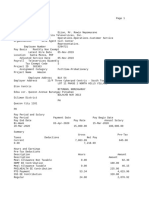

This earnings statement for Anthony Miller from Hino Motors Manufacturing U.S.A. details his pay period from February 17, 2025, to March 2, 2025, with a gross pay of $2,029.25 and a net pay of $1,707.64 after deductions. The document includes information on tax withholdings, including federal income tax, Social Security, and Medicare. It also notes that his Tennessee taxable wages for the period are $2,029.25.

Uploaded by

Gary JamesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

67 views1 pageHMM 03 07

This earnings statement for Anthony Miller from Hino Motors Manufacturing U.S.A. details his pay period from February 17, 2025, to March 2, 2025, with a gross pay of $2,029.25 and a net pay of $1,707.64 after deductions. The document includes information on tax withholdings, including federal income tax, Social Security, and Medicare. It also notes that his Tennessee taxable wages for the period are $2,029.25.

Uploaded by

Gary JamesCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

/ 1