Professional Documents

Culture Documents

FX Daily Strategist: Europe: Foreign Exchange London: 8 February 2012 07:00 GMT

Uploaded by

zinxyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FX Daily Strategist: Europe: Foreign Exchange London: 8 February 2012 07:00 GMT

Uploaded by

zinxyCopyright:

Available Formats

Click on the logo to take part

Foreign Exchange

London: 8 February 2012 07:00 GMT

FX Daily Strategist: Europe

Waiting for resolution on Greece The biggest mover yesterday was EURUSD as the USD came under a little pressure from a dovish Fed Chairman Bernanke and as more optimism surrounding the Greek bailout talks provided a boost to the single currnency. Bernankes testimony before the Senate Budget Committee was similar to his testimony before the House Budget Committee, but markets reacted to his comment that the decline in the unemployment rate understates the weakness in the labour market. The EUR rally was fuelled by a headline suggesting that the Greek government was drafting an agreement on the bailout deal for political leaders to approve on Tuesday - and although the optimism proved unfounded as the meeting among Greek politicians was delayed to today, the damage had already been done: EURUSD has broken through resistance at 1.3244, and at least on a technical basis, this opens the way for further gains. Indeed there are more signs of progress, with reports that the ECB is willing to exchange Greek bonds with the EFSF, further contributing to Greek debt reduction. While the private sector holds the majority of Greek debt, some form of official sector participation is almost inevitable for Greece to achieve the proposed 120% debt/GDP ratio by 2020. but when it comes, we may see risk currencies rally less than expected as EUR-crosses rally While the EUR gained smartly against the USD yesterday, other currencies have been much more subdued. Uncertainty over the Greek situation no doubt contributes to an unwillingness to add to risk, but the rebound in EUR crosses perhaps provide a clue to likely market moves on an eventual resolution. While we favour commodity currencies to outperform over the medium-to-long term particularly as EUR labours in the face of a struggling eurozone economy and against the backdrop of the jumbo ECB 3-year LTROs the initial move on a Greek breakthrough may see a somewhat counterintuitive reaction. With positioning still very short EUR, a positive outcome risks seeing further unwnd of EUR shorts, which runs the risk of triggering stops in many of the crosses. EURAUD and EURGBP would seem particularly at risk here. As such, these currencies may struggle to rally significantly against the USD, even if the removal of the crisis overhang suggests they should. Ultimately though we believe any spike higher will prove an attractive selling opportunity: medium-term EURAUD should continue to move lower. Japan current account surplus smaller, but BoJ removing liquidity The Japanese current account released this morning showed the smallest surplus in 15 years but confirm that the income account remains more than large enough to offset a (recovering) trade situation. Yen crosses have been bid, reportedly helped by talk of 'stealth intervention' bids in the mid-76's after confirmation yesterday that the MoF had indeed been in on the sly in the days after the October 31 operation. We give little weight to these operations - they simply represent a minor change in the MoF's methodology to ensure that intervention was a success. We remain of the view that a necessary (but not sufficient) condition for JPY weakness would be for the BoJ to ease policy and expand money supply significantly. In contrast we have seen the BoJ draining liquidity from the market over the past few days. We remain negative on USDJPY and EURJPY. Todays German trade data has consensus looking for a decline in exports; however, given the improvement in the January PMI, it is likely that the decline in exports may be a one-off. Any upside surprise could provide short-lived support for EUR as it confirms that economic conditions in the eurozone are not as bad as once perceived.

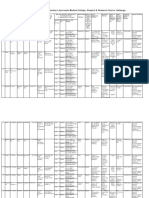

EURUSD vs. Germany-Greece 10yr yields

1.475 1.450 1.425 1.400 1.375 1.350 1.325 1.300 1.275 1.250 Aug Sep Oct 11 Nov Dec Jan Feb 12 Ger-Greece 10yr yields EURUSD -12.5 -15.0 -17.5 -20.0 -22.5 -25.0 -27.5 -30.0 -32.5 -35.0

GMT

Country

Release

BNPP Mkt Last

07:00 DE (Dec) 07:00 DE (Dec) 07:30 FR (Jan) 07:45 FR (Dec) 08:00 ES (Dec) 10:15 DE 13:15 CA (Jan) 15:30 US 17:00 CA 18:00 US 21:45 NZ (Q4)

Current Account bn 14.7 EUR Trade Balance bn EUR 14.9 (sa) BdF Bus Survey 96 96 Budget Balance bn -152.7 -90.8 EUR Industrial Prod % (y/y) -8.0 -7.0 Germany sells EUR 4 bln of 5-year Bobls Housing Starts K 195.0 200.2 420000 EIA Oil Invento 0 GoC 2-Year Auction Treasury Auctions 10Year Notes Unemployment Ra % 6.6

Reuters Ecowin, Bloomberg, BNP Paribas

This is not classified as objective research. Please refer to important information at the end of the report.

http://www.globalmarkets.bnpparibas.com London: +44(0)20 7595 8086 NY: +1 212 841 2408 Sing.: +65 6210 3263/3347

This publication is classified as non-objective research

FX Global Strategy Contacts

Foreign Exchange

Steven Saywell James Hellawell Kiran Kowshik Michael Sneyd Raymond Attrill Mary Nicola Robert Ryan Drew Brick Chin Loo Thio Jasmine Poh Gao Qi Bartosz Pawlowski Dina Ahmad Diego Donadio Head of FX Strategy, Europe Quantitative Strategist Currency Strategist Currency Strategist Head of FX Strategy, North America Currency Strategist FX & IR Asia Strategy Head of FX & IR Strategy Asia FX & IR Asia Strategy FX & IR Asia Strategy FX & IR Asia Strategy Head of FX & IR Strategy CEEMEA FX & IR CEEMEA Strategist FX & IR Latam America Strategist London London London London New York New York Singapore Singapore Singapore Singapore Shanghai London London Sao Paulo 44 20 7595 8487 44 20 7595 8485 44 20 7595 1495 44 20 7595 1307 1 212 841 2492 1 212 841 2492 65 6210 3314 65 6210 3262 65 6210 3263 65 6210 3418 86 21 2896 2876 44 20 7595 8195 44 20 7595 8620 55 11 3841 3421 steven.saywell@uk.bnpparibas.com james.hellawell@uk.bnpparibas.com kiran.kowshik@uk.bnpparibas.com michael.sneyd@uk.bnpparibas.com raymond.attrill@americas.bnpparibas.com mary.nicola@americas.bnpparibas.com robert.ryan@asia.bnpparibas.com drew.brick@asia.bnpparibas.com chin.thio@asia.bnpparibas.com jasmine.poh@asia.bnpparibas.com gao.qi@asia.bnpparibas.com bartosz.pawlowski@uk.bnpparibas.com dina.ahmad@uk.bnpparibas.com diego.donadio@br.bnpparibas.com

Emerging Markets FX & IR Strategy

Production and Distribution please contact: Roshan Kholil, Foreign Exchange, London. Tel: 44 20 7595 8486, Email: roshan.kholil@uk.bnpparibas.com

Important Disclosures

This document has been written by our strategy teams. It does not purport to be an exhaustive analysis, and may be subject to conflicts of interest resulting from their interaction with sales and trading which could affect the objectivity of this report. This document is a marketing communication. They are not independent investment research. They have not been prepared in accordance with legal requirements designed to provide the independence of investment research, and are not subject to any prohibition on dealing ahead of the dissemination of investment research. The information and opinions contained in this report have been obtained from, or are based on, public sources believed to be reliable, but no representation or warranty, express or implied, is made that such information is accurate, complete or up to date and it should not be relied upon as such. This report does not constitute an offer or solicitation to buy or sell any securities or other investment. Information and opinions contained in the report are published for the assistance of recipients, but are not to be relied upon as authoritative or taken in substitution for the exercise of judgement by any recipient, are subject to change without notice and not intended to provide the sole basis of any evaluation of the instruments discussed herein. Any reference to past performance should not be taken as an indication of future performance. To the fullest extent permitted by law, no BNP Paribas group company accepts any liability whatsoever (including in negligence) for any direct or consequential loss arising from any use of or reliance on material contained in this report. All estimates and opinions included in this report are made as of the date of this report. Unless otherwise indicated in this report there is no intention to update this report. BNP Paribas SA and its affiliates (collectively BNP Paribas) may make a market in, or may, as principal or agent, buy or sell securities of any issuer or person mentioned in this report or derivatives thereon. BNP Paribas may have a financial interest in any issuer or person mentioned in this report, including a long or short position in their securities and/or options, futures or other derivative instruments based thereon, or vice versa. BNP Paribas, including its officers and employees may serve or have served as an officer, director or in an advisory capacity for any person mentioned in this report. BNP Paribas may, from time to time, solicit, perform or have performed investment banking, underwriting or other services (including acting as adviser, manager, underwriter or lender) within the last 12 months for any person referred to in this report. BNP Paribas may be a party to an agreement with any person relating to the production of this report. BNP Paribas, may to the extent permitted by law, have acted upon or used the information contained herein, or the research or analysis on which it was based, before its publication. BNP Paribas may receive or intend to seek compensation for investment banking services in the next three months from or in relation to any person mentioned in this report. Any person mentioned in this report may have been provided with sections of this report prior to its publication in order to verify its factual accuracy. BNP Paribas is incorporated in France with limited liability. Registered Office 16 Boulevard des Italiens, 75009 Paris. This report was produced by a BNP Paribas group company. This report is for the use of intended recipients and may not be reproduced (in whole or in part) or delivered or transmitted to any other person without the prior written consent of BNP Paribas. By accepting this document you agree to be bound by the foregoing limitations. Certain countries within the European Economic Area: This report is solely prepared for professional clients. It is not intended for retail clients and should not be passed on to any such persons. This report has been approved for publication in the United Kingdom by BNP Paribas London Branch. BNP Paribas London Branch is authorised and supervised by the Autorit de Contrle Prudentiel and authorised and subject to limited regulation by the Financial Services Authority. Details of the extent of our authorisation and regulation by the Financial Services Authority are available from us on request. This report has been approved for publication in France by BNP Paribas, a credit institution licensed as an investment services provider by the Autorit de Contrle Prudentiel whose head office is 16, Boulevard des Italiens 75009 Paris, France. This report is being distributed in Germany either by BNP Paribas London Branch or by BNP Paribas Niederlassung Frankfurt am Main, regulated by the Bundesanstalt fr Finanzdienstleistungsaufsicht (BaFin). United States: This report is being distributed to US persons by BNP Paribas Securities Corp., or by a subsidiary or affiliate of BNP Paribas that is not registered as a US broker-dealer to US major institutional investors only. BNP Paribas Securities Corp., a subsidiary of BNP Paribas, is a broker-dealer registered with the Securities and Exchange Commission and a member of the Financial Industry Regulatory Authority and other principal exchanges. BNP Paribas Securities Corp. accepts responsibility for the content of a report prepared by another non-US affiliate only when distributed to US persons by BNP Paribas Securities Corp. Japan: This report is being distributed to Japanese based firms by BNP Paribas Securities (Japan) Limited or by a subsidiary or affiliate of BNP Paribas not registered as a financial instruments firm in Japan, to certain financial institutions defined by article 17-3, item 1 of the Financial Instruments and Exchange Law Enforcement Order. BNP Paribas Securities (Japan) Limited is a financial instruments firm registered according to the Financial Instruments and Exchange Law of Japan and a member of the Japan Securities Dealers Association and the Financial Futures Association of Japan. BNP Paribas Securities (Japan) Limited accepts responsibility for the content of a report prepared by another non-Japan affiliate only when distributed to Japanese based firms by BNP Paribas Securities (Japan) Limited. Some of the foreign securities stated on this report are not disclosed according to the Financial Instruments and Exchange Law of Japan. Hong Kong: This report is being distributed in Hong Kong by BNP Paribas Hong Kong Branch, a branch of BNP Paribas whose head office is in Paris, France. BNP Paribas Hong Kong Branch is regulated as a Registered Institution by Hong Kong Monetary Authority for the conduct of Advising on Securities [Regulated Activity Type 4] under the Securities and Futures Ordinance. Some or all the information reported in this document may already have been published on https://globalmarkets.bnpparibas.com BNP Paribas (2012). All rights reserved.

Foreign Exchange Strategy Wednesday, 08 February 2012 http://www.GlobalMarkets.bnpparibas.com

You might also like

- RBS On DowngradesDocument17 pagesRBS On Downgradesharlock01No ratings yet

- Foreign Exchange Daily ReportDocument5 pagesForeign Exchange Daily ReportPrashanth Goud DharmapuriNo ratings yet

- DB Special ReportDocument10 pagesDB Special ReportMorris CabrioliNo ratings yet

- ING Think FX Daily Currencies Gear Up For Another Big Week of Central Bank MeetingsDocument5 pagesING Think FX Daily Currencies Gear Up For Another Big Week of Central Bank MeetingsPositionNo ratings yet

- Bar Cap 3Document11 pagesBar Cap 3Aquila99999No ratings yet

- Barclays Capital Tuesday Credit Call 20 September 2011Document22 pagesBarclays Capital Tuesday Credit Call 20 September 2011poitrenacNo ratings yet

- Back-Testing Moody's LGD Methodology: June 2007Document16 pagesBack-Testing Moody's LGD Methodology: June 2007maverickrzysNo ratings yet

- Sassaf Citi PresDocument29 pagesSassaf Citi PresakiskefalasNo ratings yet

- Asia Maxima (Delirium) - 3Q14 20140703Document100 pagesAsia Maxima (Delirium) - 3Q14 20140703Hans WidjajaNo ratings yet

- (BNP Paribas) What Future For Dividends in EuropeDocument15 pages(BNP Paribas) What Future For Dividends in EuropeanuragNo ratings yet

- Week in Pictures 10 17 22 1666106256Document13 pagesWeek in Pictures 10 17 22 1666106256Barry HeNo ratings yet

- Week Summary: Macro StrategyDocument10 pagesWeek Summary: Macro StrategyNoel AndreottiNo ratings yet

- SBI Equity Savings Fund - Presentation PDFDocument23 pagesSBI Equity Savings Fund - Presentation PDFPankaj RastogiNo ratings yet

- Deutsche Bank Dr. Josef AckermannDocument32 pagesDeutsche Bank Dr. Josef AckermannLuis Rguez. Del BarrioNo ratings yet

- Euro Themes - SpainDocument22 pagesEuro Themes - SpainGuy DviriNo ratings yet

- Global Market Outlook - August 2013 - GWMDocument14 pagesGlobal Market Outlook - August 2013 - GWMFauzi DjauhariNo ratings yet

- JP Morgan Singapore DevelopersDocument55 pagesJP Morgan Singapore DevelopersShadow_Warrior88No ratings yet

- Unicredit CEE Quarterly 4Q2019Document76 pagesUnicredit CEE Quarterly 4Q2019Sorin DinuNo ratings yet

- Collateral OTCDocument27 pagesCollateral OTCmanoj_kvvNo ratings yet

- 0927 UsfiwDocument42 pages0927 Usfiwbbj1039No ratings yet

- Treasury Outlook MarDocument6 pagesTreasury Outlook Marelise_stefanikNo ratings yet

- ING - FX TalkingDocument18 pagesING - FX TalkingCiocoiu Vlad AndreiNo ratings yet

- 201503 - Hsbc-中国债券市场手册Document55 pages201503 - Hsbc-中国债券市场手册Jaa Nat CheungNo ratings yet

- Nomura - Global Economic Outlook MonthlyDocument32 pagesNomura - Global Economic Outlook Monthly9211No ratings yet

- Deutsche BankDocument23 pagesDeutsche Bankmichelerovatti0% (1)

- UBS Real Estate Outlook 2010Document32 pagesUBS Real Estate Outlook 2010CRE Console100% (1)

- 435x Lecture 2 Futures and Swaps VFinalDocument41 pages435x Lecture 2 Futures and Swaps VFinalMari Tafur BobadillaNo ratings yet

- ASEAN Economics: What Does A Cross-Current of DM Recovery, Rising Real Rates & China Slowdown Mean For ASEAN?Document20 pagesASEAN Economics: What Does A Cross-Current of DM Recovery, Rising Real Rates & China Slowdown Mean For ASEAN?bodai100% (1)

- 德银 全球投资策略之全球固定收益2021年展望:还需要迎头赶上 2020.12.22 110页Document112 pages德银 全球投资策略之全球固定收益2021年展望:还需要迎头赶上 2020.12.22 110页HungNo ratings yet

- FX Talking: Ing'S View On The Major Bullish and Bearish Currency ThemesDocument20 pagesFX Talking: Ing'S View On The Major Bullish and Bearish Currency ThemesCiocoiu Vlad AndreiNo ratings yet

- Nomura Report On ChinaDocument104 pagesNomura Report On ChinaSimon LouieNo ratings yet

- In For The Long Haul: Initiation: Gland Pharma LTD (GLAND IN)Document31 pagesIn For The Long Haul: Initiation: Gland Pharma LTD (GLAND IN)Doshi VaibhavNo ratings yet

- 巴克莱-美股-银行业-CCAR 2020 2.0:股票回购可以恢复,但派息率有上限-2020.12.20-27页Document29 pages巴克莱-美股-银行业-CCAR 2020 2.0:股票回购可以恢复,但派息率有上限-2020.12.20-27页HungNo ratings yet

- Treasury Practice ASSET SWAPSDocument3 pagesTreasury Practice ASSET SWAPSkevNo ratings yet

- J.P. 摩根-美股-石油与天然气行业-2021年能源会议问题库:勘探与生产、综合石油和炼油、中游、油田服务和设备以及公用事业-2020.1.4-168页Document170 pagesJ.P. 摩根-美股-石油与天然气行业-2021年能源会议问题库:勘探与生产、综合石油和炼油、中游、油田服务和设备以及公用事业-2020.1.4-168页HungNo ratings yet

- Bond Price VolatilityDocument56 pagesBond Price Volatilityanurag71500No ratings yet

- India Consumer: June'11 QTR Earnings PreviewDocument11 pagesIndia Consumer: June'11 QTR Earnings PreviewSneh KocharNo ratings yet

- GAIL Global Singapore Pte. Ltd. Business OverviewDocument10 pagesGAIL Global Singapore Pte. Ltd. Business OverviewpduvvuriNo ratings yet

- MSFL - Inflation Aug'11Document4 pagesMSFL - Inflation Aug'11Himanshu KuriyalNo ratings yet

- BNP FX WeeklyDocument22 pagesBNP FX WeeklyPhillip HsiaNo ratings yet

- Deutche Bank Doc 1 - Deutsche Bank at A GlanceDocument14 pagesDeutche Bank Doc 1 - Deutsche Bank at A GlanceUriGrodNo ratings yet

- EU Banks Pass Stress Test With Few FailuresDocument23 pagesEU Banks Pass Stress Test With Few Failuresppt46No ratings yet

- 48 - IEW March 2014Document13 pages48 - IEW March 2014girishrajsNo ratings yet

- Havells India LTD (HAVL) PDFDocument5 pagesHavells India LTD (HAVL) PDFViju K GNo ratings yet

- 2013-3-22 SREITs Roundup 2203131Document12 pages2013-3-22 SREITs Roundup 2203131phuawlNo ratings yet

- JPM Nigeria Lockdown Fa 2020-05-07 3361293 PDFDocument14 pagesJPM Nigeria Lockdown Fa 2020-05-07 3361293 PDFEfosaUwaifoNo ratings yet

- CTCBC International Central Banking Courses 2018Document82 pagesCTCBC International Central Banking Courses 2018Fransiska SihalohoNo ratings yet

- Cappuccino Notes: An Investment Offering A Enhanced Exposure To A Portfolio of Underlying AssetsDocument3 pagesCappuccino Notes: An Investment Offering A Enhanced Exposure To A Portfolio of Underlying AssetsLameuneNo ratings yet

- (BNP Paribas) DivDax. Trade 2009-2010 Dividend SwapDocument10 pages(BNP Paribas) DivDax. Trade 2009-2010 Dividend SwapaacmasterblasterNo ratings yet

- April Remit BarCApDocument21 pagesApril Remit BarCApZerohedgeNo ratings yet

- JPM - Life Insurance Overview - Jimmy Bhullar - Aug 2011Document16 pagesJPM - Life Insurance Overview - Jimmy Bhullar - Aug 2011ishfaque10No ratings yet

- Daily FX STR Europe 29 July 2011Document8 pagesDaily FX STR Europe 29 July 2011timurrsNo ratings yet

- Trade Krugman SlidesDocument24 pagesTrade Krugman SlidesHector Perez SaizNo ratings yet

- Mutual Funds Sahi HaiDocument24 pagesMutual Funds Sahi Haishiva1602No ratings yet

- Attracting Domestic & International LPs to India's Private Equity FundsDocument15 pagesAttracting Domestic & International LPs to India's Private Equity FundsvinaymathewNo ratings yet

- Unicredit, On Cruise Control - A Guide To The European Auto Abs MarketDocument34 pagesUnicredit, On Cruise Control - A Guide To The European Auto Abs MarketFlooredNo ratings yet

- Ubs GlobalDocument24 pagesUbs GlobalJoOANANo ratings yet

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketFrom EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketNo ratings yet

- Toyota Production SystemDocument32 pagesToyota Production SystemWawang SukmoroNo ratings yet

- Lift Plan v2Document3 pagesLift Plan v2Hussain YahyaNo ratings yet

- Establishing Nails Producing PlantDocument28 pagesEstablishing Nails Producing PlantFekadie TesfaNo ratings yet

- Federal Reserve: A Faustian Bargain?Document345 pagesFederal Reserve: A Faustian Bargain?William Litynski100% (3)

- FP Lean Route To MarketDocument8 pagesFP Lean Route To MarketBhavya DesaiNo ratings yet

- Shri Hingulambika Education Society's Ayurvedic Medical College, Hospital & Research Centre, GulbargaDocument6 pagesShri Hingulambika Education Society's Ayurvedic Medical College, Hospital & Research Centre, GulbargaSahal ShaikhNo ratings yet

- Econometrics Lecture Notes Ii Functional Forms of Regression ModelsDocument5 pagesEconometrics Lecture Notes Ii Functional Forms of Regression ModelsUsama RajaNo ratings yet

- Abuja Bangkok: Making Travel Better 2 5 4 0 7 5 0 9 6Document6 pagesAbuja Bangkok: Making Travel Better 2 5 4 0 7 5 0 9 6Kush ChristanoNo ratings yet

- Tourism in AustraliaDocument4 pagesTourism in AustraliaAnnisaNo ratings yet

- Zia and The EconomyDocument5 pagesZia and The EconomyHamza ChaudhryNo ratings yet

- Ra7279 Rules RegulationDocument4 pagesRa7279 Rules Regulationadian09No ratings yet

- Alamat Kantor Airlines Di Jakarta IndonesiaDocument2 pagesAlamat Kantor Airlines Di Jakarta IndonesiaSeptia Riani100% (1)

- Cik ListDocument8 pagesCik ListStaurt AttkinsNo ratings yet

- Citiesasian1011 02 PDFDocument40 pagesCitiesasian1011 02 PDFLazarus SolusNo ratings yet

- SlovakiaDocument17 pagesSlovakiaShakir KhanNo ratings yet

- AAIB Fixed Income Fund (Gozoor) : Fact Sheet JuneDocument2 pagesAAIB Fixed Income Fund (Gozoor) : Fact Sheet Juneapi-237717884No ratings yet

- Market IntegrationDocument4 pagesMarket IntegrationOrlando UmaliNo ratings yet

- Microeconomics Chapter: Consumer Choice TheoryDocument51 pagesMicroeconomics Chapter: Consumer Choice Theoryjokerightwegmail.com joke1233No ratings yet

- DRS - Micro Project PDFDocument15 pagesDRS - Micro Project PDFVikas LakadaNo ratings yet

- Level 0 DFD and Document Flowchart for S&S Cash Receipts SystemDocument11 pagesLevel 0 DFD and Document Flowchart for S&S Cash Receipts SystemGloria VivianNo ratings yet

- Maaa ChudaaoDocument1 pageMaaa ChudaaoUtkarsh GuptaNo ratings yet

- August InvoiceDocument98 pagesAugust Invoiceஇனி ஒரு விதி செய்வோம்No ratings yet

- The Story of PenangDocument2 pagesThe Story of Penangalbhome pcNo ratings yet

- Econ for Managers: Module 3 Profit MaximizationDocument36 pagesEcon for Managers: Module 3 Profit MaximizationcubanninjaNo ratings yet

- Nama AkunDocument4 pagesNama AkunAan SoloNo ratings yet

- Advt For Eligible Emp Promotion WB Audit&Accounts Service18Document5 pagesAdvt For Eligible Emp Promotion WB Audit&Accounts Service18Ranajoy BhadraNo ratings yet

- CHAPTER 15: Decision Theory: Business Statistics in Practice, Third Canadian EditionDocument5 pagesCHAPTER 15: Decision Theory: Business Statistics in Practice, Third Canadian Editionamul65No ratings yet

- Method Statement For Cable Laying, Glanding and TerminationDocument12 pagesMethod Statement For Cable Laying, Glanding and TerminationSajid Raza100% (1)

- Chapter 12 Dealing With, Resisting, and The Future Of, GlobalizationDocument2 pagesChapter 12 Dealing With, Resisting, and The Future Of, GlobalizationLABAJA, MEGUMI ERIKA O.100% (1)

- ICT Rural BankingDocument19 pagesICT Rural BankingAashu ParekhNo ratings yet