0% found this document useful (0 votes)

17 views2 pagesBudget Plan

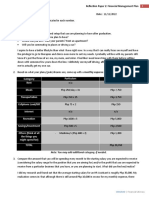

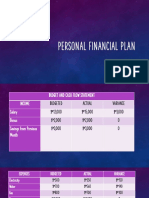

The personal budget plan outlines a monthly income of PHP 25,000 with total expenses of PHP 21,260, resulting in a net income of PHP 3,740. The individual expresses dissatisfaction with their savings rate and identifies shopping and dining out as areas to cut back on. A financial goal mentioned is to save for a property investment.

Uploaded by

marivicllenaresasCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

17 views2 pagesBudget Plan

The personal budget plan outlines a monthly income of PHP 25,000 with total expenses of PHP 21,260, resulting in a net income of PHP 3,740. The individual expresses dissatisfaction with their savings rate and identifies shopping and dining out as areas to cut back on. A financial goal mentioned is to save for a property investment.

Uploaded by

marivicllenaresasCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as DOCX, PDF, TXT or read online on Scribd