Professional Documents

Culture Documents

IRAS Acceptable Rates For Per Diem Allowances - 2012

Uploaded by

Jeremy ChuaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRAS Acceptable Rates For Per Diem Allowances - 2012

Uploaded by

Jeremy ChuaCopyright:

Available Formats

IRAS Acceptable Rates for Per Diem Allowances 2012 These rates are applicable when a Singapore-based employee

e is sent overseas in year 2012. If an employee is paid a per diem allowance that is more than the IRAS acceptable rate for a particular country, the amount in excess of the acceptable rate is taxable in the Year of Assessment 2013. Allowance < Acceptable Allowance > Acceptable Rate Rate Employers obligation to No Yes. Declare the amount report in IR8A in excess of acceptable rate. Tax impact on employee Not taxable The amount in excess of acceptable rate is taxable. Note: 1. These rates are applicable to Singapore-based employees sent overseas for short business trips and whose services rendered overseas are considered as incidental to their employment in Singapore. 2. The acceptable rates determined by IRAS are strictly for Income Tax purpose. The rates do not determine the amount of per diem allowance that the employer wishes to pay their employees. For information on per diem allowance, please see the Frequently Asked Questions on Per Diem

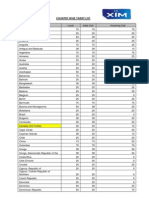

IRAS Acceptable Rates for Per Diem Allowances 2012 Countries: A to F

Country Rate Per Day (S$) Change from previous year -22 Country Rate Per Day (S$) Change from previous year -13 -12

Afghanistan Albania Algeria American Samoa Andorra Angola Anguilla Antigua Argentina Armenia Aruba Australia Austria Azerbaijan Bahamas Bahrain Bangladesh Barbados Barbuda Belarus Belgium Belize Benin Bermuda Bhutan Bolivia Bosnia & Herzgovina Botswana Brazil Brunei Bulgaria Bukina Faso Burundi Cambodia Cameroon Canada

99 89 137 41 138 185 122 75 120 60 149 116 130 122 128 164 85 113 30 125 140 77 84 144 108 54 60 89 90 100 104 138 74 62 101 110

-7 -24 -15 -15 -11 -10 -7 8 -10 -7 20 -19 -10 -15 -15

Cape Verde Canary Islands Cayman Islands Central African Rep Chad Chile China Columbia Comoros Congo, Republic Congo, Democratic Rep Cook Islands Costa Rica Cote dIvoire Croatia Cuba Cyprus Czech Republic Denmark Djibouti Dominica Dominican Republic East Timor Ecuador Egypt El Salvador Equatorial Guinea Eritrea Estonia Ethiopia Fiji Finland France French Guiana French Polynesia

87 71 122 51 122 100 105 90 71 135 108 87 72 122 131 60 98 72 145 128 81 71 65 80 90 66 152 62 83 137 45 115 145 75 90

6 -10 -10 -9

-29 -14 -10 -17 -12 6 -8 -10 -16 -11 -9 -5 -8 -12

-10 90 64

-15 14 7 -10 -24 34 -9 -8 -7

-34 9 -18

-10

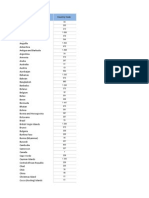

IRAS Acceptable Rates for Per Diem Allowances 2012 Countries: G to O

Country

Rate Per Day (S$)

Change from previous year -8 24 18

Country

Rate Per Day (S$)

Gabon Gambia Georgia Germany Ghana Gibraltar Greece Greenland Grenada Guadelope Guam Guatemala Guinea Guinea-Bissau Guyana Haiti Honduras Hong Kong Hungary Iceland India Indonesia Iran Iraq Ireland Israel Italy Jamaica Japan Jordan Kazakhstan Kenya Kiribati Korea, North Korea, South Kuwait Kyrgyzstan Lao Peoples Dem Latvia Lebanon

92 63 131 130 129 45 110 110 95 80 100 77 126 86 108 77 63 140 99 69 120 55 74 113 101 86 155 80 215 98 150 129 93 66 165 134 149 65 77 89

-12 -11 8 43 -15 -10 -10 -14 -6 -10 -13 -13 -12 -10 8 -10 -15 10

-11 -10 -7 12

Lesotho Liberia Libyan Arab Lithuana Luxembourg Macao Macedonia, TFRY Madagascar Malawi Malaysia Maldives Mali Malta Marshall Islands Martinique Mauritania Mauritius Mexico Micronesia Moldova, Rep of Monaco Mongolia Montenegro Montseratt Morocco Mozambique Myanmar, Union of Namibia Nauru Nepal Netherlands New Caledonia New Zealand Nicaragua Niger Nigeria Niue Norway Northern Mariana Island Oman

93 77 66 74 126 74 60 77 84 78 81 104 102 63 80 57 92 140 54 81 123 47 74 75 130 77 60 57 93 50 125 75 90 57 59 224 75 180 75 95

Change from previous year 15 -9 -11 9 -13 -8 -12

-14 6 7 -9 -17 9 -8 -8 -12 -5 -6 -6 -8 -10 -10 24 -10

-8 -22 26

-10

-9 -13

-10

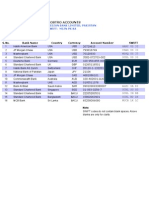

Acceptable Rates for Per Diem Allowances 2012 Countries: P to Z

Country

Rate Per Day (S$)

Change from previous year -9 -9 31 -6 -10 -10 -12 -12 -48

Country

Rate Per Day (S$)

Pakistan Palau Panama Papua New Guinea Paraguay Peru Philippines Poland Portugal Puerto Rico Qatar Reunion Romania Russian Federation Rwanda Samoa Sao Tome & Principe Saudi Arabia Senegal Serbia Seychelles Sierra Leone Slovakia Slovenia Solomon Islands Somalia South Africa Spain Sri Lanka St Kitts & Nevis St Lucia St Vincent Sudan Suriname

113 74 75 153 63 105 85 90 107 140 125 80 107 168 100 77 68 131 93 140 102 87 92 126 81 56 98 110 84 81 104 84 110 62

Swaziland Sweden Switzerland Syrian Arab Rep Taiwan Tajikistan Tanzania Thailand Togo Tokelau Islands Tonga Trinidad & Tobago Tunisia Turkey Turkmenistan Turks & Caicos Island Tuvalu Uganda Ukraine United Arab Emirates* United Kingdom United States Uruguay Uzbekistan Vanuatu Venezuela Vietnam Virgin Island (UK) Virgin Island (US) Wallis & Fatuna Island West Bank & Gaza Strip Yemen, Rep of Zambia Zimbabwe

72 173 150 120 110 126 93 80 80 39 110 110 80 62 135 104 56 92 146 135 146 114 81 81 86 155 65 114 114 70 60 69 130 53

Change from previous year -6 9 20

-10 24

-7 9 48 -12 -10

-9

-10

73 23 9 -16 -18 -24 -15 -11 -6 -10 -10 10 -15

-12 11

11 -12 6 -12

9 6 8 -9 16 -9 -13 -12 -15 -7

-8 -12

* United Arab Emirates includes Abu Dhabi, Ajman, Dubai, Fujairah, Ras al-Khaimah, Sharjah and Umm al-Qaiwain.

You might also like

- Hotels World Summary: Market Values & Financials by CountryFrom EverandHotels World Summary: Market Values & Financials by CountryNo ratings yet

- Select The Country: Hour Minutes Am / PMDocument7 pagesSelect The Country: Hour Minutes Am / PMajaydhageNo ratings yet

- Credit Cards World Summary: Market Values & Financials by CountryFrom EverandCredit Cards World Summary: Market Values & Financials by CountryNo ratings yet

- Corruption Perceptions INDEX 2012: ScoreDocument1 pageCorruption Perceptions INDEX 2012: ScoreShahid JavaidNo ratings yet

- Isd Tariff Country Code EnglishDocument1 pageIsd Tariff Country Code EnglishhalimulalamNo ratings yet

- Gross National Income Per Capita 2010, Atlas Method and PPP: Purchasing Atlas Power Parity MethodologyDocument4 pagesGross National Income Per Capita 2010, Atlas Method and PPP: Purchasing Atlas Power Parity MethodologyKhoirul UmamNo ratings yet

- Grameen Phone Bangladesh Tariff & Country CodeDocument1 pageGrameen Phone Bangladesh Tariff & Country CodeAnk BasharNo ratings yet

- DHL New RatesDocument12 pagesDHL New Ratessandeep12416No ratings yet

- Country Wise Tariff ListDocument4 pagesCountry Wise Tariff ListpurisameerNo ratings yet

- Perdiems July 2013Document5 pagesPerdiems July 2013Aleksandar MilosavljevicNo ratings yet

- Alcohol Consumption Per CountryDocument4 pagesAlcohol Consumption Per CountryvarunrayenNo ratings yet

- Table 2. Country Rankings: by Largest Average IFF Estimates, 2001-2010Document2 pagesTable 2. Country Rankings: by Largest Average IFF Estimates, 2001-2010karametoNo ratings yet

- Gross National Income Per Capita 2010, Atlas Method and PPP: Purchasing Atlas Power Parity MethodologyDocument4 pagesGross National Income Per Capita 2010, Atlas Method and PPP: Purchasing Atlas Power Parity MethodologyAlejandro AnganuzziNo ratings yet

- Auto DialerDocument2 pagesAuto DialerJames WatsonNo ratings yet

- Sat Code List InternationalDocument16 pagesSat Code List InternationalzachdblsuydgoNo ratings yet

- Mobile Country Codes (MCC) Mobile Network Codes (MNC) ImsiDocument76 pagesMobile Country Codes (MCC) Mobile Network Codes (MNC) ImsiFaissal Abdallah0% (2)

- 1 Subsistence Allowance - Foreign Travel 1.1 List of Daily Maximum Amount Per Country Which Is Deemed To Been ExpendedDocument5 pages1 Subsistence Allowance - Foreign Travel 1.1 List of Daily Maximum Amount Per Country Which Is Deemed To Been ExpendedtamminsiasNo ratings yet

- Low Income CountriesIntlDocument2 pagesLow Income CountriesIntlDenis RamdaniNo ratings yet

- Global Innovation Index 2012Document2 pagesGlobal Innovation Index 2012eftychidisNo ratings yet

- World's Mothers IndexDocument4 pagesWorld's Mothers IndexJason HardinNo ratings yet

- ,6'&rghvirudoofrxqwulhv: 15,2/+RPH Odwhvw1Hzv 9Lhzv 15,2/ ( (FOXVLYHV &RPPXQLW/ 5hvrxufhv 6Krs +hosDocument7 pages,6'&rghvirudoofrxqwulhv: 15,2/+RPH Odwhvw1Hzv 9Lhzv 15,2/ ( (FOXVLYHV &RPPXQLW/ 5hvrxufhv 6Krs +hosp364364No ratings yet

- Countries and Their CapitalsDocument7 pagesCountries and Their CapitalsSheikh ZakirNo ratings yet

- Country Power Distance Index Individualism Masculinity Uncertainty Avoidance Corruption IndexDocument14 pagesCountry Power Distance Index Individualism Masculinity Uncertainty Avoidance Corruption IndexnejaterkNo ratings yet

- CERF Funding by Country 2015Document1 pageCERF Funding by Country 2015Jesus Gary DomingoNo ratings yet

- Pie Donut Election Chart Dynamic 2D FTDocument45 pagesPie Donut Election Chart Dynamic 2D FTQuân Nguyễn MinhNo ratings yet

- World Trade StatisticsDocument28 pagesWorld Trade StatisticsubabkhanNo ratings yet

- Country Name Country CodeDocument6 pagesCountry Name Country CodePrateek SakhujaNo ratings yet

- Country or Area Year Total Men Women: Table 4e. School Life ExpectancyDocument8 pagesCountry or Area Year Total Men Women: Table 4e. School Life ExpectancyLaylson AlencarNo ratings yet

- IDD132Document1 pageIDD132reza_ghahramaniNo ratings yet

- Independent Personal ServicesDocument2 pagesIndependent Personal ServicesJapari AdamNo ratings yet

- Basic Telephone Service - Country CodesDocument5 pagesBasic Telephone Service - Country CodesNeroo KathirNo ratings yet

- Subscriber NumbersDocument2 pagesSubscriber NumbersdavidNo ratings yet

- Country Termination (Mobile, Fixed, Special) Country Code Tariff Per MinuteDocument13 pagesCountry Termination (Mobile, Fixed, Special) Country Code Tariff Per MinuteAshish JainNo ratings yet

- List of All Counrty Dailing CodesDocument8 pagesList of All Counrty Dailing Codesshekhar_bnlNo ratings yet

- Myanmar Country Report 2010Document64 pagesMyanmar Country Report 2010John SanenhNo ratings yet

- Mobile Country Codes (MCC) - Mobile Network Codes (MNC) - ImsiDocument73 pagesMobile Country Codes (MCC) - Mobile Network Codes (MNC) - ImsiSivakumar MudaliarNo ratings yet

- Fedex 10Kg and 25Kg Box: Applicable in India From 7 January, 2013Document2 pagesFedex 10Kg and 25Kg Box: Applicable in India From 7 January, 2013Sourabh ThakkarNo ratings yet

- Asian Economy: Goals of The CourseDocument5 pagesAsian Economy: Goals of The CoursePhuong TranNo ratings yet

- Cpso2206 01 TagalogDocument42 pagesCpso2206 01 TagalogKim JinsCharmsNo ratings yet

- No. Nama Negara Mata Uang Simbol Dalam RupiahDocument4 pagesNo. Nama Negara Mata Uang Simbol Dalam RupiahIchaa Paramita RosyandaNo ratings yet

- Kyoto Protocol: Carbon Dioxide Equivalent EmissionsDocument17 pagesKyoto Protocol: Carbon Dioxide Equivalent EmissionsPrasanna BabliNo ratings yet

- Country Codes ListDocument5 pagesCountry Codes ListDartfrog ImiNo ratings yet

- Ultra Inter RatesDocument11 pagesUltra Inter RatesErin OchoaNo ratings yet

- Swap TrackerDocument65 pagesSwap TrackerakynyemiNo ratings yet

- Zone 2011Document1 pageZone 2011nhatphongNo ratings yet

- Nostro 2Document1 pageNostro 2Alonewith BrokenheartNo ratings yet

- SBI Home Loan Max Gain CalculationDocument4 pagesSBI Home Loan Max Gain CalculationGaurav PatilNo ratings yet

- Sbi Maxgain Advantage: Normal Loan Emi Actual Number of Emis 180 Enter Values Maxgain AdvantageDocument4 pagesSbi Maxgain Advantage: Normal Loan Emi Actual Number of Emis 180 Enter Values Maxgain Advantagedheeraj831No ratings yet

- Sbi Maxgain Advantage: Normal Loan Emi Actual Number of Emis 180 Enter Values Maxgain AdvantageDocument4 pagesSbi Maxgain Advantage: Normal Loan Emi Actual Number of Emis 180 Enter Values Maxgain Advantageebooks_loginNo ratings yet

- Sbi Maxgain Advantage: Normal Loan Emi Actual Number of Emis 165 Enter Values Maxgain AdvantageDocument4 pagesSbi Maxgain Advantage: Normal Loan Emi Actual Number of Emis 165 Enter Values Maxgain AdvantageVeer SinghNo ratings yet

- SAT by Om 3Document8 pagesSAT by Om 3Om Tiwari PandeyNo ratings yet

- Lincoln Crowne Engineering Mining Services Report 22 November 2013Document2 pagesLincoln Crowne Engineering Mining Services Report 22 November 2013Lincoln Crowne & CompanyNo ratings yet

- Power Generation by Country - 2010Document12 pagesPower Generation by Country - 2010Paul MaposaNo ratings yet

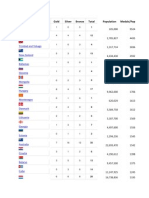

- London2012 Medal Counts FinalDocument5 pagesLondon2012 Medal Counts FinalMichael GutmannNo ratings yet

- GDP (In Billions, USD) 2009 2010 2011Document59 pagesGDP (In Billions, USD) 2009 2010 2011uma.mba9920No ratings yet

- Daily Trade Journal - 12.06.2013Document7 pagesDaily Trade Journal - 12.06.2013Randora LkNo ratings yet

- Personal - PDF Personal BondDocument6 pagesPersonal - PDF Personal BondYazid YasinNo ratings yet

- Suresave Insurance Product Disclosure StatementDocument22 pagesSuresave Insurance Product Disclosure StatementRay PasteurNo ratings yet

- GWM2010Document1 pageGWM2010JC219No ratings yet

- Gapminder World 2013 v8Document1 pageGapminder World 2013 v8Roberto MorisNo ratings yet