Professional Documents

Culture Documents

Project ON Entrepreneurial Life of Ms. Chanda Kochhar

Uploaded by

asavirkOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Project ON Entrepreneurial Life of Ms. Chanda Kochhar

Uploaded by

asavirkCopyright:

Available Formats

PROJECT ON Entrepreneurial life of Ms.

Chanda Kochhar

FMS- WISDOM ,BanasthaliUniversity SUBMITTED TO:Gragi Pant SUBMITTED BY:Prabh Sharma(8103) Prabhjeet kaur(8002) Pragya Agarwal () Pranvi() Prachi() Pragati garg)(

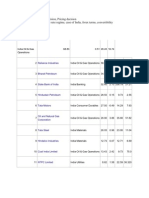

Chanda Kochhar is currently the Managing Director (MD) of ICICI Bank and Chief Executive Officer (CEO). ICICI Bank is India's largest private bank and overall second largest bank in the country. She also heads the Corporate Centre of ICICI Bank. Early Life and Education Chanda Kochhar was born on 17th November 1961 in Jodhpur, Rajasthan. She then joined Jai Hind College in Mumbai for a Bachelor of Arts degree. After completing her graduation in 1982, she pursued cost accountancy (ICWAI). Later, she did her Master's degree in management studies from the esteemed Jamnalal Bajaj Institute of Management Studies in Mumbai from where she received a Wockhardt Gold Medal for Excellence in Management Studies. In the same year, she won the J.N Bose gold medal for Cost Accountancy. She married Deepak Kochhar and has a son and a daughter. She is at present living in Mumbai. Career In 1984, after her masters, Chanda Kochhar joined 'The Industrial Credit and Investment Corporation of India Limited' or ICICI Limited as a management trainee. In her initial years in ICICI, she handled project appraisal and monitoring and various projects in Petrochemicals, Textile and Cement and Paper. She took part in the core team to set the bank in 1993. She became Assistant General Manager in 1994 and Deputy General Manager in 1996. She headed the infrastructure industry group of ICICI in 1996 and in 1998 she headed the Major Client Group that handled the top 200 clients of ICICI bank. The retail business was started by ICICI under the leadership of Chanda Kochhar in July 2000. She became the Executive Director of ICICI bank in April 2001.In April 2006, Chanda Kochhar was appointed as Deputy Managing Director of ICICI Bank. She managed the Corporate and Retail banking business of ICICI Bank. From October 2007 to April 2009, Kochhar was also the bank's Chief Financial Officer (CFO), Joint Managing Director (JMD) and the official spokesperson. CEO and MD of ICICI Bank Kochhar is CEO and MD of ICICI Bank from May 2009 for a period of five years. She succeeds K. V. Kamath, who was CEO of the bank since 1996.She is a director in ICICI International Limited and ICICI Prudential Life Insurance Company Ltd. She is the chairperson of ICICI Bank Eurasia Limited Liability Company and ICICI Investment Management Company Limited. Kochhar is the Vice-Chairperson of ICICI Bank UK PLC and ICICI Bank Canada.

Outstanding steps taken by Ms. Kochhar at various phases of her professional life

The Meeting The 11th floor conference room in the South Tower at ICICI Banks headquarters has witnessed many stormy meetings. Like the one in progress that warm April day in 2008. KV Kamaths A-team : Chanda Kochhar, V Vaidyanathan, Madhabi Puri-Buch, K Ramkumar and Sonjoy Chatterjee had assembled there, a day before presenting the banks budget to the board. Kamath had told them they ought to focus on reining in costs. But a consensus seemed to elude the group. That was because Kochhar, widely tipped to take over from Kamath, was unconvinced. Everybody else in the room reckoned Rs 7,900 crore in operating expenses was a fair number. The debate went on, until abruptly, Kochhar stood up and said: With this kind of numbers, we wont have a bank to run next year. That said, she called the meeting to a close. A couple of hours of brainstorming later without Kochhar, they reassembled in the same room. We dont have an answer, executive director and group HR head at the bank K Ramkumar recalls the team telling Kochhar. What is the number we ought to be working on? Without blinking, she said Rs 6,500 crore. For a few moments, there was a stunned silence in the room. Essentially, she was telling them to maintain operating expenses at the previous years level.

A new paradigm

For as long as most people who have followed ICICI can remember, the bank has remained married to one mission: Aggressive growth. That is why when news started trickling out that a divorce is inevitable, when asked from Chanda Kochhar. Quite honestly, it was impossible to miss the firmness in an otherwise temperate voice. Growth, she said, can mean various things. It isnt just about growing the balance sheet. To seasoned ICICI watchers, this is the kind of language that qualifies for blasphemy the kind of thing an outsider with no clue of the banks institutional history would say. But then, we all know Chanda Kocchar is, The Insider. Shes seen it all: How her predecessor KV Kamath transformed ICICI from a crumbling development financial institution (DFI) to Indias most visible universal bank; how he grew its balance sheet five fold in less than a decade; and how he commands fanatic loyalty from the troops. But everything Kochhar is executing right now may seem to be at loggerheads with what her mentor believed in. Over the next one year, she intended to grow the balance sheet by just five per cent an unthinkably low number during the Kamath years. But now, she is battening down the hatches on two of Kamaths biggest bets plant the ICICI flag outside India and aggressively woo rural India.

The major reforms And remember the credit card and personal loan businesses? Kamath goaded the bank into war with global giants Citi and Standard Chartered and eventually toppled them a few years ago. One of the first things Kochhar did after taking over was to tell her colleagues to back off from these verticals and cut losses. Then there was this period when Kamath told a whole generation of Indians why visiting a bank doesnt make sense. Use ATMs instead, he urged. And to sell a creditstarved country all that a modern bank could offer, he recruited an army of direct selling agents (DSA). It was his way of getting around infrastructural deficiencies that could otherwise hamper ICICIs growth plans. Since the time Kochhar has taken over though, the emphasis at ICICI is to get people into branches. Folks at the bank used to working at its giant headquarters in Bandra Kurla Complex in Mumbai are being redeployed to run branches. And 70 percent of

ICICIs DSA operations have been wound up. By next year, the bank may no longer rely on any outsourcing for business acquisition and collections.

An unfamiliar world Last September, soon after Lehman Brothers collapsed, ICICI Bank faced an unprecedented crisis. Speculation mounted that its exposure to Lehman held enough potential to wreck the whole bank. Edgy traders hammered the stock down and nervous depositors queued up outside its premises to take their money back. It hurt us enormously when nobody believed our exposure was limited to $81 million, recalls Ramkumar. To manage the crisis, a war room was set up and the mantle fell on Kochhar to lead the exercise. It taught me a couple of things, she says. One, if there is a challenge, your shoulder ought to become broader and your back straighter. Confidence is important. Two, you have to be the sponge that absorbs stress. Else, it passes down to the team and they cannot function efficiently. It also sensitised the team to a type of risk they hadnt factored in before reputation risk. Until then, as bankers, they had only understood market risk, credit risk and operations risk. In some part, this was the outcome of yet another controversial sequence of events in the banks history. Just before this crisis played itself out, the team had battled another. Starting 2007, the bank came under fire in the media for allegedly using strong arm tactics to collect credit card dues. We perhaps misjudged the power of public perception around collections. And that impaired our ability to collect money, says Ramkumar. It finally forced the board, led by chairman N Vaghul and Kamath to dismantle the entire network of collection agents.

A new beginning 1) In part, this was possible because ICICI has just got the licences to open another 580 branches, over the 1,453 it already has. Of these, Kochhar has earmarked 20 for special status as mega branches. These will serve corporate customers as well. In some ways, this is how Axis Bank, State Bank of India and HDFC Bank function.

2) In the past, ICICI preferred to centralise operations while branches were manned by younger staffers. The outcome was poor turnaround time. The branch staff had little control over the outcome. In the new dispensation, a premium is being placed on the branches. Veterans from headquarters are being deployed to head them. A considerable amount of authority is being vested on them to solve customer issues at the branch itself. 3) At the same time, the bank is targeting the government sector, and even stock market participants to open current accounts to improve the CASA ratio. 4) The new branch licences are also a reason to wind down the direct marketing channel, a move that brings with it considerable pain. The channel was built over the years with assiduous wooing of partners. But now that the relationship has to be terminated, there is angst in the system. 5) Her biggest challenge is to meet market expectations. So far, to keep its high growth strategy intact, the bank has had to raise funds from the markets several times. Yet at 7.8 percent, the return on equity (ROE) has been poor. But she has promised an ROE of 15 percent over the next three years.

Her approach towards challenges She always moved ahead with a meticulous planning. Shes always firm about her objectives and readily accepts all the obstacles with a firm and determined hand to outstand them which comes in her way. A good farsighted, she always had an attitude of learning from past and thus making best out of coming futures challenges and converting them into opportunities.

Awards and Achievements Kochhar is honored with Padma Bhushan Award, the third highest civilian honour by the Government of India for the year 2010 for her services to banking sector. Kochhar personally was awarded "Retail Banker of the Year 2004 (Asia-Pacific region)" by the Asian Banker, "Business Woman of the Year 2005" by The Economic Times and "Rising Star Award" for Global Awards 2006 by Retail Banker International. Kochhar has also consistently figured in Fortune's list of "Most Powerful Women in Business" since 2005.In 2009, she debuted at number

20 in the Forbes "World's 100 Most Powerful Women list, and climbed to the 10th spot in 2010.she featured in Business Today's list of the "Most Powerful Women Hall of Fame. In 2011, she also featured in the "The 50 Most Influential People in Global Finance" List of Bloomberg Markets.

REFERENCES

You might also like

- Icici Home Loan FinanceDocument78 pagesIcici Home Loan FinanceParshant GargNo ratings yet

- Corporate CreditDocument69 pagesCorporate CreditAshish chanchlani100% (1)

- Cash Flow ProjectDocument85 pagesCash Flow ProjectUsman MohammedNo ratings yet

- Credit Risk Management in HDFC BankDocument44 pagesCredit Risk Management in HDFC BankAyesha Mathur100% (2)

- History of Tata SteelDocument13 pagesHistory of Tata Steelmanoj rakesh100% (4)

- Financial Performance of ICICI BankDocument68 pagesFinancial Performance of ICICI BankAbhimanyu50% (2)

- Final ReportDocument56 pagesFinal ReportsushantaNo ratings yet

- HDFC N SbiDocument129 pagesHDFC N SbiShruti PoddarNo ratings yet

- 1991 PV Sanjay BaruDocument131 pages1991 PV Sanjay Barukishore kommi100% (2)

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Securitization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsFrom EverandSecuritization in India: Managing Capital Constraints and Creating Liquidity to Fund Infrastructure AssetsNo ratings yet

- Saraswat BanK ORIGINALDocument57 pagesSaraswat BanK ORIGINALSudama EppiliNo ratings yet

- Central Bank of IndiaDocument70 pagesCentral Bank of Indianandini_mba4870100% (6)

- Project Report On ICICI BankDocument22 pagesProject Report On ICICI Bankahemad_ali1080% (5)

- Uber MarketingDocument23 pagesUber MarketingKavya SathishNo ratings yet

- Strategic Analysis Report - Tesla MotorsDocument8 pagesStrategic Analysis Report - Tesla MotorsahmedbaloNo ratings yet

- Marketing Analysis of NestleDocument40 pagesMarketing Analysis of NestleFaizanSheikh100% (3)

- A Project Study Report ON: "Customer Awareness About Safe Banking"Document57 pagesA Project Study Report ON: "Customer Awareness About Safe Banking"Ribhanshu RajNo ratings yet

- The 11th Floor Conference Room in The South Tower at ICICI Bank - Everything Abt C.kochharDocument5 pagesThe 11th Floor Conference Room in The South Tower at ICICI Bank - Everything Abt C.kochharswapnil0324No ratings yet

- HRM and Labour LawsDocument15 pagesHRM and Labour Lawsjugan420No ratings yet

- Chanda D. Kochhar: Executive ProfileDocument5 pagesChanda D. Kochhar: Executive ProfileRahul PandeyNo ratings yet

- ICICI BankDocument32 pagesICICI Bankaditi100% (1)

- Marwari CollegeDocument35 pagesMarwari CollegeAvinashNo ratings yet

- Icici BankDocument15 pagesIcici BankarmaanNo ratings yet

- CRM in Icici BankDocument23 pagesCRM in Icici BankManindar SinghNo ratings yet

- Growth in A Downturn: HDFC BankDocument7 pagesGrowth in A Downturn: HDFC BankMufaddal HussainNo ratings yet

- Presentation On ICICI BankDocument7 pagesPresentation On ICICI Bank25bishtNo ratings yet

- 3project Report On ICICI BankDocument22 pages3project Report On ICICI Bankudit BarmanNo ratings yet

- Ritu Yadav 143Document37 pagesRitu Yadav 143RITU YADAVNo ratings yet

- Radhika Project ReportDocument114 pagesRadhika Project ReportrajapatnaNo ratings yet

- A Project Report ON: Analysis On "Credit Appraisal"Document71 pagesA Project Report ON: Analysis On "Credit Appraisal"Himanshu SharmaNo ratings yet

- ICICI Bank Company ProfileDocument6 pagesICICI Bank Company ProfilesumitpatraNo ratings yet

- Synopsis ON Credit Risk Management IN: Pooja Arora 140423533Document6 pagesSynopsis ON Credit Risk Management IN: Pooja Arora 140423533Pooja AroraNo ratings yet

- Chapter 1DFVDocument21 pagesChapter 1DFVAsif KhanNo ratings yet

- Case Study 2011Document7 pagesCase Study 2011Momi DuttaNo ratings yet

- C C C CC C CCC CCC C C C CCC CC C C C CC CCCCC CCCC C C CCC CCCC!C"C CC CC C CC#CC CCC "C C CC C CC C CCCCCCC C C! CC C CC$%&' CCCC C CCC CCC C CDocument52 pagesC C C CC C CCC CCC C C C CCC CC C C C CC CCCCC CCCC C C CCC CCCC!C"C CC CC C CC#CC CCC "C C CC C CC C CCCCCCC C C! CC C CC$%&' CCCC C CCC CCC C Cmihirshah4590No ratings yet

- Shubhankar Rawat - SCMHRD - Project ReportDocument25 pagesShubhankar Rawat - SCMHRD - Project ReportPrajapati BhavikMahendrabhaiNo ratings yet

- Axisremit OnlineDocument11 pagesAxisremit Onlineanandu3636No ratings yet

- ICICI's Chanda Kochhar: 'Whenever There's A Challenge, I See An Opportunity'Document3 pagesICICI's Chanda Kochhar: 'Whenever There's A Challenge, I See An Opportunity'Mayank GargNo ratings yet

- Telant ManagementDocument5 pagesTelant ManagementNandini RathiNo ratings yet

- Icici BankDocument69 pagesIcici BankHarsha KharkarNo ratings yet

- Sbi Minor ProjectDocument59 pagesSbi Minor ProjectYashika JainNo ratings yet

- LJLKLK OpppDocument18 pagesLJLKLK OpppNaveen KumarNo ratings yet

- Financial Analysis of Banking Industry With Special Refference in Icici BankDocument135 pagesFinancial Analysis of Banking Industry With Special Refference in Icici Bankravi singhNo ratings yet

- Chanda KochharDocument3 pagesChanda Kochharartitrivedi043No ratings yet

- Ashok Reports PFDDocument59 pagesAshok Reports PFDashok kumar vermaNo ratings yet

- Summer Training Project ReportDocument118 pagesSummer Training Project Reporttariquewali11No ratings yet

- CRM in Banking IndustryDocument16 pagesCRM in Banking IndustrypriteshhegdeNo ratings yet

- Internship - Icici Mohammed MustafaDocument22 pagesInternship - Icici Mohammed MustafaMaryam AbediNo ratings yet

- Sachin ReportDocument44 pagesSachin ReportMilap NaiduNo ratings yet

- HDFC Bank LimitedDocument5 pagesHDFC Bank LimitedRaushan MehrotraNo ratings yet

- Axis Bank Report.Document11 pagesAxis Bank Report.Rajat NidoniNo ratings yet

- 7 P's of Private Sector BankDocument21 pages7 P's of Private Sector BankMinal DalviNo ratings yet

- Cash Management - ICICI BankDocument84 pagesCash Management - ICICI BankRini Nigam100% (1)

- Icici Marketing Strategy of Icici BankDocument68 pagesIcici Marketing Strategy of Icici BankShilpi KumariNo ratings yet

- Soniya BegDocument124 pagesSoniya BegRibhanshu RajNo ratings yet

- MC Group 05Document14 pagesMC Group 05si ranNo ratings yet

- K.C.B Technical Academy: A Synopsis ofDocument9 pagesK.C.B Technical Academy: A Synopsis ofAnny JainNo ratings yet

- Icici Bank ReportDocument79 pagesIcici Bank ReportM I HASSANNo ratings yet

- Dena BNK Project FinalDocument82 pagesDena BNK Project FinalNirmal MudaliyarNo ratings yet

- Yes Bank (Case)Document6 pagesYes Bank (Case)naviiiiiNo ratings yet

- Axis Bank Literature ReviewDocument8 pagesAxis Bank Literature Reviewc5p0cd99100% (1)

- Kotak ReportDocument64 pagesKotak Report8289sumit0% (1)

- Sbi & Icici: PsychologyDocument34 pagesSbi & Icici: PsychologyRameez ShaikhNo ratings yet

- Kotak ReportDocument71 pagesKotak ReportSumit PatelNo ratings yet

- Case StudiesDocument4 pagesCase StudiesasavirkNo ratings yet

- New Microsoft Office Word DocumentDocument2 pagesNew Microsoft Office Word DocumentasavirkNo ratings yet

- CaiibrmmodelquestionsraviDocument41 pagesCaiibrmmodelquestionsraviRohit GoyalNo ratings yet

- CaiibrmmodelquestionsraviDocument41 pagesCaiibrmmodelquestionsraviRohit GoyalNo ratings yet

- Answer Key Part 4Document13 pagesAnswer Key Part 4Alfina TabitaNo ratings yet

- L03 ECO220 PrintDocument15 pagesL03 ECO220 PrintAli SioNo ratings yet

- SCHOOLDocument18 pagesSCHOOLStephani Cris Vallejos Bonite100% (1)

- MyNotesOnCNBCSoFar 2016Document38 pagesMyNotesOnCNBCSoFar 2016Tony C.No ratings yet

- WSE-LWDFS.20-08.Andik Syaifudin Zuhri-ProposalDocument12 pagesWSE-LWDFS.20-08.Andik Syaifudin Zuhri-ProposalandikszuhriNo ratings yet

- MSC Chain of Custody StandardDocument10 pagesMSC Chain of Custody StandardIMMASNo ratings yet

- JBS Usa Lux S.A. and JBS S.A. Announce Expiration Of, and Receipt of Requisite Consents in Connection With, The Consent SolicitationsDocument2 pagesJBS Usa Lux S.A. and JBS S.A. Announce Expiration Of, and Receipt of Requisite Consents in Connection With, The Consent SolicitationsJBS RINo ratings yet

- Eldorado DredgeDocument2 pagesEldorado DredgeNeenNo ratings yet

- Import - Export Tariff of Local Charges at HCM For FCL & LCL & Air (Free-Hand) - FinalDocument2 pagesImport - Export Tariff of Local Charges at HCM For FCL & LCL & Air (Free-Hand) - FinalNguyễn Thanh LongNo ratings yet

- Challan Form SargodhaDocument1 pageChallan Form SargodhaUsama NazirNo ratings yet

- Borjas 2013 Power Point Chapter 8Document36 pagesBorjas 2013 Power Point Chapter 8Shahirah Hafit0% (1)

- AbstractDocument12 pagesAbstractanmolNo ratings yet

- Unit 1 Econ VocabDocument5 pagesUnit 1 Econ VocabNatalia HowardNo ratings yet

- Accounting ProjectDocument33 pagesAccounting Projectapi-353552300100% (1)

- Double TaxationDocument8 pagesDouble TaxationArun KumarNo ratings yet

- Coas b1 AcksDocument1 pageCoas b1 AcksSanah KhanNo ratings yet

- Viney - Financial Markets and InstitutionsDocument37 pagesViney - Financial Markets and InstitutionsVilas ShenoyNo ratings yet

- Primary/Mobile/Minimal Processing UnitDocument3 pagesPrimary/Mobile/Minimal Processing UnitPushpak DeshmukhNo ratings yet

- Air Asia CompleteDocument18 pagesAir Asia CompleteAmy CharmaineNo ratings yet

- Midc MumbaiDocument26 pagesMidc MumbaiparagNo ratings yet

- Kalman Filter and Economic ApplicationsDocument15 pagesKalman Filter and Economic ApplicationsrogeliochcNo ratings yet

- OD126193179886369000Document6 pagesOD126193179886369000Refill positivityNo ratings yet

- 33611B SUV & Light Truck Manufacturing in The US Industry ReportDocument38 pages33611B SUV & Light Truck Manufacturing in The US Industry ReportSubhash BabuNo ratings yet

- Power For All - ToolsDocument6 pagesPower For All - Toolsdan marchisNo ratings yet

- September October LD Debate Kritik (Neg)Document5 pagesSeptember October LD Debate Kritik (Neg)RhuiedianNo ratings yet