0% found this document useful (0 votes)

929 views1 pagePaySlip MAY 2025

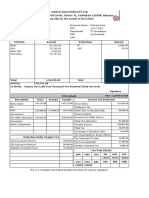

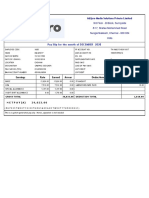

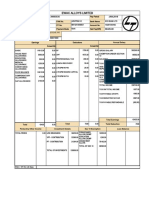

This document is a pay slip for Chandra Sekaran A from Quess Corp Limited for May 2025, detailing earnings of ₹22,408.00 and deductions of ₹1,698.00, resulting in a net pay of ₹19,710.00. It includes information on employee details, salary components, and income tax calculations. The document is computer-generated and does not require a signature.

Uploaded by

Sekar mechCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

929 views1 pagePaySlip MAY 2025

This document is a pay slip for Chandra Sekaran A from Quess Corp Limited for May 2025, detailing earnings of ₹22,408.00 and deductions of ₹1,698.00, resulting in a net pay of ₹19,710.00. It includes information on employee details, salary components, and income tax calculations. The document is computer-generated and does not require a signature.

Uploaded by

Sekar mechCopyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd