Professional Documents

Culture Documents

Dec Salary Slip

Uploaded by

PrayagOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dec Salary Slip

Uploaded by

PrayagCopyright:

Available Formats

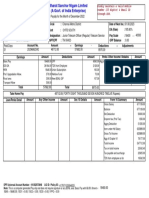

QUATRRO GLOBAL SERVICES PRIVATE LIMITED

Basement, 24, C- Block, Community Centre, Janak Puri, DELHI 110058

NEW DELHI

Pay Slip for the month of December 2014

All amounts in INR

Emp Code :QUA06710

Emp Name :PRAYAG NAGORAO MESHRAM

Department:Technical Solutions Group

Designation:SOLUTION ENGINEER

Grade

:1AB

DOB

:03 Aug 1993

DOJ:03 Nov 2014

Location

:GURGAON

Bank/MICR :110234004

Bank A/c No.:100031256789 (INDUSIND BANK LTD)

Cost Center :QBPO

PAN

:PANNOTAVBL

Payable Days:31.00 PF No.

:

ESI No.

:

Earnings

Deductions

Description

Rate

Monthly

Arrear

Total

Description

Amount

BASIC

8500.00

8500.00

0.00

8500.00 PF

1020.00

HRA

4047.00

4047.00

0.00

4047.00 ELWF

10.00

CBPB(Bonus)

2500.00

2500.00

0.00

2500.00

MED ALL

600.00

600.00

0.00

600.00

GROSS EARNINGS

15647.00 15647.00

0.00 15647.00

GROSS DEDUCTIONS

1030.00

Net Pay : 14617.00 (FOURTEEN THOUSAND SIX HUNDRED SEVENTEEN ONLY)

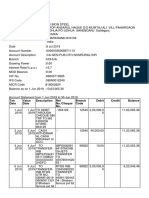

Income Tax Worksheet for the Period April 2014 - March 2015

Description

BASIC

HRA

CBPB(Bonus)

MED ALL

Gross

34000.00

16188.00

2500.00

2400.00

Exempt

Taxable

0.00 34000.00

0.00 16188.00

0.00

2500.00

2400.00

0.00

Gross

55088.00

2400.00 52688.00

Deductions

Previous Employer Taxable Income

0.00

Previous Employer Professional Tax

0.00

Professional Tax

0.00

Under Chapter VI-A

4080.00

Any Other Income

0.00

Taxable Income

48608.00

Total Tax

0.00

Tax Rebate u/s 87a

0.00

Surcharge

0.00

Tax Due

0.00

Educational Cess

0.00

Net Tax

0.00

Tax Deducted (Previous Employer)

0.00

Tax Deducted on Perq.

0.00

Tax Deducted on Any Other Income.

0.00

Tax Deducted Till Date

0.00

Tax to be Deducted

0.00

Tax/Month

0.00

Tax on Non-Recurring Earnings

0.00

Tax Deduction for this month

0.00

Deduction Under Chapter VI-A

Investments u/s 80C

Provident Fund

4080.00

Taxable HRA Calculation(Non-Metro)

Rent Paid

0.00

From

03/11/2014

To

31/03/2015

1. Actual HRA

16188.00

2. 40% or 50% of Basic

13600.00

3. Rent > 10% Basic

0.00

Least of above is exempt

0.00

Total Investments u/s 80C

4080.00 Taxable HRA

16188.00

U/S 80C

4080.00

Total Ded Under Chapter VI-A4080.00

TDS Deducted Monthly

Month

Amount

December-2014

0.00

Tax Deducted on Perq.

0.00

Total

0.00

Total Any Other Income

0.00

Personal Note: This is a system generated payslip, does not require any signature.

You might also like

- Vicky Pay Slip PDFDocument1 pageVicky Pay Slip PDFAnonymous 4AX4KCNo ratings yet

- Adecco India Pvt. LTD.: Payslip For The Month of May 2019Document2 pagesAdecco India Pvt. LTD.: Payslip For The Month of May 2019Secret EarthNo ratings yet

- Payslip Aug2022Document1 pagePayslip Aug2022Raut AbhimanNo ratings yet

- Fuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 DaysDocument1 pageFuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 Daysanup_nairNo ratings yet

- Aswini Salary Slip FebDocument1 pageAswini Salary Slip FebAvnish MisraNo ratings yet

- Payslip October 2022Document1 pagePayslip October 2022Raja guptaNo ratings yet

- Payslip For 16831Document1 pagePayslip For 16831omkassNo ratings yet

- Salary Slip A12Document1 pageSalary Slip A12Pritam GoswamiNo ratings yet

- Physic Pharma pay slips 2016Document3 pagesPhysic Pharma pay slips 2016raisNo ratings yet

- Payslip Jun PDFDocument1 pagePayslip Jun PDFtrack ViewNo ratings yet

- Salary SlipsDocument6 pagesSalary SlipsIMSaMiNo ratings yet

- HTMLReportsDocument1 pageHTMLReportsRashmi Awanish PandeyNo ratings yet

- Pushparaj R PayslipDocument3 pagesPushparaj R PayslipHenry suryaNo ratings yet

- October 2022: Employee Details Payment & Leave Details Location DetailsDocument1 pageOctober 2022: Employee Details Payment & Leave Details Location DetailsPritam GoswamiNo ratings yet

- Salary Slip SriwatiDocument2 pagesSalary Slip SriwatiFauziliza JayaNo ratings yet

- Pay Slip - 604316 - May-22Document1 pagePay Slip - 604316 - May-22ArchanaNo ratings yet

- PaySlip 221253181486P PDFDocument1 pagePaySlip 221253181486P PDFpraveenNo ratings yet

- India Local Monthly130122210312905Document1 pageIndia Local Monthly130122210312905NAGARJUNANo ratings yet

- Comviva Technologies Limited: Pay Slip For The Month of March 2012Document1 pageComviva Technologies Limited: Pay Slip For The Month of March 2012Prabhakar KumarNo ratings yet

- UnknownDocument1 pageUnknownSumanth MopideviNo ratings yet

- March Salary PDFDocument1 pageMarch Salary PDFomkassNo ratings yet

- Shrine Lifesciences Private Limited: Earnings Deductions Amount AmountDocument1 pageShrine Lifesciences Private Limited: Earnings Deductions Amount Amountralesh694No ratings yet

- Salary Slip 07Document1 pageSalary Slip 07Parveen SainiNo ratings yet

- Date:27 12 2015Document1 pageDate:27 12 2015Anonymous pKsr5vNo ratings yet

- Payslip 8 2022Document1 pagePayslip 8 2022Md SharidNo ratings yet

- InterviewDocument3 pagesInterviewThiya NalluNo ratings yet

- CRM Services India Private Limited: Earnings DeductionsDocument1 pageCRM Services India Private Limited: Earnings DeductionsInnama SayedNo ratings yet

- August 2015 pay slip Schneider Electric IndiaDocument1 pageAugust 2015 pay slip Schneider Electric IndiaArasu RajaNo ratings yet

- India JUN-2020 ...Document1 pageIndia JUN-2020 ...laxman luckyNo ratings yet

- DPRDocument5 pagesDPRANSARUL HOQUENo ratings yet

- Aug - 23 Salary SlipDocument1 pageAug - 23 Salary SlipBack-End MarketingNo ratings yet

- Salary Slip January 2023Document1 pageSalary Slip January 2023SYAHRIL 25071991No ratings yet

- 1563270990991Document11 pages1563270990991JohnNo ratings yet

- RPT Pay SlipDocument1 pageRPT Pay SlipAllia sharmaNo ratings yet

- Mylan Laboratories Limited: Payslip For The Month of APRIL 2017Document1 pageMylan Laboratories Limited: Payslip For The Month of APRIL 2017vediyappanNo ratings yet

- March StaffDocument5 pagesMarch StaffMp MandyaNo ratings yet

- Form16 Fiserv 2018-19Document8 pagesForm16 Fiserv 2018-19SiddharthNo ratings yet

- Payslip Jul 2023Document1 pagePayslip Jul 2023Kartika RaguvanshiNo ratings yet

- AugustDocument1 pageAugustNikhil DubeyNo ratings yet

- Bertelsmann Marketing Services India PVT LTD 15Th Floor, Tower C, BLDG No 8, DLF Cyber City GURGAON - 122002Document1 pageBertelsmann Marketing Services India PVT LTD 15Th Floor, Tower C, BLDG No 8, DLF Cyber City GURGAON - 122002mohit1990dodwalNo ratings yet

- Techfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032Document1 pageTechfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032manoj mohanNo ratings yet

- Salary Slip (30385759 May, 2018)Document1 pageSalary Slip (30385759 May, 2018)munafNo ratings yet

- 375 - Salary Slip July 2018 PDFDocument1 page375 - Salary Slip July 2018 PDFAnkit SolankiNo ratings yet

- Payslip For The Month of November 2016Document1 pagePayslip For The Month of November 2016chittaNo ratings yet

- Kirandeep September SalaryDocument1 pageKirandeep September Salaryprince.gill07No ratings yet

- Mindleap Payslip - PDF AUG PDFDocument1 pageMindleap Payslip - PDF AUG PDFChalla SandeepReddyNo ratings yet

- April 21 PayslipDocument1 pageApril 21 PayslipStephen SNo ratings yet

- Salry DecDocument1 pageSalry DecAnkush KumarNo ratings yet

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Document1 page2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanNo ratings yet

- Salary Slip April 2022Document1 pageSalary Slip April 2022Rohit raagNo ratings yet

- HDFC Bank statement for Deepanshu GargDocument5 pagesHDFC Bank statement for Deepanshu GargDeepanshu GargNo ratings yet

- Pay Slip PDFDocument1 pagePay Slip PDFPrakash DasNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- February 2023 PayslipDocument1 pageFebruary 2023 PayslipPritam GoswamiNo ratings yet

- Ixfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Document1 pageIxfaekuh 1 TNHPN 552 C 1 Oyh 454637235978572027924091013Anonymous NoxtOPCWNo ratings yet

- Ixfaekuh1tnhpn552c1oyh454637235978572027924091013 PDFDocument1 pageIxfaekuh1tnhpn552c1oyh454637235978572027924091013 PDFAnonymous zmxmihtJNo ratings yet

- PDF 293196870250623Document1 pagePDF 293196870250623nagesh valunjNo ratings yet

- Ubaid Salary SlipDocument1 pageUbaid Salary SlipbzvsbhanNo ratings yet

- PAY May 2022Document1 pagePAY May 2022Rohit raagNo ratings yet

- Nov QUA06710 SalarySlipwithTaxDetailsDocument1 pageNov QUA06710 SalarySlipwithTaxDetailsPrayagNo ratings yet

- Nov QUA06710 SalarySlipwithTaxDetailsDocument1 pageNov QUA06710 SalarySlipwithTaxDetailsPrayagNo ratings yet

- QUA06706 SalarySlipwithTax MaiDocument1 pageQUA06706 SalarySlipwithTax MaimrugeshkateNo ratings yet

- Dec Salary SlipDocument1 pageDec Salary SlipPrayagNo ratings yet

- MAR QUA06710 - SalarySlipwithTaxDetails PDFDocument1 pageMAR QUA06710 - SalarySlipwithTaxDetails PDFPrayagNo ratings yet

- Dec Salary SlipDocument1 pageDec Salary SlipPrayagNo ratings yet

- FEB QUA06710 - SalarySlipwithTaxDetails PDFDocument1 pageFEB QUA06710 - SalarySlipwithTaxDetails PDFPrayagNo ratings yet

- April QUA06710 SalarySlipwithTaxDetailsDocument1 pageApril QUA06710 SalarySlipwithTaxDetailsPrayagNo ratings yet