0% found this document useful (0 votes)

19 views12 pages1as2207 Lec01 Intro Fa 201

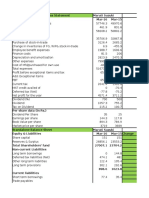

The document outlines the course structure for Finance and Financial Reporting, including lectures, tutorials, and assessment methods. It covers key topics such as financial accounting, the purpose of annual reports, and the content required in directors' reports. The course aims to equip students with the skills to prepare and interpret financial statements while adhering to accounting standards and regulations.

Uploaded by

47270013Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

19 views12 pages1as2207 Lec01 Intro Fa 201

The document outlines the course structure for Finance and Financial Reporting, including lectures, tutorials, and assessment methods. It covers key topics such as financial accounting, the purpose of annual reports, and the content required in directors' reports. The course aims to equip students with the skills to prepare and interpret financial statements while adhering to accounting standards and regulations.

Uploaded by

47270013Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd