Professional Documents

Culture Documents

Architecture Design Document For PIMS: 1. Overview 1.1. System Overview

Uploaded by

Kaustubh TawateOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Architecture Design Document For PIMS: 1. Overview 1.1. System Overview

Uploaded by

Kaustubh TawateCopyright:

Available Formats

Architecture Design Document for PIMS

1. Overview 1.1. System Overview

Personal Investment Management System (PIMS) is intended to help a user keep account of his/her investments in instruments such as shares and bean deposits. PIMS is to provide the user the rate of returns (ROR) he/she is getting, as well as net worth (NW) of the different portfolios and the total net worth. Alerts about any maturity dates can also be provided. For current value of some investment, PIMS is to obtain the information from the web.

1.2. System Context

The system context is defined clearly in the SRS. Basically, the user is the main sink of the information. The user is also a major source of information/data. The other source of data is a website from where data on current prices is obtained.

1.3. Stakeholders of PIMS

The main stakeholders for the system are the individual users who might use the system and the system designer/builder who will build PIMS. The main concerns of the two stakeholders are: For Users: The usability of the system and providing ROR and NW info. Reasonable response time is also a concern. For designer/builder: The system is easy to modify, particularly to handle future extensions mentioned in the SRS (i.e. the system may become a multi-user system, which may require use of databases instead of files for keeping data.)

Hence, the key property for which the architecture is to be evaluated is the modifiability or extensibility of the system. Response time performance is another factor for which the system needs to be evaluated.

1.4. Scope of this Document

In this document, we describe two possible architectures for PIMS, compare them for various quality attributes, and then choose the most appropriate one, which is our final proposed architecture for PIMS. By discussing the two alternatives, we also provide the rationale for selecting the final architecture. For architecture, we consider only the component and connector view.

1.5. Definitions and Acronyms

Definitions: Transaction A real event that involves flow of personal money. In the context of shares, it is buying/selling a group of shares of the

Security Portfolio Net Worth Rate of Investment

same company, and in context of Bank it is deposit/withdrawal of money to/from ones account A set of all transactions pertaining to a company share or a bank account. A set of securities. The sum total of all the money of the investor in form of shares and bank balances. The interest that user gets on a particular investment. In the context of a bank account it is the annual interest and in case of a company share it is computed on a monthly basis, details of which can be found in the appendix A of the SRS. Personal Investment Management System. Net Worth. Rate of Investment

Acronyms: PIMS NW ROI

2. Architecture Design 2.1. Architecture 1: The Repository Model

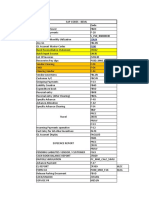

This architecture consists of a data repository, which contains information about the portfolios, securities, transactions, alerts and current share prices. There are separate modules for performing various tasks such as computation of net-worth/ROI, modification of the data repository etc. Following are the principle components of this architecture. # 1 Component Data Repository Component Type Database Description

This module is the database containing information about the Portfolio/Security/Transaction, alerts and current share prices Remote share Database (Website) This module is a database at some remote site, price database which is accessed for getting the current share prices. Master Controller Processing ( This is basically the graphical interface module Interface module) which interacts with the user on one side and makes appropriate calls to the other modules, discussed below to serve the user requests. Create/ Processing Modifies the information related to the Delete/Rename (Database investment in the data repository Portfolio/Security modification) (Portfolio/Security/Transaction) /Transaction Compute Net- Processing This module computes the net-worth and ROI Worth/ ROR (Computation) using the information in the data repository

Get/Set Alerts

Processing (Database access or modification) Net Loader Processing (Download and database modification) Get current share Processing price (Database access)

This module accesses the data repository to set/get alerts This module downloads the current share prices from a remote database and updates the data repository This module accesses the data repository and returns the price of a share

Following are the connectors of the architecture: # 1 Connector Type Description Database access/ These connectors are between the data repository modification and the modules 4, 5, 6 and 7. These represent access (R) or modification (W) of the data repository Read only Database access This connector is between the data repository connector and the modules 5 and 8. It represents reading of relevant data from the data repository Write only Database access / This connector is between the net loader module connector modification and the data repository module. This represent the updating of the current share prices URL connector HTTP This connector is between the Net Loader module and the Remote share price data module. This represents the Control connector Module invocation This connector is between the master controller or function calls module and the modules 4, 5, 6, 7 and 8. This represent the invocation of these modules by the master controller Connector R/W connectors

The diagram below shows this architecture:

Figure 3.1: The Repository Model

2.2. Architecture 2: The Access Layer Model (4 layered)

This architecture is similar to the data repository architecture. The main difference lies in the fact that here, we have a data access layer separating the business logic and data repository. Data retrieval and modification is done via this data access layer, while all the processing of data or implementation of the business logic done in the business logic layer. The 4th layer is the presentation layer (master control) which is responsible for interacting with the user and invoking modules of the business logic layer. The usefulness of the data access layer comes from the fact that if the type of database is changed then only the access layer needs to be modified while the processing logic remains the same. The components remain the same except that now we would have a new data access component get/put data which would be responsible for reading and writing data corresponding to Portfolio/Security/Transaction, alerts and share prices. There is also a component get remote which reads the current share prices from the remote database. The diagram below shows this architecture.

1. Data Repository layer

2.Data Access layer

3. Business logic layer 4. Presentation layer

Figure 4.1: The 4 layered architecture

2.3. Comparing the Architectures

Here we compare the architectures with respect to various quality attributes. Criteria Change In Data repository Change in the remote database location from which prices are extracted Addition in functionalities Extension to multiuser Provision of additional securities (passwords, etc) Architecture 1 Not easy Easy Architecture 2 Easy Easy

Easy Difficult Difficult

Easy Easier Easier

Catering of new type of securities

Easy

Easy

3. Final Architecture of PIMS

From the above table we see that architecture 2 is better as far as change in data repository is concerned. Moreover, it is also easier to extend it to a multi-user system, which involves additional security issues. However, the performance of Architecture 2 is likely to be poorer than the first one, though it should be only marginally different. Since, in future data repository may be changed, and the system may be made multi-user we prefer Architecture 2 to Architecture 1. (These have also been stated as the criteria for evaluation.) Thus we choose Architecture 2 for the Personal Investment Management System.

You might also like

- Thank You Letter Template for Cash DonationDocument3 pagesThank You Letter Template for Cash Donationbogtik100% (2)

- Work ManualDocument116 pagesWork ManualSainaath RNo ratings yet

- Bank Loan System (Document)Document72 pagesBank Loan System (Document)net635167% (3)

- Principles of Marketing Chapter 2 (Strategic PlanningDocument50 pagesPrinciples of Marketing Chapter 2 (Strategic Planningirs_ijs1967% (3)

- Mobile Shop Management System DocumentationDocument99 pagesMobile Shop Management System DocumentationVickram Jain50% (4)

- Stock Management SystemDocument19 pagesStock Management Systemshivam sainiNo ratings yet

- Report-Jewellary Management SystemDocument21 pagesReport-Jewellary Management SystemSachin More63% (8)

- Customer Bank Account Management System: Technical Specification DocumentDocument15 pagesCustomer Bank Account Management System: Technical Specification DocumentadvifulNo ratings yet

- 1-244909879656 G0093424359 PDFDocument9 pages1-244909879656 G0093424359 PDFSufian QayyumNo ratings yet

- The Rise and Evolution of the Global CorporationDocument14 pagesThe Rise and Evolution of the Global Corporationmeca DURAN50% (4)

- ArchitectureDocument6 pagesArchitectureMuhammad RachmadiNo ratings yet

- Software Requirements Specification: Online Shopping SystemDocument8 pagesSoftware Requirements Specification: Online Shopping SystemArnav SinghNo ratings yet

- Adding Some: 1. OverviewDocument10 pagesAdding Some: 1. Overviewdhirubhai91No ratings yet

- Online Shopping System Software Requirements SpecificationDocument8 pagesOnline Shopping System Software Requirements SpecificationArnav SinghNo ratings yet

- Mutual Fund Performance AnalyserDocument24 pagesMutual Fund Performance AnalyserManjula AshokNo ratings yet

- Synopsis: Master FileDocument27 pagesSynopsis: Master FileSelva KumarNo ratings yet

- ProjectDocument56 pagesProjectwalebic251No ratings yet

- Home Appliance Sales ManagementDocument23 pagesHome Appliance Sales ManagementaqibNo ratings yet

- Data Warehouses: FPT UniversityDocument46 pagesData Warehouses: FPT UniversityJane NguyễnNo ratings yet

- InformaticalakshmiDocument15 pagesInformaticalakshmiMahidhar LeoNo ratings yet

- Business Intelligence Technical Overview: An Oracle White Paper July 2005Document13 pagesBusiness Intelligence Technical Overview: An Oracle White Paper July 2005csesaravananbeNo ratings yet

- Eregulations Technical SpecificationsDocument60 pagesEregulations Technical SpecificationseregulationsNo ratings yet

- ProjectDocument37 pagesProjectRAMESH MIRDHANo ratings yet

- System AnalysisDocument7 pagesSystem AnalysisPradeep BhadauriaNo ratings yet

- E-Billing & Invoice System - SynopsisDocument21 pagesE-Billing & Invoice System - SynopsisUmesh Kumar MahatoNo ratings yet

- ITP Cloud System SRS - Final VersionDocument21 pagesITP Cloud System SRS - Final VersionAaron mkandawireNo ratings yet

- Chapter 6 - Essentials of Design and The Design ActivitiesDocument9 pagesChapter 6 - Essentials of Design and The Design ActivitiesBaby DollNo ratings yet

- Ais Chapter 4Document6 pagesAis Chapter 4Pandu Rangarao100% (1)

- Stock Trading System Software Design DocumentDocument49 pagesStock Trading System Software Design DocumentVinesh KumarNo ratings yet

- Income Tax Management System UsingDocument46 pagesIncome Tax Management System UsingVed Prakash86% (7)

- IMS1Document7 pagesIMS1Sridhar VcNo ratings yet

- Chapter1 System DevelopmentDocument18 pagesChapter1 System DevelopmentJohn Wanyoike MakauNo ratings yet

- Platform: CRM System, WPF/Silverlight, AzureDocument11 pagesPlatform: CRM System, WPF/Silverlight, AzureChamkor PanesarNo ratings yet

- Real Estate Management System Design DocumentDocument8 pagesReal Estate Management System Design DocumentjhateshkolipakulaNo ratings yet

- Unit IiiDocument25 pagesUnit IiiELAKYA R INTNo ratings yet

- A Complete NotesDocument10 pagesA Complete Notesjagadish_vuyyuruNo ratings yet

- Payroll Management SystemDocument16 pagesPayroll Management Systemphyllis MensahNo ratings yet

- E Store Srs4.0Document15 pagesE Store Srs4.0alwil1012No ratings yet

- Structure of The Information Technology Function (SLIDE 4)Document6 pagesStructure of The Information Technology Function (SLIDE 4)WenjunNo ratings yet

- Co2 - SLM (1) SeDocument13 pagesCo2 - SLM (1) SeChinnu JashuvaNo ratings yet

- Revenue Recovery System Report GenerationDocument40 pagesRevenue Recovery System Report GenerationNarendra PallaNo ratings yet

- Toaz - Info Stock Management System PRDocument20 pagesToaz - Info Stock Management System PRVattikuti SathwikNo ratings yet

- System AnalysisDocument7 pagesSystem AnalysisPradeep BhadauriaNo ratings yet

- Architectural Design Styles and ViewsDocument7 pagesArchitectural Design Styles and Viewsbrain spammerNo ratings yet

- CPP Project ReportDocument20 pagesCPP Project ReportMohit D MoreNo ratings yet

- DBMS Content PagesDocument29 pagesDBMS Content PagesAbhilash M K AcharNo ratings yet

- HCSSDocument114 pagesHCSSKhaja HussainNo ratings yet

- Software Requirement SpecificationsDocument16 pagesSoftware Requirement SpecificationsTellam JahnaviNo ratings yet

- Jewellery Management New 234Document55 pagesJewellery Management New 234Gokul Krishnan100% (1)

- E-Store Project VersionDocument10 pagesE-Store Project VersionSyed Furqan RehmaniNo ratings yet

- SRS OutlineDocument19 pagesSRS OutlineRitz VatwaniNo ratings yet

- Final Report Airline Management SystemDocument80 pagesFinal Report Airline Management SystemS lalita KumariNo ratings yet

- Informatica ETL RFP ResponseDocument18 pagesInformatica ETL RFP ResponsenareshlrpNo ratings yet

- Upstream Provisioning For A Multi-Directory Identity RepositoryDocument21 pagesUpstream Provisioning For A Multi-Directory Identity RepositorykjheiinNo ratings yet

- New 62Document2 pagesNew 62malleswari ChNo ratings yet

- Code/Module Base Setup of ApplicationDocument5 pagesCode/Module Base Setup of ApplicationDiwakarNo ratings yet

- Data WarehousingDocument20 pagesData Warehousingmkrmurthy2517No ratings yet

- Assmnt2phase1 SoftwarearchitectureDocument26 pagesAssmnt2phase1 Softwarearchitectureapi-283791392No ratings yet

- Module 8Document11 pagesModule 8efrenNo ratings yet

- Component Based Invisible Computing: Alessandro Forin, MSRDocument7 pagesComponent Based Invisible Computing: Alessandro Forin, MSRNithyananthan KrishnanNo ratings yet

- Customer Relationship ManagementDocument40 pagesCustomer Relationship ManagementbhanuprasadvishwakarNo ratings yet

- Chapter 6 - Review QuestionsDocument6 pagesChapter 6 - Review QuestionsCharis Marie UrgelNo ratings yet

- Week 3 AssignmentDocument7 pagesWeek 3 AssignmentKeagan LegitNo ratings yet

- Opening An Account: Ladbroke & Co.v Todd, The Complainant Had Written A Check To The Payee, Which Was ThenDocument5 pagesOpening An Account: Ladbroke & Co.v Todd, The Complainant Had Written A Check To The Payee, Which Was ThenHENCH GOHNo ratings yet

- Consistent Bonus History Par ProductsDocument2 pagesConsistent Bonus History Par ProductsPraveen KumarNo ratings yet

- Inter IKEA Holding B.V. Annual Report FY18 Financial StatementsDocument4 pagesInter IKEA Holding B.V. Annual Report FY18 Financial StatementsaretaNo ratings yet

- SPRO Path (Fig. 01) :: Document Splitting Configuration in S/4 Hana FinanceDocument5 pagesSPRO Path (Fig. 01) :: Document Splitting Configuration in S/4 Hana FinanceABDELMALEK .TEBOUDANo ratings yet

- Sharpe RatiosDocument56 pagesSharpe RatiosbobmezzNo ratings yet

- Estate Planning Fundamentals TestDocument231 pagesEstate Planning Fundamentals TestMCP MarkNo ratings yet

- Sri Sai Srinivasa Cotton Industries PVT LTDDocument36 pagesSri Sai Srinivasa Cotton Industries PVT LTDManisha NerellaNo ratings yet

- Study of National Pension SchemeDocument27 pagesStudy of National Pension SchemeYashpal ThakurNo ratings yet

- A Roadmap For Housing Policy ReformDocument172 pagesA Roadmap For Housing Policy ReformPUSTAKA Virtual Tata Ruang dan Pertanahan (Pusvir TRP)No ratings yet

- National Law University, OdishaDocument16 pagesNational Law University, OdishaTanmayNo ratings yet

- Definition of PledgeDocument3 pagesDefinition of PledgeWhoopiJaneMagdozaNo ratings yet

- XVIII The Apparent Victory of Democracy 97. The Advance of Democracy After 1919 Pp. 740-745Document4 pagesXVIII The Apparent Victory of Democracy 97. The Advance of Democracy After 1919 Pp. 740-745markgran100% (2)

- Central U.P Gas Limited Rating Revised to CARE A1Document5 pagesCentral U.P Gas Limited Rating Revised to CARE A1Samrat DNo ratings yet

- Section 2. Original Certificates of Title Shall Be Reconstituted From Such of TheDocument2 pagesSection 2. Original Certificates of Title Shall Be Reconstituted From Such of TheAlexylle ConcepcionNo ratings yet

- MCA Proposal For OutsourcingDocument2 pagesMCA Proposal For OutsourcingLazaros KarapouNo ratings yet

- 4PS Module Answer Sheets ChecklistDocument2 pages4PS Module Answer Sheets Checklistusep manatadNo ratings yet

- 737 Top Transnational CorporationsDocument5 pages737 Top Transnational CorporationsvalensalNo ratings yet

- Tutorial 3 Questions (Chapter 2)Document4 pagesTutorial 3 Questions (Chapter 2)jiayiwang0221No ratings yet

- BEC Study NotesDocument4 pagesBEC Study NotesCPA ChessNo ratings yet

- (Intermediate Accounting 1A) : Lecture AidDocument13 pages(Intermediate Accounting 1A) : Lecture AidShe RCNo ratings yet

- MBA 631rift Valley OutlineDocument4 pagesMBA 631rift Valley OutlineTatekia DanielNo ratings yet

- Warren Buffett 1997 BRK Annual Report To ShareholdersDocument20 pagesWarren Buffett 1997 BRK Annual Report To ShareholdersBrian McMorrisNo ratings yet

- Capital MarketDocument16 pagesCapital Marketdeepika90236100% (1)

- GLEF 4020 International Banking and Financial Regulation 2020-21 Term 2 Course OutlineDocument3 pagesGLEF 4020 International Banking and Financial Regulation 2020-21 Term 2 Course Outlinewang wendaNo ratings yet

- "The Philippines" in Political Parties and Democracy: Western Europe, East and Southeast Asia 1990-2010Document19 pages"The Philippines" in Political Parties and Democracy: Western Europe, East and Southeast Asia 1990-2010Julio TeehankeeNo ratings yet