Professional Documents

Culture Documents

Tax Decl Ration For 2011 - 2012

Uploaded by

palavanish89Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tax Decl Ration For 2011 - 2012

Uploaded by

palavanish89Copyright:

Available Formats

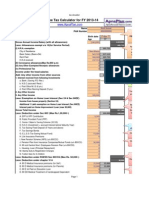

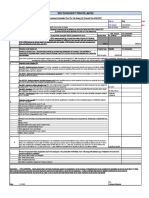

INCOME TAX DECLARATION FORM FOR 2011-2012 ( To be used to declare investment for Income Tax that will be made

during the period 2011- 2012) PLEASE RETURN THIS FORM DULY COMPLETED IN ALL RESPECT TO ACCOUNT DEPTT ON 30TH MAY 2011 COPIES OF RELEVANT RECEIPT/DOCUMENTS IN SUPPORT OF THE DECLARED INVESTMENT MUST REACH THE ACCOUNT DEPTT BEFORE 10 Feb 2012

Company Name Employee Name DOJ PAN Number MOBILE NUMBER Item Deduction Under Section 10 House Rent I am staying in a rented house and I agree to submit rent receipts when required.The Rent Paid is (Rs. 5000 X 12 months) & the house is located in a METRO. Sec 80D - Medical Insurance Premium (If the policy covers a senior citizen then exemption is Rs.20,000/-) Deduction Under Chapter VI A Sec 80DD - Medical treatment/insurance of handicapped dependant Sec 80E - Repayment of Loan for higher education ( only Interest ) Sec 80U - Handicapped Contribution to Pension Fund (Jeevan Suraksha) Life Insurance Premium Fixed Deposit with Scheduled bank with term not less 5 than yrs Public Provident Fund Deposit in Post Office Savings Scheme Deduction under Section 80C ULIP of UTI/LIC Principal Loan (Housing Loan) Repayment Mutual Funds Investment in Infrastructure Bonds Children Education Fee - restricted to a max of 2 children Deposit in NSC Others (please specify) Deduction under 80E Declared Amount If yes, Form 16 from previous employer or Form 12 B with tax computation statement Previous Employment Salary (Salary earned from 01/04/11 till date of joining) SALARY paid by the Previous Employer after Sec 10 Exemption PROFESSIONAL TAX deducted by the Previous Employer PROVIDENT FUND deducted by the Previous Employer INCOME TAX deducted by the Previous Employer Particulars AXEPP3106H 9953135260 Max Limit Declared Amount Ebix Software Asia Sez Pvt Ltd. Avanish Pal 9-Jan Employee ID D000557

84,000.00 Max Limit 15,000.00 50,000.00 50,000.00 Max Limit 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00 1,00,000.00

60,000.00 Declared Amount

Declared Amount

Income other than salary income

3 If yes, then Form 12C detailing other income is attached Max Limit Declared Amount

Deduction under Section 24

Date of Construction:

Interest on Housing Loan Interest if the loan is taken before 01/04/99

Date of Purchase:

150,000.00 30,000.00

Declaration: 1) I hereby declare that the information given above is correct and true in all respects. 2) I also undertake to indemnify the company for any loss/liability that may arise in the event of the above information being incorrect.

Date : Place:

23/12/2011 Noida Signature of the Employee Avanish pal

Page 1

You might also like

- Investors Perception Towards Stock MarketDocument67 pagesInvestors Perception Towards Stock MarketHappy Singh36% (22)

- Corporate Finance (Chapter 4) (7th Ed)Document27 pagesCorporate Finance (Chapter 4) (7th Ed)Israt Mustafa100% (1)

- FarDocument14 pagesFarKenneth Robledo100% (1)

- Full Download Managerial Economics 5th Edition Froeb Solutions ManualDocument35 pagesFull Download Managerial Economics 5th Edition Froeb Solutions Manualsebastianrus8c100% (35)

- Investment Declaration Form11-12Document2 pagesInvestment Declaration Form11-12girijasankar11No ratings yet

- As Per New Budget Technosys - Investment - Declaration Form Fy 2014-15Document4 pagesAs Per New Budget Technosys - Investment - Declaration Form Fy 2014-15sandip_chauhan5862No ratings yet

- Theorem Tax Plan 2012-13Document1 pageTheorem Tax Plan 2012-13Ashwini PadhyNo ratings yet

- IT Declaration Form Revised SalaryDocument1 pageIT Declaration Form Revised SalaryMANUBHOPALNo ratings yet

- IT Declaration FormatDocument2 pagesIT Declaration FormatKamal VermaNo ratings yet

- Investment Declaration Form 2012-13 PDFDocument1 pageInvestment Declaration Form 2012-13 PDFnovalhemantNo ratings yet

- The ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationDocument1 pageThe ABC Foundation: Investment Declaration Form For Tax Saving For Financial Year 2018-2019 The Akshaya Patra FoundationLantNo ratings yet

- IT Declaration Form 2011-2012Document1 pageIT Declaration Form 2011-2012Shishir RoyNo ratings yet

- Maulana Azad National Urdu University: CircularDocument4 pagesMaulana Azad National Urdu University: CircularDebasish BiswalNo ratings yet

- HRA, Chapter VI A - 80CCD, 80C, 80D, Other IncomeDocument9 pagesHRA, Chapter VI A - 80CCD, 80C, 80D, Other Incomefaiyaz432No ratings yet

- IT Declaration Form FY 2018-19Document3 pagesIT Declaration Form FY 2018-19sgshekar3050% (2)

- Income Tax Calculator FY 2013 14Document4 pagesIncome Tax Calculator FY 2013 14faiza17No ratings yet

- Income Tax Deductions FY 2016Document13 pagesIncome Tax Deductions FY 2016Nishant JhaNo ratings yet

- Investment Declaration Form F.Y. 2016-17Document2 pagesInvestment Declaration Form F.Y. 2016-17Sanjeev Kumar50% (2)

- Investment Declaration Form - 1314 - IshitaDocument5 pagesInvestment Declaration Form - 1314 - IshitaIshita AwasthiNo ratings yet

- Income Tax DeclarationDocument1 pageIncome Tax Declarationrajshekarmech06No ratings yet

- Tax Proof Submission FY 2021-22Document10 pagesTax Proof Submission FY 2021-22cutieedivyaNo ratings yet

- Income Tax NitDocument6 pagesIncome Tax NitrensisamNo ratings yet

- Arrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)Document2 pagesArrina Education Services Pvt. LTD.: Investment Declaration Form (FY 2012-2013)JITEN2050No ratings yet

- Template - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKDocument9 pagesTemplate - Restructuring-Tax Computation-BER-Salary Tracker For FY 2015-16 - CKajaykrsinghpintuNo ratings yet

- Deductions U/s 80C To 80 U From Gross Total Income: For The AY-2018-19 FY-2017-18Document19 pagesDeductions U/s 80C To 80 U From Gross Total Income: For The AY-2018-19 FY-2017-18Shamrao GhodakeNo ratings yet

- Investment PlanDocument1 pageInvestment PlanNitin AgarwalNo ratings yet

- Verizon Data Services India Pvt. LTDDocument2 pagesVerizon Data Services India Pvt. LTDabintmNo ratings yet

- Complete Basic of PF&ESIDocument5 pagesComplete Basic of PF&ESIDevendradangeNo ratings yet

- Investment Declaration Form (Hemarus)Document4 pagesInvestment Declaration Form (Hemarus)Shashi NaganurNo ratings yet

- Income Tax Calculator For MaleDocument19 pagesIncome Tax Calculator For MaleAlok SaxenaNo ratings yet

- Income Tax Declaration Form 2012-13Document2 pagesIncome Tax Declaration Form 2012-13asfsadfSNo ratings yet

- Budget 2015Document16 pagesBudget 2015Sachin SharmaNo ratings yet

- Pay Less Tax,: Ways To LegallyDocument1 pagePay Less Tax,: Ways To LegallyGauravNo ratings yet

- IncomeTax DeductionsDocument5 pagesIncomeTax DeductionsAjay MagarNo ratings yet

- Income Tax RulesDocument4 pagesIncome Tax RulesvenkatanagachandraNo ratings yet

- Frequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsDocument4 pagesFrequently Asked Questions (Faqs) Tax Deduction at Source On BOB Staff Pension PaymentsMayur khichiNo ratings yet

- Tax CalculatorDocument10 pagesTax Calculatorgsagar879No ratings yet

- Individual-Txation-FY-2018-19-with - JJDocument64 pagesIndividual-Txation-FY-2018-19-with - JJCOMPLETE ACADEMYNo ratings yet

- TDS & TCSDocument107 pagesTDS & TCSSANDEEP CHAURENo ratings yet

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaNo ratings yet

- Old Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Document4 pagesOld Tax Regime of The FY 2019-20 New Tax Regime of FY The 2020-21Suhas BNo ratings yet

- Income From House Property Income From Business or Profession Capital Gains Income From Other SourcesDocument4 pagesIncome From House Property Income From Business or Profession Capital Gains Income From Other SourcesPooja TanejaNo ratings yet

- Investments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenDocument8 pagesInvestments Considered Under This Section Are: 1. Maximum Limit Rs.150000/-2. Available For Self, Spouse and ChildrenGourav BathejaNo ratings yet

- Income Tax Exemptions For The Year 2010Document4 pagesIncome Tax Exemptions For The Year 2010Homework PingNo ratings yet

- Declaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12Document11 pagesDeclaration For Proposed Tax Saving Investment and Expenditures For F.Y. 2011 12nikhiljain17No ratings yet

- Saving Form-Income Tax 12-13Document9 pagesSaving Form-Income Tax 12-13khaleel887No ratings yet

- Tax SavingsDocument32 pagesTax Savingsh946073000850% (2)

- 1 .Income Tax On Salaries - (01.06.2015)Document57 pages1 .Income Tax On Salaries - (01.06.2015)yvNo ratings yet

- Direct TaxesDocument9 pagesDirect TaxesPuneet JindalNo ratings yet

- Tax Planning For Year 2010Document24 pagesTax Planning For Year 2010Mehak BhargavaNo ratings yet

- National Institute of Technology CalicutDocument7 pagesNational Institute of Technology CalicutraghuramaNo ratings yet

- TDS (Tax Deducted at Source) : ST STDocument6 pagesTDS (Tax Deducted at Source) : ST STRuchiRangariNo ratings yet

- Salary1 2022 DisDocument45 pagesSalary1 2022 Disparinita raviNo ratings yet

- For Shalini Investment Declaration-2012-13Document1 pageFor Shalini Investment Declaration-2012-13Poorni GanesanNo ratings yet

- Income Tax Calculator FY 2012 13Document4 pagesIncome Tax Calculator FY 2012 13raattaiNo ratings yet

- Chapter 12 TaxdeductionsDocument16 pagesChapter 12 TaxdeductionsRiya SharmaNo ratings yet

- FAQ S On Income Tax 2022-23Document4 pagesFAQ S On Income Tax 2022-23Ranjan SatapathyNo ratings yet

- Declaration Form (22-23)Document4 pagesDeclaration Form (22-23)vasavi kNo ratings yet

- Guidelines For Income Tax DeclarationDocument9 pagesGuidelines For Income Tax Declarationapoorva1801No ratings yet

- A Practical Experience On PF, Esi, Pension, and GratuityDocument16 pagesA Practical Experience On PF, Esi, Pension, and GratuitySunil Aggarwal83% (12)

- Deductions On Section 80CDocument12 pagesDeductions On Section 80CViraja GuruNo ratings yet

- Indian Institute of Technology Madras: CircularDocument5 pagesIndian Institute of Technology Madras: CircularAravinthram R am18m002No ratings yet

- IT Calculator 14 15 Taxguru - inDocument16 pagesIT Calculator 14 15 Taxguru - inanirbanpwd76No ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Session 1 - Bond Valuation and RisksDocument69 pagesSession 1 - Bond Valuation and RisksManuel TapiaNo ratings yet

- What Is The Definition of Investment?: StocksDocument3 pagesWhat Is The Definition of Investment?: StocksJhesnil SabundoNo ratings yet

- Case STudy On Capital MarkrtDocument12 pagesCase STudy On Capital MarkrtjilskuriyanNo ratings yet

- Module 1 - Foundations in Financial Planning StandardsDocument13 pagesModule 1 - Foundations in Financial Planning Standardsraman927No ratings yet

- M-Akiba Post Issuance Survey: Report - June 2018Document32 pagesM-Akiba Post Issuance Survey: Report - June 2018elinzolaNo ratings yet

- Understanding Collateralized Loan Obligations 2022Document11 pagesUnderstanding Collateralized Loan Obligations 2022Alex B.No ratings yet

- BNP Informe ArgDocument8 pagesBNP Informe ArgfacundoenNo ratings yet

- Future Value of 1 Sample Problem: SolutionDocument9 pagesFuture Value of 1 Sample Problem: Solutioncris_magno08No ratings yet

- Amundi FoundsDocument223 pagesAmundi FoundsRadu CiurariuNo ratings yet

- ACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityDocument7 pagesACCTG 11 Management Accounting Part 2: Lyceum-Northwestern UniversityAmie Jane MirandaNo ratings yet

- Perez v. CA DigestDocument2 pagesPerez v. CA DigestMika Arevalo100% (1)

- CMA April - 14 Exam Question PDFDocument63 pagesCMA April - 14 Exam Question PDFArup Saha50% (2)

- Chapter 15: Financial Risk Management: Techniques and ApplicationsDocument52 pagesChapter 15: Financial Risk Management: Techniques and ApplicationsShehidul Hoque RubelNo ratings yet

- Bonds Payable Straight Problems: Problem No. 1 Problem No. 3Document3 pagesBonds Payable Straight Problems: Problem No. 1 Problem No. 3gringo dreamersNo ratings yet

- Advantages and Disadvantages To InvestorsDocument4 pagesAdvantages and Disadvantages To InvestorsbhaveshNo ratings yet

- Ranganatham - Security Analysis and Portfolio Management, 2e (2011)Document3,577 pagesRanganatham - Security Analysis and Portfolio Management, 2e (2011)Yash Raj SinghNo ratings yet

- Commercial Banking Kotak Mahindra Bank NEWDocument109 pagesCommercial Banking Kotak Mahindra Bank NEWNitesh Bhardwaj100% (1)

- This Exam Consists of 7 Pages Please Ensure You Have A Complete PaperDocument7 pagesThis Exam Consists of 7 Pages Please Ensure You Have A Complete Paperudai sidhuNo ratings yet

- International Investment and Portfolio Management: AssignmentDocument8 pagesInternational Investment and Portfolio Management: AssignmentJebin JamesNo ratings yet

- Chapter 9 Cost of CapitalDocument39 pagesChapter 9 Cost of CapitalPapa ZolaNo ratings yet

- Bloomberg FunctionsDocument1 pageBloomberg Functionschandra_kumarbrNo ratings yet

- Assignment 1 Introduction To Business FinanceDocument6 pagesAssignment 1 Introduction To Business FinanceadaaNo ratings yet

- Week 2 Assessment: Accounting For Business CombinationsDocument12 pagesWeek 2 Assessment: Accounting For Business Combinationstasya salfiraNo ratings yet

- UBS Synthetic CDOsDocument6 pagesUBS Synthetic CDOsarahmedNo ratings yet

- Investment Avenues (Securities) in PakistanDocument7 pagesInvestment Avenues (Securities) in PakistanPolite Charm100% (1)

- Chapter 8: The Mathematics of Finance: Learner'S Module: Mathematics in The Modern WorldDocument6 pagesChapter 8: The Mathematics of Finance: Learner'S Module: Mathematics in The Modern Worldchibbs1324100% (2)