Rivera's Quality

Automotive

Chart of Accounts

101 Cash

102 Accounts Receivable

103 Office Supplies

104 Prepaid Insurance

105 Computer Equipment

106 Accumulated

Depreciation - Equipment

107 Furniture and Fixtures

108 Service Equipment

109 Accumulated

Depreciation - Service

Equipment

201 Accounts Payable

202 Notes Payable

�203 Interest Payable

204 Loan Payable

205 Unearned Revenue

301 Capital

302 Withdrawal

303 Income Summary

Account

401 Service Revenue

601 Salaries Expense

602 Rent Expense

603 Utilities Expense

604 Supplies Expense

605 Insurance Expense

606 Taxes and Licenses

607 Advertising Expenses

608 Depreciation Expense

– Computer Equipment

�609 Depreciation Expense

– Service Equipment

ADJUSTMENT DATA:

A. Office Supplies used

during the month, PHP

3,800.00

B. Depreciation of the

computer for the month,

PHP 2,400.00

C. Depreciation of the

service equipment for the

month, PHP 3,200.00

D. One-month insurance

was expired.

REQUIREMENTS:

�1. Prepare the journal

entries and post to the T-

Accounts

2. Prepare unadjusted trial

balance

3. Prepare the adjusting

journal entries and post to

the T-Accounts

4. Prepare adjusted trial

balance

5. Prepare the Financial

Statements: (Income

Statements, Statement of

Owner’s Equity,

Balance Sheet)

6. Prepare the closing

entries and post to the T-

Accounts

�7. Prepare post-closing

trial balance

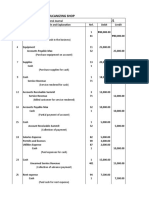

Rivera's Quality Automotive

Chart of Accounts

101 Cash 205 Unearned Revenue

102 Accounts Receivable 301 Capital

103 Office Supplies 302 Withdrawal

104 Prepaid Insurance 303 Income Summary Account

105 Computer Equipment 401 Service Revenue

106 Accumulated Depreciation - Equipment 601 Salaries Expense

107 Furniture and Fixtures 602 Rent Expense

108 Service Equipment 603 Utilities Expense

109 Accumulated Depreciation - Service 604 Supplies Expense

Equipment 605 Insurance Expense

201 Accounts Payable 606 Taxes and Licenses

202 Notes Payable 607 Advertising Expenses

203 Interest Payable 608 Depreciation Expense – Computer Equipment

204 Loan Payable 609 Depreciation Expense – Service Equipment

ADJUSTMENT DATA:

A. Office Supplies used during the month, PHP 3,800.00

B. Depreciation of the computer for the month, PHP 2,400.00

C. Depreciation of the service equipment for the month, PHP 3,200.00 D. One-month insurance was

expired.

Completing the Accounting Cycle from Journal Entries to Post closing Trial balance with a provided

worksheet and answer keys.

On December 1, Mark Rivera began an AUTO REPAIR SHOP, Rivera’s Quality Automotive. The following

transactions occurred during December:

December 1 Rivera contributed PHP 200,000.00 cash to the business in exchange of shares of common

stocks.

December 1 Purchased PHP 12,000.00 of computer equipment paid thru cash.

December 1 Paid a 3 months insurance policy starting December 1,2020, PHP 9,000.00

December 5 Purchased Office Supplies on account, PHP 5,800.00

December 8 Borrowed PHP 80,000.00 from the bank for business use. Rivera prepared and signed

promissory notes payable to bank under the name of his business.

December 9 Paid advertising expenses for only PHP 1,580.00

December 10 Paid half of the supplies on account

December 13 Rivera’s Quality Automotive paid registration and licensing fees for the business, PHP

10,800.00

December 16 The company acquired tables, chairs, shelves, and other fixtures for a total of PHP

30,000.00 The entire amount was paid in cash.

December 17 The company acquired service equipment for PHP 16,000.00 The company paid a 50%

down payment and the balance will be paid after 60 days.

December 17 The company received PHP 10,900.00 for services rendered.

December 17 Rendered services on account, PHP 78,000.00. As per agreement with the Rapid

Automotive, the amount is to be collected after 10 days

December 19 Mr. Rivera invested an additional PHP 53,200.00 into the business

�December 20 Rendered services to a big corporation on December 20. As per agreement, the PHP

33,400.00 amount due will be collected after 30 days

December 21 Paid in full the supplies on account

December 21 The owner withdrew cash due to an emergency need. Mr. Rivera withdrew PHP 60,000.00

from the company.

December 22 Paid rent for December, PHP 1,500.00

December 23 Paid salaries to its employees, PHP 3,500.00

December 27 Collected from the Rapid Automotive full amount.

December 28 Paid the bank 30% of loan payable