Professional Documents

Culture Documents

Week 2 Reg. Session

Uploaded by

RepNLandryOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Week 2 Reg. Session

Uploaded by

RepNLandryCopyright:

Available Formats

HOUSE NOTES

The Latest News from the State Capitol Louisiana House of Representatives Regular Session March 23, 2012

At the end of the second week of the 2012 Regular Session, a total of 1,598 bills have been filed for the 2012 Regular Session; 980 in the House and 618 in the Seante. This is lower than in 2010, the last general session, when 2,053 bills were filed in the House and Senate. House committees were active the first two weeks. The Appropriations Committee continued their meetings on the state budget. Other committees held organizational meetings and began hearings on legislation. The House Education Committee held an unprecedented nearly 16-hour continuous committee hearing. During the course of that meeting, several records were broken, including the most witness cards turned in, most testimony by individuals, and the most testimony by volume. Interested parties also tuned in via the Internet. Records were again broken for the 12-year period since the site went live. On Wednesday, March 14, the day of the Education Committee meeting, there were 4,260,389 hits by 24,458 visitors who viewed 740,805 pages, all records. Previously, the most hits were recorded at 3,429,907, by 21,418 visitors who viewed 740,805 pages. These records were broken on various days in 2011. Previous records were set on days when both chambers were meeting, which was not the case on Tuesday. EDUCATION * House Bill 974, which passed the House by a vote of 64 - 40, would establish 1

new provisions to be included in local superintendents contracts when a school system has received a C, D, or F grade. Additionally, the proposed law provides new policies and definitions related to teacher tenure, pay-for-performance and evaluations. Under House Bill 974, school boards would delegate the hiring of school personnel to the local superintendents. Principals would be delegated the authority to hire and place teachers in schools. Superintendents and principals would make hiring decisions based on performance and effectiveness and not seniority. Superintendents, not local school boards, would make reduction in force decisions based on demand, performance and effectiveness. Seniority and tenure would be prohibited from being used as a primary criterion relative to personnel decisions or reductions in force. Schools would be required to establish salary schedules by January 1, 2013, and base them on effectiveness, demand by subject area, and experience. References to salary schedules and the actual salary schedules under current law would be repealed. Ineffective teachers and administrators would not receive pay increases. Under this proposal, effective July 1, 2012, a teacher must be rated highly effective for five consecutive years to be eligible to acquire tenure. No school lunch supervisor hired after July 1, 2012 could acquire tenure. The legislation provides procedures for the removal of teachers. Poor performance is added as a reason that a tenured employee may be removed. House Bill 974 would become

effective July 1, 2012. * House Bill 976 , approved by a vote of 62-43, makes several changes to the state's education law including school choice, parent petitions for transferring certain schools to the Recovery School District (RSD), charter school authorizers, the chartering process, and course providers. Under the Student Scholarships for Educational Excellence Plan, low income K-6 students in "C", "D", and "F" rated schools would be able to qualify for state aid to attend public and non-public chools. Priority would be given to students in "D" and "F" schools. Low income is defined as income up to 250 percent of the poverty level. The students would be chosen by a random selection process. Under the charter process, BESE must approve a common charter application, developed by the Dept. of Education for use by all chartering authorities including school boards and BESE pursuant to present law and local charter authorizers pursuant to proposed law. BESE is also required to establish procedures for certifying other entities, other than BESE itself and local school boards, as "local charter authorizers". State agencies and nonprofit corporations with an educational mission may be certified as local charter authorizers. An entity which has been certified by BESE as a local charter authorizer may accept, evaluate, and approve applications for charter schools from charter operators. Under the Course Choice Program the State Board of Elementary and Secondary Education (BESE) is to create a process for authorizing course providers including online or virtual providers, postsecondary education institutions, and corporations that offer vocational or technical courses. BESE is required to create a process for authorizing multiple charter schools for charter operators that have demonstrated record of success, including operators that do not operate any schools in La. 2

Also under the bill, a public school may be transferred to the Recovery School District (RSD) if such transfer is approved by BESE, and parents or legal guardians representing at least 51% of the students attending the school sign a petition requesting the transfer and the school has received a letter grade of "F" or any variation thereof, for three consecutive years. The bill establishes nonprofit groups to review and grant charter applications. If rejected, an applicant may appeal to BESE. Among the amendments offered on the floor, the superintendent of education must report to the legislature the effects of the program, addition of a severability clause, and a prohibition against felons serving on a charter school authorizer organization. Also, the department of education must develop an accountability program for scholarship recipients. No locally levied school district tax revenue can be transferred to any school outside the local school district or to a nonpublic school. A list of services for children with disabilities is required to be made available to parents and allows nonpublic school to partner with a local school system to provide special ed services. TAX REBATE FOR TUITION DONATIONS * House Bill 969, would allow a 100% tax rebate for individuals or corporations donating to tax-exempt school tuition organizations that provide scholarships for qualified students to attend private and parochial schools. Maximum tuition for K-8 students is 80% of the average MFP amount, and for 9-12 students 90% of the MFP average. To qualify for the rebate, the taxpayer who makes the donation must file a Louisiana income tax return. The rebate may only be claimed by the taxpayer after the Department of Education certifies that the donation made by the taxpayer has funded a scholarship for a qualified student. The amount of the rebate shall be equal to the actual amount of the taxpayer's donation.

The bill further provides that qualified students must reside in the state, have a household income of less than 250% of the federal poverty level, be entering kindergarten for the first time or attended a public school the previous year or received such funding the previous year. The legislation stipulates that the maximum amount for a scholarship provided by the school tuition organization to a qualified student in kindergarten through eighth grade shall not exceed eighty percent of the state average MFP per pupil funding amount for the previous year, and the maximum amount for a scholarship for a qualified student in ninth through twelfth grades shall not exceed ninety percent of the state average MFP per pupil funding amount for the previous year. Qualified students would receive the scholarships on a first-come, first-served basis, with priority given to students who received a scholarship in the previous year. The proposed law requires any qualified school that receives more than $50,000 in scholarship donations from a student tuition organization (STO) to demonstrate its financial viability by filing, prior to the start of a school year, either a surety bond payable to the STO in an amount equal to the aggregate amount of donations expected to be received during the school year, or by filing financial information demonstrating its financial viability. A qualified school which has been in business for more than five years shall not be required to post a surety bond. Additionally, the bill provides that no more than 5% of a donation can be used for administrative or promotional costs, and no scholarship shall be designated, referred to, or in any way named after a private entity. House Bill 969 would become effective January 1, 2013 and applicable to donations for funding attendance beginning in the 2013-2014 school year. The legislation is tentatively scheduled 3

for floor debate on Tuesday, March 27. TAX REFUNDS * House Bill 635 gives taxpayers the option of receiving their tax refund by means of a debit card. The bill was unanimously approved by the Committee on Ways and Means and is tentatively scheduled for floor debate on Thursday, March 29. HIGHWAY SAFETY * House Bill 197 adds sports utility vehicles to the list of vehicles (cars, vans, and trucks) in which drivers are required to wear safety belts. The legislation also requires that all occupants being transported in these vehicles wear a safety belt. The legislation passed the transportation committee by a vote of 14-0 and is tentatively scheduled for floor debate on Wednesday, March 28. * House Bill 485 increases the penalties for overtaking and passing school buses when injury, serious bodily injury, or death occurs. If the violation results in the injury of another person, the fine is not less than $200 nor more than $500 and possible driver's license suspension for 90 days, or both. If serious bodily injury of another occurs the fine is not less than $500 nor more than $1,000 and a possible driver's license suspension for up to 180 days, or both. Death of another person carries a fine of not less than $1,000 nor more than $5,000 and possible driver's license suspension for up to 360 days, or both. Further, the offender may be subject to imprisonment up to 12 months. Serious bodily injury is defined as an injury which involves unconsciousness, extreme physical pain, or protracted and obvious disfigurement, protracted loss or impairment of the function of a bodily member, organ, or mental faculty, or a substantial risk of death. The bill passed by a vote of 16-0 and is tentatively scheduled for floor debate on

Thursday, March 29. ELECTION CODE *Under House Bill 385, persons who are involuntarily displaced from their residence by a declared state of emergency will be considered to be a resident of the state and parish in which he is registered to vote for the purposes of voter registration and voting. This shall not be the case if the person changes his registration address or claims a homestead exemption at a different residence. The bill was unanimously approved by the House and Governmental Affairs Committee and is tentatively scheduled for floor debate on Thursday, March 29. CORRECTIONS * In addition to provisions of present law, House Bill 123 provides that restitution may be obtained for an escape or attempted escape from custody of a law enforcement officer, the Department of Public Safety and Corrections, or any place where an offender is legally confined, including penal, correctional, community rehabilitation centers, transitional work programs, hospitals, clinics, and any and all programs where offenders are legally assigned. House Bill 123 is tentatively scheduled for floor debate on Thursday, March 29. * House Bill 827, pending House final passage, would amend the crime of simple and aggravated escape to include escape from home incarceration. The proposed law provides that any person who escapes from a home incarceration program shall be imprisoned for six months to one year, and that such sentence shall not run concurrently with any other sentence. The bill is tentatively scheduled for floor debate on Thursday, March 29. GAMING * Under present law, wagering on a licensed riverboat, at the land-based casino, or 4

at slots at track facilities may be made with tokens, chips, vouchers, coupons, or electronic cards issued by the licensed eligible facility or an approved facility manager acting on behalf of the facility. However, the use of credit cards issued by any other entity or institution is prohibited. House Bill 146 extends the prohibition to include debit cards which automatically withdraw funds from a credit, savings, or checking account. House Bill is tentatively scheduled for floor debate on Thursday, March 29. ELECTION HOURS * House Bill 209, scheduled for House consideration on Thursday, March 29, would shorten election day hours for polls and registrar of voters offices. On election days, offices of the registrar of voters would be open from 7:00 a.m. to 9:00 p.m. In the primary and general elections, the polls would open at 7:00 a.m. and close at 8:00 p.m. The proposed law would become effective on January 1, 2013. MOTOR VEHICLES * Under present law, the Commissioner of Motor Vehicles is authorized to issue a permit to dismantle, without the delivery of a title, when the vehicle intended to be sold for scrap is more than ten years old. House Bill 310 increases the age of the vehicle to be dismantled from ten to 15 years old. House Bill 310 is tentatively scheduled to be heard by the full House on Wednesday, March 28. * House Bill 586 would increase the age of applicants who are required to submit a signed statement attesting to supervised driving practice when issued a Class "E" driver's license, for the first time, to 18 years of age or older. Floor debate on House Bill 586 is tentatively scheduled for Monday, March 26.

* House Bill 696 would require the Office of Motor Vehicles (OMV) to submit fingerprint cards or other identifying information to the Louisiana Bureau of Criminal Identification and Information of the principal of any third-party tester or examiner seeking a contract to administer commercial driving examinations and tests. The bureau would then provide OMV all arrest and conviction information pertaining to the principal and forward it to the FBI for a national criminal history record check. Additionally, the principal seeking a contract to administer commercial driving examinations and tests shall consent to pass and pay the costs of an annual background check. The OMV may submit fingerprint cards or other identifying information of a person seeking employment with the OMV whose duties include the issuance of commercial drivers' licenses, or any current office of motor vehicles employee who as part of his employment issues commercial driver's licenses. Finally, the legislation provides that individuals who take a skills test for a Class "A" commercial driver's license in a motor vehicle with the power unit and towed unit connected with a pintel hook or other non-fifth wheel connection shall be issued a license with a restriction prohibiting the operation of a tractor-trailer combination connected by a fifth wheel that requires a Class "A" commercial driver's license.

You might also like

- The Mini-Guide To Sacred Codes and SwitchwordsDocument99 pagesThe Mini-Guide To Sacred Codes and SwitchwordsJason Alex100% (9)

- 6-22-22 Gov McMaster Veto Message R-271 H. 5150 FY 2022-23 Appropriations ActDocument15 pages6-22-22 Gov McMaster Veto Message R-271 H. 5150 FY 2022-23 Appropriations ActLive 5 NewsNo ratings yet

- How to Pay for College: A Guide to Student Loans, Scholarships, and Making School AffordableFrom EverandHow to Pay for College: A Guide to Student Loans, Scholarships, and Making School AffordableRating: 5 out of 5 stars5/5 (1)

- Toyota's Marketing StrategyDocument14 pagesToyota's Marketing StrategyLavin Gurnani0% (1)

- An Analysis On The Implementation of TheDocument11 pagesAn Analysis On The Implementation of TheMaryJoylene De Arca ItangNo ratings yet

- Astm D 4417Document4 pagesAstm D 4417Javier Celada0% (1)

- Vertical Transportation SystemDocument15 pagesVertical Transportation SystemAnupama MorankarNo ratings yet

- A An Some Any Jamie Oliver Pancake With Answer KeyDocument8 pagesA An Some Any Jamie Oliver Pancake With Answer Keygcciprian66570% (3)

- Proposal Setting Gi Punagaya - R1Document31 pagesProposal Setting Gi Punagaya - R1wandy RJNo ratings yet

- EducationDocument16 pagesEducationGVBBESNo ratings yet

- Frequently Asked QuestionsDocument6 pagesFrequently Asked Questionsapi-162934478No ratings yet

- Pennsylvania Association of School Business OfficialsDocument9 pagesPennsylvania Association of School Business OfficialsCollin SandiferNo ratings yet

- Governor Henry McMaster FY 2021-2022 Appropriations ActDocument12 pagesGovernor Henry McMaster FY 2021-2022 Appropriations ActSoojiNo ratings yet

- Bills We're Watching 2015Document20 pagesBills We're Watching 2015vachamberNo ratings yet

- Innovative Options For Parents of Children in The Lowest Performing SchoolsDocument7 pagesInnovative Options For Parents of Children in The Lowest Performing SchoolsCREWNo ratings yet

- Public RecordsDocument2 pagesPublic RecordsNC Policy WatchNo ratings yet

- 2014 House Notes Week EightDocument5 pages2014 House Notes Week EightRepNLandryNo ratings yet

- Third Way HEA Comments To Chairman Alexander and Ranking Member MurrayDocument8 pagesThird Way HEA Comments To Chairman Alexander and Ranking Member MurrayThird WayNo ratings yet

- Expertise SeptDocument3 pagesExpertise SeptPankaj AgarwalNo ratings yet

- TO: From: Subject: Date: Authorization (S) : Issue For DiscussionDocument7 pagesTO: From: Subject: Date: Authorization (S) : Issue For DiscussionBethanyNo ratings yet

- Sub HB 110 HighlightsDocument6 pagesSub HB 110 HighlightsKaren KaslerNo ratings yet

- R4E Memo Re Junk All Other School FeesDocument3 pagesR4E Memo Re Junk All Other School FeesSarah ElagoNo ratings yet

- Special Education School Vouchers: A Look at Southern StatesDocument16 pagesSpecial Education School Vouchers: A Look at Southern StatesThe Council of State GovernmentsNo ratings yet

- The Equity Impact of Arizona's Education Tax Credit Program: A Review of The First Three Years (1998-2000)Document35 pagesThe Equity Impact of Arizona's Education Tax Credit Program: A Review of The First Three Years (1998-2000)National Education Policy CenterNo ratings yet

- Obama Plan August 22 2013Document7 pagesObama Plan August 22 2013Barmak NassirianNo ratings yet

- College AffordabilityDocument7 pagesCollege AffordabilityMatthew LeonardNo ratings yet

- SB1 Year 4 AmendmentDocument5 pagesSB1 Year 4 AmendmentCommonwealth FoundationNo ratings yet

- DEBATEDocument4 pagesDEBATEClaudine RosalesNo ratings yet

- Position Paper HB4277Document4 pagesPosition Paper HB4277Valerie F. LeonardNo ratings yet

- C L C S F N: Olorado Egislative Ouncil Taff Iscal OteDocument2 pagesC L C S F N: Olorado Egislative Ouncil Taff Iscal Oteapi-254148709No ratings yet

- Expanded Eitc SummaryDocument1 pageExpanded Eitc SummaryjmicekNo ratings yet

- R.A No. 8545Document4 pagesR.A No. 8545Shamela Sapinit Delos SantosNo ratings yet

- Policies For School Board 7.14.22 Information and 8.11.22 ActionDocument19 pagesPolicies For School Board 7.14.22 Information and 8.11.22 ActionEzra HercykNo ratings yet

- Righttoeducationbill2008 090915052316 Phpapp01Document10 pagesRighttoeducationbill2008 090915052316 Phpapp01Pratibha SinghNo ratings yet

- Obama Administration Record On Education: To Download This PDF, Visit WWW - Whitehouse.gov/recordDocument5 pagesObama Administration Record On Education: To Download This PDF, Visit WWW - Whitehouse.gov/recordMya SumitraNo ratings yet

- SubHB59 ChangesDocument9 pagesSubHB59 ChangesJosephNo ratings yet

- 2012 Annapolis Report From The District 19 TeamDocument4 pages2012 Annapolis Report From The District 19 TeamdelegatearoraNo ratings yet

- Reichley Report Summer 2011Document4 pagesReichley Report Summer 2011PAHouseGOPNo ratings yet

- Tuition MoratoriumDocument1 pageTuition Moratoriumdiane_zapataNo ratings yet

- Description: Tags: 2004guidanceDocument12 pagesDescription: Tags: 2004guidanceanon-322092No ratings yet

- Equitable Funding For School Infrastructure Projects Shruti Lakshmanan Harshita Jalluri Eshaan Kawlra and Una JakupovicDocument5 pagesEquitable Funding For School Infrastructure Projects Shruti Lakshmanan Harshita Jalluri Eshaan Kawlra and Una Jakupovicapi-523746438No ratings yet

- 2013 Fall Charter RFP PDFDocument61 pages2013 Fall Charter RFP PDFJordan FensterNo ratings yet

- SB2237419097Document5 pagesSB2237419097ferdinandventNo ratings yet

- CHED Launches Free Tuition Law IRRDocument32 pagesCHED Launches Free Tuition Law IRRRenz AbadNo ratings yet

- Empowering Students Through Enhanced Financial Counseling Act - 116th One PagerDocument2 pagesEmpowering Students Through Enhanced Financial Counseling Act - 116th One PagerMarkWarnerNo ratings yet

- Empowering Students Through Enhanced Financial Counseling Act Final One PagerDocument2 pagesEmpowering Students Through Enhanced Financial Counseling Act Final One PagerMarkWarnerNo ratings yet

- Legislative Session Wrap June 6Document25 pagesLegislative Session Wrap June 6Roxi MackensNo ratings yet

- Insights Into Editorial: Right To Education Act Will Have To Be Amended To Scrap The No Detention' PolicyDocument4 pagesInsights Into Editorial: Right To Education Act Will Have To Be Amended To Scrap The No Detention' Policyvirender_ajaykumarNo ratings yet

- The CHOOSE Act - HB61 - AlabamaDocument21 pagesThe CHOOSE Act - HB61 - AlabamaTrisha Powell CrainNo ratings yet

- Chapter Notes: Chapter 1: Finance Definitions and Property Tax InformationDocument13 pagesChapter Notes: Chapter 1: Finance Definitions and Property Tax Informationapi-309968003No ratings yet

- Salient FeaturesDocument8 pagesSalient FeaturesJust HezekiahNo ratings yet

- Unit 5Document13 pagesUnit 5Alcoy Rose marieNo ratings yet

- Text of Proposed Laws: Proposition 38Document13 pagesText of Proposed Laws: Proposition 38blazgutNo ratings yet

- 2015 Session Summary OfficialDocument8 pages2015 Session Summary OfficialusmjacksonalumNo ratings yet

- Description: Tags: 0126Document6 pagesDescription: Tags: 0126anon-370062No ratings yet

- Reflection Paper On Current Issues and Problems in EducationDocument5 pagesReflection Paper On Current Issues and Problems in EducationArna Gnzls100% (1)

- Draft - Law ScholarNov2019Document6 pagesDraft - Law ScholarNov2019Alexar PadaNo ratings yet

- How The Following Issues Affect The Educational System in The Philippines?Document3 pagesHow The Following Issues Affect The Educational System in The Philippines?Maritess Estrada RamosNo ratings yet

- Ra 6728Document36 pagesRa 6728VIA BAWINGANNo ratings yet

- Notes On RA 10931Document15 pagesNotes On RA 10931Jonnifer Quiros100% (1)

- Trump Higher Education ActDocument5 pagesTrump Higher Education ActErin LaviolaNo ratings yet

- Newsletter 337Document11 pagesNewsletter 337Henry CitizenNo ratings yet

- June27.2014solon Wants Cap On Interest Rates Charged by Lending InstitutionsDocument1 pageJune27.2014solon Wants Cap On Interest Rates Charged by Lending Institutionspribhor2No ratings yet

- Initiative Constitutional Amendment and StatuteDocument5 pagesInitiative Constitutional Amendment and StatutelaschoolreportNo ratings yet

- Advocate Article - Frequent Foes Praise New House Education LeaderDocument1 pageAdvocate Article - Frequent Foes Praise New House Education LeaderRepNLandryNo ratings yet

- Louisiana Election Worker Application - LA Secretary of State Kyle ArdoinDocument2 pagesLouisiana Election Worker Application - LA Secretary of State Kyle ArdoinRepNLandryNo ratings yet

- PAR Guide To The 2020 Constitutional AmendmentsDocument21 pagesPAR Guide To The 2020 Constitutional AmendmentsDaniel EspinozaNo ratings yet

- SWLAVotingLocationsPoster2020 RevDocument1 pageSWLAVotingLocationsPoster2020 RevRepNLandryNo ratings yet

- 2018 PAR Guide To Constitutional AmendmentsDocument17 pages2018 PAR Guide To Constitutional AmendmentsRepNLandryNo ratings yet

- 2018 Education Legislation Shouldn't Move Us Backwards (From CABL-Wire - Council For A Better Louisiana)Document2 pages2018 Education Legislation Shouldn't Move Us Backwards (From CABL-Wire - Council For A Better Louisiana)RepNLandryNo ratings yet

- CGI Stem Camp For Middle School KidsDocument2 pagesCGI Stem Camp For Middle School KidsRepNLandryNo ratings yet

- LA Poll Results - SMOR May 2017 Findings & AnalysisDocument17 pagesLA Poll Results - SMOR May 2017 Findings & AnalysisRepNLandryNo ratings yet

- State Treasurer John Schroder Acadiana FundraiserDocument1 pageState Treasurer John Schroder Acadiana FundraiserRepNLandryNo ratings yet

- PAR Guide To The 2017 Louisiana Proposed Constitutional AmendmentsDocument9 pagesPAR Guide To The 2017 Louisiana Proposed Constitutional AmendmentsRepNLandryNo ratings yet

- Fiscal Year 2017 Fiscal HighlightsDocument131 pagesFiscal Year 2017 Fiscal HighlightsRepNLandryNo ratings yet

- SRTC - Acadiana WHOLE Package 2017Document13 pagesSRTC - Acadiana WHOLE Package 2017RepNLandryNo ratings yet

- City of Scott News ReleaseDocument1 pageCity of Scott News ReleaseRepNLandryNo ratings yet

- Louisiana Election Quick Facts December 10 2016Document1 pageLouisiana Election Quick Facts December 10 2016RepNLandryNo ratings yet

- Session Wrap Up 2016 1st Special SessionDocument14 pagesSession Wrap Up 2016 1st Special SessionRepNLandryNo ratings yet

- 2016 House Notes 2nd Special Week 1Document3 pages2016 House Notes 2nd Special Week 1RepNLandryNo ratings yet

- 2016 House Notes Regular Session Week 7Document5 pages2016 House Notes Regular Session Week 7RepNLandryNo ratings yet

- LA Scholarship Program Letter From Supt. WhiteDocument2 pagesLA Scholarship Program Letter From Supt. WhiteRepNLandryNo ratings yet

- 2016 House Notes Regular Session Wrap UpDocument12 pages2016 House Notes Regular Session Wrap UpRepNLandryNo ratings yet

- 2016 House Notes Regular Session Week 11Document5 pages2016 House Notes Regular Session Week 11RepNLandryNo ratings yet

- 2016 House Notes 2nd Special Wrap UpDocument4 pages2016 House Notes 2nd Special Wrap UpRepNLandryNo ratings yet

- 2016 House Notes Regular Session Week 5Document5 pages2016 House Notes Regular Session Week 5RepNLandryNo ratings yet

- 2016 House Notes Regular Session Week 6Document5 pages2016 House Notes Regular Session Week 6RepNLandryNo ratings yet

- 2016 House Notes Regular Session Week 2Document6 pages2016 House Notes Regular Session Week 2RepNLandryNo ratings yet

- 2016 House Notes Regular Session Week 8Document5 pages2016 House Notes Regular Session Week 8RepNLandryNo ratings yet

- 2016 House Notes Regular Session Week 10Document4 pages2016 House Notes Regular Session Week 10RepNLandryNo ratings yet

- 2016 House Notes Regular Session Week 4Document5 pages2016 House Notes Regular Session Week 4RepNLandryNo ratings yet

- 2016 House Notes Regular Session Week 3Document6 pages2016 House Notes Regular Session Week 3RepNLandryNo ratings yet

- 2016 House Notes Regular Session Week 1Document2 pages2016 House Notes Regular Session Week 1RepNLandryNo ratings yet

- India: Soil Types, Problems & Conservation: Dr. SupriyaDocument25 pagesIndia: Soil Types, Problems & Conservation: Dr. SupriyaManas KaiNo ratings yet

- Fit Friend Business Game StrategiesDocument7 pagesFit Friend Business Game StrategiesSanchit AggarwalNo ratings yet

- 2024 Yoga Vidya Training FormDocument8 pages2024 Yoga Vidya Training FormJohnNo ratings yet

- Ebola Research ProposalDocument10 pagesEbola Research ProposalChege AmbroseNo ratings yet

- Cse 3003: Computer Networks: Dr. Sanket Mishra ScopeDocument56 pagesCse 3003: Computer Networks: Dr. Sanket Mishra ScopePOTNURU RAM SAINo ratings yet

- MPU 2232 Chapter 5-Marketing PlanDocument27 pagesMPU 2232 Chapter 5-Marketing Plandina azmanNo ratings yet

- Cloud Computing For Industrial Automation Systems - A ComprehensiveDocument4 pagesCloud Computing For Industrial Automation Systems - A ComprehensiveJason FloydNo ratings yet

- CENELEC RA STANDARDS CATALOGUEDocument17 pagesCENELEC RA STANDARDS CATALOGUEHamed AhmadnejadNo ratings yet

- Enr PlanDocument40 pagesEnr PlanShelai LuceroNo ratings yet

- Year 7 Bugs Lesson 2Document1 pageYear 7 Bugs Lesson 2api-293503824No ratings yet

- Examen TSMDocument4 pagesExamen TSMKaryna VeraNo ratings yet

- Steve Jobs MarketingDocument1 pageSteve Jobs MarketingAnurag DoshiNo ratings yet

- Mfi in GuyanaDocument19 pagesMfi in Guyanadale2741830No ratings yet

- LEEA-030.2c2 Certificate of Thorough Examination (Multiple Items) (Overseas) (Dev)Document1 pageLEEA-030.2c2 Certificate of Thorough Examination (Multiple Items) (Overseas) (Dev)GaniyuNo ratings yet

- Adafruit Color SensorDocument25 pagesAdafruit Color Sensorarijit_ghosh_18No ratings yet

- CopyofCopyofMaldeepSingh Jawanda ResumeDocument2 pagesCopyofCopyofMaldeepSingh Jawanda Resumebob nioNo ratings yet

- University of Technology: Computer Engineering DepartmentDocument29 pagesUniversity of Technology: Computer Engineering DepartmentwisamNo ratings yet

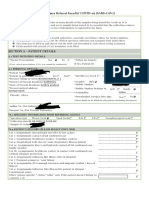

- Sample Id: Sample Id: 6284347 Icmr Specimen Referral Form Icmr Specimen Referral Form For For Covid-19 (Sars-Cov2) Covid-19 (Sars-Cov2)Document2 pagesSample Id: Sample Id: 6284347 Icmr Specimen Referral Form Icmr Specimen Referral Form For For Covid-19 (Sars-Cov2) Covid-19 (Sars-Cov2)Praveen KumarNo ratings yet

- Latest Information Technology Trends 2023Document5 pagesLatest Information Technology Trends 2023Salveigh C. TacleonNo ratings yet

- 4 Types and Methods of Speech DeliveryDocument2 pages4 Types and Methods of Speech DeliveryKylie EralinoNo ratings yet

- Reference Interval For CeruloplasminDocument3 pagesReference Interval For CeruloplasminGawri AbeyNo ratings yet

- Art PDFDocument10 pagesArt PDFbobNo ratings yet

- Electrical Experimenter 1915-08Document1 pageElectrical Experimenter 1915-08GNo ratings yet