Professional Documents

Culture Documents

Comtax e 78 2010

Comtax e 78 2010

Uploaded by

Parthi BanOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comtax e 78 2010

Comtax e 78 2010

Uploaded by

Parthi BanCopyright:

Available Formats

ABSTRACT Rules - Tamil Nadu Sales Tax (Settlement of Arrears) Rules, 2010 Issued.

. Commercial Taxes & Registration(D1) Department G.O.Ms.No.78 Dated: 1-6-2010 Vaikasi 15, Thiruvalluvar Andu 2041 Read: From the Principal Secretary/Commissioner of Commercial Taxes letter No.DC-I/37389/2009 dated 26.10.2009. ORDER: The Notification annexed to this order will be published in the Extraordinary issue of the Tamil Nadu Government Gazette, dated the 1st June of 2010. (By Order of the Governor) Md. Nasimuddin Secretary to Government To The Principal Secretary /Commissioner of Commercial Taxes, Chennai-5. The Works Manager, Government Central Press, Chennai 79.(with a request to publish the Notification in the Tamil Nadu Government Extraordinary Gazette dated 1.6.2010 and send 100 copies to the Government and 1000 copies to the Principal Secretary/Commissioner of Commercial Taxes, Chennai 5. All Joint Commissioners/ Deputy Commissioners of Commercial Taxes Department (through the Principal Secretary/ Commissioner of Commercial Taxes, Chennai-5).

The Chairman, Tamil Nadu Sales Tax Appellate Tribunal, Chennai-104. The Second Member, Main Bench, Tamil Nadu Sales Tax Appellate Tribunal, High Court Buildings, Chennai-104. The Additional Judicial Member, Tamil Nadu Sales Tax Appellate Tribunal (Additional Bench) Chennai-104/ Madurai and Coimbatore. The Chief Ministers Office, Chennai-9. The Accountant-General (A & E), Chennai-18. The Accountant General (A & E), Chennai-18. (By Name) The Principal Accountant General (Audit-I), Chennai-18. The Principal Accountant General (Audit-I), Chennai-18. ( By name) The Account General (Audit-II), Chennai-18. The Accountant General (Audit-II), Chennai-18. (By Name). The Comptroller and Auditor General of India, New Delhi-110 001. The Secretary to Government of India, Ministry of Finance, Department of Revenue, New Delhi-110 001. The Director General of Supplies and Disposals, New Delhi-110 001. The Registrar, High Court, Chennai-104. Copy to: The Finance/Law Department, Chennai-9. The Tamil Development Culture, Religious Endowments and Information Department, Chennai-9. The Legislative Assembly, Secretariat, Chennai-9. The Commercial Taxes and Registration (D1) Department, Chennai-9. (for taking further action to place the paper on the Table of the House). S.F./S.C.

/Forwarded By Order/

SECTION OFFICER.

ANNEXURE NOTIFICATION. In exercise of the powers conferred by sub-section (1) of section 15 of the Tamil Nadu Sales Tax (Settlement of Arrears) Act, 2010 (Tamil Nadu Act 20 of 2010), the Governor of Tamil Nadu hereby makes the following rules:RULES. 1. (1) These rules may be called the Tamil Nadu Sales Tax (Settlement of Arrears) Rules, 2010. (2) They shall come into force on the Ist day of June 2010. 2. In these Rules, unless the context otherwise requires,(a) Act means the Tamil Nadu Sales Tax (Settlement of Arrears) Act, 2010; (b) Form means a form appended to these rules;

(c) The words and expressions used in these rules and not defined but defined in the Act, shall have the same meanings as defined in the Act. 3. (1) An application made under sub-section (1) of section 5 of the Act shall be in Form I. It shall be in duplicate and shall be accompanied by two copies of the assessment order. (2) The said application shall either be presented to the designated authority in person or sent to the said authority by post. (3) The designated authority, on receipt of the said application, shall acknowledge the receipt of the same in Form II. (4) The designated authority shall also inform the assessing authority or appellate authority or revisional authority, as the case may be, under the relevant Act, the fact of making the said application by the applicant in Form III within seven days from the date of receipt of the said application. (5) If the designated authority finds any defect or omission in the application, he shall return the application for rectification of the defect or for supplying the omission within ten days from the date of receipt of the said application.

(6) The designated authority may call for the records pertaining to assessment, appeal or other record, as it may consider necessary to verify the correctness of the particulars furnished in the said application. 4. The designated authority shall demand further amount payable by the applicant in Form IV, if the amount paid by the applicant along with the application in Form I falls short of not more than ten percent of the amount determined under sub-section (1) of section 6 of the Act. 5. (1) The Certificate of Settlement of arrears issued under sub-section (1) of section 8 of the Act shall be in Form V. The designated authority shall serve the said Certificate on the applicant and also inform the fact of issue of the said Certificate in Form VI to the assessing authority or appellate authority or revisional authority, as the case may be, within fifteen days from the date of its issue. (2) The designated authority shall also inform the applicant and the assessing authority or appellate authority or revisional authority, as the case may be, under the relevant Act, the fact of passing the order under sub-section (2) of section 8 of the Act within seven days from the date of passing of the order. 6. The revocation of the Certificate of Settlement of arrears under sub-section (1) of section 12 of the Act shall be in Form VII. The designated authority shall serve the order of revocation on the applicant, and also inform the fact of issue of the order of revocation in Form VIII to the assessing authority or appellate authority or revisional authority, as the case may be, within fifteen days from the date of revocation of the said certificate. 7. The taxes or other amounts due under the Act shall be paid--(i) (ii) by remittance in cash into a Government Treasury or to the designated authority; by means of a crossed cheque in favour of designated authority drawn on any one of the banks referred to in subsidiary rule 1 (a) (iv) of rule 10 of the Tamil Nadu Treasury Rules and situated within the city/town where the office of designated authority is situated; or by means of a crossed demand draft or a bankers cheque drawn in favour of the designated authority:

(iii)

Provided that the mode of payment by means of cheque shall not be applicable to the casual traders and to the dealers whose cheques got dishonoured for want of funds on more than one occasion.

FORM I (See rule 3(1)) APPLICATION To The Designated Authority . .. Sir/ Madam, I hereby make an application under sub-section (1) of section 5 of the Tamil Nadu Sales Tax (Settlement of Arrears) Act, 2010. I hereby furnish the following particulars: 1. Name of the applicant (in block letters) 2. Registration Number 3. Address . .

Office: .. .. . ..Telephone No. Residence: .. . Telephone No. :

4.

Status of the applicant (State whether sole Proprietor, Partner, Director, Authorised Manager, Power of Attorney holder etc.)

5. (i) Designation and address of the Assessing Officer who made the Assessment. (ii) Act under which the levy was made (iii) Assessment number and year (iv) Date of order of Officer

: : : :

6. Details of each demand of tax, penalty or interest (other than the demands that arose as per returns) that was demanded upto the 31st day of March 2007 in respect of which this application is filed: (i) Date of arising of demand (ii) Year to which demand relates (iii) Details of final assessment order or appeal/ revision order giving rise to the demand. (iv) State whether tax / additional sales tax/ surcharge/ additional surcharge / Central sales tax / penalty / interest that arose in respect of any demand that was fully paid before 31.3.2007 .. (v) Details of Demand and settlement claimed.. Amount (Rupees) (a) Amount of demand at the time of arising of the demand (b) Part of the above demand admitted in the returns, if any (this part will not be waived under this Act) ( c) Interest till the date of receipt of application. (d) Total payment upto the date of application (excluding the amount paid for the purpose of settlement of the demand under this Act) (e) Balance to be dealt with under this Act (a) - (b) + (c) - (d) (f) Amount payable as per section 7 of the Act in respect of the balance in column(e) (g) Amount claimed to be waived under this Act (e) - (f) (h) Details of payment of amount as per column(f) (vi) Details of any pending appeal / revision in respect of the above demand: (a) (b) (c) Designation and Address of Appeallate / Revisional Authority.. Appeal / Revision reference No : Date of filing of appeal / revision .. ..

..

DECLARATION I(Name in Block Letters) son/daughter of Thirusolemnly declare that the information given in this application, statements and annexures accompanying it are correct and complete to the best of my knowledge and belief and amount of arrears and other particulars shown therein are truly stated and relate to the assessment year indicated in the application. I further declare that I am making this application in my capacity as(status) and that I am competent to make this application. I also undertake to withdraw the application pending before any appellate/ revisional authority at the time of making this application.

Place: Date : .. (Name and Signature of the Applicant) The Assessing Authority,

Copy to:

FORM

II

(See rule 3 (3)) ACKNOWLEDGEMENT To ..Applicant Received an application in Form I under the Tamil Nadu Sales Tax (Settlement of Arrears) Act, 2010 from Tvl.--------------------------------------------------------------at-------------------- on------------------------. The details of the application are as below:: : : : : Additional Sales Tax (Rs. in words) Interest Penalty

(1) Act under which the levy was made (2) Assessment number and year (3) Designation of the officer against whose order, application is made (4) Date of order of the officer (5) Amount of arrears (in rupees) Tax Surcharge Additional surcharge

Place: Date: Copy to The Assessing Authority Name, Signature and Seal of the Designated Authority.

FORM

III

(See rule 3 (4)) INTIMATION OF APPLICATION FILED To The Assessing / Appellate / Revisional Authority, This is to inform that Tvl. .................................... has filed an application in Form I under the Tamil Nadu Sales Tax (Settlement of Arrears) to the Rules, 2010 at ................ in respect on of ..........................., designated authority

Tvl(Name and address of the concern) The details of the application are as below:(1) Act under which the levy was made (2) Assessment number and year (3) Designation of the officer against whose order, application is made (4) Date of order of the officer (5) Amount of arrears : : : : :

2. The intimation is sent in accordance with sub-rule (4) of rule 3 of the said Rules. Place: Date: Name, Signature and Seal of the Designated Authority.

10

FORM IV (See rule 4) DEMAND NOTICE To ( Applicant)

Please take notice that you have filed an application under the Tamil Nadu Sales Tax (Settlement of Arrears) Act, 2010 in respect of Tvl.(Name and address of the concern) along with proof of payment for an amount of Rs. /(Rupees ..only) (in words) for the year ending under the Act and that after deducting the amount of payment already made by you towards the tax/penalty/interest for that year, you have to pay a further sum of Rs. /- (Rupees .. only) (in words). This balance of tax/penalty/interest shall be paid within 30 days from the date of receipt of this notice by remittance in cash into a Government Treasury or to the Designated authority or by means of a crossed cheque in favour of the Designated authority drawn on any one of the Banks referred to in subsidiary rule 1 (a) (iv) of rule 10 of the Tamil Nadu Treasury Rules and situated within the City/Town where the office of the Assessing Officer is situated or by means of crossed demand draft or bankers cheque drawn in favour of the Assessing Officer, failing which the application filed by you shall be rejected. 1.(i) Name of the Act : : :

(ii) Assessment number and year (iii) Assessment Circle

11

2. (i) Amount of arrears (ii) Amount determined under section 6 of the Act (iii) Amount paid upto the time of filing application (iv) Balance of arrears to be paid

Tax

Surcharge

Additional surcharge

(In rupees) Additional Penalty Interest Sales Tax

Name, Signature and Seal of the Designated authority. Place: Date :

To The Applicant Copy to: The Assessing Authority

12

FORM V (See rule 5(1) ) CERTIFICATE OF SETTLEMENT OF ARREARS WHEREAS, (Name and address of the applicant) (hereinafter referred to as applicant) had filed an application under sub-section (1) of section 5 of the Tamil Nadu Sales Tax (Settlement of Arrears) Act, 2010 in respect of Tvl.(Name and address of the concern); AND WHEREAS, the designated authority determined the amount of Rs. ./-. (Rupees.only) (in words) payable by the applicant in respect of Tvl. (Name and address of the concern) in accordance with the provisions of the Act towards full and final Settlement of arrears as per details furnished below; AND WHEREAS, the applicant has paid an amount of Rs./(Rupees.. only) (in words) being the sum determined by the designated authority; NOW, THEREFORE, in exercise of the powers conferred by sub-section (1) of section 8 of the Act, the Certificate of Settlement is issued to the said applicant(a) Certifying the receipt of payment from the applicant towards full and final settlement of arrears determined in the order of the assessing authority in.(Assessment No./Act/year) dated in respect of Tvl(Name and address on the concern) on the application made by the aforesaid applicant. Granting waiver of the balance arrear payable as detailed below: Details of arrears (1) (i) Name of the Act (ii) Assessment number and year .. ..

(b)

13

2. TNGST/ CST Act (i) Amount of arrears due (ii)Amount paid by the applicant (iii)Amount waived Tax Surcharge Additional surcharge

(in rupees) Additional Penalty Sales Tax

Interest

Date: Place: Name, Signature and Seal of the Designated Authority

To The Applicant

14

FORM VI (See rule 5(1) ) INTIMATION OF ISSUE OF CERTIFICATE OF SETTLEMENT OF ARREARS

This is to inform that on * . Nadu Sales Tax (Settlement of Arrears) Act, 2010

an order and on * have been issued in

..a Certificate of settlement of arrears under section 8(1) of the Tamil respect of Tvl...(Name and address of the applicant) for which an application was made by (Name and address of the applicant).

(a)

Certifying the receipt of payment from the applicant towards full and final settlement of arrears determined in the order of the assessing authority, dated on the application made by the aforesaid applicant. Granting waiver of the balance arrear payable as detailed below:-

(b)

Details of arrears (1)(i) Name of the Act (ii) Assessment number and year .. ..

15

2. TNGST/ CST Act (i) Amount of arrears due (ii)Amount paid by the applicant (iii)Amount waived Tax Surcharge Additional surcharge

(in rupees) Additional Penalty Sales Tax

Interest

Name, Signature and seal of the Designated Authority Date: Place: To The Assessing/Appellate /Revisional Authority,

*Relevant dates to be filled in each case.

16

FORM-VII (See rule 6 ) CERTIFICATE OF REVOCATION WHEREAS, Tvl. .. (Name and address of the concern) had been issued a Certificate of Settlement dated.. in Form V granting waiver on the application filed by .. (Name and address of the applicant) of the following amounts:Act under which the settlement was made Assessment Number and year Assessment circle Amount waived: Tax Surcharge Additional Surcharge Additional Sales Tax Penalty Interest .. Rs. .. Rs. .. Rs. .. Rs. .. Rs. .. Rs. .. .. ..

AND WHEREAS, the designated authority came to know that the applicant had obtained the benefit of settlement under the Tamil Nadu Sales Tax (Settlement of Arrears) Act, 2010 by suppressing material information/furnishing incorrect or false information/particulars (i.e) NOW, THEREFORE, in exercise of the powers conferred by sub-section (1) of section 12 of the Tamil Nadu Sales Tax (Settlement of Arrears)Act, 2010, the designated authority hereby revokes the Certificate of Settlement dated the ... issued to the said applicant. Date: Place: To The Applicant Name, Signature and Seal of the Designated Authority

17

FORM VIII (See rule 6)

INTIMATION OF ISSUE OF CERTIFICATE OF REVOCATION

This is to inform that the Certificate of Settlement of arrears dated.issued to Tvl(Name and address of the concern) based on the application filed by .............................. .(Name and address of the applicant) has been revoked on *..for having suppressed material or particulars / furnishing incorrect or false information or indicated below:--------information as particulars

Date: Place: To

Name, Signature and Seal of the Designated Authority

The Assessing / Appellate/Revisional Authority. *Relevant dates to be filled in each case.

Md. Nasimuddin Secretary to Government

//True Copy//

SECTION OFFICER.

18

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5819)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1092)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (845)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (897)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (540)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (348)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (822)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (401)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Icwim Sample PAPER 3VADocument50 pagesIcwim Sample PAPER 3VAVincenzo Stefanini100% (4)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- परिच्छेद १५ दोहोरो कर मुक्ति सम्झौता सम्बन्धी व्यवस्था PDFDocument14 pagesपरिच्छेद १५ दोहोरो कर मुक्ति सम्झौता सम्बन्धी व्यवस्था PDFRochak ShresthaNo ratings yet

- Effect of The Bumstead Pit On Personal WealthDocument2 pagesEffect of The Bumstead Pit On Personal WealthmassieguyNo ratings yet

- VAT True or FalseDocument8 pagesVAT True or FalseAshley BudotNo ratings yet

- Economic Way of Thinking 13th Edition Heyne Test Bank DownloadDocument23 pagesEconomic Way of Thinking 13th Edition Heyne Test Bank DownloadAvery Barnes100% (16)

- r01 - Examination - Guide - For - Exams - From - 1 - September - 2019 - To - 31 - August - 2020 2Document37 pagesr01 - Examination - Guide - For - Exams - From - 1 - September - 2019 - To - 31 - August - 2020 2stellaNo ratings yet

- Introduction To Customs: Lakhan (A026) Vishesh (A030) Pranav Rai (A034) Rohan Soni (A050)Document25 pagesIntroduction To Customs: Lakhan (A026) Vishesh (A030) Pranav Rai (A034) Rohan Soni (A050)Lakhan KodiyatarNo ratings yet

- Ge 2 ReviewerDocument8 pagesGe 2 ReviewerLeeann JawodNo ratings yet

- Wa0038.Document3 pagesWa0038.Usman KhanNo ratings yet

- 6072-P1-B2 Lembar Kerja Buku BesarDocument9 pages6072-P1-B2 Lembar Kerja Buku BesarSmk Muhammadiyah BanjarmasinNo ratings yet

- Kazi Masjid TrustDocument16 pagesKazi Masjid Trustsamriddhi senNo ratings yet

- RACC Group Presentation PDFDocument3 pagesRACC Group Presentation PDFsnežana_pekićNo ratings yet

- Policy Directive: Salary Packaging Policy and Procedure ManualDocument94 pagesPolicy Directive: Salary Packaging Policy and Procedure ManualBlake MiltonNo ratings yet

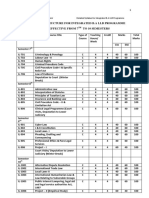

- From Seventh To Ten SemesterDocument55 pagesFrom Seventh To Ten SemesterTaashifNo ratings yet

- GROUP 3 Chapter XI Constitutional ConstructionDocument24 pagesGROUP 3 Chapter XI Constitutional ConstructionMiel Vito CruzNo ratings yet

- Ey Corporate Tax Book Sept 2023Document2,058 pagesEy Corporate Tax Book Sept 2023lscable.hannahNo ratings yet

- Schedule 2Document2 pagesSchedule 2Myreddy VijayaNo ratings yet

- Hdfcslic: Preferred Partner in Your Financial PlanningDocument17 pagesHdfcslic: Preferred Partner in Your Financial PlanningSandeep BorseNo ratings yet

- Financial Stress Test V 2Document1 pageFinancial Stress Test V 2julioNo ratings yet

- Top 30 MCQ Goods & Service TaxDocument3 pagesTop 30 MCQ Goods & Service TaxEthan HuntNo ratings yet

- Unit 3-Financial Statement AnalysisDocument55 pagesUnit 3-Financial Statement AnalysisGizaw BelayNo ratings yet

- DPA 303 - Public Finance Module CoverDocument6 pagesDPA 303 - Public Finance Module CoverchipoNo ratings yet

- National Income AccountingDocument8 pagesNational Income AccountingAlans TechnicalNo ratings yet

- Osd CorrectionDocument2 pagesOsd CorrectionSai BomNo ratings yet

- 57132bos46280p4 Inter Q PDFDocument12 pages57132bos46280p4 Inter Q PDFAyush ChowdharyNo ratings yet

- Supply Chains Operating Performance Second EditionDocument20 pagesSupply Chains Operating Performance Second EditionSharon TaylorNo ratings yet

- Economics ReviewerDocument12 pagesEconomics ReviewerAndrea PepitoNo ratings yet

- Gas Taxes in FloridaDocument9 pagesGas Taxes in FloridaGary DetmanNo ratings yet

- Form-704 NewDocument251 pagesForm-704 NewHusaina NasikwalaNo ratings yet

- Trust LawDocument12 pagesTrust LawMC NP100% (7)