0% found this document useful (0 votes)

23 views6 pagesRACL Geartech Limited

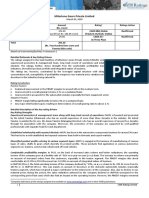

RACL Geartech Limited has reaffirmed its ratings for various bank facilities, with a positive outlook reflecting improved scalability and profitability. The company has experienced stable operational performance, despite challenges such as raw material price volatility and working capital intensity. Recent equity infusion has strengthened its capital structure, while the company continues to focus on strategic projects to enhance revenue potential.

Uploaded by

dexure651Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd

0% found this document useful (0 votes)

23 views6 pagesRACL Geartech Limited

RACL Geartech Limited has reaffirmed its ratings for various bank facilities, with a positive outlook reflecting improved scalability and profitability. The company has experienced stable operational performance, despite challenges such as raw material price volatility and working capital intensity. Recent equity infusion has strengthened its capital structure, while the company continues to focus on strategic projects to enhance revenue potential.

Uploaded by

dexure651Copyright

© © All Rights Reserved

We take content rights seriously. If you suspect this is your content, claim it here.

Available Formats

Download as PDF, TXT or read online on Scribd