Professional Documents

Culture Documents

201202291330497685500

Uploaded by

John DavisOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

201202291330497685500

Uploaded by

John DavisCopyright:

Available Formats

Company Research | HK & China

Winsway Coking Coal Holdings

February 3, 2012

Winsway Coking Coal Holdings (1733.HK)

BUY | Share price: HK$1.93 | Target price: HK$3.51 | Upside: +82%

Jonestowns accusations are flawed maintain our Buy rating

Jonestown challenges accuracy of Winsways numbers. Jonestown Research (JR) released two reports on January 19 and 20, 2012, challenging the accuracy of the value of Winsways coal inventory. Here we summarised the accusations leveled by JR, and the rebuttal by Winsway, as well as our reading of the numbers.

THE ACCUSATIONS Winsways reported inventory stockpiles are materially misstated. THE REBUTALL We believe Jonestowns methodology in calculating Winsways inventory is incorrect and its also based on a wrong assumption of the average washout ratio (Exhibit 1). (The washout ratio is the proportion of cleaned coal obtained per unit of raw coal washed). The discrepancy in the import numbers is because the 3.6 million tonnes of coal that JR referred to is actually the amount that Winsway purchased rather than imported. Moveday has five Mongolia-incorporated operating subsidiaries. Neither Winsway nor any of its controlling shareholders hold any shares of Moveday. Coal prices in Mongolia are much lower than China given the under-developed market and poor transportation facilities in Mongolia. The huge price gap in fact gives Winsway high profit margins. Besides, based on figures released by similar companies, we think the 10% net profit margin (or HK$120/tonne profit) reported by Winsway in 2010 is in fact quite reasonable.

Analyst David Lam

SFC CE No.: AVL286 +852 28993130 david.lam@guosen.com.hk

Sales Contact Dan Weil

Global Head of Institutional Sales and Trading Managing Director +852 2248 3588 dan.weil@guosen.com.hk

Official China import data shows volumes are far lower than those that Winsway reported. Winsways key transportation provider, Moveday, was actually an undisclosed related party. Margins for coal trading should not be higher than ~RMB100/tonne.

Chris Berney

Managing Director +852 2248 3568 chris.berney@guosen.com.hk

Joe Chan

Director +852 2248 3578 joe.chan@guosen.com.hk

Cancy Kong

Vice President +852 2248 3538 cancy.kong@guosen.com.hk

Maintain Buy rating. Winsway denied JRs allegations in mid-January. Based on our research on coal prices and similar companies, we believe Jonestowns calculation approach is erroneous. Winsways acquisition of GCC remains on track and the counter should continue to recover as market doubts ease. All told, we maintain a Buy rating on Winsway given its unique business model, coal-asset acquisition and rapid growth in the coming three years.

Jiafeng Li

Vice President +852 2899 7281 lijf@guosen.com.hk

Chen Long

Vice President +852 2248 3548 chen.long@guosen.com.hk

Profit forecasts

Year to Dec 31 Turnover (HK$ mn) Turnover growth (y-o-y, %) Net profit (HK$ mn) Net profit growth (y-o-y, %) EPS (HK$) Operating cash flow per share (HK$) P/E (x) P/B (x) Dividend per share (HK) 2009A 5,283 374% 515 111% 0.25 0.174 10.2 5.2 0 2010A 9,272 75% 929 80% 0.35 1.174 7.3 1.5 0 2011E 14,584 57% 1,413 52% 0.37 2.174 6.9 1.2 0 2012E 17,712 21% 1,638 16% 0.43 3.174 5.9 1.0 0 2013E 21,978 24% 1,978 21% 0.52 4.174 4.9 0.9 0.157

Shunei Kin

Vice President +852 2248 3536 shunei.kin@guosen.com.hk

Source: Guosen Securities HK

For ratings definitions and other important disclosure, refer to the Information Disclosures at the end of this report.

Winsway Coking Coal Holdings (1733.HK) February 3, 2012 | HK & China | Company Research |

Jonestowns calculation misses the mark

We believe Jonestowns methodology to calculate Winsways inventory is flawed as: It uses the ending value balance of raw coal divided by an average cost of goods sold over the year when calculating Winsways inventory value as at the beginning of 2007, whereas it should have used the ending unit cost of inventory. The average selling cost of RMB284/tonne has included the cost of purchase depreciation (COGD) of raw coal value and other intermediate costs. There will be a discrepancy by using COGD to calculate the inventory quantity instead of cost of purchase. It uses a 75% washout ratio on average. However, the actual washout ratio varies from year to year as the variety and grade of coal products vary, and the annual coal purchases fluctuate. (The washout ratio is the proportion of cleaned coal obtained per unit of raw coal washed). Exhibit 1: Illustration of calculation of Winways coal inventory vs Jonestowns methodology

Illustrative assumption: As at the beginning of 2007 Average unit cost of inventory as at the beginning of 2007 Average cost of goods purchased Inventory tonnage as at the beginning of 2007 Goods purchased in 2007 Goods sold in 2007 RMB/tonne RMB/tonne tonne tonne tonne 5 7 2 10 5

Under FIFO (First in, first out) accounting method Average sales cost RMB/tonne 6.2 As at the beginning of 2007 Inventory value Inventory tonnage RMB tonne 10 2 As at the end of 2007 49 7

Assumption used in Jonestown Researchs calculation approach A Inventory value as at the year end Average cost of goods sold Inventory as at the year-end B Changes in inventory value during the year Average cost of goods sold Net increase of inventory tonnage in 2007 C Inventory tonnage as at the year end Net increase of inventory tonnage in 2007 Inventory tonnage as at the beginning of the year RMB RMB tonne RMB RMB tonne tonne tonne tonne 49 6.2 7.9 39 6.2 6.3 7.9 6.3 1.6

Difference between the actual inventory tonnage and Jonestowns calculation results As at the beginning of 2007 Actual inventory tonnage Jonestowns estimates Difference tonne tonne 2 1.6 As at the end of 2007 7 6.6 6%

Source: Guosen Securities HK

Guosen Securities (HK) Brokerage Co., Ltd.

Winsway Coking Coal Holdings (1733.HK) February 3, 2012 | HK & China | Company Research |

Basis of Winsways profit forecast

Coal-price variance in different regions

Winsway purchases, transports, processes and sells coal. Winsway purchases most of its coals from Mongolia and then sells it in northern and eastern China, with HK$120 net profit per tonne or a 10% net profit margin. Winsways core competitiveness lies in its one-stop distribution platform and logistics facilities. Coal prices are usually much higher in other parts of China than Winsways purchase price in Mongolia, and the company can thus generate a profit. Previously, there were only two coal-mining companies, namely, MAK and TT Incorporate Company, in Southern Mongolia, whose output were limited and mainly used for local consumption purpose. Local companies, including SouthGobi and MMC, have recently started to develop local resources and export to China on a large scale. However, the Mongolian coal market is still under development, and its infrastructure is outdated. As coal prices in Mongolia remain below those in many other parts of China, the price gap can greatly benefit cross-border coal traders and logistics services providers. The following table shows coal prices in different regions: Exhibit 2: Coking coal prices in different regions

Sino-Mongolian border

Product Semi-soft coking coal Hard coking coal Washed hard coking coal 1/3 coking coal Coking coal Coking coal Origin Sale area Ash content Volatile (%) content (%) 8 25 10 10.5% 30 25 26 252 Sulphur content (%) <1 <1 <1 0.6% CSN 4-5 >6 >6 Cementation index (G) 85 Price (RMB/tonne) Appro.434 621 1000 670 684 501 Note Tax not included Tax not included Tax not included Tax not included Tax not included Tax not included Source SouthGobi MMC MMC Chinese business agent of MXM, Mongolia Chinese business agent of MXM, Mongolia coalcoke.net Ovoot Tolgoi Ceke Port coal mine Tavan Tolgoi Ganqimaodu coal mine Port Tavan Tolgoi Ganqimaodu coal mine Port Ejinaqi Ganqimaodu Port

Tavan Tolgoi Ganqimaodu coal mine Port

Hebei

Product Clean coking coal 1/3 clean coking coal Origin Sale area Tangshan, China Tangshan, China Ash content Volatile (%) content (%) 1 10 23- 5 29-32 Sulphur content (%) <1 <1 CSN Cementation index (G) >80 80-90 Price (RMB/tonne) 1600 1500 Note Ex-mine price Ex-mine price Source sxcoal.com sxcoal.com

Qinhuangdao

Product Coking coal Tianjin Port 1/3 coking coal Australia Tianjin Port 10 36 0.6 85 1330 Ex-stock price Inner-Mongolia coal trading center Origin Australia Sale area Qinhuangdao Ash content Volatile (%) content (%) 9 25 Sulphur content (%) <0.6 CSN Cementation index (G) 85 Price (RMB/tonne) 1700 Note Ex-stock price Source Inner-Mongolia coal trading center

Inner-Mongolia

Product 1/3 coking coal Rich coal Clean coking coal Origin Sale area Wuhai, China Wuhai, China Baotou, China Ash content Volatile (%) content (%) 7 <10.5 10 24 33 Sulphur content (%) 0.8 1.8-2.0 1 CSN Cementation index (G) >90 85 Price (RMB/tonne) 1450 1380 1270 Note Source C.F. (cost and Inner-Mongolia coal freight) price in Hebei trading center C.F. (cost and Inner-Mongolia coal freight) price in Hebe trading center Ex-mine price coalcoke.net

Port of Shanghai

Product 1/3 coking coal Shanxi clean coking coal Origin Russia Shanxi, China Sale area Port of Shanghai Port of Shanghai Ash content Volatile (%) content (%) 9 <9 27-39 28 Sulphur content (%) 0.2 1 CSN Cementation index (G) >70 >85 Price (RMB/tonne) 1180 1750 Note Ex-dock price Ex-dock price Source Inner-Mongolia coal trading center coalcoke.net

Source: Company information, Guosen Securities HK

Guosen Securities (HK) Brokerage Co., Ltd.

Winsway Coking Coal Holdings (1733.HK) February 3, 2012 | HK & China | Company Research |

Exhibit 3: Winsways coal purchase prices and selling prices to steel plants

Semi-soft coking coal (Ceke border)

Purchasing cost 1. Ceke border: semi-soft coking coal price 1. Ceke border: value-added taxes 4. Urad zhongqi coal preparation plant: from Ceke to Urad zhongqi preparation plant 4. Urad zhongqi coal preparation plant:coal washing cost 4. Urad zhongqi coal preparation plant: total production cost of clean coal Railway freight cost (1,180km)from coal preparation plant to Hebei 2. Hebei: sub-total Gross profit of the company Hebei: selling price 273 HK$/tonne 46 HK$/tonne 235 HK$/tonne 23 HK$/tonne 769 HK$/tonne 256 HK$/tonne 1,025 HK$/tonne 300 HK$/tonne 1,325 HK$/tonne 1. Ceke border: semi-soft coking coal price 1. Ceke border: value-added taxes 1. Ceke border: storage and processing expenses 1. Ceke border: sub-total of clean coal cost Truck freight cost (2,500km) (from the border to Hebei) 2. Hebei: total/local market price Purchasing cost for steel plants 400 HK$/tonne 68 HK$/tonne 10 HK$/tonne 478 HK$/tonne 971 HK$/tonne 1,449/1,500 HK$/tonne

Hard coking coalGanqimaodu border

Purchasing cost 3. Ganqimaodu border: hard coking coal price 3. Ganqimaodu border: value-added tax Truck freight cost150km(from Ganqimaodu border to Urad zhongqi coal preparation plant) 4. Urad zhongqi coal preparation plant: coal washing cost 4. Urad zhongqi coal preparation plant: sub-total of clean coal cost Railway freight cost1,180km)from Urad zhongqi to Hebei 2. Hebei: sub-total Gross profit of the company 2. Hebei: selling price 702 HK$/tonne 119 HK$/tonne 50 HK$/tonne 23 HK$/tonne 1,192 HK$/tonne 256 HK$/tonne 1,448 HKD/tonne 300 HKD/tonne 1,748 HKD/tonne 3. Ganqimaodu border: hard coking coal price (Ganqimaodu border) 3. Ganqimaodu border: value-added tax 3. Ganqimaodu border: storage and processing expenses 3. Ganqimaodu border: sub-total of clean coal cost Truck freight cost (1,330 km) (from border to Hebei) 2. Hebei: total/ local market price Purchasing cost for steel plants 1,170 HK$/tonne 199 HK$/tonne 10 HK$/tonne 1,379 HK$/tonne 516 HK$/tonne 1,895/1,900 HKD/tonne

Source: Company information, Guosen Securities HK

Peer comparison

According to the figures released by China Coal Resource, in 2004, most of Chinas import of metallurgical coal was from Australia, while less than 1.5 million tonnes was imported from Mongolia. However, this number surged to 3 million tonnes in 2007, and further jumped to 18 million tonnes in 2011. Winsway has a relatively new business model and operating market, which can be rarely found in other similar companies. 1. Established in 2000, Inner-Mongolia Qinghua Group operates several businesses, including coal mining, imports, logistics and coal chemical. Based on relevant government reports, during January to September 2009, Qinghua Groups output and import of raw coal reached 2.04 million tonnes and 1.1 million tonnes, respectively, while its sales revenue totaled RMB4.5 billion. According to our estimates, the groups net profit from the coal import business could have reached RMB0.15 billion, while the corresponding net profit margin stood at 10%, which is close to the net profit margin of Winsway.

Guosen Securities (HK) Brokerage Co., Ltd.

Winsway Coking Coal Holdings (1733.HK) February 3, 2012 | HK & China | Company Research |

2.

Ejina Qi Ruyi Winsway Energy is an indirectly wholly-owned subsidiary of Winsway that engages in coal processing and trading. Based on relevant government reports, the company sold 0.7 million tonnes of coal during January to September 2009, with a corresponding net profit margin of 12%.

3.

China Qinfa Group (00866.HK) is a leading non-state-owned coal operator in China that is principally engaged in the coal processing and sales businesses in relatively well-rounded markets. China Qinfas 2010 net profit margin reached 6% (Winsway: 10%).

Winsway addressed other allegations

JR claims that Moveday and Sanhe are in fact undisclosed related parties. As stated in Winsways prospectus, Sanhe was disposed off by the company to the two named individuals, both of whom are independent third parties. Neither of these individuals are an employee of Winsway or any of its subsidiaries or any company controlled by its controlling shareholders. JR questioned the role of Winsways import agents. Winsway currently engages two import agents, namely, Shenhua and Minmetals, to enhance its credit profile. The transaction costs from these two import agents are in the range of RMB3RMB5 per tonne.

Investment advice

Having analysed the data on coal prices in different regions, the expenditures incurred in each business activity and peers profit margins, and after studying the information about Winsways suppliers and downstream clients, we conclude that the fraud allegations are unfounded. Besides, as announced by Marubeni, GCC and Winsway, the acquisition of GCC will not be affected. The acquisition can improve the variety and quality of Winsways products, as well as boost its profit growth. Thus, we maintain a Buy rating on Winsway because of its unique business model, coal-asset acquisition and rapid growth in the coming three years, and we set a 12-month target price of HK$3.51.

Guosen Securities (HK) Brokerage Co., Ltd.

Winsway Coking Coal Holdings (1733.HK) February 3, 2012 | HK & China | Company Research |

Appendix 1: Winsways income statement

HK$ mn Turnover Cost of sales Gross profit Other revenue Selling expense Administrative expenses Other expenses Profit from operating activities Finance income Finance costs Net financial costs Share of losses of jointly controlled entity Profit before taxation Income tax Equity shareholders of the company Basic earnings per share Dividend per share 2009A 5,283 (4,322) 961 9 (269) (104) (1) 596 7 (42) (35) 0 561 (70) 515 0.25 0 2010A 9,272 (7,154) 2,118 26 (471) (359) (11) 1,302 66 (180) (114) (8) 1,180 (251) 929 0.35 0 2011F 14,584 (11,162) 3,421 44 (1,080) (467) (15) 1,904 145 (157) (12) (8) 1,884 (471) 1,413 0.37 0 2012F 17,712 (12,793) 4,919 53 (1,949) (567) (18) 2,439 130 (377) (247) (8) 2,184 (546) 1,638 0.43 0 2013F 21,978 (15,575) 6,403 66 (2,705) (703) (22) 3,039 130 (523) (393) (8) 2,638 (659) 1,978 0.52 0.16

Source: Guosen Securities HK

Appendix 2: Balance sheet

HK$ mn Cash and cash equivalents Trade and other receivables Inventories Other current assets Total current assets Property, plant and equipment, net Intangible assets Investment in the jointly-controlled entities Deferred tax assets Other non-current assets Other non-current assets Total non-current assets Total Assets Short-term loans Trade and other payables Income tax payable Other short-term liabilities Long-term loans Other long-term liabilities Total long-term liabilities Total equity attributable to equity shareholders of the company Minority interests Total liabilities and equity 2007A 38 251 173 37 499 79 2 0 21 49 151 651 124 194 21 0 339 0 3 3 1 308 651 2008A 99 290 322 323 1,035 289 1 0 37 47 374 1,409 599 264 9 0 873 0 2 2 0 535 1,409 2009A 277 1,840 1,190 644 3,951 447 0 0 34 67 548 4,499 1,590 1,729 35 0 3,354 0 0 0 1144 0 4,498 2010A 2,894 2,451 1,973 344 7,662 474 0 363 48 576 1,461 9,123 1,010 1,317 91 0 2,418 63 97 160 6469 76 9,123 1H2011 5,763 3,675 2,845 598 12,881 646 0 363 47 1472 2,528 15,409 572 3,533 130 1 4,236 3861 111 3972 7123 78 15,409

Source: Guosen Securities HK

Guosen Securities (HK) Brokerage Co., Ltd.

Winsway Coking Coal Holdings (1733.HK) February 3, 2012 | HK & China | Company Research |

Stock ratings, sector ratings and related definitions

Stock Ratings: Buy: A return potential of 10 % or more relative to overall market within 6 12 months. Neutral: A return potential ranging from -10% to 10% relative to overall market within 6 12 months. Sell: A negative return of 10% or more relative to overall market within 6 12 months. Sector Ratings: Buy: The sector will outperform the overall market by 10% or higher within 6 12 months. Neutral: The sector performance will range from -10% to 10% relative to overall market within 6 12 months. Sell: The sector will underperform the overall market by 10% or lower within 6 12 months.

Information Disclosures

Interest disclosure statement

The analyst is licensed by the Hong Kong Securities and Futures Commission. Neither the analyst nor his/her associates serves as an officer of the listed companies covered in this report and has no financial interests in the companies. Guosen Securities (HK) Brokerage Co., Ltd. and its associated companies (collectively Guosen Securities (HK)) has no disclosable financial interests (including securities holding) or make a market in the securities in respect of the listed companies. Guosen Securities (HK) has no investment banking relationship within the past 12 months, to the listed companies. Guosen Securities (HK) has no individual employed by the listed companies.

Disclaimers

The prices of securities may fluctuate up or down. It may become valueless. It is as likely that losses will be incurred rather than profit made as a result of buying and selling securities. The content of this report does not represent a recommendation of Guosen Securities (HK) and does not constitute any buying/selling or dealing agreement in relation to the securities mentioned. Guosen Securities (HK) may be seeking or will seek investment banking or other business (such as placing agent, lead manager, sponsor, underwriter or proprietary trading in such securities) with the listed companies. Individuals of Guosen Securities (HK) may have personal investment interests in the listed companies. This report is based on information available to the public that we consider reliable, however, the authenticity, accuracy or completeness of such information is not guaranteed by Guosen Securities (HK). This report does not take into account the particular investment objectives, financial situation or needs of individual clients and does not constitute a personal investment recommendation to anyone. Clients are wholly responsible for any investment decision based on this report. Clients are advised to consider whether any advice or recommendation contained in this report is suitable for their particular circumstances. This report is not intended to be an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. This report (including any information attached) is issued by Guosen Securities (HK) Brokerage Co., Ltd, a member of Guosen Securities Co., Ltd. Some parts of the report may have been originally published in Chinese, within the Peoples Republic of China, by Guosen Securities Co., Ltd. That material has been reviewed, translated and, where applicable, adapted by Guosen Securities (HK) Brokerage Co., Ltd. This report is for distribution only to clients of Guosen Securities (HK). Without Guosen Securities (HK)s written authorization, any form of quotation, reproduction or transmission to third parties is prohibited, or may be subject to legal action. Such information and opinions contained therein are subject to change and may be amended without any notification.

Guosen Securities (HK) Brokerage Co., Ltd.

You might also like

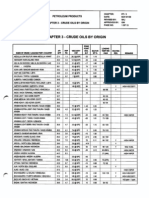

- Some Crude Oils by OriginDocument13 pagesSome Crude Oils by OriginJohn DavisNo ratings yet

- Materials Selection For Refineries and Associated Facilities PDFDocument164 pagesMaterials Selection For Refineries and Associated Facilities PDFJohn Davis100% (2)

- NCFM Module - 1 Financial Markets: A Beginner's Module by Wahid311Document93 pagesNCFM Module - 1 Financial Markets: A Beginner's Module by Wahid311Abdul Wahid KhanNo ratings yet

- Commodityfocus WorldcoalDocument17 pagesCommodityfocus WorldcoalJohn Davis100% (1)

- Eu Coal PolicyDocument24 pagesEu Coal PolicyJohn DavisNo ratings yet

- Session III Policy Perspective and Options For Clean Coal Industry DevelopmentDocument33 pagesSession III Policy Perspective and Options For Clean Coal Industry DevelopmentJohn DavisNo ratings yet

- High-density processing improves coal quality for power generationDocument16 pagesHigh-density processing improves coal quality for power generationJohn DavisNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Principles of Good Customer Service - Business Queensland1Document2 pagesPrinciples of Good Customer Service - Business Queensland1GMSNo ratings yet

- ExercisesDocument3 pagesExercisesNgọc TràNo ratings yet

- Responsibility AccountingDocument39 pagesResponsibility AccountingShaheen MahmudNo ratings yet

- RiriDocument89 pagesRiriCitraaNo ratings yet

- Analyzing the US Jewelry Market for PNG Stores in NYCDocument11 pagesAnalyzing the US Jewelry Market for PNG Stores in NYCArif GokakNo ratings yet

- Sanjana Ganpat Patil. Tybaf - Black BookDocument86 pagesSanjana Ganpat Patil. Tybaf - Black BookTasmay Enterprises100% (2)

- Venn DiagramDocument29 pagesVenn DiagramRJ DimaanoNo ratings yet

- Rekap Jurnal Nasional-InternasionalDocument3 pagesRekap Jurnal Nasional-InternasionalBhella SangDara AmazoniiaNo ratings yet

- Everr Greene CorrectDocument12 pagesEverr Greene CorrectRonNo ratings yet

- This Study Resource Was: A. $579. B. $552. C. $546. D. $585Document4 pagesThis Study Resource Was: A. $579. B. $552. C. $546. D. $585May RamosNo ratings yet

- Managerial Economics L2: Dr. Rashmi AhujaDocument26 pagesManagerial Economics L2: Dr. Rashmi AhujaPrakhar SahayNo ratings yet

- Swot Analysis of Imtiaz SupermarketDocument4 pagesSwot Analysis of Imtiaz SupermarketMuhammad MussayabNo ratings yet

- International Transfer Pricing: Income Shifting and Tax AvoidanceDocument60 pagesInternational Transfer Pricing: Income Shifting and Tax Avoidanceeconomic life - الحياة الاقتصاديةNo ratings yet

- Keegan Gm4 Ch12Document23 pagesKeegan Gm4 Ch12Ankit VermaNo ratings yet

- Leveling The Playing Field: Business Analytics For Mid-Sized CompaniesDocument20 pagesLeveling The Playing Field: Business Analytics For Mid-Sized CompaniesDeloitte AnalyticsNo ratings yet

- 117-Cns 2015 b2b BuyingDocument19 pages117-Cns 2015 b2b Buyingvinod3511No ratings yet

- Merger & ConsolidationDocument17 pagesMerger & ConsolidationRonalynPuatuNo ratings yet

- 2021 Global Marketing Trends - PartDocument15 pages2021 Global Marketing Trends - PartGuy Bertrand MessinaNo ratings yet

- Cost-Volume-Profit (CVP) AnalysisDocument42 pagesCost-Volume-Profit (CVP) AnalysisYu-Han KaoNo ratings yet

- Integration Strategies Horizontal & VerticalDocument15 pagesIntegration Strategies Horizontal & VerticalAnjali SharmaNo ratings yet

- Customer Relationship ManagementDocument33 pagesCustomer Relationship ManagementarushiparasharNo ratings yet

- Business Proposal For Navarro'S Food International, IncDocument53 pagesBusiness Proposal For Navarro'S Food International, Incjane dillanNo ratings yet

- MSQ-01 - Activity Cost & CVP Analysis (Final)Document11 pagesMSQ-01 - Activity Cost & CVP Analysis (Final)Mary Alcaflor40% (5)

- Contemporary Issues in MarketingDocument34 pagesContemporary Issues in MarketingUZAIR300No ratings yet

- B2B E-Commerce: Selling and Buying in Private E-MarketsDocument29 pagesB2B E-Commerce: Selling and Buying in Private E-Marketsasma246No ratings yet

- Solution Manual For Introduction To Accounting An Integrated Approach 6th Edition by AinsworthDocument6 pagesSolution Manual For Introduction To Accounting An Integrated Approach 6th Edition by Ainswortha755883752No ratings yet

- Designing and Implementing Brand Architecture StrategiesDocument31 pagesDesigning and Implementing Brand Architecture StrategiesKundan KumarNo ratings yet

- Conducting Marketing Research and Forecasting Demand: Learning ObjectivesDocument16 pagesConducting Marketing Research and Forecasting Demand: Learning ObjectivesSripada PriyadarshiniNo ratings yet

- Consultants DirectoryDocument36 pagesConsultants DirectoryAnonymous yjLUF9gDTSNo ratings yet

- HP Sonos AccvDocument6 pagesHP Sonos AccvDeepti AgarwalNo ratings yet