Professional Documents

Culture Documents

Carbonated Soft Drink (CSD) Industry: Economics of The US

Uploaded by

acastillo13390 ratings0% found this document useful (0 votes)

33 views27 pagesAmericans consumed 23 gallons of CSDs annually in 1970 Consumption grew by 3% per year over the next 3 decades. Coke and Pepsi claimed a combined 74.8% of the u.s. CSD market in sales volume in 2004.

Original Description:

Original Title

49709027 Cola Wars Continue Coke and Pepsi in 2006 by Group c 120426105113 Phpapp02

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentAmericans consumed 23 gallons of CSDs annually in 1970 Consumption grew by 3% per year over the next 3 decades. Coke and Pepsi claimed a combined 74.8% of the u.s. CSD market in sales volume in 2004.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

33 views27 pagesCarbonated Soft Drink (CSD) Industry: Economics of The US

Uploaded by

acastillo1339Americans consumed 23 gallons of CSDs annually in 1970 Consumption grew by 3% per year over the next 3 decades. Coke and Pepsi claimed a combined 74.8% of the u.s. CSD market in sales volume in 2004.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 27

Americans consumed 23 gallons of CSDs annually in 1970

Consumption grew by 3% per year over the next 3 decades

Increasing availability of CSDs and introduction of diet and

flavored varieties

Non-cola CSDs were introduced

Economics of the US Carbonated Soft Drink

(CSD) Industry

Production & Distribution of CSD

1. Concentrate producers

2. Bottlers

3. Retail channels

4. Suppliers

1. Concentrate Producer

Blended raw material ingredients, packaged the mixture, shipped

those container to the bottler

Key production investment areas like machinery, overhead and

labor

A typical manufacturing plant cost - $25 million to $50 million

Customer Development Agreements (CDA) with retailers like

Wal-Mart

Significant costs were spent for advertising, promotion, market

research

Coca-Cola and Pepsi-Cola claimed a combined 74.8% of the U.S.

CSD market in sales volume in 2004

2. Bottlers

Purchased concentrate

Added carbonated water and

high-fructose corn syrup

Bottled or canned the

resulting CSD product

Delivered it to customer

account

2. Bottlers

Bottling process is capital intensive.

Packaging accounted for 40% to 45% of cost of sales and same

for concentrate and sweeteners for 5% to 10%.

Coke and Pepsi bottlers offered direct store door delivery.

Under Cooperative merchandizing agreements retailers agreed

to promotional activities for sales of soft drinks

3. Retail Channels

In 2004, distribution of CSDs in U.S. was through:

Super Markets (32.9%)

Fountain outlets(23.4%)

Vending Machines(14.5%)

Mass Merchandisers(11.8%)

Convenience Stores &Gas Stations(7.9%)

Other outlets(9.5%)

4. Suppliers

Coke and Pepsi were among the Metal Can industrys largest

customers.

Major Can producers- Ball, Rexam, Crown Cork & Seal

Evolution of Coke

Formulated in 1886 by John Pemberton, a pharmacist in Atlanta,

Georgia

Sold it at a drug store soda fountains as a potion for mental and

physical disorders

In 1891, Asa Candler acquired the formula, established a sales

force and began brand advertising

The formula for Coca-Cola syrup known as Merchandise 7X

remained a secret

The rest is history

Evolution of Pepsi

Invented in 1893 in New Bern, North Carolina by pharmacist

Caleb Bradham

By 1910 built a network of 270 bottlers

Declared bankruptcy in 1923 and again in 1932

Business began to grow during the Great Depression

Pepsi lowered price of its 12 oz bottle to a Nickel the same

price Coke charged for its 6.5-oz bottle

The Cola War Begins

Marketing Campaign

Beat Coke Americans preferred taste

Pepsi Generation No wonder Coke refreshes best

Young At Heart

Year 1960s the Armageddon

CSD

Mountain Dew (1964) Sprite (1961)

Non CSD

Duncan foods (coffee, tea, hot

chocolate)

The Pepsi Challenge

Blind taste test Rebates

Rolled out blind taste campaign

nation wide

Advertisements that questions

tests validity

Leadership

2001: Steve Reinemund

Grow the core add some more

1980 Roberto Goizueta

Acquisition of Quaker Oats Use of lower priced corn syrup against

sugar

ROI capital 29.3 (2003) from 9.5 (1996) Sold non-CSD business

Expansions

Acquired Pizza hut (1978), Toco Bell

(1986), KFC (1986)

Exclusive deals with Burger king,

McDonalds

Pepsi purchased Quaker Oats

(Gatorade) in 2000

Acquired Planet Java coffee drink

brand (2001)

1996-2004: Reversal of Fortune

Pepsi flourished Coke struggled

3% growth in 2004 Annual growth in net income falls to

4.2% from 18%(1990-96)

ROI 29.3% from 9.5%(1996)

Quest for Alternatives

U.S. Market share for Pepsi and Coke

Diet soda-24.6%(1997) to 29.1%(2004)

Non-carbs 12.6%(2000) to 13.7%(2004)

No longer designing of marketing course

established as total beverage company

Reluctant to diversify

Evolving Structures and Strategies

System profitability

Price war (1990s)

Low-cost strategy by the bottlers

Incidence pricing

Retailers resist price increases (Wal-Mart)

Cokes difficult relationship with bottlers like CCE was termed as

Dysfunctional

Internationalizing the Cola Wars

Next largest market: Mexico, Brazil, Germany, China and the

United Kingdom, Asia and Eastern Europe

American: Chinese - 837 eight ounce cans: 21 eight ounce cans

Cokes dominance : Western Europe, much of Latin America,

while Pepsi: Middle East and Southeast Asia

Coca-Cola became synonymous with American culture

About 70% of Cokes sales and about 80% of its profits came from

outside the United States; only about one-third of Pepsis

beverage sales took place overseas

Arab and Soviet exclusion of Coke

Worlds Market Share: Coke 51.4% and Pepsi 21.8%

SWOT Analysis: Pepsi

Enjoys a High-Profile Global Presence

Owns the Worlds 2

nd

Best-Selling Soft Drinks

Brand

Constant Product Innovation

Aggressive Marketing Strategies

A Broad Portfolio of Products

Strength Weakness

Opportunity Threat

Carbonates Market is in Decline

Pepsi is Strongest in North America

They Only Target Young People

Increased Consumer Concerns in comparison

to bottled water

Growth in Healthier Beverages

Growth in Tea and Asian Beverages

Growth in the Functional Drinks Industry

Obesity and Health Concerns

Increased Marketing and Innovation

Spending by Coke

Restriction to only North America as target

market

SWOT Analysis: Coke

Enjoys a High-Profile Global Presence

Fourth amongst the top five leading brands

Broad-based bottling strategy

47% of global volume sales in carbonates

Strength Weakness

Opportunity Threat

Carbonates Market is in Decline

Over-complexity of relationship with bottlers

in North America

Inefficient execution of business

Soft drinks volumes in the Asia-Pacific region

forecast to increase by over 45%

Brands like Minute Maid Light and Minute

Maid Premium Heart Wise are positioned

well with the Health-concerned market

Use distribution strengths in Eastern Europe

and Latin America

Growing "health-conscience" society

PepsiCos Gatorade, Tropicana and Aquafina

are stronger brands

Boycott in the Middle East

Protest against Coke in India

Negative publicity in Western Europe

According to this case Coke and Pepsi both cumulative

spending on advertising.

Coke and Pepsi established brand identity over a long period

of time. Now these brand become culture of almost every

countries and in the case of Coke become part of World

Culture

So this is very strong point of the these brand for establish

their identity and their consumer attachment

Brand Equity

Coke and Pepsi both establish almost for more than a century

and consumers have emotional attachment with these two

brands.

Consumers identify these two brands for distance, these all

things are the brand strategies.

Advertisement create cozy relationship with their consumers

they feel relax to use these brands.

Brand Attachment

In these both companies they invests heavy amount

which other competitor do not invest in their

company.

Competitive Advantage

Coke and Pepsi have focus on customer

segmentation, for each segment they can easily

serve.

They can easily search new segment for their

products.

Franchise system is the best way to search new

segmentation, which have very strong segment.

And how can they serve in those segments.

Segmentation proved very easily approach for their

targeted customers.

Segment

Could they boost flagging domestic CSD sales?

Through Product innovation

Aggressive marketing and promotion

Packaging innovations

By diversification.

Innovation : e.g diet coke

Would newly popular beverages provide them with new (and profitable) revenue

streams?

Yes

Non carb and Bottled water contribution to total volume growth: Coke-

100%, Pepsi-75

Because of Contamination issue, Obesity issue

Was the fundamental nature of cola war changing ?

Due to the obesity issue and introduction of non carbonated drinks nature

change up-to some extent but still they have to focus on csd .

Key questions

Initially through the early 1960s Coke was the

winner.

But passage of the time Pepsi creates strong

hold on the market.

Coke was focused on overseas markets, while

Pepsi focused on the US grocery channel.

Coke and Pepsi hold almost 75% the whole

market and 25% have other local CSDs or non

CSDs brands.

Conclusion

Thank You

You might also like

- Global Brand Power: Leveraging Branding for Long-Term GrowthFrom EverandGlobal Brand Power: Leveraging Branding for Long-Term GrowthRating: 5 out of 5 stars5/5 (1)

- US Carbonated Soft Drink Industry Economics and EvolutionDocument27 pagesUS Carbonated Soft Drink Industry Economics and EvolutionRazMittalNo ratings yet

- Cola Wars Continue Coke and Pepsi in 2006 by Group CDocument22 pagesCola Wars Continue Coke and Pepsi in 2006 by Group CvbalokhraNo ratings yet

- Cola Wars ContinueDocument48 pagesCola Wars Continuedheer00795% (21)

- Cola Wars: ContinueDocument27 pagesCola Wars: ContinueVivekMandalNo ratings yet

- Korean Beauty Secrets: A Practical Guide to Cutting-Edge Skincare & MakeupFrom EverandKorean Beauty Secrets: A Practical Guide to Cutting-Edge Skincare & MakeupRating: 2.5 out of 5 stars2.5/5 (2)

- Coca - Cola Vs Pepsi CoDocument16 pagesCoca - Cola Vs Pepsi Cofm949No ratings yet

- Coke Pepsi Growth International MarketsDocument1 pageCoke Pepsi Growth International MarketsmonuagarNo ratings yet

- Cola Wars: A Battle of Strategies and InnovationDocument18 pagesCola Wars: A Battle of Strategies and InnovationarinNo ratings yet

- Prajakta Ravetkar Roll No: 31 SIMS EX-MBA 2009-12Document41 pagesPrajakta Ravetkar Roll No: 31 SIMS EX-MBA 2009-12Prajakta RavetkarNo ratings yet

- Case Study Presentation On Coke and Pepsi War: Presented byDocument16 pagesCase Study Presentation On Coke and Pepsi War: Presented byGaurav GuptaNo ratings yet

- Coke Vs Pepsi - Business Strategy Competitive AnalsysisDocument32 pagesCoke Vs Pepsi - Business Strategy Competitive AnalsysisAnshuk Pal ChaudhuriNo ratings yet

- SM Cola Wars Continue 2006Document18 pagesSM Cola Wars Continue 2006Srishti ManchandaNo ratings yet

- Coca-Cola Case StudyDocument20 pagesCoca-Cola Case StudyFathi Salem Mohammed Abdullah86% (28)

- Assignment 2Document6 pagesAssignment 2Shafqat AmeerNo ratings yet

- Case Study 2Document9 pagesCase Study 2Amna AslamNo ratings yet

- Palash Tote Aayushi Maniar Devendra Newaskar Prachi Shah Fraveshi GheestaDocument27 pagesPalash Tote Aayushi Maniar Devendra Newaskar Prachi Shah Fraveshi GheestaaayushiNo ratings yet

- IMC CocaColaDocument12 pagesIMC CocaColaSamNo ratings yet

- ColaWars Section A Group 1Document13 pagesColaWars Section A Group 1Shashank Gupta50% (2)

- Mba Marketing (1) - 1Document24 pagesMba Marketing (1) - 1Akib AnsariNo ratings yet

- A3 Cola WarsDocument29 pagesA3 Cola WarsBharatSubramonyNo ratings yet

- Coca ColaDocument32 pagesCoca ColaRamchundar KarunaNo ratings yet

- Soft Drink IndustryDocument9 pagesSoft Drink IndustryJinson RajagopalanNo ratings yet

- Colawarscontinue FinalDocument30 pagesColawarscontinue FinalAizenNo ratings yet

- Section B - Group 9 - Cola War Case StudyDocument8 pagesSection B - Group 9 - Cola War Case StudyVishal KumarNo ratings yet

- Cola Strategic PathDocument5 pagesCola Strategic PathLazaros KarapouNo ratings yet

- Cola Wars PresentationDocument13 pagesCola Wars PresentationkvnikhilreddyNo ratings yet

- IMC CocaColaDocument12 pagesIMC CocaColaHassan Mirza100% (3)

- aGFGFnu PepsiDocument31 pagesaGFGFnu PepsiYahya NiaziNo ratings yet

- Nimisha Singh (PGFB1328) Paridhi Bathwal (PGFB1329) Piyush Sharma (PGFB1330) Pooja Saraf (PGFB1331) Pratyush Sahu (PGFB1332)Document36 pagesNimisha Singh (PGFB1328) Paridhi Bathwal (PGFB1329) Piyush Sharma (PGFB1330) Pooja Saraf (PGFB1331) Pratyush Sahu (PGFB1332)Piyush SharmaNo ratings yet

- Marketing Plan for Coca Cola's New Eco-Friendly PackagingDocument16 pagesMarketing Plan for Coca Cola's New Eco-Friendly PackagingshaileshNo ratings yet

- PepsiCo 2005Document14 pagesPepsiCo 2005smjafri1No ratings yet

- Coca-Cola Marketing PlanDocument27 pagesCoca-Cola Marketing PlanCanNo ratings yet

- Cola WarsDocument6 pagesCola WarsRizal Daujr Tingkahan IIINo ratings yet

- Rizal Abdullah Nur Fadly Sudirman Mars Ega LP Rohimat EfendiDocument16 pagesRizal Abdullah Nur Fadly Sudirman Mars Ega LP Rohimat EfendiRizal AbdullahNo ratings yet

- Cola Wars Continue: Group NumberDocument23 pagesCola Wars Continue: Group NumberAnshul GolaniNo ratings yet

- Coca Cola CHPT 1Document30 pagesCoca Cola CHPT 1Mayuresh BagweNo ratings yet

- Coke vs Pepsi: A Battle for Soft Drink SupremacyDocument3 pagesCoke vs Pepsi: A Battle for Soft Drink Supremacyhithot3210No ratings yet

- Coca Cola StrategyDocument31 pagesCoca Cola StrategyparaghpatilNo ratings yet

- Section 6 - AI2 - Cola Wars ContinueDocument10 pagesSection 6 - AI2 - Cola Wars ContinueBadri NarayananNo ratings yet

- Coca Cola Vs Pepsi in India: The Battle Over BottlesDocument36 pagesCoca Cola Vs Pepsi in India: The Battle Over BottlesAbdur RahmanNo ratings yet

- PepsiCo PresentationDocument28 pagesPepsiCo PresentationsanketchauhanNo ratings yet

- Coke and Pepsi in 2010 AnalysisDocument3 pagesCoke and Pepsi in 2010 Analysisprabeenkumar100% (1)

- Most Popular Coke VariantDocument59 pagesMost Popular Coke VariantNick Salao50% (2)

- Brand Audit of Pepsi Co: BY Z.Syed Imran AhmedDocument20 pagesBrand Audit of Pepsi Co: BY Z.Syed Imran AhmedimmibhaiNo ratings yet

- Cola Wars ContinueDocument4 pagesCola Wars ContinueharishNo ratings yet

- Challenges Before Pepsi & CokeDocument10 pagesChallenges Before Pepsi & CokeAditya BansalNo ratings yet

- The Cola WarDocument23 pagesThe Cola WarEric HawkNo ratings yet

- Coca ColaDocument23 pagesCoca ColaSharmeen_Salee_9785No ratings yet

- Cola WarDocument27 pagesCola Wargyanprakashdeb302No ratings yet

- Shivaraj K (Autosaved)Document29 pagesShivaraj K (Autosaved)divyashreeNo ratings yet

- Presented By: "KINGS" Nihal - Nidhi - Rajesh - Niharika - Nitesh - Vipin - Wahid - Upendra - Sourish - Aurobinda - 09Document31 pagesPresented By: "KINGS" Nihal - Nidhi - Rajesh - Niharika - Nitesh - Vipin - Wahid - Upendra - Sourish - Aurobinda - 09Nihal SinghNo ratings yet

- Advanced Corporate Strategy Assignment - Ii Coke Vs Pepsi in Bottled Water IndustryDocument9 pagesAdvanced Corporate Strategy Assignment - Ii Coke Vs Pepsi in Bottled Water IndustryMadhula SathyamoorthyNo ratings yet

- Cola WarsDocument11 pagesCola WarsAshish MahapatraNo ratings yet

- Pepsi FinalDocument50 pagesPepsi Finalsiddhi_pandya21No ratings yet

- CokeDocument28 pagesCoketyavanee19100% (1)

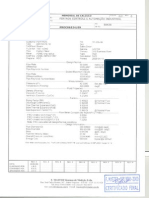

- KROSS sizing report for melasa fluidDocument2 pagesKROSS sizing report for melasa fluidacastillo1339No ratings yet

- Sizing Optimass 2000 - s150 (32000mpas)Document2 pagesSizing Optimass 2000 - s150 (32000mpas)acastillo1339No ratings yet

- Dozier Case StudyDocument6 pagesDozier Case Studywhitelizard20010% (5)

- DeltamodelDocument9 pagesDeltamodeljodrouiNo ratings yet

- Clamp and Flang CouplingDocument12 pagesClamp and Flang CouplingptafercantNo ratings yet

- American Chains OnDocument31 pagesAmerican Chains OnmichaelNo ratings yet

- DeltamodelDocument9 pagesDeltamodeljodrouiNo ratings yet

- Industrial gearbox operating dataDocument1 pageIndustrial gearbox operating dataacastillo1339No ratings yet

- KIOSDocument1 pageKIOSacastillo1339No ratings yet

- FinanceDocument8 pagesFinancebella123123321No ratings yet

- Dozier Hedging Alternatives GuideDocument2 pagesDozier Hedging Alternatives Guideacastillo1339No ratings yet

- FxExposure (Class2) TMBA5Document55 pagesFxExposure (Class2) TMBA5aizentaijoNo ratings yet

- Writing: Short Compositon Using ConnectorsDocument1 pageWriting: Short Compositon Using Connectorsacastillo1339No ratings yet

- Expansion Joint ManuelDocument20 pagesExpansion Joint Manuelgplese0No ratings yet

- BV S Reddy Sweet Sorghum Potential AlternativeDocument8 pagesBV S Reddy Sweet Sorghum Potential Alternativeacastillo1339No ratings yet

- Super SolDocument2 pagesSuper Solacastillo1339No ratings yet

- Bioethanol ComplexDocument4 pagesBioethanol Complexacastillo1339No ratings yet

- SuperDocument15 pagesSuperEuniceNo ratings yet

- Belt StackerDocument1 pageBelt Stackeracastillo1339No ratings yet

- Vertical PumpDocument1 pageVertical Pumpacastillo1339No ratings yet

- Vertical PumpDocument1 pageVertical Pumpacastillo1339No ratings yet

- Flow MasterDocument2 pagesFlow Masteracastillo1339No ratings yet

- Decision Making Its Not What You ThinkDocument5 pagesDecision Making Its Not What You Thinkpakde jongkoNo ratings yet

- 7 EstadosdeFlujosdeEfectivoDocument76 pages7 EstadosdeFlujosdeEfectivoMeneses Chino ChinoNo ratings yet

- Vertical PumpDocument1 pageVertical Pumpacastillo1339No ratings yet

- Vertical PumpDocument1 pageVertical Pumpacastillo1339No ratings yet

- Introduction To Cost and Management AccountingDocument6 pagesIntroduction To Cost and Management AccountingvpcirhNo ratings yet

- Chapter 05Document36 pagesChapter 05acastillo1339No ratings yet

- MX-403 3 HP: - Engineered To Meet The Most Severe OperatingDocument1 pageMX-403 3 HP: - Engineered To Meet The Most Severe Operatingacastillo1339No ratings yet

- G12 ABM Marketing Lesson 3Document22 pagesG12 ABM Marketing Lesson 3Leo SuingNo ratings yet

- Moengage Omnichannel MarketingDocument10 pagesMoengage Omnichannel Marketingpranjal0% (1)

- Avon Case DigestDocument2 pagesAvon Case DigestGraz DelfinNo ratings yet

- A Study ON Retail Market Survey ON: PigeonDocument7 pagesA Study ON Retail Market Survey ON: PigeonRanjith ThadakamallaNo ratings yet

- Amazon Advertising Case - RokushDocument4 pagesAmazon Advertising Case - RokushRoshan HmNo ratings yet

- Mcom Chapter 4Document22 pagesMcom Chapter 4DrVeena PrasadNo ratings yet

- 1910170MN 1518Document18 pages1910170MN 1518Yash ChhataniNo ratings yet

- Internet Marketing Strategy PDFDocument67 pagesInternet Marketing Strategy PDFDavid CruzNo ratings yet

- Bbpm2203 - Marketing Management IIDocument10 pagesBbpm2203 - Marketing Management IISimon RajNo ratings yet

- Zekarias YohannesDocument88 pagesZekarias YohannesadamNo ratings yet

- Ravi - Yadav - CV PDFDocument1 pageRavi - Yadav - CV PDFVinayNo ratings yet

- Gift Shop Business Plan ExampleDocument36 pagesGift Shop Business Plan ExampleAmaizing Wooden CraftNo ratings yet

- Abacus Busplan!!!!!!!!!!!!!!Document14 pagesAbacus Busplan!!!!!!!!!!!!!!Jazzie Raine Sanchez100% (1)

- Penilaian Sumatif (Case Study) - Ude2012 Business ResearchDocument5 pagesPenilaian Sumatif (Case Study) - Ude2012 Business ResearchAliciaNo ratings yet

- BUS 5112 - Marketing Management-Written Assignment Unit 5Document9 pagesBUS 5112 - Marketing Management-Written Assignment Unit 5YoYoNo ratings yet

- MKF1120 Lesson Guide 01 - 1 Per PageDocument29 pagesMKF1120 Lesson Guide 01 - 1 Per PageVerena TongNo ratings yet

- MKT306 Marketing StrategyDocument300 pagesMKT306 Marketing StrategyLinh LươngNo ratings yet

- 2Document1 page2Duyen LeNo ratings yet

- Income Explosion GuideDocument24 pagesIncome Explosion GuideRepahs MandharyNo ratings yet

- Basics of Corporate Re-Structuring, Mergers and AcquisitionsDocument13 pagesBasics of Corporate Re-Structuring, Mergers and AcquisitionsUbaid DarNo ratings yet

- Corporate Communications: A Dimension of Corporate MeaningDocument21 pagesCorporate Communications: A Dimension of Corporate MeaningZain LakdawalaNo ratings yet

- P&G Product PortfolioDocument43 pagesP&G Product Portfolio19 - Miten KariyaNo ratings yet

- Crafting and Executing Strategy Concepts and Cases 22nd Edition Thompson Test BankDocument63 pagesCrafting and Executing Strategy Concepts and Cases 22nd Edition Thompson Test BankAdamDelgadortgq100% (14)

- Pricing and Promotion Strategies for New Product LaunchDocument3 pagesPricing and Promotion Strategies for New Product LaunchSreyasNo ratings yet

- Business Ethics Concepts & Cases: Manuel G. VelasquezDocument21 pagesBusiness Ethics Concepts & Cases: Manuel G. Velasquezshoaib100% (1)

- Selling Junk Food To Junior High Inside The JennnnnDocument15 pagesSelling Junk Food To Junior High Inside The JennnnnMarian Joy Lozada VerboNo ratings yet

- Philippines Entrepreneurship Midterm ExamDocument3 pagesPhilippines Entrepreneurship Midterm ExamjafNo ratings yet

- Mothership Media Kit (September 2022)Document19 pagesMothership Media Kit (September 2022)LNo ratings yet

- National Account Manager in Philadelphia PA Resume Bruce CliftonDocument2 pagesNational Account Manager in Philadelphia PA Resume Bruce CliftonBruceCliftonNo ratings yet

- MG Plrcs Course ReportDocument8 pagesMG Plrcs Course ReportMariana VillegasNo ratings yet