Professional Documents

Culture Documents

Ferrell Hirt Ferrell M: Business 2 Edition

Uploaded by

Jan Dave Ogatis100%(1)100% found this document useful (1 vote)

144 views27 pagesbusiness

Original Title

Business Forms

Copyright

© © All Rights Reserved

Available Formats

PPTX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Documentbusiness

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

100%(1)100% found this document useful (1 vote)

144 views27 pagesFerrell Hirt Ferrell M: Business 2 Edition

Uploaded by

Jan Dave Ogatisbusiness

Copyright:

© All Rights Reserved

Available Formats

Download as PPTX, PDF, TXT or read online from Scribd

You are on page 1of 27

FHF

Ferrell Hirt Ferrell

M: Business

2

nd

Edition

FHF

Options for Organizing Business

Copyright 2011 by the McGraw-Hill Companies, I nc. All rights reserved. McGraw-Hill/I rwin

FHF

Sole proprietorship

Partnership

Corporation

Forms of Business Ownership

5-3

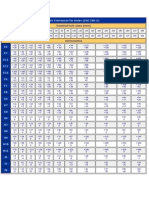

FHF Comparing Forms of Business Ownership

5-4

FHF

Comparing Forms of Business Ownership

5-5

FHF

Businesses owned and operated by one individual; the most

common form of business organization in the United States

15-20 million in the U.S.

80% of all businesses

Men 2x more likely than women to start own business

Sole Proprietorship

Restaurants

Hair salons

Flower shops

Dog kennels

Independent grocery stores

5-6

FHF

Ease and cost of formation

Secrecy

Distribution and use of profits

Flexibility and control of the

business

Government regulation

Taxation

Disadvantages

Unlimited liability

Limited sources of funds

Limited skills

Lack of continuity

Lack of Qualified Employees

Taxation

Advantages

Sole Proprietorship

5-7

FHF

Founded in 1997

Locations in Illinois, Minnesota, Washington D.C., and

Virginia

A high-end bake-at-home pizza company

Preservative-free, mostly organic gourmet pizza

Fresh-Baked Enterprises

5-8

FHF

A form of business organization defined by the Uniform

Partnership Act as an association of two or more persons who

carry on as co-owners of a business for profit

General partnership

Limited partnership

Articles of Partnership

Legal documents that set forth the basic agreement between partners

Partnership

5-9

FHF

General Partnership

A partnership that involves a complete sharing in both the

management and the liability of the business

Limited Partnership

A business organization that has at least one general partner, who

assumes unlimited liability, and at least one limited partner whose

liability is limited to his or her investment in the business

Two Types of Partnerships

5-10

FHF

1. Name, purpose, location

2. Duration of the agreement

3. Authority and responsibility of each partner

4. Character of partners (i.e., general or limited, active or silent)

5. Amount of contribution from each partner

6. Division of profits or losses

7. Salaries of each partner

Articles of Partnership

5-11

FHF

Articles of Partnership (continued)

8. How much each partner is allowed to withdraw

9. Death of partner

10.Sale of partnership interest

11.Arbitration of disputes

12.Required and prohibited actions

13.Absence and disability

14.Restrictive covenants

15.Buying and selling agreements

5-12

FHF

Ease of organization

Capital & credit

Knowledge & skills

Decision making

Regulatory controls

Disadvantages

Unlimited liability

Business responsibility

Life of the partnership

Distribution of profits

Limited sources of funds

Taxation of partnerships

Advantages

Partnership

5-13

FHF

Keep profit sharing and ownership at 50-50

Partners should have different & complementary skill sets

Honest is critical

Maintain face-to-face communications

Transparency sharing information

Awareness of funding constraints and limited resources

To be successful, you need experience

Family is priority; limit associated problems

Do not become too infatuated with the idea think

implementation

Couple optimism with realism in sales and growth expectations

Keys to Success in Partnership

5-14

FHF

Legal entities created by the state whose assets and

liabilities are separate from its owners

Typically owned by shareholders/stockholders

A corporation is created (incorporated) under the laws

of the state in which it incorporates

The individuals creating the corporation are called

incorporators

Corporations

5-15

FHF

Legal documents filed with basic information about the

business with the appropriate state office (often the secretary of

state)

Common elements:

Name & address of corporation

Objectives of the corporation

Classes of stock (common, preferred, voting, nonvoting)

Number of shares of each class of stock

Financial capital required at time of incorporation

Articles of Incorporation

5-16

FHF

Provisions for transferring shares of stock

Regulation of internal corporate affairs

Address of business office

Names and addresses of the initial board of directors

Names and addresses of the incorporators

Articles of Incorporation (continued)

5-17

FHF

Private corporation

A corporation owned by just one or a few people who are closely

involved in managing the business

Public corporation

A corporation whose stock anyone may buy, sell, or trade

I nitial Public Offering

A private corporation who wishes to go public to raise additional

capital and expand. The IPO is selling a corporations stock on public

markets for the first time

Types of Corporations

5-18

FHF

Quasi-public corporation

Corporation owned and operated by the federal, state, or local

government

NASA, U.S. Postal Service

Non-profit corporation

Focuses on providing a service rather than earning a profit but are not

owned by a government entity

The American Red Cross, The Conservation Fund

Types of Corporations (continued)

5-19

FHF

Board of directors: A group of individuals elected by the stockholders to oversee

the general operation of the corporation who set the corporations long-range objectives.

I nside Directors

Individuals who serve on a board and are employed by the corporation

(usually executives of the corporation)

Outside Directors

Individuals who serve on a board who are not directly affiliated with the

corporation (usually executives of other corporations)

Elements of a Corporation

5-20

FHF

Preferred stock

A special type of stock whose owners, though not generally

having a say in running the company, have a claim to profits

before other stockholders do.

Common Stock

Stock whose owners have voting rights in the corporation, yet

do not receive preferential treatment regarding dividends.

Stock Ownership

5-21

FHF

While trust in the stock market is generally high, it took a

hit in the wake of the 2008 recession

Confidence in the Stock Market

Source: One Year Confidence Index, The International Center for Finance at the Yale School of Management

5-22

FHF

Limited liability

Transfer of ownership

Perpetual life

External sources of funds

Expansion potential

Disadvantages

Double taxation

Forming a corporation

Disclosure of information

Employee-owner separation

Advantages

Corporations

5-23

FHF

J oint Venture

A partnership established for a specific project or for a

limited time

S-Corporation (S-Corp)

Corporation taxed as though it were a partnership with

restrictions on shareholders. Very popular with

entrepreneurs

Other Types of Business Ownership

5-24

FHF

Other Types of Business Ownership (continued)

Limited Liability Company (LLC)

Form of ownership that provides limited liability and taxation

like a partnership but places fewer restrictions on members

Cooperative (Co-Op)

An organization composed of individuals or small businesses

that have banded together to reap the benefits of belonging to

a larger organization

5-25

FHF

Merger

The combination of two companies (usually corporations) to

form a new company

Acquisition

The purchase of one company by another, usually by buying

its stock and/or assuming its debt.

Leveraged buyout (LBO)

A purchase in which a group of investors borrows money

from banks and other institutions to acquire a company (or a

division of one) using the assets of the purchased company to

guarantee repayment of the loan.

Trends in Business Ownership

5-26

FHF

5-27

You might also like

- Missouri Bill of SaleDocument1 pageMissouri Bill of SaleitargetingNo ratings yet

- 078 Federal Income TaxDocument67 pages078 Federal Income Taxcitygirl518No ratings yet

- Document Templates For Business ProfessionalsDocument10 pagesDocument Templates For Business Professionalsgetfiles67% (3)

- Marketing Plan - CARLDocument15 pagesMarketing Plan - CARLMichael HardingNo ratings yet

- Nominal Hole Sizes (MM) : ISO Tolerances For Holes (ISO 286-2)Document4 pagesNominal Hole Sizes (MM) : ISO Tolerances For Holes (ISO 286-2)Ina IoanaNo ratings yet

- Purchase ReceiptDocument3 pagesPurchase ReceiptZubair MohammedNo ratings yet

- What My Family Should Know - FillableDocument26 pagesWhat My Family Should Know - FillableSivaanand Murugesan100% (1)

- (Company Name) : Direct Deposit Agreement FormDocument1 page(Company Name) : Direct Deposit Agreement FormMalikBeyNo ratings yet

- The Insider Secret of Business: Growing Successful Financially and ProductivelyFrom EverandThe Insider Secret of Business: Growing Successful Financially and ProductivelyNo ratings yet

- Cashflow SheetDocument2 pagesCashflow SheetPamangus TappulakNo ratings yet

- Momo Statement - 250783521544-1.pdf WENDocument27 pagesMomo Statement - 250783521544-1.pdf WENJonathan HAKIZIMANA0% (1)

- SNAP VA Paper ApplicationDocument16 pagesSNAP VA Paper ApplicationMichelle HuynhNo ratings yet

- Client's Money PDFDocument3 pagesClient's Money PDFHaneefa ChNo ratings yet

- IRS Question Answer S Corp TaxesDocument1 pageIRS Question Answer S Corp TaxesSophia GrimesNo ratings yet

- NEW Sba GuideDocument4 pagesNEW Sba GuideRôxÿ BøøNo ratings yet

- 10 Step Business Start Up Worksheet and SummaryDocument3 pages10 Step Business Start Up Worksheet and SummaryMegan GepfordNo ratings yet

- Cash Flow Management WorksheetDocument5 pagesCash Flow Management WorksheetAshenafi Belete AlemayehuNo ratings yet

- Sample Engagement Letter - PartnershipsDocument12 pagesSample Engagement Letter - PartnershipsSRIVASTAV17No ratings yet

- USA Startup 2016Document16 pagesUSA Startup 2016Arthur WilsonNo ratings yet

- Rich Dad, Poor Dad ReflectionDocument6 pagesRich Dad, Poor Dad ReflectionJan Dave Ogatis0% (2)

- Cash Receipt SampleDocument20 pagesCash Receipt SamplemalaynandiNo ratings yet

- Cert of InsuranceDocument1 pageCert of Insuranceapi-297993513No ratings yet

- Home Health Care Services Business PlanDocument28 pagesHome Health Care Services Business Plantop writerNo ratings yet

- Start Up Loans Business Plan TemplateDocument18 pagesStart Up Loans Business Plan TemplateJohanna AriasNo ratings yet

- Personal Financial StatementDocument3 pagesPersonal Financial StatementIra Hilado BelicenaNo ratings yet

- FCC Rules On Do Not CallDocument3 pagesFCC Rules On Do Not CallDeanne Mitzi SomolloNo ratings yet

- 46 Things You Need To Do Before You Send Your ResumeDocument13 pages46 Things You Need To Do Before You Send Your ResumeInocêncioCollorMeloHorácioNo ratings yet

- Personal Loan Application FormDocument1 pagePersonal Loan Application FormMikky Garcia Dela CruzNo ratings yet

- Business Plan TemplateDocument5 pagesBusiness Plan TemplateRola OnrNo ratings yet

- 12steps GuidebookDocument30 pages12steps GuidebookBoris KerjnerNo ratings yet

- Document 2Document1 pageDocument 2Natalie RichardsonNo ratings yet

- Loan ApplicationDocument5 pagesLoan Applicationkhalid khayNo ratings yet

- Donation Receipt Request FormDocument1 pageDonation Receipt Request FormifyjoslynNo ratings yet

- Wire Transfer GuideDocument2 pagesWire Transfer GuideMurdoko RagilNo ratings yet

- Title Loan Contract 12-2003Document1 pageTitle Loan Contract 12-2003Lily GillNo ratings yet

- Investigating The Property Pre-Exchange SearchesDocument40 pagesInvestigating The Property Pre-Exchange SearchesFh FhNo ratings yet

- Survey Questionnaire FinalDocument2 pagesSurvey Questionnaire FinalJan Dave Ogatis100% (1)

- Salary Stretch Application Form2 1Document2 pagesSalary Stretch Application Form2 1Gilbert MendozaNo ratings yet

- Flipping Bundles: 10 Unconventional Ways To Bring Fast Cash Into Your SalonFrom EverandFlipping Bundles: 10 Unconventional Ways To Bring Fast Cash Into Your SalonNo ratings yet

- QuestionnaireDocument3 pagesQuestionnaireJan Dave OgatisNo ratings yet

- International Financial InstitutionsDocument5 pagesInternational Financial Institutionsangelverma100% (1)

- IEC 60617-13-1993 Scan PDFDocument53 pagesIEC 60617-13-1993 Scan PDFmaxz123No ratings yet

- Joint Arab-Foriegn ChambersDocument5 pagesJoint Arab-Foriegn Chambersmando_top2008No ratings yet

- New SIM Reg SIM Swap Form With Consent Version 5Document1 pageNew SIM Reg SIM Swap Form With Consent Version 5ikperha jomafuvweNo ratings yet

- 131 - Direct Deposit FormDocument1 page131 - Direct Deposit FormDipika KasyapNo ratings yet

- Nithin Resignation LetterDocument1 pageNithin Resignation LetterSujith KunjumonNo ratings yet

- KAHS Registration Doc. 2018Document2 pagesKAHS Registration Doc. 2018Kimberley Alpine Hockey SchoolNo ratings yet

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Document2 pagesFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyNo ratings yet

- Direct Deposit Form 2019Document1 pageDirect Deposit Form 2019Rudolph RushinNo ratings yet

- NuWay Foundation, IRS 990s, 2006 To The Present (Reverse Chronology)Document90 pagesNuWay Foundation, IRS 990s, 2006 To The Present (Reverse Chronology)Peter M. Heimlich100% (1)

- Mobey Forum Whitepaper - The MPOS Impact PDFDocument32 pagesMobey Forum Whitepaper - The MPOS Impact PDFDeo ValenstinoNo ratings yet

- UK Visas & Immigration: Personal InformationDocument5 pagesUK Visas & Immigration: Personal InformationMaria SaeedNo ratings yet

- Estate Tax SyllabusDocument7 pagesEstate Tax SyllabuscuteangelchenNo ratings yet

- Local Business Interview Questions & AnswersDocument4 pagesLocal Business Interview Questions & Answerszarin tasneem bibhaNo ratings yet

- CorpDocument202 pagesCorpKent Braña TanNo ratings yet

- Massachusetts Diploma Privilege Petition With APPENDIXDocument198 pagesMassachusetts Diploma Privilege Petition With APPENDIXDiploma Privilege for MANo ratings yet

- TemplatesDocument10 pagesTemplatesKayla BurnettNo ratings yet

- VanDyk Mortgage Privacy PolicyDocument5 pagesVanDyk Mortgage Privacy PolicyVanDyk Mortgage Corporation100% (1)

- TWI Appilication FormDocument3 pagesTWI Appilication FormVerdah SabihNo ratings yet

- Miami-Dade Auditor On City of Miami PTP Surtax SpendingDocument8 pagesMiami-Dade Auditor On City of Miami PTP Surtax SpendingPolitical CortaditoNo ratings yet

- Certificate of Ownership Template 08Document2 pagesCertificate of Ownership Template 08RichardwilsonNo ratings yet

- Financial Statement AssignmentDocument16 pagesFinancial Statement Assignmentapi-275910271No ratings yet

- Part TimeDocument2 pagesPart TimeAyanna SellersNo ratings yet

- Membership Options /$95 Enrollment Fee (Check One)Document7 pagesMembership Options /$95 Enrollment Fee (Check One)AmandaLeverNo ratings yet

- TYPES OF LetterDocument15 pagesTYPES OF Letter7SxBlazeNo ratings yet

- PP CH 4 Options For Organizing BusinessDocument33 pagesPP CH 4 Options For Organizing BusinessLenna BkNo ratings yet

- Business in A Changing World: Options For Organizing BusinessDocument42 pagesBusiness in A Changing World: Options For Organizing BusinessNoor DeenNo ratings yet

- IPPTChap 004Document37 pagesIPPTChap 004Zheer Safeen SuleimanNo ratings yet

- Financial Accounting: Statement of Cash FlowsDocument22 pagesFinancial Accounting: Statement of Cash FlowsJan Dave OgatisNo ratings yet

- Dac 511: Corporate Financial Reporting & Analysis Group 5 Cash Flow AnalysisDocument44 pagesDac 511: Corporate Financial Reporting & Analysis Group 5 Cash Flow AnalysisJan Dave Ogatis100% (1)

- Sme SampleDocument8 pagesSme SampleJan Dave OgatisNo ratings yet

- Roadmap To Recovery - VfinalDocument8 pagesRoadmap To Recovery - VfinalJan Dave OgatisNo ratings yet

- Notice: Corporate Governance and Finance DepartmentDocument1 pageNotice: Corporate Governance and Finance DepartmentJan Dave OgatisNo ratings yet

- Chuck Nwokocha: Presented byDocument41 pagesChuck Nwokocha: Presented byJan Dave OgatisNo ratings yet

- Covid FAQs PPDocument72 pagesCovid FAQs PPJan Dave OgatisNo ratings yet

- No. Responsible Person Procedure Remarks/ Control Notes Part A - Official Receipt MonitoringDocument3 pagesNo. Responsible Person Procedure Remarks/ Control Notes Part A - Official Receipt MonitoringJan Dave OgatisNo ratings yet

- Anti-Fraud Collaboration ReportDocument16 pagesAnti-Fraud Collaboration ReportJan Dave OgatisNo ratings yet

- 2.microfinance FundamentalsDocument33 pages2.microfinance FundamentalsJan Dave OgatisNo ratings yet

- Financial Literacy of Public School Teachers in City of KoronadalDocument11 pagesFinancial Literacy of Public School Teachers in City of KoronadalJan Dave OgatisNo ratings yet

- Inventory Management: Sage 50 Implementation GuideDocument6 pagesInventory Management: Sage 50 Implementation GuideJan Dave OgatisNo ratings yet

- Association LoanDocument11 pagesAssociation LoanJan Dave OgatisNo ratings yet

- MCM Delinquency BasicDocument25 pagesMCM Delinquency BasicJan Dave OgatisNo ratings yet

- The Art of The Leader - Cohen.ebsDocument6 pagesThe Art of The Leader - Cohen.ebsJan Dave Ogatis100% (1)

- Folk SongDocument1 pageFolk SongJan Dave OgatisNo ratings yet

- Mergers and Acquisitions (M&as) in The Nigerian BankingDocument10 pagesMergers and Acquisitions (M&as) in The Nigerian BankingRitji DimkaNo ratings yet

- 26.) Ian Gaskell, Lauren Rieder, Bruce Jin, Carol Mathis Are Warned of Other Banks Writing Down CDOs To 25:00Document1 page26.) Ian Gaskell, Lauren Rieder, Bruce Jin, Carol Mathis Are Warned of Other Banks Writing Down CDOs To 25:00Failure of Royal Bank of Scotland (RBS) Risk ManagementNo ratings yet

- APB Live BanksDocument12 pagesAPB Live BanksSumit Kumar GuptaNo ratings yet

- EyJ PDFDocument151 pagesEyJ PDFEstradaEstradaAlbertoNo ratings yet

- Irts 2008Document145 pagesIrts 2008Luis BembeleNo ratings yet

- List of International OrganizationDocument6 pagesList of International OrganizationKabeer BalochNo ratings yet

- PDF Powell Itsuki No Komoriuta PDFDocument4 pagesPDF Powell Itsuki No Komoriuta PDFjulia tamaniniNo ratings yet

- Norma IEC-479-1Document70 pagesNorma IEC-479-1vicgarofalo22100% (2)

- International Organizations Reports UPSC NotesDocument4 pagesInternational Organizations Reports UPSC NotespareshbaishyaNo ratings yet

- Law On Partnership Second Semester 2012-2013Document4 pagesLaw On Partnership Second Semester 2012-2013larrybirdyNo ratings yet

- 2341 SafestBanksPR 9 09Document2 pages2341 SafestBanksPR 9 09Danny J. BrouillardNo ratings yet

- RSRM Bank Branch CodeDocument13 pagesRSRM Bank Branch Coderockerboy61No ratings yet

- Income Tax Directive 2066Document727 pagesIncome Tax Directive 2066Krishna Kumar Shrestha100% (1)

- Rotaract Around The World Filtered by PhilippinesDocument39 pagesRotaract Around The World Filtered by PhilippinesGrace GatpandanNo ratings yet

- Rabobank Groep N.VDocument29 pagesRabobank Groep N.Vkrisz_fanfic7132No ratings yet

- HHHHHHHHHHHDocument4 pagesHHHHHHHHHHHGuru VagaNo ratings yet

- Iec 60287-3-2Document77 pagesIec 60287-3-2zwerr100% (2)

- 2023 WASH Cluster Partner Operational Precence JuneDocument2 pages2023 WASH Cluster Partner Operational Precence JuneResilient GemeNo ratings yet

- Allocations New PDFDocument35 pagesAllocations New PDFTanya AgarwalNo ratings yet

- What Is This Thing Called LoveDocument9 pagesWhat Is This Thing Called LovemarkasilvaNo ratings yet

- Statement of Axis Account No:916010041539247 For The Period (From: 01-08-2022 To: 01-02-2023)Document18 pagesStatement of Axis Account No:916010041539247 For The Period (From: 01-08-2022 To: 01-02-2023)rahulbhasinNo ratings yet

- 2juris in InsuranceDocument3 pages2juris in InsuranceTess LegaspiNo ratings yet

- Towers Watson 500 Largest Asset ManagersDocument20 pagesTowers Watson 500 Largest Asset ManagersAdam TanNo ratings yet

- Winning AnalystsDocument1 pageWinning AnalystsTiso Blackstar GroupNo ratings yet

- Private, Public and Global EnterprisesDocument5 pagesPrivate, Public and Global EnterprisesSaahil LedwaniNo ratings yet