Professional Documents

Culture Documents

Philippine Deposit Insurance Corporation

Uploaded by

Aleks OpsCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Philippine Deposit Insurance Corporation

Uploaded by

Aleks OpsCopyright:

Available Formats

DEPOSIT

INSURANCE

PHILIPPINE DEPOSIT INSURANCE

CORPORATION

R.A. 3591

I. Role of PDIC

a) Insure the deposits of all banks (only those

entitled)

b) Promote and safe guard the interest of the

depositing public

II. POWERS OF PDIC AS A CORPORATE

BODY

1) To adopt and use a corporate seal

2) To have succession until dissolved by an Act

of Congress

3) To make contracts

4) To sue and be sued, complain and defend, in

any court in the Philippines

5) To appoint by its Board of Directors such

officer and employees not otherwise

provided for by law

6. To prescribe, by its BoD, by-laws not inconsistent

with law

7. To exercise all powers specifically granted by law

and those incidental and necessary thereto

8. To conduct examination of banks with prior

approval of the Monetary Board

9. To act as receiver

10. To prescribe such rules and regulation to carry out

the provision of the PDIC law

11. To establish its own provident fund

12. To compromise condone or release any claim or

settled liability to PDIC

III. Board of Directors

A. Composition

a) Secretary of Finance (Ex-officio Chairman)

b) Governor of BSP (Ex-officio member)

c) President of PDIC (Vice-Chairman)

d) 2 members from the private sector

Qualification of the 2 appointive members:

1. good moral char.

2. unquestionable integrity and responsibility

3. recognized competence in economics, banking,

law, management administration or insurance

4. at least 35 yrs. of age

B. Disqualification from holding any office,

position or employment in any insured banks

C. Quorum

1) The presence of 3 members shall consists a

quorum. All decisions of the BoD shall require

the concurrence of at least 3 members.

2) The Sec. of Finance and the Gov. of BSP may

designate their respective representative.

(must not be lower than Undersecretary or

Deputy Gov.)

3) In the absence of the Chairman or there is

vacancy in the office of the Sec. of Finance,

the President shall act as chairman.

D. Per Diem

The Sec. of Finance shall fix the rate of per

diem for every Board Meeting attended by the

members from the private sector.

The President may fix emoluments of the

members comparable to other BoD of

Government financila institution

E. Authority of the Board

1. Prepare and issue rules and regulation as it

considers necessary for the effective discharge of

its responsibilities;

2. Direct the management, operation and

administration of PDIC;

3. Establish human resource management system

which shall govern the selection, hiring,

appointment, transfer, promotion or dismissal of

all personnel;

4. To appoint, establish the rank, fix renumeration,

approve local and foreign training and remove

any officer or employee for cause subject to

pertinent civil service laws

5. Adopt annual budget for, and authorize

such expenditure as are in the interes of the

effective administration and operation of

PDIC;

6. Approve the methodology for determining

the level and amount of provisioning for

insurance and financila assistance losses,

which shall establish reasonable levels of

deposit insurance reserves.

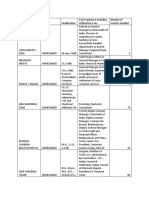

IV. OFFICERS

A. The President

1) The chief executive

2) Salary shall be fixed by the President of the Phil.

3) Sum total of the salary and other emoluments shall

be the ceiling for fixing the salary, allowances and

other emoluments of other personnel.

Powers and Duties:

a) To prepare the agenda for the meeting of the BOD

and to submit policies and measure w/c he believes

necessary to carry out the purpose of the PDIC law;

b) To execute and administer the policies and measures

approved by the Board;

c. To direct and supervise the operations and

internal administration in accordance with

the policies and measures;

d. Represent the PDIC in dealings with other

agencies;

e. To authorize contract, notes and securities

issued and the annual reports and financial

statements;

f. To represent the PDIC either personally or

through counsel, in legal proceedings;

g. To delegate his powers to represent to other

officers; and

h. To exercise such other powers as may be

vested in him by the Board.

B. The Vice-President

-Salary shall be fixed by the Board upon

recommendation by the President

- During absence or temporary incapacity

of the President, or in case vacancy or

permanent incapacity, pending

appointment of a new President; the Vice-

President shall act as President.

C. Bank Examiners

- appointed by the BOD

- have power to throrough examination of all

the affairs of the bank and shall have the

power to:

1. Administer oaths

2. Examine and take and preserve the testimony of any

of the officer and agents thereof, and

3. Compel presentation of book, documents, papers or

records necessary to his judgment to ascertain the

facts relative to the condition of the bank

D. Claims Agents

-appointed by the BoD and have the power to

investigate and examine all claims for insured

deposits and transferred deposits.

- have the power to administer oaths and examine

under oath and take and preserve testimony of any

person relating to such claim.

E. Investigators

- appointed by the BoD and have the power to conduct

investigations on fraud, irregularities and anomalies

committed in banks, based on reports of examination

conducted by the PDIC and BSP or complaints from

depositors and other governmental agencies

-also have the power to administer oaths and preserve

testimony

V. DEPOSIT INSURANCE COVERAGE

A. DEPOSIT LIABILITIES

I. Deposit liabilities of any banks or banking

institution w/c is engaged in the business of

receiving deposits shall be insured w/ PDIC.

II. Factors to be considered by the BoD:

a) The financial history and condition of bank;

b) The adequacy of its capital strucutre;

c) Its future earning prospect;

d) The general character of management

e) Convenience and the nee of the community to be

served by the bank and whether its corporate power

is consistent with PDIC purpuse

III. The term deposit means the unpaid

balance of money or its equivalent received

by a bank in the usual course of buiness and

for which it has given or its obliged to give a

credit to a respective kind of account.

IV. Any obligation of a bank which is payable at

the office of the bank located outside of the

Phil. shall not be a deposit for any of the

purposes of the PDIC law; or included as

total of insured deposits.

B. Statutory liability of PDIC

PDIC was created by law (RA 3591), thus will be

primarily be governed by the provision of said

law, therefore liability of the PDIC is statutory;

Such liability rest upon the existence of deposits

and not on the negotiability or no-negotiability

of the certificates evidencing the deposits.

Case:

PDIC vs. CA (GR No. 118317) citing Fourth Nat. Bank of Wichita vs. Wilson:

Thus, the plaintiffs in Fourth Nat. Bank of Wichita v. Wilson

argued that:

x x x the court should hold the certificates to be guaranteed because

they are negotiable instruments, and were acquired by the present

holders in due course; otherwise it is said certificates of deposit will be

deprived of the quality of commercial paper. Certificates of deposit

have been regarded as the highest form of collateral. They are of wide

currency in the banking and business worlds, and are particularly useful

to persons of small means, because they bear interest, and may be

readily cashed; therefore to deprive them of the benefit of the guaranty

fund would be a calamity. x x x

The Supreme Court of Kansas, however, found the

plaintiffs contention to be without merit, ruling thus:

x x x The argument confuses negotiability of

commercial paper with statutory guaranty of

deposits. The guaranty is something extrinsic to all

forms of evidence of bank obligation; and negotiability

of instruments has no dependence on existence or

nonexistence of the guaranty.

x x x Whatever the status of the plaintiffs may be as

holders in due course under the Negotiable

Instruments Law, they cannot be assignees of a deposit

which was not made, and cannot be entitled to the

benefit of a guaranty which did not come into

existence. x x x

C. A Deposit must in Fact be Made

i. The fact that the certificate states that the

certificates are insured by PDIC does not ipso

facto makes the latter liable for the same

should the contingency insured against arise.

A deposit should actually be made with the

bank. The banks have nothing to do with the

guaranty fund.

ii. In order that a claim with the PDIC may

prosper, the law requires that a

corresponding deposit be placed in an

insured bank (RA 3591, Sec. 1 and Sec. 10(C))

III. A deposit may be constituted only if money

or the equivalent of money is received by a

bank (RA 3591 Sec.3(f))

D. Holder in Due Course not Applicable

Even if depositor be regarded as an innocent

purchaser of certificates of deposits as

negotiable instrument, still does not relate ot

a claim against the guaranty fund.

The fund protect deposits only.

PDIC vs. CA (GR No. 118317) citing American

State Bank vs. Foster

E. Liability Under the Negotiable

Instrument vs. The Guaranty Fund

Liability of the maker of a negotiable

instrument should be distinguished from the

liability of guaranty fund.

The circumstances under each kind of liability

is entirely apart from both law governing

each, respectively.

Liability of the maker of negotiable instrument

is governed by the Negotiable Instrument Law

while liability of the guaranty fund is purely

statutory

F. Deposit Insurance of Foreign

Currency Deposits

Foreign currency deposits are insured with

PDIC.

Insurance payment shall be in the same

currency in which the insured deposits are

denominated. (Sec. 9 of RA 6426Foreign

Currency Deposit Act)

G. Duty to Indicate Insurance on

Deposits

All banks shall indicate the coverage

of the PDIC in each passbook,

certificate of time deposit and/or

cover of checkbook for demand

deposit/NOW account stating among

other thins the maximum amount of

insurance

VI. ASSESSMENT

A. Assessment Rate

Shall be determined by the Board of Directors

Note:

1. The assessment rate shall not exceed 1/5 of 1%

per annum.

Semi-annual assessment = of the assessment

rate *assessment base; but in no case shall the

amount be less than P250.00.

- The assessment base shall be the amount of the

liability of the bank deposits w/out any

deduction for indebtedness of depositor

2. The semi-annual assessment base for one

semi-annual period shall be the average of

the assessment base of the banks as of the

close of business on March 31 and June 30 or

for other semi-annual period of Sept. 30 and

Dec. 31

You might also like

- Types of WhiskyDocument5 pagesTypes of WhiskyAleks OpsNo ratings yet

- Corporate Books and Records Chapter 11Document17 pagesCorporate Books and Records Chapter 11NingClaudioNo ratings yet

- Topic 2 ExercisesDocument6 pagesTopic 2 ExercisesRaniel Pamatmat0% (1)

- Supernatural Creatures in Philippine FolkloreDocument8 pagesSupernatural Creatures in Philippine FolkloreAleks Ops100% (1)

- NU 3 Phil Deposit Insurance LawDocument36 pagesNU 3 Phil Deposit Insurance LawBack upNo ratings yet

- Investment House LawDocument7 pagesInvestment House LawJett PascuaNo ratings yet

- Statement For Telegram PDFDocument2 pagesStatement For Telegram PDFJhonel PilapilNo ratings yet

- Ra 8791 General Banking Law: Maria Ginalyn CalderonDocument54 pagesRa 8791 General Banking Law: Maria Ginalyn CalderonMaria Ginalyn CastilloNo ratings yet

- Guard Force AdminDocument13 pagesGuard Force AdminSalvador Dagoon JrNo ratings yet

- Counter Affidaavit PaoDocument6 pagesCounter Affidaavit PaoAleks Ops0% (1)

- All POB NOTESDocument249 pagesAll POB NOTESTyra Robinson74% (23)

- Chapter16 by Group CDocument33 pagesChapter16 by Group CMohamedAli AbdulleNo ratings yet

- RA 1405 & Unclaimed Deposits LawDocument4 pagesRA 1405 & Unclaimed Deposits LawJanuary Ann BeteNo ratings yet

- Cheque Issue & MGMTDocument51 pagesCheque Issue & MGMTVincent100% (1)

- Sample MoaDocument7 pagesSample MoaKool GuyNo ratings yet

- Samsung v. Febtc DigestDocument4 pagesSamsung v. Febtc DigestkathrynmaydevezaNo ratings yet

- Admisnitrative Complaint - LegitimasDocument3 pagesAdmisnitrative Complaint - LegitimasAleks OpsNo ratings yet

- Strikes, Picketing and LockoutsDocument43 pagesStrikes, Picketing and LockoutsnorzeNo ratings yet

- Direct Examination QuestionsDocument3 pagesDirect Examination QuestionsAleks OpsNo ratings yet

- Global Finance and Electronic BankingDocument2 pagesGlobal Finance and Electronic BankingMhars Dela CruzNo ratings yet

- Bond Valuation and Yield ConceptsDocument3 pagesBond Valuation and Yield Conceptskean leigh felicanoNo ratings yet

- Module 1 - Fundamental Principles - Lecture NotesDocument25 pagesModule 1 - Fundamental Principles - Lecture NotesRina Bico AdvinculaNo ratings yet

- General Banking Law of 2000Document25 pagesGeneral Banking Law of 2000John Rey Bantay RodriguezNo ratings yet

- Central Banking & Monetary Policy SyllabusDocument3 pagesCentral Banking & Monetary Policy SyllabusCielo ObriqueNo ratings yet

- The Financial System of The Philippines: and Selected Items of Monetary and Fiscal PoliciesDocument16 pagesThe Financial System of The Philippines: and Selected Items of Monetary and Fiscal PoliciesJohn Marthin ReformaNo ratings yet

- Financial Management - Chapter 1 NotesDocument2 pagesFinancial Management - Chapter 1 Notessjshubham2No ratings yet

- Asset AllocationDocument27 pagesAsset AllocationLomyna YapNo ratings yet

- Learning Module #3 Investment and Portfolio Management: Participating, and Cumulative and ParticipatingDocument6 pagesLearning Module #3 Investment and Portfolio Management: Participating, and Cumulative and ParticipatingAira AbigailNo ratings yet

- Monetary POLICYDocument21 pagesMonetary POLICYSrishti VasdevNo ratings yet

- Bangko Sentral NG PilipinasDocument26 pagesBangko Sentral NG PilipinasYna AcerdenNo ratings yet

- Strama PaperDocument17 pagesStrama PaperMacky RiveraNo ratings yet

- Chapter IDocument95 pagesChapter IAgnes BanagNo ratings yet

- Banking Law FinalDocument20 pagesBanking Law FinalRoy Vincent ManiteNo ratings yet

- ICICI Prudential ProjectDocument52 pagesICICI Prudential Projectapi-3830923100% (13)

- La Bugal B'Laan Tribal Association Vs RamosDocument1 pageLa Bugal B'Laan Tribal Association Vs RamosAleks Ops100% (1)

- Loan RestructuringDocument22 pagesLoan RestructuringNazmul H. PalashNo ratings yet

- Topic 4 Functions Operations of Central BankDocument36 pagesTopic 4 Functions Operations of Central BankChristian Gene MonterolaNo ratings yet

- Asset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionFrom EverandAsset Allocation 5E (PB): Balancing Financial Risk, Fifth EditionRating: 4 out of 5 stars4/5 (13)

- The Philippine Financial System ReportDocument28 pagesThe Philippine Financial System Reportvalerie joy camemoNo ratings yet

- PLEB Rules - ProcedureDocument19 pagesPLEB Rules - ProcedureAleks OpsNo ratings yet

- Banking Institutions History Classifications and FunctionsDocument13 pagesBanking Institutions History Classifications and FunctionsJessielyn GialogoNo ratings yet

- Universal Bank's Core Functions and DepartmentsDocument1 pageUniversal Bank's Core Functions and Departmentshailene lorenaNo ratings yet

- BSA2A WrittenReports Thrift-BanksDocument5 pagesBSA2A WrittenReports Thrift-Banksrobert pilapilNo ratings yet

- The Global Market Investment Decision: Chapter 3Document35 pagesThe Global Market Investment Decision: Chapter 3Esraa AhmedNo ratings yet

- How CAPM Helps Calculate Investment Risk and Expected ReturnsDocument7 pagesHow CAPM Helps Calculate Investment Risk and Expected ReturnsVaishali ShuklaNo ratings yet

- Foreign Currency Deposit Act of The PhilippinesDocument14 pagesForeign Currency Deposit Act of The PhilippinestheaNo ratings yet

- Jeter Advanced Accounting 4eDocument14 pagesJeter Advanced Accounting 4eMinh NguyễnNo ratings yet

- Tutorial 1: 1. What Is The Basic Functions of Financial Markets?Document6 pagesTutorial 1: 1. What Is The Basic Functions of Financial Markets?Ramsha ShafeelNo ratings yet

- Chapter 4 Commercial BanksDocument33 pagesChapter 4 Commercial BanksChichay KarenJoyNo ratings yet

- Module 1 - Philippine Deposit Insurance CorporationDocument10 pagesModule 1 - Philippine Deposit Insurance CorporationRoylyn Joy CarlosNo ratings yet

- FIMA 40023 Security Analysis FinalsDocument14 pagesFIMA 40023 Security Analysis FinalsPrincess ErickaNo ratings yet

- Be It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledDocument76 pagesBe It Enacted by The Senate and House of Representatives of The Philippine Congress AssembledFrancis Coronel Jr.No ratings yet

- Faqs 1. What Is The Philippine Deposit Insurance Corporation (PDIC) ?Document4 pagesFaqs 1. What Is The Philippine Deposit Insurance Corporation (PDIC) ?Raffy LopezNo ratings yet

- Financial Management Part 2: Analyzing ReportsDocument36 pagesFinancial Management Part 2: Analyzing ReportsJudy Anne RamirezNo ratings yet

- Secrecy of Bank DepositsDocument18 pagesSecrecy of Bank DepositsDiana BoadoNo ratings yet

- Banking CH 2 Central BankingDocument10 pagesBanking CH 2 Central BankingAbiyNo ratings yet

- Micro-Financing ProgramDocument21 pagesMicro-Financing ProgramRizzvillEspinaNo ratings yet

- Module in General Banking Law of 2000Document9 pagesModule in General Banking Law of 2000Nieves GalvezNo ratings yet

- Management of Financial Institutions - BNK604 Power Point Slides Lecture 02Document31 pagesManagement of Financial Institutions - BNK604 Power Point Slides Lecture 02aimanbatool24No ratings yet

- RFBT Special Topics 1Document6 pagesRFBT Special Topics 1Jethermaine BaybayanNo ratings yet

- Problem Loan ManagementDocument13 pagesProblem Loan ManagementAsadul HoqueNo ratings yet

- Note 08Document6 pagesNote 08Tharaka IndunilNo ratings yet

- Global Finance With Electronic Banking - Prelim ExamDocument5 pagesGlobal Finance With Electronic Banking - Prelim ExamAlfonso Joel GonzalesNo ratings yet

- Mutual Funds ExplainedDocument11 pagesMutual Funds ExplainedjchazneyNo ratings yet

- Introduction to Credit FundamentalsDocument4 pagesIntroduction to Credit FundamentalsLemon OwNo ratings yet

- Bangko Sentral NG Pilipinas: History BSP Vision and Mission Overview of Functions and OperationsDocument17 pagesBangko Sentral NG Pilipinas: History BSP Vision and Mission Overview of Functions and OperationsMichelle GoNo ratings yet

- Types of Financial InstitutionsDocument8 pagesTypes of Financial InstitutionsDevNo ratings yet

- The Structure of The Philippne Financial SystemDocument8 pagesThe Structure of The Philippne Financial SystemJon Celso Apuyan100% (2)

- RFBT-07-01a Law On Obligations Notes With MCQs Practice SetDocument110 pagesRFBT-07-01a Law On Obligations Notes With MCQs Practice SetAiza S. Maca-umbosNo ratings yet

- Deposit Substitute Operations, FeaturesDocument2 pagesDeposit Substitute Operations, FeaturesRica Nicole DiwaNo ratings yet

- Accounting Information Systems Basic Concepts and Current Issues 2nd Edition Hurt Test BankDocument5 pagesAccounting Information Systems Basic Concepts and Current Issues 2nd Edition Hurt Test BankSunny MaeNo ratings yet

- CMA Accelerated Program Test 2Document26 pagesCMA Accelerated Program Test 2bbry1No ratings yet

- Chapter 9Document10 pagesChapter 9Caleb John SenadosNo ratings yet

- BSPDocument11 pagesBSPMeloy ApiladoNo ratings yet

- Financial Management: Week 10Document10 pagesFinancial Management: Week 10sanjeev parajuliNo ratings yet

- Figuerres Vs CADocument7 pagesFiguerres Vs CAAleks OpsNo ratings yet

- LGU Expropriation Requires OrdinanceDocument6 pagesLGU Expropriation Requires OrdinanceAleks OpsNo ratings yet

- Pearanda Vs Baganga Plywood CorpDocument12 pagesPearanda Vs Baganga Plywood CorpAleks OpsNo ratings yet

- PracticeCourt Pleading - Pre Trial Brief (Plaintiff)Document3 pagesPracticeCourt Pleading - Pre Trial Brief (Plaintiff)Aleks OpsNo ratings yet

- Dissenting Opinion of Mr. Justice Artemio Panganiban On The Declaration of Nullity of MarriageDocument6 pagesDissenting Opinion of Mr. Justice Artemio Panganiban On The Declaration of Nullity of MarriageAleks OpsNo ratings yet

- Exocet Security Vs SerranoDocument8 pagesExocet Security Vs SerranoAleks OpsNo ratings yet

- Guevara Vs GuevaraDocument18 pagesGuevara Vs GuevaraAleks OpsNo ratings yet

- Salazar Vs NLRCDocument10 pagesSalazar Vs NLRCAleks OpsNo ratings yet

- Mindanao Bus Co. V City Assessor and TreasurerDocument4 pagesMindanao Bus Co. V City Assessor and TreasurermisterdodiNo ratings yet

- PracticeCourt Pleading - Pre Trial Brief (Plaintiff)Document3 pagesPracticeCourt Pleading - Pre Trial Brief (Plaintiff)Aleks OpsNo ratings yet

- Why Illegal Detention Is Non-BailableDocument5 pagesWhy Illegal Detention Is Non-BailableAleks OpsNo ratings yet

- People Vs BindoyDocument2 pagesPeople Vs BindoyAleks OpsNo ratings yet

- Reseach SB - PlebDocument5 pagesReseach SB - PlebAleks OpsNo ratings yet

- Human Development IndexDocument5 pagesHuman Development IndexAleks Ops0% (1)

- Port Workers Union of The Philippines Vs Hon. UndersecretaryDocument1 pagePort Workers Union of The Philippines Vs Hon. UndersecretaryAleks OpsNo ratings yet

- The Tire Blowout CaseDocument3 pagesThe Tire Blowout CaseAleks OpsNo ratings yet

- Paranaque King Enterprises Vs Court of AppealsDocument12 pagesParanaque King Enterprises Vs Court of AppealsAleks OpsNo ratings yet

- People Vs Bande SCRADocument3 pagesPeople Vs Bande SCRAAleks OpsNo ratings yet

- California Manufacturing Corporation Vs The Honorable Undersecretary of LaborDocument1 pageCalifornia Manufacturing Corporation Vs The Honorable Undersecretary of LaborAleks OpsNo ratings yet

- Zenith Insurance vs CA: Ruling on unreasonable delay in paying car insurance claimDocument3 pagesZenith Insurance vs CA: Ruling on unreasonable delay in paying car insurance claimAleks OpsNo ratings yet

- 9 Tumalad Vs VicencioDocument6 pages9 Tumalad Vs VicencioAleks OpsNo ratings yet

- Ds Team D Group ProjectDocument57 pagesDs Team D Group ProjectRenuka Badhoria (HRM 21-23)No ratings yet

- R M G D: ISK Anagement Uidelines For Erivatives (July 1994)Document17 pagesR M G D: ISK Anagement Uidelines For Erivatives (July 1994)loghanand_muthuramuNo ratings yet

- IFN Guide 2019 PDFDocument104 pagesIFN Guide 2019 PDFPastel IkasyaNo ratings yet

- Banking Sector ReformsDocument15 pagesBanking Sector ReformsKIRANMAI CHENNURUNo ratings yet

- The Legal Framework of The Philippine Banking System: Atty. Elmore O. CapuleDocument114 pagesThe Legal Framework of The Philippine Banking System: Atty. Elmore O. CapuleMakoy BixenmanNo ratings yet

- Introduction of Internet Banking: Keywords: Online Banking, Financial Institution, ATM, Mobile Banking EtcDocument75 pagesIntroduction of Internet Banking: Keywords: Online Banking, Financial Institution, ATM, Mobile Banking Etcakshay mouryaNo ratings yet

- Initial Public OfferingDocument23 pagesInitial Public OfferingDyheeNo ratings yet

- Arb PanelDocument46 pagesArb PanelKarthik VelletiNo ratings yet

- Wealth Management For NRIsDocument4 pagesWealth Management For NRIsVishal SoniNo ratings yet

- Module 2 Conceptual FrameworkDocument8 pagesModule 2 Conceptual FrameworkEloisa Joy MoredoNo ratings yet

- Banking NotesDocument104 pagesBanking NotesprasanthNo ratings yet

- Chapter 14Document12 pagesChapter 14Aditi SenNo ratings yet

- 10 1 1 649 8329Document300 pages10 1 1 649 8329akash deepNo ratings yet

- 2020 113 Taxmann Com 36 SAT Mumbai 10 10 2019Document23 pages2020 113 Taxmann Com 36 SAT Mumbai 10 10 2019Sejal LahotiNo ratings yet

- Navi Consumer Loans Case SubmissionDocument4 pagesNavi Consumer Loans Case SubmissionABHIRAM MOLUGUNo ratings yet

- Branding in Priority BankingDocument42 pagesBranding in Priority BankingGAUTAM BUCHHANo ratings yet

- Morgan Stanley First Quarter 2019 Earnings Results: Morgan Stanley Reports Net Revenues of $10.3 Billion and EPS of $1.39Document9 pagesMorgan Stanley First Quarter 2019 Earnings Results: Morgan Stanley Reports Net Revenues of $10.3 Billion and EPS of $1.39Valter SilveiraNo ratings yet

- The Euro-Dollar Market Friedman Principles - Jul1971Document9 pagesThe Euro-Dollar Market Friedman Principles - Jul1971Deep. L. DuquesneNo ratings yet

- Audit of Bank of BarodaDocument27 pagesAudit of Bank of BarodaKiara MpNo ratings yet

- IGCSE ACCOUNTING NOTEsDocument5 pagesIGCSE ACCOUNTING NOTEsDehan YahatugodaNo ratings yet

- Calculate Savings, Loans, Annuities and Present/Future ValuesDocument1 pageCalculate Savings, Loans, Annuities and Present/Future ValuesNaveed NawazNo ratings yet

- Ilyas Kahn, List of DirectorshipsDocument56 pagesIlyas Kahn, List of DirectorshipslifeinthemixNo ratings yet

- Bank Frauds in IndiaDocument14 pagesBank Frauds in Indiaway2iima100% (1)