Professional Documents

Culture Documents

The Sharpe Index Model: Hari Prapan Sharma

Uploaded by

Hiral Shah0 ratings0% found this document useful (0 votes)

30 views11 pagesSharpe assumed that the return of a security is linearly related to a single index like the market index. It needs 3N + 2 bits of information compared to [N(N + 3) / 2] bits of information needed in the Markowitz analysis. Portfolio return is the weighted average of the estimated return for each security.

Original Description:

Original Title

1255895_634575007396418750

Copyright

© © All Rights Reserved

Available Formats

PPT, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentSharpe assumed that the return of a security is linearly related to a single index like the market index. It needs 3N + 2 bits of information compared to [N(N + 3) / 2] bits of information needed in the Markowitz analysis. Portfolio return is the weighted average of the estimated return for each security.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

30 views11 pagesThe Sharpe Index Model: Hari Prapan Sharma

Uploaded by

Hiral ShahSharpe assumed that the return of a security is linearly related to a single index like the market index. It needs 3N + 2 bits of information compared to [N(N + 3) / 2] bits of information needed in the Markowitz analysis. Portfolio return is the weighted average of the estimated return for each security.

Copyright:

© All Rights Reserved

Available Formats

Download as PPT, PDF, TXT or read online from Scribd

You are on page 1of 11

The Sharpe Index Model

HARI PRAPAN SHARMA

To understand the basics of Sharpe Index model

To calculate the systematic and unsystematic

risk

To know the concept optimal portfolio

In Markowitz model a number of co-variances

have to be estimated.

If a financial institution buys 150 stocks, it has to

estimate 11,175 i.e., (N

2

N)/2 correlation

co-efficients.

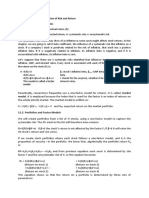

Sharpe assumed that the return of a security is

linearly related to a single index like the market

index.

It needs 3N + 2 bits of information compared to

[N(N + 3)/2] bits of information needed in the

Markowitz analysis.

Stock prices are related to the market index and

this relationship could be used to estimate the

return of stock.

R

i

= o

i

+ |

i

R

m

+ e

i

where R

i

expected return on security i

o

i

intercept of the straight line or alpha co-

efficient

|

i

slope of straight line or beta co-efficient

R

m

the rate of return on market index

e

i

error term

Systematic risk = |

i

2

variance of market index

= |

i

2

o

m

2 variance explained by the index

Unsystematic risk = Total variance Systematic risk

e

i

2

= o

i

2

Systematic risk

( unexplained variance)

Thus the total risk = Systematic risk + Unsystematic

risk

= |

i

2

o

m

2

+ e

i

2

Variance of the security has two component namely systematic risk & unsystematic risk.

The portfolio variance can be derived

where

= variance of portfolio

= expected variance of index

= variation in securitys return not related to the market

index

x

i

= the portion of stock i in the portfolio

e

2

i

o

2

N N

2 2 2 2

p i i m i i

i =1 i =1

= x + x e

(

| | (

o

(

(

|

\ .

(

2

p

o

2

m

o

For each security o

i

and |

i

should be estimated

Portfolio return is the weighted average of the

estimated return for each security in the portfolio.

The weights are the respective stocks

proportions in the portfolio.

Strongly efficient market All information is reflected on prices. Weakly efficient market All historical information is reflected on security Semi strong efficient market All public information is reflected on security prices Strongly efficient market All information is reflected on prices. Weakly efficient market All historical information is reflected on security Semi strong efficient market All public information is reflected on security prices Strongly efficient market All information is reflected on prices. Weakly efficient market All historical information is reflected on security Semi strong efficient market All public information is reflected on security prices

N

p i i i m

i =1

R = x ( + R )

A portfolios beta value is the weighted average

of the beta values of its component stocks using

relative share of them in the portfolio as weights.

|

p

is the portfolio beta.

N

p i i

i =1

= x | |

The selection of any stock is directly related to its

excess return-beta ratio.

where R

i

= the expected return on stock i

R

f

= the return on a risk free asset

|

i

= the expected change in the rate of return

on stock i associated with one unit

change in the market return

i f

i

R R

The steps for finding out the stocks to be included in the

optimal portfolio are as:

Find out the excess return to beta ratio for each stock under

consideration

Rank them from the highest to the lowest

Proceed to calculate C

i

for all the stocks according to the ranked

order using the following formula

o

m

2

= variance of the market index

o

ei

2

= variance of a stocks movement that is not associated with the

movement of market index i.e., stocks unsystematic risk

The cumulated values of C

i

start declining after a

particular C

i

and that point is taken as the cut-off point

and that stock ratio is the cut-off ratio C.

N

2

i f i

m

2

i =1

ei

i

2

N

2

i

m

2

i =1

ei

(R R )

1+

By now, you should have:

Understood the Sharpe Index model

Been able to calculate systematic and

unsystematic risk

Understood the concept of optimal portfolio

You might also like

- Corporate Finance Formulas: A Simple IntroductionFrom EverandCorporate Finance Formulas: A Simple IntroductionRating: 4 out of 5 stars4/5 (8)

- Module 2: Measuring Security Returns and RisksDocument20 pagesModule 2: Measuring Security Returns and Risksjhumli100% (1)

- Sox PDFDocument8 pagesSox PDFRoland ValNo ratings yet

- Arbitrage Pricing Theory & Sharpe Index ModelDocument16 pagesArbitrage Pricing Theory & Sharpe Index ModelMITHLESHCNo ratings yet

- Case FriaDocument7 pagesCase FriaMichelle Marie TablizoNo ratings yet

- FE 445 M1 CheatsheetDocument5 pagesFE 445 M1 Cheatsheetsaya1990No ratings yet

- Corporation Code of The Philippines ReviewerDocument3 pagesCorporation Code of The Philippines ReviewerJohnNo ratings yet

- IBP Part 05 Inventory Warehouse v02Document77 pagesIBP Part 05 Inventory Warehouse v02Rajesh Kumar Sugumaran100% (1)

- Capital Asset Pricing ModelDocument24 pagesCapital Asset Pricing ModelBrij MohanNo ratings yet

- Basic Accounting ExamDocument8 pagesBasic Accounting ExamJollibee JollibeeeNo ratings yet

- Portfolio TheoryDocument10 pagesPortfolio Theoryrameshmba100% (3)

- Asset PricingDocument23 pagesAsset PricingBrian DhliwayoNo ratings yet

- Chapter 8 Capital Asset Pricing & Artge PRNG ThryDocument64 pagesChapter 8 Capital Asset Pricing & Artge PRNG ThryAanchalNo ratings yet

- Sharpe Single Index ModelDocument11 pagesSharpe Single Index ModelSai Mala100% (1)

- The Rise and Evolution of the Global CorporationDocument14 pagesThe Rise and Evolution of the Global Corporationmeca DURAN50% (4)

- Chapter 6-Forever Young Case Solution-UpdateDocument5 pagesChapter 6-Forever Young Case Solution-UpdateYUSHIHUI75% (8)

- The Sharpe Index Model: Presented By:-Preeti Singhroha MBA/11/38Document11 pagesThe Sharpe Index Model: Presented By:-Preeti Singhroha MBA/11/38Preeti SinghNo ratings yet

- Sharpe Index Model ExplainedDocument10 pagesSharpe Index Model ExplainedAjithNo ratings yet

- Performance Evaluation of Two Optimal Portfolios by Sharpe's RatioDocument12 pagesPerformance Evaluation of Two Optimal Portfolios by Sharpe's RatioBalaji AsokanNo ratings yet

- Portfolio Theory Sharpe Index Model1 110921030315 Phpapp02Document29 pagesPortfolio Theory Sharpe Index Model1 110921030315 Phpapp02amitgoyal19899633No ratings yet

- The Sharpe Index ModelDocument3 pagesThe Sharpe Index ModelSohini Mo BanerjeeNo ratings yet

- Chap 3 TCFDocument20 pagesChap 3 TCFMuhammad Umer SaigolNo ratings yet

- Members: Deepak Sharma Manu Sadashiv Vishwambhar Singh Shruti Shetty Manjunath Patil Keshav BhatDocument33 pagesMembers: Deepak Sharma Manu Sadashiv Vishwambhar Singh Shruti Shetty Manjunath Patil Keshav BhatKeshav BhatNo ratings yet

- The Sharp Index ModelDocument11 pagesThe Sharp Index ModelSandeep BadoniNo ratings yet

- Portfolio Sharpe Index Model - 2Document9 pagesPortfolio Sharpe Index Model - 2Amit PandeyNo ratings yet

- 459 162 Libre PDFDocument9 pages459 162 Libre PDFmelisaaahwangNo ratings yet

- Portfolio ConstructionDocument27 pagesPortfolio ConstructionAgnivesh JayaNo ratings yet

- Solvency / Ratio/ Leverage / Liquididty AnalysisDocument142 pagesSolvency / Ratio/ Leverage / Liquididty AnalysisshobasridharNo ratings yet

- FINALS Investment Cheat SheetDocument9 pagesFINALS Investment Cheat SheetNicholas YinNo ratings yet

- Portfolio Using Sharpe's Single Index ModelDocument3 pagesPortfolio Using Sharpe's Single Index ModelTCNo ratings yet

- Asset Pricing Models: The Capm The Market Model The Arbitrage Pricing ModelDocument22 pagesAsset Pricing Models: The Capm The Market Model The Arbitrage Pricing ModelvtomozeiNo ratings yet

- Index Models ExplainedDocument46 pagesIndex Models ExplainedHanis RashidahNo ratings yet

- CAPM and The Characteristic LineDocument25 pagesCAPM and The Characteristic Lineagrawalrohit_228384No ratings yet

- 21573sm SFM Finalnewvol2 Cp7 Chapter 7Document62 pages21573sm SFM Finalnewvol2 Cp7 Chapter 7Prin PrinksNo ratings yet

- R (W I) /I E R Ae (X) +be (Y) Var R A Var (X) +B Var (Y) +2 Abcov (Xy) Cov (Xy) E (X E (X) Y E (Y) W A+B WDocument1 pageR (W I) /I E R Ae (X) +be (Y) Var R A Var (X) +B Var (Y) +2 Abcov (Xy) Cov (Xy) E (X E (X) Y E (Y) W A+B WMarta BarradasNo ratings yet

- 03 Index ModelDocument35 pages03 Index ModelStaccNo ratings yet

- Capital Market LineDocument8 pagesCapital Market Linecjpadin09No ratings yet

- #01 Session1Document36 pages#01 Session1YisraelaNo ratings yet

- Sharpe Index Model - Prof. S S PatilDocument36 pagesSharpe Index Model - Prof. S S Patilraj rajyadav100% (1)

- ModelsDocument21 pagesModelsEjaz Ali MaitlaNo ratings yet

- Sharpe's ModelDocument58 pagesSharpe's ModelTausif R Maredia100% (1)

- CapmDocument26 pagesCapmNiravjain33No ratings yet

- CAPM TheoryDocument11 pagesCAPM TheoryNishakdasNo ratings yet

- Ex Ante Beta MeasurementDocument24 pagesEx Ante Beta MeasurementAnonymous MUA3E8tQNo ratings yet

- CAPMDocument8 pagesCAPMSanjay TNo ratings yet

- Markowitz ModelDocument17 pagesMarkowitz ModelgultoNo ratings yet

- Foundations of Finance MidtermDocument2 pagesFoundations of Finance MidtermVamsee JastiNo ratings yet

- Single Index ModelDocument4 pagesSingle Index ModelNikita Mehta DesaiNo ratings yet

- Analysis of Systematic and Unsystematic Risks in CapitalDocument18 pagesAnalysis of Systematic and Unsystematic Risks in CapitalNishant Edwin PaschalNo ratings yet

- Port MNGT tRiskandReturn4Document105 pagesPort MNGT tRiskandReturn4guhandossNo ratings yet

- Portfolio QuestionsDocument6 pagesPortfolio QuestionsHarsh RajNo ratings yet

- L1 R50 HY NotesDocument7 pagesL1 R50 HY Notesayesha ansariNo ratings yet

- Sharpe Ratio: R R E (R RDocument17 pagesSharpe Ratio: R R E (R Rvipin gargNo ratings yet

- 10 Risk and Return - Student VersionDocument59 pages10 Risk and Return - Student VersionKalyani GogoiNo ratings yet

- Additional ReadingDocument4 pagesAdditional ReadingVishwas TripathiNo ratings yet

- Portfolio Management: Statical Analysis For Single SecurityDocument5 pagesPortfolio Management: Statical Analysis For Single SecurityJenneey D RajaniNo ratings yet

- Evaluate Portfolio Performance with Treynor, Sharpe, Jensen and Information MeasuresDocument20 pagesEvaluate Portfolio Performance with Treynor, Sharpe, Jensen and Information Measuresrajin_rammsteinNo ratings yet

- Methodology of Event StudiesDocument4 pagesMethodology of Event Studieshaichellam5577No ratings yet

- Corporate Finance Lecture 10: FoundationsDocument2 pagesCorporate Finance Lecture 10: FoundationsFarhana AfrinNo ratings yet

- Portfolio Theories1Document17 pagesPortfolio Theories1ayazNo ratings yet

- Capital Asset Pricing Model: Objectives: After Reading This Chapter, You ShouldDocument17 pagesCapital Asset Pricing Model: Objectives: After Reading This Chapter, You ShouldGerrar10No ratings yet

- Solution Manual For Capital Markets Institutions and Instruments 4th Edition Frank J Fabozzi Franco ModiglianiDocument10 pagesSolution Manual For Capital Markets Institutions and Instruments 4th Edition Frank J Fabozzi Franco ModiglianiJonathanBradshawsmkc100% (42)

- Capital Asset Pricing Model (CAPM)Document14 pagesCapital Asset Pricing Model (CAPM)Chinmay P KalelkarNo ratings yet

- Resume of Chapter 12 An Alternative View of Risk and ReturnDocument2 pagesResume of Chapter 12 An Alternative View of Risk and ReturnAimé RandrianantenainaNo ratings yet

- Ownership Structure and Dividend Policy: I J C R BDocument24 pagesOwnership Structure and Dividend Policy: I J C R BHiral ShahNo ratings yet

- Ownership Structure and Dividend Policy: I J C R BDocument24 pagesOwnership Structure and Dividend Policy: I J C R BHiral ShahNo ratings yet

- 06 PDFDocument1 page06 PDFHiral ShahNo ratings yet

- Devashish FinalDocument65 pagesDevashish FinalHiral ShahNo ratings yet

- FA MaterialDocument29 pagesFA MaterialHiral ShahNo ratings yet

- Circular:: Subject: Important Instructions For Centre Supervisors, Centre in Charge and University ObserversDocument1 pageCircular:: Subject: Important Instructions For Centre Supervisors, Centre in Charge and University ObserversHiral ShahNo ratings yet

- Year Wise DataDocument404 pagesYear Wise DataHiral ShahNo ratings yet

- No. GTU/MBA /grade Card/2013/9734 Date: 15/11/2013 CircularDocument1 pageNo. GTU/MBA /grade Card/2013/9734 Date: 15/11/2013 CircularHiral ShahNo ratings yet

- GTU Academic Even Sem Calender 2014Document1 pageGTU Academic Even Sem Calender 2014Ved GuptaNo ratings yet

- GTU Sitaram Patel Inst Strategic & Fin MgtDocument3 pagesGTU Sitaram Patel Inst Strategic & Fin MgtHiral ShahNo ratings yet

- Custodial ServicesDocument24 pagesCustodial ServicesHiral ShahNo ratings yet

- Marketing Channels and Physical DistributionDocument30 pagesMarketing Channels and Physical DistributionAmit JaiswalNo ratings yet

- Custodial ServicesDocument24 pagesCustodial ServicesHiral ShahNo ratings yet

- Anastasia Chandra - .Akuntanis A 2014 - Tugas 6xDocument21 pagesAnastasia Chandra - .Akuntanis A 2014 - Tugas 6xSriNo ratings yet

- Construction of Bridge Over Andermanik River With Related Works at Payra Port Under Payra Port's First Terminal ProjectDocument2 pagesConstruction of Bridge Over Andermanik River With Related Works at Payra Port Under Payra Port's First Terminal ProjectParvez Syed RafiNo ratings yet

- Assignment 2 BNP 30402 AnswerDocument7 pagesAssignment 2 BNP 30402 AnswerbndrprdnaNo ratings yet

- Akrss RegformDocument2 pagesAkrss Regformapi-308916869No ratings yet

- Questions of Business Administration - CSSDocument6 pagesQuestions of Business Administration - CSSSyed Faizan BariNo ratings yet

- Level Up Lesson Plans Banking 101 DDocument15 pagesLevel Up Lesson Plans Banking 101 DPriyanka artsNo ratings yet

- Martingales, Wiener Processes & Ito's LemmaDocument35 pagesMartingales, Wiener Processes & Ito's Lemmanischal mathurNo ratings yet

- Brazil Accounting Tax Processes v1 PDFDocument163 pagesBrazil Accounting Tax Processes v1 PDFGustavo GonçalvesNo ratings yet

- Source of Income Inequality PDFDocument16 pagesSource of Income Inequality PDFBeni GunawanNo ratings yet

- Can India Afford To Boycott Chinese ProductsDocument2 pagesCan India Afford To Boycott Chinese ProductsSowmya MinnuNo ratings yet

- Consolidated Intercompany TransactionsDocument73 pagesConsolidated Intercompany TransactionsFatima AL-Sayed100% (1)

- Profile PPCBL FEB 2010Document8 pagesProfile PPCBL FEB 2010alamgir786786No ratings yet

- Collection Disbursement ReportDocument6 pagesCollection Disbursement Reportmkmohit991No ratings yet

- Answer KeyDocument9 pagesAnswer KeyDeepakshiNo ratings yet

- Investment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFDocument43 pagesInvestment Banking Valuation Leveraged Buyouts and Mergers and Acquisitions 2Nd Edition Rosenbaum Test Bank Full Chapter PDFWilliamCartersafg100% (11)

- Retire as a millionaire with simple investingDocument6 pagesRetire as a millionaire with simple investingHamidNo ratings yet

- Garcia vs. Court of AppealsDocument12 pagesGarcia vs. Court of AppealsJoannah SalamatNo ratings yet

- Quizzer - Buscom 01Document7 pagesQuizzer - Buscom 01khyla Marie NooraNo ratings yet

- "The Philippines" in Political Parties and Democracy: Western Europe, East and Southeast Asia 1990-2010Document19 pages"The Philippines" in Political Parties and Democracy: Western Europe, East and Southeast Asia 1990-2010Julio TeehankeeNo ratings yet

- Nobles Acct11 Demoppt Ch21Document35 pagesNobles Acct11 Demoppt Ch21ashibhallauNo ratings yet

- Average Rate of Return ExampleDocument1 pageAverage Rate of Return Examplefxn fndNo ratings yet

- Post Transactions: Account Title Account Code Debit Credit Balance Date Item Ref Debit CreditDocument5 pagesPost Transactions: Account Title Account Code Debit Credit Balance Date Item Ref Debit CreditPaolo IcangNo ratings yet

- Proforma Mahindra TeqoDocument1 pageProforma Mahindra Teqop m yadavNo ratings yet