Professional Documents

Culture Documents

Mortgage Market

Uploaded by

Shin YiOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mortgage Market

Uploaded by

Shin YiCopyright:

Available Formats

Relationship

Securitisation

Residential

Mortgage

Market

Fixed-income

securitiesbetween

markets are

functioned to and

reduce

the dependence

of private

institutions on banks, the equity market and external resources.

Recognising the limited supply of tradable debt instruments in primary markets and the

severe liquidity problem experienced by secondary markets in the region, the government

has created mortgage-backed securities. This can help to develop and deepen fixed income

securities.

There are a lot of benefits for financial institutions which gain from securitization. These

advantages include the removal of asset from the balance sheet, retention of servicing

revenues as its continues as a service, lower financing cost than if it could issue security by

itself, reduction in regulatory capital requirement, reduction in assets, and improved assetliability management.

Hence, financial institutions, by holding a mortgage-backed security rather than the

mortgage itself, would achieve greater liquidity.

Therefore, we believe that securitisation of the residential mortgage market has transformed

the financial institution liquidity in Malaysia.

Factors Affecting the Price of Housing in Malaysia

Population - the population in Malaysia is continuing to increase, people need

more houses to live in but the production of housing is slow due to the many

laws, regulations and procedures related to the building of houses.

GDP - the demand for houses generates housing industry investment and

helps the recovery of the GDP growth rate.

Labour force - if a large amount of the labour force is involved in

construction, the cost of housing will increase. Besides, construction involving

a lot of professional workers with a high level of education, this will cause the

housing price to increase because the cost of building a unit increases.

Inflation - During inflation, most things in the economy will increase their

price. However, the cost of the raw material for building a house will increase.

In future studies, other measurements of the increase in the housing price in

Malaysia, such as investment, economy and personal income, can be used.

Mortgage Market Design

Asset pricing economists view mortgages as contracts that share various types of risk between

mortgage lenders and borrowers.

Long-term mortgages protect borrowers against deteriorations in their own creditworthiness or

in credit market conditions.

Behavioral finance confronts the fact that borrowers vary in their personal circumstances, and

in their ability to manage their financial affairs in their own long-run interest. Three particularly

important types of heterogeneity are in moving propensity, financial sophistication, and

present-biased preferences.

Mortgage loans must be funded, and this requires the involvement of financial intermediaries

who originate loans and either hold them or repackage them for sale to ultimate investors.

Other intermediaries may provide guarantees, insuring certain mortgage risks. Whatever risks

borrowers do not bear must be allocated to originators, ultimate investors, or guarantee

providers. Different mortgage systems allocate these risks differently.

The form of the mortgage system has the potential to influence macroeconomic outcomes,

principally by altering the transmission mechanism of monetary policy and the political

constraints on the central bank.

You might also like

- Financial Institutions Management - Solutions - Chap001Document10 pagesFinancial Institutions Management - Solutions - Chap001Samra AfzalNo ratings yet

- Loan Policy of A BanksDocument17 pagesLoan Policy of A Bankssajid bhattiNo ratings yet

- Designing Lending Products.Document23 pagesDesigning Lending Products.Rita Nyairo50% (2)

- Mfi TP Q&aDocument25 pagesMfi TP Q&amonizaNo ratings yet

- FINS3630Notes1 5Document17 pagesFINS3630Notes1 5Sel LiNo ratings yet

- Managing The Lending Portfolio of BanksDocument44 pagesManaging The Lending Portfolio of BanksgurudumaNo ratings yet

- Day - 2 MMDocument14 pagesDay - 2 MMihavenoidea33No ratings yet

- Contemporary Issues... Money, Capital Market...Document14 pagesContemporary Issues... Money, Capital Market...Hoyo VerseNo ratings yet

- ComplexitiesDocument2 pagesComplexitiesHassan AliNo ratings yet

- Real Estate-: Allows Diversification of Asset - Real Estate Has Almost No Direct Correlation With Other PopularDocument12 pagesReal Estate-: Allows Diversification of Asset - Real Estate Has Almost No Direct Correlation With Other PopularsanskritiNo ratings yet

- Real Estate-: Allows Diversification of Asset - Real Estate Has Almost No Direct Correlation With Other PopularDocument12 pagesReal Estate-: Allows Diversification of Asset - Real Estate Has Almost No Direct Correlation With Other PopularsanskritiNo ratings yet

- Government SubsidiesDocument6 pagesGovernment Subsidiessamy7541No ratings yet

- Introduction To Retail LoansDocument2 pagesIntroduction To Retail LoansSameer ShahNo ratings yet

- How Changes in Bank Environment Influence The Terms and Conditions of Loan and DepositDocument3 pagesHow Changes in Bank Environment Influence The Terms and Conditions of Loan and DepositS.m. Sagor AhmmedNo ratings yet

- SecuritisationDocument28 pagesSecuritisationChinmayee ChoudhuryNo ratings yet

- SecuritizationDocument23 pagesSecuritizationHarshit NagpalNo ratings yet

- 7-81 Last Pages Rupanshi Complete............Document75 pages7-81 Last Pages Rupanshi Complete............himanshu.ahirwarfeaNo ratings yet

- BNK 501 SolutionsDocument3 pagesBNK 501 SolutionsShaniaNo ratings yet

- Financial ServicesDocument22 pagesFinancial ServicessonuNo ratings yet

- Financial Crisis 2007-2008: Submitted To Dr. Archana Done by Naomy Nasambu Simiyu 2K18/MBA/128Document25 pagesFinancial Crisis 2007-2008: Submitted To Dr. Archana Done by Naomy Nasambu Simiyu 2K18/MBA/128NAOMYNo ratings yet

- Banking Credit ManagementDocument7 pagesBanking Credit ManagementashwatinairNo ratings yet

- Sta 2322 Risk Management in Financial Institutions IntroductionDocument7 pagesSta 2322 Risk Management in Financial Institutions Introductionmurayadennis215No ratings yet

- Credit SystemDocument57 pagesCredit SystemHakdog CheeseNo ratings yet

- Chap I Introduction To Financial InstitutionsDocument57 pagesChap I Introduction To Financial InstitutionsGing freexNo ratings yet

- Topic1 BICMDocument40 pagesTopic1 BICMmagentagolapNo ratings yet

- Financial Management: Live Project OnDocument13 pagesFinancial Management: Live Project OnAradhnaNo ratings yet

- Chapter 7Document73 pagesChapter 7Magix SmithNo ratings yet

- Management of Financial InstitutionDocument14 pagesManagement of Financial InstitutionShailesh SapariyaNo ratings yet

- Fixed Income Introducton To Asset Backed SecurityDocument13 pagesFixed Income Introducton To Asset Backed SecurityLUXMI TRADING COMPANYNo ratings yet

- Session 3 - Financial Intermediation NDocument33 pagesSession 3 - Financial Intermediation NVaibhav AggarwalNo ratings yet

- Lecture 1 Banking, Financial Services Industry and RegulationsDocument29 pagesLecture 1 Banking, Financial Services Industry and Regulationseugene etwireNo ratings yet

- 7-81 Last Pages Rupanshi CompleteDocument65 pages7-81 Last Pages Rupanshi Completehimanshu.ahirwarfeaNo ratings yet

- Financial ServicesDocument28 pagesFinancial ServicesPrasad Sandepudi100% (1)

- Financial ServicesDocument182 pagesFinancial ServicesVivek KuchhalNo ratings yet

- Depository & Non Depository: Financial IntermediaryDocument136 pagesDepository & Non Depository: Financial IntermediaryMoud KhalfaniNo ratings yet

- The Nature of Financial Intermediation: International BankingDocument24 pagesThe Nature of Financial Intermediation: International BankingToàn VănNo ratings yet

- Chapter ThreeDocument25 pagesChapter Threeshraddha amatyaNo ratings yet

- Shadow BankingDocument6 pagesShadow BankingSydkoNo ratings yet

- Credit Management NOTESDocument7 pagesCredit Management NOTESAkshat SolankiNo ratings yet

- Chapter 3 & 4 Banking An Operations 2Document15 pagesChapter 3 & 4 Banking An Operations 2ManavAgarwalNo ratings yet

- Principles of LendingDocument32 pagesPrinciples of LendingsugirajamsrNo ratings yet

- International Finance FinalDocument27 pagesInternational Finance FinalRishabh RaiNo ratings yet

- Tutorial Chap 5Document3 pagesTutorial Chap 5Hasya AuniNo ratings yet

- Chapter 12 The Bond MarketDocument42 pagesChapter 12 The Bond MarketJay Ann DomeNo ratings yet

- UNIT 2 Process and DocumentationDocument27 pagesUNIT 2 Process and DocumentationAroop PalNo ratings yet

- San Jose Mod3HWDocument2 pagesSan Jose Mod3HWloganramenNo ratings yet

- Financial Guarantee - ProjectDocument3 pagesFinancial Guarantee - ProjectArnab SahaNo ratings yet

- Banking & Finance Basics 1 - 1Document40 pagesBanking & Finance Basics 1 - 1fourmitos AmrlNo ratings yet

- Fm-Unit3 SummaryDocument3 pagesFm-Unit3 SummaryAngelKate MicabaniNo ratings yet

- EM4001Ch6 Gearing and Cost of CapitalDocument42 pagesEM4001Ch6 Gearing and Cost of CapitalGabriel OkuyemiNo ratings yet

- Fianacial MarketsDocument53 pagesFianacial MarketsMostafa ElgendyNo ratings yet

- 53 03Document1 page53 03Numaer SiddiqueNo ratings yet

- Principles of Banking and FinanceDocument4 pagesPrinciples of Banking and FinanceEmmanuel NyachiriNo ratings yet

- Module Compilation 1 3 Midterm ReviewerDocument57 pagesModule Compilation 1 3 Midterm ReviewerJared PaulateNo ratings yet

- Risk Management in BanksDocument16 pagesRisk Management in BankssharventhiriNo ratings yet

- Fmi ReportDocument20 pagesFmi Reportjames10000No ratings yet

- Managing Errors and ExceptionDocument12 pagesManaging Errors and ExceptionShanmuka Sreenivas100% (1)

- Energy Production From Speed BreakerDocument44 pagesEnergy Production From Speed BreakerMuhammad Bilal67% (3)

- Assignment - 1 AcousticsDocument14 pagesAssignment - 1 AcousticsSyeda SumayyaNo ratings yet

- Clinical Skills TrainingDocument12 pagesClinical Skills TrainingSri Wahyuni SahirNo ratings yet

- 6int 2008 Dec ADocument6 pages6int 2008 Dec ACharles_Leong_3417No ratings yet

- This Is A Short Presentation To Explain The Character of Uncle Sam, Made by Ivo BogoevskiDocument7 pagesThis Is A Short Presentation To Explain The Character of Uncle Sam, Made by Ivo BogoevskiIvo BogoevskiNo ratings yet

- DBM Uv W ChartDocument2 pagesDBM Uv W ChartEddie FastNo ratings yet

- Communication Skill - Time ManagementDocument18 pagesCommunication Skill - Time ManagementChấn NguyễnNo ratings yet

- Developpments in OTC MarketsDocument80 pagesDeveloppments in OTC MarketsRexTradeNo ratings yet

- Brain Injury Patients Have A Place To Be Themselves: WHY WHYDocument24 pagesBrain Injury Patients Have A Place To Be Themselves: WHY WHYDonna S. SeayNo ratings yet

- Consumer Protection ActDocument34 pagesConsumer Protection ActshikhroxNo ratings yet

- VRARAIDocument12 pagesVRARAIraquel mallannnaoNo ratings yet

- Learning English Through The Educational Games of Wordwall Website For Elementary Students by Group 1 (R4E)Document6 pagesLearning English Through The Educational Games of Wordwall Website For Elementary Students by Group 1 (R4E)NurulNo ratings yet

- Properties of WaterDocument23 pagesProperties of WaterNiken Rumani100% (1)

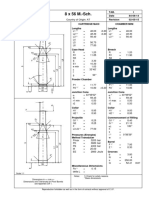

- 8 X 56 M.-SCH.: Country of Origin: ATDocument1 page8 X 56 M.-SCH.: Country of Origin: ATMohammed SirelkhatimNo ratings yet

- Kootenay Lake Pennywise April 26, 2016Document48 pagesKootenay Lake Pennywise April 26, 2016Pennywise PublishingNo ratings yet

- Fin Accounting IFRS 2e Ch13Document62 pagesFin Accounting IFRS 2e Ch13Nguyễn Vinh QuangNo ratings yet

- The Intel 8086 / 8088/ 80186 / 80286 / 80386 / 80486 Jump InstructionsDocument3 pagesThe Intel 8086 / 8088/ 80186 / 80286 / 80386 / 80486 Jump InstructionsalexiouconNo ratings yet

- Peanut AllergyDocument4 pagesPeanut AllergyLNICCOLAIONo ratings yet

- Nat Steel BREGENEPD000379Document16 pagesNat Steel BREGENEPD000379Batu GajahNo ratings yet

- Population Second TermDocument2 pagesPopulation Second Termlubna imranNo ratings yet

- Department of Education: Raiseplus Weekly Plan For Blended LearningDocument3 pagesDepartment of Education: Raiseplus Weekly Plan For Blended LearningMARILYN CONSIGNANo ratings yet

- Fertilisation and PregnancyDocument24 pagesFertilisation and PregnancyLopak TikeNo ratings yet

- APJ Abdul Kalam Success StoryDocument1 pageAPJ Abdul Kalam Success StorySanjaiNo ratings yet

- BarricadeDocument6 pagesBarricadeJithu PappachanNo ratings yet

- Physiol Toric Calculator: With Abulafia-Koch Regression FormulaDocument1 pagePhysiol Toric Calculator: With Abulafia-Koch Regression FormuladeliNo ratings yet

- Corelink Mmu600ae TRM 101412 0100 00 enDocument194 pagesCorelink Mmu600ae TRM 101412 0100 00 enLv DanielNo ratings yet

- Ticket: Fare DetailDocument1 pageTicket: Fare DetailSajal NahaNo ratings yet

- EC 2012 With SolutionsDocument50 pagesEC 2012 With Solutionsprabhjot singh1No ratings yet

- Dist - Propor.danfoss PVG32Document136 pagesDist - Propor.danfoss PVG32Michal BujaraNo ratings yet