Professional Documents

Culture Documents

Chap 03

Uploaded by

ulfaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chap 03

Uploaded by

ulfaCopyright:

Available Formats

1

Baker / Lembke / King

The Reporting

Entity and

Consolidated

Financial

Statements

Irwin/McGraw-

The McGraw-Hill

The McGraw-Hill

Companies,

Inc., 1999

Companies,

Limitations of Consolidated Financial Statements

Poor

Poorperformance

performanceof

ofone

oneor

ormore

morecompanies

companiesmay

maybe

be

hidden

hidden

Not

Notall

allthe

theconsolidated

consolidatedretained

retainedearnings

earningsbalance

balanceisis

necessarily

necessarilyavailable

availablefor

fordividends

dividendsof

ofthe

theparent

parent

Financial

Financialratios

ratiosbased

basedon

onconsolidated

consolidatedstatements

statements

are

arenot

notnecessarily

necessarilyrepresentative

representativeof

ofany

anysingle

single

company

companyin

inthe

theconsolidation

consolidation

Similar

Similaraccounts

accountsof

ofdifferent

differentcompanies

companiesthat

thatare

are

combined

combinedin

inthe

theconsolidation

consolidationmay

maynot

notbe

beentirely

entirely

comparable

comparable

Additional

Additionalinformation

informationabout

aboutindividual

individualcompanies

companies

may

mayrequire

requirevoluminous

voluminousfootnotes

footnotes

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Indirect Control

P

P owns 80 percent of X

X

X owns 60 percent of Z

Z

PPindirectly

indirectlycontrols

controlsZZ

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Indirect Control

P

.90

.70

Y

.30

.40

Z

PPindirectly

indirectlycontrols

controlsZZ

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Indirect Control

P

.80

.90

W

.80

.15

X

.30

Y

.15

Z

PPindirectly

indirectlycontrols

controlsZZ

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Questions Preparer Should Ask

Do

Dothese

thesestatements

statementsappear

appear

as

asififthe

theconsolidated

consolidated

companies

companieswere

wereactually

actually

aasingle

singlecompany?

company?

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Questions Preparer Should Ask

Are

Arethere

thereany

anyitems

itemsincluded

includedin

in

the

thestatements

statementsthat

thatwould

wouldnot

not

appear,

appear,or

orthat

thatwould

wouldbe

bestated

stated

at

atdifferent

differentamounts,

amounts,in

inthe

the

statements

statementsof

ofaasingle

singlecompany?

company?

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

Questions Preparer Should Ask

Are

Arethere

thereitems

itemsthat

thatdo

donot

notappear

appear

in

inthese

thesestatements

statementsthat

thatwould

would

appear

appearififthe

theconsolidated

consolidatedentity

entity

were

wereactually

actuallyaasingle

singlecompany?

company?

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

The Consolidated Entity

Parent

Parent

Subsidiary

Subsidiary

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

10

The Consolidated Entity

Poppers

common

stock

Suns

common

stock

Popper

Popper

Company

Company

Sun

Sun

Corporation

Corporation

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

11

Balance Sheets --December 31, 19X1

Popper

Assets

Cash

Receivable (net)

Inventory

Fixed Assets (net)

Other Assets

Investment in Sun Stock

Total Assets

Liabilities and Equities

Short-Term Payables

Long-Term Payables

Common Stock

Retained Earnings

Total Liabilities and Equities

Irwin/McGraw-

Sun

5,000

84,000

95,000

375,000

25,000

300,000

$884,000

$ 60,000

200,000

500,000

124,000

$884,000

3,000

30,000

60,000

250,000

15,000

$358,000

8,000

50,000

200,000

100,000

$358,000

The McGraw-Hill Companies, Inc., 1999

Consolidated Balance Sheet

12

Popper Company

Consolidated Balance Sheet

December 31, 19X1

Assets

Cash

Receivables (net)

Inventory

Fixed Assets (net)

Other Assets

Total Assets

Irwin/McGraw-

Liabilities and Equities

$ 8,000 Short-Term

Payables

$5,000

++$3,000

$5,000

$3,000 $ 67,000

113,000 Long-Term Payables

250,000

153,000

625,000 Common Stock

500,000

40,000 Retained Earnings

122,000

$939,000 Total Liabil. and Equities $939,000

The McGraw-Hill Companies, Inc., 1999

Consolidated Balance Sheet

13

Popper Company

Consolidated Balance Sheet

December 31, 19X1

Assets

Cash

Receivables (net)

Inventory

Fixed Assets (net)

Other Assets

Total Assets

Irwin/McGraw-

Liabilities and Equities

$ 8,000 Short-Term Payables

$ 67,000

$84,000

+

$30,000

$84,000

+ $30,000 250,000

113,000 Long-Term

Payables

--$1,000

$1,000

153,000

625,000 Common Stock

500,000

40,000 Retained Earnings

122,000

$939,000 Total Liabil. and Equities $939,000

The McGraw-Hill Companies, Inc., 1999

Consolidated Balance Sheet

14

Popper Company

Consolidated Balance Sheet

December 31, 19X1

Assets

Cash

Receivables (net)

Inventory

Fixed Assets (net)

Other Assets

Total Assets

Irwin/McGraw-

Liabilities and Equities

$ 8,000 Short-Term Payables

$ 67,000

113,000 Long-Term Payables

250,000

$95,000

$95,000++$60,000

$60,000

153,000

--$2,000

$2,000

625,000 Common Stock

500,000

40,000 Retained Earnings

122,000

$939,000 Total Liabil. and Equities $939,000

The McGraw-Hill Companies, Inc., 1999

Consolidated Balance Sheet

15

Popper Company

Consolidated Balance Sheet

December 31, 19X1

Assets

Cash

Receivables (net)

Inventory

Fixed Assets (net)

Other Assets

Total Assets

Irwin/McGraw-

Liabilities and Equities

$ 8,000 Short-Term Payables

$ 67,000

113,000 Long-Term Payables

250,000

153,000

625,000 Common

Stock ++$250,000

$375,000

$375,000

$250,000 500,000

40,000 Retained Earnings

122,000

$939,000 Total Liabil. and Equities $939,000

The McGraw-Hill Companies, Inc., 1999

Consolidated Balance Sheet

16

Popper Company

Consolidated Balance Sheet

December 31, 19X1

Assets

Cash

Receivables (net)

Inventory

Fixed Assets (net)

Other Assets

Total Assets

Irwin/McGraw-

Liabilities and Equities

$ 8,000 Short-Term Payables

$ 67,000

113,000 Long-Term Payables

250,000

153,000

625,000 Common Stock

500,000

40,000 Retained

Earnings

$25,000

++$15,000

$25,000

$15,000 122,000

$939,000 Total Liabil. and Equities $939,000

The McGraw-Hill Companies, Inc., 1999

Consolidated Balance Sheet

17

Popper Company

Consolidated Balance Sheet

December 31, 19X1

Assets

$60,000 + $8,000

Cash $60,000 + $8,000

$1,000

$1,000

Receivables--(net)

Inventory

Fixed Assets (net)

Other Assets

Total Assets

Irwin/McGraw-

Liabilities and Equities

$ 8,000 Short-Term Payables

113,000 Long-Term Payables

153,000

625,000 Common Stock

40,000 Retained Earnings

$939,000 Total Liabil. and Equities

$ 67,000

250,000

500,000

122,000

$939,000

The McGraw-Hill Companies, Inc., 1999

Consolidated Balance Sheet

18

Popper Company

Consolidated Balance Sheet

December 31, 19X1

Assets

Liabilities and Equities

Cash

$ 8,000 Short-Term Payables

$200,000

++$50,000

Receivables

(net)

$200,000

$50,000 113,000 Long-Term Payables

Inventory

153,000

Fixed Assets (net)

625,000 Common Stock

Other Assets

40,000 Retained Earnings

Total Assets

$939,000 Total Liabil. and Equities

Irwin/McGraw-

$ 67,000

250,000

500,000

122,000

$939,000

The McGraw-Hill Companies, Inc., 1999

Consolidated Balance Sheet

19

Popper Company

Consolidated Balance Sheet

December 31, 19X1

Assets

Liabilities and Equities

Cash

$ 8,000 Short-Term Payables

Receivables (net)

113,000 Long-Term Payables

Inventory

153,000

$500,000

+

$200,000

+ $200,000 625,000 Common Stock

Fixed$500,000

Assets (net)

--$200,000

$200,000

Other Assets

40,000 Retained Earnings

Total Assets

$939,000 Total Liabil. and Equities

Irwin/McGraw-

$ 67,000

250,000

500,000

122,000

$939,000

The McGraw-Hill Companies, Inc., 1999

Consolidated Balance Sheet

20

Popper Company

Consolidated Balance Sheet

December 31, 19X1

Assets

Liabilities and Equities

Cash

$ 8,000 Short-Term Payables

Receivables (net)

113,000 Long-Term Payables

Inventory

153,000

Fixed

Assets (net)

625,000 Common Stock

$124,000

+

$100,000

Other$124,000

Assets + $100,000

40,000 Retained Earnings

--$100,000

$2,000

$100,000 - $2,000 $939,000 Total Liabil. and Equities

Total Assets

Irwin/McGraw-

$ 67,000

250,000

500,000

122,000

$939,000

The McGraw-Hill Companies, Inc., 1999

Intercompany Receivable and Payable

21

Popper

Popper

Company

Company

Intercompany

receivable/payable

$1,000

Sun

Sun

Corporation

Corporation

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

22

Profits on Intercompany Sales

Cost of

goods

$4,000

Popper

Popper

Company

Company

Sales

$6,000

Sun

Sun

Corporation

Corporation

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

23

Proprietary Theory

NonconParents trolling

share

share

Goodwill

Portion

included in

consolidated

financial

statements

Irwin/McGraw-

Fair value

increment

Book value

Recognition

Recognition of

of

Subsidiary

Subsidiary Net

NetAssets

Assets

The McGraw-Hill Companies, Inc., 1999

24

Proprietary Theory

NonconParents trolling

share

share

Revenue

Portion

included in

consolidated

financial

statements

Expenses

Net income

Irwin/McGraw-

Recognition

Recognition of

of

Subsidiary

SubsidiaryNet

Net Income

Income

The McGraw-Hill Companies, Inc., 1999

25

Parent Company Theory

NonconParents trolling

share

share

Goodwill

Portion

included in

consolidated

financial

statements

Irwin/McGraw-

Fair value

Increment

Book value

Recognition

Recognition of

of

Subsidiary

Subsidiary Net

NetAssets

Assets

The McGraw-Hill Companies, Inc., 1999

26

Parent Company Theory

NonconParents trolling

share

share

Revenue

Portion

included in

consolidated

financial

statements

Expenses

Net income

Irwin/McGraw-

Recognition

Recognition of

of

Subsidiary

SubsidiaryNet

Net Income

Income

The McGraw-Hill Companies, Inc., 1999

27

Entity Theory

NonconParents trolling

share

share

Goodwill

Portion

included in

consolidated

financial

statements

Irwin/McGraw-

Fair value

increment

Book value

Recognition

Recognition of

of

Subsidiary

Subsidiary Net

NetAssets

Assets

The McGraw-Hill Companies, Inc., 1999

28

Entity Theory

NonconParents trolling

share

share

Revenue

Portion

included in

consolidated

financial

statements

Expenses

Net income

Irwin/McGraw-

Recognition

Recognition of

of

Subsidiary

SubsidiaryNet

Net Income

Income

The McGraw-Hill Companies, Inc., 1999

29

Chapter Three

The

The

End

End

Irwin/McGraw-

The McGraw-Hill Companies, Inc., 1999

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Banking & Financial Services Job Skills & Competencies FrameworkDocument19 pagesBanking & Financial Services Job Skills & Competencies FrameworkMithun KNo ratings yet

- Leida Kristin GardeDocument4 pagesLeida Kristin Garderealjosh21No ratings yet

- Davis Langdon Africa Handbook Jan 2009Document94 pagesDavis Langdon Africa Handbook Jan 2009Caesar 'Dee' Rethabile SerumulaNo ratings yet

- Summer InternshipDocument18 pagesSummer InternshipMohit SinghalNo ratings yet

- Running Head: YUVA: (Name) (Institute) (Date)Document29 pagesRunning Head: YUVA: (Name) (Institute) (Date)Liam GreenNo ratings yet

- Contract of BailmentDocument10 pagesContract of BailmentPravah ShuklaNo ratings yet

- MBA630 Price-Barret Minor Project 1Document21 pagesMBA630 Price-Barret Minor Project 1sylvia priceNo ratings yet

- Financial Instruments Cost of Capital Qs PDFDocument28 pagesFinancial Instruments Cost of Capital Qs PDFJust ForNo ratings yet

- Intermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldDocument34 pagesIntermediate Accounting IFRS Edition: Kieso, Weygandt, WarfieldPaulina RegginaNo ratings yet

- Randstad - White Paper Choosing The Right RPODocument12 pagesRandstad - White Paper Choosing The Right RPOAditya VermaNo ratings yet

- KVS Agra XII ACC QP & MS (Pre-Board) 23-24Document21 pagesKVS Agra XII ACC QP & MS (Pre-Board) 23-24ragingcaverock696No ratings yet

- Role of Entrepreneurship in Economic DevelopmentDocument8 pagesRole of Entrepreneurship in Economic DevelopmentHimanshu Garg100% (1)

- UofMaryland Smith Finance Assoc Resume Book (1Y)Document46 pagesUofMaryland Smith Finance Assoc Resume Book (1Y)Jon CannNo ratings yet

- BUSINESS ANALYS-WPS OfficeDocument15 pagesBUSINESS ANALYS-WPS OfficeIssachar BarezNo ratings yet

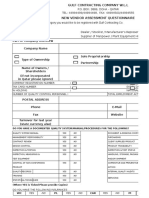

- QMS F 09A Rev 05 New Vendor Assessment QuestionnaireDocument16 pagesQMS F 09A Rev 05 New Vendor Assessment QuestionnairermdarisaNo ratings yet

- Social Media Content Creation InstagramDocument10 pagesSocial Media Content Creation InstagramtabilinNo ratings yet

- DM A1.1Document33 pagesDM A1.1NaNóngNảyNo ratings yet

- Digital Pharmaceutical Marketing StrategiesDocument21 pagesDigital Pharmaceutical Marketing StrategiesdanogsNo ratings yet

- Job EvaluationDocument34 pagesJob EvaluationRakshit BhargavaNo ratings yet

- Chap 6 and 8 Midterm Review SeatworkDocument2 pagesChap 6 and 8 Midterm Review SeatworkLouina Yncierto0% (1)

- C03 Krugman 12e AccessibleDocument92 pagesC03 Krugman 12e Accessiblesong neeNo ratings yet

- HR CompendiumDocument13 pagesHR CompendiumNeelu Aggrawal100% (1)

- Art Centre Contractors & Supplies LTD P.O Box 165, KAGADI Tel: 0772530672/0752530672Document1 pageArt Centre Contractors & Supplies LTD P.O Box 165, KAGADI Tel: 0772530672/0752530672kitderoger_391648570No ratings yet

- Coors UaeDocument14 pagesCoors UaeSamer Al-MimarNo ratings yet

- ENT600 G3 NPD Project - TGGL SummaryDocument23 pagesENT600 G3 NPD Project - TGGL SummaryFahmi YahyaNo ratings yet

- Strategic Management MBA III 538483064Document2 pagesStrategic Management MBA III 538483064Sidharth KapoorNo ratings yet

- HSBC Bank Audit ReportDocument30 pagesHSBC Bank Audit Reporta_nevrekarNo ratings yet

- BouteraaDocument12 pagesBouteraavasu guptaNo ratings yet

- CertempDocument1 pageCertempjelidom22No ratings yet

- Case Digests - Corporation LawDocument37 pagesCase Digests - Corporation LawFrancis Jan Ax ValerioNo ratings yet